Annuity Is A Mcq 2024, a term often encountered in financial discussions, refers to a series of payments made over a specific period. Annuities can be a powerful tool for financial planning, particularly for retirement. This guide will explore the fundamentals of annuities, delving into their types, calculations, risks, and their role in wealth management.

Google Tasks is a great to-do list app, but is it right for you? Read more about Google Tasks 2024 to see if it’s the perfect fit for your needs.

From understanding the different types of annuities, like fixed and variable, to navigating the intricacies of annuity payments and calculations, we will provide a clear and concise overview of this financial instrument. We will also examine the potential risks and considerations associated with annuities, highlighting the importance of informed decision-making.

Express yourself with unique avatars! Dollify 2024 lets you create custom avatars with tons of options for style, personality, and even emotions.

By understanding the tax implications and regulations surrounding annuities, individuals can make informed investment choices.

Contents List

Understanding Annuities

Annuity is a financial product that provides a stream of regular payments over a specified period of time. It is often used by individuals to secure a steady income stream during retirement or to provide financial protection for their loved ones.

Building a successful Android app in 2024 requires a blend of technical skill, market understanding, and a dash of creativity. Learn how to build a successful Android app in 2024 and take your app development journey to the next level.

Annuities can be complex financial instruments, and it’s crucial to understand their different types, advantages, disadvantages, and potential risks before making any investment decisions.

Defining Annuities and Their Key Characteristics

An annuity is a contract between an individual and an insurance company. The individual makes a lump-sum payment or a series of payments to the insurance company, which in turn guarantees regular payments to the individual for a specific period, either for life or for a fixed term.

Key characteristics of annuities include:

- Guaranteed Payments:Annuities provide a guaranteed stream of income, ensuring financial stability for the annuitant.

- Long-Term Investment:Annuities are designed for long-term financial planning, typically for retirement or other long-term goals.

- Tax-Deferred Growth:In many cases, the earnings from an annuity grow tax-deferred, meaning that taxes are not paid until the payments are received.

- Variety of Options:There are different types of annuities available, each with its own features and benefits.

Types of Annuities

Annuities are categorized based on various factors, including payment options, investment options, and payout periods. Here are some common types of annuities:

- Fixed Annuities:These annuities guarantee a fixed interest rate and fixed payment amounts for the duration of the contract. They provide predictable income streams, but their returns may not keep pace with inflation.

- Variable Annuities:These annuities allow the annuitant to invest in a variety of sub-accounts, similar to mutual funds. The payments are not fixed and fluctuate based on the performance of the underlying investments. Variable annuities offer the potential for higher returns but also come with greater risk.

Want to learn how to build a successful Android app in 2024? Learn about Google Tasks 2024 and how to use it effectively to get started.

- Immediate Annuities:These annuities begin making payments immediately after the initial investment. They are suitable for individuals who need immediate income, such as retirees.

- Deferred Annuities:These annuities start making payments at a future date, typically at retirement. They allow individuals to accumulate wealth over time before receiving income.

- Indexed Annuities:These annuities link their returns to the performance of a specific index, such as the S&P 500. They offer the potential for growth while providing some protection against market downturns.

Advantages and Disadvantages of Annuities

Annuities offer several advantages, but it’s important to consider their potential drawbacks as well.

Advantages:

- Guaranteed Income:Annuities provide a guaranteed stream of income, which can be especially beneficial for retirees who need financial stability.

- Tax-Deferred Growth:Earnings from annuities grow tax-deferred, allowing for potential tax savings over time.

- Protection Against Market Volatility:Fixed annuities offer protection against market downturns, providing a stable income stream regardless of market conditions.

- Long-Term Investment:Annuities are designed for long-term financial planning, allowing individuals to accumulate wealth over time.

Disadvantages:

- Limited Liquidity:Annuities can have surrender charges, which are penalties for withdrawing money early. This can limit access to funds in case of an emergency.

- Lower Returns:Fixed annuities typically offer lower returns compared to other investments, such as stocks or bonds.

- Complexity:Annuities can be complex financial instruments, requiring careful research and understanding before making any investment decisions.

- Potential for Scams:Annuities are sometimes targeted by scammers, so it’s essential to work with a reputable financial advisor.

Real-World Scenarios Where Annuities Are Used

Annuities are commonly used in various real-world scenarios, including:

- Retirement Income:Annuities can provide a steady stream of income during retirement, ensuring financial stability for individuals who have saved for their golden years.

- Long-Term Care:Annuities can be used to cover the costs of long-term care, such as nursing homes or assisted living facilities.

- Estate Planning:Annuities can be used to provide income for beneficiaries after the death of the annuitant.

- Income Protection:Annuities can provide income protection in case of disability or other unexpected events.

Annuity Payments and Calculations: Annuity Is A Mcq 2024

Annuity payments are the regular income streams that annuitants receive from their annuity contracts. These payments can be made monthly, quarterly, annually, or at other intervals, depending on the terms of the contract. Understanding how annuity payments are calculated is crucial for determining the potential income stream and making informed investment decisions.

Concept of Annuity Payments and Their Frequency

Annuity payments are based on the initial investment amount, the interest rate, and the duration of the annuity. The frequency of payments can significantly impact the overall amount received. For example, monthly payments will result in more frequent but smaller payments compared to annual payments.

Tablets are becoming more powerful, and Snapdragon 2024 is expected to bring even more power to tablets , making them ideal for work, entertainment, and everything in between.

Methods Used to Calculate Annuity Payments

Several methods are used to calculate annuity payments, each with its own assumptions and considerations. Some common methods include:

- Present Value:This method calculates the present value of a future stream of payments, considering the time value of money. It helps determine the lump-sum amount needed to fund the annuity.

- Future Value:This method calculates the future value of a series of payments, considering compound interest. It helps estimate the total amount received over the annuity’s duration.

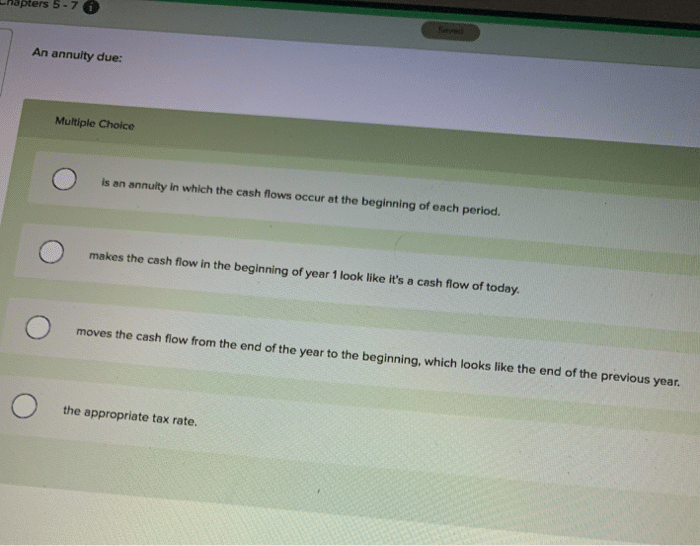

- Annuity Due:This method calculates payments made at the beginning of each period, as opposed to the end of the period.

- Perpetuity:This method calculates payments that continue indefinitely, with no end date.

Examples of Annuity Payment Calculations, Annuity Is A Mcq 2024

Consider a scenario where an individual invests $100,000 in a fixed annuity with a 5% annual interest rate for 20 years. Using the present value method, the annuity payment would be approximately $8,024 per year. This calculation assumes that payments are made at the end of each year.

Want to get the most out of Google Tasks? Learn some tips and tricks for using Google Tasks effectively in 2024 and boost your productivity.

If payments were made at the beginning of each year (annuity due), the payment amount would be slightly higher.

Table Comparing Different Annuity Payment Methods

| Method | Description | Formula | Example |

|---|---|---|---|

| Present Value | Calculates the present value of a future stream of payments | PV = PMT

The Android app development landscape is constantly evolving. Keep up with the latest trends in Android app development in 2024 to create successful and engaging apps.

|

PV = $8,024

The world of avatars is evolving rapidly, and AI is playing a huge role in how we create avatars. Dollify 2024 is a prime example of how AI is changing the game.

|

| Future Value | Calculates the future value of a series of payments | FV = PMT

|

FV = $8,024

|

| Annuity Due | Calculates payments made at the beginning of each period | PV = PMT

Want to streamline your team’s workflow? Setting up Google Tasks for teams can be a game changer. It allows you to assign tasks, set deadlines, and track progress, all in one place.

|

PV = $8,024

Android WebView is getting a major performance boost in 2024! The improvements in Android WebView 202 are making browsing on Android smoother and faster than ever.

|

| Perpetuity | Calculates payments that continue indefinitely | PV = PMT / r | PV = $8,024 / 0.05 = $160,480 |

Annuity Risks and Considerations

While annuities can provide financial security and income streams, they also come with inherent risks and considerations. It’s crucial to understand these potential drawbacks before making any investment decisions. Failure to consider these risks can lead to financial losses or unexpected outcomes.

Looking for a convenient way to order food from your favorite restaurants? The Glovo app makes restaurant delivery easy , allowing you to browse menus, order, and track your delivery all in one place.

Potential Risks Associated with Annuities

Here are some potential risks associated with annuities:

- Market Risk:Variable annuities are subject to market risk, meaning the value of the underlying investments can fluctuate, potentially leading to losses.

- Interest Rate Risk:Fixed annuities can be affected by interest rate changes. If interest rates rise, the fixed rate offered by the annuity may become less attractive compared to other investment options.

- Inflation Risk:The purchasing power of annuity payments can be eroded by inflation. If inflation outpaces the annuity’s growth rate, the payments may not provide the same level of living standards over time.

- Surrender Charges:Annuities often have surrender charges, which are penalties for withdrawing money early. These charges can significantly reduce the amount received if the annuitant needs to access their funds before the annuity’s maturity.

- Company Risk:Annuities are issued by insurance companies, and there is a risk that the company could become insolvent or unable to fulfill its obligations. This risk is mitigated by choosing a reputable and financially stable insurance company.

Factors to Consider When Choosing an Annuity

Several factors should be considered when choosing an annuity, including:

- Financial Goals:What are your financial goals for the annuity? Are you seeking guaranteed income, tax-deferred growth, or a combination of both?

- Risk Tolerance:How much risk are you willing to take? Fixed annuities offer lower risk but potentially lower returns, while variable annuities offer higher potential returns but also greater risk.

- Time Horizon:How long do you plan to hold the annuity? Annuities are typically long-term investments, so it’s essential to consider your time horizon.

- Fees and Expenses:Compare the fees and expenses associated with different annuity products. Some annuities have higher fees than others, which can impact your overall returns.

- Company Reputation:Choose an annuity from a reputable and financially stable insurance company. Research the company’s track record and financial stability before making any investment decisions.

Importance of Understanding the Terms and Conditions of an Annuity Contract

It’s crucial to carefully review the terms and conditions of an annuity contract before making any investment decisions. The contract should clearly Artikel the annuity’s features, benefits, risks, and limitations. Pay particular attention to the following:

- Payment Schedule:How often will payments be made? What is the duration of the payment period?

- Interest Rate:What is the interest rate on the annuity? Is it fixed or variable?

- Surrender Charges:Are there any surrender charges for withdrawing money early?

- Death Benefit:What happens to the annuity upon the death of the annuitant? Is there a death benefit payable to beneficiaries?

- Fees and Expenses:What are the fees and expenses associated with the annuity? How will these fees impact your overall returns?

Common Annuity Scams and How to Avoid Them

Annuities are sometimes targeted by scammers who prey on individuals seeking financial security. Here are some common annuity scams and tips for avoiding them:

- High-Pressure Sales Tactics:Be wary of salespeople who use high-pressure tactics or make unrealistic promises of high returns. Legitimate financial advisors will provide you with unbiased information and allow you to make informed decisions.

- Guaranteed Returns:No investment, including annuities, can guarantee returns. Be skeptical of any promises of guaranteed profits.

- Free Money or Bonuses:Be cautious of offers of free money or bonuses for purchasing an annuity. These offers may be designed to lure you into a scam.

- Limited-Time Offers:Don’t feel pressured to make a decision based on a limited-time offer. Legitimate financial products are available year-round.

- Check the Company’s Reputation:Before investing in an annuity, check the reputation of the insurance company issuing the product. You can use online resources such as the Better Business Bureau or the National Association of Insurance Commissioners to research the company’s track record.

Annuity Taxation and Regulations

Understanding the tax implications of annuities is crucial for making informed investment decisions. The tax treatment of annuities can vary depending on the type of annuity, the payment structure, and other factors. It’s essential to consult with a tax professional to determine the specific tax implications of your annuity.

Tax Implications of Annuities

Annuities generally offer tax-deferred growth, meaning that taxes are not paid until the payments are received. However, the tax treatment of annuity payments can vary depending on the type of annuity and the payment structure.

Don’t have a big budget for a new phone? Android Authority has some great budget phone recommendations for 2024 , proving you don’t need to spend a fortune to get a great Android experience.

- Fixed Annuities:Payments from fixed annuities are typically taxed as ordinary income. The interest earned on the annuity is taxed at the annuitant’s ordinary income tax rate.

- Variable Annuities:Payments from variable annuities are taxed as a combination of ordinary income and capital gains. The portion of the payment representing the original investment is not taxed, while the portion representing earnings is taxed at the appropriate income tax rate or capital gains tax rate.

Looking for the best chipset for your next gaming phone? Snapdragon 2024 is rumored to be a powerhouse for gaming, boasting incredible performance and graphics capabilities.

- Deferred Annuities:When payments from a deferred annuity begin, the annuitant will typically receive a combination of principal and earnings. The portion of the payment representing the original investment is not taxed, while the portion representing earnings is taxed as ordinary income.

Regulations Governing Annuities

Annuities are subject to various regulations at both the federal and state levels. These regulations are designed to protect consumers and ensure that annuity products are sold fairly and transparently.

If you’re planning on using an annuity, it’s important to understand the tax implications. Annuity income is taxable in 2024 , so make sure to factor that into your financial planning.

- The Employee Retirement Income Security Act (ERISA):ERISA governs employer-sponsored retirement plans, including annuities offered through these plans.

- The Internal Revenue Code (IRC):The IRC defines the tax treatment of annuities and other retirement income sources.

- State Insurance Regulations:Each state has its own insurance regulations that govern the sale and regulation of annuity products within that state.

Examples of How Annuity Taxation Can Impact Investment Decisions

Consider two individuals, both of whom are 65 years old and have invested $100,000 in a fixed annuity. Individual A is in a lower tax bracket and has a 15% marginal tax rate, while Individual B is in a higher tax bracket and has a 25% marginal tax rate.

If both individuals receive $10,000 in annuity payments annually, Individual A will pay $1,500 in taxes, while Individual B will pay $2,500 in taxes. This demonstrates how tax brackets can significantly impact the after-tax income received from annuities.

Flowchart Illustrating the Tax Treatment of Different Annuity Types

The tax treatment of annuities can be complex, and it’s essential to understand the different tax implications of various annuity types. Here’s a simplified flowchart illustrating the tax treatment of different annuity types:

[Insert flowchart image here. The flowchart should visually represent the tax treatment of fixed annuities, variable annuities, and deferred annuities, including the taxability of principal and earnings.]

Closing Summary

Annuities can be a valuable component of a well-structured financial plan, offering income security and the potential for growth. By understanding the key concepts, risks, and considerations involved, individuals can effectively incorporate annuities into their financial strategies. Remember to seek professional advice and carefully evaluate the terms and conditions of any annuity contract before making a decision.

Key Questions Answered

What are the different types of annuities?

Annuities can be categorized based on payment structure, investment options, and other factors. Common types include fixed annuities, variable annuities, immediate annuities, and deferred annuities.

How are annuity payments calculated?

Annuity payments are calculated using various methods, including present value, future value, and amortization. The specific method depends on the type of annuity and the desired outcome.

Are annuities safe investments?

Annuities, like any investment, carry risks. The level of risk depends on the type of annuity chosen. It’s crucial to understand the potential risks and carefully consider the terms and conditions of the annuity contract.

How are annuities taxed?

If you’re looking for the best camera phones of the year, Android Authority has you covered. They’ve compiled a list of the top picks for 2024, so you can find the perfect camera phone for your needs.

The tax implications of annuities can vary depending on the type of annuity and the specific circumstances. It’s essential to consult with a tax advisor to understand the tax treatment of your annuity.