Will the 401k contribution limit change in 2024? This question is on the minds of many Americans as they plan for their retirement. The current limit for 2023 is $22,500, with an additional $7,500 catch-up contribution for those 50 and older.

But with inflation and economic uncertainty, many wonder if this limit will stay the same or increase next year.

Understanding the historical trends in 401k contribution limits can provide valuable insights into potential changes for 2024. In recent years, the limit has steadily increased, often in line with inflation. However, other factors like government policy and economic conditions can also play a significant role.

Contents List

- 1 Current 401(k) Contribution Limits

- 2 Historical Trends in 401(k) Contribution Limits

- 3 Factors Influencing Potential Changes in 2024: Will The 401k Contribution Limit Change In 2024

- 4 Potential Scenarios for 2024 Contribution Limits

- 5 Implications of Potential Changes for Individuals

- 6 Resources and Further Information

- 7 Conclusive Thoughts

- 8 FAQ Overview

Current 401(k) Contribution Limits

The amount you can contribute to your 401(k) plan is subject to annual limits set by the IRS. These limits are designed to help you save for retirement while also ensuring that you don’t exceed certain contribution thresholds.

Those over 50 have the opportunity to contribute more to their retirement savings. Discover the Ira contribution limits for people over 50 in 2024 and boost your retirement nest egg.

2023 Contribution Limits

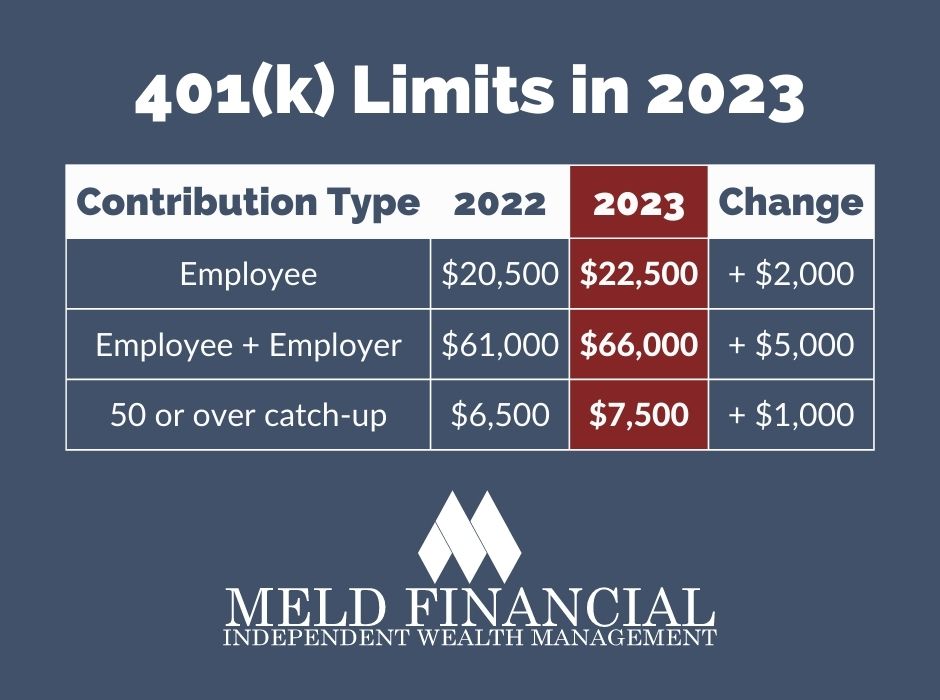

The maximum amount you can contribute to your 401(k) plan in 2023 is $22,500. This limit applies to both traditional and Roth 401(k) plans.

Planning for retirement? Get the latest information on Ira limits for October 2024 to ensure you’re on track for your financial goals.

The 2023 contribution limit is $22,500.

Single filers, find out the IRA contribution limits for 2024 for single filers to maximize your retirement savings.

Catch-Up Contributions

Individuals aged 50 and over can contribute an additional amount to their 401(k) plans, known as catch-up contributions. This allows them to make up for lost contributions in earlier years. The catch-up contribution limit for 2023 is $7,500. This means that individuals aged 50 and over can contribute a total of $30,000 to their 401(k) plans in 2023 ($22,500 regular contribution + $7,500 catch-up contribution).

If you’re self-employed, check out the Ira contribution limits for SEP IRA in 2024 to learn how much you can contribute.

The catch-up contribution limit for 2023 is $7,500.

Married couples filing jointly? Learn about the standard deduction for married filing jointly in 2024 to see how much you can deduct from your taxes.

Historical Trends in 401(k) Contribution Limits

The contribution limits for 401(k) plans have steadily increased over the past few years, reflecting the rising cost of living and the importance of retirement savings. Examining historical trends in these limits can provide valuable insights into the factors influencing these changes and potential future adjustments.

Historical Contribution Limits

The following table shows the annual contribution limits for 401(k) plans over the past five years:

| Year | Contribution Limit |

|---|---|

| 2019 | $19,000 |

| 2020 | $19,500 |

| 2021 | $19,500 |

| 2022 | $20,500 |

| 2023 | $22,500 |

Factors Influencing Contribution Limit Changes

Several factors contribute to the adjustments in 401(k) contribution limits. These factors include:

- Inflation:As the cost of living rises, the purchasing power of savings decreases. Increasing contribution limits helps to offset inflation and maintain the value of retirement savings. For instance, the 2023 contribution limit increase to $22,500 from $20,500 in 2022 was partly attributed to the higher inflation rate in 2022.

- Economic Growth:When the economy is strong and wages are growing, individuals have more disposable income to contribute to retirement savings. Higher contribution limits can encourage greater savings during periods of economic prosperity. For example, the significant jump in the contribution limit from $19,500 in 2020 to $20,500 in 2022 coincided with a period of economic recovery following the COVID-19 pandemic.

- Demographic Shifts:The aging population and increasing life expectancy have prompted a need for individuals to save more for retirement. Adjusting contribution limits to reflect these demographic changes ensures that people can accumulate sufficient funds for a longer retirement. For instance, the rising number of Baby Boomers entering retirement has contributed to the gradual increase in contribution limits over the years.

- Government Policy:The government plays a role in influencing contribution limits through tax incentives and retirement savings legislation. Changes in tax policies or retirement savings regulations can affect the contribution limits and encourage individuals to save more. For example, the Tax Cuts and Jobs Act of 2017 included provisions that encouraged retirement savings, which may have contributed to the upward trend in contribution limits.

Factors Influencing Potential Changes in 2024: Will The 401k Contribution Limit Change In 2024

The 401(k) contribution limit, like many aspects of the economy, is subject to change. Various factors, including economic conditions, inflation, and government policies, can influence how the limit is adjusted each year. Understanding these factors can help individuals and employers better anticipate potential changes and adjust their retirement savings strategies accordingly.

Economic Factors

Several economic factors can influence the 401(k) contribution limit. These factors play a role in shaping the overall economic climate and can affect the government’s decisions regarding retirement savings policies.

Want to know how much you can deduct from your taxes? Check out the 2024 standard deduction for single filers to see how much you can save.

- Economic Growth:A strong economy, characterized by high GDP growth and low unemployment rates, generally leads to higher 401(k) contribution limits. When the economy is thriving, there’s typically more revenue available for government programs, including those related to retirement savings.

- Inflation:Inflation erodes the purchasing power of money, making it more expensive to save for retirement. In response to rising inflation, the government might increase the 401(k) contribution limit to help individuals maintain their savings goals. For instance, in 2023, the limit increased to $22,500 from $20,500 in 2022, partly due to rising inflation.

Self-employed and looking to save for retirement? Find out the Ira contribution limits for small business owners in 2024 to maximize your savings.

- Interest Rates:Interest rates influence the cost of borrowing money. Higher interest rates can make it more expensive for individuals to borrow for housing or other major expenses, potentially leading to less disposable income for retirement savings. In such scenarios, the government might consider increasing the 401(k) contribution limit to incentivize retirement savings.

Inflation and the Cost of Living

Inflation is a significant factor impacting retirement savings. As the cost of goods and services rises, individuals need to save more to maintain their purchasing power in retirement. The 401(k) contribution limit is often adjusted to reflect these changes.

The 401(k) contribution limit is typically adjusted annually to account for inflation, ensuring that individuals can contribute a meaningful amount to their retirement savings plans.

For example, the 2023 contribution limit was increased by $2,000 from the previous year, partly due to rising inflation. This adjustment aimed to ensure that individuals could save enough to maintain their living standards in retirement, despite the rising cost of living.

Government Policies and Legislation

Government policies and legislation play a crucial role in shaping retirement savings plans, including 401(k) limits.

Looking to save for retirement with a Roth IRA? Check out the Roth IRA contribution limit for 2024 to see how much you can contribute.

- Retirement Security Act of 2019:This act aimed to increase retirement savings by making it easier for small businesses to offer retirement plans and encouraging automatic enrollment in 401(k) plans. The act also included provisions for adjusting the contribution limit to reflect inflation, ensuring that individuals could keep pace with rising costs.

- SECURE Act 2.0:This act, passed in 2022, aims to further improve retirement security by increasing the age at which required minimum distributions (RMDs) begin from 72 to 75, expanding access to retirement savings for part-time workers, and providing incentives for employers to offer matching contributions.

Stay informed about any potential October 2024 mileage rate changes to ensure you’re using the correct rate for your business travel.

While the act doesn’t directly address the 401(k) contribution limit, it highlights the government’s commitment to strengthening retirement savings policies.

Potential Scenarios for 2024 Contribution Limits

Predicting the future is always a challenge, especially when it comes to economic factors that influence retirement savings. However, by analyzing historical trends and current economic conditions, we can create potential scenarios for the 401(k) contribution limit in 2024.

Need more time to file your business taxes? Find out the Extension Tax Deadline October 2024 for Businesses and avoid any penalties.

Scenario 1: Moderate Increase, Will the 401k contribution limit change in 2024

This scenario assumes a continued, albeit moderate, economic growth. The Consumer Price Index (CPI) is expected to remain elevated, but at a slower pace than in 2023. The government might adjust the contribution limit to account for inflation, but a significant increase is unlikely.

High earners, find out the 401k contribution limits for 2024 for high earners to see how much you can contribute to your retirement plan.

This scenario reflects a cautious approach by policymakers, aiming to balance encouraging retirement savings with controlling inflation.

Scenario 2: No Change

This scenario assumes a more volatile economic environment. The Federal Reserve may continue to raise interest rates to combat inflation, potentially slowing economic growth. In this case, the government might prioritize fiscal responsibility and maintain the current contribution limit to avoid further strain on the budget.

This scenario emphasizes the potential impact of economic uncertainty on government spending, making a contribution limit increase less likely.

Scenario 3: Significant Increase

This scenario assumes a robust economic recovery and sustained growth. Inflation is expected to moderate, and the government might prioritize increasing retirement savings to address concerns about future economic security. This could lead to a substantial increase in the contribution limit, encouraging individuals to save more for their retirement.

Don’t get caught off guard! Keep up-to-date on when the mileage rate will be updated for October 2024 to ensure you’re using the correct rate for your business travel.

This scenario reflects a more optimistic economic outlook, with the government prioritizing long-term retirement security by encouraging higher contribution limits.

Looking to maximize your retirement savings? Find out the latest IRS 401k contribution limit for 2024 to ensure you’re making the most of your contributions.

Implications of Potential Changes for Individuals

The prospect of 401(k) contribution limit changes in 2024 has significant implications for individuals seeking to secure their financial future. Understanding these potential changes and their impact on your retirement savings strategy is crucial.

Planning a road trip? Make sure you’re aware of the current mileage rate for October 2024 to accurately track your expenses.

Impact of Increased Contribution Limits

Increased contribution limits offer a welcome opportunity to boost your retirement savings. This can be especially beneficial for those in their peak earning years who are looking to maximize their contributions. However, it’s important to remember that increased contribution limits do not necessarily translate to increased returns.

Your investment strategy and market performance still play a significant role in the overall growth of your retirement savings.

It’s important to stay on top of tax deadlines. Learn about the potential tax penalties for missing the October 2024 deadline to avoid any financial surprises.

Impact of Decreased Contribution Limits

Decreased contribution limits could potentially hinder your ability to save as much as you’d like for retirement. This could lead to a smaller nest egg and potentially impact your financial security in your later years.

Adapting Savings Strategies

Adapting your savings strategy to potential changes in contribution limits is essential. Here are some strategies to consider:

- Increase your contribution percentage:If contribution limits increase, consider increasing your contribution percentage to take advantage of the higher limit. This can help you accelerate your savings and potentially reach your retirement goals sooner.

- Contribute more frequently:If you can’t increase your contribution percentage due to budget constraints, consider contributing more frequently. For example, instead of contributing once a month, you could contribute twice a month or even weekly.

- Explore other retirement savings options:If contribution limits decrease, consider exploring other retirement savings options such as Roth IRAs, traditional IRAs, or even taxable investment accounts. These options may offer different contribution limits and tax advantages.

Maximizing Retirement Savings

Here are some additional strategies to maximize your retirement savings, regardless of potential changes in contribution limits:

- Start saving early:The earlier you start saving, the more time your money has to grow through compounding. Even small contributions can make a big difference over time.

- Invest in a diversified portfolio:Diversifying your investments across different asset classes (stocks, bonds, real estate, etc.) can help reduce risk and potentially increase returns over the long term.

- Review your investment strategy regularly:As your financial situation and goals change, it’s essential to review your investment strategy and make adjustments as needed.

- Consider working with a financial advisor:A financial advisor can provide personalized guidance and support in developing and implementing a retirement savings plan that meets your individual needs and goals.

Resources and Further Information

Staying updated on 401(k) contribution limits is crucial for maximizing your retirement savings. Thankfully, there are numerous reliable sources that provide accurate and timely information.

Government Websites

Government websites are the most authoritative sources for information on 401(k) contribution limits. These websites provide official guidelines, regulations, and updates on any changes.

- Internal Revenue Service (IRS):The IRS website is a primary source for tax-related information, including 401(k) contribution limits. You can find the latest annual contribution limits and other relevant details on their website.

- U.S. Department of Labor:The Department of Labor oversees employee retirement plans, including 401(k)s.

Their website provides information on retirement planning, plan regulations, and other relevant resources.

Financial Institutions

Financial institutions, including banks, investment firms, and retirement plan providers, often offer resources and information on 401(k) contribution limits.

- Banks and Credit Unions:Many banks and credit unions offer retirement planning services and resources, including information on 401(k) contribution limits.

- Investment Firms:Investment firms that specialize in retirement planning provide insights into 401(k) contribution limits and other retirement planning strategies.

- Retirement Plan Providers:Your employer’s retirement plan provider is a valuable resource for information on your specific 401(k) plan, including contribution limits.

Staying Informed

Staying updated on potential changes in 401(k) contribution limits is essential. Here are some strategies to stay informed:

- Subscribe to Newsletters:Sign up for newsletters from reputable financial institutions, retirement planning organizations, or government agencies to receive regular updates on 401(k) contribution limits and other relevant information.

- Follow Industry Experts:Follow financial advisors, retirement planning specialists, and industry experts on social media or through their blogs for insights and updates.

- Check Government Websites Regularly:Visit the IRS and Department of Labor websites periodically for any official announcements or updates on 401(k) contribution limits.

Conclusive Thoughts

While predicting the future is never certain, understanding the factors that influence 401k contribution limits is crucial for retirement planning. Staying informed about potential changes and adapting your savings strategy accordingly can help you maximize your retirement savings and achieve your financial goals.

FAQ Overview

What happens if the contribution limit increases?

If the contribution limit increases, you can save more for retirement each year. This can lead to a larger nest egg and a more comfortable retirement.

What happens if the contribution limit decreases?

If the contribution limit decreases, you may need to adjust your savings strategy to make up for the difference. This could involve contributing more to other retirement accounts or delaying retirement.

Where can I find the latest information on 401k contribution limits?

You can find the latest information on 401k contribution limits from the IRS website, your employer, or your financial advisor.