An Annuity Is Best Defined As 2024 – An Annuity Is Best Defined As: A Guide for 2024 delves into the world of annuities, a financial instrument that can provide a steady stream of income during retirement. This guide will explore the different types of annuities, how they work, and their potential benefits and drawbacks.

Annuity is a financial product that provides a series of payments over time. Learn more about annuities and how they can work for you.

We’

Android WebView 202 offers a powerful way to integrate web content into your mobile apps. Learn how to use Android WebView 202 for mobile development.

Android WebView 202 offers a great way to create custom web views within your Android apps. Explore the possibilities of using Android WebView 202 for custom web views.

ll cover the basics of annuities, from their definition and types to their advantages and disadvantages, offering insights into the complexities of this financial product.

Google Tasks is getting a refresh! Explore the new features and enhancements coming to Google Tasks in 2024.

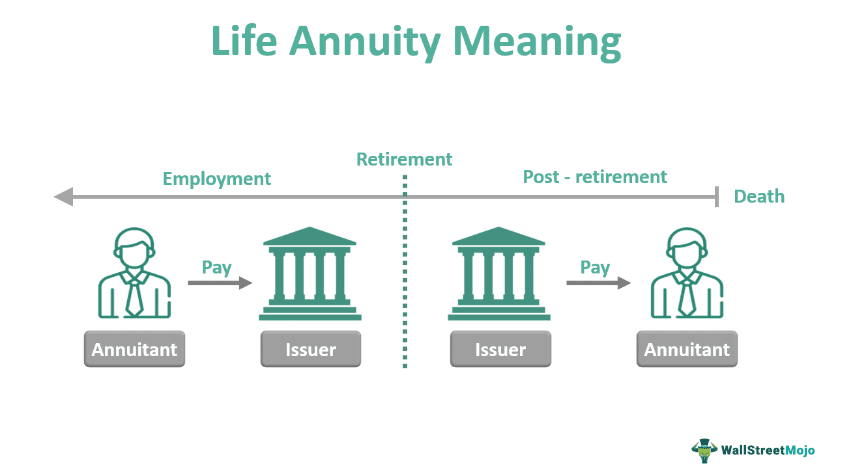

An annuity is a financial product that provides a series of payments over a set period. These payments can be fixed or variable, and they can be paid out for a specific period or for life. Annuities are often used as a way to generate income during retirement, but they can also be used for other purposes, such as providing income for a loved one or funding a college education.

AI is making a big impact on Android app development. Learn about the impact of AI and how it’s transforming the development process.

Contents List

What is an Annuity?

An annuity is a financial product that provides a stream of regular payments over a set period of time. It’s like a structured savings plan where you invest a lump sum upfront, and the insurance company guarantees you a regular income stream in return.

Developing Android apps can be challenging, but it’s a rewarding endeavor. Learn about the challenges you might face in Android app development in 2024.

Defining an Annuity

Think of an annuity as a financial agreement where you trade a lump sum of money for a series of guaranteed payments, much like exchanging a large apple for a basket of smaller apples. These payments can be monthly, quarterly, or annually, and they can last for a fixed period, like 10 years, or for the rest of your life.

Annuity Example

Imagine you’re retiring and have saved a substantial amount of money. You could buy an annuity that provides you with a fixed monthly income for the rest of your life, giving you peace of mind about your financial future. This income stream would help you cover essential expenses like housing, healthcare, and daily living costs.

Types of Annuities

There are various types of annuities, each with its own unique features and benefits. The most common types include:

Fixed Annuities

- Guaranteed Return:Fixed annuities offer a guaranteed interest rate, providing predictable income payments.

- Low Risk:They are considered relatively low-risk investments, as your principal is protected from market fluctuations.

- Limited Growth Potential:However, fixed annuities generally have lower growth potential compared to other investments.

Android WebView 202 has brought some exciting new features to the table, making it even more powerful for developers. Check out these new features and see how they can enhance your web view experiences.

Variable Annuities, An Annuity Is Best Defined As 2024

- Potential for Higher Returns:Variable annuities invest your money in the stock market, offering the potential for higher returns.

- Market Risk:However, they also carry the risk of losing money if the market performs poorly.

- Flexibility:Variable annuities often provide more flexibility in how you manage your investments.

Immediate Annuities

- Payments Start Immediately:Immediate annuities begin making payments as soon as you purchase them.

- Ideal for Retirement Income:They are a good option for retirees who need a steady income stream right away.

- Limited Flexibility:Once you purchase an immediate annuity, you generally can’t change the payment amount or frequency.

Snapdragon is a popular processor for smartphones, and the latest version is expected to be released soon. Get the latest information on the Snapdragon 2024 release date and price.

Deferred Annuities

- Payments Start Later:Deferred annuities begin making payments at a later date, typically in retirement.

- Tax-Deferred Growth:They allow your investment to grow tax-deferred until you start receiving payments.

- Long-Term Savings:Deferred annuities are suitable for long-term savings goals, such as retirement planning.

Ready to dive into Android app development? Check out these top courses and start building your dream app.

Annuity Comparison Table

| Type | Pros | Cons |

|---|---|---|

| Fixed | Guaranteed interest rate, low risk | Limited growth potential |

| Variable | Potential for higher returns, flexibility | Market risk |

| Immediate | Payments start immediately, ideal for retirement income | Limited flexibility |

| Deferred | Tax-deferred growth, long-term savings | Payments start later |

In 2024, best practices are crucial for building high-quality Android apps. Discover the best practices that will help you create a stellar Android app.

How Annuities Work

The process of purchasing an annuity involves choosing the type of annuity that best suits your needs and then investing a lump sum of money. The insurance company will then use your investment to generate a stream of regular payments, which can be tailored to your specific requirements.

Annuity Payment Calculation

Annuity payments are calculated based on several factors, including:

- Principal Amount:The amount of money you invest in the annuity.

- Interest Rate:The rate of return on your investment, which can be fixed or variable.

- Payout Period:The length of time you will receive payments, such as a fixed number of years or for life.

Factors Influencing Payout Amounts

The amount of your annuity payments can be influenced by various factors, including:

- Your Age:Older individuals typically receive larger payments than younger individuals.

- Your Health:Some annuities offer higher payments to individuals with longer life expectancies.

- Interest Rates:Higher interest rates generally result in larger payments.

Advantages of Annuities

Annuities offer several potential advantages, making them an attractive investment option for many individuals.

Building a successful Android app in 2024 requires careful planning and execution. Learn how to build a successful Android app with these valuable tips.

Income Security in Retirement

Annuities can provide a steady stream of income during retirement, helping you cover essential expenses and maintain your lifestyle.

Dollify is a fun and easy way to create adorable avatars for social media. Learn how to use Dollify to create unique and expressive avatars.

Tax Advantages

Some annuities offer tax advantages, such as tax-deferred growth or tax-free withdrawals.

Disadvantages of Annuities

While annuities have their benefits, it’s important to consider the potential drawbacks as well.

Potential Drawbacks

- Limited Flexibility:Once you purchase an annuity, you may have limited flexibility to access your funds or change the payment terms.

- Low Returns:Some annuities, such as fixed annuities, may offer lower returns compared to other investments.

- Risk of Losing Principal:Variable annuities carry the risk of losing your principal if the market performs poorly.

Annuity Considerations

Choosing the right type of annuity is crucial for maximizing your benefits and minimizing your risks.

Google Tasks can be a powerful tool for staying organized. Discover some tips and tricks to get the most out of Google Tasks.

Choosing the Right Annuity

When selecting an annuity, consider your individual needs, financial goals, and risk tolerance. Consult with a financial advisor to discuss your options and determine the best annuity for your situation.

Android Authority has shared its predictions for the smartphone landscape in 2024. Read about the trends and predictions that could shape the future of Android.

Consulting with a Financial Advisor

A financial advisor can help you understand the complexities of annuities and guide you through the decision-making process. They can also provide personalized advice based on your unique circumstances.

Factors to Consider

When deciding if an annuity is right for you, consider the following factors:

- Your Financial Goals:What are you trying to achieve with your investment?

- Your Risk Tolerance:How comfortable are you with potential losses?

- Your Time Horizon:How long do you need the income stream?

- Your Tax Situation:How will taxes affect your investment?

Final Wrap-Up

Understanding the intricacies of annuities is crucial for anyone seeking financial security. This guide has provided a comprehensive overview of annuities, exploring their types, workings, advantages, and disadvantages. By weighing the pros and cons and considering your individual needs, you can make informed decisions about whether an annuity is right for you.

Remember, consulting with a financial advisor is always recommended to ensure you make the best choice for your financial goals.

Helpful Answers: An Annuity Is Best Defined As 2024

What is the difference between a fixed and a variable annuity?

A fixed annuity guarantees a set rate of return, while a variable annuity’s return fluctuates based on the performance of underlying investments.

Are annuities a good investment for everyone?

Annuities may not be suitable for everyone. It’s important to consider your individual financial goals, risk tolerance, and time horizon before making a decision.

What are the tax implications of annuities?

The tax treatment of annuities can vary depending on the type of annuity and how it is structured. It’s essential to consult with a tax advisor to understand the tax implications.

Need groceries delivered? Glovo has you covered! Learn how to use the Glovo app to order groceries and have them delivered right to your doorstep.

How do I choose the right annuity for me?

It’s recommended to consult with a financial advisor to determine the best type of annuity for your specific needs and financial situation.