Roth IRA contribution limits and retirement planning in 2024 are crucial topics for anyone seeking to secure their financial future. Understanding these limits and how they affect your retirement savings strategy is essential for maximizing your contributions and building a comfortable nest egg.

This guide delves into the specifics of Roth IRA contributions in 2024, exploring contribution limits, income limitations, and the potential tax benefits of this popular retirement savings option. We’ll also discuss how Roth IRA contributions can be strategically utilized to achieve various retirement goals, from early retirement to supplementing Social Security income.

By examining the advantages of Roth IRAs, including tax-free withdrawals in retirement, we’ll provide a comprehensive overview of how these accounts can contribute to a successful retirement plan. We’ll also address common questions about Roth IRA contributions, such as the impact of income on eligibility and how to avoid potential pitfalls in your contribution strategy.

Contents List

- 1 Roth IRA Contribution Limits in 2024

- 2 Roth IRA Contribution Strategies

- 2.1 Step-by-Step Guide to Contributing to a Roth IRA in 2024

- 2.2 Roth IRA Contribution Strategies for Different Income Levels and Financial Goals

- 2.3 Examples of How Roth IRA Contributions Can Be Used to Achieve Specific Retirement Goals, Roth IRA contribution limits and retirement planning in 2024

- 2.4 Common Roth IRA Contribution Mistakes to Avoid

- 3 Roth IRA and Retirement Planning: Roth IRA Contribution Limits And Retirement Planning In 2024

- 4 Roth IRA in Retirement

- 5 Concluding Remarks

- 6 FAQ Explained

Roth IRA Contribution Limits in 2024

The Roth IRA is a popular retirement savings vehicle that offers tax-free withdrawals in retirement. In 2024, the contribution limit for Roth IRAs is $6,500 for individuals under age 50 and $7,500 for those 50 and older. This means that you can contribute up to these amounts to your Roth IRA each year, and you will not have to pay taxes on the withdrawals when you retire.

Looking for a credit card with no annual fee? You’re in luck! The best credit cards with no annual fee in October 2024 offer a variety of perks and benefits without the added cost of an annual fee.

Find the card that fits your needs and start saving today!

Income Limitations for Roth IRA Contributions

There are income limitations for making full Roth IRA contributions. If your modified adjusted gross income (MAGI) is above a certain threshold, you may not be able to contribute the full amount or may not be eligible to contribute at all.

If you’re over 50, you’ll want to know the 401k contribution limits for 2024. The limit for those over 50 is higher than for those under 50, so you can save more for retirement. Make sure to take advantage of this extra contribution room to reach your retirement goals.

For 2024, the income limits are as follows:

- Single Filers:If your MAGI is $153,000 or more, you cannot contribute to a Roth IRA.

- Married Filing Jointly:If your MAGI is $228,000 or more, you cannot contribute to a Roth IRA.

- Head of Household:If your MAGI is $189,000 or more, you cannot contribute to a Roth IRA.

If your income is above these limits, you may still be able to contribute to a Roth IRA, but your contribution may be limited or phased out. For example, if your MAGI is between $144,000 and $153,000 as a single filer, you will be able to contribute a reduced amount to a Roth IRA.

Don’t worry, you can still get an extension on your taxes even if you owe money. The extension will give you more time to file your taxes, but it won’t extend the payment deadline. You’ll still need to pay your taxes by the original deadline, even if you file for an extension.

It is important to note that these limits can change from year to year, so it is always best to check with the IRS or a financial advisor to confirm the current limits.

Wondering how much you can contribute to your IRA in 2024? Check out the IRA contribution limits for 2024 to see what you can save for your retirement. Don’t miss out on the opportunity to build your nest egg!

Comparison of Roth IRA and Traditional IRA Contribution Limits

The contribution limit for traditional IRAs is the same as for Roth IRAs in 2024: $6,500 for individuals under age 50 and $7,500 for those 50 and older. However, there are key differences between Roth IRAs and traditional IRAs.

- Roth IRA:Contributions are made with after-tax dollars, and withdrawals in retirement are tax-free.

- Traditional IRA:Contributions are made with pre-tax dollars, and withdrawals in retirement are taxed as ordinary income.

The best choice for you depends on your individual circumstances and financial goals.

Tax Benefits of Contributing to a Roth IRA

Contributing to a Roth IRA offers several tax benefits.

If you’re a freelancer who drives for work, you’ll want to know the IRS mileage rate for October 2024. This rate can help you deduct your driving expenses on your taxes, saving you money. The mileage rate changes throughout the year, so be sure to check for the most up-to-date information.

- Tax-Free Growth:Your contributions and earnings grow tax-deferred, and you will not have to pay taxes on them when you withdraw them in retirement.

- Tax-Free Withdrawals:When you withdraw your contributions and earnings in retirement, they are tax-free. This can be a significant benefit, especially if you expect to be in a higher tax bracket in retirement.

It is important to note that there are income limitations for making full Roth IRA contributions. If your income is above a certain threshold, you may not be able to contribute the full amount or may not be eligible to contribute at all.

Running a business can be challenging, but the right credit card can make it easier. Check out the best credit cards for business owners in October 2024 to find the card that best suits your needs. From rewards points to cash back, there’s a card out there that can help you save money and grow your business.

However, even if you are not able to contribute the full amount, you may still be able to contribute a reduced amount.

If you’re planning on contributing to your 401k in 2024, you might be wondering if the 401k contribution limit will change. The IRS sets the contribution limits each year, so be sure to check for the most up-to-date information.

Roth IRA Contribution Strategies

Contributing to a Roth IRA is a powerful way to save for retirement and potentially reduce your tax burden in the future. Here’s a breakdown of how to make the most of your Roth IRA contributions in 2024.

The October 2024 tax filing deadline is a crucial date for everyone, especially freelancers who need to file their taxes on time. Make sure to plan ahead and gather all the necessary documents to avoid any late penalties. If you need more time, you can always file for an extension.

Step-by-Step Guide to Contributing to a Roth IRA in 2024

To contribute to a Roth IRA, you’ll need to follow these steps:

- Choose a Roth IRA provider.There are many different financial institutions that offer Roth IRAs, including banks, credit unions, and brokerage firms. It’s important to compare the fees, investment options, and customer service of different providers before making a decision.

- Open a Roth IRA account.Once you’ve chosen a provider, you’ll need to open an account. You’ll typically need to provide some basic information, such as your Social Security number and date of birth.

- Make your contributions.You can contribute to your Roth IRA throughout the year, up to the annual limit of $6,500 in 2024 (or $7,500 if you’re 50 or older). You can make contributions in lump sums or through regular, automatic transfers from your checking or savings account.

Even if you have a 401k, you can still contribute to an IRA. The IRA contribution limit is independent of the 401k limit, so you can save even more for retirement. Don’t miss out on this opportunity to build your nest egg!

- Choose your investments.Roth IRAs allow you to invest in a wide range of assets, including stocks, bonds, mutual funds, and ETFs. You can choose investments that align with your risk tolerance and financial goals.

- Monitor your account.Once you’ve made your contributions and chosen your investments, it’s important to monitor your account regularly. This will help you track your progress and make any necessary adjustments to your investment strategy.

Roth IRA Contribution Strategies for Different Income Levels and Financial Goals

The right Roth IRA contribution strategy will depend on your individual circumstances, including your income level, financial goals, and risk tolerance. Here’s a table outlining some potential strategies:

| Income Level | Financial Goals | Contribution Strategy |

|---|---|---|

| Low Income | Maximize retirement savings | Contribute the full $6,500 (or $7,500 if 50 or older) annually, even if it means reducing other expenses. |

| Middle Income | Build a diversified retirement portfolio | Contribute a significant amount, such as 10-15% of your income, to your Roth IRA. |

| High Income | Minimize taxes in retirement | Contribute the full $6,500 (or $7,500 if 50 or older) to take advantage of the tax-free growth and withdrawals in retirement. |

Examples of How Roth IRA Contributions Can Be Used to Achieve Specific Retirement Goals, Roth IRA contribution limits and retirement planning in 2024

- Early Retirement:A young professional could contribute the maximum to a Roth IRA each year, starting early in their career, to build a substantial nest egg that could allow them to retire early.

- Purchasing a Home in Retirement:A middle-aged individual could contribute to a Roth IRA to help fund a down payment on a new home in retirement.

- Covering Healthcare Costs:An individual nearing retirement could contribute to a Roth IRA to help cover potential healthcare expenses in retirement, as healthcare costs can be significant in later years.

Common Roth IRA Contribution Mistakes to Avoid

- Not contributing enough:Many people underestimate how much they’ll need to save for retirement. Contributing the maximum amount possible to your Roth IRA is crucial for maximizing your savings potential.

- Contributing too late:The sooner you start contributing to a Roth IRA, the more time your money has to grow. Don’t wait until you’re older to start saving for retirement.

- Not diversifying your investments:Investing all of your Roth IRA contributions in a single asset class can be risky. It’s important to diversify your investments across different asset classes to reduce your risk.

- Not monitoring your account:It’s important to monitor your Roth IRA account regularly to track your progress and make any necessary adjustments to your investment strategy.

Roth IRA and Retirement Planning: Roth IRA Contribution Limits And Retirement Planning In 2024

The Roth IRA offers a unique opportunity to build a secure retirement future while enjoying the benefits of tax-free withdrawals in retirement. This approach to retirement planning provides a valuable strategy for maximizing your financial well-being.

If you’re working with government agencies, you’ll need to fill out a W9 Form. This form is used to provide your tax identification number and other information to the agency. Make sure to have this form completed and ready to go, so you can get paid on time.

Tax Advantages of Roth IRAs

The Roth IRA offers significant tax advantages that can enhance your retirement savings. It allows you to contribute after-tax dollars, meaning you won’t have to pay taxes on the money you contribute or the earnings it generates. This is in contrast to traditional IRAs, where contributions are tax-deductible but withdrawals in retirement are taxed.

Whether you’re driving to work or running errands for your business, the October 2024 mileage rate for driving to work can help you save money on your taxes. Make sure to keep track of your mileage and use the correct rate when filing your taxes.

- Tax-Free Growth:One of the most compelling advantages of the Roth IRA is that your contributions and earnings grow tax-free. This means you can accumulate wealth without having to worry about paying taxes on your investment gains.

- Tax-Free Withdrawals:When you withdraw your Roth IRA funds in retirement, you won’t have to pay any taxes on the money you take out. This can be a significant advantage, especially if you’re in a higher tax bracket during retirement.

- Flexibility:Unlike traditional IRAs, there are no required minimum distributions (RMDs) for Roth IRAs. This means you can keep your money invested and continue to grow your savings for as long as you like.

Comparing Roth IRAs to Other Retirement Savings Options

Roth IRAs offer distinct tax advantages compared to other retirement savings options, such as 401(k)s.

If you’re looking for the mileage rate for October 2024 , you can find it on the IRS website. The mileage rate is updated throughout the year, so be sure to check for the most up-to-date information.

- 401(k)s:While 401(k)s allow for pre-tax contributions, withdrawals in retirement are taxed. Roth 401(k)s offer similar tax advantages as Roth IRAs, but they are only available through employer-sponsored plans.

- Traditional IRAs:Traditional IRAs allow for tax-deductible contributions, but withdrawals in retirement are taxed. The Roth IRA provides the opposite scenario: tax-free contributions and tax-free withdrawals.

How Roth IRA Contributions Can Reduce Taxes in Retirement

The tax-free withdrawals from a Roth IRA can significantly reduce your tax burden in retirement. Imagine you’ve contributed $5,000 per year to a Roth IRA for 30 years, and your account has grown to $500,000. When you withdraw that money in retirement, you won’t have to pay any taxes on it.

The tax extension deadline for freelancers in October 2024 gives you extra time to file your taxes. However, it’s important to note that this only extends the filing deadline, not the payment deadline. You still need to pay your taxes by the original deadline, even if you file for an extension.

This can save you thousands of dollars in taxes compared to withdrawing from a traditional IRA or 401(k).

Moving can be a stressful experience, but the October 2024 mileage rate for moving expenses can help ease the financial burden. This rate allows you to deduct your moving expenses on your taxes, saving you money. Keep track of your mileage and make sure to use the correct rate when filing your taxes.

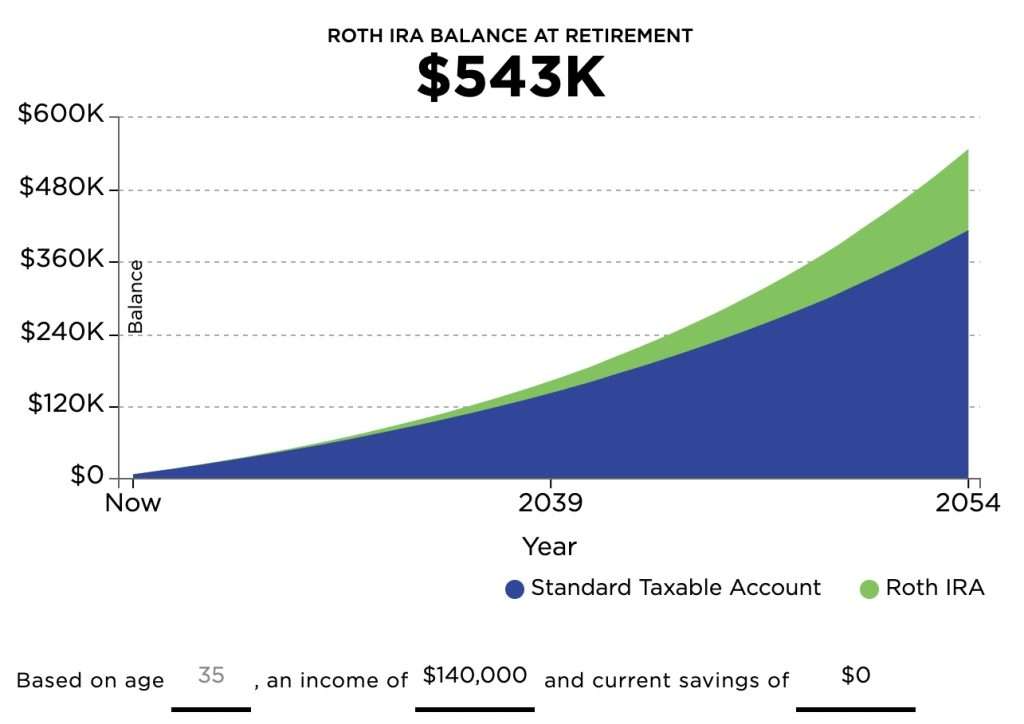

Potential Growth of Roth IRA Contributions Over Time

The power of compound interest can significantly boost the growth of your Roth IRA contributions over time.

| Years | Contribution (Annual) | Average Annual Return | Total Contributions | Account Balance |

|---|---|---|---|---|

| 10 | $6,500 | 7% | $65,000 | $94,000 |

| 20 | $6,500 | 7% | $130,000 | $282,000 |

| 30 | $6,500 | 7% | $195,000 | $688,000 |

This table demonstrates the potential growth of a Roth IRA with an annual contribution of $6,500 and an average annual return of 7%. As you can see, the account balance grows significantly over time due to the power of compounding.

Roth IRA in Retirement

The Roth IRA offers a unique advantage for retirement planning: tax-free withdrawals. This means that when you withdraw your contributions and earnings in retirement, you won’t have to pay any taxes on them. This can be a significant benefit, especially if you expect to be in a higher tax bracket in retirement.

Tax-Free Withdrawals

The ability to withdraw contributions and earnings from a Roth IRA tax-free in retirement is one of its key features. This is in contrast to traditional IRAs, where withdrawals are taxed in retirement. The tax-free nature of Roth IRA withdrawals can be particularly advantageous for those who anticipate being in a higher tax bracket in retirement.

Impact on Social Security Benefits

While Roth IRA withdrawals are tax-free, they can potentially impact your Social Security benefits. This is because Social Security benefits are subject to taxation based on your overall income, which includes income from Roth IRA withdrawals. If your Roth IRA withdrawals, combined with other income, push you into a higher tax bracket, a portion of your Social Security benefits could become taxable.

Scenarios Favoring Roth IRA Withdrawals

There are several scenarios where withdrawing from a Roth IRA in retirement could be advantageous:* High Expected Tax Bracket:If you anticipate being in a higher tax bracket in retirement, withdrawing from a Roth IRA can help you avoid paying taxes on your savings.

Limited Retirement Income

If your other retirement income sources are limited, withdrawing from a Roth IRA can provide a tax-free source of income.

Minimizing Taxes on Social Security

By carefully planning your Roth IRA withdrawals, you can potentially minimize the amount of your Social Security benefits that are subject to taxation.

Maximizing Roth IRA Withdrawals in Retirement

Here are some strategies for maximizing your Roth IRA withdrawals in retirement:* Timing:Withdraw your contributions first, as they are always tax-free and penalty-free.

Withdrawals During Low-Income Years

If you have other income sources that are lower than your usual income, consider withdrawing from your Roth IRA during those years to avoid pushing yourself into a higher tax bracket.

Consult with a Financial Advisor

A financial advisor can help you develop a personalized strategy for maximizing your Roth IRA withdrawals in retirement, taking into account your individual circumstances and goals.

If you’re a head of household, you’ll want to check out the tax brackets for head of household in 2024 to see how much you’ll owe in taxes. The good news is that the tax filing deadline is in October, giving you plenty of time to get your affairs in order.

Just remember that the deadline is October 15th, not October 31st, so don’t wait until the last minute!

Concluding Remarks

In conclusion, Roth IRA contribution limits and retirement planning in 2024 are intertwined elements that play a significant role in shaping your financial future. By carefully considering the contribution limits, income limitations, and potential tax benefits of Roth IRAs, you can make informed decisions that align with your individual retirement goals.

Whether you’re just starting your retirement savings journey or looking to optimize your existing strategy, understanding the nuances of Roth IRAs is crucial for building a secure and fulfilling retirement.

FAQ Explained

What are the income limitations for contributing to a Roth IRA in 2024?

The ability to contribute the full amount to a Roth IRA in 2024 is subject to income limitations. If your modified adjusted gross income (MAGI) exceeds certain thresholds, your contribution ability may be reduced or you may not be eligible to contribute at all.

It’s important to check the current income limitations to determine your eligibility.

Can I contribute to a Roth IRA and a traditional IRA in the same year?

Yes, you can contribute to both a Roth IRA and a traditional IRA in the same year, but there are limitations. The total amount you can contribute to both types of IRAs combined is subject to the annual contribution limit.

Additionally, your income may affect your eligibility for both types of accounts.

How do Roth IRA withdrawals affect Social Security benefits?

Roth IRA withdrawals in retirement are generally tax-free, and they don’t have a direct impact on Social Security benefits. However, it’s important to note that the amount of your retirement income, including withdrawals from Roth IRAs, can potentially affect your Social Security benefits if you’re claiming benefits before your full retirement age.