Roth IRA contribution limits for 2024 are a key factor in retirement planning, offering the potential for tax-free withdrawals in the future. This guide delves into the specifics of these limits, exploring eligibility criteria, contribution strategies, and the tax implications of this popular retirement savings option.

Understanding Roth IRA contribution limits is crucial for individuals seeking to maximize their retirement savings. These limits dictate the amount you can contribute each year, impacting your potential for tax-free growth and withdrawals. Whether you’re just starting your retirement journey or looking to optimize your existing strategy, a thorough understanding of these limits is essential.

Contents List

Roth IRA Contribution Limits

A Roth IRA is a retirement savings plan that allows you to contribute after-tax dollars and potentially withdraw your earnings tax-free in retirement. This type of IRA offers a unique advantage – you can enjoy tax-free withdrawals in retirement, as opposed to traditional IRAs where withdrawals are taxed.

Want to know the 401(k) contribution limits for 2024, regardless of your age? This article provides a comprehensive guide to the limits for all age groups.

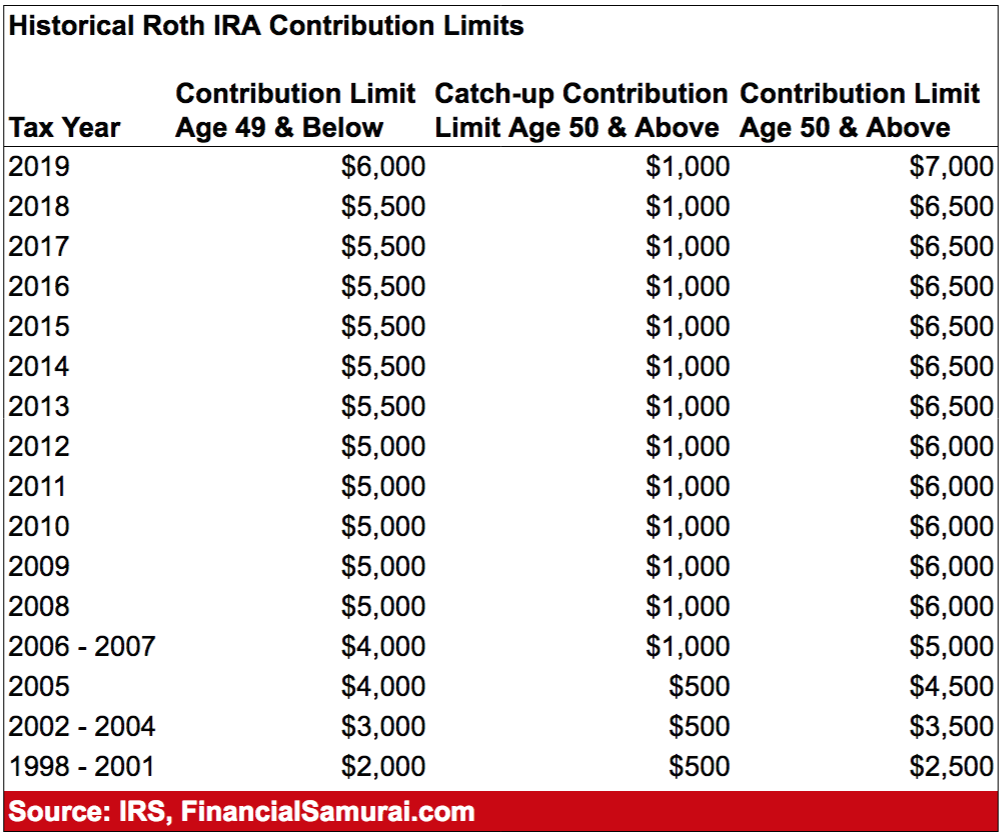

The Roth IRA contribution limit is the maximum amount of money you can contribute to your Roth IRA in a given year. These limits are set by the IRS and are adjusted annually to reflect inflation.

Contribution Limits for 2024

The contribution limit for Roth IRAs in 2024 is $7,000 for individuals and $14,000 for married couples filing jointly. If you are 50 years old or older, you can contribute an additional $1,000 as a catch-up contribution.

The 2024 Roth IRA contribution limit is $7,000 for individuals and $14,000 for married couples filing jointly.

Are you eligible for the standard deduction in 2024? This article explains the standard deduction and helps you determine if you can claim it.

2024 Contribution Limits

The contribution limit for Roth IRAs in 2024 remains the same as in 2023, providing consistency for individuals seeking to save for retirement.

Contribution Limit, Roth IRA contribution limits for 2024

The maximum amount you can contribute to a Roth IRA in 2024 is $6,500. This limit applies to individuals of all ages.

Catch-Up Contributions for Individuals Aged 50 and Over

Individuals aged 50 and over can make additional “catch-up” contributions to their Roth IRAs. This allows older individuals to contribute more to their retirement savings and potentially reach their financial goals.

The catch-up contribution limit for 2024 is $1,000. This means that individuals aged 50 and over can contribute up to $7,500to their Roth IRAs in 2024.

Curious about how the 401(k) contribution limits have changed from 2023 to 2024? This article compares the limits for both years, giving you a clear understanding of any adjustments.

Eligibility for Roth IRA Contributions

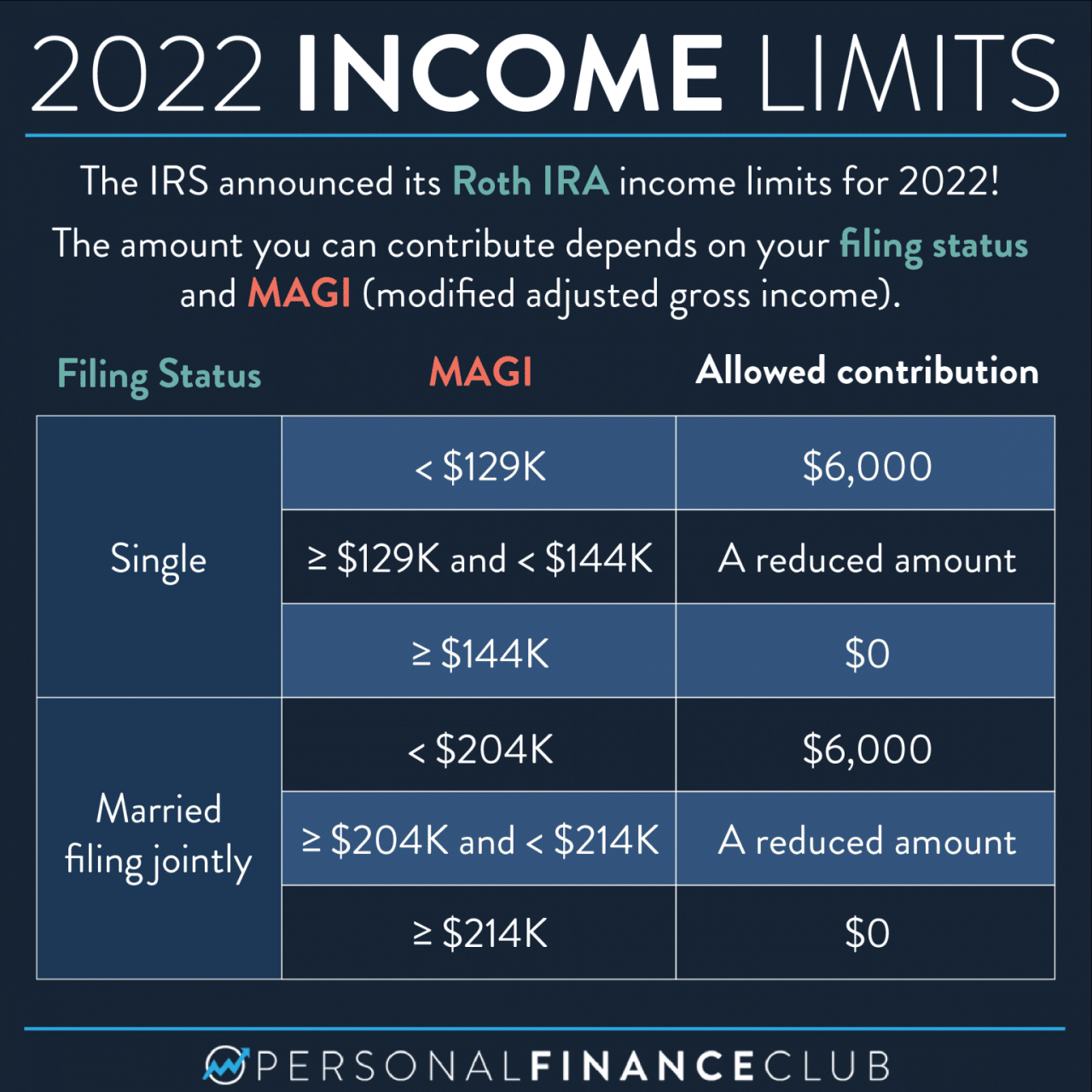

Not everyone is eligible to contribute to a Roth IRA. The IRS sets income limits that determine who can contribute to a Roth IRA and how much they can contribute. These limits are adjusted annually for inflation.

Filing your taxes jointly in 2024? Learn about the standard deduction amount for married couples filing jointly and maximize your tax savings.

Income Limits for Roth IRA Contributions

The IRS sets income limits for Roth IRA contributions. These limits apply to your modified adjusted gross income (MAGI), which is your adjusted gross income (AGI) plus certain deductions. If your MAGI exceeds these limits, you may not be able to contribute to a Roth IRA, or you may be limited in the amount you can contribute.

- For 2024, the income limits for Roth IRA contributions are as follows:

- If you are single, married filing separately, or head of household, your MAGI cannot exceed $153,000 to contribute the full amount to a Roth IRA.

- If you are married filing jointly or are qualifying widow(er), your MAGI cannot exceed $228,000 to contribute the full amount to a Roth IRA.

How Income Limits Affect Individuals with Higher Incomes

If your MAGI exceeds the income limits, you may not be able to contribute to a Roth IRA. This is because you are considered to be “high-income” and the IRS has determined that you can afford to save for retirement in other ways, such as through a traditional IRA or a 401(k).

Planning for retirement? Wondering how much you can contribute to your 401(k) in 2024 and 2025? Check out this article for the latest contribution limits and make sure you’re maximizing your retirement savings.

If you exceed the income limits, you can still contribute to a traditional IRA, but your contributions will be tax-deductible. This means that you will not pay taxes on the money you contribute until you withdraw it in retirement.

Planning your taxes for 2024? Get familiar with the tax brackets for 2024 in the United States and make informed financial decisions.

Alternative Retirement Savings Options for Those Exceeding the Income Limits

There are several alternative retirement savings options available to those who exceed the income limits for Roth IRA contributions.

Are you over 50 and looking to contribute more to your IRA? Find out if there’s a catch-up contribution limit for IRAs in 2024 and take advantage of this opportunity to boost your retirement savings.

- Traditional IRA:A traditional IRA is a retirement savings account that allows you to make pre-tax contributions. This means that you will not pay taxes on the money you contribute until you withdraw it in retirement. Traditional IRA contributions may be tax-deductible, depending on your income and other factors.

Looking to maximize your IRA contributions in 2024? Learn about the maximum IRA contribution limit for 2024 and start planning your retirement savings strategy.

- 401(k):A 401(k) is a retirement savings plan offered by employers. With a 401(k), you can contribute a portion of your salary to the plan, and your employer may match a portion of your contributions. 401(k) contributions are tax-deferred, meaning you will not pay taxes on the money you contribute until you withdraw it in retirement.

Missed the October 2024 deadline for filing your taxes? Learn about the potential tax penalties and take steps to minimize the impact on your finances.

- Solo 401(k):A solo 401(k) is a retirement savings plan that is available to self-employed individuals and small business owners. With a solo 401(k), you can contribute both as an employee and as an employer. Solo 401(k) contributions are tax-deferred, meaning you will not pay taxes on the money you contribute until you withdraw it in retirement.

- SEP IRA:A SEP IRA is a retirement savings plan that is available to self-employed individuals and small business owners. With a SEP IRA, you can contribute a percentage of your net earnings as a self-employed individual. SEP IRA contributions are tax-deductible, meaning you will not pay taxes on the money you contribute until you withdraw it in retirement.

Stay informed about any tax changes that might impact the October 2024 deadline. Read this article to understand potential changes and how they could affect your tax obligations.

Contribution Strategies

Maximizing your Roth IRA contributions can be a smart move for your financial future. There are several strategies you can employ to make the most of this valuable retirement savings tool.

Early and Frequent Contributions

Contributing early and often is crucial for maximizing the benefits of a Roth IRA. The power of compounding works in your favor, allowing your contributions to grow exponentially over time.

“The earlier you start investing, the more time your money has to grow. Even small contributions made regularly can add up to a significant amount over the long term.”

- Time Value of Money:Early contributions allow your money to grow for a longer period, benefiting from the power of compounding.

- Dollar-Cost Averaging:Regular contributions help smooth out market fluctuations, reducing the risk of investing at unfavorable times.

- Tax-Free Growth:With a Roth IRA, your contributions grow tax-free, meaning you won’t have to pay taxes on withdrawals in retirement.

Making Contributions Throughout the Year

Rather than contributing a lump sum at the end of the year, consider making regular contributions throughout the year. This strategy can help you:

- Avoid a Large Financial Burden:Spreading contributions out can make it easier to manage your finances and avoid a large financial burden at the end of the year.

- Take Advantage of Market Fluctuations:By contributing regularly, you can buy more shares when prices are low and fewer shares when prices are high, potentially leading to higher returns.

- Build a Consistent Savings Habit:Regular contributions help establish a consistent savings habit, making it easier to stick to your retirement goals.

Tax Implications

Roth IRA contributions are treated differently for tax purposes than traditional IRA contributions. Understanding these differences is crucial for making informed decisions about retirement savings.

Tax Treatment of Roth IRA Contributions

Roth IRA contributions are made with after-tax dollars. This means that you’ve already paid taxes on the money you contribute to your Roth IRA. As a result, you won’t have to pay taxes on the money you withdraw in retirement.

Are you self-employed and planning to contribute to an IRA in 2024? Find out the maximum contribution limits for self-employed individuals and make the most of your retirement savings plan.

Roth IRA contributions are made with after-tax dollars, so you won’t have to pay taxes on withdrawals in retirement.

Tax Advantages of Roth IRAs During Retirement

The tax-free withdrawals in retirement make Roth IRAs a popular choice for many individuals.

- Tax-free withdrawals in retirement:You can withdraw your contributions and earnings tax-free in retirement, providing significant tax savings.

- Predictable retirement income:You can accurately estimate your retirement income without worrying about taxes.

- Flexibility in retirement:You can withdraw your contributions at any time, tax-free and penalty-free, unlike traditional IRAs, which have early withdrawal penalties.

Comparison with Traditional IRA Contributions

Traditional IRA contributions are made with pre-tax dollars. This means you receive a tax deduction for your contributions in the year you make them, but you’ll have to pay taxes on your withdrawals in retirement.

Thinking about contributing to an IRA in 2024? Learn about the IRA contribution limits for 2024 and start planning your retirement savings strategy.

| Feature | Roth IRA | Traditional IRA |

|---|---|---|

| Contribution Type | After-tax | Pre-tax |

| Tax Treatment of Contributions | No tax deduction | Tax deduction |

| Tax Treatment of Withdrawals | Tax-free | Taxable |

Traditional IRA contributions are made with pre-tax dollars, resulting in a tax deduction but taxable withdrawals in retirement.

Considerations for Retirement Planning

Retirement planning is a crucial aspect of financial well-being, ensuring a comfortable and fulfilling life after leaving the workforce. A well-structured retirement plan considers various factors and establishes a clear path toward achieving financial goals.

Ready to boost your retirement savings? Find out how much you can contribute to your 401(k) in 2024 and start planning your financial future.

Key Factors in Retirement Planning

Retirement planning involves considering various factors that influence financial security and lifestyle choices. These factors are interconnected and should be carefully assessed to create a comprehensive plan.

The deadline for filing your W9 Form for October 2024 is approaching! Make sure you meet the deadline to avoid any potential tax penalties.

| Factor | Description |

|---|---|

| Age | Your current age and the number of years until retirement are critical in determining your savings timeline and investment strategy. The younger you are, the longer you have to save, allowing for greater potential growth. |

| Income | Your current income and anticipated future earnings play a significant role in determining your potential retirement savings. Higher income allows for greater contributions to retirement accounts, accelerating savings growth. |

| Expenses | Anticipating your retirement expenses is crucial for setting realistic savings goals. Consider housing costs, healthcare, travel, leisure activities, and other potential expenses. |

| Savings Goals | Establish clear and measurable savings goals based on your desired retirement lifestyle and anticipated expenses. This will provide a target for your savings efforts. |

Role of Roth IRAs in Retirement Planning

Roth IRAs play a valuable role in a comprehensive retirement plan, offering several advantages:

- Tax-Free Withdrawals in Retirement:Contributions to a Roth IRA grow tax-deferred, and withdrawals in retirement are tax-free, providing a significant tax advantage.

- Flexibility:Roth IRAs offer flexibility in investment options, allowing you to choose from a wide range of investments to suit your risk tolerance and financial goals.

- Potential for Growth:Earnings within a Roth IRA grow tax-free, maximizing the potential for long-term wealth accumulation.

- Early Withdrawal Options:Under certain circumstances, you can withdraw contributions to a Roth IRA before age 59 1/2 without penalty, offering flexibility in case of unexpected expenses.

Resources and Additional Information: Roth IRA Contribution Limits For 2024

You might want to explore additional resources to gain a deeper understanding of Roth IRAs and retirement planning. These resources can provide detailed information on specific aspects of Roth IRAs, eligibility requirements, contribution limits, and other relevant topics.

If you’re a small business owner, you might be wondering about the 401(k) contribution limits for your employees in 2024. This article provides a breakdown of the limits for both employees and employers, helping you make informed decisions for your business.

Official Government Websites

The following government websites provide authoritative information on Roth IRAs:

- Internal Revenue Service (IRS):The IRS website offers comprehensive information on Roth IRAs, including publications, forms, and frequently asked questions. It is a reliable source for official guidance on tax-related matters.

- U.S. Department of Labor:The Department of Labor website provides resources on retirement planning, including information on Roth IRAs and other retirement savings options.

Financial Institutions

Financial institutions, such as banks and brokerage firms, offer a wide range of retirement planning services, including Roth IRA accounts. You can consult with these institutions to learn more about their specific Roth IRA offerings and how to open an account.

- Banks:Many banks offer Roth IRA accounts as part of their investment services. They can provide guidance on opening an account, making contributions, and managing your investments.

- Brokerage Firms:Brokerage firms specialize in investment services and offer a variety of Roth IRA options. They can provide assistance with investment strategies, portfolio management, and account management.

Retirement Planning Resources

There are numerous online resources dedicated to retirement planning. These websites provide information on various aspects of retirement, including Roth IRAs, investment strategies, and financial planning tools.

- Financial Planning Websites:Websites like NerdWallet, Investopedia, and Bankrate offer articles, calculators, and tools to help you plan for retirement. They provide insights into different retirement savings options, including Roth IRAs.

- Retirement Planning Books and Articles:Many books and articles are available on retirement planning, covering topics such as Roth IRAs, investment strategies, and estate planning. You can find these resources at libraries, bookstores, and online.

Last Point

Navigating Roth IRA contribution limits in 2024 requires careful consideration of your individual circumstances and financial goals. By understanding the intricacies of eligibility, contribution strategies, and tax implications, you can make informed decisions to maximize your retirement savings potential. Remember to consult with a financial advisor to tailor a plan that aligns with your unique needs and aspirations.

Expert Answers

What happens if I contribute more than the Roth IRA limit for 2024?

Contributing more than the limit will result in an excess contribution penalty. You’ll need to withdraw the excess amount, along with any earnings, to avoid penalties.

Can I contribute to both a Roth IRA and a traditional IRA in 2024?

Yes, you can contribute to both, but the total contribution amount cannot exceed the annual limit for either type of IRA.

Can I change my mind and convert a traditional IRA to a Roth IRA after contributing?

Yes, you can convert a traditional IRA to a Roth IRA, but this may trigger taxable income in the year of conversion.