An Annuity Is A Stream Of 2024: Your Guide to Retirement Income. Annuities, a financial instrument that provides a steady stream of income for life, have become increasingly popular in recent years. With interest rates fluctuating and market volatility on the rise, many individuals are seeking ways to secure their financial future.

Pushbullet is a great tool for file sharing, but if you’re looking for alternatives, check out our article, Pushbullet 2024: What are the best Pushbullet alternatives for file sharing? , where we explore the best options for seamless file transfer.

Annuities offer a potential solution, providing a guaranteed income stream that can help supplement other retirement savings.

Snapdragon processors are known for their camera performance. Our article, Snapdragon 2024 camera performance , delves into the latest Snapdragon chips and their impressive camera capabilities.

This guide explores the intricacies of annuities in 2024, covering everything from the basics to advanced strategies. We’ll delve into the different types of annuities, their advantages and disadvantages, and how to choose the right one for your individual needs.

The landscape of Android app development is constantly evolving. Learn about the latest trends and future directions in our article, Future of Android app development in 2024 , giving you insights into the exciting future of this field.

We’ll also discuss the current market conditions and their impact on annuity payouts, providing valuable insights to help you make informed decisions.

Google Tasks is evolving to become a more comprehensive task management solution. Explore the future of task management in our article, Google Tasks 2024: The Future of Task Management , and see how Google Tasks is shaping the future of productivity.

Contents List

What is an Annuity?

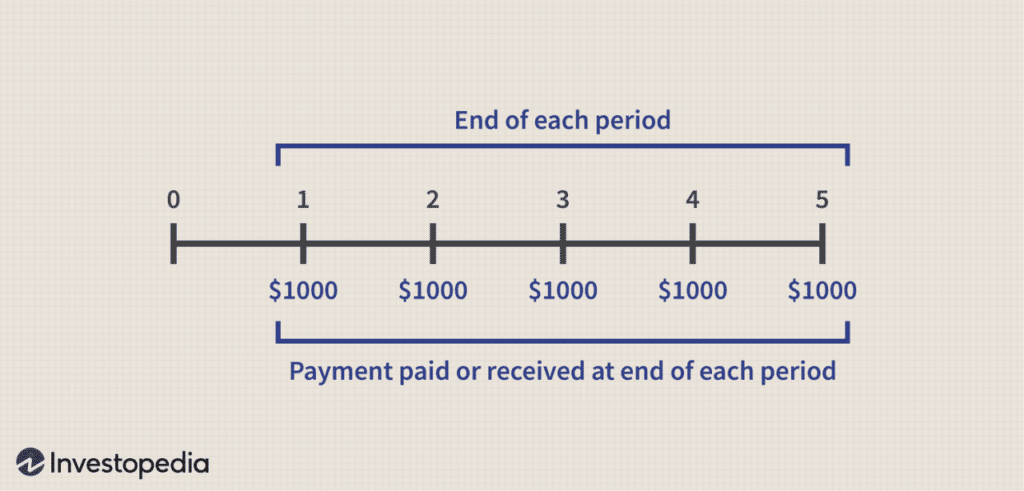

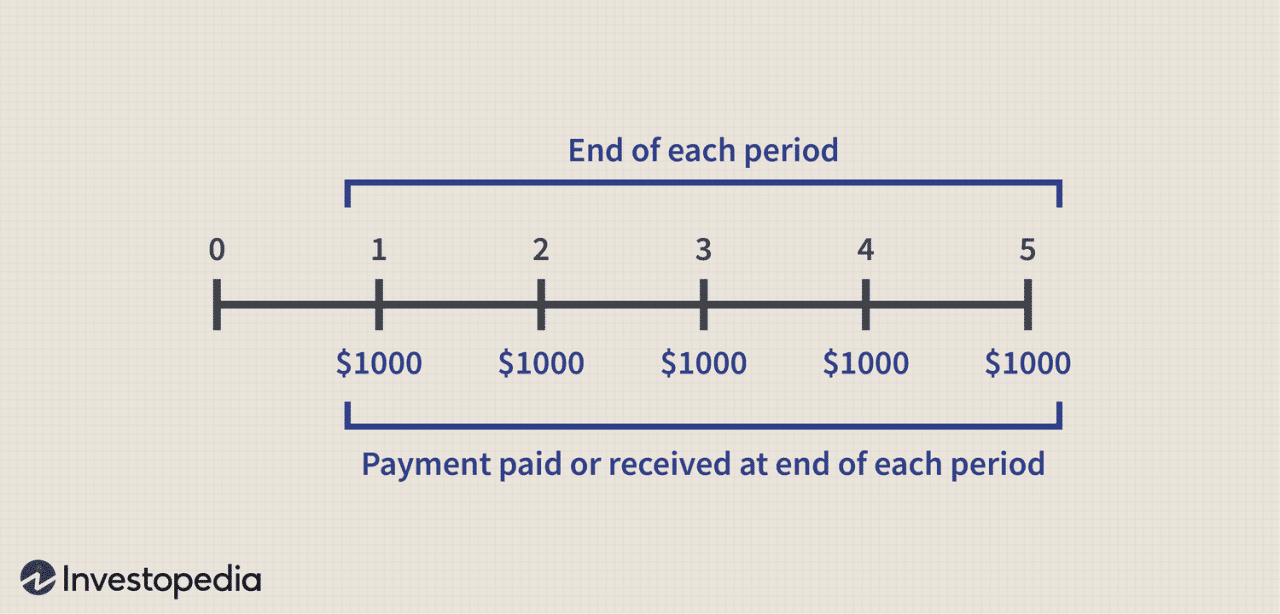

An annuity is a financial product that provides a stream of regular payments, either for a fixed period or for the lifetime of the annuitant. Annuities are designed to provide a steady income stream, particularly during retirement, and can be used for a variety of financial goals, such as income generation, retirement planning, and estate planning.

Interested in Android app development but not sure where to start? Our article, Android app development for beginners in 2024 , provides a beginner-friendly guide to help you navigate the world of Android development.

Types of Annuities

Annuities come in various forms, each with its own characteristics and features. Here are some of the most common types:

- Fixed Annuities:These annuities offer a guaranteed rate of return on your investment, providing a predictable income stream. The payout amount is fixed and does not fluctuate with market conditions.

- Variable Annuities:These annuities allow your investment to grow based on the performance of underlying investment options, such as mutual funds. The payout amount can fluctuate based on the market performance of the chosen investment options.

- Immediate Annuities:These annuities begin paying out immediately after you purchase them. They are often used to provide a steady income stream for retirees.

- Deferred Annuities:These annuities begin paying out at a later date, typically during retirement. They are often used for long-term savings and retirement planning.

Examples of Annuity Use Cases, An Annuity Is A Stream Of 2024

- Retirement Planning:Annuities can provide a guaranteed income stream during retirement, helping to ensure financial security. They can be used to supplement other retirement income sources, such as Social Security and savings.

- Income Generation:Annuities can be used to generate a steady stream of income, even after retirement. This can be helpful for covering expenses, paying off debt, or pursuing other financial goals.

- Estate Planning:Annuities can be used to provide a legacy for loved ones. They can be structured to provide income payments to beneficiaries for a set period or for their lifetime.

How Annuities Work in 2024

The annuity market is constantly evolving, influenced by factors such as interest rates, inflation, and economic conditions. Understanding these factors is crucial for evaluating the potential benefits and risks of annuities in 2024.

Dollify offers a fun way to create avatars, but if you’re looking for more realistic results, check out our article, Dollify 2024: Creating Realistic Avatars , where we explore tools that can help you achieve a more lifelike representation.

Current Market Conditions and Impact on Annuities

Interest rates have been on an upward trajectory in recent years, which can impact the returns on fixed annuities. However, this can also lead to higher payouts for immediate annuities. Variable annuities are more sensitive to market volatility, and their performance can fluctuate based on the underlying investment options.

Looking for alternatives to Dollify? Check out our list of the best Dollify alternatives in 2024 , offering diverse styles and features for creating your unique avatar.

Key Factors Influencing Annuity Payouts and Growth Potential

Several factors can influence annuity payouts and growth potential, including:

- Interest Rates:Higher interest rates generally lead to higher payouts for fixed annuities and lower payouts for variable annuities.

- Inflation:Inflation can erode the purchasing power of annuity payouts, particularly for fixed annuities.

- Investment Performance:The performance of underlying investment options can significantly impact the payouts for variable annuities.

- Annuity Contract Terms:The terms and conditions of the annuity contract, such as the payout schedule and surrender charges, can also influence payouts.

Advantages and Disadvantages of Purchasing an Annuity in 2024

Purchasing an annuity can offer certain advantages, such as guaranteed income, protection against market volatility, and potential tax benefits. However, there are also potential drawbacks, such as limited flexibility, potential for lower returns compared to other investments, and surrender charges.

Google Tasks is a simple and effective task management tool. Our article, Google Tasks 2024: Is it Right for You? , explores its features and helps you decide if it’s the right fit for your needs.

Choosing the Right Annuity

Selecting the right annuity requires careful consideration of your individual financial goals, risk tolerance, and time horizon. It’s essential to compare different annuity options and understand their features and terms.

Pushbullet is a versatile tool, and our article, Pushbullet 2024: How to use Pushbullet to send files from your phone to your computer , provides a step-by-step guide on how to transfer files between your phone and computer effortlessly.

Types of Annuity Contracts and Their Features

Annuities come in various contract types, each with its own features and benefits. Some common types include:

- Fixed Annuities:Offer guaranteed interest rates and predictable payouts, but may not keep up with inflation.

- Variable Annuities:Offer potential for higher returns but also carry higher risk, as payouts are tied to the performance of underlying investments.

- Indexed Annuities:Offer a combination of guaranteed interest rates and potential for growth tied to a specific index, such as the S&P 500.

- Immediate Annuities:Provide immediate income payments, suitable for retirees seeking a steady income stream.

- Deferred Annuities:Allow for tax-deferred growth, suitable for long-term savings and retirement planning.

Comparing and Contrasting the Pros and Cons of Each Type of Annuity

Each type of annuity has its own advantages and disadvantages, and the best choice for you will depend on your individual circumstances. Here’s a comparison of some key factors:

| Annuity Type | Pros | Cons |

|---|---|---|

| Fixed Annuity | Guaranteed interest rate, predictable payouts | May not keep up with inflation, limited growth potential |

| Variable Annuity | Potential for higher returns, investment flexibility | Higher risk, payouts fluctuate based on market performance |

| Indexed Annuity | Combination of guaranteed interest rates and potential for growth | May have limited upside potential compared to variable annuities |

| Immediate Annuity | Immediate income payments, suitable for retirees | Limited flexibility, lower payouts compared to deferred annuities |

| Deferred Annuity | Tax-deferred growth, potential for higher returns | Payouts start at a later date, may not be suitable for immediate income needs |

Step-by-Step Guide for Selecting the Most Suitable Annuity

Here’s a step-by-step guide to help you choose the right annuity:

- Define your financial goals:What are you hoping to achieve with an annuity? Retirement income, income generation, estate planning?

- Assess your risk tolerance:How comfortable are you with market volatility? Do you prefer guaranteed payouts or potential for higher returns?

- Consider your time horizon:When do you need the annuity payments to begin? Immediate or deferred?

- Research different annuity types:Understand the features and terms of each type of annuity and how they align with your goals.

- Compare quotes from multiple providers:Get quotes from different annuity providers and compare their rates, fees, and contract terms.

- Consult with a financial advisor:A qualified financial advisor can provide personalized advice and help you choose the most suitable annuity for your needs.

Annuity Regulations and Considerations: An Annuity Is A Stream Of 2024

Annuities are subject to various regulations and legal frameworks, designed to protect consumers and ensure fair market practices. Understanding these regulations is crucial for making informed decisions about annuity purchases.

Wondering if an annuity is right for you? We explore the pros and cons of annuities in our article, Annuity Is What 2024 , helping you understand this financial product in the context of 2024.

Legal and Regulatory Framework Surrounding Annuities in 2024

Annuities are regulated by both federal and state agencies, including the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and state insurance departments. These regulations cover aspects such as disclosure requirements, suitability standards, and consumer protection.

Android WebView has gone through significant changes. Our article, Android WebView 202 vs previous versions , compares the latest version with previous ones, highlighting the key improvements and differences.

Importance of Understanding Annuity Fees, Surrender Charges, and Other Terms and Conditions

It’s essential to carefully review the terms and conditions of any annuity contract before making a purchase. Pay close attention to:

- Fees:Annuities may involve various fees, such as administrative fees, surrender charges, and mortality and expense charges. These fees can impact your overall returns.

- Surrender Charges:These charges are typically imposed if you withdraw your funds from the annuity before a certain period. Understanding the surrender charge schedule is crucial for planning your withdrawals.

- Guarantee Period:The guarantee period refers to the length of time the annuity provider guarantees the interest rate or payout amount. This period can vary depending on the annuity type and provider.

- Death Benefit:Some annuities offer a death benefit, which pays a lump sum to your beneficiaries upon your death. The death benefit amount and payout structure can vary.

Here are some tips for navigating the annuity market and finding reputable providers:

- Do your research:Compare different annuity providers and their products before making a decision.

- Check the provider’s financial stability:Ensure the provider has a strong financial track record and is well-regulated.

- Read the contract carefully:Understand all the terms and conditions before signing any contract.

- Consult with a financial advisor:A qualified financial advisor can help you understand annuity options and choose the best one for your needs.

The Future of Annuities

Annuities are expected to continue playing a significant role in retirement planning and wealth management, with ongoing innovation and advancements shaping the industry.

Pushbullet is a powerful tool for sharing files across devices. Our article, Pushbullet 2024: How to use Pushbullet to share files between devices , provides a detailed guide on how to leverage Pushbullet for seamless file sharing.

Evolving Role of Annuities in Retirement Planning and Wealth Management

As life expectancies increase and individuals seek more flexible and personalized retirement solutions, annuities are becoming increasingly relevant. They can provide a guaranteed income stream, help manage longevity risk, and offer tax-advantaged growth opportunities.

The rise of delivery apps like Glovo has a significant impact on local economies and employment. Our article, Glovo app impact on local economy and employment , explores the economic and employment implications of this trend.

Potential Impact of Technological Advancements and Market Trends on the Annuity Industry

Technological advancements, such as artificial intelligence and data analytics, are transforming the annuity industry. These technologies are enabling personalized product offerings, streamlined customer experiences, and more efficient risk management.

Curious about how Glovo delivers your restaurant orders? We explain the process in our article, How does Glovo app work for restaurant delivery , detailing the steps from order placement to delivery.

Future of Annuity Products and Their Potential for Innovation

The future of annuities holds exciting possibilities for innovation. We can expect to see new product offerings, such as:

- Hybrid Annuities:Combining features of fixed and variable annuities to offer more flexibility and potential for growth.

- Annuity-Based Retirement Income Strategies:Tailored annuity solutions designed to meet specific retirement income needs.

- Digital Annuities:Leveraging technology to provide more accessible and user-friendly annuity products.

Final Summary

As you navigate the complex world of annuities, remember that careful planning and research are key. By understanding the nuances of different annuity contracts, assessing your risk tolerance, and seeking professional advice, you can make informed decisions that align with your financial goals.

With a well-structured annuity strategy, you can create a secure and predictable income stream for your retirement years, ensuring financial peace of mind.

Essential FAQs

Are annuities right for everyone?

Annuities can be a valuable tool for retirement planning, but they are not suitable for everyone. It’s essential to consider your individual financial situation, risk tolerance, and investment goals before making a decision.

What are the tax implications of annuities?

The tax treatment of annuity payments varies depending on the type of annuity and how it is structured. It’s important to consult with a tax advisor to understand the tax implications of your specific annuity.

Restaurant owners and businesses can leverage Glovo’s features to enhance their operations and reach a wider audience. Our article, Glovo app features for restaurant owners and businesses , highlights the benefits and features specifically designed for restaurants using the Glovo platform.