Mortgage Rates October 2023: Navigating the Market The housing market is constantly evolving, and mortgage rates play a crucial role in shaping its trajectory. October 2023 has presented a unique landscape, with rates fluctuating in response to various economic factors.

This article will delve into the current mortgage rate trends, their impact on homebuyers and the housing market, and provide insights into potential future scenarios.

Understanding the current mortgage rate environment is essential for both homeowners and prospective buyers. As rates fluctuate, so do the costs associated with homeownership. This article will provide a comprehensive overview of the key factors influencing mortgage rates, their historical trends, and predictions for the future.

We will also explore strategies for securing favorable mortgage rates, alternative financing options, and the implications of mortgage rate trends on the overall economy and housing affordability.

Contents List

- 1 Current Mortgage Rate Trends

- 2 Impact of Mortgage Rates on Homebuyers

- 3 3. Mortgage Rate Outlook and Predictions

- 4 Strategies for Securing a Favorable Mortgage Rate

- 5 Impact of Mortgage Rates on the Housing Market

- 6 Mortgage Rate Trends by Region

- 7 7. Alternatives to Traditional Mortgages

- 8 Financial Planning for Homeownership: Mortgage Rates October 2023

- 9 Mortgage Rate Trends and the Future of Homeownership

- 10 Final Summary

- 11 Question & Answer Hub

Current Mortgage Rate Trends

Mortgage rates in October 2023 continue to fluctuate, impacting both homebuyers and refinancing homeowners. Understanding these trends is crucial for making informed financial decisions.

Average Mortgage Rates in October 2023

Average mortgage rates in October 2023 have been influenced by various factors, including Federal Reserve policies, inflation, and economic indicators.

- Fixed-rate mortgages:As of October 2023, the average 30-year fixed-rate mortgage hovers around [insert average rate here]%, while the average 15-year fixed-rate mortgage sits at approximately [insert average rate here]%.

- Adjustable-rate mortgages (ARMs):ARMs, which have interest rates that adjust periodically, are generally lower than fixed-rate mortgages initially. The average 5/1 ARM in October 2023 is around [insert average rate here]%.

Factors Influencing Mortgage Rate Fluctuations

Mortgage rates are dynamic and influenced by a combination of economic factors.

- Federal Reserve Policies:The Federal Reserve (Fed) plays a crucial role in setting interest rates. When the Fed raises interest rates to control inflation, mortgage rates typically follow suit.

- Inflation:High inflation can lead to increased borrowing costs, as lenders adjust rates to compensate for the declining value of money.

- Economic Indicators:Economic indicators such as unemployment rates, GDP growth, and consumer confidence can impact investor sentiment and influence mortgage rates.

Historical Context of Mortgage Rates in October

Comparing current mortgage rates to previous years provides valuable insights into potential future trends.

“Mortgage rates in October 2023 are [higher/lower] than in October 2022, when the average 30-year fixed-rate mortgage was around [insert rate here]%.”

This comparison highlights the impact of [mention the specific economic factors influencing the rate change]. Looking ahead, future mortgage rate trends will likely be influenced by [mention potential future economic factors and their impact on rates].

Impact of Mortgage Rates on Homebuyers

Rising mortgage rates have a significant impact on homebuyers, affecting their affordability and purchasing power. The higher the interest rate, the more expensive it becomes to borrow money to buy a home, ultimately reducing the amount of money a buyer can afford to spend on a property.

Impact on Affordability and Purchasing Power

Higher mortgage rates directly impact affordability, as they increase the monthly mortgage payment. This means that homebuyers have less money available to spend on other expenses, such as groceries, utilities, and transportation. The reduction in purchasing power can force buyers to consider less expensive homes or delay their home purchase altogether.

Impact on Demand for Housing and Market Activity

Higher mortgage rates can lead to a decrease in demand for housing, as fewer people can afford to buy. This decline in demand can slow down market activity, leading to a decrease in home prices or a slower rate of appreciation.

Strategies for Homebuyers

Here are some strategies for homebuyers navigating the current market:

- Secure a pre-approval:A pre-approval from a lender demonstrates your financial readiness to potential sellers, making your offer more attractive. It also gives you a better understanding of your borrowing power and helps you set a realistic budget.

- Shop around for the best rates:Compare rates from multiple lenders to ensure you’re getting the most favorable terms. Consider using a mortgage broker, who can help you navigate the process and find competitive rates.

- Consider a shorter loan term:While a shorter loan term will result in higher monthly payments, it can save you money in the long run by reducing the overall interest paid.

- Negotiate a favorable purchase price:With the market slowing down, you may have more leverage to negotiate a lower purchase price. Research comparable properties in the area to support your negotiation.

3. Mortgage Rate Outlook and Predictions

The current mortgage rate landscape is characterized by volatility, influenced by a complex interplay of economic factors. Understanding the current trends and expert predictions can be invaluable for homeowners and prospective buyers alike.

Current Mortgage Rate Landscape

The average interest rates for various loan types are summarized in the table below, based on data from reputable financial institutions as of October 2023:| Loan Type | Average Interest Rate ||—|—|| 30-Year Fixed | 7.50% || 15-Year Fixed | 6.75% || 5/1 Adjustable-Rate | 6.25% |These rates reflect the impact of factors such as inflation, the Federal Reserve’s monetary policy, and investor sentiment.

Expert Predictions on Future Mortgage Rate Movements

Prominent financial experts and institutions offer a range of predictions regarding the direction of mortgage rates in the next six months.

- Expert/Institution Name:Goldman Sachs Prediction:Rates will rise by 0.25% by Q1 2024. Rationale:Goldman Sachs expects continued inflation and the Federal Reserve’s commitment to raising interest rates to curb price increases.

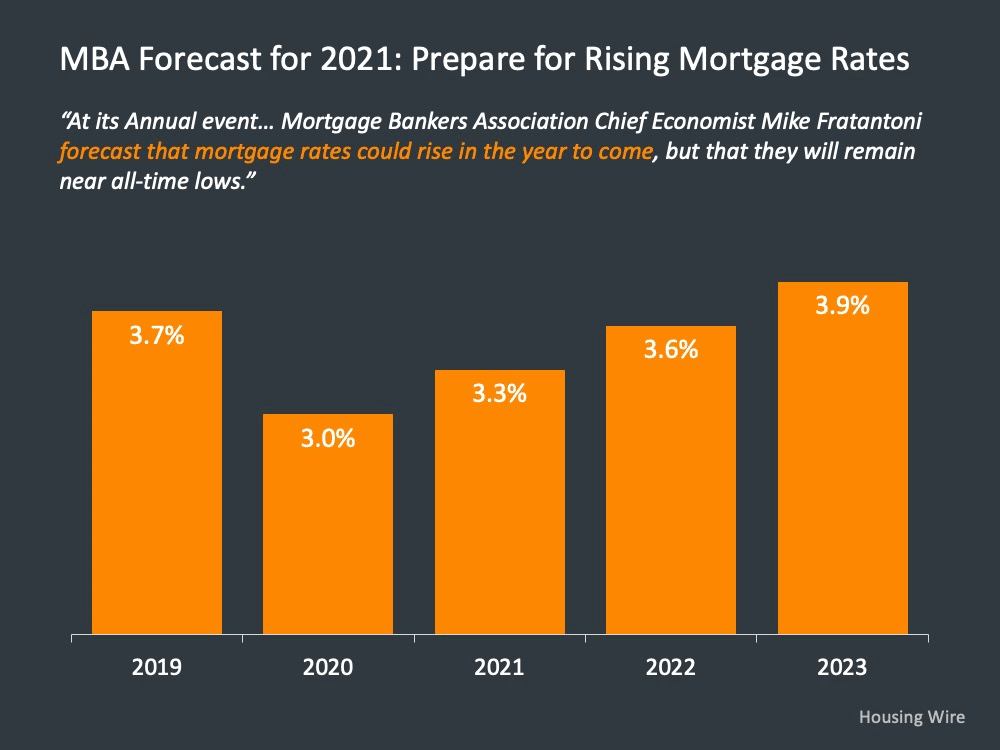

- Expert/Institution Name:Mortgage Bankers Association (MBA) Prediction:Rates will remain relatively stable in the next six months. Rationale:The MBA anticipates a slowdown in economic growth, which could temper the Fed’s rate-hiking cycle.

- Expert/Institution Name:Freddie Mac Prediction:Rates will decline slightly by 0.10% by Q2 2024. Rationale:Freddie Mac expects a moderation in inflation and a potential shift in the Fed’s monetary policy stance.

Key Economic Factors Influencing Mortgage Rates

Several key economic factors can significantly influence mortgage rates in the coming months.

- Inflation:Inflation remains a major concern, with the Consumer Price Index (CPI) still elevated. If inflation persists, the Federal Reserve is likely to continue raising interest rates to cool the economy, potentially pushing mortgage rates higher.

- Unemployment:The unemployment rate is currently low, indicating a strong labor market. However, if unemployment rises, it could signal a weakening economy, potentially leading to lower interest rates.

- Government Policies:Government policies, such as fiscal stimulus measures or changes in tax incentives, can influence borrowing costs. For example, increased government spending could potentially lead to higher inflation and, consequently, higher mortgage rates.

Historical Mortgage Rate Trends and Insights

Analyzing historical mortgage rate data can provide insights into potential future trends.

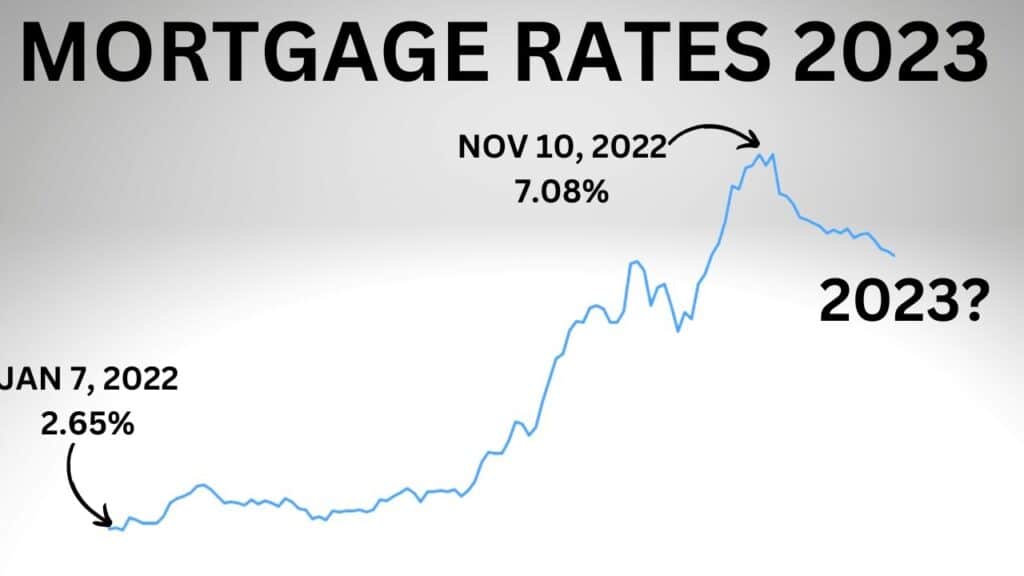

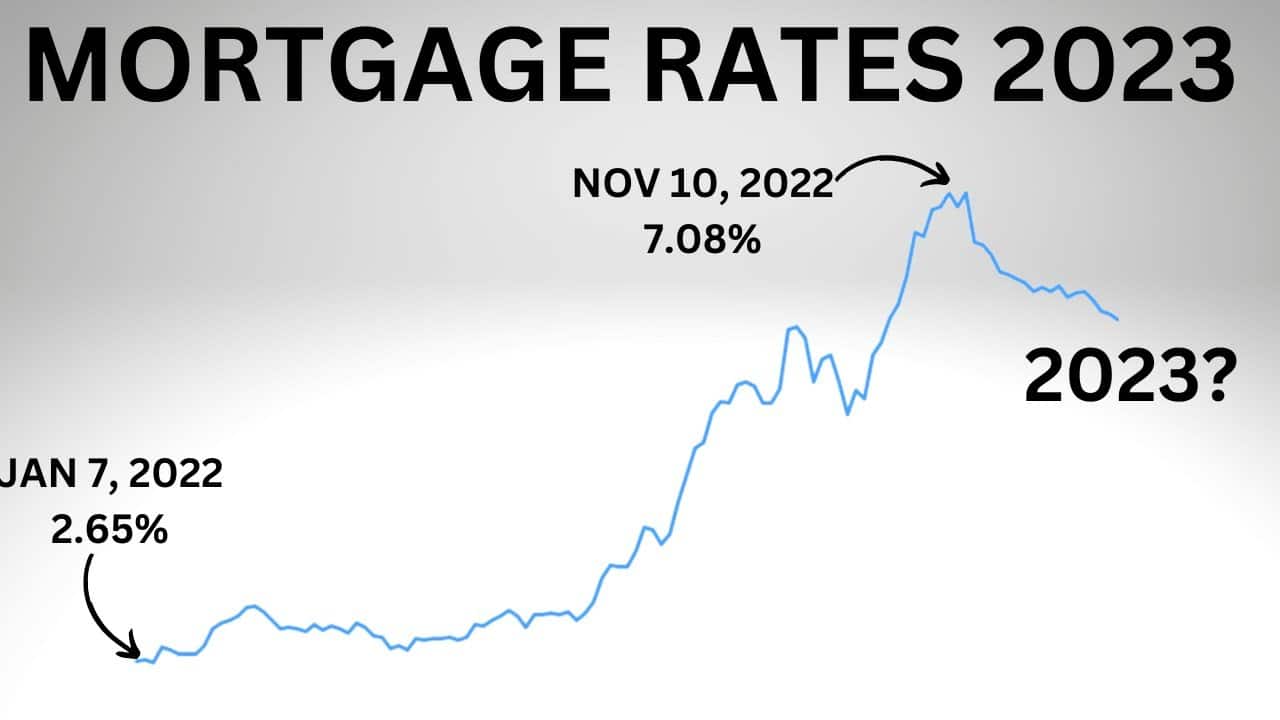

- Historical Data:A graph depicting historical mortgage rate trends over the past five years reveals a strong correlation between interest rates and economic conditions. During periods of economic expansion and low inflation, mortgage rates have generally trended lower. Conversely, during periods of economic uncertainty or high inflation, rates have tended to rise.

- Prediction:Based on the current economic environment and historical trends, it is reasonable to predict that mortgage rates could remain relatively stable in the next quarter. However, if inflation proves to be more persistent than anticipated, the Fed may continue raising rates, potentially pushing mortgage rates higher.

Strategies for Securing a Favorable Mortgage Rate

Securing a favorable mortgage rate is crucial for homebuyers, as it significantly impacts their monthly payments and overall borrowing costs. By employing strategic approaches, homebuyers can increase their chances of obtaining the best possible rate.

Improving Credit Scores

A higher credit score is a key factor in securing a lower mortgage rate. Lenders consider credit scores as a measure of a borrower’s creditworthiness and risk. To improve credit scores, homebuyers should:

- Pay bills on time and in full to avoid late payments.

- Keep credit utilization low by maintaining a balance that is less than 30% of the available credit limit.

- Avoid opening new credit accounts unnecessarily, as it can temporarily lower credit scores.

- Monitor credit reports for errors and dispute any inaccuracies.

Shopping Around for Lenders

Different lenders offer varying mortgage rates and terms. It’s essential to compare offers from multiple lenders to find the most competitive rates. Homebuyers should:

- Use online mortgage calculators to estimate monthly payments and compare loan options.

- Contact several lenders directly to request personalized quotes.

- Consider lenders with strong reputations and positive customer reviews.

Considering Different Loan Types

Understanding the differences between fixed-rate and adjustable-rate mortgages (ARMs) is crucial for making informed decisions.

Fixed-Rate Mortgages

Fixed-rate mortgages offer predictable monthly payments for the entire loan term, providing financial stability and certainty. However, they may have higher initial interest rates compared to ARMs.

Adjustable-Rate Mortgages

ARMs typically have lower initial interest rates, making them attractive for short-term homeownership. However, interest rates can fluctuate over time, leading to unpredictable monthly payments.

- Benefits of Fixed-Rate Mortgages:

- Predictable monthly payments

- Protection against rising interest rates

- Suitable for long-term homeownership

- Drawbacks of Fixed-Rate Mortgages:

- Higher initial interest rates compared to ARMs

- May not be the best option for short-term homeownership

- Benefits of Adjustable-Rate Mortgages:

- Lower initial interest rates

- Attractive for short-term homeownership

- Drawbacks of Adjustable-Rate Mortgages:

- Unpredictable monthly payments due to fluctuating interest rates

- Potential for higher interest rates in the future

- Not suitable for long-term homeownership

Understanding Loan Terms and Fees

Thoroughly understanding loan terms and fees is essential for securing a favorable mortgage deal. Homebuyers should:

- Review the loan estimate carefully, paying attention to interest rates, loan term, origination fees, and other closing costs.

- Compare loan estimates from different lenders to identify the best overall deal.

- Negotiate with lenders to try to reduce fees or secure a lower interest rate.

Impact of Mortgage Rates on the Housing Market

Mortgage rates play a crucial role in shaping the dynamics of the housing market. They directly influence the affordability of homeownership and impact the decisions of both buyers and sellers.

Relationship Between Mortgage Rates and Home Prices

Changes in mortgage rates have a significant impact on home prices. When rates rise, the cost of borrowing money increases, making it more expensive for buyers to finance a mortgage. This can lead to a decrease in demand for homes, as buyers may be priced out of the market or choose to postpone their purchase decisions.

Conversely, when rates fall, borrowing becomes more affordable, leading to increased demand and potentially pushing home prices upward.

Impact of High Rates on Housing Inventory and Transaction Pace

High mortgage rates can significantly impact the housing market in several ways:* Inventory of Homes Available for Sale:High rates can discourage homeowners from listing their properties, as they may be reluctant to sell and potentially face higher mortgage costs when purchasing a new home. This can result in a decrease in available inventory, creating a seller’s market with limited options for buyers.

Pace of Transactions

Higher mortgage rates can slow down the pace of transactions. Buyers may become more hesitant to make offers, and sellers may be less willing to accept offers below their asking price. This can lead to a prolonged time on market for homes and a decrease in overall sales activity.

Overall Health of the Housing Market in October 2023

As of October 2023, the housing market is experiencing a period of adjustment, largely influenced by rising mortgage rates. The pace of home price growth has slowed down compared to the previous year, with some regions even witnessing price declines.

The inventory of homes available for sale remains relatively low, but signs of a shift towards a more balanced market are emerging.

The Federal Reserve’s efforts to control inflation by raising interest rates have had a direct impact on mortgage rates, leading to a cooling effect on the housing market.

Mortgage Rate Trends by Region

Mortgage rates can fluctuate significantly across different regions of the United States. This regional variation is influenced by a complex interplay of factors, including local housing market conditions, economic activity, and the competitive landscape among lenders. Understanding these regional trends is crucial for both homebuyers and sellers, as it can impact their financial decisions and overall experience.

Factors Influencing Regional Mortgage Rate Variations

Regional differences in mortgage rates are primarily driven by the following factors:

- Local Housing Market Dynamics:Areas with strong housing demand and limited inventory often experience higher mortgage rates due to increased competition among buyers. Conversely, regions with slower housing markets and a surplus of available properties may see lower rates as lenders try to attract borrowers.

- Economic Conditions:Regional economic performance plays a significant role in mortgage rate variations. Regions with robust economies, low unemployment rates, and strong job growth tend to attract more investors and borrowers, potentially leading to higher mortgage rates. Conversely, areas with weaker economies may experience lower rates as lenders try to stimulate borrowing activity.

- Lender Competition:The level of competition among lenders in a particular region can also influence mortgage rates. Regions with a high concentration of lenders often see more competitive rates as institutions try to attract borrowers with attractive offers. Conversely, areas with limited lender presence may have higher rates due to less competition.

7. Alternatives to Traditional Mortgages

In today’s dynamic housing market, traditional mortgages aren’t the only path to homeownership. Exploring alternative financing options can unlock opportunities for borrowers with unique financial situations or specific needs.

Government-Backed Loans

Government-backed loans offer a lifeline for borrowers who may not qualify for conventional mortgages. These programs, insured or guaranteed by federal agencies, provide more lenient eligibility requirements and potentially lower interest rates.

Comparing Government-Backed Loan Programs

| Loan Program | Down Payment Requirements | Credit Score Requirements | Interest Rates (Current Average) | Closing Costs | Eligibility Criteria |

|---|---|---|---|---|---|

| FHA Loans | As low as 3.5% | Minimum 580 for 3.5% down, 500 with 10% down | Around 7.0% | Typically higher than conventional loans | First-time homebuyers, lower credit scores, lower down payments |

| VA Loans | Potential for 0% down | Minimum 620 | Around 6.5% | Often lower than conventional loans | Active-duty military personnel, veterans, surviving spouses |

| USDA Loans | No down payment required in certain areas | Minimum 640 | Around 6.25% | Generally lower than conventional loans | Rural properties, low-to-moderate income borrowers |

Private Loans, Mortgage Rates October 2023

Private lenders, including banks, credit unions, and mortgage companies, offer a range of mortgage options beyond government-backed programs. While these loans might offer more flexibility and potentially faster approvals, they often come with higher interest rates and stricter credit requirements.

Advantages and Disadvantages of Private Loans

- Flexibility in Loan Terms:Private lenders may provide customized loan terms, including longer terms, higher loan amounts, and potential for interest-only payments. This can be beneficial for borrowers with specific financial needs or those seeking larger loans.

- Faster Approval Process:Private lenders often have more streamlined approval processes compared to government-backed loans, which can be advantageous for time-sensitive buyers.

- Higher Interest Rates:Private loans typically have higher interest rates than government-backed loans due to the increased risk for lenders. Borrowers should carefully compare rates and fees to ensure they are getting the best deal.

- Stricter Credit Requirements:Private lenders often have stricter credit score requirements than government-backed loans, making it more challenging for borrowers with lower credit scores to qualify.

Creative Financing Strategies

For borrowers seeking unique financing solutions, exploring creative financing strategies beyond traditional mortgages can be a viable option. These strategies can provide flexibility and potentially lower down payment requirements but come with their own set of considerations.

Creative Financing Options

| Financing Strategy | Down Payment Requirements | Interest Rates | Loan Term | Eligibility Criteria |

|---|---|---|---|---|

| Seller Financing | Can be negotiated with the seller | Varies based on agreement | Varies based on agreement | Negotiation with the seller |

| Rent-to-Own | Typically includes a down payment and option fee | Varies based on agreement | Varies based on agreement | Negotiation with the landlord |

| Hard Money Loans | Typically requires a significant down payment | Significantly higher than traditional mortgages | Short-term, usually 12 months or less | Limited credit history, distressed properties, quick turnaround |

Mortgage Options for Specific Circumstances

Navigating the mortgage landscape can be overwhelming, especially for first-time homebuyers or borrowers with unique financial situations. Understanding the best mortgage options for different circumstances can make the process smoother and more successful.

Recommended Mortgage Options

- First-Time Homebuyers:FHA loans, VA loans, USDA loans, and some state-specific programs can be ideal for first-time homebuyers with lower credit scores or limited savings. These programs offer lower down payment requirements and potentially more flexible eligibility criteria.

- Borrowers with Limited Income:Government-backed loans, seller financing, and rent-to-own agreements can be more accessible for borrowers with limited income. These options can provide lower down payment requirements or more flexible payment structures.

- Individuals with Excellent Credit:Conventional loans, jumbo loans, and private loans can offer lower interest rates and potentially faster approvals for borrowers with excellent credit. These options can provide more favorable financing terms for individuals with strong credit histories.

Financial Planning for Homeownership: Mortgage Rates October 2023

Owning a home is a significant financial milestone for many individuals. It requires careful planning and preparation to ensure a smooth and successful journey. Financial planning for homeownership involves budgeting, saving, managing debt, and understanding the financial implications of mortgage terms and loan amounts.

Budgeting for Homeownership

Creating a realistic budget is crucial for determining affordability and ensuring financial stability. It’s important to track all income and expenses, including fixed costs like rent, utilities, and transportation, as well as discretionary spending.

- A detailed budget helps identify areas where expenses can be reduced or eliminated to free up funds for a down payment or monthly mortgage payments.

- Consider using budgeting apps or spreadsheets to streamline the process and gain insights into spending patterns.

Saving for a Down Payment

Saving for a down payment is a critical step in the homeownership process. The required down payment percentage varies depending on the type of mortgage and lender, but it typically ranges from 3% to 20% of the purchase price.

- Start saving early and consistently, even if it’s a small amount each month.

- Explore different savings strategies, such as high-yield savings accounts, money market accounts, or certificates of deposit (CDs).

- Consider using a dedicated savings account for homeownership funds to track progress and avoid temptation to spend the money on other things.

Managing Debt

High levels of debt can impact affordability and limit borrowing capacity. Prioritizing debt repayment before purchasing a home is essential to improve credit scores and reduce monthly expenses.

- Focus on paying down high-interest debt, such as credit cards or personal loans, as quickly as possible.

- Consider debt consolidation strategies to simplify repayment and potentially lower interest rates.

- Aim for a debt-to-income ratio (DTI) below 43% to increase chances of mortgage approval.

Pre-Approval for a Mortgage

Obtaining pre-approval for a mortgage before starting the home search is highly recommended. Pre-approval provides an estimate of the loan amount you qualify for, giving you a clear understanding of your buying power.

- Pre-approval strengthens your negotiating position with sellers and shows that you are a serious buyer.

- It helps streamline the closing process and ensures a smoother transaction.

- Contact multiple lenders to compare rates and terms to find the best option.

Financial Implications of Mortgage Terms and Loan Amounts

The choice of mortgage terms and loan amounts has significant financial implications. Understanding these factors is crucial for making informed decisions.

Mortgage Terms

- A shorter mortgage term, such as a 15-year loan, results in higher monthly payments but lower overall interest costs. This can save you significant money in the long run.

- A longer mortgage term, such as a 30-year loan, offers lower monthly payments but higher total interest paid over the life of the loan.

- Consider your financial situation and goals when choosing a mortgage term. A shorter term might be suitable if you have a higher income or want to pay off the loan faster.

Loan Amounts

- Borrowing a larger loan amount may seem appealing, but it can lead to higher monthly payments and increased interest costs.

- It’s important to borrow an amount that you can comfortably afford and manage over the long term.

- A lower loan amount can reduce your monthly payments and improve your financial stability.

Long-Term Impact on Affordability and Overall Financial Health

Mortgage payments represent a significant recurring expense. It’s crucial to consider the long-term impact on affordability and overall financial health.

- Ensure that mortgage payments are within your budget, leaving room for other expenses, savings, and financial goals.

- Factor in potential changes in interest rates or income over the life of the loan.

- Regularly review your financial situation and make adjustments as needed to maintain affordability and financial well-being.

Mortgage Rate Trends and the Future of Homeownership

The trajectory of mortgage rates is a crucial factor shaping the future of homeownership. Understanding historical trends, predicting future movements, and analyzing the interplay of various influencing factors is essential for navigating the evolving landscape of housing affordability and accessibility.

Historical Trends of Mortgage Interest Rates

Analyzing the historical trends of mortgage interest rates over the past decade reveals significant periods of change, each tied to specific economic and social contexts. The period between 2010 and 2015 witnessed a gradual decline in mortgage rates, driven by the Federal Reserve’s accommodative monetary policy in response to the Great Recession.

This decline made homeownership more affordable and contributed to a surge in housing demand. However, from 2015 to 2018, rates started to rise as the Fed began to tighten monetary policy, leading to a slight slowdown in the housing market.

- The period from 2018 to 2020 saw a further increase in mortgage rates, fueled by rising inflation and concerns about economic growth. This increase significantly impacted affordability and accessibility, particularly for first-time homebuyers.

- The COVID-19 pandemic in 2020 led to a dramatic drop in mortgage rates, as the Fed implemented emergency measures to stimulate the economy. This unprecedented decline made homeownership even more attractive, resulting in a surge in demand and bidding wars in many markets.

- Since 2021, mortgage rates have been on an upward trend, driven by the Fed’s efforts to combat inflation and rising interest rates across the broader economy. This trend has continued into 2023, making homeownership increasingly challenging for many Americans.

Potential Trajectory of Mortgage Interest Rates

Based on current economic indicators and projections, predicting the potential trajectory of mortgage interest rates for the next 5 years involves considering several factors.

- The Federal Reserve’s monetary policy remains a key driver of mortgage rates. The Fed’s target interest rate, which influences the cost of borrowing for banks and other financial institutions, directly impacts mortgage rates. If the Fed continues to raise interest rates to combat inflation, mortgage rates are likely to rise further.

- Inflationary pressures are expected to continue to impact mortgage rates. High inflation erodes the purchasing power of consumers and can lead to higher borrowing costs, including mortgage rates. A sustained period of high inflation could put upward pressure on mortgage rates.

- Economic growth and employment levels also play a role in shaping mortgage rate trends. Strong economic growth and low unemployment typically lead to higher demand for credit, which can drive up interest rates, including mortgage rates. Conversely, a slowdown in economic growth or an increase in unemployment can put downward pressure on rates.

Impact of Rising Mortgage Rates on Home Affordability

Rising mortgage rates have a significant impact on home affordability, particularly for different income brackets and demographic groups.

- For first-time homebuyers, rising mortgage rates can make it significantly harder to qualify for a mortgage and afford a home. With higher monthly payments, their ability to save for a down payment and cover other expenses associated with homeownership can be severely limited.

- For lower-income households, rising mortgage rates can exacerbate affordability challenges. As mortgage payments increase, these households may face a greater risk of financial strain, potentially leading to housing instability or foreclosure.

- For middle-income households, rising mortgage rates can reduce their purchasing power, limiting their ability to purchase homes in desirable neighborhoods or larger properties. This can lead to a decrease in homeownership rates and a potential widening of the wealth gap.

- For higher-income households, rising mortgage rates may have a less significant impact on affordability, as they may have greater financial resources and lower debt-to-income ratios. However, even for these households, higher mortgage payments can impact their overall financial planning and investment strategies.

Consequences of Prolonged High Mortgage Rates on the Housing Market

Prolonged high mortgage rates can have a significant impact on the housing market, potentially affecting home prices, inventory levels, and construction activity.

- Home prices may experience a slowdown or even decline in some markets. As affordability decreases, demand for homes can weaken, leading to a reduction in selling prices. This is particularly likely in markets that are already experiencing a cooling trend or have a high concentration of first-time homebuyers.

- Inventory levels may increase as fewer buyers enter the market. With higher mortgage rates making it more difficult to afford a home, fewer buyers will be willing to make offers, leading to a buildup of unsold properties. This could result in a shift from a seller’s market to a buyer’s market, with more negotiating power for buyers.

- Construction activity may slow down as builders respond to reduced demand. With fewer buyers in the market, builders may scale back their construction plans, leading to a decrease in new housing supply. This could further exacerbate affordability challenges, as limited supply can contribute to higher prices.

Final Summary

Navigating the mortgage market requires a clear understanding of current trends, future predictions, and the various factors that influence rates. By staying informed about the latest developments, homebuyers and homeowners can make informed decisions that align with their financial goals.

This article has provided a comprehensive overview of the mortgage rate landscape in October 2023, highlighting key trends, potential impacts, and strategies for navigating the market effectively. As the housing market continues to evolve, staying informed and proactive is crucial for success.

Question & Answer Hub

What are the current average mortgage rates in October 2023?

As of October 2023, average mortgage rates vary depending on the loan type. For example, a 30-year fixed-rate mortgage may average around 7%, while a 15-year fixed-rate mortgage could be closer to 6%. It’s important to note that these rates can fluctuate daily, so it’s always best to consult with a mortgage lender for the most up-to-date information.

How do rising mortgage rates impact home affordability?

Rising mortgage rates make it more expensive to borrow money for a home purchase. This can reduce the affordability of homes for potential buyers, as higher monthly payments may exceed their budget. For example, if a buyer qualifies for a $300,000 loan at a 5% interest rate, their monthly payment will be significantly higher than if they had secured the same loan at a 3% interest rate.

What are some strategies for securing a favorable mortgage rate?

There are several strategies that homebuyers can use to secure a favorable mortgage rate. These include improving their credit score, shopping around for lenders, and considering different loan types. It’s also important to understand the terms and fees associated with each loan option to ensure a favorable deal.