What is the Roth IRA income limit for 2024 contributions? This question is at the forefront of many minds, especially those looking to secure a comfortable retirement. The Roth IRA, known for its tax-free withdrawals in retirement, offers a powerful tool for building wealth.

However, its accessibility is determined by income, with specific limits set annually. This article delves into the intricacies of these limits for 2024, examining how they impact contribution eligibility, and exploring alternative retirement savings options for those who may not meet the criteria.

Understanding these limits is crucial for maximizing retirement savings potential. While the Roth IRA offers significant tax advantages, exceeding the income thresholds can result in reduced contribution limits or even disqualify individuals from contributing altogether. This article will provide a comprehensive overview of the 2024 Roth IRA income limits, outlining the factors that influence eligibility and providing insights into the potential consequences of exceeding these limits.

Contents List

Roth IRA Income Limits for 2024: What Is The Roth IRA Income Limit For 2024 Contributions

The Roth IRA is a popular retirement savings account that allows you to withdraw your earnings tax-free in retirement. However, there are income limits for contributing to a Roth IRA, and if you exceed these limits, you may not be able to contribute the full amount or may be ineligible to contribute at all.

If you’re 50 or older, you can contribute extra to your 401(k) through catch-up contributions. This can help you boost your retirement savings. You can find out how much you can contribute to your 401(k) in 2024 with catch-up contributions in this article: How much can I contribute to my 401k in 2024 with catch-up contributions.

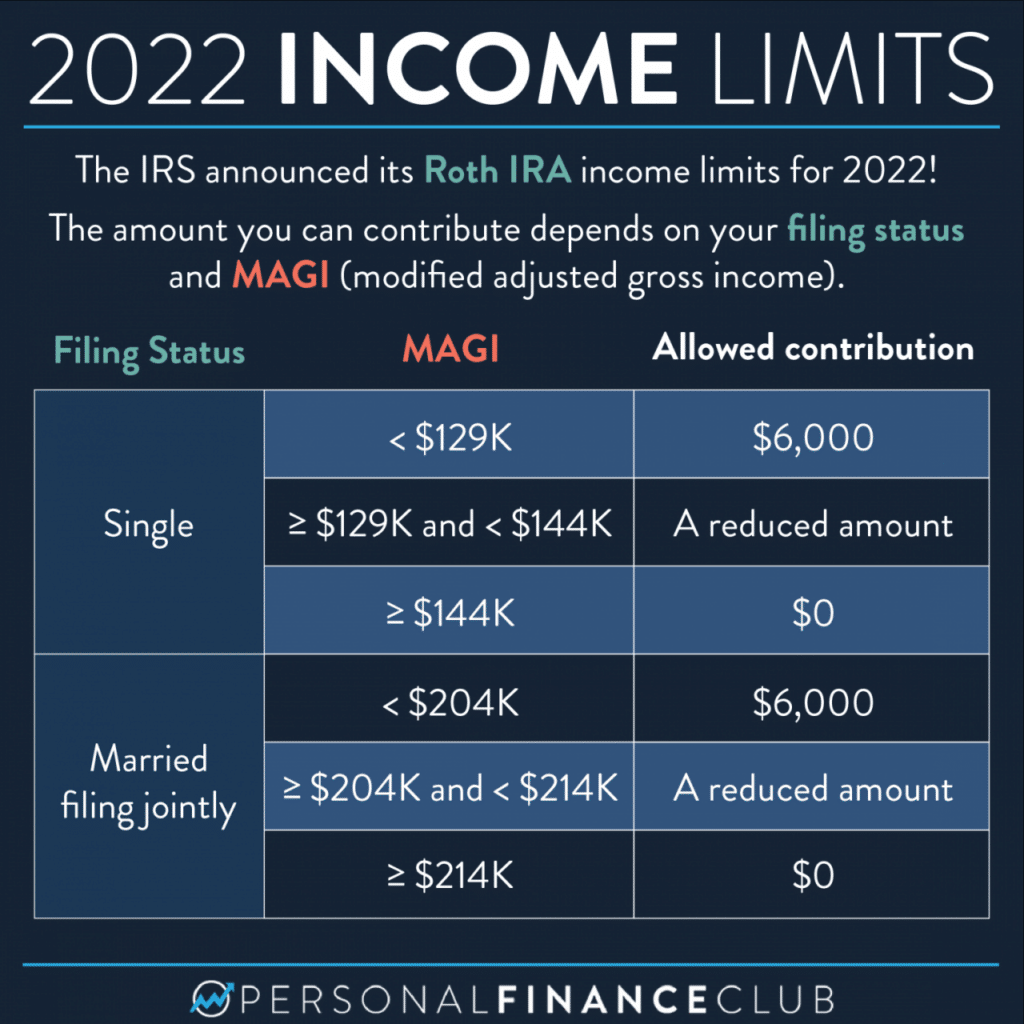

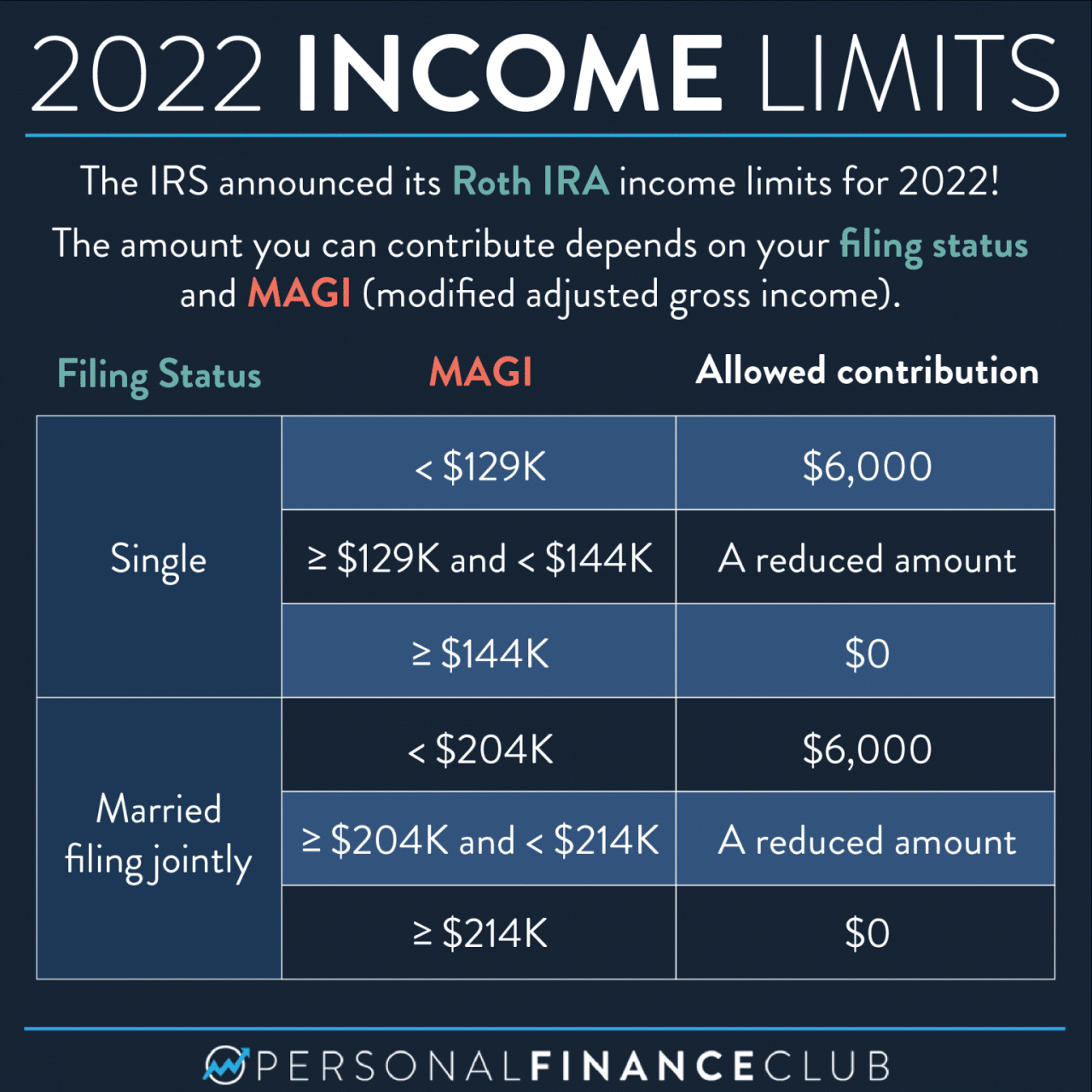

Income Limits and Eligibility

The Roth IRA income limits for 2024 determine how much you can contribute to the account based on your modified adjusted gross income (MAGI). Here are the limits for different filing statuses:

- Single filers:$153,000 or higher

- Married couples filing jointly:$228,000 or higher

- Head of household:$204,000 or higher

If your MAGI falls below these limits, you can contribute the full amount to your Roth IRA. However, if your MAGI exceeds the limit, your contribution ability is reduced. This means you may only be able to contribute a portion of the full amount, or you may be ineligible to contribute at all.

Small businesses have unique tax considerations. A tax calculator designed for small businesses can help you understand your tax obligations and plan your finances effectively. This tax calculator for small businesses in October 2024 can be a valuable tool: Tax calculator for small businesses in October 2024.

Consequences of Exceeding the Income Limits

Exceeding the Roth IRA income limits can have several consequences:

- Reduced contributions:You may be able to contribute a reduced amount to your Roth IRA, but not the full amount. This means you will have less money in your retirement account, which can impact your future financial security.

- Complete ineligibility:If your MAGI exceeds the limit, you may not be able to contribute to a Roth IRA at all. This can be a significant setback for your retirement planning.

- Tax implications:Contributions to a Roth IRA are not tax deductible, but withdrawals in retirement are tax-free. However, if you exceed the income limits and make a contribution, the IRS may require you to pay taxes on the withdrawals in retirement.

It is important to note that the Roth IRA income limits are subject to change each year. It is essential to check the most up-to-date information before making any contributions.

Understanding tax brackets is crucial for managing your finances. Knowing how your income is taxed based on different brackets can help you make informed decisions about your spending and saving. You can find a detailed explanation of tax brackets for 2024 in this article: Understanding tax brackets for 2024.

Contribution Limits

The Roth IRA contribution limit represents the maximum amount of money you can contribute to your Roth IRA account in a given year. It’s crucial to understand these limits to maximize your retirement savings and avoid any potential penalties.

Income tax rates can change from year to year. It’s essential to know the current rates to accurately calculate your tax liability. You can find the income tax rates for October 2024 in this article: Income tax rates for October 2024.

Contribution Limit for 2024

The maximum annual contribution limit for Roth IRAs in 2024 is $7,000. This applies to individuals, regardless of their age.

A Roth IRA can be a valuable tool for retirement savings, allowing you to withdraw your earnings tax-free in retirement. The contribution limits for Roth IRAs can change annually. To find out the Roth IRA contribution limits for 2024, check out this article: Roth IRA contribution limits for 2024.

Contribution Limit for Couples

For couples filing jointly, the maximum contribution limit is $14,000for 2024. This means that each spouse can contribute up to $7,000 to their respective Roth IRA accounts, totaling $14,000 for the couple.

If you’re considering contributing to a Roth IRA, it’s important to know the income limits. These limits determine if you’re eligible to contribute the full amount or if your contributions will be phased out. You can find the income limits for Roth IRA contributions in 2024 in this article: What are the income limits for Roth IRA contributions in 2024.

Contributing More Than the Limit

If you contribute more than the allowed limit to your Roth IRA, you may be subject to penalties. The IRS considers excess contributions as a taxable distribution, meaning you’ll need to pay taxes on the excess amount. In addition, a 6% penalty may be applied to the excess contribution.

Retiring in October 2024? It’s a good time to review your tax situation. There are specific tax considerations for retirees, and a tax calculator can help you understand your potential tax liability. Check out this tax calculator for retirees in October 2024: Tax calculator for retirees in October 2024.

Example:If you contribute $8,000 to your Roth IRA in 2024, you’ll have an excess contribution of $1,000 ($8,000$7,000). This excess amount will be considered a taxable distribution and you’ll be subject to a 6% penalty on the $1,000.

Divorced individuals may have different retirement savings strategies. The Roth IRA contribution limit can be affected by your marital status. Check out this article to learn about the Roth IRA contribution limit in 2024 for divorced individuals: Roth IRA contribution limit 2024 for divorced individuals.

It’s important to note that the IRS allows you to withdraw excess contributions before the tax filing deadline for the year. This will help you avoid the 6% penalty, but you’ll still need to pay taxes on the excess contribution.

If you’re wondering how much you can contribute to your 401(k) in 2024, you’re not alone! The amount you can contribute each year depends on your age and whether you’re eligible for catch-up contributions. You can find out the specific limits for 2024 by checking out this article: How much can I contribute to my 401k in 2024.

Phase-Out of Contributions

The Roth IRA income limit for 2024 contributions is not a hard and fast rule. It is a gradual phase-out, meaning that the contribution limit is reduced as your income increases. This means that if your income is above a certain threshold, you may not be able to contribute the full amount to a Roth IRA, or you may not be able to contribute at all.

As a head of household, you’ll be taxed based on your income level. Knowing the tax brackets for 2024 can help you estimate your tax liability and plan accordingly. You can find the tax brackets for head of household in 2024 here: Tax brackets for head of household in 2024.

Phase-Out Range

The phase-out range is the income bracket where your ability to contribute to a Roth IRA is gradually reduced. The phase-out range for 2024 is based on your modified adjusted gross income (MAGI).

Filing taxes as a married couple filing jointly comes with its own set of deductions and rules. The standard deduction is one of the key factors to consider. You can find out what the 2024 standard deduction is for married couples filing jointly in this article: What is the 2024 standard deduction for married filing jointly.

Table: Phase-Out Range for 2024 Roth IRA Contributions

| Filing Status | Lower Limit | Upper Limit |

|---|---|---|

| Single Filers | $153,000 | $168,000 |

| Married Filing Jointly | $228,000 | $243,000 |

| Head of Household | $183,000 | $198,000 |

Implications of Being in the Phase-Out Range

If your MAGI falls within the phase-out range, the amount you can contribute to a Roth IRA will be reduced. The exact amount of the reduction is determined by a formula that is based on your income and the phase-out range.

Having a 401(k) doesn’t necessarily mean you can’t also contribute to an IRA. In fact, contributing to both can be a great way to diversify your retirement savings. Find out if you can contribute to an IRA if you have a 401(k) in this article: Can I contribute to an IRA if I have a 401k.

For example, if you are a single filer with a MAGI of $160,000, you will be able to contribute a reduced amount to a Roth IRA. The exact amount of the reduction will be calculated based on your income and the phase-out range.

Gas prices can fluctuate, making it a significant expense for many. Using a credit card with gas rewards can help you save money on your fuel costs. Check out this list of the best credit cards for gas rewards in October 2024: Best credit cards for gas rewards in October 2024.

It is important to note that even if you are in the phase-out range, you may still be able to contribute to a Roth IRA. However, the amount you can contribute will be less than the full contribution limit.

Impact of Income Limits on Retirement Planning

The income limits for Roth IRA contributions can significantly impact your retirement planning, especially if you’re a high-income earner. Understanding how these limits affect your savings options is crucial for maximizing your retirement nest egg.

Impact on Different Income Levels, What is the Roth IRA income limit for 2024 contributions

The income limits for Roth IRA contributions create different scenarios for individuals at various income levels. For those who fall below the limit, the Roth IRA offers tax-free withdrawals in retirement, making it a highly attractive option. However, exceeding the income limit can significantly impact your retirement planning.

Calculating your income tax can seem daunting, but it’s essential for filing your taxes correctly. This article provides a step-by-step guide on how to calculate your income tax in October 2024: How to calculate income tax in October 2024.

- Individuals below the income limit:These individuals can contribute to a Roth IRA and enjoy the benefits of tax-free withdrawals in retirement. This can be particularly advantageous for those who expect to be in a higher tax bracket in retirement.

- Individuals approaching the income limit:Individuals nearing the income limit should carefully consider their options, as even a small increase in income could disqualify them from contributing to a Roth IRA. They might consider adjusting their income or exploring alternative retirement savings options.

- Individuals exceeding the income limit:Exceeding the income limit for Roth IRA contributions can significantly impact your retirement planning. While you can’t contribute directly to a Roth IRA, you still have options for retirement savings.

Benefits and Drawbacks of Exceeding Income Limits

Exceeding the income limits for Roth IRA contributions presents both potential benefits and drawbacks:

- Benefits:

- You can still contribute to a traditional IRA, which allows you to deduct contributions from your taxable income. This can reduce your current tax liability.

- You can explore other retirement savings options, such as 401(k)s, which often have higher contribution limits than Roth IRAs.

- Drawbacks:

- You lose the benefit of tax-free withdrawals in retirement with a traditional IRA. Your withdrawals will be taxed as ordinary income.

- You may face limitations on other retirement savings options, such as higher contribution limits for 401(k)s.

Alternative Retirement Savings Options

If you exceed the income limits for Roth IRA contributions, you can explore other retirement savings options:

- Traditional IRA:While withdrawals are taxed in retirement, traditional IRA contributions are tax-deductible, reducing your current tax liability.

- 401(k)s:These employer-sponsored retirement plans often have higher contribution limits than Roth IRAs. While withdrawals are taxed in retirement, contributions may be pre-tax.

- 403(b)s:Similar to 401(k)s, these plans are available to employees of certain organizations, such as educational institutions and non-profits.

- Solo 401(k)s:This plan is for self-employed individuals or small business owners. You can contribute both as an employee and an employer.

Final Review

Navigating the complexities of Roth IRA income limits can feel overwhelming, but with a clear understanding of the rules and available options, you can make informed decisions that align with your financial goals. Remember, retirement planning is a long-term endeavor, and it’s crucial to explore all avenues to ensure a secure and comfortable future.

If you find yourself exceeding the income limits, don’t despair – alternative retirement savings options are available, and seeking professional financial advice can help you navigate these complexities and chart a path towards a fulfilling retirement.

Expert Answers

What happens if I exceed the income limits for Roth IRA contributions in 2024?

If your income exceeds the limits, you may not be able to contribute to a Roth IRA, or your contribution limit may be reduced. In some cases, you may be able to convert a traditional IRA to a Roth IRA, but this can have tax implications.

Can I contribute to a Roth IRA if I’m self-employed?

Yes, self-employed individuals can contribute to a Roth IRA. However, they will need to use a Solo 401(k) or SEP IRA to do so.

Are there any other retirement savings options besides a Roth IRA?

Yes, there are many other retirement savings options, including traditional IRAs, 401(k)s, and 403(b)s. Each option has its own rules and regulations, so it’s important to research them carefully before making a decision.

How often are the Roth IRA income limits adjusted?

The Roth IRA income limits are adjusted annually based on inflation. The IRS releases the updated limits each year.

If you’re planning to contribute to a Roth IRA in 2024, it’s helpful to know the maximum contribution amount. This limit can change annually, so it’s essential to stay up-to-date. You can find the maximum Roth IRA contribution for 2024 in this article: What is the maximum Roth IRA contribution in 2024.