Annuity Is What 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Annuities, often viewed as complex financial instruments, are gaining increasing attention as individuals seek reliable income streams and protection against market volatility.

Android WebView 202 brings significant improvements over previous versions, offering enhanced security, performance, and compatibility. It’s built on Chromium, the same open-source project that powers Google Chrome, ensuring a more modern and reliable web browsing experience. To learn more about the differences between Android WebView 202 and previous versions, check out this article: Android WebView 202 vs previous versions.

This guide delves into the world of annuities, exploring their relevance in today’s financial landscape and how they can contribute to achieving your financial goals.

Glovo offers various payment methods for your convenience. You can use your credit card, debit card, or even pay in cash upon delivery. The app also prioritizes your security with features like secure payment gateways and encryption to protect your sensitive information.

For a detailed breakdown of payment methods and security features, check out this link: Glovo app payment methods and security features.

From understanding the fundamentals of annuities to navigating the intricacies of the market, we aim to empower you with the knowledge and insights needed to make informed decisions. We’ll cover key aspects such as different types of annuities, their potential benefits and drawbacks, and how to choose the right annuity for your unique needs.

Android Authority has put together a comprehensive comparison of battery life for various Android phones in 2024. Whether you prioritize long-lasting battery performance or want a phone that can handle heavy usage, this comparison will help you find the perfect device for your needs.

Check out the detailed analysis here: Android Authority 2024 phone battery life comparison.

Whether you’re approaching retirement, seeking income generation strategies, or simply looking to enhance your financial plan, this guide serves as your comprehensive resource to navigate the world of annuities.

GameGuardian is a popular tool for Call of Duty Mobile players who want to enhance their gameplay experience. It allows you to modify game variables, such as health, ammo, and even your score. However, using such tools is against the game’s terms of service, so use it at your own risk.

Learn more about GameGuardian and its capabilities here: GameGuardian 2024 for Call of Duty Mobile.

Contents List

- 1 What is an Annuity?

- 2 Annuity in 2024: Market Trends and Outlook

- 3 How Annuities Can Benefit Individuals in 2024

- 4 Choosing the Right Annuity for Your Needs

- 5 The Role of Annuities in a Comprehensive Financial Plan: Annuity Is What 2024

- 6 The Future of Annuities

- 7 Closing Notes

- 8 Commonly Asked Questions

What is an Annuity?

An annuity is a financial product that provides a stream of regular payments for a specified period of time. It’s essentially a contract between you and an insurance company, where you make a lump sum payment or a series of payments in exchange for guaranteed income payments later on.

Looking for the best camera phones in 2024? Android Authority has compiled a list of the top picks, featuring devices with exceptional camera capabilities. Whether you’re a professional photographer or just want to capture stunning photos and videos, these phones have got you covered.

See the full list here: Android Authority 2024 top camera phone picks.

Think of it as a retirement savings plan with a built-in income guarantee.

Pushbullet is a popular app for sharing files and data between your devices. But is it safe and secure? The answer depends on how you use it and what information you’re sharing. While Pushbullet offers encryption and other security measures, it’s important to be aware of potential risks.

Read more about Pushbullet’s safety and security features here: Pushbullet 2024: Is Pushbullet a safe and secure way to share data?.

Types of Annuities

There are various types of annuities, each with its own features and benefits:

- Fixed Annuities:These offer a guaranteed rate of return, providing predictable income payments. They’re ideal for those seeking stability and protection against market fluctuations.

- Variable Annuities:These tie the growth of your payments to the performance of a specific investment portfolio. While they offer the potential for higher returns, they also come with higher risks.

- Indexed Annuities:These link the growth of your payments to the performance of a specific market index, such as the S&P 500. They offer a balance between potential growth and downside protection.

Key Features and Benefits of Annuities

Annuities offer several key features and benefits:

- Guaranteed Income:One of the biggest advantages of annuities is their ability to provide guaranteed income for life, regardless of market conditions. This can offer peace of mind during retirement, knowing you have a reliable source of income.

- Tax Advantages:Depending on the type of annuity, your income payments may be taxed favorably. This can help you save on taxes and maximize your retirement income.

- Protection Against Market Volatility:Annuities can offer protection against market downturns, providing a safety net for your retirement savings. This can be especially valuable during periods of economic uncertainty.

Annuity in 2024: Market Trends and Outlook

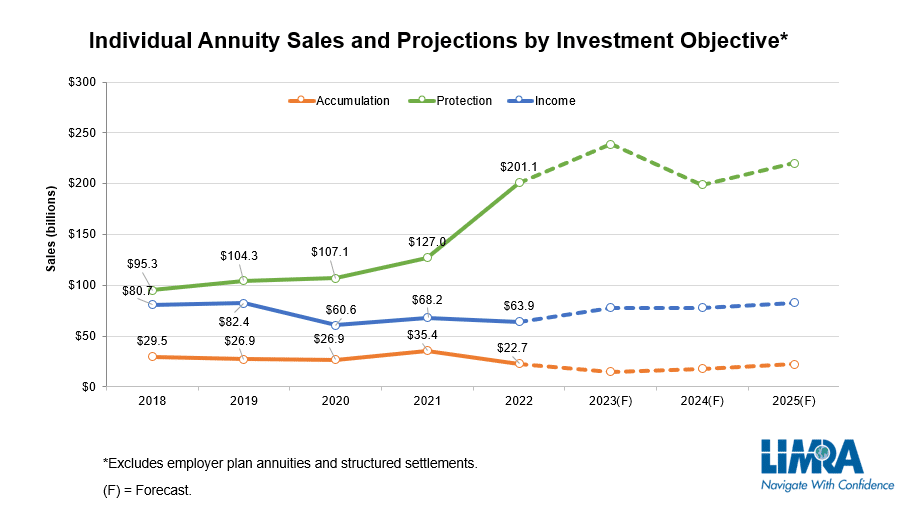

The annuity market is expected to continue its growth trajectory in 2024, driven by several key factors.

Glovo is expanding its services rapidly, but it’s not available in every city or country yet. If you’re wondering whether Glovo is available in your area, you can check their website or app for coverage information. They’re constantly adding new locations, so keep an eye out for updates! You can also check out this article to see if Glovo is available in your location: Is Glovo app available in my city or country.

Factors Driving Demand for Annuities

- Rising Interest Rates:Higher interest rates can make annuities more attractive as they offer the potential for higher guaranteed income payments.

- Increasing Life Expectancy:As people live longer, they need more secure and reliable sources of income to support their retirement years. Annuities can provide this much-needed financial security.

- Concerns About Retirement Security:The increasing cost of healthcare and other living expenses has led to growing concerns about retirement security. Annuities can help address these concerns by providing a guaranteed income stream.

Risks and Challenges Associated with Annuities

While annuities offer many benefits, they also come with certain risks and challenges:

- Inflation:Inflation can erode the purchasing power of your annuity payments over time, reducing the real value of your income.

- Market Volatility:Variable and indexed annuities are subject to market fluctuations, which can impact the growth of your payments.

- Early Withdrawal Penalties:Many annuities have early withdrawal penalties, which can discourage you from accessing your funds before a certain age or period.

How Annuities Can Benefit Individuals in 2024

Annuities can play a crucial role in helping individuals achieve their financial goals in 2024.

Pushbullet is a versatile tool for sharing files between your devices. You can easily send photos, videos, documents, and even links from your phone to your computer or vice versa. To learn how to use Pushbullet for file sharing, check out this article: Pushbullet 2024: How to use Pushbullet to share files between devices.

Retirement Planning

Annuities can provide a reliable source of income during retirement, supplementing other sources like Social Security and savings. They can help ensure you have enough money to cover your essential expenses and maintain your desired lifestyle.

Curious about how Glovo works for restaurant delivery? You can easily order your favorite meals through the app. Just browse through the available restaurants, select your dishes, and place your order. The app will then connect you with a delivery driver who will pick up your food and deliver it to your doorstep.

To learn more about the process, check out this article: How does Glovo app work for restaurant delivery.

Income Generation

Annuities can be used to generate a steady stream of income for various purposes, such as paying for healthcare expenses, funding travel, or supporting loved ones.

Google Tasks has received several new features and enhancements in 2024, making it a more powerful and user-friendly task management tool. From improved task organization to better collaboration features, these updates aim to enhance your productivity. To discover the latest additions to Google Tasks, check out this article: Google Tasks 2024: New Features and Enhancements.

Estate Planning

Annuities can be used to create a legacy for your heirs. By naming a beneficiary, you can ensure that your loved ones will receive a guaranteed income stream after your passing.

Google Tasks has undergone significant improvements in 2024, including deeper integration with Google Workspace. This means you can now seamlessly manage your tasks across different platforms and collaborate with colleagues. Check out this article to learn more about the integration and other new features: Google Tasks 2024: Integration with Google Workspace.

Benefits for Different Demographics, Annuity Is What 2024

Annuities can offer specific benefits for different demographics:

- Retirees:Annuities can provide guaranteed income for life, helping retirees meet their financial needs and maintain their standard of living.

- Pre-retirees:Annuities can be used to supplement retirement savings and ensure a smooth transition into retirement.

- Individuals with Special Needs:Annuities can provide a secure and reliable source of income for individuals with special needs, ensuring they receive the financial support they require.

Choosing the Right Annuity for Your Needs

Selecting the right annuity for your individual needs is crucial to maximizing its benefits.

Glovo faces fierce competition in the delivery app market, with rivals like Uber Eats, Deliveroo, and Foodpanda vying for market share. The competition is fierce, pushing each company to innovate and offer better services to customers. To learn more about Glovo’s competition and its market share, check out this article: Glovo app app competition and market share.

Step-by-Step Guide

- Define Your Financial Goals:Determine your financial objectives, such as retirement income, income generation, or estate planning.

- Assess Your Risk Tolerance:Consider your comfort level with market volatility and choose an annuity that aligns with your risk profile.

- Determine Your Time Horizon:Consider how long you need the annuity to provide income, whether for a fixed period or for life.

- Compare Different Annuity Products:Research different annuity products from reputable insurance companies, comparing features, rates, and fees.

- Seek Professional Advice:Consult with a financial advisor to get personalized recommendations and ensure you choose the best annuity for your situation.

Important Factors to Consider

- Guaranteed Income:Consider the level of guaranteed income the annuity provides and how it aligns with your income needs.

- Growth Potential:Evaluate the potential for growth in your payments, depending on the type of annuity.

- Fees and Expenses:Understand the fees associated with the annuity, such as surrender charges, administrative fees, and mortality and expense charges.

- Flexibility:Consider the flexibility of the annuity, such as the ability to access your funds early or adjust your payments.

- Reputation of the Insurance Company:Choose an annuity from a reputable insurance company with a strong financial rating.

The Role of Annuities in a Comprehensive Financial Plan: Annuity Is What 2024

Annuities can be a valuable component of a comprehensive financial plan, alongside other financial products.

Thinking about becoming a Glovo delivery driver? It’s a great way to earn extra income and be your own boss. You can set your own hours and choose your delivery areas. To get an idea of the potential earnings and tips, check out this article: Glovo app delivery driver earnings and tips.

Key Components of a Financial Plan

- Retirement Savings:Annuities can supplement retirement savings accounts, such as 401(k)s and IRAs, providing a guaranteed income stream during retirement.

- Investment Portfolio:Annuities can diversify your investment portfolio, providing a balance between growth and protection against market volatility.

- Estate Planning:Annuities can be used to create a legacy for your heirs, ensuring they receive a guaranteed income stream after your passing.

- Insurance:Annuities can provide a safety net against unexpected events, such as job loss or health problems.

Benefits and Drawbacks of Annuities

| Feature | Benefits | Drawbacks |

|---|---|---|

| Guaranteed Income | Provides predictable and reliable income for life | Income payments may be lower than potential market returns |

| Tax Advantages | Income payments may be taxed favorably | May be subject to taxes on growth |

| Protection Against Market Volatility | Provides downside protection for your retirement savings | May limit potential for growth |

| Flexibility | Some annuities offer flexibility in accessing your funds or adjusting your payments | May have early withdrawal penalties |

The Future of Annuities

The annuity market is expected to continue evolving in the years to come, driven by technological advancements and changing consumer needs.

Emerging Technologies and Innovations

- Artificial Intelligence (AI):AI-powered tools are being used to personalize annuity recommendations and streamline the purchasing process.

- Blockchain Technology:Blockchain can enhance the security and transparency of annuity contracts, making them more accessible and efficient.

- Digital Platforms:Online platforms are making it easier for consumers to compare and purchase annuities, increasing accessibility and convenience.

Predictions for the Role of Annuities

- Increased Demand:The demand for annuities is expected to continue growing as individuals seek guaranteed income and protection against market volatility.

- Innovation in Product Design:The annuity industry is expected to develop new and innovative products to meet the evolving needs of consumers.

- Greater Accessibility:Annuities are expected to become more accessible and affordable for a wider range of individuals.

Closing Notes

As we conclude our exploration of “Annuity Is What 2024,” it’s clear that annuities have emerged as a valuable tool for individuals seeking financial security and stability. By understanding the intricacies of annuities, their potential benefits, and the importance of careful planning, you can position yourself to make informed decisions that align with your financial aspirations.

Whether you’re seeking guaranteed income streams, protection against market volatility, or a combination of both, annuities can play a significant role in achieving your financial goals.

Commonly Asked Questions

What are the tax implications of annuities?

The tax implications of annuities can vary depending on the type of annuity and how it is structured. Generally, the earnings from an annuity are taxed as ordinary income when withdrawn, but there may be tax-deferred growth during the accumulation phase.

Can I withdraw my money from an annuity before retirement?

Most annuities have surrender charges or penalties for early withdrawals, which can vary depending on the contract. However, there may be exceptions for certain situations, such as medical expenses or disability. It’s important to review your annuity contract carefully before making any withdrawals.

How do I find a reputable annuity provider?

It’s essential to choose a reputable annuity provider with a strong track record. You can research providers through independent sources like the Better Business Bureau, consumer reviews, and financial advisors. Consider factors such as financial strength, customer service, and product offerings.

GameGuardian is a popular tool for modifying Subway Surfers, allowing players to boost their scores, unlock new characters, and even get unlimited coins. However, using such tools is against the game’s terms of service, so use them at your own risk.

If you’re interested in learning more about GameGuardian’s capabilities in Subway Surfers, check out this article: GameGuardian 2024 for Subway Surfers.

Need to contact Glovo customer support? They offer various ways to get in touch, including their website, app, and social media channels. You can also find their phone number and email address for more direct communication. For a complete list of Glovo customer support contact information, check out this article: Glovo app customer support contact information.