2024 October Tax Deadline is a crucial date for many individuals and businesses, marking the final deadline for filing taxes for those who filed for an extension. This deadline carries significant weight, as missing it can result in penalties and interest charges.

Understanding the implications and navigating the filing process effectively is essential for avoiding potential complications.

The October 2024 deadline applies to self-employed individuals, small business owners, and others who filed for an extension from the initial April tax deadline. It encompasses a range of tax obligations, including income tax, self-employment tax, and estimated taxes. Failing to meet this deadline can have serious consequences, including penalties, interest charges, and potential legal issues.

Contents List

- 1 Understanding the 2024 October Tax Deadline

- 1.1 The Significance of the October 2024 Tax Deadline

- 1.2 Definition of the October 2024 Tax Deadline

- 1.3 Specific Date and Time for the October 2024 Tax Deadline

- 1.4 Filing Taxes by the October 2024 Deadline

- 1.5 Importance of Meeting the October 2024 Tax Deadline

- 1.6 Comparing the October 2024 Tax Deadline to Other Important Tax Deadlines

- 2 Who is Affected by the October 2024 Tax Deadline?

- 3 3. Filing Requirements for the October 2024 Tax Deadline

- 4 4. Common Tax Issues Related to the October 2024 Deadline

- 5 5. Tax Extensions and Payment Options for the October 2024 Deadline

- 6 Resources and Support for the October 2024 Tax Deadline

- 7 7. Tax Planning Tips for the October 2024 Deadline

- 8 Impact of the October 2024 Tax Deadline on Businesses

- 8.1 Impact on Different Business Structures

- 8.2 Impact on Different Industries

- 8.3 Impact on Business Size

- 8.4 Potential Penalties for Non-Compliance

- 8.5 Impact on Business Cash Flow

- 8.6 Tax Obligations for Businesses

- 8.7 Reporting Requirements for Businesses

- 8.8 Tax Planning Strategies for Businesses

- 8.9 Record Keeping for Businesses

- 8.10 Deadline Reminders for Businesses

- 8.11 Table: Tax Obligations and Reporting Requirements

- 9 Historical Context of the October Tax Deadline

- 10 Future Implications of the October 2024 Tax Deadline

- 11 Case Studies of the October 2024 Tax Deadline: 2024 October Tax Deadline

- 12 Tax Filing and Payment Strategies for the October 2024 Deadline

- 13 Understanding Tax Terminology Related to the October 2024 Tax Deadline

- 14 Outcome Summary

- 15 Commonly Asked Questions

Understanding the 2024 October Tax Deadline

The October 2024 tax deadline is a crucial date for many individuals and businesses. This deadline applies to those who have filed for an extension on their federal income taxes, providing them with additional time to complete their tax obligations.

Understanding the significance of this deadline and its implications is essential for ensuring timely tax compliance and avoiding potential penalties.

The Significance of the October 2024 Tax Deadline

The October 2024 tax deadline is unique because it applies to a specific group of taxpayers who have been granted an extension. This deadline is not for everyone; it is specifically for individuals and businesses that have filed for an extension on their federal income taxes.

Missing this deadline can have serious consequences, including penalties and interest charges on unpaid taxes.

Definition of the October 2024 Tax Deadline

The October 2024 tax deadline is the final date for filing federal income tax returns for individuals and businesses who have been granted an extension. This deadline applies to the filing of both the tax return and the payment of any outstanding taxes.

It is important to note that this deadline does not apply to state income taxes, which may have their own separate deadlines.

Specific Date and Time for the October 2024 Tax Deadline

The October 2024 tax deadline falls on October 15, 2024, at 11:59 PM. This deadline applies to all states, although some states may have their own specific deadlines for state income tax returns. It is always advisable to confirm the specific deadline for your location with the relevant tax authorities.

Filing Taxes by the October 2024 Deadline

To ensure timely tax filing by the October 2024 deadline, follow these steps:

- Gather all necessary documents, including W-2 forms, 1099 forms, receipts, and other relevant documentation.

- Choose a suitable tax preparation method, whether it be using tax software, hiring a tax professional, or filing manually.

- Complete all required forms and schedules accurately and thoroughly.

- Review your tax return carefully for any errors or omissions.

- File your tax return electronically or by mail, depending on your chosen method.

- Make any necessary tax payments by the deadline.

Importance of Meeting the October 2024 Tax Deadline

Missing the October 2024 tax deadline can result in significant financial penalties and interest charges. The IRS imposes penalties for late filing and late payment, which can add up quickly. Additionally, missing this deadline can impact your credit score and make it more difficult to obtain loans or credit in the future.

Cigna layoffs in October 2023 have raised concerns about the healthcare industry. Stay informed about the situation and its potential implications for the future of healthcare.

To avoid these consequences, it is crucial to prioritize meeting the October 2024 tax deadline. Plan your tax preparation process in advance, gather all necessary documents, and file your return on time.

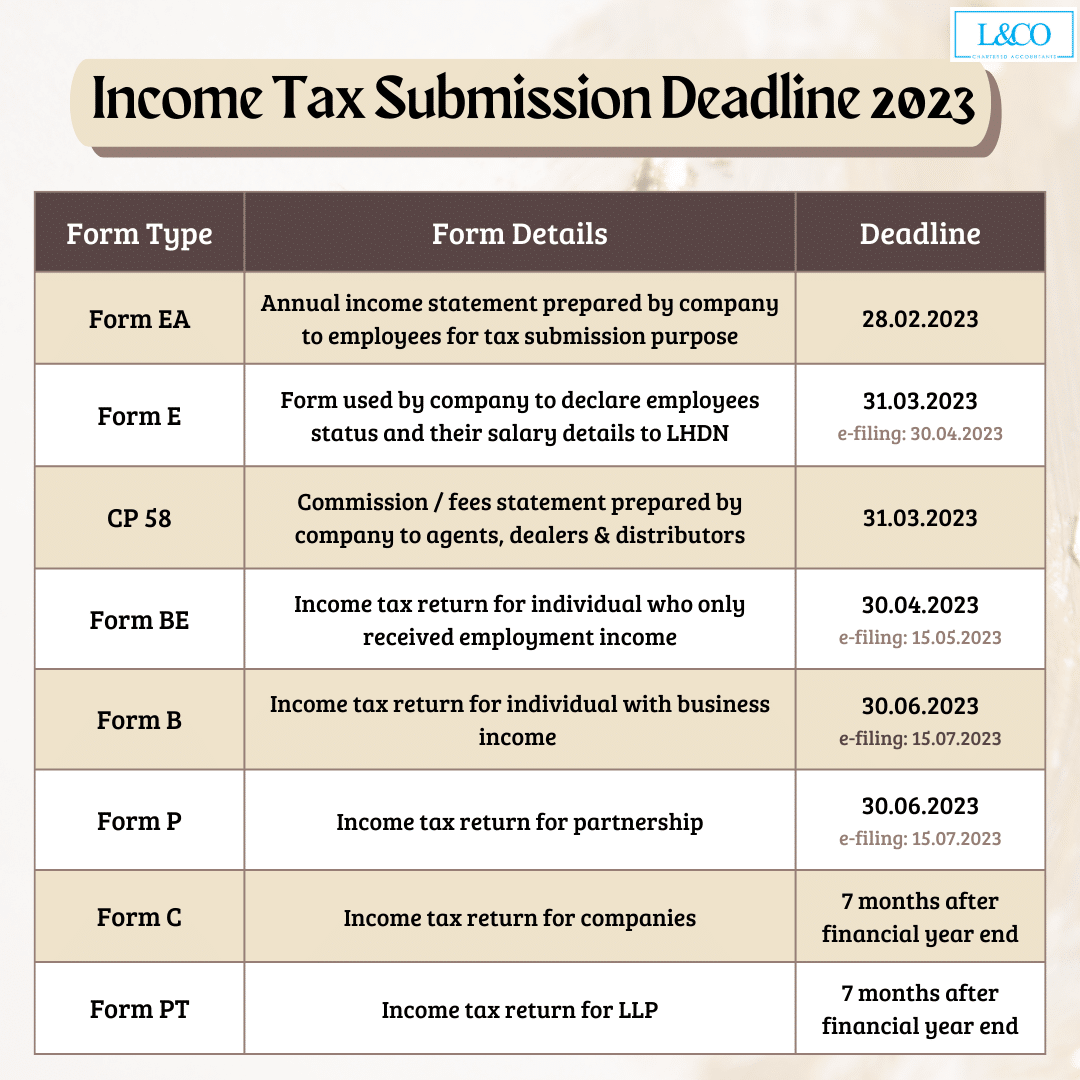

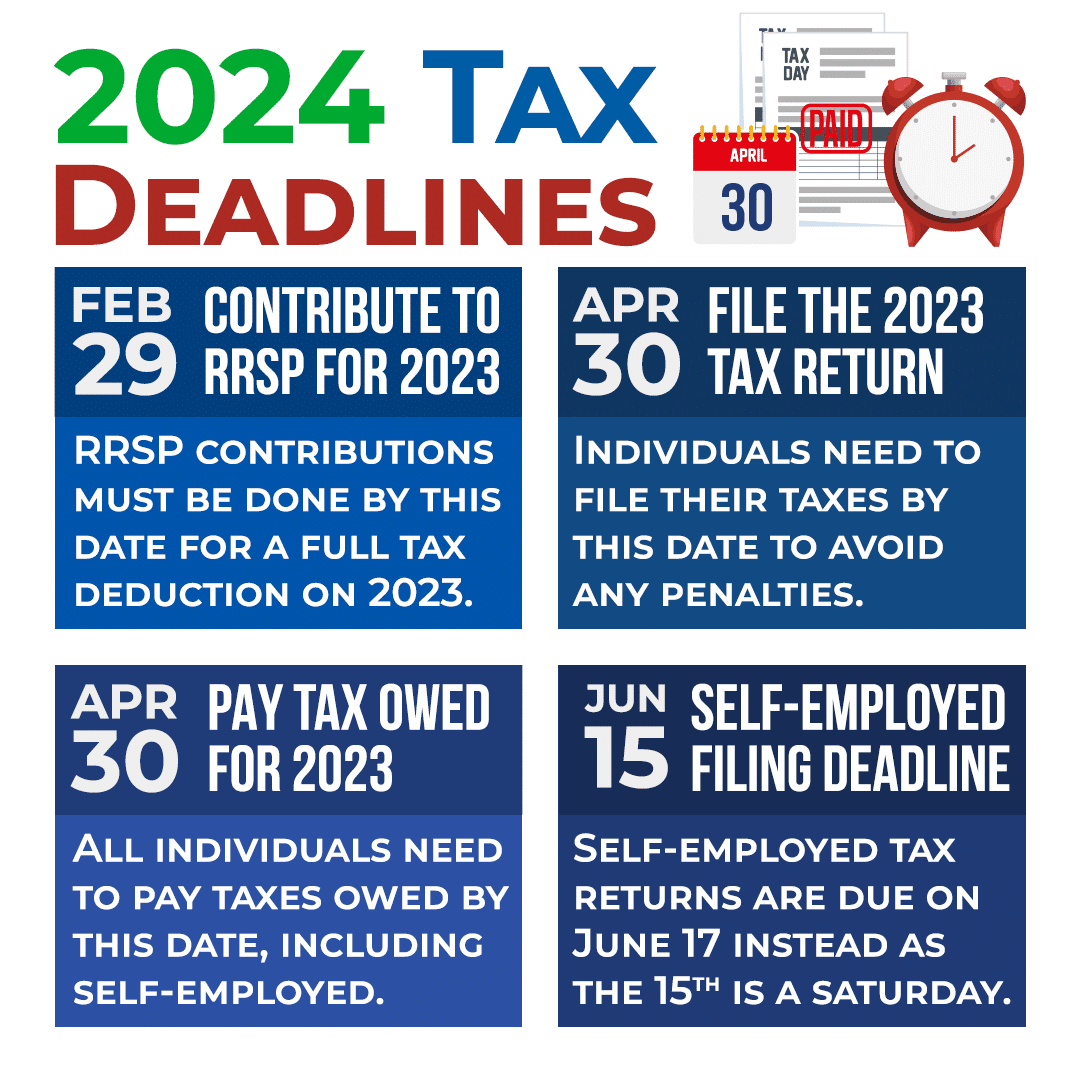

Comparing the October 2024 Tax Deadline to Other Important Tax Deadlines

| Deadline | Date | Time | Description |

|---|---|---|---|

| October 2024 Tax Deadline | October 15, 2024 | 11:59 PM | Deadline for filing taxes for self-employed individuals and others who file an extension. |

| April 15, 2024 Tax Deadline | April 15, 2024 | 11:59 PM | Deadline for filing federal income tax returns for most individuals and businesses. |

| January 15, 2024 Estimated Tax Payment Deadline | January 15, 2024 | 11:59 PM | Deadline for making the first estimated tax payment for the current tax year. |

| April 15, 2024 Estimated Tax Payment Deadline | April 15, 2024 | 11:59 PM | Deadline for making the second estimated tax payment for the current tax year. |

| June 15, 2024 Estimated Tax Payment Deadline | June 15, 2024 | 11:59 PM | Deadline for making the third estimated tax payment for the current tax year. |

| September 15, 2024 Estimated Tax Payment Deadline | September 15, 2024 | 11:59 PM | Deadline for making the fourth and final estimated tax payment for the current tax year. |

Who is Affected by the October 2024 Tax Deadline?

The October 2024 tax deadline applies to certain individuals and businesses, primarily those who are granted an extension to file their taxes beyond the standard April deadline. This extension allows taxpayers additional time to gather necessary documents and complete their tax returns.

Taxpayers Subject to the October Deadline

The October 2024 deadline primarily affects individuals and businesses who have been granted a tax filing extension. This extension is usually granted to taxpayers who need more time to gather information, complete their tax forms, or resolve any outstanding tax issues.

Here are some common scenarios where taxpayers may be subject to the October deadline:

- Individuals who are self-employed or have complex tax situations.

- Individuals who are overseas or traveling during the April tax deadline.

- Individuals who have received a tax audit or are facing tax-related issues.

- Businesses with complex financial transactions or tax structures.

- Businesses operating in multiple states or countries.

Circumstances Triggering the October Deadline

Several circumstances can lead to the October tax deadline. The most common is filing an extension request with the IRS.

To file for an extension, taxpayers must complete Form 4868, “Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.”

This extension grants an additional six months to file their tax return, moving the deadline from April to October. However, it is crucial to note that an extension only grants more time to file the return, not to pay the taxes owed.

Consequences of Missing the October Deadline

Failing to file your tax return by the October deadline can result in significant penalties and interest charges. The IRS imposes penalties for late filing and late payment, which can be substantial.

The penalty for late filing is typically 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25%.

Furthermore, interest charges are applied to unpaid taxes, adding to the financial burden.

Looking for the best CD rates in October 2023? This resource helps you compare rates and find the best options for your savings goals. Secure your financial future with high-yield CDs.

The interest rate for underpayment is determined by the IRS and is usually based on the federal short-term rate.

Missing the October deadline can also lead to other consequences, such as:

- Difficulty in obtaining loans or credit.

- Legal action by the IRS.

- Loss of tax deductions or credits.

3. Filing Requirements for the October 2024 Tax Deadline

The October 2024 tax deadline applies to certain individuals and entities, requiring them to file their tax returns by this extended date. Understanding the filing requirements is crucial for ensuring accurate and timely tax compliance.

Necessary Documents and Information

To file your taxes by the October 2024 deadline, you’ll need to gather essential documents and information. This includes evidence of your income, deductions, and credits.

- Income:

- W-2 Forms:These forms report your wage and salary income from your employer(s). You should receive a W-2 form from each employer you worked for during the tax year.

- 1099 Forms:These forms report various income sources, including:

- 1099-INT:Interest income from banks, savings accounts, and other financial institutions.

- 1099-DIV:Dividend income from stocks and mutual funds.

- 1099-NEC:Non-employee compensation, such as payments for services from clients or customers.

- 1099-MISC:Miscellaneous income, including royalty payments, prizes, and certain other income.

- Deductions:

- Charitable Contributions:Donations to qualified charities are deductible. You’ll need receipts or other documentation to support your claims.

- Medical Expenses:Medical expenses exceeding a certain percentage of your Adjusted Gross Income (AGI) are deductible. Keep detailed records of your medical expenses, including receipts and insurance statements.

- Student Loan Interest:You may be able to deduct up to $2,500 in interest paid on student loans.

- Homeownership:If you own a home, you may be eligible for deductions related to mortgage interest, property taxes, and insurance premiums.

- Business Expenses:If you are self-employed or operate a business, you can deduct various expenses related to your business activities, such as rent, utilities, and supplies.

- Credits:

- Earned Income Tax Credit (EITC):This credit is available to low- and moderate-income working individuals and families. It can reduce your tax liability or result in a refund.

- Child Tax Credit:This credit provides a tax break for each qualifying child under 17 years old. It can reduce your tax liability or result in a refund.

- Energy Efficiency Improvements:You may be eligible for tax credits for making energy-efficient improvements to your home, such as installing solar panels or energy-efficient windows.

- Other:

- Social Security Numbers:You’ll need your Social Security number and the Social Security numbers of any dependents you are claiming.

- Dependents’ Information:If you are claiming dependents, you’ll need their names, birth dates, and Social Security numbers.

- Other Relevant Documents:Depending on your individual circumstances, you may need other documents, such as bank statements, investment statements, or other financial records.

Methods of Filing

There are several ways to file your taxes by the October 2024 deadline. Choose the method that best suits your needs and preferences.

- Online Filing:

- Popular Online Tax Filing Services:Several reputable online tax filing services are available, including TurboTax, H&R Block, and TaxAct. These services provide user-friendly interfaces and guidance throughout the filing process.

- Free Filing Options:The IRS offers free online filing options for low-income taxpayers through the Free File program. You can access this program through the IRS website or through participating tax preparation software providers.

- Mail Filing:

- Obtaining Necessary Forms:You can obtain the necessary tax forms from the IRS website or from the IRS by mail. You can also find forms at libraries and post offices.

- Filling Out Forms:Carefully and accurately complete all required forms, providing all necessary information and documentation.

- Mailing to the Correct Address:Mail your completed tax forms to the address specified by the IRS. You can find the correct mailing address on the IRS website or on the instructions for the tax forms.

- Postmark Deadline:To avoid late filing penalties, ensure your tax forms are postmarked by the October 2024 deadline. The postmark date is the date the U.S. Postal Service stamps your envelope.

- Professional Assistance:

- Hiring a Tax Professional:You can hire a tax professional, such as a Certified Public Accountant (CPA) or an Enrolled Agent (EA), to prepare and file your taxes.

- Advantages of Professional Assistance:Tax professionals have expertise in tax law and can provide personalized advice to help you minimize your tax liability and avoid errors. They can also handle complex tax situations that you may not be comfortable dealing with yourself.

Step-by-Step Guide to Filing Taxes

Here is a step-by-step guide to filing your taxes by the October 2024 deadline:

- Gather all necessary documents and information.This includes your W-2 forms, 1099 forms, receipts for deductions, and any other relevant documentation.

- Choose a filing method.You can file online, by mail, or with the assistance of a tax professional.

- If filing online, select a tax filing service and follow their instructions.Many online tax filing services offer free versions for basic tax returns or discounted rates for more complex returns.

- If filing by mail, obtain the necessary forms from the IRS website or other authorized sources.Complete all required forms accurately and thoroughly, providing all necessary information and documentation.

- Review your completed forms for accuracy.Ensure that all information is correct and that you have included all relevant deductions and credits.

- File your taxes by the October 2024 deadline.The specific deadline for filing by mail or online may vary, so check with the IRS website or your tax filing service for the most up-to-date information.

- Keep copies of all filed documents for your records.This will help you if you need to refer to your tax return in the future.

4. Common Tax Issues Related to the October 2024 Deadline

Taxpayers with an extended October 2024 deadline often face unique challenges and potential issues that can lead to complications and even penalties. Understanding these common issues is crucial for navigating the tax filing process effectively and avoiding unnecessary complications.

Common Tax Issues Related to the October 2024 Deadline

| Issue | Description | Impact |

|---|---|---|

| Incorrect Filing Status | Choosing the wrong filing status, such as single, married filing jointly, or head of household, can result in an inaccurate calculation of taxes owed or refunds. | Incorrect tax liability, potential penalties for filing an inaccurate return, and delays in receiving refunds. |

| Missing or Incorrect Income Reporting | Failing to report all income sources, including wages, interest, dividends, and capital gains, can lead to underpayment of taxes. | Underpayment of taxes, potential penalties for failing to report all income, and audits. |

| Incorrect Deductions and Credits | Claiming deductions and credits that you are not eligible for or making errors in calculating their amounts can result in an overstatement of deductions or credits. | Overstatement of deductions or credits, leading to an overpayment of taxes or a reduced refund. |

| Incomplete or Inaccurate Documentation | Lack of supporting documentation, such as receipts, W-2 forms, and 1099 forms, can make it difficult to verify deductions and credits. | Inability to substantiate deductions and credits, potential penalties for failing to provide adequate documentation, and audits. |

| Failure to Pay Estimated Taxes | Taxpayers who are self-employed or have significant income from sources other than wages may need to make estimated tax payments throughout the year. Failure to do so can result in penalties. | Underpayment of taxes, potential penalties for failing to pay estimated taxes, and interest charges. |

Circumstances Contributing to Common Tax Mistakes

* Complex Tax Situations:Individuals with complex tax situations, such as those with multiple income sources, significant deductions, or investments, are more likely to make mistakes. For example, a taxpayer with a rental property, freelance income, and investments may struggle to track all income and expenses accurately.

Changes in Personal Circumstances

Major life events, such as marriage, divorce, or the birth of a child, can lead to changes in tax obligations and filing requirements. For example, a newly married couple may need to file jointly and adjust their withholding to reflect their combined income.

Lack of Tax Knowledge

Individuals who are unfamiliar with tax laws and regulations are more prone to making mistakes. This can be particularly true for taxpayers who are new to filing taxes or who have not filed in several years. For example, a recent college graduate who is filing taxes for the first time may not understand the different deductions and credits available to them.

Time Constraints

Taxpayers who wait until the last minute to file their taxes may be more likely to make mistakes due to time pressure and stress. For example, a taxpayer who waits until the week before the deadline to gather all necessary documentation may overlook important information or make errors in their calculations.

Technological Errors

If you’re wondering about taxes due in October, this article provides a comprehensive overview of deadlines and potential extensions. Make sure you’re prepared and avoid any penalties.

Taxpayers who use online tax preparation software or file electronically may encounter technical difficulties or make errors due to software glitches or misunderstandings. For example, a taxpayer who enters their information incorrectly into a tax preparation software program may end up with an inaccurate return.

For those needing clarity on tax deadlines, this article provides a detailed breakdown of when taxes are due in October 2023. Stay organized and avoid any potential penalties.

Tips and Strategies to Avoid Common Tax Issues

* Gather all necessary documentation early:This includes W-2 forms, 1099 forms, receipts, and any other supporting documents that you will need to claim deductions or credits.

Review your tax situation carefully

Consider any changes in your income, expenses, or filing status since your last tax filing.

Use reliable tax preparation software or consult a tax professional

These resources can help you navigate the tax filing process and ensure that you are claiming all eligible deductions and credits.

Keep track of estimated tax payments

If you are self-employed or have significant income from sources other than wages, make sure to make timely estimated tax payments throughout the year.

File your taxes on time

Want to maximize your savings in October 2023? Compare CD rates and find the best options for your financial goals. Secure your future with high-yield CDs.

Avoid waiting until the last minute to file your taxes, as this can lead to mistakes and penalties.

Review your tax return carefully before filing

Double-check all information for accuracy and completeness.

Keep copies of all tax-related documents

This includes your tax return, supporting documentation, and any correspondence with the IRS.

Failing to address common tax issues related to the October 2024 deadline can result in significant financial penalties, including interest charges, late filing penalties, and accuracy-related penalties. In addition, unresolved tax issues can lead to audits, legal complications, and damage to your credit score.

5. Tax Extensions and Payment Options for the October 2024 Deadline

The October 2024 tax deadline might seem far off, but it’s essential to start planning now. Understanding your options for extensions and payment methods can significantly impact your tax obligations.

1. Tax Extension Process

A tax extension allows you to postpone the filing deadline without extending the payment deadline. This can be beneficial if you need more time to gather necessary documents or complete your tax return.Here’s a step-by-step guide to obtain a tax extension:

- File Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return: This form can be filed electronically or by mail.

- Provide accurate information: Ensure your name, Social Security number, and contact information are correct.

- Estimate your tax liability: While you can extend the filing deadline, you still need to pay your estimated taxes by the original deadline. Failure to do so may result in penalties.

- File the extension by the deadline: The deadline for filing for an extension is October 15, 2024, for the October 2024 tax deadline. Filing after this deadline may result in penalties.

2. Payment Options for October 2024 Taxes

Several payment options are available for taxes due by the October 2024 deadline. Understanding the advantages and disadvantages of each method can help you choose the most suitable option.

- Electronic Funds Withdrawal: This option allows you to pay directly from your bank account. It’s fast, secure, and often free. However, it requires providing your bank account details.

- Credit Card Payment: Several third-party payment processors allow you to pay your taxes using a credit card. While convenient, this method typically comes with processing fees.

- Debit Card Payment: Similar to credit card payments, you can pay using a debit card through third-party processors. Fees may apply.

- Check or Money Order: You can mail a check or money order to the IRS. This method can be time-consuming, as processing may take several weeks. Ensure you include your name, address, Social Security number, and the relevant tax year.

- Cash Payment: You can pay your taxes in cash at a designated payment location. This option is generally not recommended due to security concerns and the potential for errors.

3. Comparing Tax Extension and Payment Options

| Option Name | Description | Filing Deadline | Payment Deadline | Fees | Processing Time | Security | Advantages | Disadvantages ||—|—|—|—|—|—|—|—|—|| Tax Extension (Form 4868) | Postpones filing deadline but not payment deadline | October 15, 2024 | October 15, 2024 | None | Immediate | Secure | Allows more time to file | Doesn’t extend payment deadline || Electronic Funds Withdrawal | Direct payment from bank account | October 15, 2024 | October 15, 2024 | Often free | Immediate | Secure | Fast and convenient | Requires bank account details || Credit Card Payment | Payment through third-party processor | October 15, 2024 | October 15, 2024 | Processing fees | Varies | Secure | Convenient | Fees apply || Debit Card Payment | Payment through third-party processor | October 15, 2024 | October 15, 2024 | Processing fees | Varies | Secure | Convenient | Fees apply || Check or Money Order | Mail payment to IRS | October 15, 2024 | October 15, 2024 | None | Several weeks | Secure | No fees | Time-consuming || Cash Payment | Pay in person at designated location | October 15, 2024 | October 15, 2024 | None | Immediate | Not secure | Convenient | Security concerns, potential for errors |

4. Writing a Blog Post on Tax Extensions and Payment Options

Navigating Tax Extensions and Payment Options for the October 2024 Deadline

The October 2024 tax deadline might seem far off, but it’s crucial to start planning now. Understanding your options for extensions and payment methods can significantly impact your tax obligations. Let’s break down these options:* Tax Extension:Need more time to gather documents or complete your return?

You can file for an extension using Form 4868. This grants you additional time to file, but not to pay. Remember, you still need to estimate your tax liability and pay by the original deadline.

Payment Options

Several payment options are available, each with its advantages and disadvantages.

Electronic Funds Withdrawal

Looking for the best lease deals in October 2023? Explore these offers and find the perfect car at a price you can afford. Don’t miss out on these amazing deals.

This is the fastest and often the most secure method. It’s free and allows you to pay directly from your bank account.

Credit Card Payment

Wondering when taxes are due in October 2023? This article clarifies the deadlines and potential extensions, ensuring you’re on top of your financial responsibilities.

Convenience is the key here. You can pay using a credit card through third-party processors, but be aware of processing fees.

Debit Card Payment

Similar to credit card payments, you can use a debit card through third-party processors. Again, fees may apply.

Check or Money Order

This traditional method is secure but time-consuming, as processing can take weeks. Ensure you include all necessary details.

Cash Payment

While convenient, this option isn’t recommended due to security concerns and potential errors. Understanding these options is vital to ensure you meet your tax obligations on time and avoid any penalties.If you’re unsure about your tax obligations or need help navigating the process, consider seeking professional advice from a tax advisor.

The October 2023 Jepi dividend is a hot topic for investors. Find out more about the details , including the amount and payment schedule, to make informed decisions about your portfolio.

Resources and Support for the October 2024 Tax Deadline

Navigating the tax landscape can be complex, even for seasoned taxpayers. Thankfully, a wealth of resources and support systems exist to guide you through the process and ensure you meet the October 2024 deadline.

Government Websites

Government websites are the primary source for accurate and up-to-date tax information. They provide official guidelines, forms, and publications to help taxpayers understand their obligations and file their returns correctly.

Looking for great lease deals in October 2023? Check out these offers for some amazing deals on new vehicles. You might find your dream car at a price you can afford.

- Internal Revenue Service (IRS):The IRS website is the ultimate authority on tax matters. It offers a wide range of resources, including publications, forms, instructions, and FAQs. You can also find information on tax credits, deductions, and payment options. [https://www.irs.gov/](https://www.irs.gov/)

- State Tax Agencies:Each state has its own tax agency, which administers state income taxes and other levies. These websites provide information specific to your state, including filing deadlines, tax rates, and forms.

Tax Preparation Software

Tax preparation software offers a convenient and user-friendly way to file your taxes. These programs guide you through the process, calculate your tax liability, and electronically file your return.

| Software | Features | Pricing |

|---|---|---|

| TurboTax | Comprehensive features, guided assistance, and support | Free to paid plans, depending on complexity |

| H&R Block | User-friendly interface, live support, and tax advice | Free to paid plans, based on your needs |

| TaxAct | Affordable options, straightforward filing process, and tax tips | Free to paid plans, with various features |

Financial Advisors

Financial advisors can provide personalized tax advice and help you develop strategies to minimize your tax liability. They can guide you on deductions, credits, and other tax-saving opportunities.

- Certified Public Accountants (CPAs):CPAs are licensed professionals who specialize in accounting and taxation. They can offer comprehensive tax advice and representation during audits.

- Enrolled Agents (EAs):EAs are federally authorized tax practitioners who can represent taxpayers before the IRS. They are knowledgeable in tax laws and can assist with various tax-related matters.

- Financial Planners:Financial planners can provide holistic financial advice, including tax planning and investment strategies.

Tax Assistance Programs

For taxpayers with limited income, there are several tax assistance programs available. These programs offer free or low-cost tax preparation services and guidance.

October 2023 brings a crucial IRS tax deadline. Learn about the deadline and ensure you’re prepared to meet your tax obligations. Avoid any potential penalties and stay on top of your finances.

- Volunteer Income Tax Assistance (VITA):VITA is a program that provides free tax preparation services to low- and moderate-income taxpayers, seniors, and individuals with disabilities. [https://www.irs.gov/individuals/free-tax-preparation](https://www.irs.gov/individuals/free-tax-preparation)

- Tax Counseling for the Elderly (TCE):TCE offers free tax assistance to seniors, focusing on issues relevant to their age group, such as pensions and Social Security. [https://www.irs.gov/individuals/free-tax-preparation](https://www.irs.gov/individuals/free-tax-preparation)

Tax Assistance Hotlines

Tax assistance hotlines offer telephone support for taxpayers who have questions or need help with their tax returns.

- IRS Taxpayer Assistance Line:The IRS offers a helpline for taxpayers with general tax questions. [https://www.irs.gov/help-resources/contact-your-local-irs-office](https://www.irs.gov/help-resources/contact-your-local-irs-office)

- State Tax Agency Hotlines:Most states have a hotline dedicated to tax-related inquiries.

7. Tax Planning Tips for the October 2024 Deadline

The October 2024 tax deadline is approaching, and it’s crucial for individuals and small business owners to plan strategically to maximize deductions and minimize tax liability. This section provides practical tax planning tips to help you navigate the October 2024 deadline effectively.

Tax Deductions

Understanding available deductions is essential for reducing your taxable income. Here’s a comprehensive list of potential tax deductions for individuals and small businesses in October 2024:

- Homeownership Deductions:This includes deductions for mortgage interest, property taxes, and real estate taxes. The amount of these deductions may be limited, so it’s important to consult tax guidelines for specific details.

- Charitable Contributions:You can deduct cash donations or the fair market value of donated items. The deduction amount may be limited to a percentage of your adjusted gross income. Consult tax regulations for details.

- Medical Expenses:You can deduct medical expenses exceeding a certain percentage of your adjusted gross income. Keep detailed records of all medical expenses, including doctor’s visits, prescription drugs, and medical equipment.

- State and Local Taxes (SALT):This deduction allows you to deduct up to $10,000 in state and local taxes, including property taxes, income taxes, and sales taxes. This deduction can be particularly beneficial for individuals in high-tax states.

- Business Expenses:For small businesses, various deductions are available for expenses related to business operations, including rent, utilities, supplies, and salaries. Keep detailed records of all business expenses.

Tax Credits

Tax credits directly reduce your tax liability, offering a more significant tax benefit than deductions. Here are some common tax credits relevant to individuals and small businesses in October 2024:

- Earned Income Tax Credit (EITC):This credit is available to low- and moderate-income working individuals and families. The amount of the credit depends on your income, marital status, and the number of children you have.

- Child Tax Credit:This credit provides a tax break for families with qualifying children. The credit amount depends on the child’s age and the family’s income.

- American Opportunity Tax Credit:This credit is available for qualified students pursuing higher education. The credit amount depends on the student’s enrollment status and the family’s income.

- Small Business Tax Credits:Various tax credits are available for small businesses, such as the Work Opportunity Tax Credit (WOTC) and the Research and Development (R&D) Tax Credit.

Financial Record Organization

Maintaining accurate and organized financial records is crucial for accurate tax filing. Here’s a checklist of essential financial records to gather and organize:

- Income Statements:Gather all documents related to your income, including pay stubs, 1099 forms, and business income statements.

- Expense Receipts:Collect receipts for all deductible expenses, including medical expenses, charitable contributions, business expenses, and homeownership expenses.

- Tax Forms:Obtain copies of all relevant tax forms, such as W-2, 1099, and Form 1040.

- Investment Records:Keep records of all investment transactions, including stock purchases, sales, and dividends.

Tax Filing Process

Following a step-by-step guide can simplify the tax filing process and ensure you meet all deadlines.

- Gather Necessary Documents:Collect all relevant financial documents, including income statements, expense receipts, tax forms, and investment records.

- Choose a Filing Method:Decide whether to file electronically or by mail. E-filing offers faster processing and fewer errors, while paper filing may be more suitable for complex situations.

- Select a Tax Preparation Software:If e-filing, choose a reputable tax preparation software that meets your specific needs.

- Review and File:Carefully review all information before submitting your tax return. Ensure all deductions and credits are claimed correctly.

- Pay Taxes Due:If you owe taxes, make sure to pay them by the October 2024 deadline.

Professional Advice

If you’re unsure about specific tax planning strategies, consulting a tax professional can provide valuable guidance.

Scenario:A small business owner is considering making a significant investment in new equipment. They are unsure about the tax implications of this investment, such as potential depreciation deductions and tax credits.

Geico layoffs in October 2023 have been making headlines. Get the latest information on the situation and its potential impact on the insurance industry.

Tax Professional Advice:A tax professional can analyze the specific investment, assess potential deductions and credits, and recommend strategies to minimize tax liability.

Impact of the October 2024 Tax Deadline on Businesses

The October 2024 tax deadline presents a crucial juncture for businesses, requiring them to navigate complex tax obligations and reporting requirements. This deadline, often referred to as the “fiscal year end” for businesses, necessitates meticulous planning and timely execution to avoid penalties and maintain healthy cash flow.

Impact on Different Business Structures

The October 2024 tax deadline affects various business structures differently, each with its unique tax obligations and reporting requirements.

- Sole Proprietorships:Sole proprietorships, where the business owner and the business are legally the same, file their taxes using Schedule C of Form 1040. The owner’s personal income tax liability is directly impacted by the business’s profits or losses.

- Partnerships:Partnerships, where two or more individuals share ownership and profits, file Form 1065. While the partnership itself doesn’t pay taxes, the partners report their share of income or losses on their individual tax returns.

- Corporations:Corporations, separate legal entities from their owners, file Form 1120. They are subject to corporate income tax on their profits and may face double taxation when dividends are distributed to shareholders.

- LLCs:Limited liability companies (LLCs) offer flexibility in taxation. They can choose to be taxed as a sole proprietorship, partnership, or corporation, depending on their operating agreement and election.

Impact on Different Industries

The October 2024 deadline presents unique challenges and opportunities for businesses in various industries.

- Retail:Businesses in the retail sector may experience increased demand during the holiday season, impacting their tax obligations and cash flow.

- Technology:The tech industry, characterized by rapid innovation and growth, faces complexities in navigating tax regulations, particularly related to intellectual property and international operations.

- Healthcare:Healthcare providers grapple with evolving regulations and complex billing processes, requiring careful tax planning and compliance.

Impact on Business Size

The October 2024 deadline’s impact varies based on business size.

- Small Businesses:Small businesses often face tight cash flow and may struggle to afford professional tax assistance. They need to be especially vigilant in managing their tax obligations and seeking affordable solutions.

- Medium Businesses:Medium businesses have more resources to dedicate to tax planning and compliance but may still face challenges in managing complex tax regulations.

- Large Businesses:Large businesses have dedicated tax departments and often employ specialized tax advisors. They face greater scrutiny from tax authorities and must comply with complex reporting requirements.

Potential Penalties for Non-Compliance

Failure to meet the October 2024 tax deadline can result in significant penalties for businesses.

- Late Filing Penalty:The IRS imposes a penalty of 0.5% of the unpaid tax for each month or part of a month that the tax return is late, up to a maximum of 25% of the unpaid tax.

- Late Payment Penalty:A penalty of 0.5% of the unpaid tax is charged for each month or part of a month that the tax payment is late, up to a maximum of 25% of the unpaid tax.

- Accuracy-Related Penalty:This penalty applies if the tax return contains a substantial understatement of tax liability, either due to negligence or intentional disregard of tax laws.

Impact on Business Cash Flow

Tax obligations can significantly impact business cash flow, especially for smaller businesses with limited resources.

- Tax Payments:Businesses are required to make estimated tax payments throughout the year, which can strain their cash flow.

- Tax Liability:A large tax liability can tie up a significant portion of a business’s working capital, potentially limiting its ability to invest in growth or expansion.

Tax Obligations for Businesses

Businesses are subject to various federal, state, and local tax obligations.

- Federal Taxes:

- Income Tax:Businesses pay income tax on their profits, based on their chosen tax structure.

- Payroll Tax:Businesses withhold payroll taxes from employee wages, including Social Security and Medicare taxes.

- Employment Tax:Businesses are responsible for paying unemployment taxes and workers’ compensation insurance premiums.

- State Taxes:

- Sales Tax:Businesses that sell goods or services in a state may be required to collect and remit sales tax.

- Corporate Income Tax:Corporations are subject to state income tax on their profits.

- Local Taxes:

- Property Tax:Businesses may pay property tax on their real estate holdings.

- Business License Fees:Businesses are often required to obtain licenses and pay fees to operate in a particular locality.

Reporting Requirements for Businesses

Businesses must file specific tax forms to report their income, expenses, and tax liability.

- Form 1040:Used by sole proprietorships and partnerships to report their business income and expenses.

- Form 1120:Filed by corporations to report their income, expenses, and tax liability.

- Form 1065:Used by partnerships to report their income, expenses, and allocation of profits and losses to partners.

- Other Relevant Forms:Businesses may need to file additional forms depending on their industry, operations, and specific tax obligations.

Tax Planning Strategies for Businesses

Effective tax planning is essential for businesses to minimize their tax liability and optimize their cash flow.

PNC Bank layoffs in October 2023 have sparked concerns. Stay updated on the latest developments and their potential impact on the financial sector.

- Tax Deductions:Businesses can reduce their taxable income by claiming eligible deductions, such as business expenses, depreciation, and charitable contributions.

- Tax Credits:Businesses may qualify for various tax credits, such as the research and development tax credit or the work opportunity tax credit.

Record Keeping for Businesses

Accurate and organized record keeping is crucial for tax compliance.

- Digital Tools:Businesses can leverage digital tools, such as accounting software, to streamline record keeping and automate tasks.

- Professional Assistance:Seeking professional assistance from tax advisors or accountants can help businesses navigate complex tax regulations and ensure accurate record keeping.

Deadline Reminders for Businesses

Businesses should set reminders and establish clear deadlines for tax-related activities.

- Calendar Reminders:Use digital calendars or scheduling tools to set reminders for important tax deadlines.

- Tax Filing Checklist:Create a checklist of tasks to ensure all necessary documents are gathered and tax returns are filed on time.

Table: Tax Obligations and Reporting Requirements

| Business Structure | Tax Obligations | Reporting Requirements ||—|—|—|| Sole Proprietorship | Income tax, self-employment tax | Form 1040 (Schedule C) || Partnership | Income tax (allocated to partners) | Form 1065 || Corporation | Corporate income tax, payroll tax, employment tax | Form 1120 || LLC | Varies depending on election | Varies depending on election |

“Proactive tax planning is essential for businesses to avoid penalties and maximize their financial well-being. By understanding their tax obligations and seeking professional guidance, businesses can navigate the October 2024 deadline with confidence.”

The tax extension deadline in 2023 is approaching. Check out this article to understand the deadline and whether you qualify for an extension. Make sure you’re on track with your tax obligations.

[Tax Expert Name]

Historical Context of the October Tax Deadline

The October tax deadline is a relatively recent phenomenon in the United States. The deadline has evolved significantly over the years, influenced by various factors such as legislation, economic events, and social trends. Understanding this historical context helps us appreciate the current tax filing process and its implications for taxpayers.

Evolution of the October Tax Deadline

- Prior to 1913, there was no federal income tax in the United States. The Sixteenth Amendment to the Constitution, ratified in 1913, authorized Congress to levy an income tax. The first federal income tax was imposed in 1914, with a tax deadline of March 1st.

- In 1918, the tax deadline was shifted to March 15th, a date that has remained largely unchanged for over a century.

- The Taxpayer Relief Act of 1997 introduced the concept of an extended tax deadline for certain taxpayers, including those living abroad.

This extended deadline was initially set for June 15th.

- In 2017, the Tax Cuts and Jobs Act made significant changes to the tax code, including the introduction of a new October 15th deadline for certain taxpayers who are self-employed or operate as a small business.

Comparison of the October Deadline to Previous Deadlines

The October tax deadline represents a significant departure from the traditional March 15th deadline. It is a new deadline specifically for self-employed individuals and small business owners, designed to give them additional time to file their taxes. This deadline is intended to streamline the tax filing process and provide greater flexibility for those who need it.

The IRS October deadline in 2023 is crucial for many taxpayers. Learn more about this deadline and how it affects your tax obligations.

- The most significant change is the extended filing period for certain taxpayers. This change allows self-employed individuals and small business owners more time to gather their financial records and prepare their tax returns.

- The filing requirements for the October deadline are generally the same as those for the March 15th deadline.

However, there are some specific forms and schedules that may be required for self-employed individuals and small business owners.

- The consequences of missing the October deadline are similar to those of missing the March 15th deadline. Penalties may be assessed for late filing and late payment.

Significant Changes and Updates to the October Tax Deadline

The October tax deadline has been subject to several updates and changes over time. These changes have primarily been driven by the need to simplify the tax filing process and to address the unique needs of self-employed individuals and small business owners.

Are you a Jepi investor interested in the October 2023 dividend? This article provides details on the dividend amount and payment schedule, keeping you informed about your potential earnings.

- The introduction of electronic filing has made it easier for taxpayers to file their taxes by the October deadline. Online filing platforms have streamlined the process, allowing taxpayers to complete their returns more efficiently and accurately.

- Recent tax reforms, such as the Tax Cuts and Jobs Act, have introduced new tax laws and regulations that have impacted the October deadline.

These reforms have affected the way self-employed individuals and small business owners calculate their taxes and report their income.

Future Implications of the October 2024 Tax Deadline

The October 2024 tax deadline, while a recent development, has far-reaching implications for taxpayers and the tax system. It’s important to understand the potential changes and impacts this deadline might have in the future. The October 2024 deadline is a result of the Tax Cuts and Jobs Act of 2017, which shifted the tax year from January to December.

This change led to a compressed tax filing season in 2018, with the deadline moved to April 15. However, it also created a unique situation for individuals and businesses with certain income types.

Potential Changes to the October Deadline

The October 2024 deadline could be subject to changes in the future, influenced by factors such as legislative updates, tax reform initiatives, and evolving economic conditions.

- Legislative Updates:Congress might introduce legislation to modify the October deadline, perhaps extending it or adjusting the qualifying income types. For instance, if future legislation aims to simplify the tax code or streamline filing processes, the October deadline could be affected.

- Tax Reform Initiatives:Major tax reform initiatives, such as changes to the tax brackets, deductions, or credits, could necessitate adjustments to the October deadline. For example, if tax reform aims to simplify the tax system and eliminate certain income types that trigger the October deadline, the deadline could be abolished or modified.

- Economic Conditions:Fluctuations in economic conditions might influence the October deadline. For instance, if a recession or economic downturn leads to a need for tax relief, the deadline could be extended to provide taxpayers with more time to manage their finances.

Impact of Future Legislation or Tax Reforms, 2024 October Tax Deadline

Future legislation or tax reforms could have a significant impact on the October deadline. For example, if Congress decides to simplify the tax code by eliminating certain income types that trigger the October deadline, it could result in a shorter tax season and a more standardized filing process.

- Tax Simplification:If future tax reforms aim to simplify the tax code, the October deadline could be eliminated or modified. This simplification could reduce the number of taxpayers affected by the October deadline, making the filing process more straightforward for everyone.

- Income Type Adjustments:Changes to the types of income that trigger the October deadline could also occur. For example, if future legislation expands the definition of “qualified business income” to include additional income sources, it could potentially lead to a wider range of taxpayers being subject to the October deadline.

- Tax Rate Changes:Changes to tax rates or brackets could also impact the October deadline. For example, if tax reform introduces new tax brackets or adjusts existing rates, it could affect the way taxpayers calculate their taxes and potentially impact the October deadline.

Long-Term Implications for Taxpayers

The October 2024 deadline has long-term implications for taxpayers, as it could influence their tax planning strategies and financial decisions.

- Tax Planning Strategies:Taxpayers might need to adjust their tax planning strategies to accommodate the October deadline. For example, individuals and businesses may need to factor in the October deadline when making financial decisions, such as investments or business transactions, that could affect their income and tax liability.

- Financial Decisions:The October deadline could also influence financial decisions, such as retirement planning or estate planning. Taxpayers may need to consider the October deadline when making decisions that could affect their tax liability in the long term.

- Tax Compliance:The October deadline could increase the complexity of tax compliance for some taxpayers. For example, individuals and businesses with certain income types may need to navigate a more complex filing process and keep track of additional tax-related information.

Case Studies of the October 2024 Tax Deadline: 2024 October Tax Deadline

The October 2024 tax deadline has brought about various challenges and opportunities for individuals and businesses alike. Examining real-life scenarios can provide valuable insights into the practical implications of this extended deadline.

Impact on Self-Employed Individuals

The October 2024 tax deadline has significantly impacted self-employed individuals. These individuals often have more complex tax situations, requiring meticulous record-keeping and careful tax planning. Consider the case of Sarah, a freelance graphic designer. Sarah’s income fluctuates throughout the year, making it challenging to estimate her tax liability accurately.

The extended deadline gave her additional time to organize her finances and ensure accurate reporting of her income and expenses. However, the extended deadline also meant that Sarah had to wait longer to receive her tax refund, which she had planned to use for business expansion.

Tax Filing and Payment Strategies for the October 2024 Deadline

With the October 2024 tax deadline approaching, it’s crucial to develop a strategic plan for filing your taxes and making payments. This section explores various strategies, their advantages and disadvantages, and how to choose the best approach for your individual circumstances.

Tax Filing and Payment Strategies

Choosing the right tax filing and payment strategy can significantly impact your tax liability and financial well-being. Here are some common strategies:

| Strategy | Advantages | Disadvantages |

|---|---|---|

| File and Pay in Full by the Deadline |

|

|

| Request a Payment Plan |

|

|

| File for an Extension |

|

|

| Use a Tax Preparation Service |

|

|

| Utilize Tax Software |

|

|

Choosing the Right Strategy

The most suitable tax filing and payment strategy depends on your individual circumstances, including:

- Income level and tax liability:Higher earners with significant tax obligations may benefit from professional guidance or a payment plan.

- Financial situation and cash flow:Individuals facing financial constraints might consider payment plans or extensions.

- Complexity of your tax situation:Complex tax situations, such as self-employment or business income, may require professional assistance.

- Time available for tax preparation:Those with limited time might opt for tax software or professional preparation services.

It’s crucial to research and understand the implications of each strategy before making a decision. Consult with a tax professional if you have complex tax situations or require personalized advice.

Understanding Tax Terminology Related to the October 2024 Tax Deadline

The October 2024 tax deadline applies to certain individuals and businesses. Understanding the related tax terminology is crucial for navigating the filing process effectively. Here’s a glossary of key terms:

Tax Terminology Related to the October 2024 Deadline

The October 2024 tax deadline affects individuals and businesses with specific tax situations. Understanding the related tax terminology is crucial for navigating the filing process effectively. Here’s a glossary of key terms:

- Tax Extension: A formal request to extend the filing deadline for taxes. This allows taxpayers more time to gather necessary information and prepare their returns, but not to pay taxes owed. The extension usually grants an additional six months to file, pushing the deadline to October 15th.

- Estimated Taxes: Payments made throughout the year to cover income tax liability. Self-employed individuals, independent contractors, and those with income not subject to withholding (e.g., investments) are generally required to pay estimated taxes quarterly.

- Tax Liability: The total amount of taxes owed to the government based on income, deductions, and credits. This includes federal, state, and local taxes.

- Tax Deductions: Expenses that can be subtracted from taxable income, reducing the overall tax liability. Examples include mortgage interest, charitable donations, and medical expenses.

- Tax Credits: Direct reductions in the amount of taxes owed, unlike deductions that only reduce taxable income. Examples include the Earned Income Tax Credit (EITC) and the Child Tax Credit.

- Tax Withholding: Taxes deducted from an employee’s paycheck by their employer. This is a way to pre-pay income tax liability throughout the year.

- Self-Employment Tax: Taxes paid by self-employed individuals on their earnings. This includes Social Security and Medicare taxes, which are typically split between employer and employee for regular employees.

- Tax Form 1040: The primary federal income tax form used by most individuals to file their taxes. It includes various schedules for different types of income, deductions, and credits.

- Tax Form 1040-ES: The form used to pay estimated taxes for individuals.

- Tax Form 1040-X: The form used to amend a previously filed tax return. This may be necessary to correct errors, claim additional deductions or credits, or adjust income reported.

Outcome Summary

The October 2024 tax deadline serves as a reminder of the importance of meticulous financial planning and timely tax compliance. By understanding the filing requirements, utilizing available resources, and seeking professional assistance when needed, individuals and businesses can navigate this deadline successfully and avoid potential pitfalls.

Proactive planning and adherence to deadlines are key to ensuring a smooth and stress-free tax season.

Commonly Asked Questions

What happens if I miss the October 2024 tax deadline?

Missing the October 2024 tax deadline can result in penalties and interest charges. The penalty for late filing is typically calculated as a percentage of the unpaid tax, and interest is charged on both the unpaid tax and any penalties.

Additionally, the IRS may take enforcement actions, such as liens or levies, to collect the unpaid taxes.

Can I file my taxes early before the October 2024 deadline?

Yes, you can file your taxes early before the October 2024 deadline. Filing early can help you avoid potential delays and ensure that your taxes are filed on time. However, keep in mind that you may need to wait until you receive all of your income documentation before you can file.

What if I don’t owe any taxes? Do I still need to file by the October 2024 deadline?

Even if you don’t owe any taxes, you may still need to file a tax return. This is because you may be eligible for certain tax credits or refunds. For example, if you had taxes withheld from your paycheck, you may be entitled to a refund.

Where can I find more information about the October 2024 tax deadline?

The IRS website is a great resource for information about the October 2024 tax deadline and other tax-related matters. You can also consult with a tax professional for personalized advice.