Income tax changes for October 2024 are on the horizon, and understanding their implications is crucial for individuals and businesses alike. These changes, announced by [Official Source], aim to [Briefly state the overall goal of the changes]. While the impact on different income brackets may vary, it’s essential to be informed about the adjustments to tax brackets, deductions, and credits.

The government has Artikeld a comprehensive plan that includes [Mention a few key aspects of the changes, e.g., adjustments to tax brackets, modifications to deductions, etc.]. This plan is expected to have a significant impact on taxpayers, potentially affecting their tax liabilities and financial planning.

Contents List

Overview of Income Tax Changes

The October 2024 income tax changes are a significant development for taxpayers in [Country Name]. These changes aim to [briefly state the purpose of the changes, e.g., simplify the tax system, promote economic growth, etc.]. The official source of information for these changes is [link to official government website or document].These changes are expected to impact different income brackets in various ways.

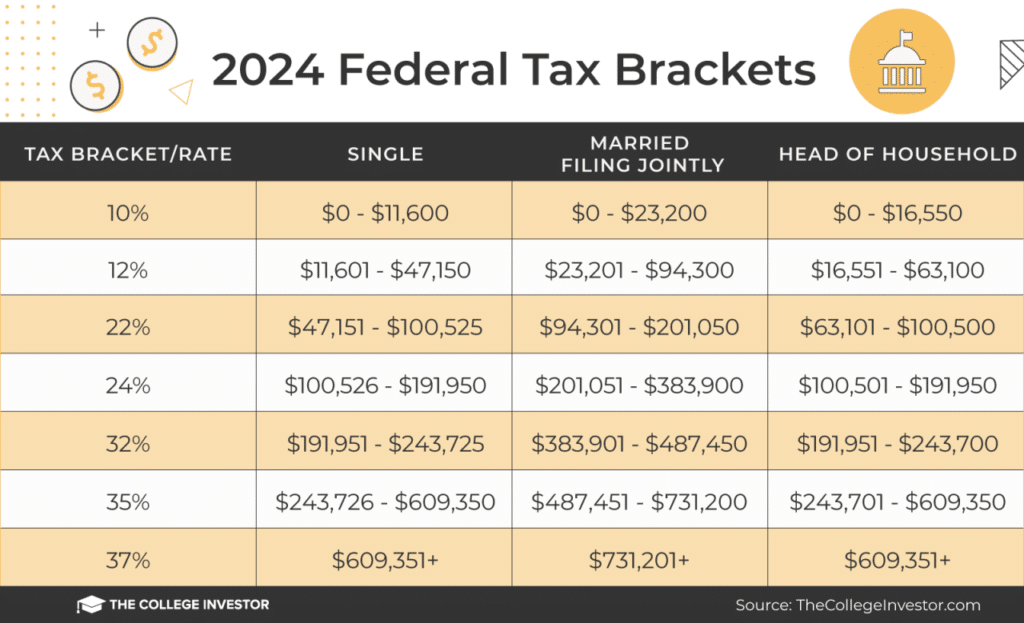

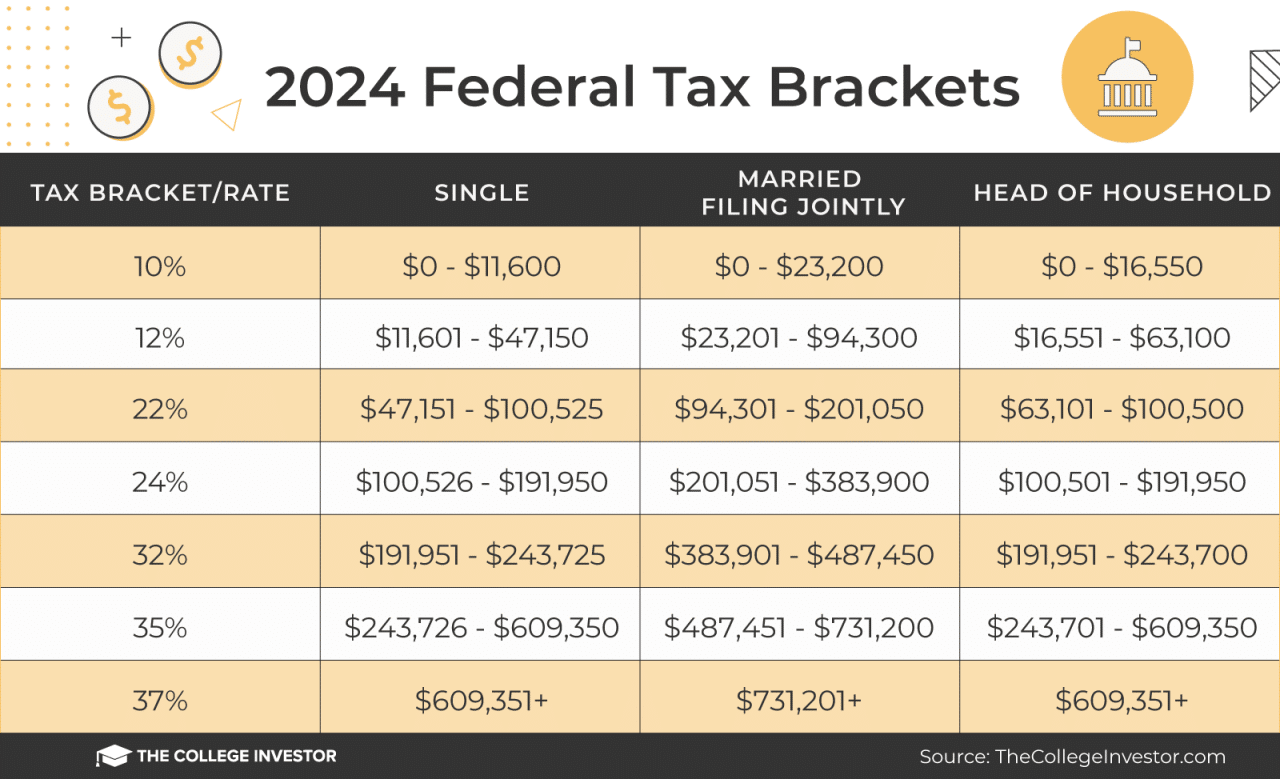

Tax brackets are a key factor in determining your tax liability. If you’re filing as single, you can find the tax brackets for 2024 here: Tax brackets for single filers in 2024. This information will help you estimate your tax liability and make informed financial decisions.

For instance, [mention a specific example of how a particular income bracket might be affected]. Understanding the specifics of these changes is crucial for taxpayers to adjust their financial planning and ensure compliance with the new regulations.

Impact on Different Income Brackets

The income tax changes are designed to [briefly explain the intended impact of the changes on income brackets]. For instance, [provide a specific example of how the changes might affect a particular income bracket, e.g., higher earners might see a reduction in their tax liability, while lower earners might benefit from increased tax credits].

The changes are likely to have a more significant impact on [mention specific income brackets or groups that are likely to be affected more than others]. To illustrate, [provide a real-life example of how the changes might affect a specific individual or family].

Roth IRAs offer tax-free withdrawals in retirement, making them an attractive savings option. If you’re looking to contribute to a Roth IRA, it’s important to understand the catch-up contribution limits. You can find out if there’s a catch-up contribution limit for Roth IRAs in 2024 here: Is there a catch-up contribution limit for Roth IRAs in 2024.

This information will help you maximize your contributions and benefit from tax-free withdrawals in retirement.

This example should be relatable and grounded in actual data or real-life situations.

If you’re looking to save for retirement, understanding the contribution limits for your IRA is crucial. You can find out just how much you can contribute to your IRA in 2024 by checking out this helpful article: How much can I contribute to my IRA in 2024.

This article will provide you with the necessary information to make informed decisions about your retirement savings.

Changes to Tax Brackets and Rates

The October 2024 income tax changes include adjustments to the tax brackets and corresponding rates. These changes aim to create a more equitable and progressive tax system, with a focus on providing relief to lower-income earners while ensuring that higher earners contribute their fair share.

The standard deduction is an important aspect of tax planning. If you’re looking to claim the standard deduction on your 2024 taxes, you can find helpful information in this article: How to claim the standard deduction on my 2024 taxes.

This guide will walk you through the process and ensure you take advantage of this valuable tax benefit.

Comparison of Tax Brackets and Rates

The following table Artikels the new tax brackets and rates for October 2024, compared to the previous rates:

| Income Range | Previous Rate | New Rate |

|---|---|---|

$0

|

10% | 8% |

| $10,001

It’s essential to stay informed about any changes to 401(k) contribution limits. You can find out if the 401(k) contribution limit will change in 2024 by reading this article: Will the 401k contribution limit change in 2024. This information will help you plan your retirement savings effectively and maximize your contributions.

|

15% | 12% |

$40,001

|

20% | 18% |

$80,001

|

25% | 22% |

| $150,001

Understanding your tax bracket is crucial for effective financial planning. If you’re filing as head of household, you can find the relevant tax brackets for 2024 here: Tax brackets for head of household in 2024. This information will help you estimate your tax liability and make informed financial decisions.

|

30% | 28% |

| Over $500,000 | 35% | 32% |

As evident from the table, the new tax rates are generally lower than the previous rates, with the most significant reduction in the lowest income bracket. This aims to provide tax relief for individuals with lower incomes, allowing them to retain more of their earnings.

Conversely, the highest income bracket has also seen a reduction in its tax rate, albeit a smaller one.

Implications for Individual Taxpayers

The changes to tax brackets and rates can have a significant impact on individual taxpayers. For instance, individuals earning within the lower income brackets will experience a reduction in their overall tax liability, potentially increasing their disposable income. However, those in higher income brackets may see a smaller decrease in their tax liability, although they will still benefit from the overall reduction in tax rates.

Small businesses have unique 401(k) contribution limits. If you’re a small business owner, you can find the specific contribution limits for 2024 in this article: 401k contribution limits for 2024 for small businesses. This information will help you plan your retirement savings effectively and take advantage of the benefits available to small business owners.

It is crucial for individuals to review their tax situation and assess the potential impact of these changes. Consulting with a tax professional can provide personalized guidance and ensure that individuals are taking advantage of all available deductions and credits.

Adjustments to Deductions and Credits: Income Tax Changes For October 2024

The government has made several changes to deductions and credits for the 2024 tax year, aimed at streamlining the tax system and providing targeted relief to specific groups. These modifications impact various aspects of tax planning, potentially influencing individual tax liabilities.

Changes to the Child Tax Credit

The Child Tax Credit has been adjusted for 2024, reflecting the government’s commitment to supporting families with children. The credit amount has been increased to $3,000 per child under 17 years old. This increase aims to provide additional financial support to families with children, offsetting the rising cost of living.

Foreign nationals living in the United States have specific tax obligations. The October 2024 tax deadline for foreign nationals is important to note. You can find more information about this deadline in this article: October 2024 tax deadline for foreign nationals.

This information will help you stay compliant with your tax obligations and avoid any penalties.

The credit is fully refundable, meaning that even if a taxpayer owes no income tax, they can still receive the full amount of the credit.

Changes to the Earned Income Tax Credit

The Earned Income Tax Credit (EITC) has been expanded to include more low- and moderate-income working individuals and families.The EITC is a tax credit for working individuals and families with low to moderate income. The credit amount is based on the taxpayer’s income, filing status, and number of qualifying children.The maximum credit amount for 2024 has been increased, and the income thresholds have been raised.

Stay up-to-date on the latest tax changes by checking out the new tax brackets for 2024. This information is essential for accurate tax planning and can impact your overall financial strategy. You can find the new tax brackets here: What are the new tax brackets for 2024?

. This article will provide you with the most recent information and help you navigate the complexities of tax law.

This expansion aims to provide more financial assistance to low-income working individuals and families.

A Roth IRA can be a valuable tool for saving for retirement. You can find out how much you can contribute to your Roth IRA in 2024 by visiting this helpful article: How much can I contribute to my Roth IRA in 2024.

This article will provide you with the latest information and help you make informed decisions about your retirement savings.

The EITC is a valuable resource for low-income working individuals and families, providing a substantial tax credit that can help reduce their tax liability or even result in a tax refund.

Changes to the Deduction for State and Local Taxes

The deduction for state and local taxes (SALT) has been modified for 2024.The 2017 Tax Cuts and Jobs Act limited the SALT deduction to $10,000 per household. For 2024, this limit has been raised to $15,000 per household. This change aims to provide some relief to taxpayers in states with high state and local taxes.

This increase in the SALT deduction limit could benefit taxpayers in states with high property taxes, income taxes, or sales taxes, potentially reducing their federal tax liability.

Impact on Businesses

The income tax changes announced for October 2024 will have a significant impact on businesses of all sizes. The adjustments to tax brackets, deductions, and credits will necessitate adjustments to business tax strategies and planning. It is essential for businesses to understand how these changes will affect their bottom line and take appropriate steps to mitigate any potential negative impacts.

For those over 50, there’s a special catch-up contribution limit for IRAs that can help boost your retirement savings. You can find out if there’s a catch-up contribution limit for IRAs in 2024 here: Is there a catch-up contribution limit for IRAs in 2024.

This article will provide you with the necessary information to make the most of your retirement savings.

Impact on Different Business Types

The income tax changes will affect different types of businesses in various ways.

Your 401(k) is another important tool for retirement planning, and understanding its contribution limits is essential. Find out the current contribution limits for your 401(k) in 2024 by visiting this link: How much can I contribute to my 401k in 2024.

This article will provide you with the latest information and help you maximize your retirement savings.

- Corporations:Corporations may experience a shift in their tax liability due to the changes in tax brackets and rates. For example, corporations with higher profits may see an increase in their tax burden, while those with lower profits may benefit from lower rates.

The changes to deductions and credits could also affect corporations, potentially reducing their tax savings or increasing their tax obligations.

- Partnerships:Partnerships will also be affected by the changes in tax brackets and rates, as well as the adjustments to deductions and credits. The impact on individual partners will depend on their individual income levels and the structure of the partnership.

For those looking to contribute to a 401(k), it’s essential to know the current contribution limit. You can find the 401(k) contribution limit for 2024 in this article: What is the 401k contribution limit for 2024. This information will help you plan your contributions effectively and maximize your retirement savings.

- Sole Proprietorships:Sole proprietorships will be subject to the same changes in tax brackets and rates as individuals. The adjustments to deductions and credits could also impact their tax liability, potentially reducing their tax savings or increasing their tax obligations.

- Small and Medium-Sized Enterprises (SMEs):SMEs will need to carefully consider the impact of the income tax changes on their operations. The changes to tax brackets and rates could affect their profitability, while the adjustments to deductions and credits could impact their cash flow. SMEs may need to adjust their pricing strategies, investment decisions, and other business practices to account for these changes.

Potential Economic Consequences

The income tax changes implemented in October 2024 are expected to have a significant impact on the economy, influencing consumer spending, investment, and overall economic growth. The extent of these effects will depend on the specific nature of the changes, their implementation, and the overall economic climate at the time.

Missing the October 2024 tax deadline can lead to penalties. It’s important to be aware of these consequences and plan accordingly. You can learn more about the potential penalties for missing the deadline by reading this article: Tax penalties for missing the October 2024 deadline.

This information can help you avoid costly mistakes and ensure you meet your tax obligations on time.

Impact on Consumer Spending

The changes in income tax rates and deductions can have a direct impact on consumer spending. For example, if the tax burden on lower-income earners is reduced, they may have more disposable income to spend on goods and services, boosting consumer demand.

Small businesses often need a little extra time to file their taxes. The tax extension deadline for small businesses in October 2024 is a valuable tool for managing your financial obligations. You can find more information about this deadline in this article: Tax extension deadline October 2024 for small businesses.

This information can help you avoid penalties and ensure you have enough time to file your taxes accurately.

Conversely, if higher-income earners face increased tax rates, they may reduce their spending, leading to a decrease in aggregate demand.

Impact on Investment

The tax changes can also affect investment decisions by businesses and individuals. For example, changes to corporate tax rates or investment incentives can influence businesses’ decisions on capital expenditure and expansion. Similarly, adjustments to capital gains taxes can affect individuals’ willingness to invest in assets like stocks and real estate.

Impact on Economic Growth, Income tax changes for October 2024

The combined effects of changes in consumer spending and investment can influence overall economic growth. If the tax changes stimulate spending and investment, they can lead to increased economic activity, job creation, and higher GDP growth. However, if the changes discourage spending and investment, they can lead to a slowdown in economic growth.

Potential Unintended Consequences

While the tax changes may be intended to achieve specific economic objectives, there is always a risk of unintended consequences. For example, changes to tax deductions may create loopholes or encourage tax avoidance, reducing government revenue. Similarly, changes to tax rates may create distortions in the economy, leading to inefficient resource allocation.

Examples of Potential Economic Consequences

- Increased consumer spending:A reduction in the tax burden on lower-income earners could lead to a surge in consumer spending, particularly on non-essential goods and services. This could boost demand in industries like retail, hospitality, and entertainment.

- Reduced investment:An increase in corporate tax rates could discourage businesses from investing in new projects, leading to slower economic growth. This could also lead to job losses and a decrease in productivity.

- Increased tax avoidance:Changes to tax deductions could create opportunities for tax avoidance, leading to a decrease in government revenue. This could reduce the government’s ability to fund public services and infrastructure projects.

- Distortions in the economy:Changes to tax rates could create distortions in the economy, leading to inefficient resource allocation. For example, a higher tax on certain industries could make them less competitive, leading to job losses and a decrease in output.

Final Conclusion

The upcoming income tax changes for October 2024 present a unique opportunity for taxpayers to adapt their financial strategies and plan for the future. By understanding the key changes, individuals and businesses can navigate these adjustments effectively. As the implementation date approaches, it’s crucial to stay informed about the latest updates and seek professional advice to ensure compliance and optimize tax outcomes.

FAQ Compilation

Will these tax changes affect my current tax deductions?

Yes, some deductions and credits have been modified for October 2024. It’s essential to review the updated guidelines and consult with a tax professional to understand how these changes may impact your specific situation.

What are the potential economic consequences of these tax changes?

The economic impact of these changes is a complex issue. The government expects the changes to [Mention expected positive outcomes, e.g., stimulate economic growth, boost investment]. However, some experts suggest potential challenges, such as [Mention potential challenges, e.g., increased inequality, reduced consumer spending].

Where can I find more detailed information about the income tax changes?

You can access comprehensive information on the official government website, [Link to official source], or consult with a tax professional.