Is there a catch-up contribution limit for Roth IRAs in 2024? The answer is yes, and it’s a valuable tool for those nearing retirement. If you’re 50 or older, you can contribute an extra amount to your Roth IRA, potentially boosting your retirement savings significantly.

This extra contribution allows you to catch up on your retirement savings, especially if you started contributing later in life or had periods where you couldn’t save as much.

Understanding the catch-up contribution limit is crucial for anyone approaching retirement. This extra contribution provides a valuable opportunity to maximize your retirement savings and enjoy tax-free withdrawals in retirement. In this guide, we’ll delve into the intricacies of catch-up contributions, covering eligibility, contribution limits, and tax implications.

Contents List

- 1 Roth IRA Catch-Up Contributions

- 2 Understanding the Catch-Up Contribution Limit: Is There A Catch-up Contribution Limit For Roth IRAs In 2024

- 3 Catch-Up Contributions and Tax Implications

- 4 Strategies for Maximizing Catch-Up Contributions

- 5 The Importance of Catch-Up Contributions

- 6 Final Review

- 7 User Queries

Roth IRA Catch-Up Contributions

Retirement planning often involves saving for the future, and Roth IRAs offer a valuable tool for tax-free withdrawals in retirement. However, individuals who start saving later in life might need an extra boost to reach their retirement goals. This is where Roth IRA catch-up contributions come in.

Tax brackets can shift from year to year, so it’s good to stay updated. You can find information on the tax bracket changes for 2024 to see how your income will be affected.

Catch-Up Contributions Explained

Catch-up contributions are an additional amount that eligible individuals can contribute to their Roth IRA beyond the regular annual limit. These contributions are designed to help individuals who are 50 years of age or older catch up on their retirement savings.

You can contribute a certain amount to your IRA each year. The IRA contribution limits for 2024 are a good starting point for your retirement savings.

Eligibility Criteria for Catch-Up Contributions

Individuals who are 50 years of age or older by the end of the tax year are eligible to make catch-up contributions to their Roth IRAs. The catch-up contribution amount is added to the regular annual contribution limit.

If you’re married filing separately, the Roth IRA contribution limit might be different for you. The Roth IRA contribution limit for 2024 for married filing separately is specific to this filing status.

Annual Contribution Limits for Roth IRAs in 2024

The annual contribution limit for Roth IRAs in 2024 is $6,500 for individuals under 50 years of age. Individuals aged 50 and older can contribute an additional $1,000 in catch-up contributions, bringing their total annual contribution limit to $7,500.

If you’re participating in a SIMPLE IRA, you’ll want to be aware of the contribution limits for 2024. The IRA contribution limits for SIMPLE IRA in 2024 are different from traditional IRAs, so it’s important to know the specifics.

“The contribution limit for Roth IRAs in 2024 is $6,500 for individuals under 50 years of age, and $7,500 for those 50 and older.”

Don’t miss the October 2024 deadline for filing your taxes! There are tax penalties for missing the October 2024 deadline , so make sure you get your paperwork in on time.

Understanding the Catch-Up Contribution Limit: Is There A Catch-up Contribution Limit For Roth IRAs In 2024

The catch-up contribution limit allows individuals aged 50 and older to contribute an additional amount to their retirement accounts, such as Roth IRAs, beyond the regular contribution limit. This allows older individuals to accelerate their retirement savings and potentially accumulate a larger nest egg.

Foreign entities have specific requirements for filing W9 forms. The W9 Form October 2024 for foreign entities deadline is something to keep in mind for international businesses.

Catch-Up Contribution Limit Explained

The catch-up contribution limit is an additional amount that individuals aged 50 and above can contribute to their retirement accounts. This limit is separate from the regular contribution limit, which applies to all individuals, regardless of age. The catch-up contribution limit is designed to help older individuals make up for lost time in saving for retirement.

Freelancers have a different tax deadline than traditional employees. The October 2024 tax deadline for freelancers is something to keep in mind as you manage your finances.

The catch-up contribution limit for Roth IRAs in 2024 is $1,000.

The standard deduction is a valuable tax break, and seniors may be eligible for a higher amount. Check out the standard deduction for seniors in 2024 to see if you qualify.

This means that individuals aged 50 and above can contribute up to $7,500 to their Roth IRA in 2024 ($6,500 regular contribution limit + $1,000 catch-up contribution limit).

If you’re a small business owner, you might have different contribution limits for your 401k. The 401k contribution limits for 2024 for small business owners can be found online.

Comparison with Regular Contribution Limit

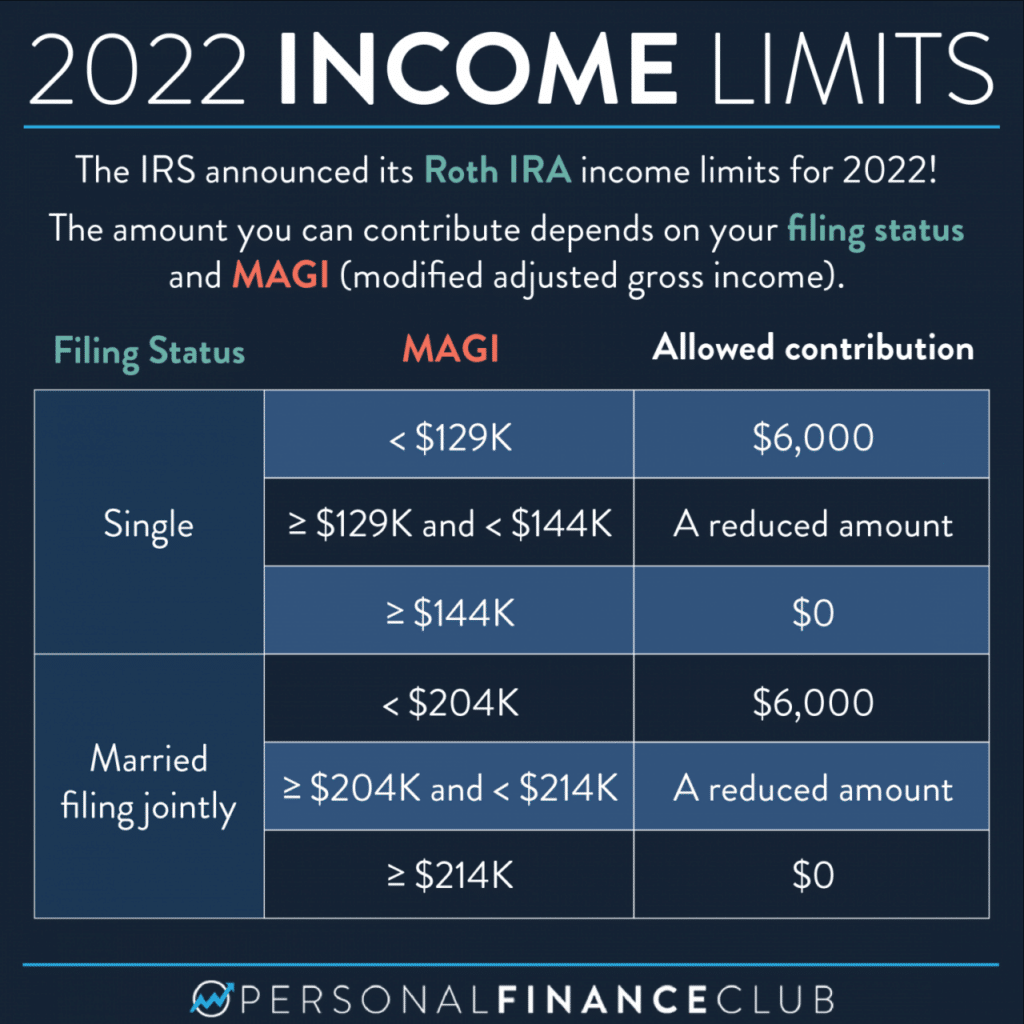

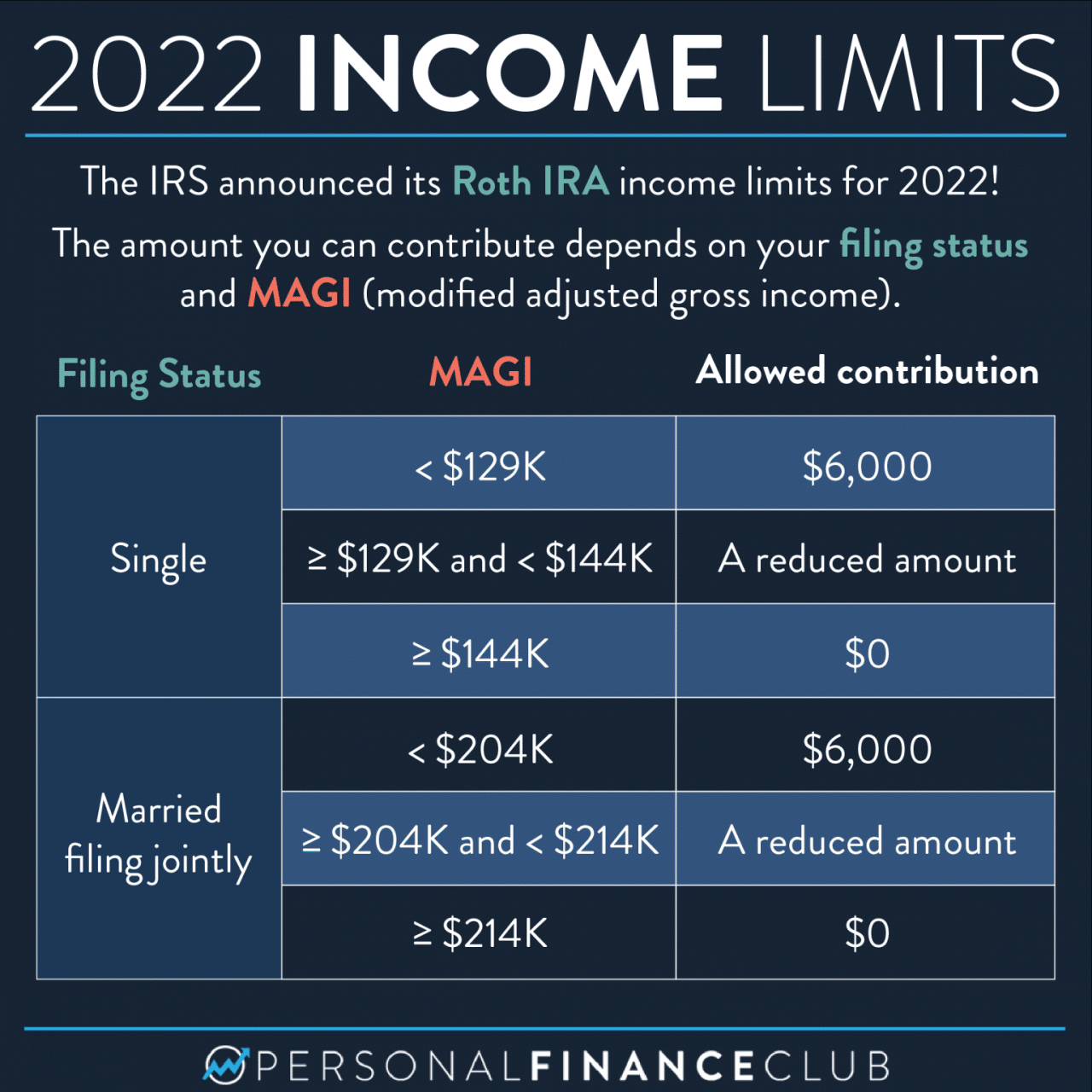

The regular contribution limit for Roth IRAs in 2024 is $6,500. This limit applies to all individuals, regardless of age. However, individuals aged 50 and above can take advantage of the catch-up contribution limit, which allows them to contribute an additional $1,000 to their Roth IRA.The following table summarizes the contribution limits for Roth IRAs in 2024:

| Age | Regular Contribution Limit | Catch-Up Contribution Limit | Total Contribution Limit |

|---|---|---|---|

| Under 50 | $6,500 | $0 | $6,500 |

| 50 and Over | $6,500 | $1,000 | $7,500 |

It’s important to note that the catch-up contribution limit is only available to individuals who are 50 years of age or older. Individuals under the age of 50 cannot contribute more than the regular contribution limit, which is $6,500 in 2024.

Catch-Up Contributions and Tax Implications

Catch-up contributions for Roth IRAs offer a valuable opportunity for individuals aged 50 and over to boost their retirement savings. While these contributions provide tax benefits, it’s crucial to understand their tax implications.

The standard deduction is a valuable tax break. The standard deduction for married filing separately in 2024 might be different from other filing statuses, so be sure to check.

Tax Treatment of Contributions and Withdrawals

Catch-up contributions to Roth IRAs are made with after-tax dollars. This means you’ve already paid taxes on the money you contribute. The benefit lies in the tax-free growth and withdrawals in retirement.

- Contributions:Contributions to a Roth IRA are not tax-deductible. This means you don’t receive a tax break for making contributions. However, your contributions grow tax-free, and withdrawals in retirement are also tax-free.

- Withdrawals:Withdrawals from a Roth IRA in retirement are tax-free and penalty-free, provided you meet the five-year holding period requirement and are at least 59 1/2 years old. This tax-free nature of withdrawals is a significant advantage of Roth IRAs compared to traditional IRAs, where withdrawals are taxed in retirement.

Planning to contribute to a Roth 401k? The contribution limit for Roth 401k plans in 2024 is important to know before you start saving.

Tax Benefits of Catch-Up Contributions

Catch-up contributions can offer substantial tax benefits by accelerating retirement savings and maximizing tax-free growth.

Self-employed individuals have different contribution limits for their IRAs. The IRA contribution limits for self-employed in 2024 are important to understand for your retirement planning.

- Tax-Free Growth:Catch-up contributions, like all Roth IRA contributions, grow tax-free. This means you won’t have to pay taxes on the earnings generated within the account.

- Tax-Free Withdrawals:When you withdraw money from your Roth IRA in retirement, the withdrawals are tax-free, assuming you meet the eligibility requirements. This allows you to enjoy your retirement savings without worrying about tax liabilities.

- Potential for Lower Tax Liability in Retirement:Catch-up contributions can help reduce your overall tax liability in retirement by increasing the amount of tax-free income you have available. This can be particularly beneficial if you expect to be in a higher tax bracket in retirement.

Strategies for Maximizing Catch-Up Contributions

Maximizing Roth IRA catch-up contributions can significantly boost your retirement savings. By strategically utilizing these extra contributions, you can potentially accumulate a larger nest egg and enjoy tax-free withdrawals in retirement.

Factors to Consider When Determining Contribution Amounts

When determining how much to contribute to your Roth IRA each year, several factors should be considered:

- Your income:If your income is higher than the contribution limit for a traditional IRA, a Roth IRA may be a better option, especially if you expect to be in a higher tax bracket in retirement.

- Your age:Catch-up contributions are available to individuals aged 50 and over, so if you are in this age group, consider taking advantage of this opportunity to maximize your contributions.

- Your retirement goals:The amount you contribute to your Roth IRA should align with your retirement goals. If you have ambitious retirement goals, consider contributing the maximum amount possible, including catch-up contributions.

- Your risk tolerance:Since Roth IRA contributions are made with after-tax dollars, there is no tax deduction for these contributions. However, qualified withdrawals in retirement are tax-free. If you are risk-averse, a Roth IRA may be a suitable choice.

Comparing Different Contribution Strategies

Here’s a comparison of different contribution strategies, highlighting their advantages and disadvantages:

| Contribution Strategy | Advantages | Disadvantages |

|---|---|---|

| Contribute the Maximum Catch-Up Contribution | Maximizes retirement savings potential, potentially leading to a larger nest egg. | May require significant financial resources, especially if you have other financial obligations. |

| Contribute a Portion of the Catch-Up Contribution | Allows for a more manageable contribution amount, balancing retirement savings with other financial goals. | May result in a smaller retirement nest egg compared to contributing the maximum. |

| Contribute to Other Retirement Accounts | Diversifies retirement savings, potentially leading to a more balanced portfolio. | May not maximize the benefits of Roth IRA catch-up contributions. |

The Importance of Catch-Up Contributions

Catch-up contributions can be a powerful tool for boosting your retirement savings, especially if you’re in your later working years. They allow you to contribute more to your Roth IRA each year, potentially leading to a significantly larger nest egg.

You can contribute a certain amount to your 401k each year. The contribution limit for 401k plans in 2024 has been set, so you can start planning your retirement savings strategy.

The Potential Impact of Catch-Up Contributions on Retirement Savings

Catch-up contributions can significantly impact your retirement savings, especially as you approach retirement. Let’s look at an example:

Assume you’re 50 years old and contribute the maximum $6,500 to your Roth IRA each year. If you also make the catch-up contribution of $1,000, your total annual contribution will be $7,500.

If you continue contributing at this rate for the next 15 years until retirement, your total contributions will be $112,500. Assuming an average annual return of 7%, your account balance at retirement would be approximately $240,000. This is a significant increase compared to contributing only the regular limit, which would result in a balance of around $178,000 at retirement.

Want to know how much you can sock away for retirement in 2024? The contribution limit for 401k plans in 2024 has been updated, so check it out to see how much you can contribute.

This illustrates the potential power of catch-up contributions in building a substantial retirement nest egg.

Growth of Catch-Up Contributions Over Time, Is there a catch-up contribution limit for Roth IRAs in 2024

Here’s a table illustrating the growth of catch-up contributions over time, assuming an average annual return of 7%:| Year | Catch-Up Contribution | Total Contributions | Account Balance ||—|—|—|—|| 1 | $1,000 | $1,000 | $1,000 || 2 | $1,000 | $2,000 | $2,140 || 3 | $1,000 | $3,000 | $3,308 || 4 | $1,000 | $4,000 | $4,514 || 5 | $1,000 | $5,000 | $5,766 || 6 | $1,000 | $6,000 | $7,067 || 7 | $1,000 | $7,000 | $8,418 || 8 | $1,000 | $8,000 | $9,821 || 9 | $1,000 | $9,000 | $11,280 || 10 | $1,000 | $10,000 | $12,800 || 11 | $1,000 | $11,000 | $14,384 || 12 | $1,000 | $12,000 | $16,035 || 13 | $1,000 | $13,000 | $17,757 || 14 | $1,000 | $14,000 | $19,555 || 15 | $1,000 | $15,000 | $21,432 |As you can see, the power of compounding works in your favor over time, allowing your catch-up contributions to grow significantly.

How Catch-Up Contributions Can Help Bridge the Retirement Savings Gap

Many individuals find themselves facing a retirement savings gap, meaning they may not have enough saved to meet their financial needs in retirement. Catch-up contributions can play a crucial role in bridging this gap. By contributing more in your later years, you can accelerate your savings and potentially reach your retirement goals.

For example, if you’re 55 and have only $50,000 saved for retirement, you may be significantly behind your goal. Catch-up contributions can help you catch up and potentially reach your retirement savings goals by allowing you to contribute more each year and take advantage of the power of compounding.

If you’re over 50, you can contribute more to your IRA than younger folks. The IRA contribution limits for 2024 for those over 50 are higher, giving you a chance to catch up on retirement savings.

Final Review

While catch-up contributions can be a powerful tool for retirement planning, it’s essential to remember that they are not a magic bullet. It’s crucial to develop a comprehensive retirement savings strategy that considers your individual circumstances and goals. By understanding the benefits and limitations of catch-up contributions, you can make informed decisions about your retirement savings and ensure a more secure financial future.

User Queries

Can I contribute to a Roth IRA and a traditional IRA in the same year?

Yes, you can contribute to both a Roth IRA and a traditional IRA in the same year, as long as you meet the eligibility requirements for both. However, you may have to consider the income limitations for Roth IRA contributions.

Can I contribute to a Roth IRA if I already have a 401(k)?

Yes, you can contribute to both a Roth IRA and a 401(k) in the same year, as long as you meet the contribution limits for both. This can be a great way to diversify your retirement savings.

What happens to my Roth IRA catch-up contributions if I withdraw them before age 59 1/2?

Withdrawals from a Roth IRA before age 59 1/2 are generally subject to taxes and a 10% penalty. However, withdrawals of contributions, including catch-up contributions, are always tax-free and penalty-free.