How to maximize my Roth IRA contributions in 2024? It’s a question many individuals are asking, especially as they strive to secure their financial future. The Roth IRA, with its potential for tax-free growth and withdrawals in retirement, is a powerful tool for building wealth.

But knowing how to maximize your contributions is crucial for reaping the full benefits of this retirement savings vehicle.

This guide will walk you through the intricacies of Roth IRAs, including eligibility requirements, contribution limits, investment strategies, and tax implications. Whether you’re a seasoned investor or just starting your retirement planning journey, this comprehensive resource will equip you with the knowledge you need to make informed decisions about your Roth IRA contributions.

Contents List

Understanding Roth IRA Contributions

A Roth IRA is a retirement savings account that offers tax advantages, allowing you to grow your savings tax-free. Unlike traditional IRAs, where you deduct contributions from your taxes and pay taxes on withdrawals in retirement, Roth IRAs work in reverse: you contribute after-tax dollars, and your withdrawals in retirement are tax-free.

Tax season is approaching, and families need to be prepared. A tax calculator for families in October 2024 can help you estimate your tax liability and plan accordingly.

This makes Roth IRAs an attractive option for those who expect to be in a higher tax bracket in retirement than they are now.

Roth IRA vs. Traditional IRA, How to maximize my Roth IRA contributions in 2024

Understanding the key differences between Roth IRAs and traditional IRAs can help you decide which type of retirement account is right for you.

Want to get a better understanding of how your investments will be taxed? You can use a tax calculator for investments in October 2024 to estimate your tax liability.

- Contribution Type:Roth IRAs are funded with after-tax dollars, while traditional IRAs are funded with pre-tax dollars.

- Tax Treatment:Roth IRA withdrawals in retirement are tax-free, while traditional IRA withdrawals are taxed as ordinary income.

- Tax Deductibility:Roth IRA contributions are not tax-deductible, while traditional IRA contributions are typically tax-deductible.

- Income Limits:Roth IRA contribution eligibility is based on modified adjusted gross income (MAGI), while traditional IRA contribution eligibility is based on your filing status.

- Withdrawal Rules:Early withdrawals from Roth IRAs are generally tax-free and penalty-free if you meet certain conditions, while early withdrawals from traditional IRAs may be subject to taxes and penalties.

Roth IRA Contribution Limits for 2024

The annual contribution limit for Roth IRAs in 2024 is $6,500 for individuals under age 50 and $7,500 for those age 50 and older. This limit applies to both single and married individuals, and it’s the same regardless of your income level.

Planning to contribute to a Roth IRA in 2024? Make sure you’re aware of the Roth IRA contribution limits for 2024.

However, it’s important to note that your ability to contribute the full amount may be affected by your income. If your modified adjusted gross income (MAGI) exceeds certain thresholds, you may not be able to contribute the full amount, or you may be ineligible to contribute at all.

It’s important to understand the tax brackets for married filing separately in 2024 to estimate your tax liability.

Maximizing Your Contributions

Now that you understand the basics of Roth IRA contributions, let’s dive into how to maximize your contributions in 2024. Maximizing your contributions means taking full advantage of the annual contribution limit, which can significantly impact your retirement savings.

Saving for retirement? If you’re married, you’ll want to know the IRA contribution limits for 2024 for married couples to maximize your contributions.

Strategies for Increasing Contributions

Here are some strategies for increasing your Roth IRA contributions throughout the year:

- Set a Budget and Track Your Spending:Knowing where your money goes can help you identify areas where you can cut back and allocate more funds towards your Roth IRA.

- Automate Your Contributions:Set up automatic transfers from your checking account to your Roth IRA. This ensures regular contributions without you having to manually remember to make them.

- Consider a Side Hustle:Earning extra income through a side hustle can provide additional funds to contribute to your Roth IRA.

- Negotiate a Raise:Asking for a raise can increase your disposable income, allowing you to contribute more to your Roth IRA.

- Review Your Expenses:Regularly review your expenses to identify areas where you can reduce spending and reallocate funds towards your Roth IRA.

Benefits of Maximizing Contributions

The benefits of maximizing your Roth IRA contributions extend beyond simply saving more money. Here are some of the key advantages:

- Tax-Free Growth:Your Roth IRA contributions grow tax-free, meaning you won’t have to pay taxes on your earnings when you withdraw them in retirement.

- Potential Tax Savings:Contributing to a Roth IRA can reduce your taxable income, potentially lowering your tax bill in the present.

- Retirement Income Growth:The longer your contributions grow tax-free, the more your retirement savings will accumulate, potentially leading to a larger nest egg.

- Flexibility in Retirement:Having a substantial Roth IRA balance can provide flexibility in retirement, allowing you to withdraw contributions tax-free and penalty-free at any time.

Roth IRA Eligibility

While the Roth IRA offers tax-free withdrawals in retirement, it’s not available to everyone. Income limitations determine your eligibility to contribute to a Roth IRA.

Looking to maximize your retirement savings? You might be able to contribute more than the standard limit with the maximum 401k contribution in 2024 with catch-up.

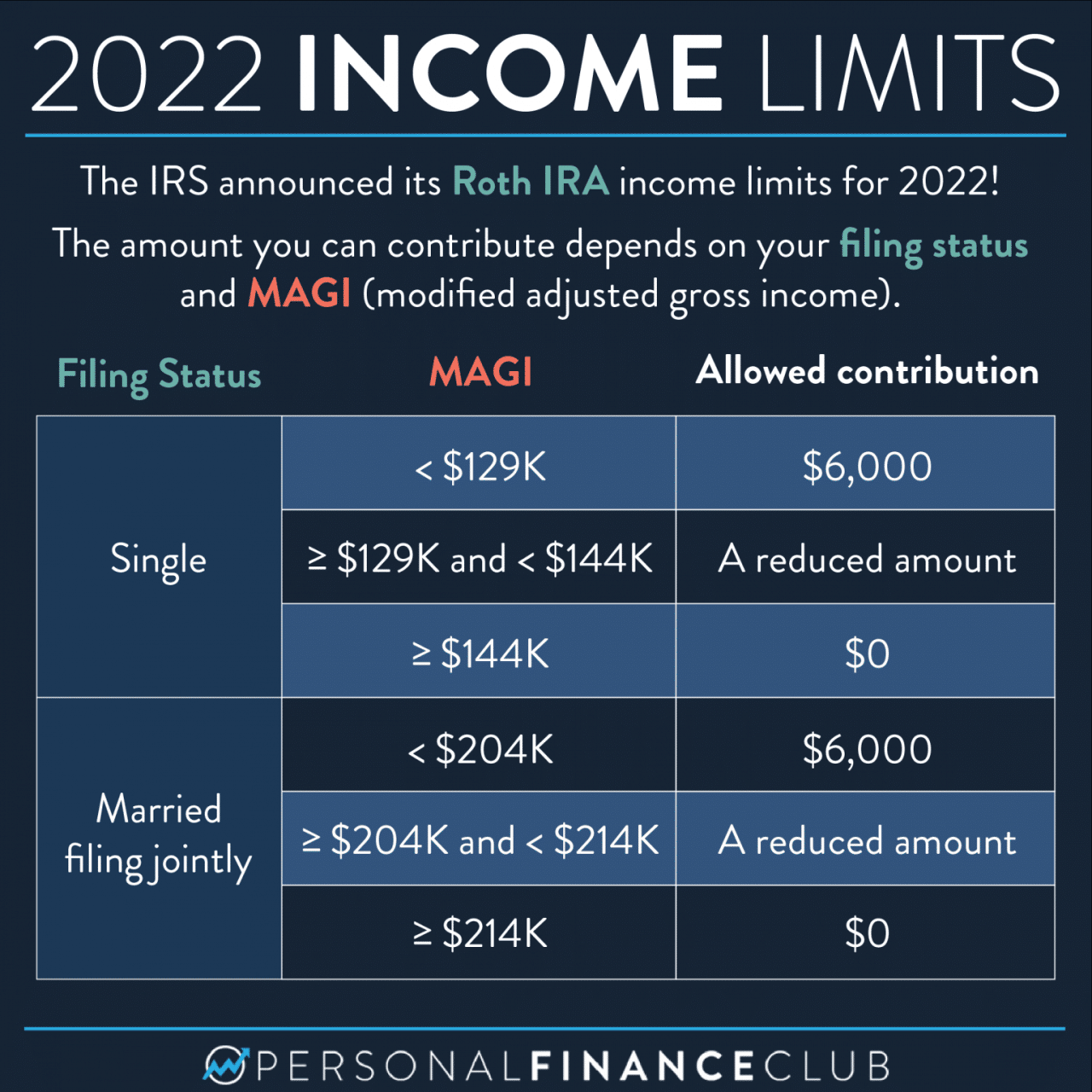

Income Limits

Income limits are adjusted annually by the IRS, so it’s crucial to check the latest guidelines. If your modified adjusted gross income (MAGI) exceeds these limits, you may not be able to contribute to a Roth IRA, or you might face a partial contribution limitation.

Curious about how much you’ll owe in taxes in 2024? You can get an estimate by using a tax calculator, but it’s also helpful to understand the basics of how much you’ll pay in taxes in 2024.

The MAGI is your adjusted gross income (AGI) with some additions and subtractions.

2024 Income Limits for Roth IRA Contributions

- Single Filers and Head of Household:$153,000 or higher

- Married Filing Jointly:$228,000 or higher

- Married Filing Separately:$114,000 or higher

Examples of Income Scenarios and their Implications for Roth IRA Eligibility

- Scenario 1:Sarah is single and her MAGI is $140,000. She is eligible to contribute the full amount to a Roth IRA in 2024.

- Scenario 2:John and Mary are married filing jointly and their MAGI is $235,000. They are not eligible to contribute to a Roth IRA in 2024 because their income exceeds the limit.

- Scenario 3:David is single and his MAGI is $155,000. He is not eligible to contribute to a Roth IRA in 2024.

Investment Strategies

Once you’ve determined your Roth IRA contribution amount, you need to decide how to invest those funds. There are many different investment options available, each with its own risk and return profile.

Wondering how much you can deduct if you’re filing as head of household in 2024? Check out the standard deduction for head of household in 2024 to see if you qualify for a larger deduction.

Comparing Investment Options

| Asset Class | Risk Level | Potential Returns | Fees |

|---|---|---|---|

| Stocks | High | High | Variable |

| Bonds | Moderate | Moderate | Variable |

| Mutual Funds | Variable | Variable | Variable |

Here is a detailed look at each investment option:

Stocks

Stocks represent ownership in a company. They can be bought and sold on stock exchanges. Stocks are considered a higher-risk investment than bonds, but they also have the potential for higher returns. The value of stocks can fluctuate significantly, so it’s important to diversify your stock investments.

If you’re considering a Roth IRA, be sure to check the Roth IRA income limits for 2024 to see if you qualify.

- Pros:

- Potential for high returns

- Liquidity

- Growth potential

- Cons:

- High risk

- Volatility

- Requires research and due diligence

Bonds

Bonds are debt securities that represent a loan to a company or government. They typically pay a fixed interest rate, and the principal is repaid at maturity. Bonds are considered a lower-risk investment than stocks, but they also have the potential for lower returns.

If you need to file an extension, it’s important to know the deadline. Find out what happens if you miss the tax extension deadline in October 2024 to avoid any penalties.

- Pros:

- Lower risk than stocks

- Regular income payments

- Diversification

- Cons:

- Lower potential returns than stocks

- Interest rate risk

- Inflation risk

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets. They are managed by professional fund managers who make investment decisions on behalf of the fund’s investors. Mutual funds can be a good option for investors who don’t have the time or expertise to manage their own investments.

Make sure you know the Roth IRA contribution limits for 2024 to maximize your retirement savings.

- Pros:

- Diversification

- Professional management

- Liquidity

- Cons:

- Fees

- Lack of control over individual investments

- Performance can vary

Tax Implications

The tax implications of Roth IRA contributions and withdrawals are crucial to understanding the long-term benefits of this retirement savings strategy. While Roth IRA contributions are made with after-tax dollars, withdrawals in retirement are tax-free, making it a powerful tool for tax-efficient retirement planning.

If you’re a high earner, you’ll want to know the 401k contribution limits for 2024 for high earners to make sure you’re maximizing your retirement savings.

Tax-Free Withdrawals in Retirement

Roth IRA withdrawals in retirement are tax-free, meaning you won’t owe any federal or state income tax on the money you withdraw. This is a significant advantage over traditional IRAs, where withdrawals are taxed as ordinary income.

While there’s a limit on how much you can contribute to your 401(k), you may be able to contribute more if you’re a high earner. Learn more about contributing more than the 401k limit in 2024.

“With a Roth IRA, you’re essentially paying taxes upfront on your contributions, but then you get to enjoy tax-free withdrawals in retirement.”

Don’t forget to check the Roth IRA contribution limits for 2024 to ensure you’re maximizing your contributions.

This tax-free benefit can significantly reduce your overall tax liability in retirement, allowing you to keep more of your hard-earned money.

It’s important to stay within the contribution limits for your Roth IRA. Check out this article on penalties for exceeding the Roth IRA contribution limit in 2024 to avoid any unexpected surprises.

Examples of Tax Implications

Let’s consider two scenarios to illustrate the tax benefits of Roth IRA withdrawals:

- Scenario 1:You contribute $6,500 annually to a Roth IRA for 30 years, earning an average annual return of 7%. At retirement, your account balance is $500,000. If you withdraw $50,000 annually, you’ll receive tax-free income for 10 years.

- Scenario 2:You contribute the same amount to a traditional IRA and withdraw $50,000 annually in retirement. You’ll owe income tax on every withdrawal, potentially increasing your tax liability and reducing your retirement income.

As you can see, the tax-free nature of Roth IRA withdrawals can make a significant difference in your retirement income and overall tax liability.

Roth IRA Conversion: How To Maximize My Roth IRA Contributions In 2024

A Roth IRA conversion allows you to move money from a traditional IRA to a Roth IRA. This can be a strategic move if you expect to be in a higher tax bracket in retirement than you are now.

Tax Implications of Roth IRA Conversions

Converting a traditional IRA to a Roth IRA is a taxable event. This means you’ll need to pay taxes on the amount of money you convert in the year of the conversion. The good news is that you won’t have to pay taxes on the money you withdraw from the Roth IRA in retirement.

Benefits of Roth IRA Conversions

- Tax-free withdrawals in retirement: One of the most significant benefits of a Roth IRA is that withdrawals in retirement are tax-free. This can be a major advantage if you expect to be in a higher tax bracket in retirement.

- Potential for tax savings: If you expect to be in a lower tax bracket now than you will be in retirement, converting a traditional IRA to a Roth IRA can save you money on taxes in the long run.

- No required minimum distributions: Unlike traditional IRAs, Roth IRAs don’t have required minimum distributions (RMDs). This means you can let your money grow tax-free for as long as you want.

Drawbacks of Roth IRA Conversions

- Tax liability: As mentioned earlier, converting a traditional IRA to a Roth IRA is a taxable event. You’ll need to pay taxes on the amount of money you convert in the year of the conversion.

- Potential for tax bracket creep: If you convert a large amount of money to a Roth IRA, you could potentially push yourself into a higher tax bracket in the year of the conversion.

- Limited contribution space: If you already have a Roth IRA, you’ll need to consider your contribution limits. You can only contribute up to a certain amount to a Roth IRA each year.

Conclusion

By understanding the nuances of Roth IRAs and strategically maximizing your contributions, you can set yourself on a path toward a financially secure retirement. Remember, every dollar you contribute to your Roth IRA is an investment in your future.

Take advantage of the tax benefits, explore various investment options, and stay informed about the ever-evolving landscape of retirement planning. The journey to financial freedom starts with taking control of your retirement savings.

Frequently Asked Questions

What are the penalties for withdrawing Roth IRA contributions before age 59 1/2?

Withdrawals of contributions to a Roth IRA before age 59 1/2 are generally tax-free and penalty-free, as long as the contributions have been held for at least five years.

Can I contribute to both a Roth IRA and a traditional IRA in the same year?

Yes, you can contribute to both a Roth IRA and a traditional IRA in the same year, but there are limits on the total amount you can contribute.

Can I change my mind about contributing to a Roth IRA and switch to a traditional IRA?

Yes, you can typically roll over your Roth IRA contributions to a traditional IRA, but you may have to pay taxes on the earnings.