Roth IRA contribution limit changes in 2024 are a significant topic for individuals planning for retirement. The Roth IRA, known for its tax-free withdrawals in retirement, has become a popular savings tool for many. The annual contribution limit for Roth IRAs is adjusted each year to account for inflation and other economic factors.

These changes can impact how much you can contribute to your Roth IRA and how much you can save for retirement.

Understanding these changes is crucial for maximizing your retirement savings. We will explore the factors influencing these changes, the potential impact on individuals, and strategies for maximizing your Roth IRA contributions in light of the new limits. We will also delve into the tax implications of Roth IRA contributions and compare it to a traditional IRA.

Contents List

- 1 Overview of Roth IRA Contribution Limits

- 2 Factors Influencing Contribution Limit Changes

- 3 Implications of 2024 Contribution Limit Changes

- 4 Contribution Strategies and Considerations

- 5 Tax Implications and Considerations

- 6 Comparison to Traditional IRA: Roth IRA Contribution Limit Changes In 2024

- 7 Resources and Additional Information

- 8 Last Word

- 9 Questions Often Asked

Overview of Roth IRA Contribution Limits

A Roth IRA is a retirement savings plan that allows individuals to contribute after-tax dollars and grow their investments tax-free. This means that you won’t have to pay taxes on withdrawals in retirement. This is a popular option for individuals who expect to be in a higher tax bracket in retirement than they are today.The Roth IRA contribution limit for 2023 is $6,500 for individuals under the age of 50, and $7,500 for those 50 and older.

However, these limits are expected to change in 2024.

The standard deduction amount can vary depending on your filing status. The Standard deduction for married filing separately in 2024 page provides details on the standard deduction for married couples filing separately.

Anticipated Changes to Roth IRA Contribution Limits in 2024

The IRS has not yet announced the Roth IRA contribution limit for 2024. However, based on historical trends and the current economic climate, it is anticipated that the limit will increase to $7,000 for individuals under 50 and $8,000 for those 50 and older.These changes are based on the Cost of Living Adjustment (COLA), which is used to adjust various benefits and limits based on inflation.

Potential Impact of Contribution Limit Changes

Changes in contribution limits can impact individuals’ retirement planning in several ways.

- Increased Contribution Limits:Higher contribution limits provide individuals with the opportunity to save more for retirement, which can lead to a larger nest egg and a more comfortable retirement.

- Potential for Higher Returns:As more money is invested, the potential for higher returns also increases.

- Impact on Retirement Planning:The increase in contribution limits may encourage individuals to adjust their retirement savings goals and strategies.

It is important for individuals to stay informed about the latest changes to contribution limits and adjust their retirement planning accordingly.

Factors Influencing Contribution Limit Changes

The annual contribution limit for Roth IRAs is adjusted periodically to reflect changes in the economy and ensure the program remains effective for retirement savings. These adjustments are influenced by a combination of factors, primarily focusing on inflation and economic growth.

The standard deduction is a valuable tax benefit for many married couples. The What is the 2024 standard deduction for married filing jointly page provides details on the standard deduction amount for married couples filing jointly.

Inflation and Economic Growth

Inflation is a key driver of Roth IRA contribution limit changes. The Internal Revenue Service (IRS) uses the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to adjust the contribution limits annually. This index measures the average change in prices paid by urban wage earners and clerical workers for a basket of consumer goods and services.

Looking for a way to save money on your credit card debt? The Best credit cards for balance transfers in October 2024 page provides a list of credit cards that offer balance transfer benefits.

If inflation rises, the contribution limit will likely increase to maintain the purchasing power of contributions. Economic growth also plays a role in determining contribution limits. When the economy is growing, wages tend to rise, and individuals may have more disposable income to contribute to retirement savings.

Understanding how tax brackets affect your income is essential for financial planning. The How will tax brackets affect my 2024 income? page provides insights into how tax brackets work and how they can impact your income.

This can lead to an increase in contribution limits to reflect the growing capacity of individuals to save.

Missing tax deadlines can lead to penalties. To learn more about the potential consequences, check out the Tax penalties for missing the October 2024 deadline page.

Implications of 2024 Contribution Limit Changes

The increased Roth IRA contribution limit for 2024 presents both opportunities and challenges for individuals seeking to save for retirement. Understanding the potential benefits and drawbacks, along with how these changes might impact individuals with different income levels and retirement goals, is crucial for making informed financial decisions.

If you’re an independent contractor, you’ll need to fill out a W9 form to provide your tax information to the businesses you work for. You can find more information on the W9 Form October 2024 for independent contractors page, which includes details on the form and how to complete it.

Impact on Individuals with Different Income Levels

The increased contribution limit might benefit individuals with higher incomes who can afford to contribute more. They can potentially save more for retirement and benefit from tax-free withdrawals in retirement. However, individuals with lower incomes might not see as much benefit from the increased limit, as they may already be contributing the maximum amount they can afford.

- Higher-Income Individuals:The increased contribution limit allows higher-income individuals to contribute more to their Roth IRAs, potentially maximizing their tax-free retirement savings.

- Lower-Income Individuals:While the increased limit might not significantly impact lower-income individuals, it could potentially benefit them by providing a larger potential tax-free retirement nest egg in the long run.

Impact on Individuals with Different Retirement Goals

Individuals with aggressive retirement goals might benefit from the increased limit, as they can potentially save more and reach their financial goals faster. Individuals with more conservative goals might not see as much benefit from the increased limit, as they may already be contributing the maximum amount they feel comfortable with.

The amount you can contribute to a Roth IRA each year is limited. To find out the current contribution limit, check out the How much can I contribute to a Roth IRA in 2024 page.

- Aggressive Retirement Goals:Individuals with ambitious retirement goals can leverage the increased limit to accelerate their savings and potentially achieve their financial objectives sooner.

- Conservative Retirement Goals:Individuals with more moderate retirement goals may not find the increased limit to be a significant factor, as they might already be contributing the maximum amount they deem appropriate.

Contribution Strategies and Considerations

Now that you understand the 2024 Roth IRA contribution limits, let’s dive into how you can make the most of your contributions. This section will guide you through the steps of contributing to a Roth IRA and explore different contribution strategies to maximize your retirement savings.

Contributing to a Roth IRA

To contribute to a Roth IRA in 2024, you’ll need to open an account with a financial institution that offers Roth IRAs. Once you have an account, you can start making contributions. Here’s a step-by-step guide:

- Choose a Roth IRA provider:Select a reputable financial institution that offers Roth IRAs. Consider factors such as fees, investment options, and customer service.

- Open an account:Once you’ve chosen a provider, you’ll need to open a Roth IRA account. This typically involves filling out an application and providing some personal information.

- Make contributions:You can make contributions to your Roth IRA throughout the year, either through direct deposits or rollovers.

- Choose investments:Within your Roth IRA, you’ll need to decide how to invest your contributions. You have a variety of options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

Contribution Options

There are two main ways to contribute to a Roth IRA:

- Direct deposits:This is the most common method. You can make regular contributions from your checking or savings account.

- Rollovers:You can roll over funds from other retirement accounts, such as a traditional IRA or 401(k), into a Roth IRA. This can be a good option if you want to take advantage of the tax-free withdrawals offered by Roth IRAs.

Knowing the tax bracket thresholds can help you plan your finances. The Tax bracket thresholds for 2024 page provides a detailed overview of the income levels that correspond to each tax bracket.

However, rollovers from traditional IRAs are subject to taxes.

Diversifying Roth IRA Investments

Diversification is a crucial aspect of any investment strategy, and it’s particularly important for Roth IRAs. Diversification helps to mitigate risk by spreading your investments across different asset classes, such as stocks, bonds, and real estate. This can help to reduce the impact of market fluctuations on your portfolio.

Choosing the right tax calculator can make a big difference in your tax planning. The Best tax calculator for October 2024: A comparison page compares different tax calculators and helps you find the best one for your needs.

“Don’t put all your eggs in one basket.”

Knowing your income tax bracket is crucial for planning your finances. The What are the income tax brackets for October 2024 page provides a comprehensive overview of the different tax brackets and how they affect your income.

Warren Buffett

For example, you might choose to invest in a mix of stocks, bonds, and real estate investment trusts (REITs) within your Roth IRA. This diversification can help to protect your portfolio from market downturns.

Tax Implications and Considerations

Contributing to a Roth IRA offers several tax advantages that can significantly benefit your retirement savings. Understanding these advantages and the tax implications associated with Roth IRA contributions and withdrawals is crucial for making informed financial decisions.

Tax Advantages of Contributing to a Roth IRA, Roth IRA contribution limit changes in 2024

The primary tax advantage of a Roth IRA is that contributions are made with after-tax dollars, meaning you’ve already paid taxes on the money you contribute. This means you won’t have to pay taxes on the money you withdraw in retirement.

If you’re over 50, you can contribute more to your 401k. The 401k contribution limit for 2024 for over 50 page provides information on the contribution limits for those over 50.

- Tax-free growth:Earnings on your contributions grow tax-deferred, meaning you won’t have to pay taxes on the interest, dividends, or capital gains until you withdraw the money in retirement.

- Tax-free withdrawals in retirement:When you withdraw your contributions and earnings in retirement, they are completely tax-free, providing a significant tax benefit.

Tax Implications of Roth IRA Withdrawals in Retirement

While Roth IRA withdrawals in retirement are tax-free, there are some important considerations:

- Qualified withdrawals:To ensure tax-free withdrawals, you must meet certain requirements, including being at least 59 1/2 years old and having held the account for at least five years.

- Early withdrawals:If you withdraw money from your Roth IRA before age 59 1/2, you may have to pay taxes and a 10% penalty on the earnings portion of the withdrawal. However, there are exceptions to the penalty, such as for first-time home purchases, medical expenses, or disability.

The tax brackets for head of household filers are different from other filing statuses. To find out the tax brackets for head of household filers in October 2024, visit the October 2024 income tax brackets for head of household page.

Tax Implications of Exceeding the Contribution Limit

Exceeding the annual contribution limit for a Roth IRA can result in tax penalties and may even require you to withdraw excess contributions.

Saving for retirement through a Roth IRA offers several advantages. You can learn more about the benefits of contributing to a Roth IRA in 2024 by visiting the What are the benefits of contributing to a Roth IRA in 2024 page.

- Excess contribution penalty:The IRS charges a 6% penalty on excess contributions each year until the excess is withdrawn. This penalty is calculated on the excess amount for each year it remains in the account.

- Withdrawal requirement:You are required to withdraw excess contributions and any related earnings. This withdrawal is subject to income tax and may also be subject to the 10% early withdrawal penalty if you are under age 59 1/2.

Comparison to Traditional IRA: Roth IRA Contribution Limit Changes In 2024

Both Roth and Traditional IRAs are retirement savings accounts offering tax advantages, but they differ in how taxes are handled. Understanding these differences is crucial for choosing the IRA that best aligns with your financial goals.

Tax credits can help reduce your tax liability. To find out what tax credits are available in October 2024, visit the Tax credits available in October 2024 page.

Contribution Limits and Tax Implications

Contribution limits for both Roth and Traditional IRAs are the same. In 2024, the maximum contribution limit is $7,000 for individuals and $14,000 for couples filing jointly. However, the tax implications differ significantly:

- Roth IRA:Contributions are made with after-tax dollars, meaning you’ve already paid taxes on the money you’re contributing. This allows for tax-free withdrawals in retirement.

- Traditional IRA:Contributions are made with pre-tax dollars, reducing your taxable income in the present. However, withdrawals in retirement are taxed as ordinary income.

Factors Influencing IRA Choice

Choosing between a Roth and Traditional IRA depends on various factors, including:

- Current Tax Bracket:If you’re currently in a lower tax bracket and expect to be in a higher bracket in retirement, a Traditional IRA might be more advantageous. This allows you to defer taxes until retirement when you’re likely in a higher tax bracket.

Conversely, if you anticipate being in a lower tax bracket in retirement, a Roth IRA could be more beneficial, as your withdrawals will be tax-free.

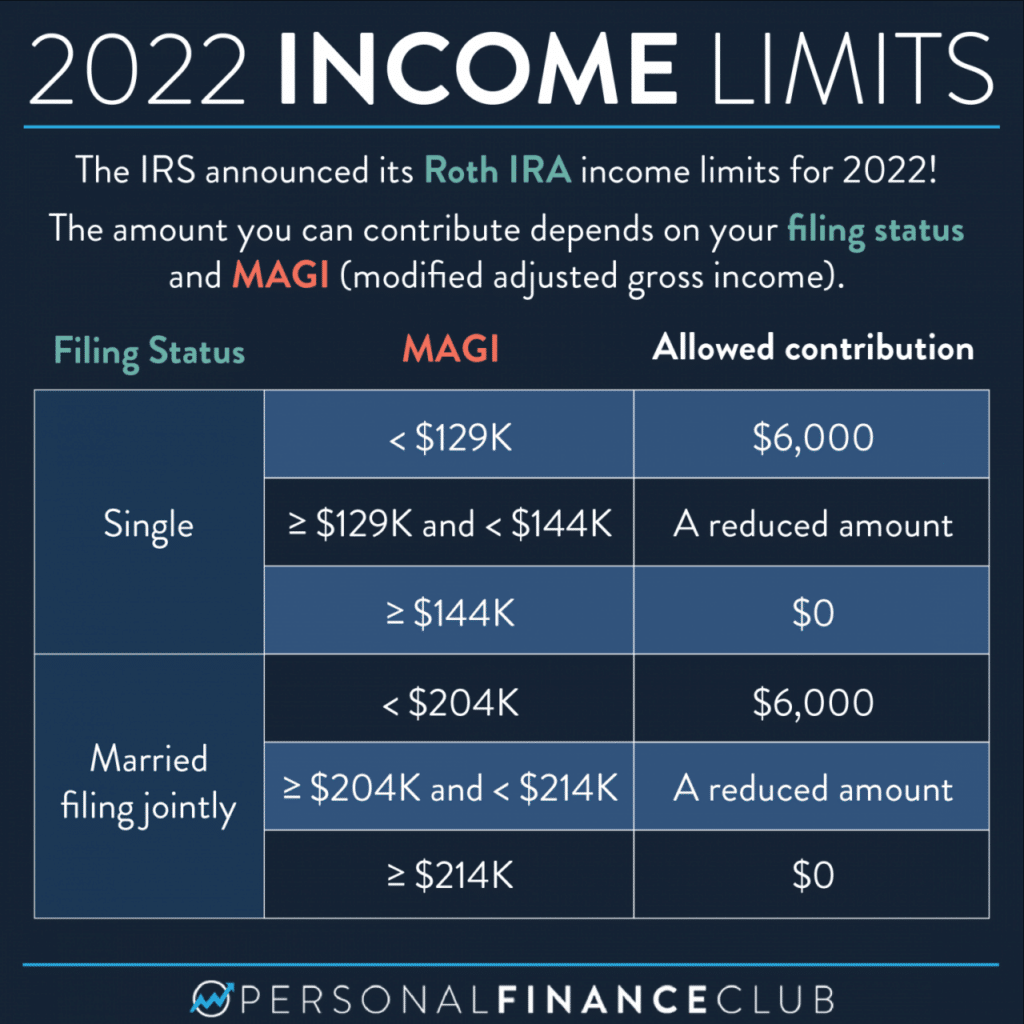

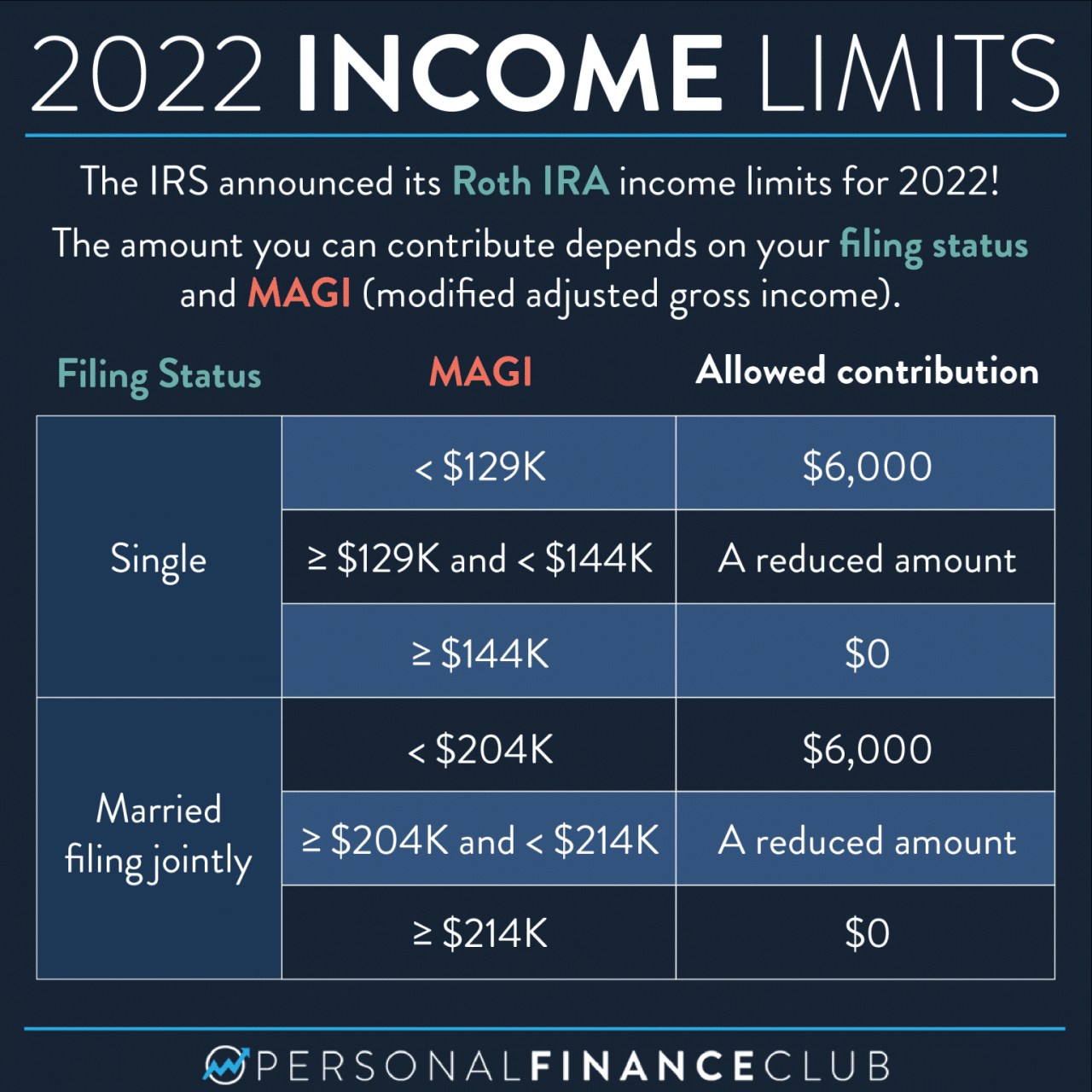

- Income:If your income exceeds certain limits, you may not be eligible to contribute to a Roth IRA. For 2024, the income limit for single filers is $153,000, and for couples filing jointly, it’s $228,000.

- Retirement Goals:If you expect to need a large amount of income in retirement, a Roth IRA could be advantageous, as your withdrawals will be tax-free. If you expect to need a smaller amount of income, a Traditional IRA might be a better choice, as you can defer taxes until retirement.

- Long-Term Investment Strategy:Consider your long-term investment strategy. If you plan to invest in a diversified portfolio of stocks and bonds, a Roth IRA might be a better choice. This allows you to potentially grow your investments tax-free.

Strategies for Choosing the Right IRA

To make an informed decision, consider:

- Consult with a financial advisor:A financial advisor can help you assess your individual circumstances and recommend the best IRA for your needs.

- Analyze your current and projected tax bracket:Determine if you’re currently in a higher or lower tax bracket and if you anticipate any changes in the future.

- Consider your income level:Check if you meet the income eligibility requirements for a Roth IRA.

- Assess your risk tolerance:If you’re comfortable with a higher risk tolerance, a Roth IRA could be more advantageous.

- Evaluate your long-term investment goals:Consider your investment horizon and expected returns.

Resources and Additional Information

This section provides links to reliable sources for further information on Roth IRA contribution limits and changes, as well as relevant government websites and financial institutions that offer Roth IRA accounts.

Divorce can change your financial picture, and it’s important to understand how it affects your retirement savings. The Roth IRA contribution limit 2024 for divorced individuals page provides information on the contribution limits and other relevant factors for divorced individuals.

Key Websites and Resources

The following resources offer comprehensive information on Roth IRA contribution limits and other related details:

- Internal Revenue Service (IRS):The IRS website is the primary source for official information on Roth IRA contribution limits and tax regulations. You can find detailed information on the IRS website, including the current contribution limits, eligibility requirements, and tax implications.

- U.S. Department of Labor:The Department of Labor provides resources on retirement planning and savings, including information on Roth IRAs.

- Financial Institutions:Most financial institutions, such as banks, credit unions, and investment firms, offer Roth IRA accounts. Their websites often provide information on contribution limits, investment options, and other details specific to their Roth IRA offerings.

Financial Institutions Offering Roth IRAs

Here are some examples of financial institutions that offer Roth IRA accounts:

- Fidelity:Fidelity Investments is a well-known financial institution that offers a variety of investment options, including Roth IRA accounts.

- Vanguard:Vanguard is another reputable financial institution that provides low-cost investment options, including Roth IRA accounts.

- Schwab:Charles Schwab offers a range of financial services, including Roth IRA accounts.

Key Takeaways for 2024 Roth IRA Contribution Limits

The following table summarizes key takeaways regarding Roth IRA contribution limits for 2024:

| Key Takeaway | Details |

|---|---|

| Contribution Limit | $7,000 for individuals and $14,000 for married couples filing jointly |

| Age Limit | There is no age limit for contributing to a Roth IRA |

| Income Limits | There are income limits for contributing to a Roth IRA, but these limits are expected to increase for 2024. |

| Tax Benefits | Contributions to a Roth IRA are made with after-tax dollars, and qualified withdrawals in retirement are tax-free. |

Last Word

As you plan for your financial future, staying informed about Roth IRA contribution limits and other retirement planning strategies is essential. By understanding the factors that influence these limits and the potential impact on your retirement savings, you can make informed decisions about your contributions and maximize your retirement savings potential.

Consider consulting with a financial advisor to determine the best course of action for your individual circumstances.

Questions Often Asked

What is the anticipated Roth IRA contribution limit for 2024?

The anticipated Roth IRA contribution limit for 2024 is $7,000 for individuals and $14,000 for couples filing jointly. However, this is subject to change based on economic conditions and legislative decisions.

What are the tax benefits of contributing to a Roth IRA?

Contributions to a Roth IRA are made with after-tax dollars, meaning you don’t receive a tax deduction for your contributions. However, the major benefit is that qualified withdrawals in retirement are tax-free. This can significantly reduce your tax burden in retirement.

How do I know if a Roth IRA is right for me?

The decision of whether a Roth IRA or a traditional IRA is right for you depends on your individual circumstances, such as your income level, tax bracket, and retirement goals. It’s recommended to consult with a financial advisor to determine the best option for you.