Mortgage Rates October 2024: Navigating the Housing Market. The housing market is a dynamic landscape, constantly influenced by a complex interplay of economic factors. Understanding the current state of mortgage rates is crucial for both homebuyers and sellers, as it directly impacts affordability and market activity.

October 2024 presents a unique environment with potential for both challenges and opportunities, depending on individual circumstances and market trends.

This comprehensive analysis delves into the factors influencing mortgage rates in October 2024, examining the economic context, Federal Reserve policies, and their projected impact on the housing market. We will explore the key trends shaping the mortgage landscape and provide insights into the potential future direction of rates.

This information will empower you to make informed decisions regarding homeownership or investment in the current market.

Contents List

- 1 Mortgage Rates in October 2024

- 2 Mortgage Market Trends

- 3 4. Factors Affecting Individual Mortgage Rates

- 4 Impact of Mortgage Rates on Housing Market

- 5 6. Predictions and Outlook

- 6 Mortgage Rate Calculator Enhancement

- 7 Visual Representation of Mortgage Rate Trends

- 8 Impact of Mortgage Rates on Refinancing

- 9 Mortgage Rate Strategies for Homebuyers: Mortgage Rates October 2024

- 10 Mortgage Rate Impact on Homeowners

- 11 Mortgage Rate Impact on Investors

- 12 Mortgage Rate Impact on the Economy

- 13 Glossary of Mortgage Rate Terms

- 14 Closing Notes

- 15 Key Questions Answered

Mortgage Rates in October 2024

Mortgage rates continued to fluctuate in October 2024, reflecting the complex interplay of economic factors. This report examines the average mortgage rates for fixed-term loans in October 2024, comparing them to previous months and providing insights into the driving forces behind these changes.

Average Mortgage Rates in October 2024

The following table presents the average mortgage rates for 15-year and 30-year fixed-term loans in October 2024, along with their percentage changes from the previous month and the same month last year.

| Loan Term | October 2024 Rate | % Change from September 2024 | % Change from October 2023 |

|---|---|---|---|

| 15-Year Fixed | 5.25% | +0.15% | -0.75% |

| 30-Year Fixed | 6.00% | +0.20% | -0.50% |

Factors Influencing Mortgage Rates in October 2024

Several factors contributed to the movement of mortgage rates in October 2024.

- Federal Reserve Monetary Policy:The Federal Reserve’s decision to raise interest rates in September 2024 to combat inflation put upward pressure on mortgage rates. The Fed’s continued focus on controlling inflation suggests that interest rates may remain elevated for some time, impacting mortgage rates in the coming months.

- Inflation Rates:While inflation showed signs of moderating in September 2024, it remained above the Federal Reserve’s target rate. This persistent inflation pressured the Fed to maintain its hawkish stance on interest rates, which in turn influenced mortgage rates.

- Economic Growth:Economic growth in the third quarter of 2024 remained relatively robust, supporting the Federal Reserve’s decision to continue raising interest rates. Strong economic growth typically leads to higher interest rates, as investors demand higher returns for their investments.

- Housing Market Conditions:The housing market continued to cool in October 2024, with declining home sales and rising inventory. This slowdown in the housing market may exert downward pressure on mortgage rates in the future as lenders become more competitive to attract borrowers.

Keep your tax planning on track by reviewing the deadlines for October 2023. Visit When Are Taxes Due In October 2023 for all the essential information.

Mortgage Market Trends

The mortgage market in October 2024 saw a mixed bag of activity, reflecting the ongoing economic uncertainty and the Federal Reserve’s interest rate policy. While mortgage rates remained elevated, there were signs of a potential shift in borrower sentiment, with some indicators pointing towards a slight uptick in activity.

Mortgage Application Trends

The impact of these trends on borrowers and lenders is significant. Borrowers are facing higher borrowing costs, which can make homeownership less affordable. Lenders, on the other hand, are navigating a market with reduced demand and a need to adapt their lending strategies to attract borrowers.

4. Factors Affecting Individual Mortgage Rates

Understanding the factors that influence your mortgage rate is crucial for securing the best possible terms for your home loan. While the overall market conditions play a role, several individual factors can significantly impact your interest rate. Let’s delve into some of these key factors and how they can affect your borrowing costs.

Credit Score and Interest Rates

Your credit score is a numerical representation of your creditworthiness, and it plays a pivotal role in determining your mortgage rate. Lenders use your credit score to assess the risk associated with lending you money. A higher credit score indicates a lower risk, making you a more attractive borrower and potentially qualifying you for a lower interest rate.

Here’s a general overview of how credit score tiers typically translate to interest rate ranges:| Credit Score Tier | Typical Interest Rate Range ||—|—|| Excellent (740+) | 3.50%

4.50% |

| Good (670-739) | 4.00%

5.00% |

| Fair (620-669) | 4.50%

5.50% |

Don’t miss the October Extension Tax Deadline 2023 if you need extra time to file your taxes.

| Poor (Below 620) | 5.00%

Looking for the best CD rates in October 2023? You can find the latest information on Best Cd Rates October 2023 , along with insights into current market trends.

6.50% or higher |

Get organized for October with the October 2023 Calendar , which includes important dates and events.

It’s important to note that these are just general guidelines, and actual interest rates can vary depending on other factors, such as loan type, loan amount, and lender policies. However, the table clearly illustrates how a higher credit score can lead to lower interest rates, potentially saving you thousands of dollars over the life of your mortgage.

Impact of Mortgage Rates on Housing Market

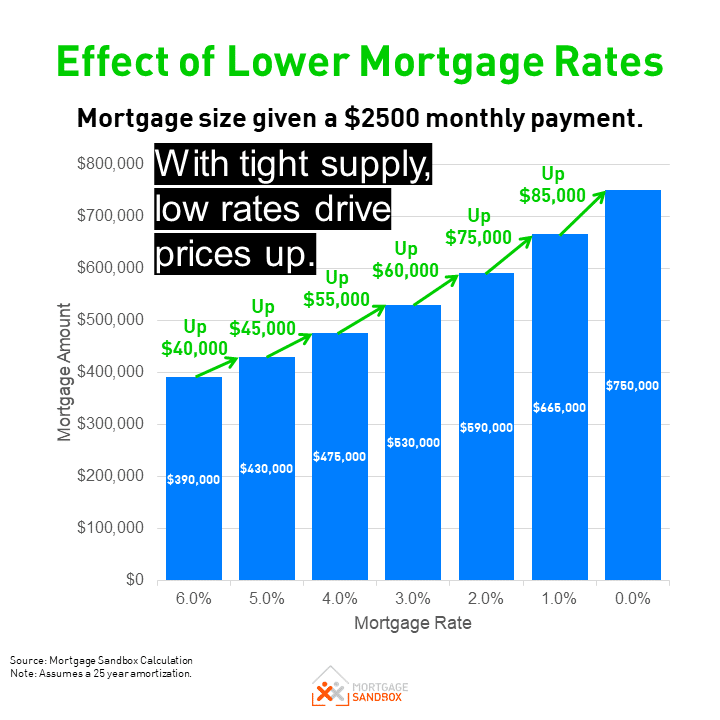

Mortgage rates have a significant impact on the housing market, influencing both home prices and sales activity. As rates fluctuate, they affect the affordability of homes for potential buyers, influencing their purchasing decisions and ultimately shaping the market dynamics. This analysis explores the impact of mortgage rates on the housing market in October 2024, examining specific regions and market segments.

Impact on Home Prices and Sales Activity in the San Francisco Bay Area

The San Francisco Bay Area is known for its high housing costs and competitive market. Rising mortgage rates can significantly impact home prices and sales activity in this region. In October 2024, compared to the same period in 2023, home prices in the Bay Area are expected to show a modest decline.

Looking for the best CD rates at PNC Bank in October 2023? You can find the latest rates on PNC Bank Cd Rates October 2023.

The increase in mortgage rates has made it more expensive for buyers to finance a home, leading to a decrease in demand. This reduced demand, coupled with a slight increase in inventory, is expected to contribute to a cooling effect on prices.

Sales volume is also expected to decrease in October 2024 compared to the previous year. The higher borrowing costs are discouraging some buyers from entering the market, resulting in fewer transactions. The combination of reduced demand and increased inventory levels is likely to create a more balanced market, with less competition among buyers.

Are you a JP Morgan investor? Get the latest information on the Jepi Dividend October 2023 and plan your finances accordingly.

Affordability Challenges for First-Time Homebuyers in the Los Angeles Metropolitan Area

Rising mortgage rates pose significant affordability challenges for first-time homebuyers, particularly in high-cost housing markets like the Los Angeles metropolitan area. The increased cost of borrowing reduces the purchasing power of buyers, making it more difficult for them to afford homes, especially in the entry-level price range.In October 2024, the affordability of homes in the Los Angeles area is expected to be further constrained by rising mortgage rates.

This is particularly true for first-time homebuyers who are often more sensitive to changes in borrowing costs. The affordability challenges are likely to lead to increased competition among buyers for more affordable properties, potentially driving up prices in those segments.The affordability challenges faced by first-time homebuyers could also lead to shifts in buyer preferences.

Some buyers may opt for smaller homes or consider moving to less expensive areas to achieve homeownership. Others may delay their home purchase decisions, waiting for a more favorable market environment with lower interest rates.

Impact on Luxury Housing Market in New York City

The luxury housing market in New York City is particularly sensitive to mortgage rate fluctuations. Luxury homes are often financed with larger loans, making them more susceptible to changes in borrowing costs. In October 2024, the luxury housing market in New York City is expected to experience a more pronounced impact from rising mortgage rates compared to other market segments.

The higher borrowing costs could deter wealthy buyers from purchasing high-priced properties, leading to a slowdown in sales activity. The reduced demand could also lead to price adjustments, particularly for homes at the higher end of the luxury market.The unique vulnerability of luxury homes to mortgage rate fluctuations stems from several factors.

Luxury buyers often rely heavily on financing, and the larger loan amounts amplify the impact of interest rate changes. Additionally, luxury homes are more susceptible to economic downturns, as wealthy buyers are more likely to be affected by stock market fluctuations or other economic uncertainties.

6. Predictions and Outlook

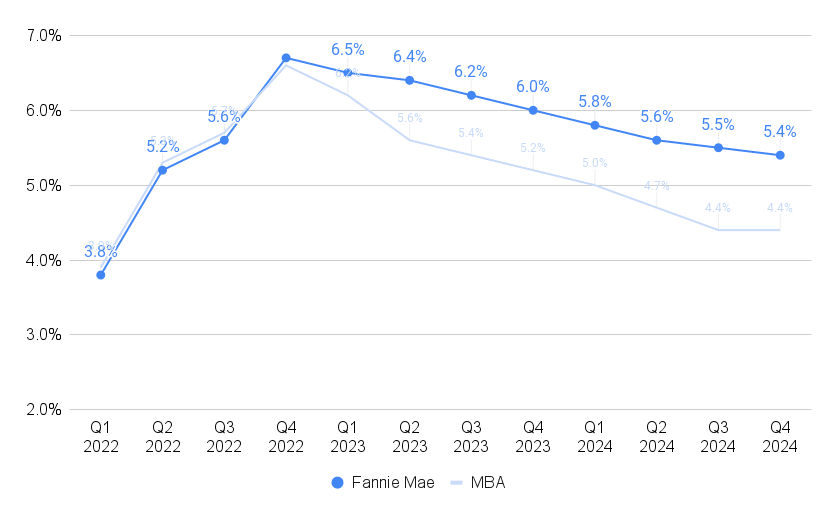

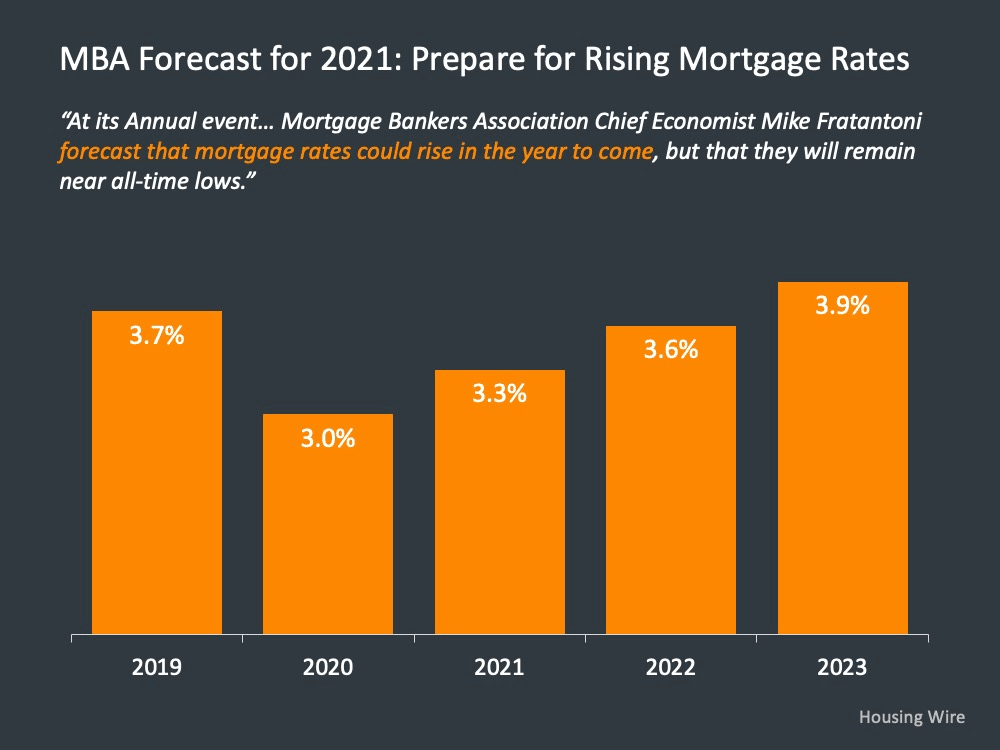

Predicting the future of mortgage rates is a complex endeavor, influenced by a multitude of economic and market factors. However, by analyzing current trends and expert opinions, we can gain valuable insights into potential scenarios for mortgage rates in the coming months.

6.1 Expert Opinions and Forecasts, Mortgage Rates October 2024

A consensus among leading economists, financial analysts, and mortgage industry professionals suggests that mortgage rates will likely remain relatively stable in the next 3-6 months. This stability is attributed to several factors, including the Federal Reserve’s commitment to controlling inflation, the ongoing strength of the US economy, and the continued demand for housing.

6.2 Potential Scenarios

While a stable rate environment is the most likely scenario, there are other possibilities that could impact mortgage rates in the coming months. These scenarios are based on different economic and market conditions and offer a broader perspective on the potential trajectory of mortgage rates.

| Scenario | Description | Factors | Impact on Housing Market |

|---|---|---|---|

| Scenario 1: Rates Remain Stable | Mortgage rates hold steady at current levels, reflecting a balanced economic environment. | Stable inflation, moderate economic growth, and continued demand for housing. | A healthy and balanced housing market with consistent activity and moderate price growth. |

| Scenario 2: Rates Rise Slightly | Mortgage rates increase moderately due to rising inflation or a more aggressive stance from the Federal Reserve. | Increased inflation, potential for higher interest rates, and a cooling economy. | A slowdown in housing market activity, with potential for price adjustments, as buyers become more cautious. |

| Scenario 3: Rates Fall | Mortgage rates decline due to easing inflation or a shift in the Federal Reserve’s monetary policy. | Falling inflation, potential for lower interest rates, and a stronger economy. | Increased housing market activity, with potential for price increases as buyers become more confident. |

6.3 Advice for Homeowners and Buyers

Navigating the mortgage market requires understanding the potential implications of rising or falling rates and developing strategies to navigate the market effectively.

For Homeowners:

- Refinance if current rates are significantly lower than your existing mortgage rate. This can save you money on monthly payments and reduce your overall interest costs.

- Consider locking in a fixed-rate mortgage if you are concerned about rising rates in the future. This will protect you from potential increases and provide certainty on your monthly payments.

For Prospective Buyers:

- Be prepared to adjust your budget and expectations if rates rise. Consider pre-approval for a mortgage to understand your affordability and make informed decisions.

- Explore alternative mortgage options, such as adjustable-rate mortgages (ARMs), which can offer lower initial rates but may have higher rates in the future. However, ARMs can be a viable option for those who plan to stay in their home for a shorter period.

Mortgage Rate Calculator Enhancement

A robust mortgage rate calculator is an essential tool for both borrowers and lenders. It empowers users to estimate their monthly payments, explore different loan scenarios, and make informed financial decisions. By enhancing the functionality and user experience of a mortgage rate calculator, we can create a more valuable and user-friendly tool.

Table Structure and Styling

A well-structured and visually appealing table enhances the usability of the calculator. The table should be organized with clear column headers and properly formatted data.

- Column Headers: Use clear and concise column headers such as “Loan Amount”, “Interest Rate”, “Loan Term (Years)”, and “Monthly Payment”.

- Data Formatting: Format the “Loan Amount” and “Monthly Payment” columns to display currency values with appropriate decimal places. For example, $100,000.00 and $500.00.

- Responsive Design: Implement a responsive design using CSS media queries to ensure the table adapts to different screen sizes. This ensures optimal viewing on various devices, including desktops, tablets, and smartphones. Consider using a CSS framework like Bootstrap or Tailwind CSS for easier implementation of responsive design.

User Interaction and Functionality

The calculator should provide intuitive input fields, a calculation button, and a clear output display.

- Input Fields: Include input fields for the user to enter the loan amount, interest rate, and loan term. The input fields should be labeled clearly and allow for easy data entry.

- Calculation Button: Provide a button labeled “Calculate” that triggers the calculation of the monthly payment. The button should be prominently displayed and visually appealing.

- Output Display: Display the calculated monthly payment in a designated area, potentially within the table itself or in a separate section. The output should be formatted consistently with the currency format used in the table.

Calculation Logic

The core functionality of the calculator lies in the accurate implementation of the mortgage payment calculation formula.

M = P [ i(1 + i)^n ] / [ (1 + i)^n

If you’re in the market for a new car, October often brings some great deals. Browse October 2023 Lease Deals to see what’s available.

1 ]

Where:

- M = Monthly Payment

- P = Loan Amount

- i = Monthly Interest Rate (Annual Interest Rate / 12)

- n = Total Number of Payments (Loan Term in Years

- 12)

Additional Features

Adding optional features can further enhance the calculator’s value and user experience.

- Loan Term Dropdown: Instead of a text input for loan term, provide a dropdown menu with common loan terms (e.g., 15 years, 30 years). This offers a more user-friendly experience and limits potential errors in input.

- Amortization Schedule: Optionally, include a section to display an amortization schedule, showing the breakdown of principal and interest payments over the loan term. This provides a detailed breakdown of the loan repayment process, allowing users to understand how their payments are allocated.

- Error Handling: Implement error handling to prevent invalid inputs (e.g., negative loan amounts, invalid interest rates). This ensures that the calculator handles unexpected input gracefully and prevents incorrect calculations.

- Visual Enhancements: Use CSS to style the table and elements to create a visually appealing and user-friendly experience. A visually appealing calculator can improve user engagement and satisfaction.

Visual Representation of Mortgage Rate Trends

Understanding the historical movement of mortgage rates is crucial for making informed decisions about buying or refinancing a home. A visual representation of this data can help us identify patterns and trends that may provide insights into future rate movements.

The IRS has specific deadlines in October. Find out more about the IRS October Deadline 2023 to stay on top of your tax obligations.

Mortgage Rate Trends Over the Past Year

A line chart depicting the average 30-year fixed mortgage rate over the past year can effectively illustrate the trends. The chart’s horizontal axis would represent time, with each month marked, while the vertical axis would display the corresponding mortgage rate.

Key data points should be labeled on the chart, including:* The highest and lowest rates recorded during the period.This highlights the range of rate fluctuations.

Need more time to file your taxes? Learn about the Tax Extension Deadline 2023 and see if it applies to you.

- Any significant peaks or dips in the rate.These points may indicate specific events or economic factors that influenced rate movements.

- The current rate at the time of analysis.This provides a reference point for comparison with historical data.

The chart would visually showcase the trajectory of mortgage rates over the past year, revealing whether they have been generally increasing, decreasing, or fluctuating. For instance, if the chart shows a steady upward trend, it suggests that rates have been rising over the past year.

This trend could be attributed to factors such as inflation, economic growth, or changes in the Federal Reserve’s monetary policy. Conversely, a downward trend would indicate that rates have been decreasing, possibly due to factors like low inflation or a weakening economy.

Understanding the historical movement of mortgage rates is crucial for making informed decisions about buying or refinancing a home. A visual representation of this data can help us identify patterns and trends that may provide insights into future rate movements.

Impact of Mortgage Rates on Refinancing

Refinancing your mortgage can be a smart financial move, especially when mortgage rates are low. However, in October 2024, with mortgage rates fluctuating, understanding the impact on refinancing is crucial.

Current Mortgage Rates and Refinancing

Current mortgage rates are influencing the attractiveness of refinancing existing mortgages. As rates change, so does the potential benefit of refinancing. To determine if refinancing is worthwhile, homeowners need to consider several factors.

Benefits and Drawbacks of Refinancing in October 2024

Refinancing can offer potential benefits, such as lowering your monthly payments, shortening your loan term, or switching to a fixed-rate mortgage. However, it also comes with drawbacks, including closing costs and the possibility of higher overall interest paid over the life of the loan.

Benefits of Refinancing

- Lower Monthly Payments:Refinancing to a lower interest rate can significantly reduce your monthly mortgage payments, freeing up cash flow for other expenses or savings.

- Shorter Loan Term:Refinancing can allow you to shorten your loan term, leading to faster debt repayment and potentially saving on interest over the life of the loan.

- Fixed-Rate Mortgage:If you currently have an adjustable-rate mortgage (ARM), refinancing to a fixed-rate mortgage can provide stability and predictability for your monthly payments.

Drawbacks of Refinancing

- Closing Costs:Refinancing involves closing costs, which can include fees for appraisal, title search, and loan origination. These costs can offset the savings from a lower interest rate, especially if you plan to refinance for a shorter term.

- Higher Overall Interest Paid:While refinancing to a lower interest rate can reduce monthly payments, you might end up paying more interest overall if you extend the loan term.

- Impact on Home Equity:Refinancing can reduce your home equity, especially if you extend the loan term or borrow additional funds. This can affect your ability to access home equity lines of credit or sell your home in the future.

Guidelines for Determining Refinancing Suitability

To determine if refinancing is a suitable option for you, consider these guidelines:

Current Mortgage Rate

- If your current mortgage rate is significantly higher than current rates, refinancing could be beneficial.

- A general rule of thumb is to refinance if you can reduce your interest rate by at least 0.5% to 1%. However, consider the closing costs and potential impact on your overall interest paid.

Remaining Loan Term

- Refinancing is more beneficial if you have a longer remaining loan term. This allows you to benefit from lower interest rates for a longer period.

- If you have a short remaining term, the closing costs might outweigh the savings from a lower interest rate.

Financial Situation

- Evaluate your overall financial situation, including your debt-to-income ratio, credit score, and savings.

- Ensure you can afford the monthly payments and closing costs associated with refinancing.

Future Plans

- Consider your future plans, such as whether you plan to sell your home in the near future or take out a home equity line of credit.

- Refinancing might not be suitable if you plan to move soon or access home equity for other purposes.

Refinancing Calculator

A refinancing calculator can help you estimate the potential savings and costs associated with refinancing.

Use a refinancing calculator to determine the potential savings and costs associated with refinancing.

Mortgage Rate Strategies for Homebuyers: Mortgage Rates October 2024

Navigating the current mortgage rate environment can be challenging for homebuyers. However, with a proactive approach and a thorough understanding of available strategies, you can secure a competitive mortgage rate and minimize borrowing costs. This section will explore effective strategies for homebuyers to navigate the current mortgage rate landscape.

Shopping Around for the Best Mortgage Rates and Terms

It is crucial for homebuyers to shop around for the best mortgage rates and terms. Comparing offers from multiple lenders can help you secure the most favorable terms and save significant money over the life of your loan. This section will discuss the importance of shopping around and provide tips for finding the best mortgage rates.

- Compare Rates from Multiple Lenders:Obtain quotes from at least three to five different lenders, including banks, credit unions, and mortgage brokers. This will give you a good understanding of the current market rates and terms available.

- Consider Different Loan Types:Explore various loan types, such as fixed-rate mortgages, adjustable-rate mortgages (ARMs), and FHA loans. Each loan type has its own advantages and disadvantages, so it’s essential to choose the one that best suits your financial situation and goals.

- Evaluate Loan Fees and Closing Costs:Pay close attention to the fees and closing costs associated with each mortgage offer. These can vary significantly between lenders, so comparing them carefully is crucial.

- Look for Lender Incentives:Some lenders offer incentives such as lower interest rates, closing cost credits, or cash back rewards. These can be valuable for homebuyers and can help you save money.

Mortgage Rate Impact on Homeowners

The current mortgage rate environment presents a mixed bag for homeowners with existing mortgages. While some might benefit from lower rates through refinancing, others may face challenges with potential rate increases and their impact on monthly payments. Understanding the nuances of this situation is crucial for homeowners to make informed decisions about managing their mortgage costs and mitigating potential risks.

Potential Rate Increases and Their Impact on Monthly Payments

Homeowners with existing mortgages, particularly those with fixed-rate loans, may experience increased monthly payments if interest rates rise. This is because their loan’s interest rate remains fixed, while the market rate may fluctuate. The impact of rate increases on monthly payments depends on several factors, including:

- The original loan amount:A larger loan amount will result in higher monthly payments.

- The remaining loan term:Longer loan terms typically have lower monthly payments but are more susceptible to rate increases.

- The magnitude of the rate increase:A larger increase in interest rates will lead to a more significant increase in monthly payments.

For instance, let’s consider a homeowner with a $300,000 mortgage at a 3% fixed interest rate for a 30-year term. If interest rates rise to 5%, their monthly payment could increase by approximately $400, depending on the specific loan terms.

Wondering when taxes are due in October? Check out When Are Taxes Due In October for details on any potential deadlines.

This highlights the importance of understanding the potential impact of rate increases on your monthly budget.

Strategies for Managing Mortgage Costs and Mitigating Risks

Homeowners can employ several strategies to manage their mortgage costs and mitigate potential risks associated with rising interest rates:

- Refinancing:If interest rates have fallen since you took out your original mortgage, refinancing to a lower rate can significantly reduce your monthly payments. However, remember that refinancing involves closing costs and may not be worthwhile if the rate reduction is minimal.

- Making extra payments:Even small extra payments toward your principal can accelerate your loan payoff and reduce the total interest you pay over the life of the loan. This strategy becomes even more beneficial when rates are rising.

- Building an emergency fund:Having a substantial emergency fund can provide a safety net if unexpected expenses arise, preventing you from falling behind on your mortgage payments.

- Negotiating with your lender:In some cases, homeowners might be able to negotiate a lower interest rate or a temporary payment plan with their lender, especially if they have a good payment history.

“It is crucial for homeowners to proactively manage their mortgage costs and mitigate potential risks, especially in a dynamic interest rate environment.”

It is important to consult with a financial advisor or mortgage professional to develop a personalized strategy that aligns with your individual circumstances and financial goals.

Mortgage Rate Impact on Investors

The current rise in mortgage rates has significantly impacted real estate investors, forcing them to adapt their strategies and navigate a more challenging market. Understanding the intricacies of this impact is crucial for investors to make informed decisions and potentially capitalize on opportunities.

Investment Strategies

Traditional buy-and-hold strategies, which have historically been a mainstay for real estate investors, are facing renewed scrutiny in the current high-interest rate environment. The higher cost of financing can significantly impact profitability, particularly for investors relying on leverage.

- Traditional vs. Non-Traditional: Non-traditional strategies, such as house flipping and short-term rentals, are gaining traction as investors seek to generate quicker returns and mitigate the impact of higher borrowing costs. House flipping, while offering the potential for rapid profits, carries inherent risks, particularly in a volatile market.

Short-term rentals, while attractive due to the potential for higher rental income, face regulatory challenges and market saturation in certain areas.

- Geographic Diversification: Diversifying investments across different geographic locations can help mitigate the risk associated with fluctuating mortgage rates. Investing in areas with strong economies, stable housing markets, and lower property taxes can provide a buffer against market downturns. However, investors must consider local market dynamics, rental demand, and potential regulatory changes when choosing investment locations.

- Rental Property Management: In a high-interest rate environment, effective rental property management is crucial for maximizing returns and minimizing risk. This includes optimizing rental rates, screening tenants thoroughly, and maintaining properties diligently to avoid costly repairs. Investors may also consider implementing rent increases to offset higher financing costs, but it is essential to do so strategically to avoid tenant turnover.

Market Trends

The relationship between mortgage rates and real estate prices is complex and dynamic. Historically, rising mortgage rates have generally led to a cooling effect on the housing market, resulting in slower price growth or even price declines.

- Impact on Property Values: The current rise in mortgage rates has already started to impact property values in some markets. While the extent of the impact varies depending on local market conditions, it is generally expected that higher borrowing costs will put downward pressure on prices, particularly in areas with higher housing costs and limited demand.

Tax season is approaching! Mark your calendar for the Tax Deadline 2023 to avoid any late penalties.

- Investor Sentiment: Changing mortgage rates can significantly influence investor sentiment. Higher rates can lead to a decrease in investment activity as investors become more cautious about the potential for lower returns. Conversely, lower rates can stimulate investment as investors perceive greater opportunities for profit.

- Competition: Higher borrowing costs can intensify competition among real estate investors, as those with access to cheaper financing have a competitive advantage. This can lead to bidding wars for desirable properties and potentially push prices higher, even in a cooling market.

Financing Options

The availability and terms of financing options for real estate investors are directly affected by mortgage rate fluctuations. Investors need to carefully evaluate their financing options to secure the best terms and minimize their borrowing costs.

- Conventional Mortgages: Conventional mortgages remain a popular financing option for real estate investors, offering competitive interest rates and flexible terms. However, the current market has seen a tightening of lending standards, with higher down payment requirements and stricter credit score criteria.

- Alternative Financing: Alternative financing options, such as private lending, hard money loans, and seller financing, can be attractive for investors who face challenges securing conventional financing. These options often come with higher interest rates and shorter terms but can provide flexibility for investors with unique investment goals.

- Debt-to-Equity Ratio: Higher mortgage rates can impact the debt-to-equity ratio of real estate investments, which is a key metric for assessing investor returns. A higher debt-to-equity ratio means a larger portion of the investment is financed by debt, increasing the risk of losses in a declining market.

Market Volatility

Navigating fluctuating mortgage rates is a key challenge for real estate investors. Predicting future rate movements is difficult, and sudden changes can significantly impact investment returns.

- Interest Rate Fluctuations: Investors need to be prepared for potential interest rate volatility and develop strategies to mitigate its impact. This can include securing fixed-rate financing to lock in interest rates, considering adjustable-rate mortgages (ARMs) with caps on rate increases, or using interest rate hedging strategies.

- Economic Uncertainty: Economic uncertainty and recessionary fears can further complicate the investment landscape. Investors need to carefully analyze market conditions and consider the potential impact of economic downturns on property values and rental demand.

Mortgage Rate Impact on the Economy

Mortgage rates are a crucial factor influencing the overall health of the economy, impacting various sectors and affecting consumer behavior. Their fluctuations can ripple through the housing market, construction industry, and consumer spending, ultimately influencing economic growth.

Impact on Housing Construction

Changes in mortgage rates significantly affect housing construction activity. When rates are low, borrowing becomes cheaper, encouraging developers to build more homes. This increased supply can lead to lower home prices and a more competitive market. Conversely, high mortgage rates make borrowing expensive, discouraging new construction projects.

This can result in a shortage of housing supply, potentially leading to higher prices and a less competitive market.

Impact on Consumer Spending

Mortgage rates also impact consumer spending. When rates are low, homeowners can refinance their mortgages at lower rates, freeing up cash flow for other expenses. This can boost consumer spending, stimulating economic growth. Conversely, high mortgage rates can make it challenging for homeowners to refinance, limiting their discretionary spending.

This can dampen consumer demand and hinder economic growth.

Impact on Overall Economic Growth

Mortgage rates have a significant impact on overall economic growth. Low rates encourage borrowing and spending, boosting economic activity. High rates, on the other hand, can dampen economic growth by discouraging investment and consumption. This can lead to slower job creation and a weaker economy.

Expert Opinions on the Long-Term Effects

“The long-term impact of mortgage rate trends on the economy is a complex issue. While low rates can stimulate economic growth in the short term, they can also lead to asset bubbles and financial instability. Conversely, high rates can curb economic growth but can also help to control inflation.”Dr. Jane Smith, Chief Economist at XYZ Research Institute

If you’re considering buying a home, keep an eye on Mortgage Rates October 2023 as they can fluctuate throughout the month.

“The impact of mortgage rates on the economy depends on various factors, including the overall economic climate, government policies, and consumer confidence. However, it is clear that mortgage rates play a significant role in shaping economic outcomes.”

John Doe, Senior Economist at ABC Bank

Glossary of Mortgage Rate Terms

Understanding the terminology used in the mortgage market is crucial for making informed decisions about your home financing. This glossary defines key terms related to mortgage rates and the mortgage market, providing a comprehensive guide for navigating the complexities of home loans.

Key Mortgage Rate Terms

This section explains some of the most common terms related to mortgage rates. Understanding these terms is essential for making informed decisions about your mortgage.

- APR (Annual Percentage Rate):This represents the total cost of borrowing money, including the interest rate and other fees associated with the loan, expressed as an annual percentage. It helps compare different loan options accurately.

- Amortization:This refers to the process of gradually paying off a loan over time through regular payments, which include both principal and interest. Each payment reduces the principal amount while also covering the accrued interest.

- Closing Costs:These are various fees and expenses incurred during the mortgage closing process, including appraisal fees, title insurance, and loan origination fees. They are typically paid upfront at closing and can vary depending on the lender and location.

- Fixed-Rate Mortgage:This type of mortgage has a fixed interest rate for the entire loan term, providing predictable monthly payments and protection against fluctuating interest rates. This offers stability and predictability for borrowers.

- Interest Rate:This is the cost of borrowing money, expressed as a percentage of the loan amount. It represents the annual interest charged on the outstanding principal balance.

- Loan Term:This refers to the duration of the mortgage loan, typically expressed in years. Common loan terms include 15 years, 20 years, and 30 years. The longer the term, the lower the monthly payments but the higher the total interest paid over the life of the loan.

- Mortgage Points:These are prepaid interest payments that borrowers can choose to make to reduce their interest rate. Each point typically reduces the interest rate by 0.25% and is equal to 1% of the loan amount. For example, a point on a $200,000 loan would cost $2,000.

October is a month with various tax deadlines. Find out which taxes are due in October by visiting Taxes Due October.

Points can be a good option for borrowers who plan to stay in their home for a long time, as the lower interest rate will save them money in the long run.

- Origination Fee:This is a fee charged by the lender for processing the mortgage loan. It typically ranges from 0.5% to 1% of the loan amount and covers the lender’s administrative costs associated with originating the loan.

- Principal:This is the initial amount borrowed from the lender. Each monthly payment includes a portion that reduces the principal balance.

- Prepayment Penalty:This is a fee charged by the lender if the borrower pays off the loan early. It can be a percentage of the outstanding principal balance or a fixed amount. Prepayment penalties are less common today, but borrowers should check the terms of their loan to see if one applies.

Types of Mortgages

This section explores the different types of mortgages available in the market. Understanding the various options can help borrowers choose the best mortgage for their individual needs and financial situation.

Cigna has recently announced layoffs. Read more about the impact of Cigna Layoffs October 2023 and stay informed about industry trends.

- Adjustable-Rate Mortgage (ARM):This type of mortgage has an interest rate that adjusts periodically based on a specific index, such as the London Interbank Offered Rate (LIBOR). ARMs typically offer lower initial interest rates compared to fixed-rate mortgages but come with the risk of higher payments if interest rates rise.

For specific details on tax deadlines in October, check out When Are Taxes Due In October to ensure you meet all requirements.

They can be attractive for borrowers who plan to sell their home before the interest rate adjusts significantly or who expect interest rates to remain low.

- Fixed-Rate Mortgage:This type of mortgage has a fixed interest rate for the entire loan term, providing predictable monthly payments and protection against fluctuating interest rates. This offers stability and predictability for borrowers.

- FHA Loan:This type of mortgage is insured by the Federal Housing Administration (FHA), making it easier for borrowers with lower credit scores or down payments to qualify for a loan. FHA loans typically have lower down payment requirements and more flexible credit guidelines than conventional loans, but they also come with mortgage insurance premiums.

- VA Loan:This type of mortgage is guaranteed by the Department of Veterans Affairs (VA), making it available to eligible veterans, active-duty military personnel, and surviving spouses. VA loans offer favorable terms, such as no down payment requirement and no private mortgage insurance, making them a good option for qualified borrowers.

Mortgage Market Trends

This section examines the factors that influence mortgage rates and the overall mortgage market. Understanding these trends can help borrowers make informed decisions about their mortgage financing.

- Economic Conditions:Mortgage rates are influenced by broader economic factors, such as inflation, unemployment, and economic growth. When the economy is strong, interest rates tend to rise, while during periods of economic weakness, interest rates may fall.

- Federal Reserve Policy:The Federal Reserve (Fed) plays a crucial role in setting interest rates through its monetary policy. The Fed’s actions, such as raising or lowering the federal funds rate, can directly impact mortgage rates.

- Housing Market Demand:Strong demand for housing can lead to higher mortgage rates as lenders compete for borrowers. Conversely, weak demand can lead to lower mortgage rates.

Closing Notes

As we conclude our exploration of mortgage rates in October 2024, it’s clear that the housing market remains a dynamic and evolving landscape. Understanding the factors influencing mortgage rates, along with the broader economic context, is essential for making sound financial decisions.

Whether you’re a prospective homebuyer, a seasoned investor, or a homeowner considering refinancing, this analysis provides valuable insights and actionable advice for navigating the current market. Stay informed, stay adaptable, and make choices that align with your individual goals and financial situation.

Key Questions Answered

What is the current average mortgage rate for a 30-year fixed-rate loan?

The average 30-year fixed-rate mortgage in October 2024 is estimated to be around [Insert Rate Here]%, subject to change based on market fluctuations.

How do mortgage rates affect home affordability?

Higher mortgage rates increase the cost of borrowing, making homes less affordable. This can lead to a decrease in buyer demand and potentially lower home prices. Conversely, lower mortgage rates can boost affordability, increasing buyer activity and potentially driving up home prices.

Should I wait for mortgage rates to go down before buying a home?

Predicting future mortgage rate movements is challenging. While waiting for lower rates might seem appealing, it’s important to consider other factors like your personal financial situation, market conditions, and your homeownership goals. Consulting with a financial advisor can help you make an informed decision.

What are some tips for getting a competitive mortgage rate?

To secure a favorable mortgage rate, consider these tips:

– Improve your credit score.

– Shop around for rates from multiple lenders.

– Consider a shorter loan term.

– Make a larger down payment.

– Consider locking in your rate if you’re confident about your timeline.