How do Roth IRA contribution limits affect my taxes in 2024? This is a question on the minds of many Americans, especially those looking to secure a comfortable retirement. Understanding how Roth IRA contribution limits work is crucial for maximizing your tax savings and ensuring you’re on the right track to financial freedom.

This guide will explore the ins and outs of Roth IRA contribution limits in 2024, providing insights into how they affect your tax liability and how you can optimize your contributions to achieve your financial goals.

The Roth IRA offers a unique opportunity to grow your retirement savings tax-free, but there are limits to how much you can contribute each year. These limits are set by the IRS and can change annually. Knowing these limits is essential to avoid exceeding them and potentially facing penalties.

This guide will delve into the specifics of these limits, their impact on your taxes, and the strategies you can use to maximize your contributions within the allowed parameters.

Contents List

Understanding Roth IRA Contribution Limits

The Roth IRA contribution limit is an important factor to consider when planning your retirement savings strategy. This limit, set by the IRS, determines the maximum amount you can contribute to your Roth IRA each year. Understanding how this limit affects your taxes and your savings strategy is crucial.

If you’re over 50, you can contribute more to your IRA than someone younger. The catch-up contribution limit for 2024 is an extra $1,500, so you can contribute up to $7,500. This can be a great way to boost your retirement savings.

To learn more about IRA contribution limits for those over 50, check out this article: IRA contribution limits for 2024 for those over 50.

Contribution Limits for 2024

The 2024 Roth IRA contribution limit is the maximum amount that individuals can contribute to their Roth IRA accounts in a given year. This limit applies to all individuals, regardless of their income level.

If you have income from rental properties, you’ll need to report this income on your taxes. There are different tax rules and deductions that apply to rental income, and it can be complicated to calculate your tax liability. To help you with this, you can use a tax calculator specifically designed for income from rental properties.

Check out this article to find a tax calculator for income from rental properties: Tax calculator for income from rental properties in October 2024.

- Individuals:$7,500

- Married Couples Filing Jointly:$15,000

It’s important to note that if you are 50 or older, you can contribute an additional $1,500 per year, which is referred to as the “catch-up contribution”.

Missing the tax extension deadline in October 2024 can result in penalties. The penalty for late filing is typically 0.5% of the unpaid taxes for each month or part of a month that the return is late. There are also penalties for late payment, which can be as high as 0.5% of the unpaid taxes per month.

To avoid these penalties, it’s important to file your taxes on time or request an extension if needed. You can learn more about the consequences of missing the tax extension deadline by clicking here: What happens if I miss the tax extension deadline in October 2024.

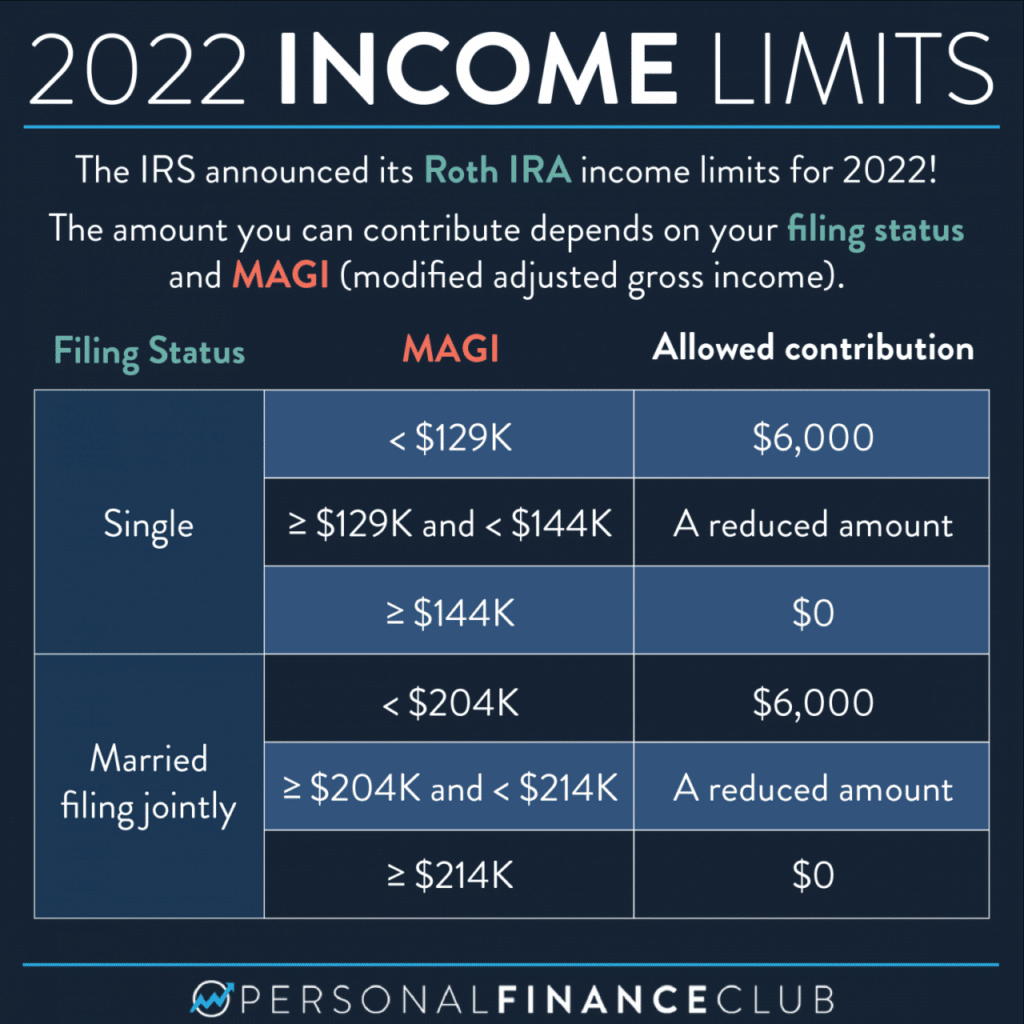

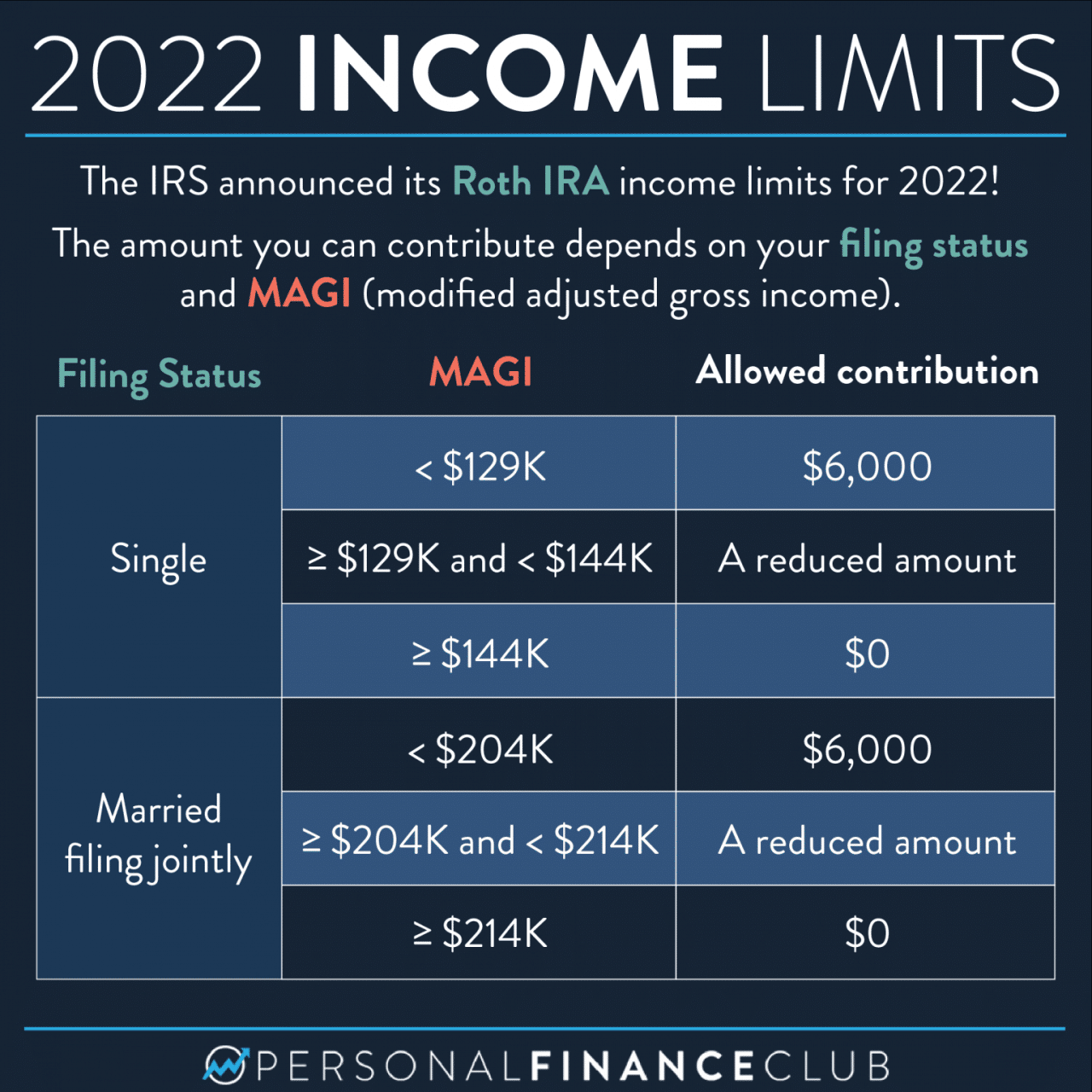

Income Limits and Roth IRA Contributions

While there is no income limit to contribute to a Roth IRA, your eligibility to make tax-free withdrawals in retirement is subject to income limits. For 2024, these limits are:

- Single Filers:$153,000

- Married Filing Jointly:$228,000

If your modified adjusted gross income (MAGI) exceeds these limits, you may not be able to contribute the full amount to a Roth IRA or may not be eligible for tax-free withdrawals in retirement.

The Roth IRA is a great way to save for retirement while potentially reducing your tax burden. The contribution limit for 2024 is $7,000, but it’s important to note that there are income limits for contributing to a Roth IRA.

For more information about the Roth IRA contribution limit for 2024, check out this article: What is the Roth IRA contribution limit for 2024.

Examples of Contribution Adjustments

Here are some examples of how individuals might adjust their Roth IRA contributions based on their income and financial goals:

- Example 1:A single individual with a MAGI of $130,000 can contribute the full $7,500 to their Roth IRA in 2024 and expect to be able to withdraw the funds tax-free in retirement. This is because their income is below the limit for tax-free withdrawals.

The highest tax bracket in 2024 is 37%, and it applies to taxable income over $650,000 for single filers and $1,300,000 for married couples filing jointly. Understanding the highest tax bracket can help you plan your finances and potentially minimize your tax liability.

You can learn more about the highest tax bracket in 2024 by clicking here: What is the highest tax bracket in 2024?.

- Example 2:A married couple filing jointly with a MAGI of $250,000 can contribute to a Roth IRA, but they may not be able to withdraw the funds tax-free in retirement. This is because their income exceeds the limit for tax-free withdrawals.

If you’re over 50, you can contribute more to your 401(k) than someone younger. The catch-up contribution limit for 2024 is an extra $7,500, so you can contribute up to $30,500. Want to know more? Check out this article on What are the 401k limits for 2024 for over 50.

They may choose to contribute to a traditional IRA instead, where contributions are tax-deductible, and withdrawals are taxed in retirement.

Tax Implications of Roth IRA Contributions

Roth IRA contributions are made with after-tax dollars, meaning you’ve already paid taxes on the money you contribute. This sets them apart from traditional IRA contributions, which are made with pre-tax dollars. The key advantage of Roth IRAs lies in their tax-free withdrawals in retirement.

Planning for retirement? Understanding IRA contribution limits is key. In 2024, you can contribute up to $7,000, and if you’re over 50, you can contribute an extra $1,500. To learn more about these limits, check out this article: Ira contribution limits for 2024 and beyond.

Tax-Free Withdrawals in Retirement

When you withdraw money from a Roth IRA in retirement, it’s completely tax-free, as long as you meet certain requirements, such as being at least 59 1/2 years old and having held the account for at least five years. This tax-free benefit can significantly boost your retirement income.

If you owe taxes in October 2024, you might be wondering if you can get an extension. The answer is yes! You can file for an extension to give yourself more time to pay your taxes. However, it’s important to note that this extension only grants you more time to pay, not more time to file.

Learn more about tax extensions in this article: Can I get an extension on my taxes if I owe money in October 2024.

Comparison with Traditional IRA Contributions

Traditional IRA contributions are made with pre-tax dollars, meaning you get a tax deduction for your contributions in the year you make them. This can lower your taxable income and reduce your tax bill. However, when you withdraw money from a traditional IRA in retirement, it’s taxed as ordinary income.

The standard deduction is the amount you can subtract from your taxable income before calculating your taxes. For married couples filing jointly in 2024, the standard deduction is $28,700. This can be a significant amount, so it’s important to understand how the standard deduction works.

To learn more about the 2024 standard deduction for married filing jointly, check out this article: What is the 2024 standard deduction for married filing jointly.

For example, let’s say you contribute $6,500 to a Roth IRA in 2024. You won’t receive a tax deduction for this contribution, but when you withdraw the money in retirement, it will be tax-free. If you contribute $6,500 to a traditional IRA, you’ll receive a tax deduction in 2024, but when you withdraw the money in retirement, it will be taxed as ordinary income.

Want to maximize your 401(k) contributions? In 2024, you can contribute up to $30,500, and if you’re over 50, you can contribute an extra $7,500. These catch-up contributions can help you reach your retirement goals faster. To learn more about 401(k) contribution limits and catch-up contributions, check out this article: 401k contribution limit 2024 and catch-up contributions.

The best choice between a Roth IRA and a traditional IRA depends on your individual circumstances, such as your current tax bracket, expected tax bracket in retirement, and your financial goals.

Filing taxes as married filing separately? Knowing the tax brackets for this filing status is essential. The IRS has set different tax brackets for each filing status, and understanding these brackets can help you estimate your tax liability.

You can find the tax brackets for married filing separately in 2024 here: Tax brackets for married filing separately in 2024.

Roth IRA Contribution Limits and Income Eligibility

While Roth IRAs offer tax-free withdrawals in retirement, there are income limits to consider when contributing to them. These limits can impact your eligibility for making contributions, so it’s crucial to understand how they work.

Married couples have different IRA contribution limits than individuals. In 2024, each spouse can contribute up to $7,000, and if they’re over 50, they can contribute an extra $1,500 each. This means that married couples can contribute up to $15,000 to their IRAs in 2024.

To learn more about IRA contribution limits for married couples, check out this article: Ira contribution limits for married couples in 2024.

Income Limits for Roth IRA Contributions in 2024

The IRS sets annual income limits for Roth IRA contributions. If your modified adjusted gross income (MAGI) exceeds these limits, you may not be able to contribute to a Roth IRA or you may be limited in the amount you can contribute.

Divorced individuals have the same Roth IRA contribution limit as everyone else, which is $7,000 in 2024. However, it’s important to note that there are income limits for contributing to a Roth IRA, and these limits can vary depending on your filing status.

To learn more about the Roth IRA contribution limit for divorced individuals in 2024, check out this article: Roth IRA contribution limit 2024 for divorced individuals.

The income limits for 2024 are:

- Single filers: $153,000 or higher

- Married filing jointly: $228,000 or higher

- Head of household: $189,000 or higher

If your MAGI falls below these limits, you can contribute the full amount to a Roth IRA in 2024, which is $7,000 for individuals under 50 and $8,000 for those 50 and over. However, if your MAGI exceeds the limits, your contribution ability will be reduced.

International taxpayers often have different tax deadlines than domestic taxpayers. In October 2024, the tax extension deadline for international taxpayers is the same as for domestic taxpayers, which is October 15th. However, there are specific rules and regulations that international taxpayers need to be aware of.

To learn more about the tax extension deadline for international taxpayers, check out this article: Tax extension deadline October 2024 for international taxpayers.

Impact of Exceeding Income Limits

Exceeding the income limits for Roth IRA contributions can have a significant impact on your ability to contribute to a Roth IRA.

- Reduced contribution limit:If your MAGI falls within a specific range above the income limits, you may be able to contribute a reduced amount to a Roth IRA. For example, in 2024, if your MAGI is between $153,000 and $168,000 (for single filers), you can only contribute a portion of the full amount, and that portion decreases as your MAGI increases.

High earners have different 401(k) contribution limits than those with lower incomes. In 2024, the limit for high earners is $30,500, but they can also contribute an extra $7,500 for catch-up contributions if they’re over 50. You can find more details about the 401(k) contribution limits for high earners in 2024 by clicking here: 401k contribution limits for 2024 for high earners.

Once your MAGI exceeds $168,000, you can no longer contribute to a Roth IRA.

- Complete contribution restriction:If your MAGI exceeds the income limits for the year, you are completely prohibited from contributing to a Roth IRA.

Alternatives for Individuals Exceeding Income Limits, How do Roth IRA contribution limits affect my taxes in 2024

If you exceed the income limits for Roth IRA contributions, there are other retirement savings options you can consider:

- Traditional IRA:While contributions to a traditional IRA are tax-deductible, withdrawals in retirement are taxed. Traditional IRAs have no income limits, so anyone can contribute, regardless of their income.

- 401(k):If you have access to a 401(k) through your employer, this can be a great option for retirement savings. Contributions to a 401(k) are often pre-tax, meaning you can reduce your taxable income. The contribution limits for 401(k)s are generally higher than Roth IRAs, and there are no income limits.

Planning for Roth IRA Contributions in 2024: How Do Roth IRA Contribution Limits Affect My Taxes In 2024

Planning for Roth IRA contributions in 2024 requires careful consideration of your individual circumstances, including your income, retirement goals, and tax implications. Understanding how these factors interact is crucial for making informed decisions about your contributions.

Key Factors to Consider

The following table Artikels the key factors to consider when planning your Roth IRA contributions for 2024:

| Factor | Description | Impact on Roth IRA Contributions |

|---|---|---|

| Income | Your modified adjusted gross income (MAGI) determines your eligibility for Roth IRA contributions and potential phase-out limits. | If your MAGI exceeds certain thresholds, your contribution ability may be limited or completely phased out. |

| Retirement Goals | Your desired retirement lifestyle and financial needs influence the amount you contribute to your Roth IRA. | Higher contributions can lead to greater tax-free growth and withdrawals in retirement, helping you reach your goals. |

| Tax Implications | Roth IRA contributions are made with after-tax dollars, meaning you won’t owe taxes on withdrawals in retirement. | Consider your current and future tax bracket to determine if contributing to a Roth IRA is beneficial. |

Determining the Optimal Roth IRA Contribution Amount

Determining the optimal Roth IRA contribution amount involves a step-by-step process:

- Assess your income:Determine your modified adjusted gross income (MAGI) for the current tax year. Refer to the IRS guidelines for the income limits that apply to Roth IRA contributions.

- Evaluate your retirement goals:Consider your desired retirement lifestyle and financial needs. This will help you estimate the amount you need to save for retirement.

- Analyze your current tax bracket:Assess your current and projected future tax bracket. Consider if contributing to a Roth IRA is beneficial, given the potential for tax-free withdrawals in retirement.

- Calculate your maximum contribution:Determine the maximum contribution amount allowed for the year, which is $6,500 for individuals and $13,000 for married couples filing jointly in

2024.

- Determine your optimal contribution

Based on your income, retirement goals, and tax situation, choose a contribution amount that is both affordable and maximizes the benefits of the Roth IRA.

Strategies for Maximizing Roth IRA Contributions

Here are some strategies for maximizing your Roth IRA contributions while staying within income limits:

- Contribute early in the year:Contributing early allows your investments to grow for a longer period, potentially leading to greater tax-free growth.

- Consider a Roth IRA conversion:If you have a traditional IRA, you can convert it to a Roth IRA, potentially paying taxes on the conversion but allowing for tax-free withdrawals in retirement.

- Utilize catch-up contributions:Individuals aged 50 and over can contribute an additional $1,000 per year, increasing their maximum contribution to $7, 500.

- Automate contributions:Set up automatic contributions from your checking account to your Roth IRA, ensuring regular and consistent contributions.

Last Word

Understanding Roth IRA contribution limits is essential for maximizing your tax benefits and ensuring you’re on the right track to a secure retirement. By carefully considering your income, retirement goals, and the impact of contribution limits, you can make informed decisions about your Roth IRA contributions and enjoy the benefits of tax-free withdrawals in retirement.

Remember, planning is key. By seeking professional advice and staying informed about any changes to contribution limits, you can navigate the world of Roth IRAs with confidence and achieve your financial aspirations.

Questions Often Asked

What happens if I contribute more than the Roth IRA limit?

If you contribute more than the allowed limit, the excess contribution will be subject to a 6% penalty. You’ll also have to pay taxes on the excess contribution.

Can I withdraw contributions from my Roth IRA before retirement?

Yes, you can withdraw contributions from a Roth IRA at any time without penalty or tax. However, withdrawals of earnings before retirement are subject to taxes and penalties.

Can I contribute to a Roth IRA if I already have a 401(k)?

Yes, you can contribute to both a Roth IRA and a 401(k) if you meet the eligibility requirements for both. This can be a great way to maximize your retirement savings.