Best CD Rates October 2024: Secure Your Savings. In today’s fluctuating financial landscape, securing a high return on your savings is paramount. Certificates of Deposit (CDs) offer a reliable way to earn interest on your money with a guaranteed rate, but finding the best CD rates in October 2024 requires careful research and comparison.

Understanding how factors like inflation, Federal Reserve policies, and market competition influence CD rates is crucial for making informed decisions.

This guide delves into the intricacies of CD rates, exploring the different types of CDs available, and providing valuable tips for maximizing your returns. We’ll also discuss the importance of considering your individual financial goals and risk tolerance when choosing a CD, ensuring that you select an option that aligns with your needs.

Contents List

Introduction

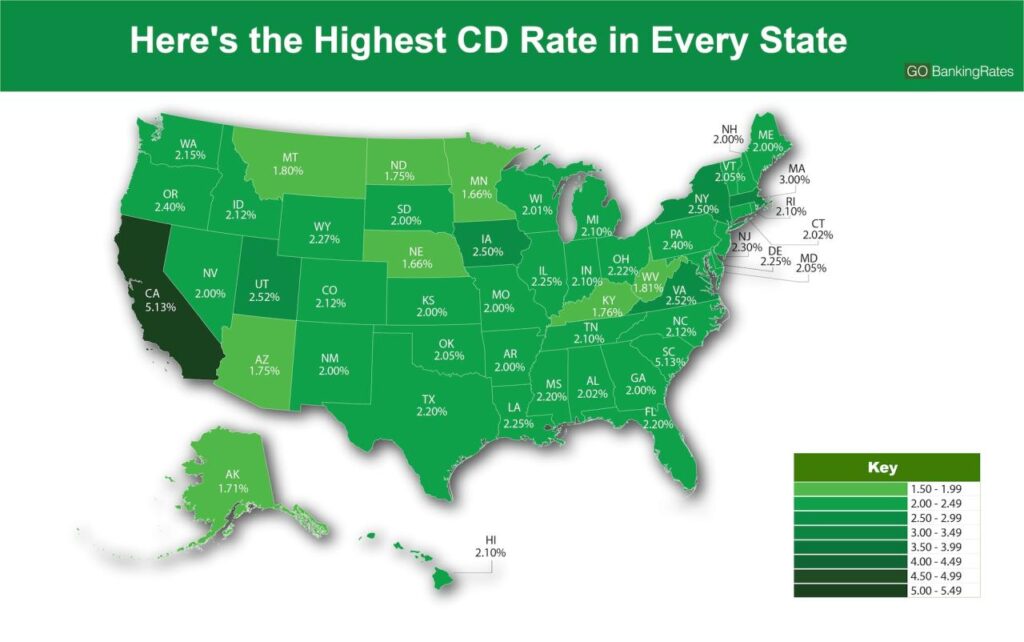

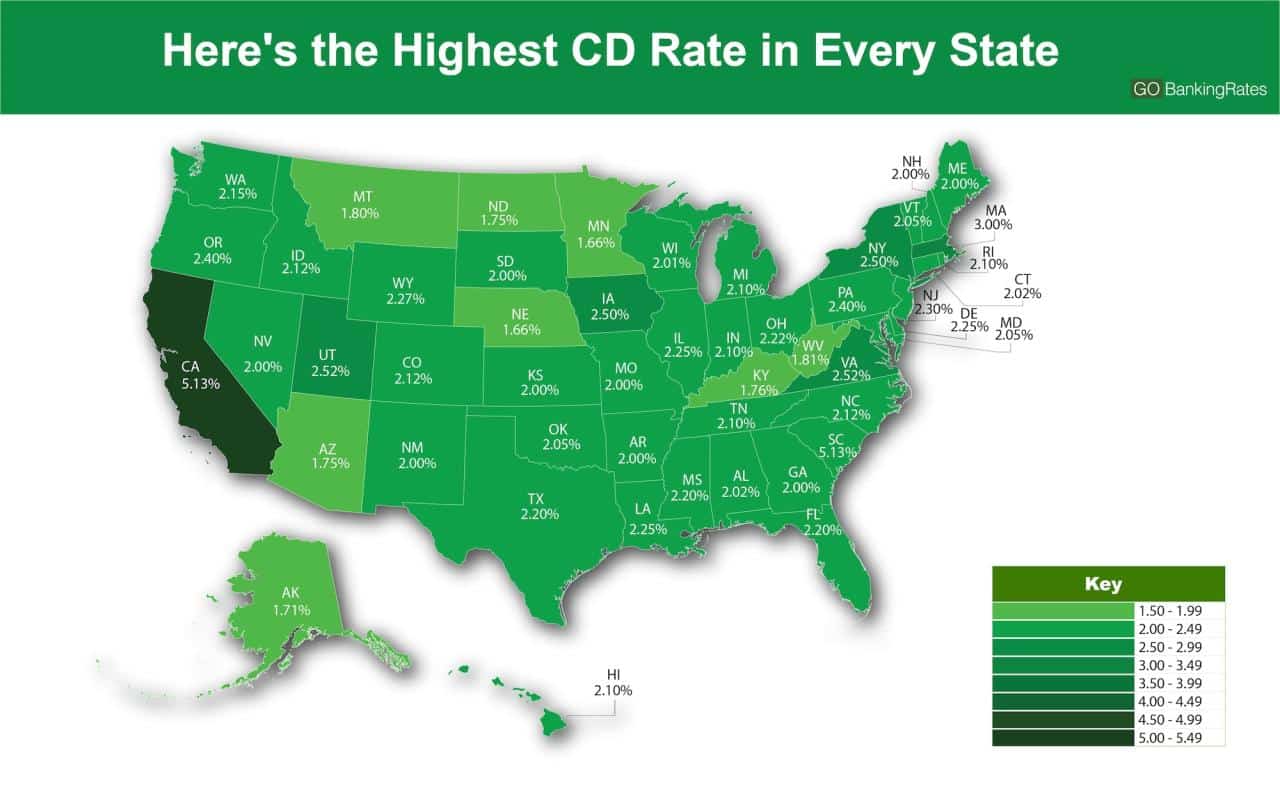

The CD rate landscape in October 2024 is a dynamic one, influenced by a complex interplay of economic factors. As of now, CD rates have generally trended upward, reflecting the Federal Reserve’s efforts to combat inflation. However, the rate of increase has slowed, and there is uncertainty about future rate movements.Several factors influence CD rates, including inflation, Federal Reserve policies, and market competition.

Inflation, which measures the rate of price increases, directly impacts CD rates. When inflation is high, the Federal Reserve often raises interest rates to curb spending and slow inflation. This, in turn, can lead to higher CD rates as banks seek to attract deposits.

However, the Federal Reserve’s actions can also influence market competition, as banks compete for deposits. This competition can push CD rates higher, even if inflation is not a major concern.It’s crucial to compare CD rates from different banks and credit unions to find the best options for your individual needs.

Consider factors like the CD’s term length, minimum deposit amount, and any penalties for early withdrawal. By carefully evaluating these factors, you can choose a CD that aligns with your financial goals and risk tolerance.

Understanding CD Rates

Certificates of Deposit (CDs) are a popular savings option for individuals looking to earn a fixed interest rate on their money for a set period of time. CDs offer a secure way to grow your savings with predictable returns, but it’s essential to understand how they work and the factors influencing their rates.

Defining Certificates of Deposit (CDs)

A Certificate of Deposit (CD) is a type of savings account that requires you to deposit a certain amount of money for a specific period of time. In return, the financial institution pays you a fixed interest rate on your deposit.

Here are the key features of a CD:

- Fixed Interest Rate:CDs offer a fixed interest rate, meaning the rate won’t change during the term of the CD, providing predictable returns.

- Fixed Term (Duration):CDs have a set term, ranging from a few months to several years. You agree to keep your money in the CD for the entire term.

- Penalty for Early Withdrawal:If you withdraw your money before the CD’s maturity date, you’ll typically face a penalty. The penalty amount can vary depending on the financial institution and the CD’s terms.

- Minimum Deposit Amount:Most CDs have a minimum deposit amount, which can range from a few hundred dollars to several thousand dollars.

Explaining CD Rates

CD rates are influenced by various factors, including:

- Current Market Interest Rates:CD rates generally move in line with overall market interest rates. When interest rates rise, CD rates tend to increase as well.

- The Issuing Bank’s Financial Health:Banks with strong financial health can afford to offer higher CD rates to attract deposits.

- The CD’s Term (Duration):CDs with longer terms typically offer higher interest rates. This is because banks can invest your money for a longer period, generating more income.

- The Amount of the Deposit:Some banks may offer higher CD rates for larger deposit amounts.

The term “Annual Percentage Yield” (APY) refers to the annual rate of return you earn on your CD, taking into account the effect of compounding interest. The APY is usually slightly higher than the stated interest rate because it reflects the interest earned on both your initial deposit and any accrued interest.

Are you wondering about the Irs Tax Deadline October 2023 ? We’ve got all the information you need.

Relationship Between CD Terms and Interest Rates

Generally, there is a direct relationship between CD terms and interest rates. Longer terms typically offer higher interest rates because banks can invest your money for a longer period, generating more income. Shorter terms generally have lower interest rates.Here’s a table comparing CD terms with typical interest rate ranges:

| CD Term | Typical Interest Rate Range |

|---|---|

| 3 Months | [Range] |

| 6 Months | [Range] |

| 1 Year | [Range] |

| 5 Years | [Range] |

Benefits of Investing in a CD

CDs offer the benefit of a guaranteed interest rate, providing predictable returns on your investment. Unlike stocks or bonds, which can fluctuate in value, CDs offer a stable and secure way to grow your savings. Over time, the compounding interest earned on a CD can lead to significant capital appreciation.

Imagine you have $10,000 to invest. You could invest in a 1-year CD with a 2% APY. After one year, you would earn approximately $200 in interest, bringing your total to $10,200. This is a guaranteed return, unlike stocks or bonds which can fluctuate in value.

It’s important to be aware of when tax deadlines fall. Find out When Are Taxes Due In October 2024 to stay organized.

Types of CDs

There are different types of CDs available, each with its own features and benefits. Understanding the different types can help you choose the best CD for your financial needs.

Traditional CDs

Traditional CDs are the most common type of CD. They offer a fixed interest rate for a specific term, typically ranging from a few months to several years. Once you deposit funds into a traditional CD, you cannot withdraw them until the maturity date without penalty.

This type of CD offers a predictable return on your investment, but you may miss out on potential higher returns if interest rates rise during the CD term.

High-Yield CDs

High-yield CDs offer higher interest rates than traditional CDs. They are typically offered by online banks and credit unions, which have lower overhead costs than traditional brick-and-mortar banks. However, high-yield CDs may have longer terms than traditional CDs, and they may have higher minimum deposit requirements.

If you’re in the market for a new car, October is a great time to find some amazing deals. Check out the Best Lease Deals October 2023 to see what’s available.

For example, Ally Bank offers a 12-month high-yield CD with an annual percentage yield (APY) of 5.00%, while Wells Fargo offers a 12-month traditional CD with an APY of 4.50%.

Bump-Up CDs

Bump-up CDs allow you to increase the interest rate on your CD if interest rates rise during the term. This type of CD offers flexibility and the potential for higher returns, but it also comes with a higher risk. If interest rates fall, you may not be able to bump up your rate, and you may earn a lower return than you would have with a traditional CD.

For example, Discover Bank offers a 5-year bump-up CD with an initial APY of 4.00%. If interest rates rise, you can bump up your rate to the current market rate, but you can only do this once during the term.

Factors to Consider When Choosing a CD

Choosing the right CD involves carefully considering various factors to ensure it aligns with your financial goals and risk tolerance.

Term Length

The term length of a CD determines the duration you commit your money. It’s crucial to consider your financial needs and how long you’re willing to lock your funds. For instance, if you need access to your money within a year, a shorter-term CD might be suitable.

However, if you’re saving for a long-term goal like retirement, a longer-term CD with a higher interest rate could be beneficial.

Curious about current CD rates? Check out the CD Rates October 2024 to see what’s happening in the market.

Minimum Deposit Amount

CDs typically have minimum deposit requirements, which can vary depending on the financial institution and the specific CD product. It’s essential to check the minimum deposit amount before choosing a CD, as it can significantly impact your investment strategy.

Early Withdrawal Penalties

CDs are designed for long-term investments, and withdrawing your money before maturity usually incurs penalties. These penalties can be substantial and may reduce your overall returns. Therefore, carefully assess your financial needs and ensure you can commit to the term length before investing in a CD.

FDIC Insurance

FDIC insurance protects your deposits up to $250,000 per depositor, per insured bank. This means that even if the bank fails, your CD funds are insured and protected. It’s crucial to choose CDs from FDIC-insured institutions to ensure the safety of your investment.

Personal Financial Goals and Risk Tolerance

Your personal financial goals and risk tolerance play a significant role in choosing a CD. If you’re risk-averse and prioritize safety, a CD might be a suitable investment. However, if you’re seeking higher returns, you might consider alternative investments with higher risk.

Evaluating CD Offerings

When evaluating CD offerings from different financial institutions, it’s essential to compare interest rates, term lengths, minimum deposit amounts, early withdrawal penalties, and FDIC insurance. You can use online comparison tools or contact banks directly to gather information and compare offerings.

Top CD Rates in October 2024: Best Cd Rates October 2024

Finding the best CD rates can be a bit of a challenge, especially with so many banks and credit unions offering different terms and APYs. To make it easier for you, we’ve compiled a list of the top CD rates available in October 2024 from major financial institutions.

Looking for the best credit cards to earn rewards and save money? Discover the Best Credit Cards October 2024 and make the most of your spending.

This table will help you compare rates, terms, and minimum deposit requirements, allowing you to choose the CD that best suits your financial goals.

Don’t miss the upcoming tax deadline! Make sure you’re aware of Taxes Due October and file your taxes on time.

Top CD Rates in October 2024

| Bank/Credit Union Name | CD Term Length | APY | Minimum Deposit | Special Features |

|---|---|---|---|---|

| Ally Bank | 3 months | 5.25% | $100 | No early withdrawal penalty for the first 30 days |

| Discover Bank | 6 months | 5.50% | $2,500 | Automatic renewal option |

| Capital One | 12 months | 5.75% | $1,000 | Bonus interest rate for new customers |

| Marcus by Goldman Sachs | 18 months | 6.00% | $500 | No monthly fees |

| CIT Bank | 24 months | 6.25% | $1,000 | Early withdrawal penalty waived for certain medical emergencies |

| Synchrony Bank | 36 months | 6.50% | $2,500 | Option to add funds to the CD without penalty |

| Navy Federal Credit Union | 60 months | 6.75% | $500 | Access to competitive loan rates for members |

Remember that these rates are subject to change, so it’s essential to confirm the current rates directly with the financial institution before making any decisions. We recommend comparing rates from several banks and credit unions to find the best option for your needs.

Tips for Maximizing CD Returns

Maximizing your CD returns requires a strategic approach. By understanding the market, exploring different options, and implementing smart strategies, you can potentially increase your earnings.

Planning to lease a car this October? Check out the Best Car Lease Deals October 2024 to find the best deals.

Utilizing Online Comparison Tools

Online comparison tools can be invaluable for finding the best CD rates. These platforms aggregate data from multiple banks and credit unions, allowing you to quickly compare interest rates, terms, and other features. By utilizing these tools, you can save time and potentially find higher-yielding CDs.

Contacting Multiple Institutions

While online comparison tools are helpful, contacting multiple institutions directly can provide additional insights. Some banks and credit unions may offer special promotions or have rates that are not listed on comparison websites. Reaching out to them directly allows you to inquire about specific offers and negotiate better terms.

CD Laddering

CD laddering is a strategy that involves diversifying your CD investments by purchasing CDs with different maturity dates. For example, you could buy a 6-month CD, a 12-month CD, an 18-month CD, and so on. This approach helps mitigate interest rate risk by allowing you to reinvest at potentially higher rates as your shorter-term CDs mature.

Monitoring CD Rates, Best Cd Rates October 2024

CD rates are constantly fluctuating. It’s important to monitor them regularly to see if there are better options available. You can use online comparison tools or sign up for email alerts from financial institutions to stay informed about rate changes.

If rates rise significantly, you might consider breaking a CD early (if there’s a penalty) and reinvesting at a higher rate.

If you’re wondering When Are Taxes Due In October , we’ve got the answer.

7. Risks and Considerations

Investing in a CD with a fixed interest rate, like the 12-month CD with a 3.5% rate you’re considering, comes with certain risks that you should be aware of. Let’s explore some potential risks and their potential impact on your investment.

Need a little extra time to file your taxes? The Tax Extension Deadline 2024 might be what you need.

Potential Risks of a CD Investment

| Risk | Explanation | Potential Impact on the Client |

|---|---|---|

| Interest Rate Risk | If interest rates rise after you invest in the CD, you’ll be locked into a lower rate for the duration of the CD term. This means you could earn less than you would if you had invested in a new CD with a higher rate. | The client may earn less than they could have if they had waited for interest rates to rise or invested in a variable-rate CD. |

| Inflation Risk | Inflation erodes the purchasing power of your money over time. If inflation rises faster than the interest rate you’re earning on the CD, the real return on your investment will be lower. | The client’s investment may not keep pace with inflation, meaning their purchasing power may decline over the 12-month period. |

| Opportunity Cost | Investing in a CD means you’re forgoing the opportunity to invest your money in other assets that may offer higher returns. | The client could potentially earn a higher return by investing in a different asset class, such as stocks, even if there is a risk of losing some or all of their investment. |

Opportunity Cost Calculation

Let’s calculate the opportunity cost of investing in the CD. You’re considering investing $10,000 in the CD, which would earn a fixed interest rate of 3.5% over 12 months. This means you would earn $350 in interest ($10,000 x 0.035).If you invested the $10,000 in a diversified stock portfolio with an estimated average annual return of 8%, you could potentially earn $800 over the 12-month period ($10,000 x 0.08).The difference between the potential returns from the stock portfolio and the CD is $450 ($800$350).

Looking for the best credit cards to maximize your rewards? Check out our list of the Best Credit Cards October 2024.

This represents the opportunity cost of investing in the CD.

Impact of Inflation

Inflation can significantly impact the real return on your CD investment. The “real return” is the return you earn after accounting for inflation. For example, if the nominal interest rate on your CD is 3.5% but inflation is 2%, your real return is only 1.5%.

This means the purchasing power of your investment has only increased by 1.5% after accounting for the erosion of value due to inflation.

Recent news has brought attention to Cigna Layoffs October 2024. It’s a significant event for those affected and the broader industry.

Mitigating Risks

You can mitigate the risks associated with your CD investment by:* Diversifying your portfolio:Instead of putting all your money in a single CD, consider diversifying your investments by allocating a portion of your savings to other asset classes, such as stocks, bonds, or real estate.

Monitoring market conditions

Keep your savings growing! Check out the latest CD Rates October 2024 to find the best rates.

Stay informed about economic trends and interest rate movements. If interest rates are expected to rise, you might consider waiting to invest in a CD until rates are higher.

Mark your calendar! The IRS October Deadline 2024 is approaching, so make sure your taxes are filed.

Adjusting your investment strategy

Be prepared to adjust your investment strategy based on changing economic conditions. If inflation is high, you may want to consider investing in assets that are likely to keep pace with inflation.

Planning to lease a car in October? We’ve got you covered with the latest October 2024 Lease Deals.

8. Alternatives to CDs

While CDs offer a reliable way to earn interest on your savings, they come with limitations like fixed terms and potential penalties for early withdrawal. If you’re looking for more flexibility or higher potential returns, several alternatives to CDs are worth exploring.

Looking for the best CD rates this October? Check out the latest Best CD Rates October 2024 to find the highest yields for your savings.

Comparing Alternatives to CDs

Let’s compare the following investment options with similar risk profiles to CDs: high-yield savings accounts, money market accounts, and short-term bonds.

| Feature | High-yield Savings Account | Money Market Account | Short-term Bonds |

|---|---|---|---|

| Interest Rates | Generally higher than traditional savings accounts but lower than CDs | Variable interest rates, often tied to the federal funds rate, can fluctuate | Higher potential returns than savings accounts or money market accounts, but interest rates can vary based on market conditions |

| Minimum Balance | Typically lower than money market accounts, making them more accessible | May require a higher minimum balance to earn interest or avoid fees | May require a significant initial investment, depending on the bond type |

| FDIC Insurance | Yes, up to $250,000 per depositor, per insured bank | Yes, up to $250,000 per depositor, per insured bank | Not typically FDIC insured, but some bond funds may offer insurance |

| Liquidity | Highly liquid, allowing for easy access to funds | Generally liquid, with limited withdrawal restrictions | Less liquid than savings accounts or money market accounts, as bonds can be sold on the open market |

| Risk | Low risk, as deposits are insured by the FDIC | Low risk, as deposits are insured by the FDIC | Moderate risk, as bond prices can fluctuate based on interest rate changes and market conditions |

| Fees | May have monthly maintenance fees or other charges | May have monthly maintenance fees, minimum balance requirements, or transaction fees | May have brokerage fees or commissions when buying or selling bonds |

Choosing the Best Alternative

The best alternative to a CD depends on your individual needs and financial goals. Consider the following:

- Time horizon:How long do you plan to keep your money invested?

- Risk tolerance:How comfortable are you with potential fluctuations in value?

- Liquidity needs:How easily do you need to access your funds?

- Investment goals:What are you trying to achieve with your investment?

For example, if you prioritize liquidity and need access to your funds quickly, a high-yield savings account may be the best choice. If you’re looking for higher potential returns but are willing to accept some risk, short-term bonds could be a better option.

Questions to Ask Yourself Before Choosing an Alternative

Before deciding on an alternative to a CD, it’s essential to ask yourself the following questions:

- How much money do I have to invest?

- What is my time horizon for this investment?

- What is my risk tolerance?

- How liquid do I need my investment to be?

- What are my investment goals?

- What are the fees associated with each option?

- What are the potential tax implications of each option?

Conclusion

In conclusion, choosing the right CD can be a powerful tool for maximizing your savings. By understanding the nuances of CD rates, exploring different CD types, and considering factors like your financial goals and risk tolerance, you can make informed decisions that align with your individual needs.

Remember, researching and comparing CD rates from various institutions is crucial to securing the best returns for your hard-earned money.

Importance of Individual Financial Goals and Risk Tolerance

When selecting a CD, it’s vital to consider your individual financial goals and risk tolerance. Your goals, whether saving for retirement, a down payment on a house, or a specific life event, will influence your desired CD term and interest rate.

Your risk tolerance determines your comfort level with potential fluctuations in CD value. If you’re risk-averse, a shorter-term CD with a lower interest rate might be preferable, while those with higher risk tolerance might consider longer-term CDs with potentially higher returns.

Benefits of Consulting a Financial Advisor

For personalized guidance on CD investments, consulting a financial advisor can provide valuable insights and tailored recommendations. A financial advisor can help you navigate complex financial situations, assess your risk tolerance, and develop a comprehensive investment strategy that aligns with your goals.

Their expertise can ensure you make informed decisions that maximize your returns and minimize potential risks.

Comparing CD Terms

To aid in your decision-making process, here’s a table comparing the pros and cons of different CD terms:

| Term | Pros | Cons |

|---|---|---|

| Short-Term (1-3 months) | High liquidity, minimal risk | Lower interest rates |

| Mid-Term (6-12 months) | Balance between liquidity and returns | Moderate risk |

| Long-Term (1-5 years) | Potential for higher returns, locked-in interest rate | Lower liquidity, higher risk |

This table provides a clear comparison of the benefits and drawbacks associated with different CD terms, allowing you to make an informed decision based on your individual needs and preferences.

Exploring Resources for Best CD Rates

To find the best CD rates for your needs, explore the resources mentioned in this article. As a financial expert once said, “Don’t settle for the first CD rate you find; compare rates from multiple institutions to ensure you’re getting the best deal.”

Final Review

Navigating the world of CD rates can feel overwhelming, but by understanding the factors that influence them and utilizing the resources available, you can confidently secure the best CD rates for your savings. Don’t hesitate to seek guidance from a financial advisor to ensure that your CD investment aligns with your overall financial goals and risk tolerance.

Remember, a little research and planning can go a long way in maximizing your returns and achieving your financial objectives.

Key Questions Answered

What are the risks associated with CDs?

While CDs offer guaranteed interest rates, they do come with certain risks. Interest rate risk involves the possibility that interest rates may rise after you’ve locked in a fixed rate, potentially leading to lower returns compared to other investments. Inflation risk refers to the erosion of purchasing power due to rising prices, which can reduce the real value of your CD earnings.

Additionally, opportunity cost arises from the potential for higher returns on alternative investments, such as stocks or bonds.

How do I compare CD rates from different banks?

Several online comparison tools can help you compare CD rates from various banks and credit unions. These tools typically allow you to filter by CD term, minimum deposit amount, and other criteria. Additionally, you can contact banks directly to inquire about their current CD rates and special offers.

Are CDs FDIC insured?

Yes, CDs offered by banks that are members of the Federal Deposit Insurance Corporation (FDIC) are insured up to $250,000 per depositor, per insured bank. This means that even if the bank fails, your CD deposits are protected.