I Bond rate November 2024 for long-term savings – I Bond rate November 2024: Long-Term Savings Strategy – In a world of fluctuating markets, I Bonds offer a unique and potentially lucrative avenue for long-term savings. These government-backed securities provide a fixed interest rate, coupled with a variable rate tied to inflation, making them an attractive option for investors seeking to protect their savings from erosion.

With a minimum holding period of one year, I Bonds offer a level of stability and security not often found in other investment vehicles.

Understanding the nuances of I Bonds is essential for making informed investment decisions. This guide delves into the intricacies of I Bond rates, their potential for long-term growth, and the strategic considerations that can help you maximize your returns.

From the current I Bond rate as of November 2024 to a comparative analysis of I Bonds versus other investment options, this comprehensive resource provides the information you need to confidently navigate the world of I Bonds.

Contents List

I Bonds for Long-Term Savings: I Bond Rate November 2024 For Long-term Savings

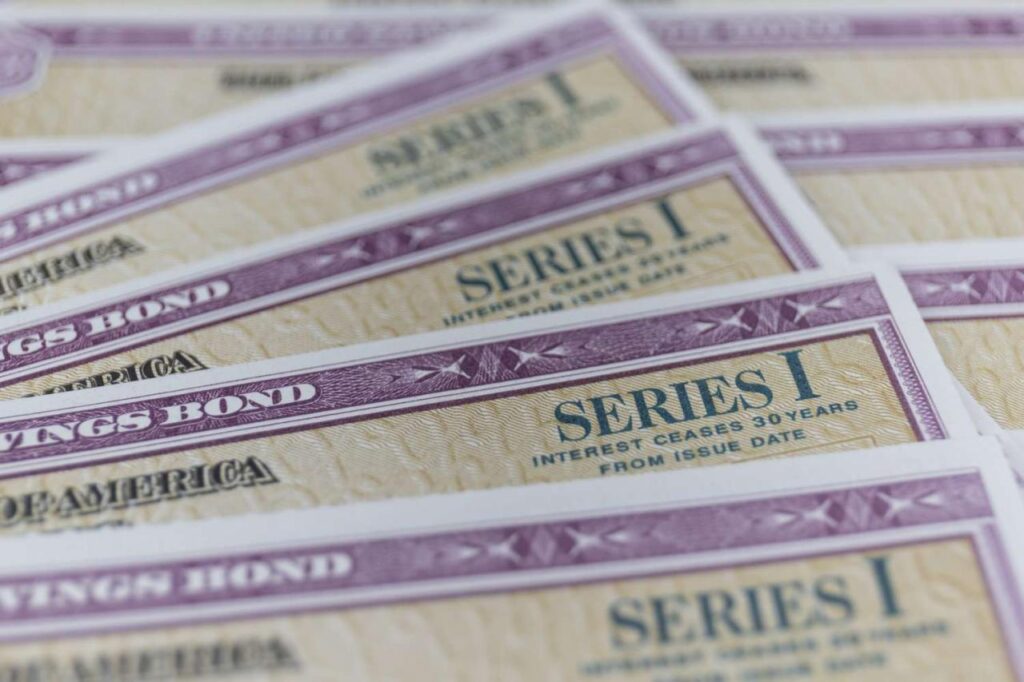

I Bonds, or Series I Savings Bonds, are a type of savings bond offered by the U.S. Treasury that earns interest based on a combination of a fixed rate and an inflation rate. While I Bonds can be a suitable option for long-term savings goals, it’s important to understand their characteristics and compare them to other investment options before making a decision.

Tax brackets can change from year to year, so it’s important to stay informed. You can compare the tax bracket changes for 2024 vs 2023 here. Understanding these changes can help you plan your finances and potentially minimize your tax liability.

Suitability of I Bonds for Long-Term Savings, I Bond rate November 2024 for long-term savings

I Bonds can be a good choice for long-term savings goals because they offer a guaranteed rate of return that protects against inflation. The inflation rate component of the I Bond’s interest rate ensures that your investment keeps pace with rising prices.

If you need more time to file your taxes, you may be eligible for an extension. Check out the details about tax filing extensions for October 2024 here. This can give you some extra time to gather all the necessary documents and ensure accuracy.

This makes them particularly attractive for individuals seeking to preserve the purchasing power of their savings over time.

The Erste Bank Open 2024, a prestigious tennis tournament, will be held in Vienna, Austria. You can find out more about the venue and court surface information here. The tournament is known for its high-quality tennis and exciting matches, attracting top players from around the world.

Comparison of I Bonds to Other Long-Term Savings Options

- Traditional Savings Accounts: Traditional savings accounts offer low interest rates that often do not keep pace with inflation. They are less suitable for long-term savings goals as the purchasing power of your savings can erode over time.

- Certificates of Deposit (CDs): CDs offer fixed interest rates for a specified period, making them suitable for short-term savings goals. However, they can lock up your money for a set period, making them less flexible for long-term savings.

- Stocks: Stocks offer the potential for higher returns but also carry a higher risk of losing money. They are more suitable for long-term investors with a higher risk tolerance.

Risks and Rewards of Investing in I Bonds for the Long Term

- Risks:

- Limited Liquidity: I Bonds have a one-year holding period. If you withdraw your investment before five years, you forfeit the last three months of interest earned.

- Interest Rate Fluctuations: The inflation rate component of the I Bond’s interest rate can fluctuate, potentially leading to lower returns than expected.

- Interest Rate Caps: The interest rate on I Bonds is capped at a certain percentage, which can limit potential returns.

- Rewards:

- Inflation Protection: I Bonds offer a guaranteed rate of return that protects against inflation.

- Tax-Deferred Interest: Interest earned on I Bonds is not taxed until redemption.

- Potential for Higher Returns: While I Bonds do not offer the same potential for growth as stocks, they can provide a consistent rate of return over the long term.

Summary

I Bonds offer a compelling blend of security and potential growth, making them a valuable tool for long-term savings strategies. By carefully considering the factors that influence I Bond rates, the minimum holding period, and the potential impact of inflation, you can make informed decisions that align with your financial goals.

While I Bonds may not be the ideal solution for all investors, their unique features and government backing make them a worthy addition to a diversified portfolio. As you explore the world of I Bonds, remember that careful planning and a comprehensive understanding of the investment landscape are key to maximizing your returns and achieving your financial aspirations.

Key Questions Answered

What is the current I Bond rate as of November 2024?

The current I Bond rate as of November 2024 is not yet available. The rate is typically announced on the first of each month, and the current rate will be based on the inflation rate for the previous six months.

To stay up-to-date on the latest I Bond rates, check the TreasuryDirect website.

How long can I hold an I Bond?

You can hold an I Bond for a minimum of one year and a maximum of 30 years. After the first year, you can redeem your I Bond without penalty. However, if you redeem your I Bond before five years, you will forfeit the last three months of interest earned.

Can I buy I Bonds through my brokerage account?

You cannot buy I Bonds through your brokerage account. You must purchase I Bonds directly from the TreasuryDirect website.

Are I Bonds subject to state and local taxes?

I Bonds are not subject to state and local taxes. However, you will have to pay federal income tax on the interest earned when you redeem your I Bonds.

If you’ve exceeded your IRA contribution limit, you might face penalties. Learn more about the penalties for exceeding IRA contribution limits here. It’s crucial to stay within the limits to avoid any unexpected financial consequences.

Self-employed individuals have a specific tax extension deadline. Find out the tax extension deadline for self-employed individuals in October 2024 here. Staying on top of these deadlines is essential for avoiding late filing penalties.

The Erste Bank Open 2024 is sure to be a thrilling event, featuring top tennis players. You can find information about player interviews and press conferences here. Get a behind-the-scenes look at the tournament and learn about the players’ perspectives.

The Erste Bank Open has a rich history and a long list of past champions. Discover the tournament history and winners here. This information can provide context and insight into the upcoming tournament.

If you have a SIMPLE IRA, there are specific contribution limits. Find out the IRA contribution limits for SIMPLE IRAs in 2024 here. Understanding these limits can help you maximize your retirement savings.

Planning for retirement is crucial, and knowing your 401(k) contribution limits is essential. Discover how much you can contribute to your 401(k) in 2024 here. Take advantage of these limits to build a strong financial foundation for your future.

If you’re over 50, you might have a higher Roth IRA contribution limit. Find out the Roth IRA contribution limit for people over 50 in 2024 here. This can be a valuable tool for maximizing your retirement savings.

Understanding the contribution limits for your 401(k) is essential for retirement planning. Find out the 401(k) contribution limits for 2024 for traditional 401(k)s here. Stay informed about these limits to make the most of your retirement savings.

Tax brackets can vary by state, so it’s essential to understand your state’s tax rules. Find out the income tax brackets for October 2024 by state here. This information can help you plan your finances and minimize your tax liability.

If you’re considering a Roth IRA, it’s important to know the contribution limits. Discover the Roth IRA contribution limits for 2024 here. These limits can help you plan your retirement savings and potentially reduce your tax burden.

If you’re driving for business purposes, you can deduct mileage expenses. Find out the mileage rate for October 2024 here. Staying updated on this rate can help you maximize your tax deductions.

International taxpayers may have different tax deadlines. Find out the tax extension deadline for international taxpayers in October 2024 here. Staying informed about these deadlines is essential for avoiding late filing penalties.