IRS October Deadline 2024: It’s not just for businesses! Many individuals are also affected by this extended tax filing deadline, offering a crucial opportunity to get your finances in order. But with this extra time comes the added responsibility of understanding the nuances of the October deadline and ensuring you meet your tax obligations.

This October deadline applies to a range of tax-related activities, including filing extensions, paying estimated taxes, and claiming certain credits or deductions. Whether you’re self-employed, have income not subject to withholding, or simply need a little more time to gather your tax documents, understanding the specifics of this deadline is crucial.

Let’s explore the key aspects of the IRS October Deadline 2024, so you can navigate this period with confidence.

Contents List

- 1 IRS October Deadline Overview: Irs October Deadline 2024

- 2 Understanding the October Tax Deadline

- 3 4. Extensions and Penalties

- 4 IRS Resources and Contact Information

- 5 Tax Preparation Tips for October Deadline

- 6 Impact of the October Deadline on Taxpayers

- 7 Common Mistakes and How to Avoid Them

- 8 The October Deadline in Historical Context

- 9 The Future of the October Deadline

- 10 Planning for Future Tax Obligations

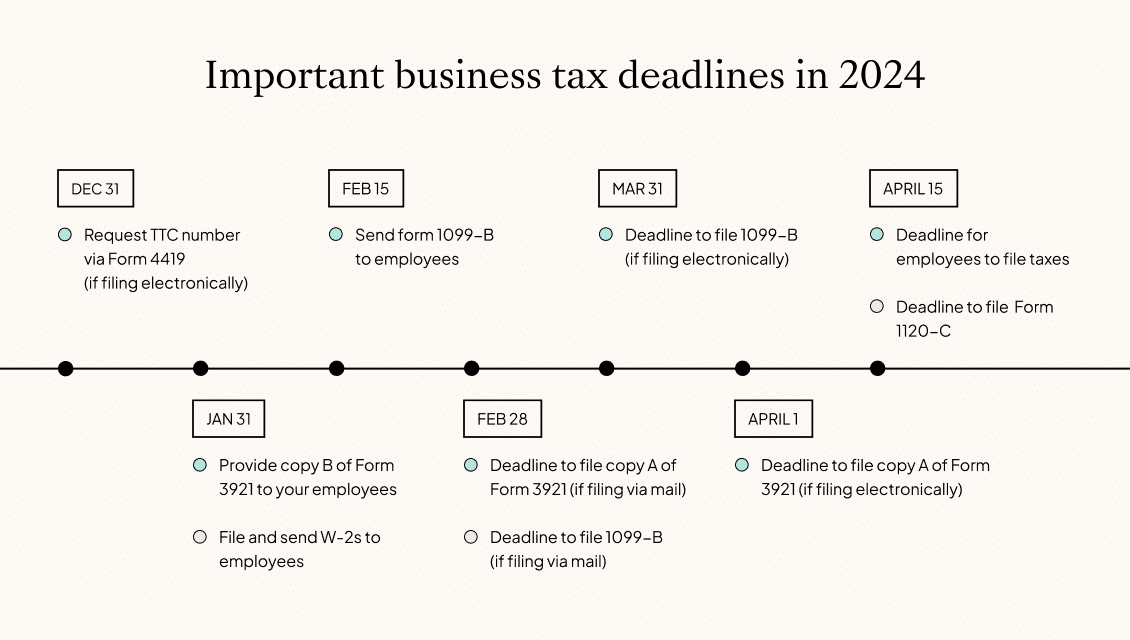

- 11 Impact of the October Deadline on Businesses

- 12 The October Deadline and the Economy

- 13 Tax Reform and the October Deadline

- 14 Taxpayer Advocacy and the October Deadline

- 15 Conclusive Thoughts

- 16 Clarifying Questions

IRS October Deadline Overview: Irs October Deadline 2024

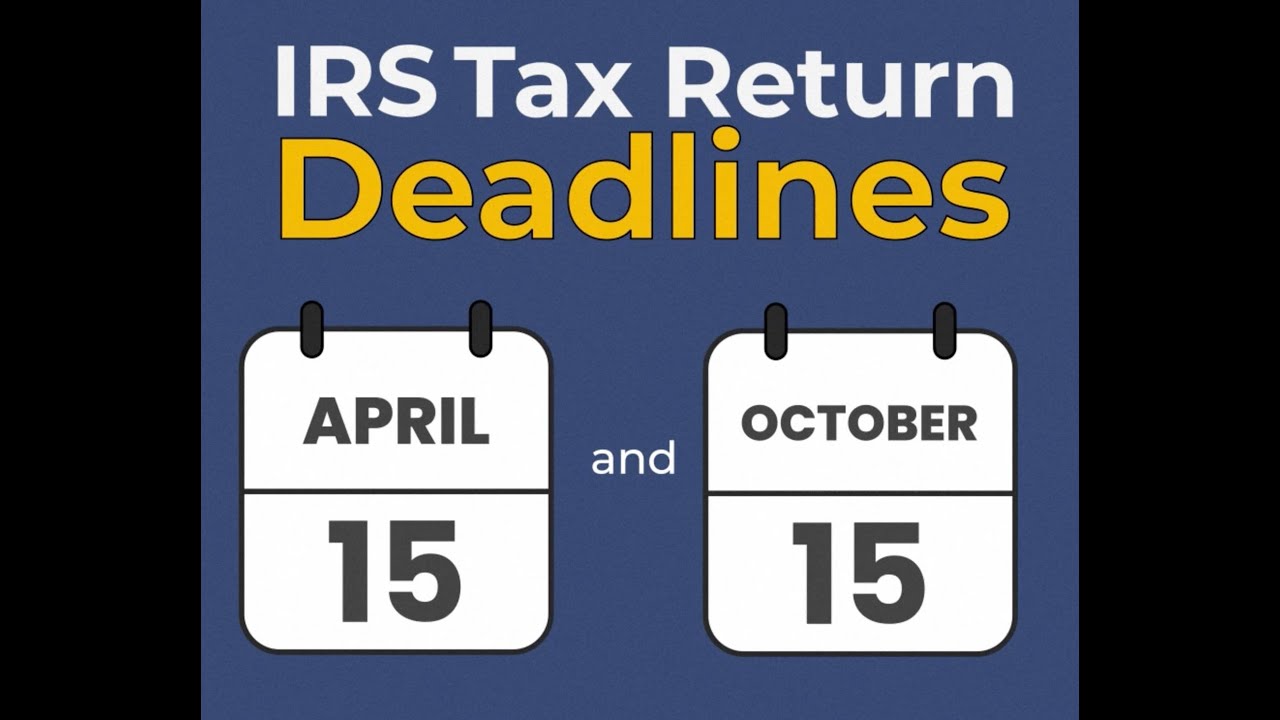

The IRS October deadline is a crucial date for certain taxpayers who have been granted an extension to file their federal income tax return. This deadline applies to individuals and businesses that have filed for an extension to file their tax return, pushing the original April deadline to October.

While the traditional April deadline is for filing tax returns, the October deadline is for completing the tax filing process, including paying any remaining taxes owed.

If you’re wondering about tax deadlines, you might be curious about when taxes are due in October. While most tax deadlines fall earlier in the year, some situations can lead to extensions. It’s always best to check with the IRS to ensure you’re on top of your tax obligations.

The Significance of the October Deadline

The October deadline is significant because it represents the final opportunity for taxpayers who have filed for an extension to complete their tax obligations. Missing this deadline can lead to penalties and interest charges.

- Taxpayers affected by the October deadline include those who have filed for an extension to file their federal income tax return, such as individuals, businesses, and trusts.

- The October deadline differs from the traditional April tax filing deadline in that it provides an extended timeframe for completing tax-related activities. However, it does not extend the deadline for paying taxes owed.

- The October deadline is crucial because it allows taxpayers to gather all necessary information, complete their tax returns, and pay any remaining taxes owed. Failing to meet this deadline can result in penalties and interest charges.

Tax-Related Activities Due in October

Taxpayers with an extension must complete various tax-related activities by the October deadline. These activities include:

| Activity | Deadline |

|---|---|

| File an amended tax return (Form 1040-X) | October 15th |

| Pay any remaining tax liability | October 15th |

| File an extension for a business partnership (Form 1065) | October 15th |

| File an extension for a corporation (Form 1120) | October 15th |

Consequences of Missing the October Deadline

Missing the October deadline can result in penalties and interest charges. The penalties for late filing and late payment are typically calculated as a percentage of the unpaid tax liability.

- The penalty for late filing is generally 0.5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid taxes.

- The penalty for late payment is 0.5% of the unpaid taxes for each month or part of a month that the payment is late, up to a maximum of 25% of the unpaid taxes.

- Interest may also be charged on the unpaid taxes, which is calculated based on the federal short-term interest rate.

Avoiding the October Deadline, Irs October Deadline 2024

Taxpayers can avoid missing the October deadline by staying organized and completing their tax-related activities well in advance of the deadline.

- Gather all necessary documents and information, including income statements, receipts, and tax forms.

- Prepare and file your tax return as early as possible, even if you have an extension.

- Set reminders and deadlines to stay on track.

- Consult a tax professional if you have any questions or need assistance with your taxes.

Understanding the October Tax Deadline

The IRS offers an extended deadline for certain tax filers, allowing them to file their taxes by October 15th instead of the usual April 15th deadline. This extended deadline provides relief for individuals and businesses facing specific circumstances.

The Difference Between April and October Deadlines

The April 15th deadline applies to most taxpayers, while the October 15th deadline is specifically for those who meet certain criteria. The key difference lies in the reason for the extension: the October deadline is granted to individuals and businesses who are filing for an extension to their tax return.

This means they have already requested additional time to prepare and submit their tax information. For example, a self-employed individual might request an extension if they need more time to gather all their business income and expense records.

Who is Eligible for the October Deadline?

The October deadline is not a universal extension. It is available only to specific groups of taxpayers.

| Category | Example |

|---|---|

| Individuals who are abroad | A US citizen living and working in Germany might be granted an extension to file their taxes by October 15th. |

| Members of the military serving outside the US | A soldier stationed in South Korea might qualify for the October deadline. |

| Taxpayers who are victims of a disaster | Individuals affected by a hurricane or earthquake in a designated disaster area might be eligible for the October deadline. |

| Taxpayers who are facing a hardship | Someone experiencing a severe illness or a family emergency might request an extension. |

Tax-Related Activities Subject to the October Deadline

The October deadline applies to various tax-related activities, including:* Filing an extension for an individual income tax return:This allows taxpayers to delay filing their return but does not extend the time to pay any taxes owed.

Paying estimated taxes

Individuals and businesses who are self-employed or have income from other sources, such as investments, are often required to make quarterly estimated tax payments. These payments can also be extended to October 15th.

Making a payment on a tax liability

If a taxpayer owes taxes, they can request an extension to pay the amount owed. This extension will also apply to the penalty for late payment.

Looking for the best rates on your savings? You might want to explore PNC Bank Cd Rates October 2024. Comparing rates from different banks can help you find the most competitive offers.

Filing certain business tax returns

Some business tax returns, such as those for partnerships and S corporations, can be filed by October 15th.

Understanding the Importance of the October Deadline

While the October deadline provides flexibility, it is crucial to understand its nuances. Failing to meet the October deadline can result in penalties and interest charges. For example, if a taxpayer files for an extension but does not file their tax return by October 15th, they will be subject to late filing penalties.

Similarly, failing to pay taxes owed by the October deadline will result in interest charges.If you are unsure about your tax obligations or the specific deadlines that apply to you, it is always advisable to seek professional advice from a qualified tax advisor.

For those considering a home purchase, understanding Mortgage Rates October 2024 is essential. Mortgage rates can fluctuate, so staying up-to-date can help you make the best financial decision.

4. Extensions and Penalties

The October deadline for tax filing is a crucial date for many individuals and businesses. However, situations may arise that prevent timely completion of tax obligations. In such cases, understanding the options for requesting extensions and the potential consequences of missing the deadline is essential.

Extension Request

If you need more time to file your taxes, you can request an extension. The IRS offers automatic extensions for filing your tax return, but not for paying your taxes. To request an extension, you must file Form 4868, Application for Automatic Extension of Time to File U.S.

Individual Income Tax Return.

Example Email:Subject: Request for Extension

- [Your Name]

- [Tax Year]

Dear [Recipient Name],I am writing to request an extension for filing my tax return for the [Tax Year] tax year. Due to [briefly explain your reason for the delay], I am unable to complete my return by the October deadline.I would appreciate it if you could grant me an extension until [new deadline].

I am committed to completing my return and submitting it by the new deadline.Thank you for your understanding and consideration.Sincerely,[Your Name]

Penalty Inquiry

Failing to meet the October deadline for filing your tax return can result in penalties. The IRS imposes penalties for late filing and late payment.

- Late Filing Penalty:The late filing penalty is generally 0.5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax.

- Late Payment Penalty:The late payment penalty is generally 0.5% of the unpaid tax for each month or part of a month that the tax is late, up to a maximum of 25% of the unpaid tax.

The severity of the penalties can vary depending on the extent of the delay and the circumstances surrounding the late filing.

Extension Request Process

Requesting an extension for the October deadline involves a formal process. Here’s a step-by-step guide:

- Complete Form 4868:This form is available on the IRS website. You can file it electronically or by mail.

- Provide Supporting Documentation:If applicable, include any supporting documentation that justifies your request for an extension, such as medical records or a letter from your employer.

- Submit Your Request:You can submit your request online through the IRS website, by mail, or by fax.

- Track the Status of Your Request:You can track the status of your request online through the IRS website.

Extension Request Justification

When requesting an extension, you need to provide a compelling justification for your request.

Example Justification:I am requesting an extension due to [explain the reason for the delay]. This situation has significantly impacted my ability to gather the necessary documents and complete my tax return. I have taken steps to [explain the steps taken to mitigate the delay], and I am confident that I can complete my return by [new deadline].

Completing my tax return within the extended timeframe is crucial for [explain the importance of meeting the deadline].

IRS Resources and Contact Information

The IRS provides a wealth of resources to help taxpayers understand their tax obligations and navigate the October deadline. These resources include online tools, publications, and contact information for direct assistance.The IRS offers various ways to access information and get assistance with tax-related matters.

Online Resources

The IRS website is a comprehensive source of information about taxes, including the October deadline. The website offers numerous resources, including:

- IRS Publication 505, Tax Withholding and Estimated Tax– This publication provides detailed information on withholding and estimated tax payments.

- IRS Publication 17, Your Federal Income Tax– This publication covers various aspects of federal income tax, including filing requirements, deductions, and credits.

- IRS Tax Forms and Publications– This section allows taxpayers to download various tax forms and publications.

- IRS Taxpayer Advocate Service (TAS)– This service assists taxpayers who are experiencing difficulties with the IRS.

- IRS Interactive Tax Assistant (ITA)– The ITA is an online tool that provides answers to tax-related questions.

Contact Information

For additional support or inquiries, taxpayers can contact the IRS through various channels:

- IRS Telephone Assistance– Taxpayers can call the IRS at 1-800-829-1040 for assistance with tax-related matters.

- IRS Online Account– Through an online account, taxpayers can access their tax records, track the status of their refund, and make payments.

- IRS Taxpayer Advocate Service (TAS)– The TAS can be contacted through their website or by calling 1-877-777-4778.

- IRS Office Locations– Taxpayers can find the nearest IRS office through the IRS website.

Tax Preparation Tips for October Deadline

The October tax deadline can be a stressful time, but with proper preparation and organization, you can navigate the process smoothly. Here’s a breakdown of tips for individuals and businesses to make tax filing easier.

Tax Preparation Tips for Individuals

It’s essential to gather all the necessary tax documents to ensure accurate calculations and avoid potential penalties. Here’s a breakdown of the documents you’ll need:

- Income Documents:

- W-2s: Received from employers, reflecting your wages and withholdings.

- 1099s: Issued for various income sources like freelance work, interest, dividends, and retirement distributions.

- Other Income Statements: If you have any other income sources, such as rental income or royalties, you’ll need the corresponding statements.

- Expense Documents:

- Receipts: Keep all receipts for deductible expenses, such as medical expenses, charitable donations, and business expenses (if applicable).

- Property Tax Statements: If you own a home, you’ll need statements for property taxes paid.

- Student Loan Interest Statements: You may be eligible for a deduction on student loan interest.

- Deduction Documents:

- Charitable Donation Statements: Obtain documentation from charities for any donations you made.

- Medical Expense Receipts: Keep detailed receipts for medical expenses, as you may be able to deduct some costs.

- Home Improvement Receipts: If you made energy-efficient home improvements, you may be eligible for tax credits.

Organizing your tax documents is crucial for accurate filing. Here are some effective methods:

- Folders:Create separate folders for different categories of documents (income, expenses, deductions) for easy retrieval.

- Spreadsheets:Use a spreadsheet to track income, expenses, and deductions. This can be helpful for organizing and calculating your tax liability.

- Digital Organization Tools:Utilize cloud-based storage or file management systems to store and access documents securely online.

When organizing your documents, ensure they are clearly labeled with the relevant tax year and category. Store them securely in a fireproof safe or a secure location.

Calculating income and deductions accurately is essential to avoid overpaying or underpaying taxes. Here are some tips:

- Understand Your Tax Bracket:Familiarize yourself with the tax brackets for your income level. This will help you determine your tax liability.

- Utilize Tax Calculators:Online tax calculators can help you estimate your tax liability and identify potential deductions.

- Seek Professional Advice:Consult with a tax professional if you have complex financial situations or need assistance with deductions.

Filing your taxes on time is crucial to avoid penalties. Late filing can result in fines and interest charges. It’s best to file electronically for faster processing and reduced risk of errors.

Electronic filing offers numerous advantages:

- Faster Processing:Electronic returns are processed faster than paper returns.

- Reduced Errors:Tax preparation software helps minimize errors and ensures accuracy.

- Convenience:File your taxes from the comfort of your home or on the go.

Certified tax preparation software is highly recommended for its reliability and security features. Ensure the software is IRS-approved for accurate filing.

Tax Preparation Tips for Businesses

Businesses have unique tax requirements, and accurate record-keeping is essential for tax compliance. Here’s a checklist of tax documents for businesses:

- Income Statements:Summarize your business’s revenue and expenses over a specific period.

- Balance Sheets:Show your business’s assets, liabilities, and equity at a specific point in time.

- Expense Reports:Detailed records of all business expenses, including receipts, invoices, and expense summaries.

Managing business expenses effectively can help maximize deductions and reduce tax liability. Here are some strategies:

- Track Expenses:Maintain detailed records of all business expenses, including receipts, invoices, and expense summaries.

- Utilize Accounting Software:Accounting software can help you track expenses, generate reports, and streamline financial management.

- Consult with a Tax Professional:Seek advice from a qualified tax professional to understand deductions and optimize your tax strategy.

Detailed record-keeping is crucial for businesses, as it can be helpful for tax audits and financial planning. Here are some tips:

- Keep Detailed Records:Maintain thorough records of all transactions, including invoices, receipts, and bank statements.

- Organize Records:Create a system for organizing and storing business records, such as folders, binders, or digital storage.

- Retain Records:Retain business records for the recommended period (typically 3-7 years) for potential audits.

Businesses need to file various tax forms, depending on their structure and income. Here are some common forms:

- Form 1040:Used for filing individual income tax returns, including business income.

- Schedule C:Used to report profit or loss from a business operated as a sole proprietorship or partnership.

- Form 1120:Used by corporations to file their income tax returns.

Hiring a qualified tax professional for business tax preparation is highly recommended. A tax professional can help you navigate complex tax regulations, maximize deductions, and ensure compliance with tax laws.

General Tax Preparation Tips

Understanding tax brackets is essential for calculating your tax liability. Here’s a brief explanation:

Tax brackets are income ranges with different tax rates. The more income you earn, the higher your tax bracket. However, your entire income is not taxed at the highest rate. Only the portion of your income that falls within the highest bracket is taxed at that rate.

There are various tax deductions and credits available to reduce your tax liability. Here are some common examples:

- Standard Deduction:A fixed amount you can deduct from your taxable income, instead of itemizing deductions.

- Homeowner’s Deduction:Deductible expenses for homeownership, such as mortgage interest and property taxes.

- Charitable Donations:You can deduct cash and non-cash contributions to qualified charities.

- Child Tax Credit:A tax credit for families with qualifying children.

Strategic financial planning and investment strategies can help reduce your tax liability. Here are some tips:

- Retirement Planning:Contribute to tax-advantaged retirement accounts, such as 401(k)s and IRAs.

- Tax-Loss Harvesting:Sell losing investments to offset capital gains and reduce your tax liability.

- Tax-Efficient Investing:Consider investments with tax-efficient structures, such as index funds and ETFs.

Tax scams are prevalent, so it’s essential to be aware of common tactics and how to avoid them. Here are some tips:

- Beware of Phishing Emails:Never click on links or open attachments from unknown senders, especially those claiming to be from the IRS.

- Verify Identity:The IRS will never call, email, or text you to demand immediate payment or threaten legal action. Always verify any communication through official channels.

- Use Secure Websites:When filing your taxes online, ensure you are using a secure website and reputable tax preparation software.

Impact of the October Deadline on Taxpayers

The October tax deadline can have a significant impact on taxpayers, influencing their financial well-being and tax planning strategies. It is crucial to understand how meeting or missing this deadline can affect your tax refund or liability.

Impact on Tax Refunds and Liabilities

The October deadline is for taxpayers who have filed for an extension on their tax return. If you filed for an extension, you have until October 15th to submit your tax return and pay any remaining taxes owed. This can impact your tax refund or liability in several ways:

- Receiving a refund:If you are expecting a tax refund, filing your return by the October deadline ensures you receive it as soon as possible. Delays in filing can result in a delayed refund.

- Avoiding penalties:Missing the October deadline can result in penalties for late filing and late payment. The penalty for late filing is typically 0.5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid taxes.

News of layoffs can be unsettling. If you’re concerned about potential job cuts, you might be interested in learning more about Geico Layoffs October 2024. Staying informed about industry trends can help you make informed decisions about your career path.

Additionally, there is a penalty for late payment of 0.5% of the unpaid taxes for each month or part of a month that the payment is late, up to a maximum of 25% of the unpaid taxes.

- Interest on unpaid taxes:If you owe taxes and do not pay them by the October deadline, you will be charged interest on the unpaid amount. The interest rate for underpayment is generally the same as the federal short-term rate plus 3 percentage points.

For example, if the federal short-term rate is 5%, the interest rate for underpayment would be 8%.

Tax Planning Strategies

The October deadline can impact your tax planning strategies in various ways:

- Time to adjust your tax liability:Filing an extension gives you more time to gather all necessary documents and make adjustments to your tax liability. This can be crucial for taxpayers who anticipate changes in their income or deductions.

- Consider tax-saving strategies:The extended deadline provides an opportunity to explore tax-saving strategies, such as making tax-advantaged contributions to retirement accounts or adjusting your withholdings. This can help reduce your overall tax burden.

- Plan for potential tax liabilities:If you expect to owe taxes, the October deadline provides an opportunity to plan for the payment. You can set aside funds or consider alternative payment options, such as a payment plan.

Common Mistakes and How to Avoid Them

While the October tax deadline provides extra time, it’s crucial to avoid common pitfalls that can lead to penalties or delays in receiving your refund. Understanding these mistakes and taking proactive steps to prevent them can ensure a smooth and stress-free tax filing experience.

Common Mistakes

| Mistake | Description |

|---|---|

| Incorrect Filing Status | Choosing the wrong filing status (e.g., single, married filing jointly) can result in an inaccurate tax liability. |

| Missing or Incorrect Deductions and Credits | Overlooking eligible deductions or claiming ineligible ones can impact your tax refund or liability. |

| Errors in Income Reporting | Inaccuracies in reporting income from various sources (e.g., wages, investments, self-employment) can lead to penalties. |

| Failing to File on Time | Missing the October deadline can result in penalties, even if you owe no taxes. |

| Not Keeping Adequate Records | Poor record-keeping can make it difficult to accurately file your taxes and may lead to errors or delays. |

Importance of Filing on Time

Filing your taxes on time is essential to avoid penalties and ensure timely processing of your refund. Missing the October deadline can result in late filing penalties, which can be significant. Additionally, failing to file on time may hinder your ability to receive certain benefits or credits.

Timely filing also helps maintain a good standing with the IRS, making future interactions smoother.

Tips to Avoid Mistakes

- Gather All Necessary Documents:Collect all relevant tax forms, receipts, and other documentation before starting to prepare your taxes.

- Double-Check Your Information:Carefully review all entries for accuracy, ensuring that all income sources, deductions, and credits are correctly reported.

- Seek Professional Help:Consult a qualified tax professional for assistance with complex tax situations or if you need guidance on maximizing deductions and credits.

Benefits of Professional Tax Advice

Seeking professional tax advice from a qualified accountant or tax advisor can provide significant benefits. Tax professionals have in-depth knowledge of tax laws and regulations, helping you navigate complex situations and optimize your tax strategy. They can also identify potential deductions and credits you may be eligible for, ensuring you receive the maximum refund possible.

Their expertise can save you time, money, and potential penalties.

Tax deadlines are crucial for responsible tax filing. If you’re wondering about the Irs Tax Deadline October 2024 , it’s essential to stay informed and plan accordingly.

Importance of Accurate Record-Keeping

“Keeping accurate records is crucial for avoiding mistakes during tax season. It allows you to easily track income, expenses, and other relevant information, making the tax filing process smoother and more accurate.”

A taxpayer named Sarah was discussing the importance of accurate record-keeping with her tax advisor, David. Sarah was concerned about potential mistakes during tax season and wanted to ensure a smooth filing process. David explained that maintaining detailed and organized records is essential for avoiding errors and ensuring accurate tax filing.

The October Deadline in Historical Context

The October tax deadline, while seemingly recent, has a history that reflects evolving tax laws and the changing needs of the IRS. Understanding the historical context of the October deadline helps taxpayers grasp its significance and the factors that have led to its current form.

Changes to the October Deadline

The October tax deadline has seen significant changes in recent years, primarily due to the impact of major events like the COVID-19 pandemic and the IRS’s ongoing efforts to modernize its systems.

- 2020-2023:The deadline for filing taxes was extended to July 15, 2020, due to the COVID-19 pandemic. This extension aimed to provide taxpayers with additional time to adjust to the economic disruptions caused by the pandemic. The deadline for filing taxes was also extended to May 17, 2021, and to April 18, 2022, and to April 15, 2023.

- 2024:The October deadline for 2023 taxes is a return to the traditional tax season calendar. This change reflects the IRS’s efforts to restore the filing process to its pre-pandemic schedule.

The Historical Context of the October Deadline

The October deadline is a relatively recent development in the history of tax filing. Prior to 2023, the standard deadline for filing taxes was April 15. The October deadline for 2023 taxes is a temporary measure implemented by the IRS due to the COVID-19 pandemic.

- Early Years:In the early days of the IRS, the tax filing deadline was set at March 15. This deadline was later moved to April 15 to give taxpayers more time to file their returns.

- Evolution of the Deadline:Over the years, the IRS has made adjustments to the tax filing deadline in response to various factors, such as economic conditions and technological advancements. For example, the IRS introduced electronic filing in the 1990s, which significantly streamlined the tax filing process.

- The Pandemic and the October Deadline:The COVID-19 pandemic prompted the IRS to extend the tax filing deadline to July 15, 2020. This extension was intended to provide taxpayers with additional time to adjust to the economic disruptions caused by the pandemic. The October deadline for 2023 taxes is a reflection of the IRS’s ongoing efforts to manage the impact of the pandemic on the tax filing process.

The Future of the October Deadline

The October tax deadline, while seemingly permanent, could be subject to change in the future. Several factors, including legislative shifts, technological advancements, and evolving economic circumstances, might influence the IRS’s tax filing calendar.

Potential Changes to the October Deadline

The October deadline could face various changes in the future. These changes could include:

- Extension of the deadline:Due to economic downturns or major events like pandemics, the IRS might extend the October deadline to provide taxpayers with more time to file. This extension could be temporary or permanent, depending on the circumstances.

- Shifting the deadline to a different date:The IRS might consider shifting the October deadline to a different date, potentially aligning it with the traditional April deadline. This could simplify the tax filing process and minimize confusion for taxpayers.

- Elimination of the October deadline:In the future, the IRS might completely eliminate the October deadline, merging it with the traditional April deadline. This would streamline the tax filing process and reduce the administrative burden on both taxpayers and the IRS.

Planning for Future Tax Obligations

Proactive tax planning is crucial for individuals and families, especially as financial goals evolve over time. By strategically managing your tax obligations, you can maximize your financial well-being and achieve long-term financial objectives.

Tax Planning Strategies

Effective tax planning involves considering your current financial situation and future aspirations. By implementing suitable strategies, you can optimize your tax burden and potentially enhance your financial outcomes.

| Strategy Name | Description | Benefits | Risks | Examples |

|---|---|---|---|---|

| Tax-Advantaged Investments | Investing in accounts that offer tax deferral or exemption, such as 401(k)s, IRAs, and Roth IRAs. | Reduced current tax liability, potential for tax-free growth, and tax-free withdrawals in retirement. | Potential for investment losses, limited access to funds before retirement, and potential for tax penalties for early withdrawals. | Contributing to a 401(k) plan offered by your employer, opening a traditional IRA for tax-deductible contributions, or establishing a Roth IRA for tax-free withdrawals in retirement. |

| Tax-Loss Harvesting | Selling losing investments to offset capital gains and reduce tax liability. | Reduces capital gains taxes and potentially lowers overall tax burden. | May result in short-term capital losses, which are taxed at ordinary income rates. | Selling a stock that has declined in value to offset gains from another investment, or selling a bond that has decreased in price to offset gains from a real estate sale. |

| Estate Planning | Planning for the transfer of assets upon death, including wills, trusts, and beneficiary designations. | Minimizes estate taxes and ensures assets are distributed according to your wishes. | Potential for legal complexities and costs associated with estate planning. | Creating a will to distribute assets to beneficiaries, establishing a trust to manage assets for heirs, and designating beneficiaries for retirement accounts and life insurance policies. |

| Charitable Giving | Making charitable donations to eligible organizations to receive tax deductions. | Reduces taxable income and supports worthy causes. | Potential for limitations on deductible amounts and restrictions on eligible organizations. | Donating to a registered charity, volunteering time and skills, or establishing a donor-advised fund for future charitable giving. |

Minimizing Tax Liabilities

Understanding and utilizing tax deductions, credits, and exemptions can significantly reduce your tax burden. These tax-saving opportunities can be applied to various aspects of your financial life, including income, expenses, and investments.“`pythondef calculate_tax_savings(income, expenses): “”” Calculates potential tax savings based on user-inputted income and expenses.

Looking for the best rates on your savings? You might want to explore Best CD Rates October 2024. With fluctuating interest rates, it’s smart to shop around for the most competitive offers.

Args: income: Annual income. expenses: Annual expenses. Returns: Potential tax savings. “”” # Assuming a standard deduction of $12,950 for 2024 deductible_expenses = expenses

Investors often keep an eye on dividend payouts. If you’re a JEPI shareholder, you’ll want to check out Jepi Dividend October 2024. Understanding dividend schedules is essential for maximizing your investment returns.

12950

taxable_income = income

deductible_expenses

tax_rate = 0.25 # Assuming a 25% tax rate for illustrative purposes potential_tax_savings = taxable_income

tax_rate

return potential_tax_savings# Example usageincome = 100000expenses = 50000tax_savings = calculate_tax_savings(income, expenses)print(f”Potential tax savings: $tax_savings:.2f”)“`

Maximizing Tax Benefits

Tax benefits are designed to encourage certain behaviors and financial planning strategies. By taking advantage of these benefits, you can enhance your financial well-being and achieve your goals more efficiently.

Early Career

Retirement Savings

Contribute to a 401(k) or Roth IRA to save for retirement and reduce your current tax liability.

Student Loan Interest Deduction

If you’re wondering about tax deadlines, you might be curious about Taxes Due October. While most tax deadlines fall earlier in the year, some situations can lead to extensions. It’s always best to check with the IRS to ensure you’re on top of your tax obligations.

Deduct interest paid on student loans to reduce your taxable income.

If you’re thinking about investing in a Certificate of Deposit, you might be interested in Best Cd Rates October 2024. Researching different banks and their CD rates can help you find the best deal for your financial goals.

Tax Credits for Education Expenses

Utilize tax credits for tuition and other education-related expenses.

Family Formation

Child Tax Credit

Claim the Child Tax Credit for each qualifying child to reduce your tax liability.

Dependent Care Credit

Obtain a tax credit for expenses related to childcare or care for a dependent with a disability.

Deductions for Homeownership

Take advantage of deductions for mortgage interest and property taxes.

Retirement Planning

Tax-Free Withdrawals from Roth IRAs

Withdraw contributions and earnings tax-free in retirement.

Tax-Deferred Withdrawals from Traditional IRAs

Withdraw contributions and earnings tax-deferred in retirement.

Estate Planning

Implement estate planning strategies to minimize estate taxes and ensure assets are distributed according to your wishes.

If you’re looking for a new car, you might be interested in checking out Best Lease Deals October 2024. With competitive lease offers available, you can find a great deal on a new vehicle.

Staying Informed

Staying informed about tax laws and regulations is crucial for effective tax planning. Tax laws are subject to change, and staying updated can help you avoid potential penalties and maximize your tax benefits.

“It is important to stay informed about changes in tax laws and regulations, as these changes can affect your tax liability and the strategies you use to manage your taxes.”

News of layoffs can be unsettling. If you’re concerned about potential job cuts, you might be interested in learning more about Geico Layoffs October 2024. Staying informed about industry trends can help you make informed decisions about your career path.

Internal Revenue Service

For those who need to file taxes, the When Are Taxes Due In October 2024 question is an important one. Understanding tax deadlines can help you avoid penalties and ensure your finances are in order.

* IRS Website:Visit the IRS website (www.irs.gov) for official tax information, publications, and updates.

Tax Publications

Utilize IRS publications and guides for comprehensive information on various tax topics.

Tax Professionals

Consult with a qualified tax professional for personalized advice and assistance with tax planning.

News of layoffs can be concerning. If you’re curious about potential job cuts at PNC Bank, you might want to look into PNC Bank Layoffs October 2024. Staying informed about industry trends can help you make informed decisions about your career.

Impact of the October Deadline on Businesses

The October tax deadline significantly impacts businesses, requiring them to finalize various tax-related tasks and adjust their financial planning strategies. This deadline necessitates a comprehensive understanding of the tax obligations businesses face and the implications for their overall financial health.

For those who need to file taxes, the 2024 October Tax Deadline is an important date to remember. Whether you’re filing an extension or paying your taxes, staying on top of deadlines is crucial for avoiding penalties.

Tax-Related Activities for Businesses

Businesses need to complete several tax-related activities by the October deadline, ensuring compliance with tax regulations and avoiding potential penalties. These activities include:

- Filing Estimated Taxes:Businesses with significant income are required to make quarterly estimated tax payments throughout the year. The October deadline marks the final payment for the third quarter, ensuring businesses have paid their fair share of taxes on their earnings. Failure to meet these deadlines can result in penalties.

- Reconciling Estimated Taxes:Businesses must reconcile their estimated tax payments with their actual tax liability at the end of the tax year. This process involves comparing the amount paid in estimated taxes to the actual tax owed, determining any adjustments or refunds due.

- Completing Tax Forms:Businesses must file various tax forms depending on their structure and activities. This includes forms like Form 1040, Form 1120, and Form 1065, depending on whether they are sole proprietorships, corporations, or partnerships. These forms report income, expenses, and other relevant financial data.

- Paying Taxes:Businesses must pay their final tax liability by the October deadline. This includes any outstanding taxes owed after reconciling estimated payments, as well as any taxes resulting from specific business activities.

Impact on Business Planning and Financial Management

The October deadline significantly impacts business planning and financial management, requiring businesses to consider the tax implications of their decisions.

- Cash Flow Management:Businesses need to ensure sufficient cash flow to cover their tax obligations by the October deadline. This involves careful budgeting, financial forecasting, and potentially adjusting business operations to generate sufficient revenue to meet their tax liabilities.

- Investment Decisions:Businesses must consider the tax implications of investment decisions, including the potential tax deductions or credits associated with specific investments. Understanding these implications helps businesses make informed decisions that maximize their returns and minimize their tax burden.

- Strategic Planning:The October deadline serves as a crucial reminder for businesses to review their tax strategies and ensure they are maximizing tax efficiency. This involves considering potential tax deductions, credits, and other strategies that can minimize their overall tax liability.

The October Deadline and the Economy

The October tax deadline, while primarily a fiscal event, can have significant ripple effects on the economy. It impacts consumer spending, business investment, and overall economic activity. Understanding these connections is crucial for both individuals and businesses to navigate the economic landscape effectively.

Impact on Consumer Spending

The October deadline can influence consumer spending in several ways. For instance, taxpayers who owe money to the IRS might experience a temporary reduction in disposable income, leading to decreased spending on non-essential goods and services. Conversely, taxpayers receiving refunds might experience a boost in disposable income, potentially leading to increased spending.

Impact on Business Investment

Businesses also feel the impact of the October deadline. Companies with significant tax liabilities might need to adjust their investment plans to accommodate these obligations. This could lead to delayed expansion, reduced hiring, or a shift in resource allocation. On the other hand, businesses receiving tax benefits or refunds might see an opportunity for increased investment, potentially driving economic growth.

Relationship to Broader Economic Trends

The October deadline’s impact on the economy is often intertwined with broader economic trends. For example, during periods of economic uncertainty, taxpayers might be more inclined to save their refunds, leading to a dampening effect on consumer spending. Conversely, during periods of economic growth, the October deadline might have a less pronounced impact, as taxpayers are more likely to spend their refunds or use them to pay down debt.

Tax Reform and the October Deadline

The October deadline for tax filings is a crucial aspect of the U.S. tax system, and recent tax reform legislation has introduced significant changes that could impact this deadline. Understanding the potential implications of these reforms is essential for taxpayers and businesses alike.

Background and Context

The Tax Cuts and Jobs Act (TCJA) of 2017, enacted in December 2017, was a major overhaul of the U.S. tax code. Key provisions of the TCJA included a reduction in the corporate tax rate from 35% to 21%, changes to individual tax brackets and deductions, and modifications to the treatment of business expenses.

Planning your month? You can easily stay organized with the October 2024 Calendar. This calendar can help you keep track of important dates, appointments, and events. It’s a handy tool for managing your schedule and making sure you don’t miss anything.

The TCJA’s provisions took effect in 2018, and some of its provisions are scheduled to expire in 2025. The October deadline for tax filings typically refers to the extended filing deadline for individuals and businesses who have been granted an extension to file their tax returns.

This deadline provides taxpayers with additional time to gather necessary documentation, complete their tax calculations, and file their returns.

Impact on Tax Filings

The TCJA’s provisions have the potential to affect the timing of tax filings in several ways. For instance, changes to deductions and credits might necessitate more complex tax calculations, potentially leading to an increase in requests for filing extensions. Moreover, the TCJA’s impact on business tax provisions, such as the deductibility of certain expenses, could influence the timing of corporate tax filings.The nature of tax filings could also be significantly altered by the TCJA.

The new tax law introduced changes to the calculation of taxable income, the availability of deductions and credits, and the tax rates applicable to various income levels. These changes could necessitate adjustments to the information required on tax forms and the methods used to calculate tax liabilities.

Implications for Taxpayers and Businesses

The TCJA’s impact on individual taxpayers could be substantial. Changes to tax brackets, deductions, and credits could significantly alter individual tax liabilities. For example, the standard deduction was increased under the TCJA, potentially benefiting some taxpayers. However, the elimination of personal exemptions could offset these benefits for others.The TCJA’s implications for businesses are equally significant.

The reduction in the corporate tax rate to 21% could boost corporate profits and investment. However, changes to depreciation schedules and investment incentives could affect business investment decisions. The TCJA also introduced new provisions related to international taxation, which could impact the tax obligations of multinational corporations.

Specific Scenarios

Consider a scenario where a taxpayer, previously claiming a large number of deductions, finds their available deductions significantly reduced under the TCJA. This taxpayer might need to revise their tax planning strategies, potentially leading to a higher tax liability. They might need to seek professional advice to navigate the complexities of the new tax law and ensure accurate tax filing.A business considering a major investment project might be impacted by the TCJA’s changes to depreciation schedules.

The new depreciation rules could affect the timing and amount of tax deductions related to the investment, potentially altering the project’s financial feasibility. The business would need to carefully assess the implications of the tax reform on their investment plans and adjust their strategies accordingly.

Taxpayer Advocacy and the October Deadline

Taxpayer advocacy groups play a crucial role in supporting individuals and businesses facing the October tax deadline. These organizations provide essential resources, guidance, and assistance to navigate the complexities of the tax system.

The Role of Taxpayer Advocacy Groups

Taxpayer advocacy groups are dedicated to ensuring fairness and transparency in the tax system. They advocate for taxpayers’ rights and provide support during challenging tax situations, such as the October deadline. These groups often offer a wide range of services, including:

- Information and Education:They provide clear and concise information about tax laws, regulations, and deadlines, empowering taxpayers to make informed decisions.

- Tax Assistance and Representation:They offer assistance with tax preparation, filing, and audits. Some groups even provide legal representation for taxpayers facing tax disputes.

- Taxpayer Rights Advocacy:They advocate for taxpayer rights and protections, ensuring that taxpayers are treated fairly by the IRS.

- Public Awareness Campaigns:They conduct public awareness campaigns to educate taxpayers about their rights and responsibilities.

- Lobbying for Tax Reform:They advocate for changes to the tax system that benefit taxpayers and promote fairness.

Conclusive Thoughts

The IRS October deadline offers a valuable opportunity for individuals and businesses alike to get their tax affairs in order. While it provides extra time, it’s essential to remember that this deadline comes with its own set of requirements and potential consequences.

By understanding the nuances of this extended deadline, you can make informed decisions and avoid any unexpected surprises. If you have any questions or concerns, seeking professional advice from a qualified tax advisor can provide peace of mind and ensure you’re on the right track.

Clarifying Questions

What happens if I miss the October deadline?

Missing the October deadline can result in penalties, including interest charges and late fees. The severity of the penalties can vary depending on the amount owed and the length of the delay. It’s crucial to contact the IRS immediately if you miss the deadline to explore your options and potentially mitigate the penalties.

Can I file an extension for the October deadline?

While the October deadline is an extension in itself, you may be able to request a further extension in certain circumstances. However, it’s important to note that an extension only grants you more time to file your taxes, not to pay them.

You’ll still need to make any payments due by the original October deadline to avoid penalties.

What types of tax forms are due by the October deadline?

Various tax forms are due by the October deadline, including Form 1040-ES (Estimated Tax for Individuals), Form 1040 (U.S. Individual Income Tax Return), and Form 1120 (U.S. Corporation Income Tax Return), among others. It’s essential to consult the IRS website or a qualified tax professional for a comprehensive list of forms applicable to your specific situation.

What are the benefits of filing my taxes by the October deadline?

Filing your taxes by the October deadline provides you with extra time to gather your tax documents, organize your finances, and ensure accuracy in your filings. It also allows you to potentially claim certain deductions or credits that may be available to you.

Where can I find more information about the IRS October Deadline 2024?

The most reliable source of information is the IRS website. You can find detailed guidance, FAQs, and resources on the IRS October deadline and other tax-related matters. You can also consult with a qualified tax professional for personalized advice and assistance.