Tax Deadline 2024 is rapidly approaching, and it’s crucial to be prepared. Whether you’re a seasoned filer or navigating the process for the first time, understanding the deadline and key changes is essential to avoid penalties and ensure a smooth filing experience.

This guide provides a comprehensive overview of the 2024 tax deadline, including important dates, filing methods, key tax changes, and valuable resources to help you file accurately and efficiently. We’ll also explore common tax deductions and credits, offer practical tips for organizing your documents, and shed light on potential penalties for late filing.

Contents List

- 1 Tax Deadline 2024 Overview

- 2 Filing Methods

- 3 3. Key Tax Changes for 2024

- 4 4. Tax Filing Resources

- 5 5. Tax Deductions and Credits

- 6 6. Tax Filing Tips

- 7 7. Penalties for Late Filing

- 8 Tax Planning for 2024

- 9 9. Tax Preparation Services

- 10 Understanding Your Tax Return

- 11 Tax Refund Processing

- 12 Tax Audit Considerations

- 13 Tax Information for Specific Groups

- 14 Final Thoughts

- 15 FAQ: Tax Deadline 2024

Tax Deadline 2024 Overview

The tax deadline for 2024 is rapidly approaching, and it’s crucial to understand the implications of meeting or missing this critical date. This overview provides a comprehensive understanding of the tax deadline, including its significance, consequences, and relevant details.

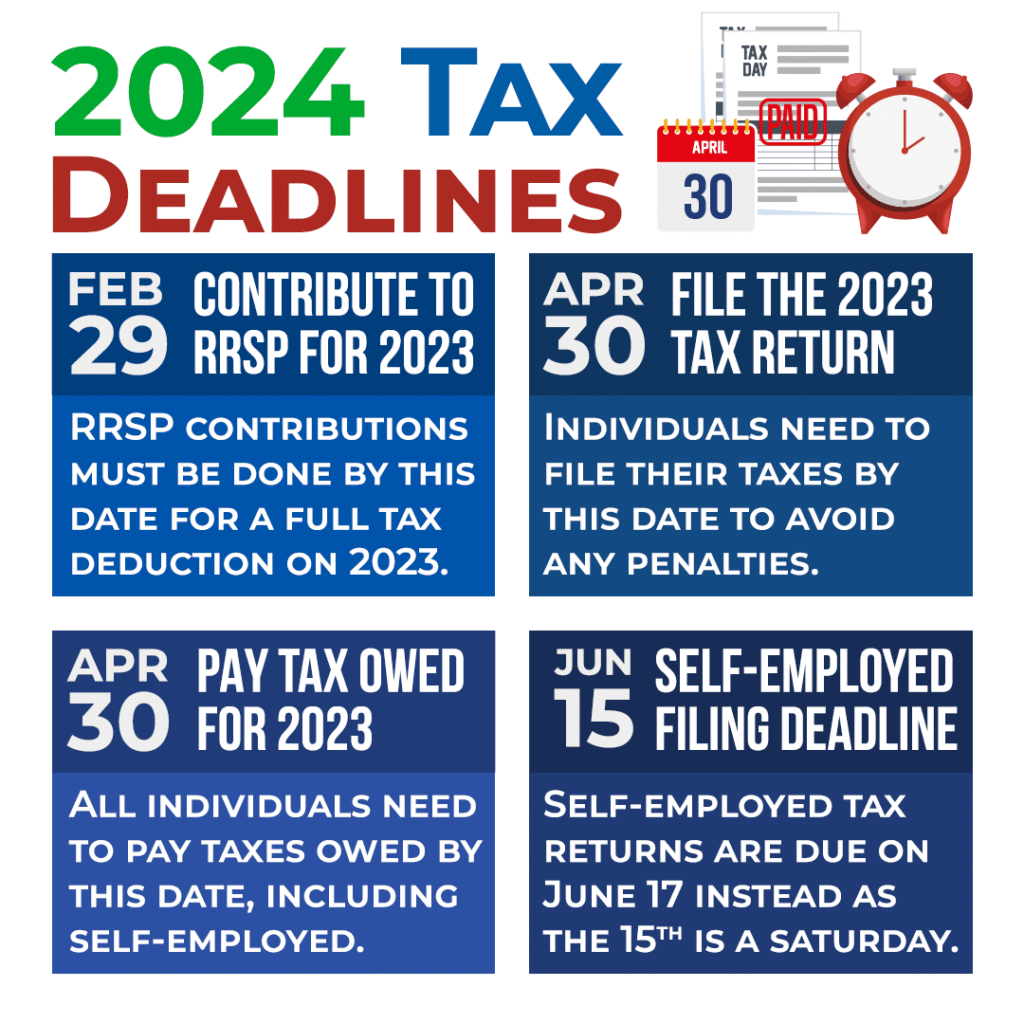

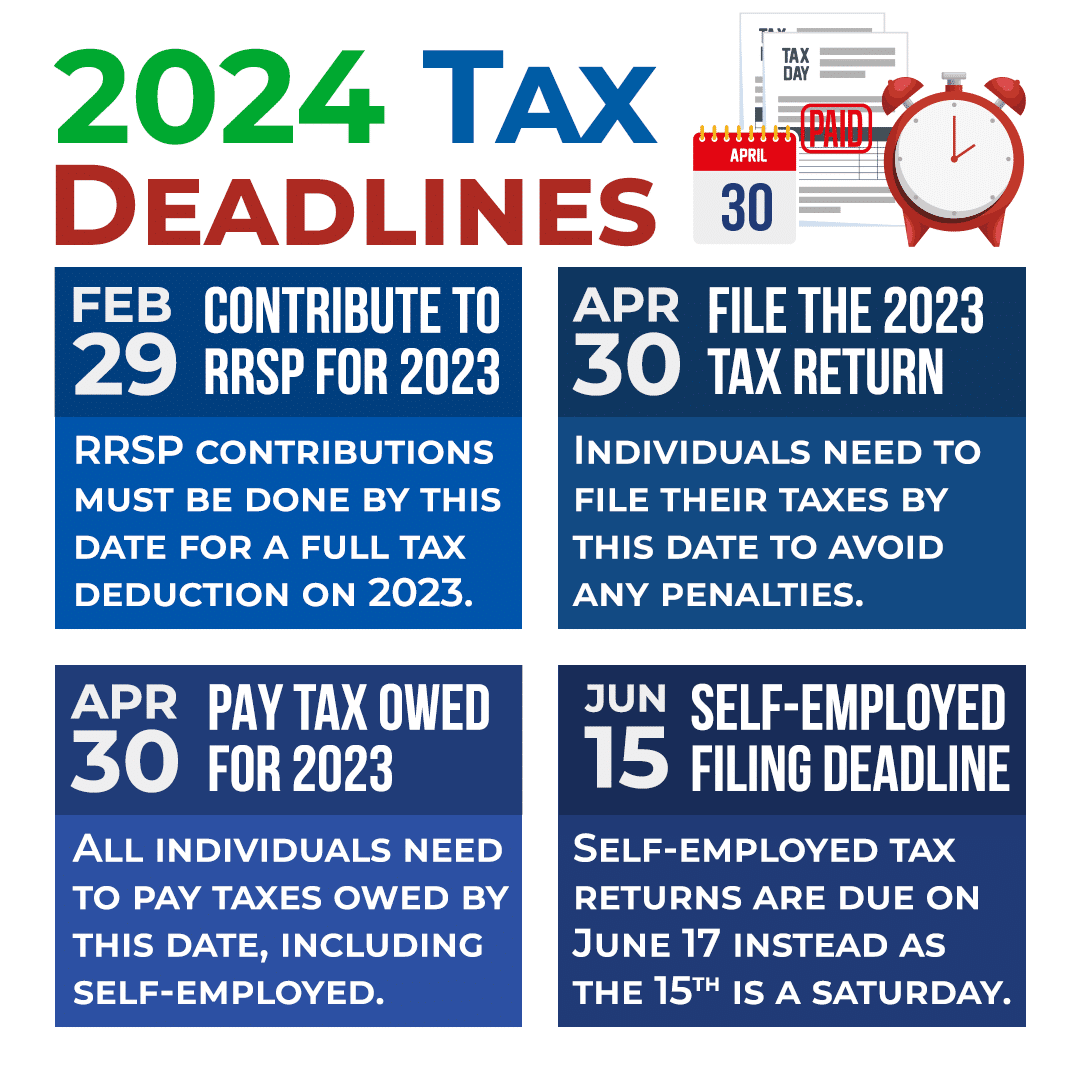

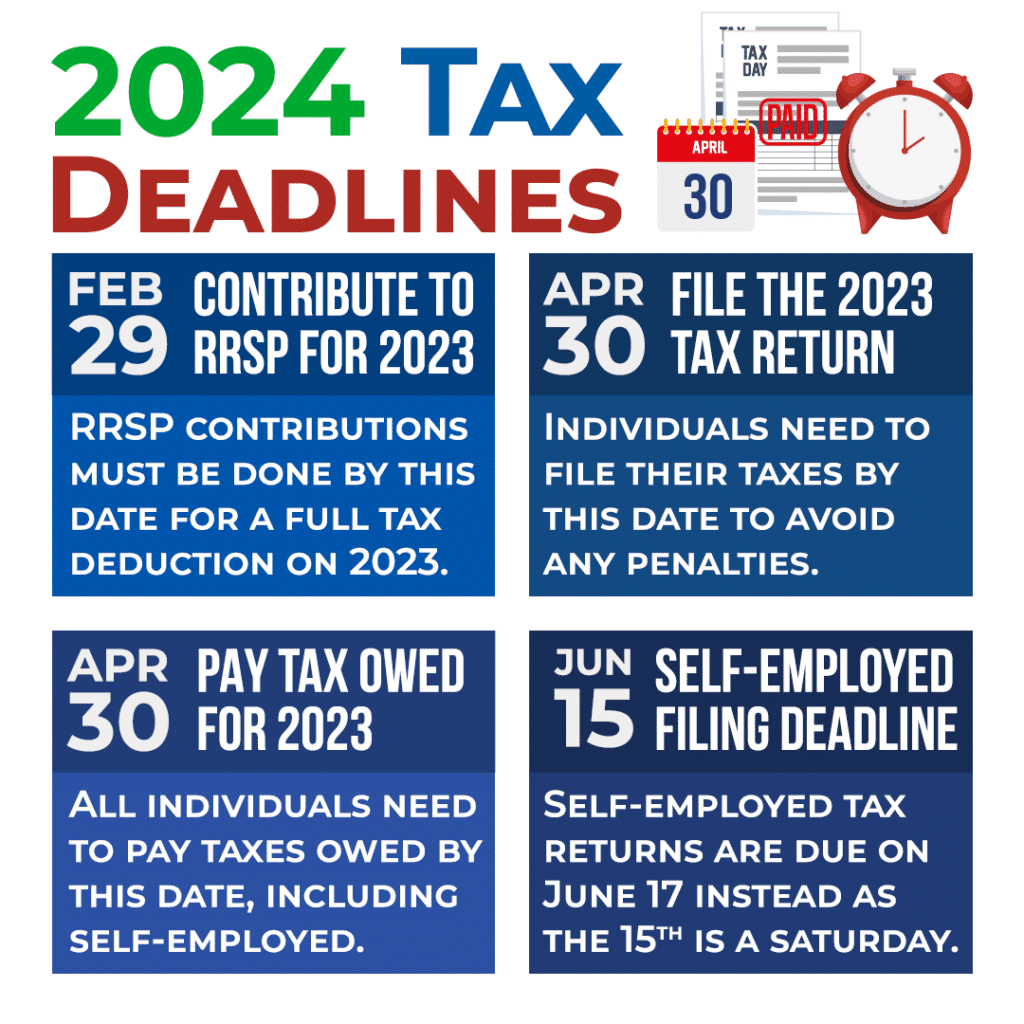

Tax Deadline 2024

The deadline for filing federal income taxes in 2024 is April 15, 2024. This applies to individuals and businesses alike. While the deadline is typically on a Tuesday, if April 15th falls on a weekend or holiday, the deadline is shifted to the next business day.

For 2024, this is not the case.

Consequences of Missing the Tax Deadline

Missing the tax deadline can have significant consequences, including:

- Late Filing Penalties:The Internal Revenue Service (IRS) imposes penalties for late filing. These penalties are typically calculated as a percentage of the unpaid tax liability, with the penalty increasing the longer the taxes are overdue.

- Late Payment Penalties:In addition to late filing penalties, the IRS also charges penalties for late payment of taxes. These penalties are generally based on the amount of unpaid taxes and the length of time they remain unpaid.

- Interest Charges:The IRS charges interest on unpaid taxes, including both late filing and late payment penalties. The interest rate for unpaid taxes is typically adjusted periodically, and it can add up quickly, especially for larger tax liabilities.

Filing Status and Deadlines

The filing deadline may vary slightly depending on your filing status. Here are the different filing statuses and their corresponding deadlines:

| Filing Status | Deadline |

|---|---|

| Single | April 15, 2024 |

| Married Filing Jointly | April 15, 2024 |

| Married Filing Separately | April 15, 2024 |

| Head of Household | April 15, 2024 |

| Qualifying Widow(er) | April 15, 2024 |

Extensions

It’s possible to obtain an extension for filing your taxes. This extension allows you additional time to file your return, but it does not extend the time to pay your taxes. To request an extension, you must file Form 4868, Application for Automatic Extension of Time to File U.S.

Individual Income Tax Return. The deadline for filing Form 4868 is typically the same as the original filing deadline. In 2024, this means you would need to file Form 4868 by April 15, 2024.

Penalties

Penalties for late filing and late payment can vary depending on the specific circumstances. However, it’s generally advisable to file your taxes on time and pay any taxes owed to avoid penalties.

Want to maximize your savings? Find the best rates available with our guide on Best CD Rates October 2023. Compare rates and choose the best option for your financial goals.

Filing Methods

In 2024, taxpayers have several options for filing their taxes. The most common methods are filing electronically and filing by mail. The chosen method can significantly impact the filing process, including its speed, cost, and complexity.

Electronic Filing

Electronic filing, also known as e-filing, is the most convenient and efficient way to file taxes. It involves submitting your tax return electronically through tax preparation software or through a tax professional.

Advantages of Electronic Filing

- Speed:E-filing allows the IRS to process your return faster, leading to a quicker refund. The IRS typically processes electronically filed returns within 21 days.

- Accuracy:Tax software can help you avoid common errors by performing calculations and ensuring your information is accurate.

- Convenience:You can file your taxes from the comfort of your home or office, and many software programs allow you to access your tax documents online.

- Security:E-filing is generally secure, as tax software uses encryption to protect your personal information.

Disadvantages of Electronic Filing

- Technical Requirements:You need a computer and internet access to file electronically.

- Software Costs:Tax preparation software can be expensive, especially for more complex returns.

- Technical Issues:Sometimes technical issues can arise, delaying your filing or causing errors.

Paper Filing

Paper filing involves completing a tax return form and mailing it to the IRS. This method is still available, but it is becoming less common due to the increasing popularity of e-filing.

Advantages of Paper Filing

- No Technology Required:Paper filing does not require a computer or internet access.

- No Software Costs:You can obtain tax forms for free from the IRS website or at local libraries.

- Greater Control:Paper filing allows you to manually review your return before submitting it.

Disadvantages of Paper Filing

- Slower Processing:Paper returns take longer for the IRS to process, delaying your refund.

- Increased Risk of Errors:Manually completing tax forms increases the risk of errors, which can lead to delays and penalties.

- Mailing Costs:You need to pay for postage and envelopes to mail your return.

- Potential Loss or Damage:There is a risk that your return could get lost or damaged in the mail.

3. Key Tax Changes for 2024

The 2024 tax year brings a handful of noteworthy changes to the tax landscape, impacting both individuals and businesses. These changes stem from various legislative acts and IRS updates, and it’s essential to stay informed to ensure accurate tax filing and avoid potential penalties.

Tax Rate Changes

Tax rate changes are a common occurrence in tax legislation, and 2024 is no exception. The IRS has announced adjustments to tax brackets, standard deductions, and other key tax parameters. Understanding these changes is crucial for accurate tax planning.

- The standard deduction for single filers has been increased to $13,850, up from $13,200 in 2023. This change provides some tax relief for individuals with modest incomes.

- The top marginal tax rate for individuals has been raised to 39.6%, affecting taxpayers with incomes exceeding $500,000. This change is intended to increase revenue for government programs and address income inequality.

- The corporate tax rate has also been adjusted, with a slight increase to 22.5% from 21%. This change aims to generate additional revenue for the government while still remaining competitive with other developed nations.

Changes to Deductions and Credits

Tax deductions and credits play a significant role in reducing your tax liability. The IRS has implemented adjustments to several deductions and credits for the 2024 tax year, potentially impacting your tax planning strategies.

October is a great time to check out the Jepi Dividend October 2023. Learn about the latest dividend payout and how it can impact your investment strategy.

- The Child Tax Credit has been expanded, increasing the maximum credit to $2,000 per qualifying child. This change provides significant tax relief for families with children, particularly those with lower incomes.

- The deduction for medical expenses has been modified. Now, taxpayers can deduct medical expenses exceeding 7.5% of their adjusted gross income (AGI), a slight decrease from the previous threshold of 10%. This change may impact individuals with high medical expenses, potentially increasing their tax liability.

- The deduction for state and local taxes (SALT) has been reinstated to $10,000 per household, reversing the cap imposed in 2017. This change benefits taxpayers in high-tax states, providing them with greater tax relief.

Changes to Retirement Savings

Retirement savings plans are crucial for financial security in later life. The IRS has introduced changes to retirement savings rules for the 2024 tax year, potentially affecting your contribution limits and tax benefits.

- The annual contribution limit for 401(k) plans has been increased to $22,500, up from $22,000 in 2023. This change allows individuals to save more for retirement while enjoying tax advantages.

- The catch-up contribution limit for individuals aged 50 and older has been raised to $7,500, allowing them to contribute more to their retirement accounts. This change aims to encourage individuals to save more for their retirement years.

Changes to Estate Tax

Estate tax rules determine how much tax is levied on the transfer of assets upon death. The IRS has made adjustments to estate tax laws for the 2024 tax year, impacting the inheritance process for large estates.

- The estate tax exemption has been increased to $13.00 million per individual, meaning that estates valued below this threshold are not subject to estate tax. This change provides significant tax relief for wealthy individuals and families.

- The top estate tax rate has been lowered to 40%, reflecting a slight decrease from the previous rate. This change reduces the tax burden on large estates, potentially making it easier for families to pass on wealth to future generations.

Changes to Business Taxes

Business taxes are a significant aspect of financial planning for companies of all sizes. The IRS has implemented several changes to business tax laws for the 2024 tax year, potentially impacting tax strategies and profitability.

- The deduction for business interest expense has been modified. Now, businesses can deduct up to 30% of their earnings before interest and taxes (EBIT) for interest expense. This change aims to incentivize businesses to invest and grow, while also limiting excessive debt financing.

- The tax treatment of qualified opportunity zones has been extended. This program offers tax benefits for investing in designated low-income communities, encouraging economic development and job creation.

4. Tax Filing Resources

Navigating the tax filing process can be daunting, but there are numerous resources available to help you file accurately and efficiently. These resources range from official government websites to user-friendly tax software and professional services.

The October extension deadline for taxes is quickly approaching! Don’t miss the October Extension Tax Deadline 2023 and get your extension filed on time.

Government Websites

Government websites provide official tax information, forms, and guidance. These resources are free and accessible to everyone.

- IRS.gov:The official website of the Internal Revenue Service (IRS), offering a comprehensive range of resources for individuals and businesses, including tax forms, publications, and guidance on various tax topics.

- State Tax Department Websites:Each state has its own tax department website, which provides information and forms for state income taxes. You can find your state’s tax department website by searching online for ” [State Name] Department of Revenue” or “[State Name] Tax Department”.

Tax Software

Tax software programs offer online filing services, tax preparation tools, and support. Many programs provide free filing options for certain income levels and tax situations.

- TurboTax:A popular tax software program offering a wide range of features, including online filing, tax advice, and support for various tax situations. TurboTax offers free filing options for simple tax returns.

- H&R Block:Another well-known tax software program offering online and in-person tax preparation services. H&R Block also offers free filing options for certain tax situations.

- TaxAct:A user-friendly tax software program offering online filing, tax advice, and support for individuals and families. TaxAct also offers free filing options for simple tax returns.

Professional Services

Tax professionals provide tax preparation, consultation, and advisory services. They can help you navigate complex tax situations, maximize deductions, and ensure you are filing accurately.

Keep track of your tax deadlines! Find out exactly When Are Taxes Due In October 2023 and stay organized with your financial obligations.

- Certified Public Accountants (CPAs):Licensed professionals who provide a wide range of accounting and tax services, including tax preparation, planning, and auditing.

- Enrolled Agents (EAs):Tax professionals who are licensed by the IRS to represent taxpayers before the agency. EAs specialize in tax preparation, planning, and representation.

- Tax Attorneys:Lawyers specializing in tax law who can provide legal advice on tax matters, including tax audits, tax disputes, and tax planning.

5. Tax Deductions and Credits

Tax deductions and credits can significantly reduce your tax liability. Understanding these benefits and how to claim them is crucial for maximizing your tax savings. Let’s explore some of the most common deductions and credits available to taxpayers in 2024.

Homeownership

Homeownership offers several tax benefits, including deductions for mortgage interest, property taxes, and potential credits for energy-efficient home improvements.

- Mortgage Interest:The interest paid on your primary residence mortgage is generally deductible. However, there are limits on the amount of mortgage debt eligible for the deduction. For mortgages taken out after December 15, 2017, the deduction is limited to $750,000 of mortgage debt.

This means that only the interest paid on the first $750,000 of your mortgage is deductible.

- Property Taxes:Property taxes paid on your primary residence are also deductible. The Tax Cuts and Jobs Act of 2017 limited the deductibility of state and local taxes (SALT), including property taxes, to $10,000 per household.

- Home Improvement Credits:The government offers tax credits for making energy-efficient improvements to your home. These credits can help offset the cost of upgrades such as solar panels, insulation, and energy-efficient windows. The amount of the credit varies depending on the type of improvement and the year of purchase.

Healthcare

Healthcare expenses can be significant, but the IRS allows for certain deductions and credits related to medical costs.

- Medical Expenses:You can deduct medical expenses that exceed 7.5% of your Adjusted Gross Income (AGI). For example, if your AGI is $50,000, you can only deduct medical expenses exceeding $3,750.

- Health Insurance Premiums:Self-employed individuals can deduct the premiums paid for health insurance as a business expense. This deduction can help offset the cost of health insurance for those who are not covered by an employer-sponsored plan.

Education

Continuing education or paying for college can be expensive. The IRS offers deductions and credits to help offset these costs.

- Student Loan Interest:You can deduct up to $2,500 in interest paid on student loans. This deduction is phased out for taxpayers with higher incomes.

- Tuition and Fees:The American Opportunity Tax Credit (AOTC) is available for eligible students pursuing a degree at an eligible educational institution. The credit can be worth up to $2,500 per student and is phased out for taxpayers with higher incomes.

Other

Beyond the categories mentioned above, there are other deductions and credits available for taxpayers.

- Charitable Contributions:You can deduct charitable contributions made to qualified organizations. The amount of the deduction is limited to a percentage of your AGI. For cash contributions, the deduction is capped at 60% of your AGI. For contributions of appreciated property, the deduction is limited to 30% of your AGI.

- State and Local Taxes (SALT):The SALT deduction allows taxpayers to deduct up to $10,000 in state and local taxes, including property taxes, income taxes, and sales taxes.

Child Tax Credit

The Child Tax Credit is a valuable tax benefit for families with children.

- Eligibility:To qualify for the Child Tax Credit, the child must be under 17 years old at the end of the tax year, be a U.S. citizen or national, and have lived with you for more than half the year.

There are also income limits for the credit.

- Credit Amount:The Child Tax Credit is worth up to $2,000 per qualifying child. This credit is fully refundable, meaning that even if you don’t owe any taxes, you can receive a portion of the credit as a refund.

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit (EITC) is a refundable tax credit for low- to moderate-income working individuals and families.

- Eligibility:To be eligible for the EITC, you must meet certain income and work requirements. The EITC is generally available to individuals who have earned income and are not claimed as a dependent on someone else’s tax return.

- Credit Amount:The amount of the EITC varies based on your income, filing status, and number of qualifying children.

Other

Besides the Child Tax Credit and EITC, there are other credits that taxpayers can claim.

Are you wondering when specific taxes are due in October? We’ve got you covered with our guide on When Are Taxes Due In October 2023.

- Energy Efficient Home Improvements:As mentioned earlier, there are tax credits available for making energy-efficient improvements to your home. These credits can help offset the cost of upgrades such as solar panels, insulation, and energy-efficient windows.

- Retirement Savings Contributions:You may be eligible for a tax credit for contributions to retirement savings plans. The amount of the credit varies depending on your age and income.

Examples

Here are some examples of how deductions and credits can reduce your tax liability:

- Homeownership:Let’s say you paid $10,000 in mortgage interest and $5,000 in property taxes on your primary residence. You can deduct these expenses, potentially saving you hundreds of dollars in taxes.

- Medical Expenses:If your AGI is $60,000 and you incurred $5,000 in medical expenses, you can deduct the amount exceeding 7.5% of your AGI, which is $4,500.

- Child Tax Credit:If you have two qualifying children, you can claim a Child Tax Credit of up to $4,000. This credit can significantly reduce your tax liability.

- EITC:If you have earned income and meet the eligibility requirements for the EITC, you can receive a refundable tax credit that can offset your tax liability or result in a tax refund.

6. Tax Filing Tips

Filing your taxes can feel overwhelming, especially if you’re new to it. But don’t worry, with a little organization and preparation, you can make the process smoother. Here are some helpful tips to get you started.

Gathering Tax Documents

Before you start filing, it’s crucial to gather all the necessary documents. This will help you avoid delays and ensure accuracy. Here’s a checklist of essential documents:

- Social Security card:You’ll need this to verify your identity and ensure your earnings are properly reported.

- W-2 forms:These forms summarize your income and taxes withheld from your employer for the year.

- 1099 forms:If you received income from sources other than your employer, like freelance work or investments, you’ll receive 1099 forms.

- Receipts for expenses:If you’re claiming deductions, you’ll need receipts for any expenses you’re deducting, such as medical expenses, charitable donations, or home office expenses.

- Previous year’s tax return:This can be helpful for reference, especially if you’re using the same tax software or filing method.

Common Tax Filing Mistakes

| Mistake | Consequence | Solution |

|---|---|---|

| Failing to file on time | Penalties and interest charges | File your taxes on time or request an extension if needed. |

| Incorrectly reporting income or deductions | Tax liability discrepancies and potential audits | Double-check all information on your tax forms and consult a tax professional if needed. |

| Missing required documentation | Delays in processing your return and potential audits | Gather all necessary documents before filing, including receipts, W-2s, and 1099s. |

The Importance of Accurate Record-Keeping

Accurate record-keeping is crucial for tax purposes. It ensures you can support any deductions or credits you claim on your tax return. Keeping detailed records, such as receipts, invoices, and bank statements, allows you to accurately report your income and expenses, reducing the risk of errors and potential audits.

Tax Filing for Self-Employed Individuals

If you’re self-employed, filing taxes requires additional steps. Here’s a step-by-step guide to help you navigate the process:

- Gather all necessary documentation:This includes receipts for business expenses, invoices for services rendered, bank statements, and any other relevant documents.

- Determine your business income and expenses:Carefully track all income received and expenses incurred throughout the year. This will help you calculate your net business income.

- Choose the appropriate tax filing method:Self-employed individuals typically use Schedule C or Schedule C-EZ to report their business income and expenses.

- File your tax return with the IRS:Once you’ve completed your tax return, you can file it electronically or by mail. The IRS offers various filing options, including online tax software, mail-in forms, and tax preparation services.

7. Penalties for Late Filing

Filing your federal income taxes on time is crucial, as failure to do so can result in significant penalties. These penalties are designed to encourage timely compliance with tax obligations. Understanding the various penalties and their implications can help taxpayers avoid costly consequences.

Late Filing Penalty

The late filing penalty applies when you file your tax return after the deadline, even if you owe no taxes. This penalty is calculated as a percentage of the unpaid tax owed, and it can be substantial. The percentage varies depending on the number of days the return is late.

The penalty is generally 0.5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax.

Late Payment Penalty

The late payment penalty is assessed when you fail to pay your taxes by the deadline, even if you filed your return on time. This penalty is also calculated as a percentage of the unpaid tax, but it is based on the number of days the payment is late and the applicable interest rate.

Looking for the best credit card deals this month? Check out our list of the Best Credit Cards October 2023 and find the perfect card for your needs. Whether you’re looking for cash back, travel rewards, or low interest rates, we’ve got you covered.

The penalty for late payment is generally 0.5% of the unpaid tax for each month or part of a month that the payment is late, up to a maximum of 25% of the unpaid tax.

Failure to Pay Penalty

The failure to pay penalty applies in situations where you do not file your return by the deadline and you owe taxes. This penalty is separate from the late filing penalty and can be applied in addition to it. It is calculated as a percentage of the unpaid tax and can be quite significant.

The penalty for failure to pay is generally 0.5% of the unpaid tax for each month or part of a month that the payment is late, up to a maximum of 25% of the unpaid tax.

Accuracy-Related Penalty

The accuracy-related penalty applies when you make a mistake on your tax return that results in an underpayment of taxes. This penalty is designed to encourage taxpayers to be accurate and diligent in their tax reporting. It is calculated as a percentage of the underpayment, and the percentage can vary depending on the nature of the error.

It’s tax season! Check out our guide on Tax Deadline 2023 to ensure you meet all the deadlines and requirements.

The penalty for an accuracy-related penalty is generally 20% of the underpayment.

Penalty Table

The following table summarizes the potential penalties for late filing of federal income taxes in the United States:| Penalty Type | Description | Calculation ||—|—|—|| Late Filing Penalty | Applies when you file your tax return after the deadline, even if you owe no taxes.

| 0.5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax. || Late Payment Penalty | Applies when you fail to pay your taxes by the deadline, even if you filed your return on time.

| 0.5% of the unpaid tax for each month or part of a month that the payment is late, up to a maximum of 25% of the unpaid tax. || Failure to Pay Penalty | Applies in situations where you do not file your return by the deadline and you owe taxes.

| 0.5% of the unpaid tax for each month or part of a month that the payment is late, up to a maximum of 25% of the unpaid tax. || Accuracy-Related Penalty | Applies when you make a mistake on your tax return that results in an underpayment of taxes.

| 20% of the underpayment. |

Penalties Scenarios

Here are three scenarios where penalties for late filing of federal income taxes might apply:* Scenario 1:A taxpayer files their taxes on April 17th, but they owe the government $5,000. In this case, the taxpayer would be subject to a late filing penalty, as they filed their return after the April 15th deadline.

The penalty would be calculated as 0.5% of the unpaid tax ($5,000) for each month or part of a month that the return is late.

Scenario 2

A taxpayer files their taxes on April 15th, but they forget to include a form that results in an underpayment of $2,000. The taxpayer would be subject to an accuracy-related penalty because they made a mistake on their tax return that resulted in an underpayment.

The penalty would be calculated as 20% of the underpayment ($2,000).

The IRS has set a deadline for taxes in October. Make sure you’re aware of the Irs Tax Deadline October 2023 and get your taxes filed on time to avoid any penalties.

Scenario 3

A taxpayer files their taxes on May 1st, but they mistakenly claim a deduction they are not entitled to. The taxpayer would be subject to an accuracy-related penalty because they made a mistake on their tax return that resulted in an underpayment.

The penalty would be calculated as 20% of the underpayment.

Did you know there are specific dates in October when taxes are due? Check out our guide on When Are Taxes Due In October to ensure you meet all the deadlines.

Appealing Penalties

Taxpayers have the right to appeal penalties for late filing of federal income taxes. Appeals can be filed with the IRS, and there are specific grounds for appeal.

October is a month for tax deadlines! Find out about the specific taxes that are due this month by checking our list of Taxes Due October.

Grounds for Appeal

There are several reasons why a taxpayer might appeal a penalty, including:* Reasonable Cause:The taxpayer can argue that they had a reasonable cause for filing late or failing to pay on time. This could include unforeseen circumstances such as a serious illness, a natural disaster, or a death in the family.

If you’re considering putting your savings into a Certificate of Deposit (CD), you’ll want to check out the current CD Rates October 2023. With interest rates fluctuating, it’s important to compare rates and find the best deal for your financial goals.

Lack of Knowledge

The taxpayer can argue that they were unaware of the tax laws or that they were misled by the IRS or a tax professional.

Mistakes by the IRS

The taxpayer can argue that the IRS made a mistake in calculating the penalty or that they were wrongly assessed the penalty.

Procedure

To appeal a penalty, the taxpayer must file a Form 1040-X, Amended U.S. Individual Income Tax Return. The taxpayer must also provide supporting documentation to support their claim. The IRS will review the appeal and make a decision.

If you’re in the market for a new car, you’ll want to check out the Best Car Lease Deals October 2023. Find the best deals on your dream car and get behind the wheel.

Outcome

The outcome of an appeal can vary. The IRS may reduce or cancel the penalty, or they may uphold the penalty. If the IRS upholds the penalty, the taxpayer can appeal the decision to the Tax Court or to a federal district court.

Tax Planning for 2024

Tax planning is an essential aspect of financial management that can help you minimize your tax liability and maximize your after-tax income. By strategically planning your financial decisions throughout the year, you can take advantage of tax deductions, credits, and other strategies to reduce your tax burden.

Tax Planning Strategies for Individuals

Tax planning strategies can vary depending on your income level, financial situation, and individual circumstances. Here are some general strategies that can be beneficial for most individuals:

- Maximize Tax-Advantaged Accounts:Contribute to retirement accounts like 401(k)s and IRAs to reduce your taxable income and save for retirement.

- Take Advantage of Tax Credits:Explore available tax credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit, which can provide significant tax savings.

- Optimize Deductions:Utilize eligible deductions for medical expenses, charitable donations, homeownership, and other expenses to reduce your taxable income.

- Consider Tax-Loss Harvesting:Sell losing investments to offset capital gains and reduce your tax liability.

- Plan for Major Life Events:Anticipate major life events, such as buying a home, getting married, or having a child, and consider their tax implications.

Tax Planning Strategies for Businesses

Businesses can also benefit from proactive tax planning. Here are some strategies for businesses to consider:

- Choose the Right Business Structure:Select a business structure that aligns with your goals and minimizes tax liability.

- Optimize Business Expenses:Deductible business expenses can significantly reduce your tax burden.

- Utilize Tax Credits:Explore available tax credits for businesses, such as the Research and Development (R&D) Tax Credit or the Work Opportunity Tax Credit.

- Plan for Business Growth:Consider tax implications when expanding your business or making significant investments.

Tax-Smart Financial Decisions

Making tax-smart financial decisions throughout the year can contribute to long-term tax savings. Here are some key considerations:

- Consider Timing of Income and Expenses:Timing your income and expenses strategically can impact your tax liability.

- Invest in Tax-Advantaged Accounts:Invest in tax-advantaged accounts like 529 plans for education expenses or health savings accounts (HSAs) for healthcare costs.

- Consult with a Tax Professional:Seek professional guidance from a tax advisor to develop a personalized tax plan that meets your specific needs.

Tax Planning Examples for Different Income Levels

Example 1: Low-Income IndividualsLow-income individuals can benefit from maximizing tax credits, such as the Earned Income Tax Credit (EITC), which can provide a substantial refund. They can also consider contributing to retirement accounts like IRAs, which may offer tax advantages. Example 2: High-Income IndividualsHigh-income individuals may benefit from strategies like tax-loss harvesting to offset capital gains and reduce their tax liability.

If you need to file a tax extension, the Tax Extension Deadline 2023 is an important date to remember. Get your extension filed on time to avoid any penalties.

They can also consider charitable giving, which can provide tax deductions and support worthy causes. Example 3: Small Business OwnersSmall business owners can utilize tax deductions for business expenses and explore available tax credits to reduce their tax burden. They can also consider incorporating their business to potentially benefit from lower tax rates.

Example 4: Real Estate InvestorsReal estate investors can take advantage of deductions for mortgage interest, property taxes, and depreciation. They can also consider strategies like 1031 exchanges to defer capital gains taxes. Example 5: RetireesRetirees can benefit from strategies like Roth conversions to potentially reduce their future tax liability.

They can also explore tax-efficient withdrawal strategies from retirement accounts. Remember:These are just a few examples, and specific tax planning strategies will vary depending on your individual circumstances. It is crucial to consult with a qualified tax professional for personalized advice.

9. Tax Preparation Services

Navigating the complex world of taxes can be daunting, especially with ever-changing rules and regulations. Hiring a professional tax preparer can offer significant advantages in ensuring accuracy, compliance, and potentially maximizing your tax savings.

Benefits of Professional Tax Preparation

Professional tax preparation services provide several benefits, including:

- Accuracy:Tax professionals are well-versed in tax laws and regulations, minimizing the risk of errors that could lead to penalties or audits.

- Compliance:They ensure your tax return adheres to all applicable laws and regulations, reducing the likelihood of penalties or audits.

- Potential Tax Savings:Professionals can identify all eligible deductions and credits, helping you maximize your tax savings. For example, they can help you claim deductions for homeownership, charitable contributions, or business expenses.

Downsides of Professional Tax Preparation

While professional tax preparation offers many advantages, it also has potential drawbacks:

- Cost:Hiring a tax professional can be expensive, especially for complex returns or specialized services.

- Potential for Errors:Even qualified tax professionals can make mistakes, although the risk is generally lower than doing your own taxes.

- Need for Careful Selection:Choosing a qualified and reputable tax preparer is crucial. You should carefully research and vet potential professionals before engaging their services.

Types of Tax Preparation Services

Tax preparation services vary based on complexity, industry specialization, and specific needs. Here are some common categories:

- Individual Tax Preparation:This covers basic tax returns for individuals, including income, deductions, and credits.

- Business Tax Preparation:This involves preparing tax returns for businesses of all sizes, including corporations, partnerships, and sole proprietorships.

- Estate Tax Preparation:This focuses on preparing tax returns for estates and trusts, including inheritance taxes and estate planning.

- Specialized Services:Professionals offer specialized services tailored to specific industries or needs, such as real estate tax preparation, healthcare tax preparation, or international tax compliance.

Choosing a Qualified Tax Preparer

Selecting a qualified tax preparer is essential to ensure accuracy, compliance, and peace of mind. Here’s what to consider:

- Credentials:Look for professionals with relevant credentials, such as a Certified Public Accountant (CPA), Enrolled Agent (EA), or Tax Attorney.

- Experience:Choose a preparer with experience in your specific tax situation, such as individual, business, or estate taxes.

- Reputation:Check online reviews and testimonials to gauge the preparer’s reputation and client satisfaction.

- Fees:Inquire about the preparer’s fees and payment options. Be sure to compare fees from different professionals.

- Availability:Ensure the preparer is available to meet your deadlines and provide timely service.

Verifying Tax Preparer Credentials

It’s crucial to verify a tax preparer’s credentials and licensing to ensure they are qualified and authorized to practice. Here are some tips:

- Check for Licensing:Confirm that the preparer is licensed in your state, if applicable.

- Look for Credentials:Verify their credentials, such as CPA, EA, or Tax Attorney, by checking with the relevant professional organizations.

- Identify Red Flags:Be wary of preparers who promise unrealistic tax savings or offer questionable advice.

Tax Professional Qualifications

The following table summarizes the qualifications of different types of tax professionals:

| Tax Professional | Education | Licensing Requirements | Areas of Expertise |

|---|---|---|---|

| Certified Public Accountant (CPA) | Bachelor’s degree in accounting, passing the Uniform CPA Examination, and meeting state licensing requirements. | Licensed by state boards of accountancy. | Broad range of tax services, including individual, business, and estate taxes. |

| Enrolled Agent (EA) | Must pass a comprehensive IRS exam or have experience working for the IRS. | Licensed by the IRS. | Specialize in federal tax matters, including representing taxpayers before the IRS. |

| Tax Attorney | Juris Doctor (JD) degree from an accredited law school and passing the bar exam. | Licensed by state bar associations. | Provide legal advice on tax matters, including tax planning, audits, and litigation. |

Understanding Your Tax Return

Your tax return is a crucial document that summarizes your financial activity for the tax year and determines your tax liability. It provides a detailed breakdown of your income, deductions, and credits, ultimately calculating the amount of tax you owe or the refund you are eligible for.

Understanding the key components of your tax return is essential for ensuring accuracy and maximizing your tax benefits.

Key Components of a Tax Return

The primary components of a tax return include:

- Personal Information:This section includes your name, Social Security number, address, and filing status. It is crucial to ensure all information is accurate and up-to-date.

- Income:This section lists all your sources of income, such as wages, salaries, interest, dividends, and capital gains. It is essential to report all income accurately, regardless of its source.

- Deductions:Deductions are expenses that can be subtracted from your income to reduce your taxable income. Common deductions include mortgage interest, charitable contributions, and state and local taxes.

- Credits:Tax credits are direct reductions to your tax liability. Examples include the earned income tax credit, the child tax credit, and the American Opportunity Tax Credit.

- Tax Liability:This is the amount of tax you owe based on your taxable income and the applicable tax rates. It is calculated by subtracting deductions and credits from your adjusted gross income.

- Payments:This section reflects any tax payments you have already made, such as withholdings from your paycheck or estimated tax payments.

- Refund or Balance Due:This is the final outcome of your tax return. If your payments exceed your tax liability, you will receive a refund. Conversely, if your tax liability exceeds your payments, you will owe the remaining balance.

Understanding the Different Sections, Tax Deadline 2024

Each section of your tax return serves a specific purpose:

- Form 1040:This is the primary tax form used by most individuals to file their federal income tax return. It gathers all the essential information needed to calculate your tax liability.

- Schedules:Various schedules are used to provide more detailed information about specific income sources, deductions, or credits. For example, Schedule A is used to itemize deductions, while Schedule C is used to report income and expenses from a business.

- Forms:Additional forms may be required to provide further information, such as Form W-2 for wages and salaries, Form 1099 for various types of income, and Form 1098 for mortgage interest.

Interpreting and Understanding Your Tax Return

To effectively interpret your tax return, you should:

- Review all the information carefully:Ensure that all income, deductions, and credits are accurately reported and that your personal information is correct.

- Understand the terminology:Familiarize yourself with common tax terms and concepts, such as adjusted gross income, taxable income, and tax liability.

- Compare your tax return to previous years:This can help you identify any significant changes in your income, deductions, or credits.

- Seek professional assistance if needed:If you are unsure about any aspect of your tax return, consider consulting a tax professional for guidance and assistance.

Tax Refund Processing

Getting a tax refund is a welcome surprise for many taxpayers. However, understanding the process and factors that influence its arrival is crucial. This section explores the journey of your tax refund, from filing to receiving it.

Factors Affecting Refund Processing Time

The time it takes to receive your tax refund can vary depending on several factors. Here are some key factors that can influence the processing time:

- Filing Method:E-filing is generally faster than filing by mail. Electronic filing allows the IRS to process your return quickly and efficiently.

- Accuracy of Information:Errors or inconsistencies in your tax return can delay processing. Double-checking your information before filing is crucial.

- Completeness of Documentation:Providing all necessary supporting documents, such as W-2s and 1099s, is essential for accurate processing.

- IRS Processing Volume:The IRS receives millions of tax returns each year, especially during peak filing season. This can lead to processing delays.

- Tax Credits and Deductions:Certain tax credits and deductions may require additional review, potentially delaying processing.

- Fraudulent Activity:The IRS may flag returns for fraud or identity theft, leading to a more thorough review and potentially delaying processing.

Tracking Your Refund Status

Once you’ve filed your tax return, you can track the status of your refund using the IRS’s online tools:

- Where’s My Refund?This tool allows you to check the status of your refund online using your Social Security number, filing status, and the amount of your refund. It provides updates on the processing and delivery of your refund.

- IRS2Go Mobile App:The IRS2Go mobile app provides a convenient way to check your refund status, as well as other tax-related information.

Tax Audit Considerations

A tax audit is a review of your tax return by the Internal Revenue Service (IRS) to verify the accuracy of your reported income, deductions, and credits. While most taxpayers will never be audited, it’s important to understand the process and potential reasons for an audit.

October is a busy month for taxes! If you need to file an extension, the IRS October Deadline 2023 is a crucial date to remember. Make sure you’re aware of the deadlines and requirements to avoid any penalties.

The Process of a Tax Audit

A tax audit typically begins with a notification letter from the IRS. This letter will Artikel the specific areas of your tax return that are being reviewed and will provide instructions on how to respond. The audit can be conducted in person, by mail, or by phone.

During the audit, the IRS will request supporting documentation to verify the information on your tax return. This may include:

- W-2 forms

- 1099 forms

- Receipts for deductions

- Bank statements

- Other relevant documents

The IRS will then review the documentation and may ask you to provide additional information or explanations. If the IRS finds errors on your tax return, you may be required to pay additional taxes, penalties, and interest.

Looking for the best CD rates from PNC Bank? Check out our list of PNC Bank Cd Rates October 2023 and find the perfect rate for your savings goals.

Common Reasons for Tax Audits

There are several reasons why the IRS may choose to audit your tax return. Some common reasons include:

- Disproportionate deductions or credits:If your deductions or credits are significantly higher than average for your income level, this may trigger an audit.

- Unusual income sources:If you have income from sources that are not typical for your profession or lifestyle, such as gambling winnings or foreign income, this could increase your chances of being audited.

- Errors on your tax return:Mistakes on your tax return, such as incorrect deductions or missing information, can lead to an audit.

- Discrepancies in your tax return:If your tax return contains discrepancies, such as conflicting information from different sources, this could raise red flags for the IRS.

- Prior audits:If you have been audited in the past, you may be more likely to be audited again.

Preparing for and Responding to a Tax Audit

If you receive a notification letter from the IRS, it’s important to take the following steps:

- Read the letter carefully:Understand the specific areas of your tax return that are being reviewed and the instructions for responding.

- Gather supporting documentation:Collect all relevant documents that support the information on your tax return.

- Respond promptly:Don’t ignore the letter from the IRS. Respond within the specified timeframe.

- Seek professional help:If you are unsure how to respond or need assistance with the audit, consider consulting with a tax professional.

It’s also important to be polite and cooperative with the IRS during the audit process.

“It is important to understand that the IRS is not looking to penalize taxpayers unnecessarily. They are simply trying to ensure that everyone is paying their fair share of taxes.”

Tax Information for Specific Groups

Navigating the tax system can be complex, especially for individuals with unique circumstances. This section provides information tailored to specific groups, outlining special considerations, relevant resources, and key deadlines.

Tax Filing for Different Groups

The following table summarizes key tax information for various groups:

| Group | Special Considerations | Relevant Resources | Key Deadlines |

|---|---|---|---|

| Students |

|

|

|

| Seniors |

|

|

|

| Self-Employed Individuals |

|

|

|

| Military Personnel |

|

|

|

Final Thoughts

Filing your taxes on time is crucial to avoid penalties and maintain a good standing with the IRS. By understanding the deadline, key changes, and available resources, you can navigate the tax season with confidence. Remember, if you have any questions or need personalized assistance, consult with a qualified tax professional.

FAQ: Tax Deadline 2024

What if I can’t file my taxes by the deadline?

You can request an extension to file your taxes, which gives you additional time to gather your documents and complete your return. However, it’s important to note that an extension only delays the filing deadline, not the payment deadline. You’ll still need to pay any taxes owed by the original deadline.

What are the consequences of missing the tax deadline?

The IRS imposes penalties for late filing and late payment. These penalties can be significant, so it’s essential to file your taxes on time or request an extension if necessary.

Where can I find more information about tax changes for 2024?

You can find comprehensive information about tax changes on the IRS website (IRS.gov) and through reputable tax publications.