L Acoustics Merch 2024 offers a unique glimpse into the world of high-end audio gear, catering to music enthusiasts and professionals alike. This collection goes beyond typical merchandise, featuring innovative products that embody the company’s commitment to pushing the boundaries of sound quality and design.

From apparel that showcases the L-Acoustics brand to exclusive accessories that enhance the listening experience, this merchandise line caters to a diverse audience. Whether you’re a seasoned audio engineer or a casual music lover, L Acoustics Merch 2024 provides a way to connect with the brand and express your passion for exceptional sound.

Contents List

- 1 L-Acoustics: A Legacy of Audio Excellence

- 2 L-Acoustics Merch 2024: A Celebration of Sound

- 3 Target Audience and Marketing Strategies

- 4 Merchandise Availability and Distribution: L Acoustics Merch 2024

- 5 Customer Experience and Brand Loyalty

- 6 Sustainability and Ethical Considerations

- 7 Future Trends and Innovations

- 8 Closing Summary

- 9 General Inquiries

L-Acoustics: A Legacy of Audio Excellence

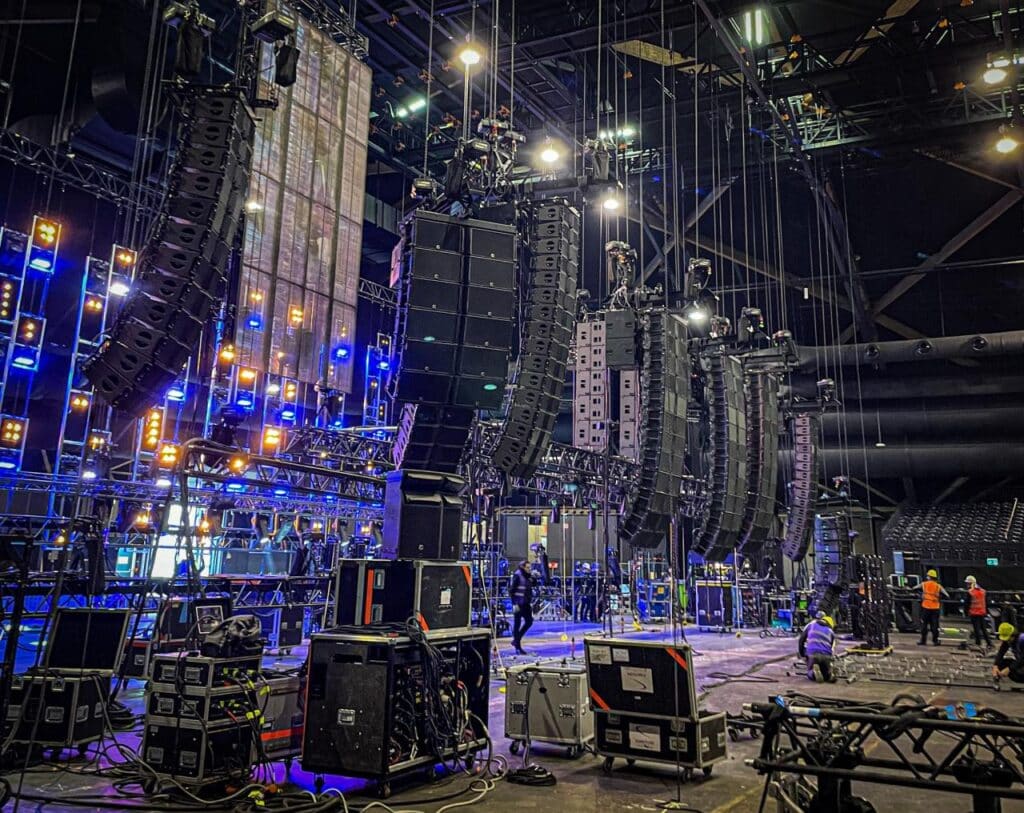

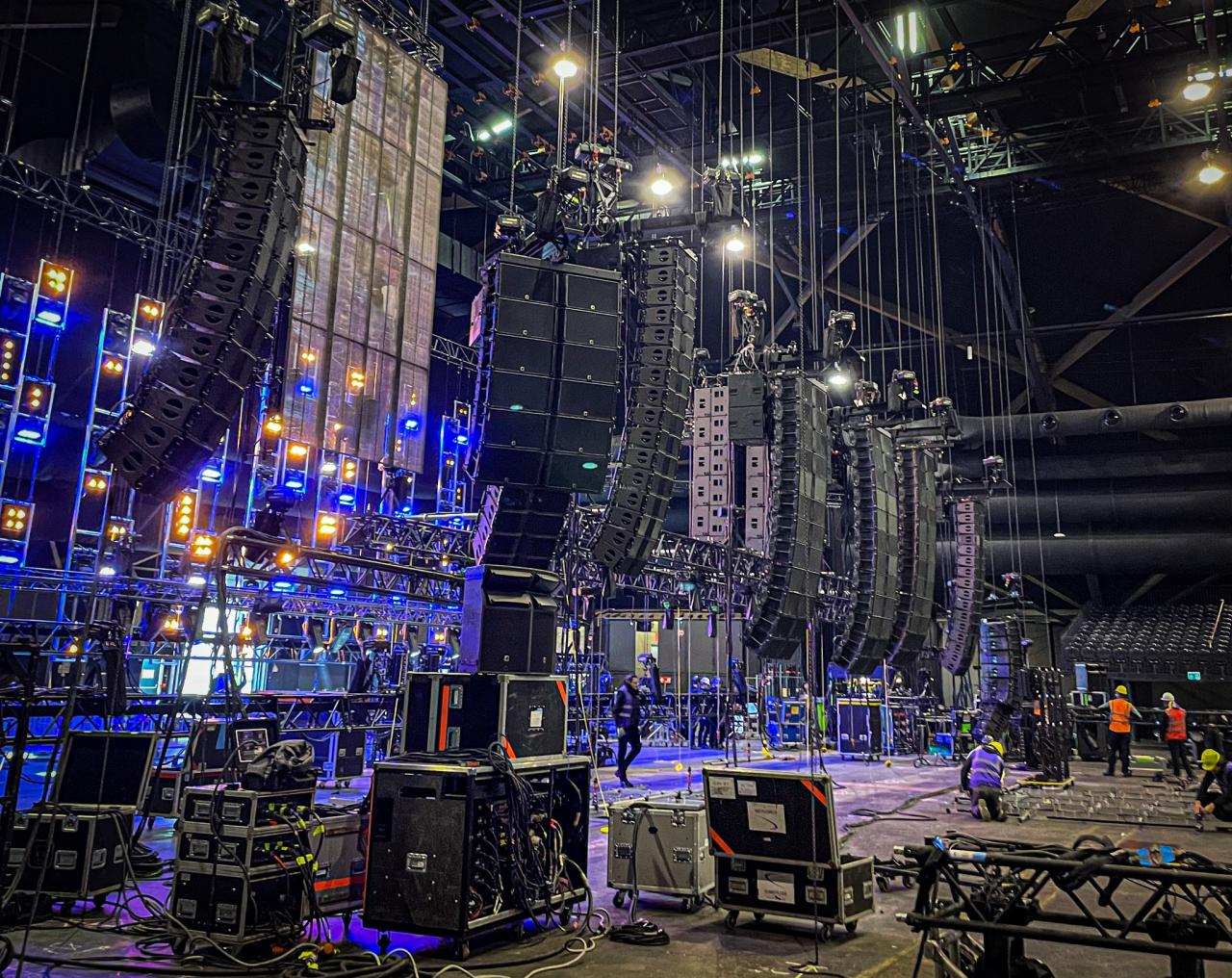

L-Acoustics, a name synonymous with high-fidelity sound, has been shaping the audio landscape for over 40 years. Founded in 1984 by Christian Heil, the company has established itself as a leading innovator in professional audio systems, renowned for its commitment to pushing the boundaries of sound quality and technological advancement.

L-Acoustics’ Core Values and Mission

At the heart of L-Acoustics’ success lies its unwavering dedication to its core values: innovation, quality, and customer satisfaction. The company’s mission is to provide the highest quality audio solutions for a wide range of applications, from live concerts and festivals to corporate events and fixed installations.

Key Innovations and Technologies

L-Acoustics has a rich history of groundbreaking innovations, constantly pushing the boundaries of audio technology. Some of its key contributions include:

- The V-DOSC System:This revolutionary line array system, introduced in 1993, revolutionized the way sound was distributed in large venues. Its unique design and sophisticated control software enabled precise sound coverage and exceptional clarity, even at high volumes.

- The L-Drive System:L-Acoustics’ proprietary L-Drive amplifier technology is known for its high power output, low distortion, and advanced processing capabilities, ensuring optimal performance and reliability for its speakers.

- Soundvision Software:This powerful software tool allows sound engineers to predict and visualize sound coverage in any venue, enabling them to optimize system design and achieve perfect sound quality.

L-Acoustics Merch 2024: A Celebration of Sound

Beyond its audio systems, L-Acoustics has expanded its reach into the world of merchandise, offering a range of products that allow fans and audiophiles to express their passion for the brand.

For acoustic music enthusiasts, the The Acoustic Music Archive 2024 is a treasure trove of recordings, resources, and information. Dive into the history and evolution of this beloved genre.

Key Product Lines and Collections

L-Acoustics’ merchandise offerings are designed to appeal to a wide range of tastes and preferences, encompassing:

- Apparel:L-Acoustics offers a diverse selection of clothing items, including t-shirts, hoodies, jackets, and caps, featuring the brand’s iconic logo and signature design elements.

- Accessories:From keychains and phone cases to bags and water bottles, L-Acoustics accessories are practical and stylish, allowing fans to showcase their love for the brand in everyday life.

- Limited Edition Items:L-Acoustics occasionally releases limited-edition merchandise, such as special edition t-shirts commemorating significant events or collaborations, making them highly sought-after collector’s items.

Design Elements and Features, L Acoustics Merch 2024

L-Acoustics merchandise is known for its clean and modern aesthetic, often incorporating bold graphics and a minimalist color palette. The brand’s logo, featuring a stylized sound wave, is a prominent design element across all products, representing the company’s commitment to delivering high-quality audio experiences.

What exactly is it about Acoustic Music Meaning 2024 that resonates so deeply with listeners? Explore the unique qualities and emotional impact of this genre.

Target Audience and Marketing Strategies

L-Acoustics merchandise targets a diverse audience, including:

- Audio Professionals:Sound engineers, technicians, and other professionals working in the audio industry are drawn to L-Acoustics’ merchandise as a way to express their pride in using the brand’s equipment.

- Music Lovers:Fans of live music and concerts often purchase L-Acoustics merchandise as a way to connect with their favorite artists and events, showcasing their appreciation for the brand’s role in creating memorable audio experiences.

- Tech Enthusiasts:Individuals passionate about technology and innovation are drawn to L-Acoustics’ merchandise for its association with cutting-edge audio systems and its commitment to pushing the boundaries of sound quality.

Marketing Channels and Strategies

L-Acoustics employs a multi-faceted marketing approach to promote its merchandise, including:

- Online Retailers:L-Acoustics merchandise is available for purchase through its own website and through various online retailers specializing in music and audio equipment.

- Social Media:The company actively engages with its audience on social media platforms, showcasing new merchandise releases and running promotional campaigns.

- Trade Shows and Events:L-Acoustics participates in industry trade shows and events, providing attendees with the opportunity to view and purchase merchandise firsthand.

Branding and Messaging

L-Acoustics’ merchandise branding is consistent with its overall brand identity, emphasizing quality, innovation, and a passion for sound. The brand’s messaging often highlights the technical excellence of its audio systems and the positive impact of its products on the listening experience.

Whether you’re a seasoned musician or just starting out, finding the right Acoustic Music Equipment 2024 is essential. From guitars and microphones to amplifiers and accessories, there’s a wide range of tools to enhance your acoustic journey.

Merchandise Availability and Distribution: L Acoustics Merch 2024

L-Acoustics merchandise is available through a variety of channels, ensuring accessibility for a wide range of customers.

Online Retailers

L-Acoustics merchandise can be purchased directly from the company’s website, as well as through online retailers such as:

- Amazon

- eBay

- Music & Arts

- Sweetwater

Offline Retailers

L-Acoustics merchandise is also available at select brick-and-mortar retailers, including:

- Music stores specializing in professional audio equipment

- Select retail stores at major events and festivals

Pricing and Purchase Options

L-Acoustics merchandise is priced competitively, offering a range of options to suit different budgets. Customers can choose from individual items or purchase bundled packages for greater value. Payment options typically include credit cards, debit cards, and PayPal.

The world of acoustic music is constantly evolving. Discover the latest trends, artists, and innovations in Acoustic Music 2024 and stay connected to the vibrant community of acoustic enthusiasts.

Distribution Channels and Logistics

L-Acoustics utilizes a network of distribution partners to ensure timely and efficient delivery of merchandise to customers worldwide. Orders are typically shipped via standard shipping carriers, with delivery times varying depending on the customer’s location and chosen shipping method.

Customer Experience and Brand Loyalty

L-Acoustics merchandise has received positive feedback from customers, who appreciate its quality, design, and association with the brand’s renowned audio systems.

The Acoustic Echo Cancellation Challenge Github 2024 invites developers to tackle the complex issue of eliminating unwanted echoes in audio recordings. This challenge pushes the boundaries of technology and improves the quality of audio experiences.

Customer Reviews and Feedback

Online reviews and customer testimonials highlight the positive aspects of L-Acoustics merchandise, praising its durability, comfort, and stylish designs. Customers often express their satisfaction with the quality of the products and their ability to showcase their love for the brand.

The Q Acoustic 300 speakers are known for their exceptional sound quality. Explore the latest developments and reviews of the Q Acoustic 300 2024 to elevate your listening experience.

Role of Merchandise in Fostering Brand Loyalty

L-Acoustics merchandise plays a significant role in fostering brand loyalty among customers. By providing tangible ways for fans to express their support for the brand, merchandise creates a deeper connection and strengthens the relationship between L-Acoustics and its audience.

The acoustic guitar has a timeless appeal, and these 4 Chord Acoustic Songs 2024 showcase the genre’s versatility. From folk to pop, these tracks offer a glimpse into the contemporary acoustic landscape.

Impact of Merchandise on the Overall L-Acoustics Brand Experience

L-Acoustics merchandise contributes to the overall brand experience by extending the brand’s reach beyond its core audio products. By offering a range of items that appeal to a diverse audience, L-Acoustics enhances its brand image and strengthens its connection with its customers.

Get ready to immerse yourself in the soothing sounds of Acoustic Avenue Music 2024. This curated collection of acoustic tracks will transport you to a tranquil musical haven, perfect for unwinding after a long day.

Sustainability and Ethical Considerations

L-Acoustics is committed to responsible manufacturing practices, incorporating sustainability and ethical considerations into its merchandise production.

Tony’s Acoustic Challenge is a popular online program that helps aspiring guitarists learn new skills. Discover the cost and benefits of Tony’s Acoustic Challenge Cost 2024 and see if it’s the right fit for your musical journey.

Sustainability in Merchandise Production

L-Acoustics prioritizes the use of sustainable materials and manufacturing processes in its merchandise production. The company aims to minimize its environmental impact by sourcing materials responsibly and implementing energy-efficient production methods.

Even seasoned guitarists can encounter challenges when learning new chords. Explore common Issues Acoustic Chords 2024 and find helpful tips and tricks to overcome them.

Ethical Considerations Regarding Sourcing and Manufacturing

L-Acoustics ensures that its merchandise is produced ethically, adhering to fair labor practices and responsible sourcing of materials. The company works with suppliers who share its commitment to ethical manufacturing and environmental sustainability.

Jack Johnson’s laid-back acoustic style has captivated audiences for years. Explore the latest sounds of Acoustic Jack Johnson 2024 and rediscover the magic of his music.

Potential Environmental Impact of Merchandise

L-Acoustics is aware of the potential environmental impact of its merchandise and strives to minimize its footprint. The company actively seeks ways to reduce waste, promote recycling, and use environmentally friendly packaging materials.

Hull, England, is a vibrant hub for acoustic music. Discover the thriving scene and upcoming events in Acoustic Music Hull 2024 , where talented musicians share their passion for the acoustic sound.

Future Trends and Innovations

L-Acoustics is constantly evolving and adapting to the changing landscape of the audio industry, and its merchandise offerings are expected to reflect these advancements.

Potential Future Trends in L-Acoustics Merchandise

Future trends in L-Acoustics merchandise could include:

- Increased Focus on Sustainability:As environmental consciousness grows, L-Acoustics is likely to continue incorporating sustainable materials and practices into its merchandise production.

- Personalized Merchandise:L-Acoustics might offer customized merchandise options, allowing customers to personalize their items with their names, logos, or other unique designs.

- Interactive Merchandise:L-Acoustics could explore incorporating technology into its merchandise, such as wearable devices or interactive displays, to enhance the customer experience.

Emerging Technologies and Design Concepts

Emerging technologies and design concepts could influence future L-Acoustics merchandise, such as:

- 3D Printing:L-Acoustics might leverage 3D printing technology to create customized and limited-edition merchandise, offering greater flexibility in design and production.

- Smart Materials:L-Acoustics could explore the use of smart materials in its merchandise, such as fabrics that change color or texture based on temperature or light.

- Augmented Reality (AR):L-Acoustics might integrate AR technology into its merchandise, allowing customers to interact with virtual content and enhance their experience with the products.

Adaptation to Evolving Customer Preferences

L-Acoustics will likely continue to adapt its merchandise offerings to meet the evolving preferences of its customers. This could involve incorporating new trends in design, materials, and technology, as well as responding to feedback and suggestions from its audience.

Mastering the D Acoustic Guitar Chord 2024 is a crucial step for any aspiring guitarist. This fundamental chord opens doors to countless songs and musical styles.

Closing Summary

L Acoustics Merch 2024 is more than just a collection of products; it’s a statement about dedication to sound quality and the pursuit of a truly immersive audio experience. This merchandise not only reflects the company’s heritage but also hints at the future of audio, where innovation and design intertwine to create a lasting impression.

Want to hear the latest and greatest in acoustic music? Look no further than our list of Guitar Acoustic Hits 2024. These songs are topping charts and radio waves, showcasing the enduring popularity of the acoustic guitar.

General Inquiries

Where can I buy L Acoustics Merch 2024?

Looking to learn some new tunes on your acoustic guitar? Check out this list of 4 Chord Acoustic Guitar Songs 2024 , perfect for beginners or those wanting to brush up on their skills. These easy-to-learn songs are great for practicing your chords and getting a feel for playing along with others.

L Acoustics Merch 2024 is available through the official L-Acoustics website, select authorized retailers, and online marketplaces. You can find a complete list of retailers on the L-Acoustics website.

What are the most popular items in the L Acoustics Merch 2024 collection?

The most popular items in the L Acoustics Merch 2024 collection include limited-edition t-shirts, high-quality headphones, and unique accessories like speaker stands and cable organizers. These items are highly sought after by audiophiles and L-Acoustics enthusiasts.