Is it better to contribute to a traditional or Roth IRA in 2024? This question is a common dilemma for individuals seeking to maximize their retirement savings. Both traditional and Roth IRAs offer tax advantages, but the specific benefits vary depending on your current tax bracket, income level, and financial goals.

Understanding the nuances of each account type can help you make an informed decision that aligns with your long-term financial strategy.

This guide delves into the key differences between traditional and Roth IRAs, exploring their tax implications, contribution limits, and withdrawal rules. We’ll also discuss how your current and projected tax brackets, income eligibility, and investment preferences can influence your choice.

By understanding these factors, you can determine which IRA type best suits your individual circumstances and helps you build a secure financial future.

Contents List

- 1 Understanding Traditional and Roth IRAs

- 2 Tax Bracket Considerations

- 3 Income Eligibility and Contribution Limits

- 4 Withdrawal Rules and Tax Implications

- 5 Investment Options and Growth Potential: Is It Better To Contribute To A Traditional Or Roth IRA In 2024

- 6 Long-Term Financial Planning Considerations

- 7 Wrap-Up

- 8 FAQs

Understanding Traditional and Roth IRAs

Retirement accounts are crucial for building wealth for your future. Two popular options are traditional and Roth IRAs, each with unique features and tax implications. This guide will explore the key differences between these two IRA types, providing a comprehensive understanding of their contribution mechanics and tax treatment.

Contribution Mechanics

Both traditional and Roth IRAs allow individuals to contribute a specific amount each year. The contribution limit for 2024 is $7,000 for individuals under 50 and $7,500 for those 50 and older. However, the way these contributions are treated for tax purposes differs significantly between the two IRA types.

If you’re self-employed, you have until October 15th, 2024 to file your taxes. This extension gives you more time to gather your records and prepare your return.

- Traditional IRA:Contributions are made with pre-tax dollars, meaning they reduce your taxable income in the year you contribute. This lowers your current tax liability but leads to taxation upon withdrawal during retirement.

- Roth IRA:Contributions are made with after-tax dollars, meaning they do not reduce your taxable income in the year you contribute. However, qualified withdrawals in retirement are tax-free.

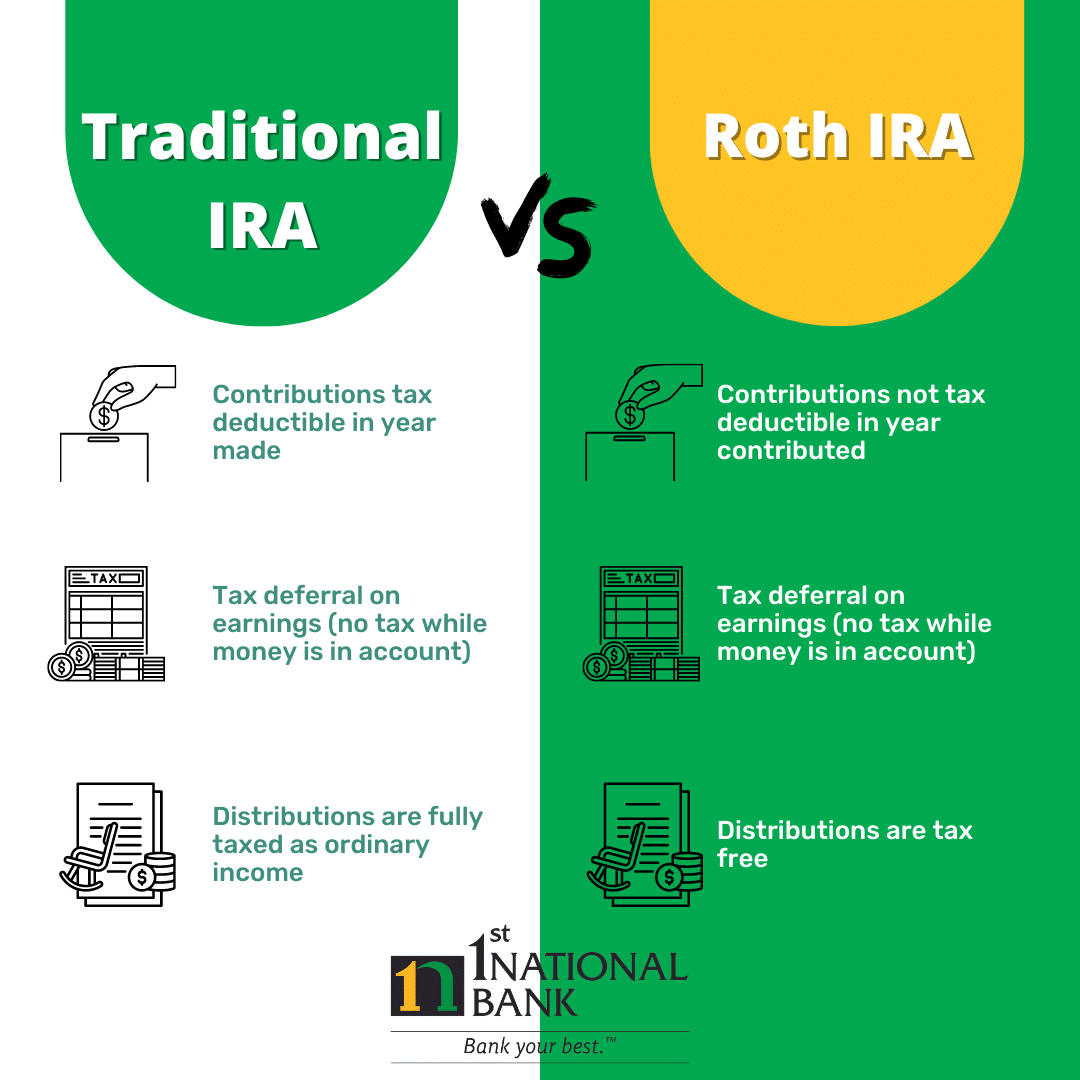

Tax Implications

The tax implications of traditional and Roth IRAs differ during both the contribution and withdrawal phases.

If you drive to work, you can deduct a certain amount per mile on your taxes. Check out the mileage rate for 2024 to see how much you can deduct.

Tax Treatment During Contributions

- Traditional IRA:Contributions are tax-deductible, meaning they reduce your taxable income for the year. This lowers your tax bill in the present.

- Roth IRA:Contributions are not tax-deductible, meaning they do not reduce your taxable income for the year. This means you pay taxes on your contributions upfront, but withdrawals in retirement are tax-free.

Tax Treatment During Withdrawals

- Traditional IRA:Withdrawals in retirement are taxed as ordinary income. This means you will pay taxes on the amount you withdraw, just like you would on any other income.

- Roth IRA:Qualified withdrawals in retirement are tax-free. This means you will not pay any taxes on the money you withdraw.

Key Differences

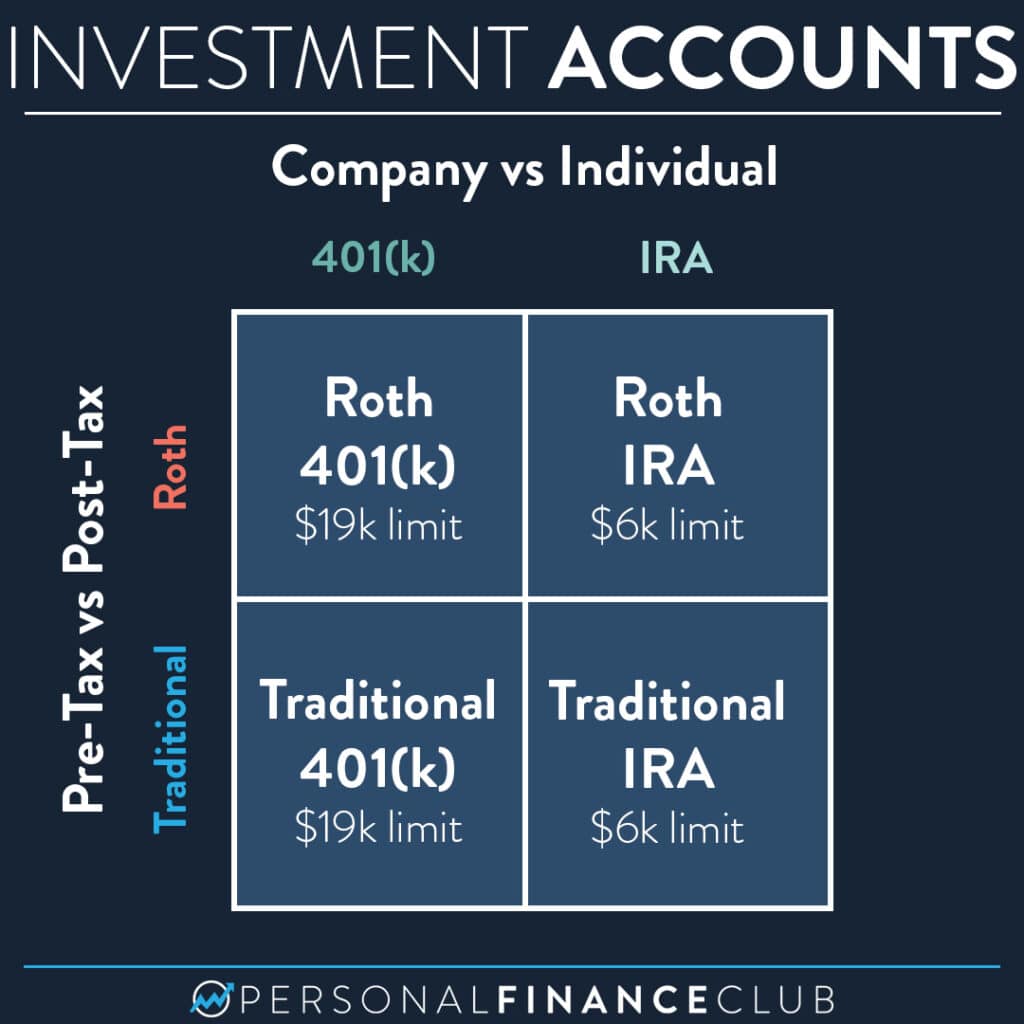

The following table summarizes the key differences between traditional and Roth IRAs:

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Contribution Type | Pre-tax dollars | After-tax dollars |

| Tax Deductibility of Contributions | Tax-deductible | Not tax-deductible |

| Taxability of Withdrawals | Taxed as ordinary income | Tax-free |

| Income Limits | No income limits for contributions | Income limits for contributions (in 2024, contributions are phased out for single filers with modified adjusted gross income (MAGI) of $153,000 or more, and for married couples filing jointly with MAGI of $228,000 or more) |

Tax Bracket Considerations

Choosing between a traditional and Roth IRA in 2024 involves considering your current and projected tax bracket. Understanding how your tax situation might change in the future is crucial, as it can significantly impact the long-term benefits of each IRA type.

Tax Benefits of Traditional IRAs in 2024

Traditional IRAs offer a tax deduction for contributions, which can lower your current tax liability. The deduction reduces your taxable income, resulting in lower taxes in the present. This can be particularly advantageous if you are in a higher tax bracket now.

The tax brackets for 2024 have changed slightly compared to 2023. Learn more about the changes and how they might affect your taxes.

The deduction for traditional IRA contributions can be claimed on Form 1040, Schedule 1, Line 16a.

Tax Benefits of Roth IRAs in 2024

Unlike traditional IRAs, Roth IRAs do not offer a tax deduction for contributions. Instead, you contribute after-tax dollars. However, qualified withdrawals in retirement are tax-free. This means you won’t have to pay taxes on your distributions, which can be a significant advantage if you expect to be in a higher tax bracket in retirement.

You can withdraw contributions from a Roth IRA at any time without penalties or taxes.

If you have good credit, there are several credit cards that can offer great rewards. Check out some of the best options available in October 2024.

Impact of Current and Projected Tax Brackets

The choice between a traditional and Roth IRA hinges on your current and projected tax brackets. If you anticipate being in a lower tax bracket in retirement than you are now, a traditional IRA might be more beneficial. The tax deduction you receive now will be offset by taxes on your withdrawals in retirement, but the overall tax burden will be lower since you’ll be in a lower tax bracket.

The 401k contribution limits for 2024 vary by age. Find out how much you can contribute based on your age.

Conversely, if you expect to be in a higher tax bracket in retirement, a Roth IRA could be more advantageous. While you don’t receive a tax deduction now, your withdrawals in retirement will be tax-free, saving you money in the long run.

The amount you can contribute to your 401k depends on your income level. Learn more about the contribution limits for different income brackets.

The tax brackets for 2024 are yet to be determined.

Even if you have a 401k, you may still be able to contribute to an IRA. Find out if you’re eligible to contribute to both.

Income Eligibility and Contribution Limits

It’s important to understand that income eligibility and contribution limits play a significant role in determining whether a traditional IRA or Roth IRA is a better fit for you. These limits can affect your ability to contribute, the tax benefits you receive, and even the potential tax implications in retirement.

If you’re participating in a traditional 401k, you can contribute up to $25,500 in 2024. Find out more about the contribution limits for traditional 401ks.

Traditional IRA Income Limits

For 2024, if your modified adjusted gross income (MAGI) is above a certain threshold, you may not be able to contribute to a traditional IRA or you may only be able to make a partial contribution. These income limits vary depending on your filing status.

- Single filers and married individuals filing separately: $73,000

- Married couples filing jointly: $146,000

- Head of household: $109,000

If your MAGI exceeds these limits, you won’t be able to deduct your contributions to a traditional IRA, meaning you won’t receive any tax benefits from your contributions. However, you can still contribute to a traditional IRA, but your contributions won’t be tax-deductible.

Roth IRA Income Limits

Similar to traditional IRAs, there are income limits for contributing to a Roth IRA. These limits apply to your MAGI, and they are also based on your filing status.

Looking for a great credit card for travel rewards? Check out some of the best options available in October 2024.

- Single filers and married individuals filing separately: $153,000

- Married couples filing jointly: $228,000

- Head of household: $204,000

If your MAGI exceeds these limits, you can’t contribute to a Roth IRA.

For 2024, you can contribute up to $7,500 to a Roth IRA. Learn more about the contribution limits for Roth IRAs.

Impact of Income Eligibility on IRA Choice

Your income eligibility can significantly impact your choice between a traditional and Roth IRA. Here’s a breakdown:* Lower Income:If your income is below the income limits for both traditional and Roth IRAs, you have the flexibility to choose either. A traditional IRA might be a better choice if you expect to be in a lower tax bracket in retirement, while a Roth IRA might be better if you expect to be in a higher tax bracket in retirement.

Income Within Limits for Traditional IRA but Above Limits for Roth IRA

In this scenario, you can only contribute to a traditional IRA. You can deduct your contributions, potentially lowering your current tax bill, but you’ll have to pay taxes on withdrawals in retirement.

Income Above Limits for Both Traditional and Roth IRAs

If your income exceeds the limits for both types of IRAs, you can’t contribute to either. You might want to explore other retirement savings options, such as a 401(k) or 403(b).

Self-employed individuals have until October 15th, 2024 to file their taxes. Make sure you understand the deadlines and get your paperwork in on time.

Withdrawal Rules and Tax Implications

When it comes to retirement savings, understanding the rules for withdrawing your funds is crucial. This section delves into the withdrawal rules and tax implications of both traditional and Roth IRAs.

Traditional IRA Withdrawals

Traditional IRA contributions are tax-deductible, meaning you can deduct them from your taxable income in the year you contribute. However, this tax benefit comes with a trade-off: withdrawals in retirement are taxed as ordinary income.

The 2024 tax brackets can affect your retirement savings. Find out how the tax brackets might impact your retirement planning.

- Before age 59 1/2:Withdrawals before age 59 1/2 are generally subject to a 10% early withdrawal penalty, plus your usual income tax rate. There are exceptions to the penalty, such as for first-time home purchases, certain medical expenses, or disability.

- After age 59 1/2:Withdrawals after age 59 1/2 are taxed as ordinary income, but the 10% penalty is waived.

Roth IRA Withdrawals

Roth IRA contributions are made with after-tax dollars, meaning you don’t receive a tax deduction at the time of contribution. However, this results in tax-free withdrawals in retirement.

- Before age 59 1/2:Withdrawals of contributions (not earnings) before age 59 1/2 are always tax-free and penalty-free. However, withdrawing earnings before age 59 1/2 is subject to both taxes and a 10% early withdrawal penalty, unless you qualify for an exception.

- After age 59 1/2:Withdrawals of both contributions and earnings after age 59 1/2 are tax-free and penalty-free, as long as the account has been open for at least five years.

Impact of Early Withdrawals

Early withdrawals from both traditional and Roth IRAs can have significant financial consequences, including:

- Tax Liability:As mentioned earlier, early withdrawals from traditional IRAs are subject to both income tax and a 10% penalty. Early withdrawals from Roth IRAs are also subject to taxes and a 10% penalty if the account has not been open for at least five years.

Looking to save for retirement? Small businesses can contribute up to $25,500 to their 401k plans in 2024. Check out the contribution limits to see how much you can save.

- Reduced Retirement Savings:Withdrawing funds early depletes your retirement savings, potentially leaving you with less money to live on in your later years.

- Potential Impact on Other Financial Goals:Early withdrawals can disrupt other financial goals, such as saving for a down payment on a house or paying for your children’s education.

Investment Options and Growth Potential: Is It Better To Contribute To A Traditional Or Roth IRA In 2024

Both traditional and Roth IRAs offer a wide range of investment options, allowing you to customize your portfolio based on your risk tolerance and financial goals. Understanding the investment options available within each type of IRA and their potential for growth is crucial in making an informed decision.

Traditional IRA Investment Options

Traditional IRAs offer a wide range of investment options, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and even real estate investments. These options are typically held within a custodial account managed by a financial institution.

The specific investment options available within a traditional IRA may vary depending on the custodian or provider you choose.

Tax-Deferred Growth in Traditional IRAs

One of the key advantages of traditional IRAs is the potential for tax-deferred growth. This means that any earnings from your investments within the IRA are not taxed until you withdraw them in retirement.

For example, if you invest $10,000 in a traditional IRA and it grows to $20,000 over 20 years, you will only pay taxes on the $10,000 in earnings when you withdraw the money in retirement.

Roth IRA Investment Options

Roth IRAs also offer a diverse range of investment options, including stocks, bonds, mutual funds, ETFs, and real estate investments. These options are typically held within a custodial account managed by a financial institution.

The standard deduction for single filers in 2024 is $14,000. Find out more about the standard deduction for single filers.

The specific investment options available within a Roth IRA may vary depending on the custodian or provider you choose.

Tax-Free Growth in Roth IRAs

A major advantage of Roth IRAs is the potential for tax-free growth. This means that any earnings from your investments within the Roth IRA are not taxed when you withdraw them in retirement.

For example, if you invest $10,000 in a Roth IRA and it grows to $20,000 over 20 years, you will not have to pay any taxes on the $10,000 in earnings when you withdraw the money in retirement.

Long-Term Financial Planning Considerations

IRAs can play a significant role in your long-term financial planning, helping you build wealth and secure your future. Understanding the differences between traditional and Roth IRAs can help you make informed decisions about how to use them to reach your financial goals.

Traditional and Roth IRAs for Long-Term Financial Goals, Is it better to contribute to a traditional or Roth IRA in 2024

Traditional and Roth IRAs offer distinct advantages for long-term financial planning, depending on your individual circumstances and financial goals.

For 2024, you can contribute up to $25,500 to a traditional 401k. Learn more about the contribution limits for traditional 401ks.

- Traditional IRA:Traditional IRAs allow you to contribute pre-tax dollars, reducing your taxable income in the present. This can be beneficial if you expect to be in a lower tax bracket in retirement than you are currently. Your contributions will grow tax-deferred, and you will only pay taxes on your withdrawals in retirement.

- Roth IRA:Roth IRAs allow you to contribute after-tax dollars, meaning you will not have to pay taxes on your withdrawals in retirement. This can be beneficial if you expect to be in a higher tax bracket in retirement than you are currently.

Your contributions will grow tax-free, providing a significant tax advantage in retirement.

Potential Benefits of Each IRA Type for Retirement Planning

Both traditional and Roth IRAs offer distinct benefits for retirement planning.

- Traditional IRA:

- Tax deduction:Traditional IRA contributions are tax-deductible, lowering your current tax liability.

- Tax-deferred growth:Your contributions and earnings grow tax-deferred, allowing for greater potential returns.

- Roth IRA:

- Tax-free withdrawals in retirement:You won’t pay taxes on withdrawals in retirement, making it a valuable tool for long-term savings.

- Potential for higher after-tax returns:The tax-free growth can lead to higher returns over time, especially in a higher tax bracket.

Using IRAs to Supplement Other Retirement Savings Strategies

IRAs can be used to supplement other retirement savings strategies, such as employer-sponsored retirement plans (401(k)s or 403(b)s).

- Catch-up contributions:If you are 50 or older, you can make catch-up contributions to both traditional and Roth IRAs, allowing you to contribute more than the standard limit to accelerate your savings.

- Rollover IRAs:You can roll over funds from a traditional IRA to a Roth IRA, allowing you to take advantage of the tax-free withdrawals of a Roth IRA.

Wrap-Up

Ultimately, the decision of whether to contribute to a traditional or Roth IRA depends on your unique financial situation and long-term goals. Carefully considering your current tax bracket, income level, and projected future financial needs can help you make an informed choice.

Consulting with a financial advisor can provide personalized guidance and ensure your investment strategy aligns with your individual objectives.

FAQs

What is the contribution limit for traditional and Roth IRAs in 2024?

The contribution limit for both traditional and Roth IRAs in 2024 is $6,500 for individuals under age 50 and $7,500 for those 50 and older.

Can I contribute to both a traditional and Roth IRA in the same year?

Yes, you can contribute to both a traditional and Roth IRA in the same year, but your total contributions cannot exceed the annual limit for each type of IRA.

Can I withdraw contributions from a traditional or Roth IRA before age 59 1/2 without penalty?

You can generally withdraw contributions from a Roth IRA at any time without penalty, but withdrawals of earnings before age 59 1/2 are subject to taxes and penalties. For traditional IRAs, withdrawals of both contributions and earnings before age 59 1/2 are typically subject to taxes and penalties, unless you meet certain exceptions.

What happens to my IRA if I die?

Upon your death, your IRA will be passed on to your beneficiaries according to your designated beneficiary information. The tax implications of your IRA distribution will depend on the type of IRA and the beneficiary’s circumstances.