Income tax brackets for October 2024 by state are a crucial aspect of financial planning for individuals and businesses alike. Understanding how these brackets work and how they differ across states is essential for making informed decisions about income, investments, and tax liabilities.

This guide provides a comprehensive overview of the projected income tax brackets for each state in October 2024, highlighting key factors that influence these brackets and exploring their potential implications.

We will delve into the concept of income tax brackets, explaining how they function and the distinction between federal and state brackets. We’ll also examine the key factors that influence state income tax brackets, such as state budget needs, economic conditions, political considerations, and tax policies and legislation.

Finally, we will explore the potential impact of income tax brackets on individual taxpayers, state revenue, and economic growth.

Contents List

Understanding Income Tax Brackets

Income tax brackets are a system used by governments to determine how much income tax an individual or entity owes. This system divides income into different ranges, with each range having a specific tax rate. This means that higher earners pay a higher percentage of their income in taxes.

People with disabilities often have unique tax situations. You can find information about the standard deduction specifically for people with disabilities in 2024 here.

Federal and State Income Tax Brackets, Income tax brackets for October 2024 by state

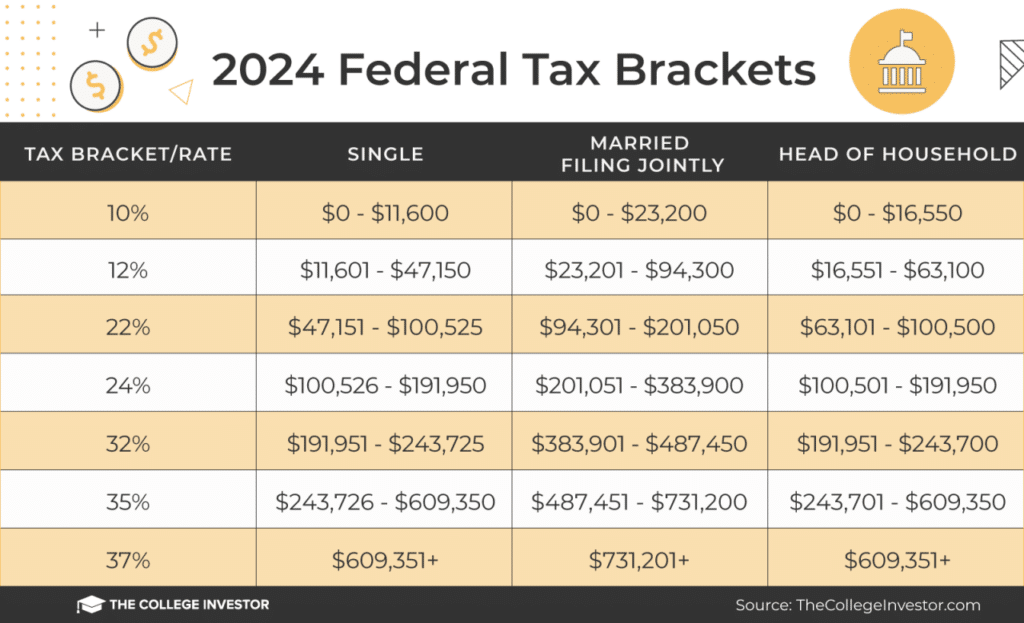

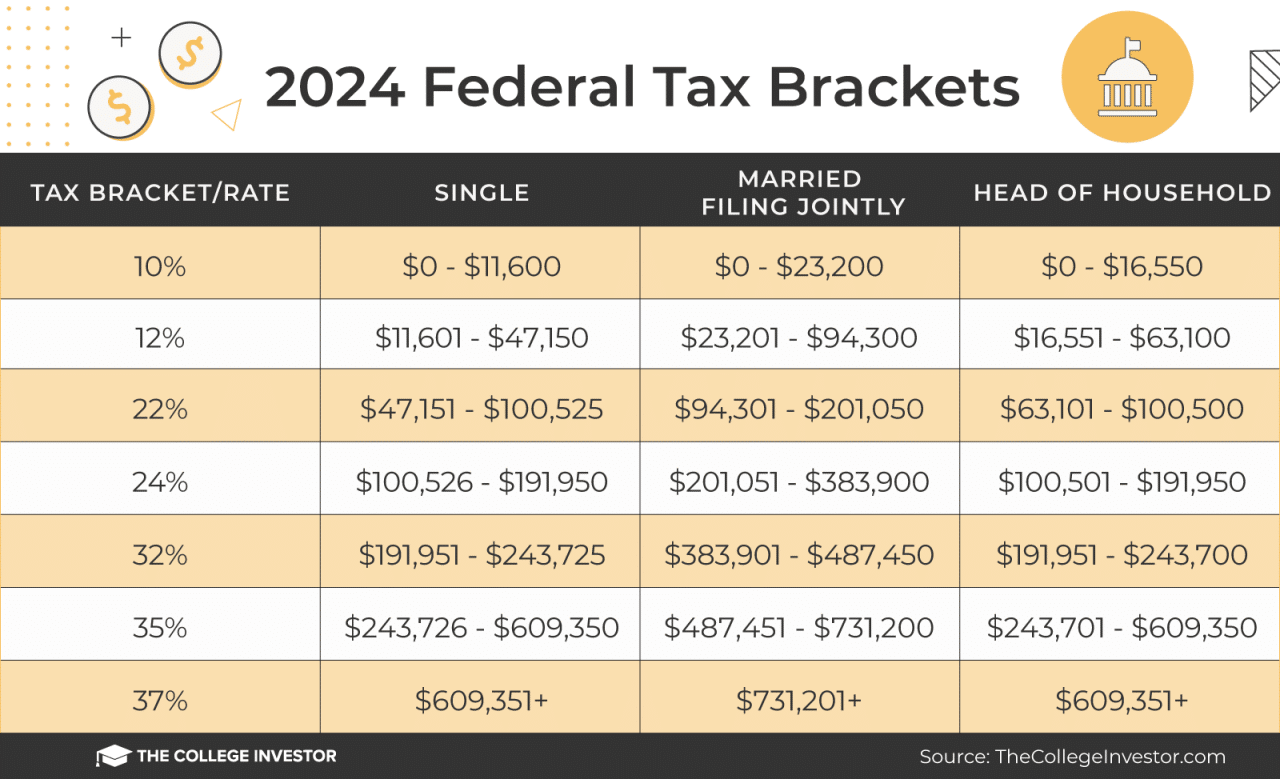

Federal and state income tax brackets differ in several ways.

- Federal income tax brackets apply to all taxpayers nationwide, while state income tax brackets vary by state. Some states have no income tax, while others have progressive tax systems with multiple brackets.

- The number of brackets and the tax rates within each bracket can vary between federal and state systems. The federal system has seven income tax brackets, while state systems can range from a single bracket to multiple brackets, depending on the state’s tax policies.

It’s important to understand the income tax brackets for your filing status. Find out what the October 2024 income tax brackets are for head of household here.

- The income thresholds that define each bracket also differ between federal and state systems. These thresholds are adjusted annually for inflation.

How Income Tax Brackets Are Determined

Income tax brackets are determined by a combination of factors, including:

- Tax policy:Governments set the tax rates and income thresholds for each bracket based on their fiscal policies and economic goals. They consider factors such as revenue generation, social equity, and economic growth.

- Economic conditions:Economic factors, such as inflation and unemployment, can influence tax bracket adjustments. Governments may adjust brackets to address economic challenges or stimulate growth.

- Political considerations:Political considerations can also influence tax policy. Governments may adjust tax brackets to align with their political ideologies or respond to public opinion.

Factors Influencing Income Tax Brackets

State income tax brackets are not static and can change over time due to various factors. These changes are often influenced by a complex interplay of economic, political, and social considerations.

State Budget Needs

State governments rely heavily on income tax revenue to fund essential services like education, healthcare, infrastructure, and public safety. When state budgets face a shortfall, lawmakers may consider raising income tax rates or expanding the number of tax brackets to increase revenue.

If you’re a foodie, you’ll love these credit cards! Check out the best credit cards for dining rewards in October 2024 here.

Conversely, if the state has a surplus, they may consider lowering rates or simplifying the tax structure.

Don’t miss the deadline for filing your business taxes! Find out the October 2024 tax deadline for businesses here.

For example, in 2023, California faced a budget deficit due to a decline in revenue during the pandemic. The state legislature responded by increasing income tax rates for high earners to address the shortfall.

Figuring out how much you can contribute to your 401k in 2024? The contribution limits for all ages are outlined here. This information can help you plan your retirement savings strategy effectively.

Economic Conditions

The state’s economic performance significantly influences income tax brackets. During periods of economic growth, states may see increased tax revenue, leading to discussions about tax cuts or investments in social programs. Conversely, during economic downturns, states may face budget pressures and consider raising taxes or reducing tax breaks to maintain essential services.

If you’re married, you can contribute to an IRA as a couple. This article here explains the IRA contribution limits for married couples in 2024.

For instance, during the 2008 recession, many states implemented temporary tax increases or reduced tax breaks to balance their budgets.

The standard deduction is a valuable tax break, and it’s important to know how it might change in 2024. Check out this article here to see if the changes impact you.

Political Considerations

Political ideologies and priorities play a significant role in shaping tax policies. States with more progressive political leanings often favor higher income tax rates for high earners to fund social programs and address income inequality. Conversely, states with more conservative political leanings may favor lower income tax rates and tax cuts to stimulate economic growth.

Small business owners have unique retirement savings options. Find out about the 401k contribution limits specifically for small business owners in 2024 here.

For example, in states with Republican-controlled legislatures, tax cuts and a simplified tax structure are often prioritized.

Students often have unique tax situations. You can find information about the standard deduction specifically for students in 2024 here.

Tax Policies and Legislation

State tax policies and legislation are constantly evolving, leading to changes in income tax brackets. Tax reforms, such as simplifying the tax structure, eliminating certain deductions, or introducing new tax credits, can directly impact income tax brackets.

For instance, some states have implemented flat tax systems, eliminating progressive income tax brackets and imposing a single tax rate on all earners.

Comparing Income Tax Brackets Across States: Income Tax Brackets For October 2024 By State

Understanding how income tax brackets vary across states is crucial for individuals and businesses making financial decisions. This section will explore the differences in income tax brackets across various states, highlighting states with the highest and lowest tax rates, significant changes in tax brackets from previous years, and unique tax policies or exemptions.

If you’re a qualifying widow(er), you may be eligible for a special standard deduction. Find out more about this deduction and how it applies to you in 2024 here.

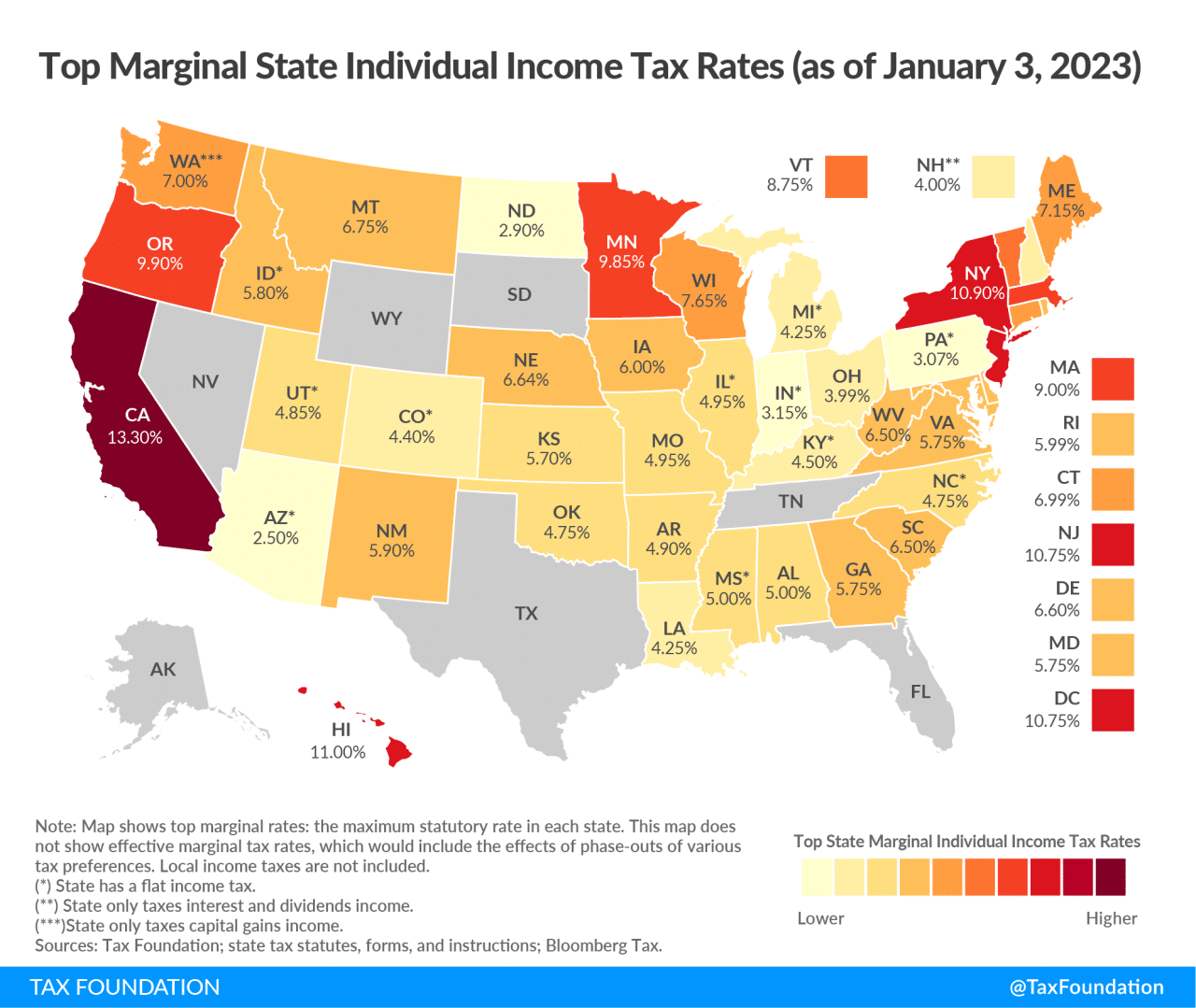

States with the Highest and Lowest Tax Rates

The income tax rates vary significantly across states. Some states impose high income tax rates, while others have no income tax at all. Comparing the income tax brackets for several states can help individuals and businesses understand the tax burden they might face in different locations.

You may be wondering if you can contribute to an IRA even if you have a 401k. The answer is yes! Learn more about the rules and how to maximize your retirement savings here.

| State | Highest Tax Rate | Lowest Tax Rate |

|---|---|---|

| California | 13.3% | 1% |

| New York | 10.9% | 4% |

| Oregon | 9.9% | 5% |

| Texas | 0% | 0% |

| Florida | 0% | 0% |

States with Significant Changes in Tax Brackets

Some states have made significant changes to their income tax brackets in recent years, either by adjusting the tax rates or by adding new brackets. These changes can impact taxpayers’ tax liability and should be considered when making financial decisions.

- New Jersey: In 2023, New Jersey implemented a new income tax bracket for high earners, raising the top marginal tax rate to 10.75%. This change resulted in higher tax liabilities for individuals earning above a certain threshold.

- Illinois: Illinois has been gradually reducing its income tax rates over the past few years. In 2024, the state’s top income tax rate is expected to be 4.95%, down from 4.99% in 2023. This reduction in tax rates aims to make Illinois more competitive with other states.

States with Unique Tax Policies or Exemptions

Several states have unique tax policies or exemptions that can benefit certain taxpayers. Understanding these policies can help individuals and businesses minimize their tax liability.

- Nevada: Nevada has no income tax, making it a popular destination for individuals and businesses looking to minimize their tax burden. However, Nevada does impose taxes on other sources of income, such as sales and property.

- Wyoming: Wyoming has no income tax, no sales tax, and no corporate income tax. This makes Wyoming an attractive state for businesses and individuals seeking a low-tax environment.

- Alaska: Alaska has a unique tax system where residents receive an annual dividend payment from the state’s oil revenues. The amount of the dividend varies each year based on oil prices and state revenue. Additionally, Alaska has a progressive income tax system with a top rate of 9.9% for income over $250,000.

Implications of Income Tax Brackets

Income tax brackets, which define the different rates at which income is taxed, have a significant impact on individuals, governments, and the overall economy. Understanding these implications is crucial for informed financial planning, policy decisions, and economic forecasting.

Impact on Individual Taxpayers and Financial Planning

Income tax brackets directly affect how much tax individuals pay on their earnings. Higher earners in a progressive tax system pay a larger proportion of their income in taxes. This can influence individual financial planning decisions, such as:

- Saving and Investing:Individuals may adjust their savings and investment strategies based on their expected tax liability. For example, they might prioritize tax-advantaged accounts like 401(k)s or IRAs to reduce their current tax burden.

- Income Management:Individuals may try to optimize their income within a tax bracket to minimize their tax liability. This could involve strategies like deferring income or accelerating deductions.

- Retirement Planning:Tax brackets can affect retirement planning decisions, such as choosing between traditional and Roth IRAs, which have different tax implications in retirement.

Impact on State Revenue and Government Spending

State income tax brackets are a major source of revenue for state governments. Changes in tax brackets can significantly affect state revenue collection, which, in turn, influences government spending on public services like education, healthcare, and infrastructure.

Do you have rental properties? You’ll want to understand how to calculate your taxes on rental income. Find a helpful tax calculator for income from rental properties in October 2024 here.

- Budgetary Planning:States rely on income tax revenue forecasts to develop their annual budgets. Changes in tax brackets can affect these forecasts and necessitate adjustments to spending plans.

- Public Services:The availability of funds for public services is directly linked to state income tax revenue. Changes in tax brackets can impact the quality and availability of services like education, healthcare, and infrastructure.

- Economic Stimulus:Governments may adjust tax brackets as a way to stimulate the economy. Lowering tax rates can put more money in the hands of consumers, potentially leading to increased spending and economic growth.

Impact on Economic Growth and Investment

Income tax brackets can influence economic growth and investment by affecting incentives for businesses and individuals.

The standard deduction is a valuable tax break, but not everyone is eligible. Find out who qualifies for the standard deduction in 2024 here.

- Investment Decisions:High tax rates on investment income can discourage individuals and businesses from investing, potentially hindering economic growth. Conversely, lower tax rates can incentivize investment and economic activity.

- Entrepreneurship:High tax rates on business income can discourage entrepreneurship and new business formation, potentially limiting job creation and economic growth.

- International Competitiveness:High income tax rates can make a country less competitive internationally, as businesses may choose to invest in countries with more favorable tax environments.

Benefits and Drawbacks of Different Tax Bracket Structures

Different tax bracket structures can have varying benefits and drawbacks.

Looking for a credit card that rewards you for good credit? This article here highlights the best credit cards for people with good credit in October 2024.

- Progressive Tax Systems:Progressive tax systems, where higher earners pay a larger proportion of their income in taxes, are often seen as fairer and more equitable. However, they can potentially discourage high earners from working and investing, potentially hindering economic growth.

Progressive tax systems aim to distribute the tax burden more evenly, ensuring that those with higher incomes contribute a larger share to support public services.

If you’re looking to maximize your retirement savings in 2024, you’ll want to know the contribution limits for traditional 401ks. You can find a detailed breakdown of these limits here.

- Regressive Tax Systems:Regressive tax systems, where lower earners pay a larger proportion of their income in taxes, can disproportionately impact lower-income households. However, they can potentially stimulate economic growth by encouraging work and investment.

Regressive tax systems can lead to a greater burden on lower-income individuals, as they often rely on essential goods and services subject to sales taxes.

- Flat Tax Systems:Flat tax systems, where everyone pays the same percentage of their income in taxes, can be seen as simpler and more efficient. However, they can be seen as less fair, as they do not account for differences in income and ability to pay.

Flat tax systems can simplify the tax code and reduce administrative burdens, but they may not adequately address income inequality.

Concluding Remarks

By understanding the dynamics of income tax brackets and their potential impact, individuals and businesses can navigate the complex world of taxation with greater confidence. This guide provides a valuable resource for staying informed about the ever-evolving landscape of income tax brackets, empowering you to make informed financial decisions and maximize your tax benefits.

Question Bank

How often do income tax brackets change?

Income tax brackets can change annually or even more frequently, depending on factors like economic conditions, government policies, and budget needs.

What are the implications of a higher marginal tax rate?

A higher marginal tax rate means that a larger percentage of your income is taxed at that rate, which can affect your overall tax liability.

Are there any deductions or credits available to reduce my income tax liability?

Yes, various deductions and credits are available, depending on your individual circumstances and state tax laws. Consult a tax professional for personalized advice.