What happens if I exceed the Roth IRA contribution limit in 2024? This question might arise for those who are diligently saving for retirement and want to maximize their contributions. While the Roth IRA offers tax-free withdrawals in retirement, exceeding the annual contribution limit can lead to unexpected consequences.

Understanding these implications is crucial to ensure you don’t face penalties and maintain your retirement savings strategy.

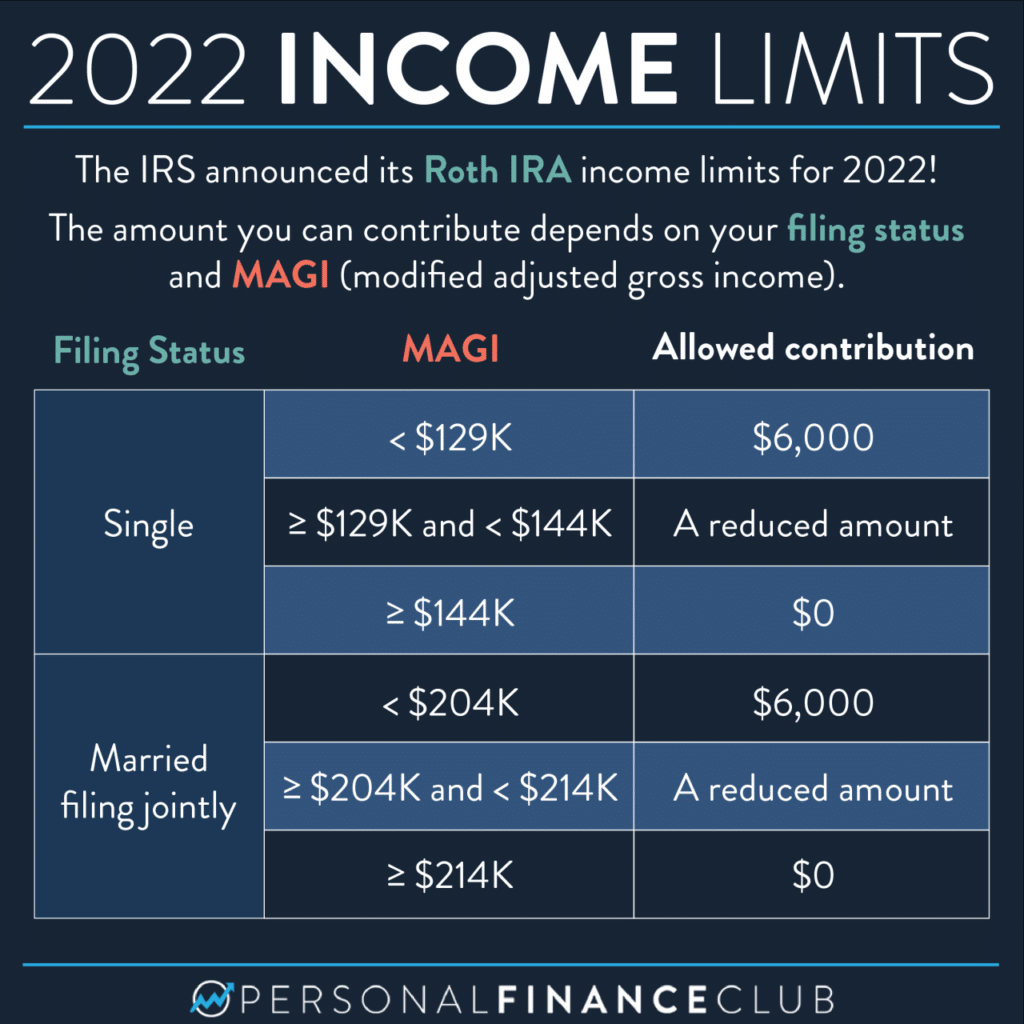

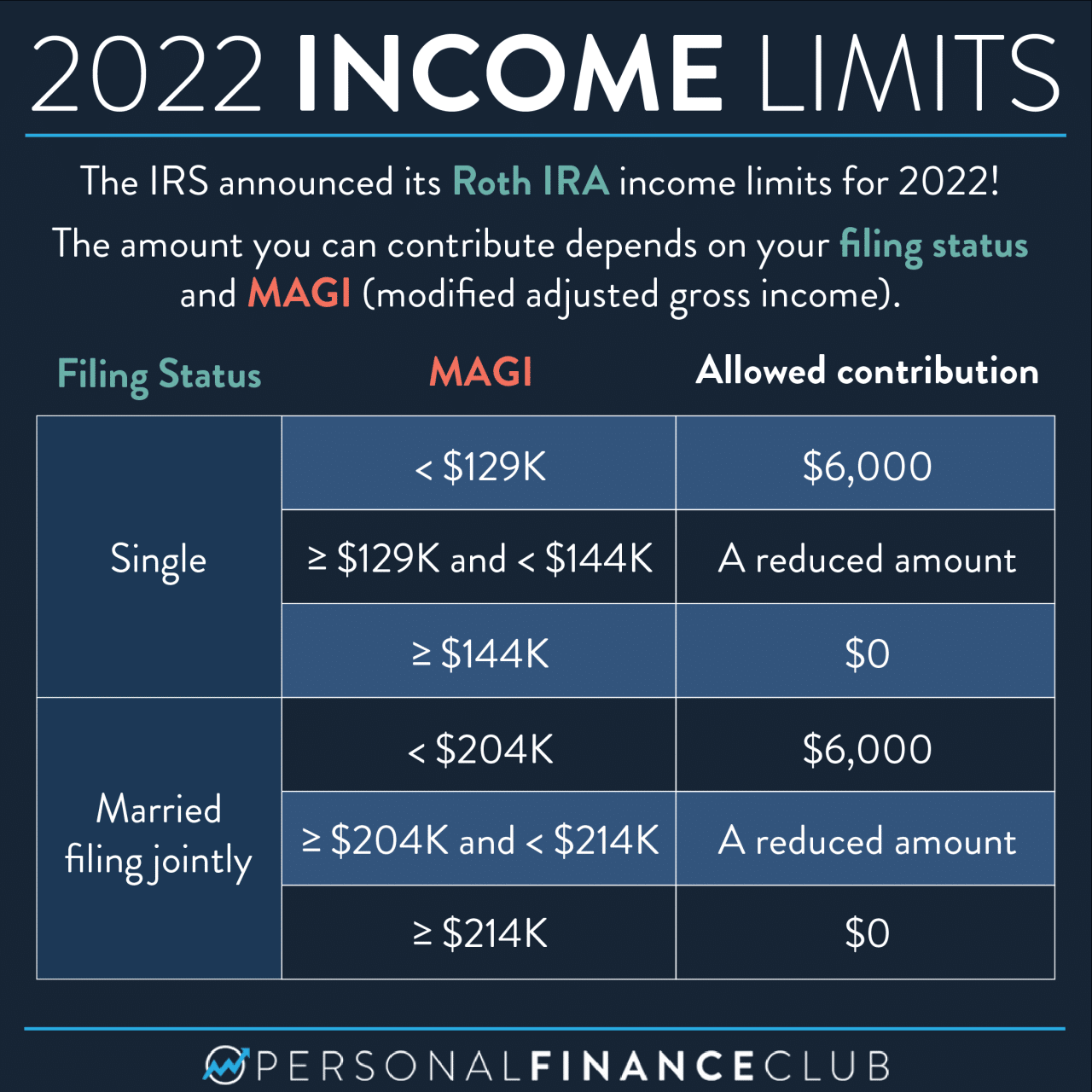

The Roth IRA contribution limit for 2024 is set at $6,500 for individuals under 50 and $7,500 for those 50 and older. Exceeding this limit can result in penalties, and your excess contributions might be subject to taxes. Let’s delve into the details and explore the best ways to navigate this potential scenario.

Contents List

Roth IRA Contribution Limit in 2024: What Happens If I Exceed The Roth IRA Contribution Limit In 2024

The Roth IRA contribution limit for 2024 is $6,500 for individuals under the age of 50. Individuals who are 50 or older can contribute an additional $1,000, bringing their total contribution limit to $7,500. These limits apply to both traditional and Roth IRAs.If you exceed the Roth IRA contribution limit, you may be subject to a penalty.

It’s a good idea to stay informed about changes in tax brackets. The tax bracket changes for 2024 vs. 2023 can be found here: Tax bracket changes for 2024 vs 2023. This information can help you understand how your tax liability might change.

The penalty is a 6% excise tax on the amount of the excess contribution. This penalty applies to the entire amount of the excess contribution, not just the amount that exceeds the limit.

There are different 401k contribution limits based on your age. To find out what the 401k contribution limits for 2024 are by age, you can check out this link: 401k contribution limits for 2024 by age. This information can help you make the most of your retirement savings.

Scenarios of Exceeding the Limit

Exceeding the Roth IRA contribution limit can happen in various situations. Here are some examples:

- You may accidentally contribute more than the limit if you are not aware of the current contribution limit.

- You may contribute more than the limit if you are trying to maximize your retirement savings and are not aware of the limits.

If you’re filling out a W9 form for October 2024, you can find helpful information on how to fill it out correctly here: How to fill out W9 Form for October 2024. Completing the form accurately is important for tax purposes.

- You may contribute more than the limit if you are receiving a large sum of money, such as a bonus or inheritance, and want to invest it in a Roth IRA.

Consequences of Exceeding the Limit

If you exceed the Roth IRA contribution limit for 2024, the IRS will consider the excess contributions as a tax-ineligible contribution. This means that you will be subject to penalties and may need to take steps to rectify the situation.

Need to know when you can file your taxes for October 2024? The tax deadline extension for October 2024 is usually on October 15th. When is the tax deadline extension for October 2024 You can find more information on the IRS website.

Tax Penalties

The IRS imposes a 6% excise tax on excess contributions to a Roth IRA. This penalty applies to the amount of the excess contribution each year, and it is calculated on the amount that was over the limit. For example, if you contribute $7,000 to your Roth IRA in 2024, and the limit is $6,500, you will be penalized on $500 (the excess contribution).

Planning your taxes for October 2024? Knowing the tax brackets is important. The 2024 tax brackets for married filing separately can be found here: 2024 tax brackets for married filing separately. It’s important to review the tax brackets and make sure you’re filing correctly.

Treatment of Excess Contributions for Tax Purposes

Excess Roth IRA contributions are treated differently for tax purposes depending on whether you withdraw them or not.

Foreign entities often need to fill out a W9 form for tax purposes. If you’re a foreign entity filing in October 2024, you can find more information about the W9 form here: W9 Form October 2024 for foreign entities.

Make sure to fill out the form accurately and completely.

- Withdraw Excess Contributions: If you withdraw excess contributions, you can do so tax-free and penalty-free. This means you can avoid the 6% excise tax penalty and the income tax that would have been applied if you had left the excess contributions in the account.

Did you know that the mileage reimbursement rate can change throughout the year? If you need to know the mileage reimbursement rate for October 2024, you can find it here: What is the mileage reimbursement rate for October 2024?

It’s helpful to keep track of these rates for your records.

- Do Not Withdraw Excess Contributions: If you do not withdraw the excess contributions, they will be treated as a regular contribution to the Roth IRA, but they will be subject to the 6% excise tax penalty. This means that you will pay the penalty each year until you withdraw the excess contributions.

If you’re claiming medical expenses, you might need to know the mileage rate for October 2024. You can find the mileage rate for medical expenses for October 2024 here: October 2024 mileage rate for medical expenses. It’s important to keep track of your mileage for tax purposes.

Withdraw Excess Contributions to Avoid Penalties

You can avoid the 6% excise tax penalty by withdrawing the excess contributions from your Roth IRA. You can withdraw the excess contributions at any time, but it is best to do so as soon as possible to avoid paying the penalty for multiple years.

Rectifying Excess Contributions

Don’t panic if you realize you’ve overcontributed to your Roth IRA. The IRS allows you to withdraw excess contributions, including earnings, to avoid penalties. This process helps you stay compliant and minimize potential tax liabilities.

Tax laws are always changing. If you’re wondering about any tax changes impacting the October 2024 deadline, you can find more information here: Tax changes impacting the October 2024 deadline. It’s always a good idea to stay up-to-date on tax regulations.

Withdrawing Excess Contributions

You can withdraw excess contributions from your Roth IRA to correct the overcontribution. This withdrawal should include any earnings attributed to the excess contribution. The process involves contacting your IRA custodian and requesting the withdrawal. They will guide you through the necessary paperwork and procedures.

It’s important to know how to file your taxes correctly and on time. You can find helpful information about how to file taxes by the October 2024 deadline here: How to file taxes by the October 2024 deadline.

Take advantage of the resources available to make sure you’re prepared.

Timeframe for Withdrawing Excess Contributions

To avoid penalties, you must withdraw excess contributions, including earnings, by the tax filing deadline for the year following the year of the overcontribution. This deadline includes extensions. For example, if you overcontributed in 2024, you must withdraw the excess contributions by April 15, 2025 (including extensions).

The standard deduction can vary each year. If you’re wondering how much the standard deduction is in 2024, you can find the answer here: How much is the standard deduction in 2024. This information is important when filing your taxes.

Tax Implications of Withdrawing Excess Contributions

The good news is that withdrawing excess contributions from a Roth IRA is tax-free. This means you won’t have to pay any taxes on the amount you withdraw. However, any earnings on the excess contributions are taxable. These earnings are taxed as ordinary income in the year of withdrawal.

Don’t forget about the tax deadline for October 2024! You can find out what the deadline is here: What is the tax deadline for October 2024. Make sure you file your taxes on time to avoid penalties.

Example:If you overcontributed $2,000 to your Roth IRA in 2024 and earned $100 in interest on the excess contribution, you would need to withdraw $2,100 by April 15, 2025. The $2,000 excess contribution is tax-free, but the $100 in earnings is taxable as ordinary income.

Alternative Strategies for Saving

If you’ve maxed out your Roth IRA contribution for the year and still want to save for retirement, there are other options available. You can explore alternative retirement savings options like traditional IRAs, 401(k)s, or even taxable investment accounts.

Each has its own advantages and disadvantages, so it’s important to carefully consider your individual circumstances before making a decision.

Are you a part-time worker? The IRA contribution limits for 2024 for part-time workers can be found here: IRA contribution limits for 2024 for part-time workers. Knowing these limits can help you plan your retirement savings.

Traditional IRA, What happens if I exceed the Roth IRA contribution limit in 2024

A traditional IRA is another retirement savings account that offers tax advantages. Contributions to a traditional IRA are tax-deductible, which means you can reduce your taxable income in the year you make the contribution. However, you’ll need to pay taxes on the distributions in retirement.

Advantages

- Tax-deductible contributions: You can deduct your contributions from your taxable income, reducing your tax liability in the present.

- Tax-deferred growth: Earnings on your investments grow tax-deferred, meaning you won’t owe taxes on them until you withdraw the money in retirement.

- Flexibility: You can choose to contribute to a traditional IRA even if you don’t have a 401(k) plan through your employer.

Disadvantages

- Taxable withdrawals in retirement: You’ll need to pay taxes on your withdrawals in retirement.

- Income limitations: There are income limitations for deducting traditional IRA contributions, so you may not be eligible if your income is too high.

- Required minimum distributions (RMDs): You’ll need to start taking required minimum distributions from your traditional IRA after age 72.

401(k)

A 401(k) is a retirement savings plan offered by your employer. You can contribute pre-tax dollars to a 401(k), reducing your taxable income in the present. Your contributions grow tax-deferred, and you won’t owe taxes on them until you withdraw the money in retirement.

Saving for retirement is important, and IRA contributions can help you reach your goals. If you’re over 50, you can find the IRA contribution limits for 2024 here: IRA contribution limits for 2024 for those over 50. Knowing these limits can help you maximize your contributions.

Advantages

- Tax-deductible contributions: You can deduct your contributions from your taxable income, reducing your tax liability in the present.

- Tax-deferred growth: Earnings on your investments grow tax-deferred, meaning you won’t owe taxes on them until you withdraw the money in retirement.

- Employer matching: Many employers offer matching contributions to their employees’ 401(k) plans, which can significantly boost your retirement savings.

Disadvantages

- Limited investment options: The investment options available in a 401(k) plan are typically limited to those offered by your employer.

- Potential for employer stock: Some 401(k) plans may invest heavily in employer stock, which can be risky if the company’s performance declines.

- Vesting schedule: Your employer’s matching contributions may be subject to a vesting schedule, meaning you may not own all of them until you’ve worked for the company for a certain amount of time.

Taxable Investment Accounts

If you’ve already maxed out your Roth IRA and 401(k) contributions, you can consider investing in a taxable investment account. These accounts don’t offer any tax advantages, but they provide you with more investment flexibility.

Advantages

- Investment flexibility: You can invest in a wide range of assets, including stocks, bonds, mutual funds, and ETFs.

- No contribution limits: There are no limits on how much you can contribute to a taxable investment account.

- Early withdrawals: You can withdraw your investments at any time, although you may have to pay capital gains taxes on any profits.

Disadvantages

- Taxable growth: You’ll need to pay taxes on any capital gains or dividends you earn on your investments.

- No tax deductions: You can’t deduct your contributions from your taxable income.

- Potential for higher taxes: You may end up paying higher taxes on your investments than you would if you had invested in a tax-advantaged account.

Impact on Future Contributions

Exceeding the Roth IRA contribution limit in one year can have implications for your future contributions. While it doesn’t permanently disqualify you from contributing to a Roth IRA, it might affect how much you can contribute in subsequent years.

Are you planning on contributing to your 401k in 2024? The contribution limits for 2024 are different than in 2023. You can find the 401k contribution limits for 2024 vs. 2023 here: 401k contribution limits 2024 vs 2023.

It’s good to be aware of the changes so you can plan accordingly.

Potential Limitations on Future Contributions

The IRS has a specific rule regarding exceeding the Roth IRA contribution limit. If you overcontribute, you’ll be subject to a 6% penalty on the excess amount. This penalty is calculated annually on the excess contribution until it’s removed from the account.

Furthermore, exceeding the limit in one year doesn’t mean you can’t contribute to a Roth IRA in the future. However, it might affect your ability to contribute the full amount in subsequent years. For example, if you overcontributed in 2024, you might not be able to contribute the full amount in 2025.

You’ll need to account for the excess amount from the previous year when determining your contribution limit for the current year.

Avoiding Exceeding the Limit in Future Years

To avoid exceeding the Roth IRA contribution limit in the future, it’s crucial to stay informed about the annual contribution limit. The IRS typically announces the annual contribution limit for the upcoming year in the fall of the previous year.

You can find this information on the IRS website or consult a financial advisor.Keep track of your contributions throughout the year. Use a spreadsheet or a financial tracking app to monitor your contributions and ensure you stay within the limit.

If you’re unsure about your contribution limit or have any questions, consult a financial advisor.

Last Point

Navigating the Roth IRA contribution limit can be a complex process, but understanding the potential consequences of exceeding the limit is essential. By carefully planning your contributions, considering alternative savings options, and addressing any excess contributions promptly, you can safeguard your retirement savings and ensure you’re on track for a financially secure future.

Detailed FAQs

What happens if I accidentally exceed the Roth IRA contribution limit?

If you exceed the Roth IRA contribution limit, the IRS may impose a penalty on the excess contributions. This penalty is typically 6% of the excess amount. You can avoid this penalty by withdrawing the excess contributions, including earnings, before the tax filing deadline for the year in which the excess contributions were made.

Can I withdraw excess contributions from a Roth IRA tax-free?

Yes, you can withdraw excess contributions from a Roth IRA tax-free and penalty-free, but you’ll also need to withdraw any earnings on those contributions. It’s important to remember that you’ll only be able to withdraw the excess contributions, not the earnings, tax-free.

Any earnings withdrawn will be subject to ordinary income tax rates.

What if I don’t have enough money to withdraw the excess contributions?

If you can’t afford to withdraw the excess contributions, you may have to pay the penalty. However, you can request a waiver from the IRS if you can demonstrate that the excess contribution was due to reasonable error. It’s important to note that this waiver is not guaranteed and requires documentation to support your claim.

Can I avoid the penalty by simply waiting until next year to withdraw the excess contributions?

No, you must withdraw the excess contributions before the tax filing deadline for the year in which the excess contributions were made to avoid the penalty. Waiting until next year will not prevent the penalty from being assessed.