Annuity Is A Life Insurance Product That 2024: A Comprehensive Guide, delves into the world of annuities, exploring their nature, benefits, and potential drawbacks. Annuities are financial instruments that provide a stream of income, often for life, and can be a valuable tool for retirement planning.

Mastering GameGuardian 2024 for Android is a valuable skill for gamers who want to customize their experience. Explore the features and unlock the power of this tool.

This guide aims to provide a clear and concise understanding of annuities, shedding light on their complexities and potential benefits for individuals seeking financial security.

We’ll discuss different types of annuities, such as fixed and variable annuities, and explore their unique features. We’ll also examine how annuities can be considered a form of life insurance, with death benefit components that can provide financial protection for loved ones.

Looking for a powerful processor for your laptop? Snapdragon 2024 is designed to deliver exceptional performance and efficiency, making it a great choice for mobile computing.

Finally, we’ll analyze the current market trends and future outlook for annuities in 2024, highlighting their role in addressing the evolving needs of individuals in a dynamic financial landscape.

Creating an avatar in Dollify 2024 raises important ethical considerations about representation and diversity in digital spaces.

Contents List

Understanding Annuities

Annuities are financial products that provide a stream of regular payments, either for a fixed period or for the rest of your life. They are often used for retirement planning, but they can also be helpful for other financial goals, such as providing income for a surviving spouse or funding long-term care expenses.

Keep your personal projects organized with Google Tasks 2024. It’s a simple and effective way to manage your to-do list.

Types of Annuities

There are many different types of annuities, each with its own unique features and benefits. Here are a few of the most common types:

- Fixed annuitiesprovide a guaranteed rate of return, which means that your payments will be the same each month. This type of annuity is ideal for those who want predictable income and are not comfortable with market risk.

- Variable annuitiesoffer the potential for higher returns, but they also carry more risk. The payments you receive from a variable annuity will fluctuate based on the performance of the underlying investments. This type of annuity is suitable for those who are willing to take on more risk in exchange for the potential for higher returns.

Control your computer from your phone with Pushbullet 2024. It’s a versatile tool for managing notifications, transferring files, and more.

- Immediate annuitiesbegin paying out immediately after you purchase them. This type of annuity is ideal for those who need immediate income, such as retirees who are looking to supplement their Social Security benefits.

- Deferred annuitiesbegin paying out at a later date, such as when you reach retirement age. This type of annuity is a good option for those who are saving for retirement and want to grow their savings tax-deferred.

Key Features of Annuities

Annuities are different from other financial products in several key ways. Some of the key features of annuities include:

- Guaranteed payments: Most annuities provide guaranteed payments for a specific period or for life, which can provide peace of mind during retirement.

- Tax-deferred growth: The earnings on annuities are typically tax-deferred, which means that you will not have to pay taxes on them until you begin receiving payments.

- Longevity protection: Annuities can provide longevity protection, which means that you will continue to receive payments even if you live longer than expected.

Annuity as a Life Insurance Product

Annuities can be considered a life insurance product because they provide a death benefit. This means that if you die before you receive all of your payments, your beneficiary will receive the remaining amount of the annuity.

The future of task management is exciting! Google Tasks 2024 is constantly evolving, offering new features and integrations to simplify your workflow.

Death Benefit Component

The death benefit component of an annuity is typically equal to the amount of the annuity that has not yet been paid out. This can provide a financial safety net for your loved ones if you die unexpectedly.

Looking for an edge in Brawl Stars? GameGuardian 2024 can help you unlock new strategies and dominate the competition.

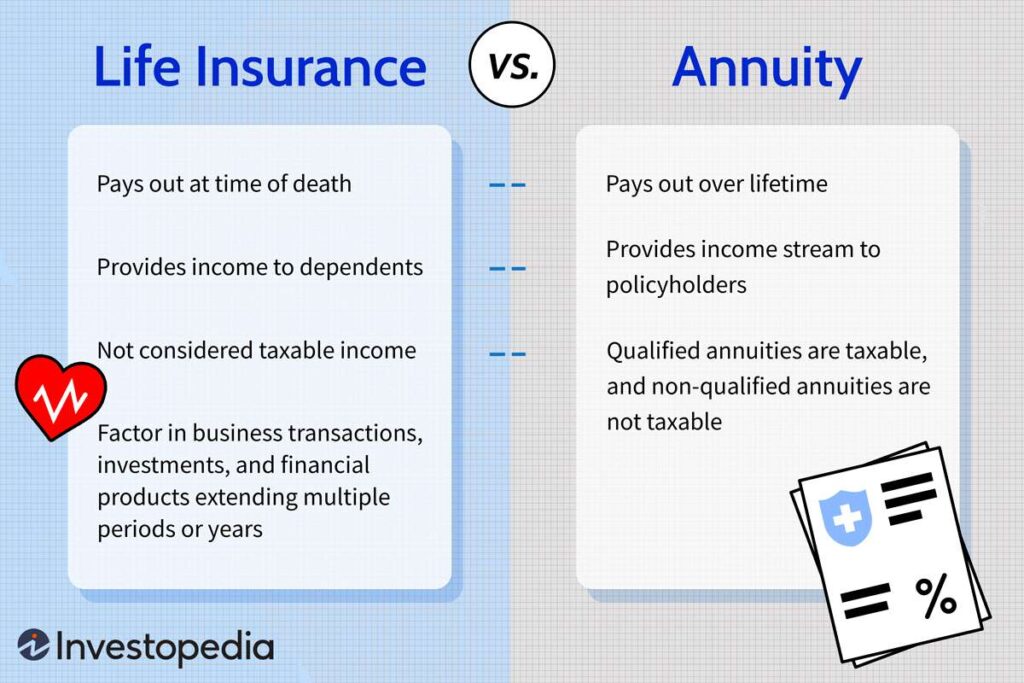

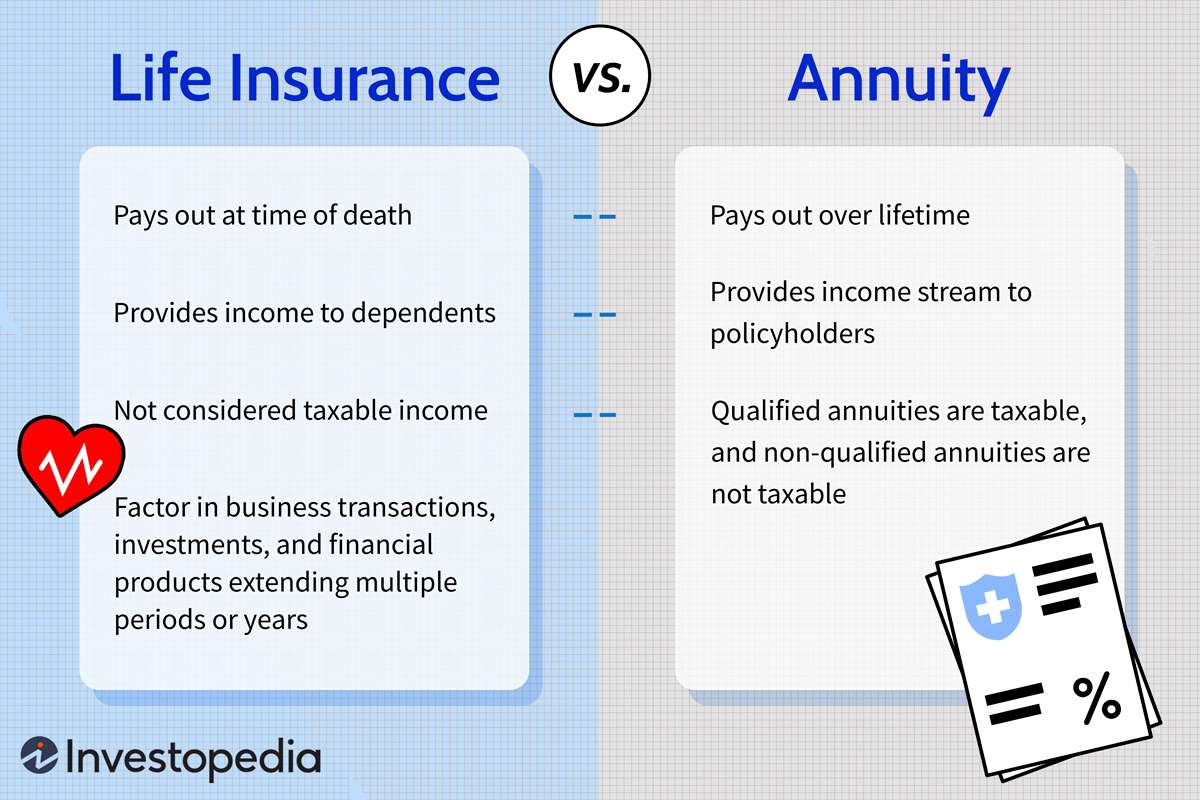

Comparison with Traditional Life Insurance

Annuities are similar to traditional life insurance policies in that they both provide a death benefit. However, there are some key differences between the two products.

Developers need to be aware of the latest Android WebView 202 API changes to ensure their apps remain compatible and secure.

- Life insurance policiestypically have a higher death benefit than annuities, but they also have higher premiums.

- Annuitiescan provide income for life, while life insurance policies typically pay out a lump sum death benefit.

Benefits of Annuities

Annuities can offer several benefits, including:

Income Generation

Annuities can provide a guaranteed stream of income for life, which can be especially helpful during retirement. This can help you cover your living expenses, such as housing, food, and healthcare.

Stay up-to-date with the best Android apps of the year. Android Authority 2024 provides a curated list of top-rated apps across various categories.

Tax Benefits

The earnings on annuities are typically tax-deferred, which means that you will not have to pay taxes on them until you begin receiving payments. This can help you save on taxes over the long term.

Looking for sweet deals on your next delivery? Glovo app offers a range of discounts and promotions to help you save money on your orders.

Longevity Protection

Annuities can provide longevity protection, which means that you will continue to receive payments even if you live longer than expected. This can help you avoid outliving your savings.

Want to unlock the full potential of Subway Surfers? GameGuardian 2024 provides tools to customize your gaming experience and take your gameplay to the next level.

Table of Annuity Benefits

| Benefit | Impact on Financial Planning |

|---|---|

| Income generation | Provides a guaranteed stream of income for life, helping cover living expenses. |

| Tax benefits | Allows for tax-deferred growth, potentially saving on taxes over the long term. |

| Longevity protection | Ensures continued income even if you live longer than expected, preventing outliving your savings. |

Retirement Planning Scenario

Imagine a couple nearing retirement who are concerned about outliving their savings. They could consider purchasing an annuity to provide a guaranteed stream of income for life, giving them peace of mind and ensuring they have a steady source of funds to cover their expenses in retirement.

Curious about the battery life of the latest Snapdragon processors? Snapdragon 2024 promises impressive battery efficiency, keeping you powered up for longer.

Considerations Before Purchasing an Annuity

While annuities offer several benefits, it’s important to consider the potential risks and drawbacks before purchasing one.

Building hybrid apps? Android WebView 202 is a game-changer, offering enhanced security and performance for web-based content within your app.

Potential Risks and Drawbacks

- Limited liquidity: Annuities are not as liquid as other investments, such as stocks or bonds. This means that it can be difficult to access your money if you need it before you begin receiving payments.

- Fees and expenses: Annuities often have high fees and expenses, which can eat into your returns.

- Potential for lower returns: Annuities may not keep up with inflation, which can erode the purchasing power of your payments over time.

Factors to Consider

Before purchasing an annuity, you should consider several factors, including:

- Age: Younger individuals may not need an annuity as much as older individuals who are nearing retirement.

- Health: Your health can impact the type of annuity you choose. For example, if you have a serious health condition, you may want to consider an annuity with a shorter payout period.

- Financial goals: Your financial goals will help you determine the type of annuity that is right for you. For example, if you are looking for income for life, you may want to consider a fixed annuity.

Importance of Understanding Terms and Conditions

It is crucial to carefully read and understand the terms and conditions of the annuity contract before purchasing an annuity. This includes understanding the fees, expenses, and any other restrictions that may apply.

AI is revolutionizing the way we develop Android apps. AI is streamlining development processes and creating new possibilities for innovative apps.

Annuity in 2024

The annuity market is constantly evolving, with new products and regulations emerging regularly. It is important to stay up-to-date on the latest trends and developments in the annuity market.

Current Market Trends and Regulations

In 2024, the annuity market is expected to continue to grow, driven by factors such as the aging population and the need for guaranteed income in retirement. The regulatory landscape is also evolving, with new rules being implemented to protect consumers and ensure the stability of the annuity market.

Future Outlook for Annuities, Annuity Is A Life Insurance Product That 2024

Annuities are likely to play an increasingly important role in financial planning in the years to come. As people live longer and face more financial uncertainty, annuities can provide a valuable source of income and longevity protection.

Compare Glovo’s delivery fees to other apps to find the best value for your money. Glovo app delivery fees are competitive, offering a range of options to suit your budget.

Addressing Evolving Needs in 2024

In 2024, annuities can help individuals address a range of financial needs, such as:

- Retirement planning: Annuities can provide a guaranteed stream of income for life, helping retirees cover their living expenses.

- Longevity protection: Annuities can help individuals avoid outliving their savings, providing peace of mind during retirement.

- Estate planning: Annuities can provide a death benefit, which can help ensure that your loved ones are financially secure if you die unexpectedly.

Closing Notes: Annuity Is A Life Insurance Product That 2024

In conclusion, annuities offer a multifaceted approach to financial planning, providing income generation, tax benefits, and longevity protection. While there are potential risks and drawbacks to consider, a well-informed decision can lead to significant financial security. By understanding the intricacies of annuities and their role in the evolving financial landscape, individuals can make informed choices to achieve their financial goals and secure their future.

Key Questions Answered

What are the tax implications of annuities?

The tax implications of annuities can vary depending on the type of annuity and the specific provisions of the contract. It’s essential to consult with a financial advisor to understand the tax treatment of your annuity.

How do I choose the right annuity for my needs?

Choosing the right annuity depends on your individual circumstances, including your age, health, financial goals, and risk tolerance. It’s crucial to consult with a qualified financial advisor to determine the most suitable annuity for your specific situation.

Are annuities regulated by the government?

Yes, annuities are regulated by state and federal agencies to ensure consumer protection and financial stability. These regulations govern various aspects of annuity contracts, including the terms and conditions, disclosures, and sales practices.