Annuity Certain Is An Example Of 2024, a financial tool that provides a steady stream of income for a predetermined period, is gaining popularity in today’s uncertain economic climate. This guide delves into the world of annuities certain, exploring their core concepts, different types, and applications in various financial scenarios.

Dollify is a popular app that allows you to create cute and personalized avatars. If you’re curious about the new features and updates in Dollify 2024, you can find information in this article: Dollify 2024: New Features and Updates.

We’ll analyze how these financial instruments are evolving in 2024, navigating the changing market trends and regulations. Prepare to uncover the potential benefits and risks associated with annuities certain, empowering you to make informed financial decisions.

The release date and price of new Snapdragon processors are eagerly awaited by tech enthusiasts. If you’re looking for information on the Snapdragon 2024 release date and price, you can find it here: Snapdragon 2024 release date and price.

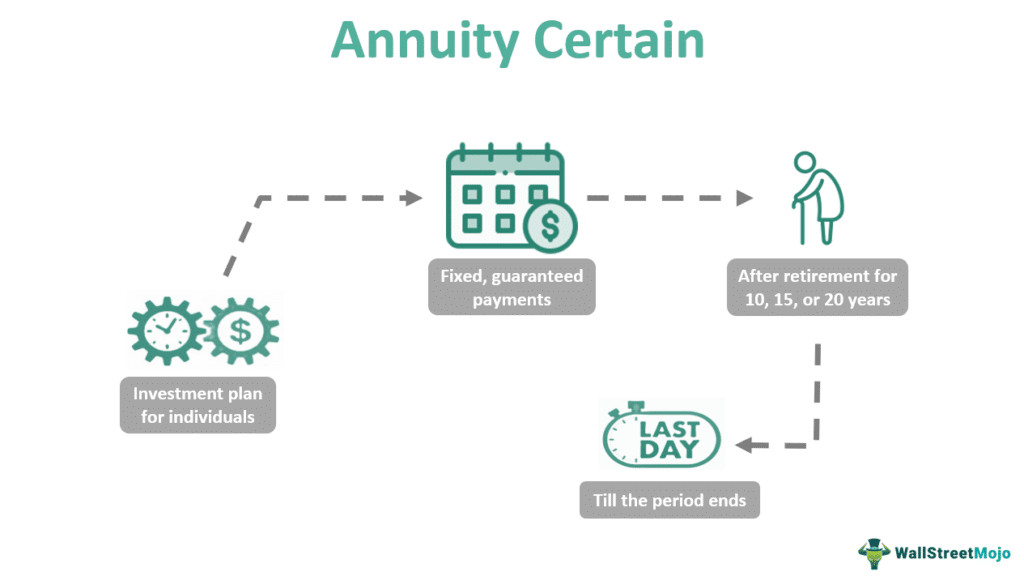

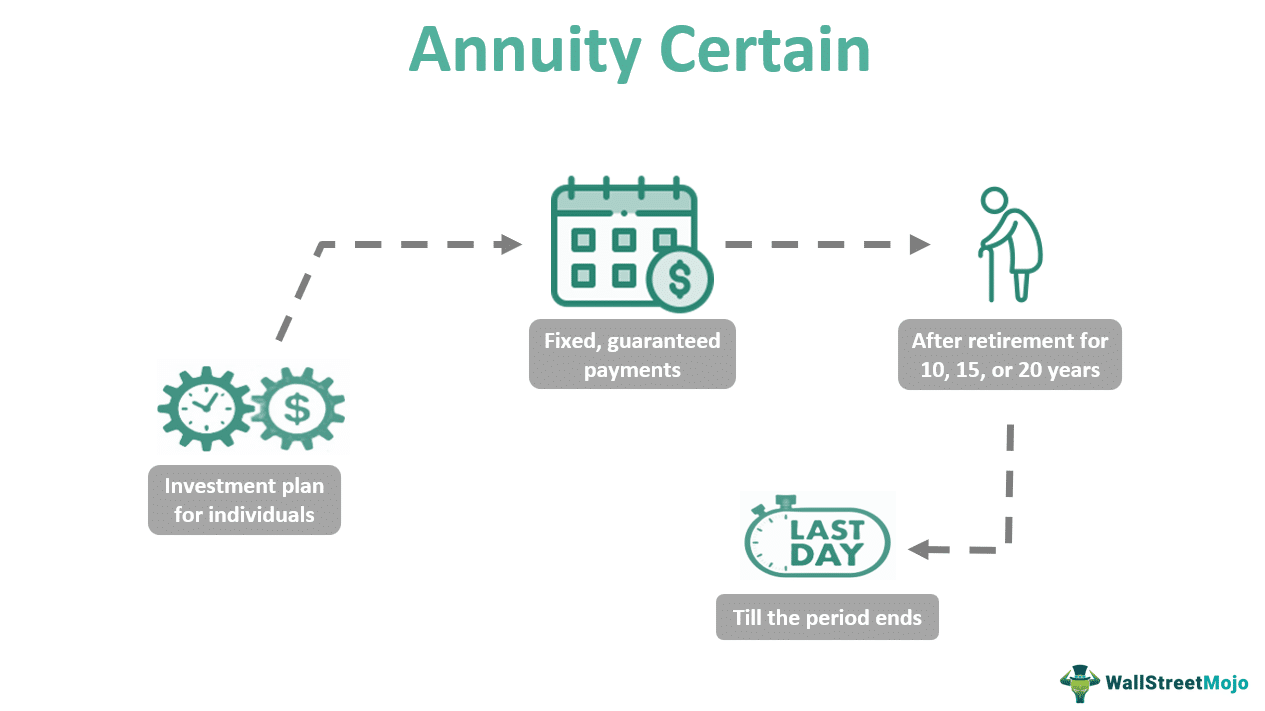

Annuities certain are contracts that guarantee a fixed stream of payments for a specific duration, regardless of market fluctuations or life expectancy. These contracts offer a sense of security and predictability, making them attractive to individuals seeking reliable income streams for retirement, estate planning, or other financial goals.

Glovo offers a convenient way to get food and other items delivered. If you’re interested in knowing the estimated delivery times for different orders on Glovo, you can find that information in this article: Glovo app delivery time estimates for different orders.

Contents List

Defining Annuities Certain

An annuity certain, as the name suggests, is a financial product that provides a stream of fixed payments for a predetermined period. Unlike other types of annuities, the duration of an annuity certain is not dependent on any uncertain event, such as the lifespan of an individual.

This fixed duration makes it a predictable and reliable source of income for a specific timeframe.

Choosing the right delivery app can be tricky, with different platforms offering varying fees and services. If you’re looking for a comparison of Glovo’s delivery fees against other popular apps, this article provides valuable insights: Glovo app delivery fees compared to other apps.

Real-World Examples of Annuities Certain

- Retirement Planning:Individuals can use an annuity certain to ensure a steady income stream during their retirement years, providing financial security and peace of mind.

- Estate Planning:Annuities certain can be incorporated into estate plans to provide beneficiaries with regular payments for a set period, ensuring that their financial needs are met.

- Business Transactions:Annuities certain can be used in business transactions, such as structured settlements or lease agreements, to facilitate payments over a predetermined period.

Key Characteristics of Annuities Certain

- Fixed Duration:The most defining characteristic of an annuity certain is its fixed duration, meaning payments are guaranteed for a specific period, regardless of any external factors.

- Regular Payments:Annuities certain typically involve regular payments, either monthly, quarterly, annually, or at other predetermined intervals.

- Guaranteed Payments:The payments are guaranteed by the issuing financial institution, providing a level of certainty and security for the recipient.

Types of Annuities Certain

Annuities certain can be categorized into different types, each with its own specific features and payment structures. Understanding these types is crucial for selecting the most suitable option for your financial needs.

Planning for the future is essential, and understanding how to manage your assets is crucial. If you’re considering a trust as a beneficiary for your annuity, this article can provide helpful information: Annuity Beneficiary Is A Trust 2024.

Immediate Annuities Certain

- Payment Commencement:Payments begin immediately upon purchase of the annuity.

- Suitable for:Individuals seeking immediate income, such as retirees or those needing a steady cash flow.

- Example:A person buys an immediate annuity certain for $100,000, receiving monthly payments for 10 years.

Deferred Annuities Certain, Annuity Certain Is An Example Of 2024

- Payment Commencement:Payments begin at a future date, after a predetermined deferral period.

- Suitable for:Individuals who want to build up savings and delay income generation, such as those planning for retirement.

- Example:A person purchases a deferred annuity certain for $50,000, with payments starting in 5 years for a duration of 15 years.

Life Annuities

While not strictly an annuity certain, life annuities are often compared due to their guaranteed income stream. However, unlike annuities certain, life annuities are not guaranteed for a fixed period but continue until the annuitant’s death. This makes them more suitable for individuals seeking lifetime income, but they are not as predictable in terms of duration.

The Android app market is constantly evolving, and building a successful app requires careful planning and execution. If you’re interested in creating a successful Android app, this article offers valuable tips and strategies: How to build a successful Android app in 2024.

Calculating Annuity Certain Payments

The present value of an annuity certain is the current worth of the future stream of payments. It is calculated using a formula that considers the amount of each payment, the number of payments, and the discount rate.

A user-friendly app is crucial for success. If you’re designing an Android app, you’ll want to ensure a smooth and intuitive user experience. This article provides helpful insights on designing a user-friendly Android app: How to design a user-friendly Android app in 2024.

Formula for Present Value of Annuity Certain

PV = PMT

Tablets are becoming increasingly popular, and Snapdragon processors are often used in these devices. To learn more about the Snapdragon 2024 processor for tablets, you can check out this article: Snapdragon 2024 for tablets.

- [1

- (1 + r)^-n] / r

Where:

- PV = Present Value

- PMT = Payment Amount

- r = Discount Rate

- n = Number of Payments

Step-by-Step Calculation Guide

- Determine the payment amount (PMT):This is the fixed amount you will receive each payment period.

- Identify the discount rate (r):This reflects the time value of money, representing the rate of return you could earn on an alternative investment.

- Calculate the number of payments (n):This is the total number of payments you will receive over the annuity’s duration.

- Plug the values into the formula:Substitute the PMT, r, and n values into the formula to calculate the present value (PV).

Hypothetical Example

Let’s say you are considering an annuity certain that pays $1,000 per month for 10 years. The discount rate is 5% per annum. To calculate the present value, we first need to convert the annual discount rate to a monthly rate: 5% / 12 = 0.4167% per month.

Annuity is a type of insurance product that can provide you with a guaranteed stream of income. If you’re interested in learning more about how annuities work as a life insurance product, this article provides valuable information: Annuity Is A Life Insurance Product That 2024.

Next, we need to determine the total number of payments: 10 years – 12 months/year = 120 payments.

Pushbullet is a popular tool for cross-platform communication, allowing you to seamlessly share files and notifications between devices. To learn how to set up Pushbullet for cross-platform communication, you can check out this guide: Pushbullet 2024: How to set up Pushbullet for cross-platform communication.

Now, we can plug the values into the formula:

PV = $1,000

Pushbullet offers a convenient way to stay connected across multiple devices, but it’s important to weigh the pros and cons before using it. This article explores the advantages and disadvantages of using Pushbullet: Pushbullet 2024: What are the pros and cons of using Pushbullet?

.

- [1

- (1 + 0.004167)^-120] / 0.004167

Calculating this, we get a present value of approximately $95,071. This means that the current worth of the future stream of payments is $95,071.

Snapdragon processors are known for their performance, and the latest generation is no exception. If you’re curious about the performance benchmarks of Snapdragon 2024, you can find detailed information in this article: Snapdragon 2024 performance benchmarks.

Applications of Annuities Certain

Annuities certain find applications in various financial contexts, serving as a versatile tool for achieving specific financial goals.

Artificial intelligence is rapidly transforming various industries, including Android app development. If you’re interested in learning about the impact of AI on Android app development in 2024, you can find insightful information in this article: The impact of AI on Android app development in 2024.

Retirement Planning

- Guaranteed Income:Annuities certain provide a guaranteed income stream during retirement, ensuring a predictable source of funds to cover living expenses.

- Longevity Protection:They can help mitigate the risk of outliving your savings, ensuring that you have a steady income for the duration of your retirement.

- Income Supplement:Annuities certain can be used to supplement other retirement income sources, such as Social Security or pensions.

Estate Planning

- Beneficiary Income:Annuities certain can be used to provide beneficiaries with regular payments for a set period, ensuring their financial needs are met after your passing.

- Asset Protection:They can help protect assets from estate taxes and probate, ensuring that the intended beneficiaries receive the full benefit.

- Income for Dependents:Annuities certain can provide a steady income for dependents, such as children or spouses, for a predetermined period.

Investment Strategies

- Income Generation:Annuities certain can be used to generate a regular income stream from a lump sum investment.

- Capital Preservation:They can help preserve capital, providing a guaranteed income while protecting the principal investment.

- Tax-Efficient Income:Depending on the type of annuity, the income generated can be tax-efficient, reducing overall tax liability.

Annuity Certain in 2024: Annuity Certain Is An Example Of 2024

The use of annuities certain continues to evolve in 2024, influenced by factors such as interest rates, market volatility, and regulatory changes. Understanding these trends is crucial for making informed decisions about using annuities certain in your financial planning.

Current Market Trends

- Low Interest Rates:The current low-interest rate environment may make annuities certain less attractive to some investors, as the guaranteed returns may be lower than alternative investments.

- Market Volatility:The increased market volatility in recent years has led some investors to seek the stability and predictability of annuities certain.

- Inflation Concerns:Rising inflation rates can erode the purchasing power of annuity payments, making it important to consider inflation-indexed annuities.

Regulatory Updates

- Tax Law Changes:Any changes to tax laws related to annuities could impact their attractiveness and usage.

- Consumer Protection Regulations:New regulations may be introduced to enhance consumer protection in the annuity market, potentially affecting product features and pricing.

Future Outlook

The future outlook for annuities certain is uncertain, influenced by a complex interplay of economic, regulatory, and demographic factors. However, they are likely to remain a relevant financial product for individuals seeking guaranteed income and longevity protection.

Annuity is a financial product that can provide you with a steady stream of income during retirement. If you’re considering an annuity, it’s helpful to understand the different types and how they work. You can learn more about annuities and their benefits by reading this article: Annuity Is A Series Of 2024.

Last Word

Understanding the intricacies of annuities certain is crucial in today’s complex financial landscape. As we move forward into 2024, it’s important to stay informed about the latest trends and regulations impacting these financial instruments. By carefully considering your individual financial circumstances and goals, you can determine if an annuity certain is the right choice for you.

Remember, seeking professional financial advice can help you navigate the complexities of annuities and make informed decisions that align with your long-term financial objectives.

FAQ Overview

What are the potential risks associated with annuities certain?

While annuities certain offer stability and predictability, they also come with certain risks. For example, interest rates can fluctuate, potentially impacting the return on your investment. Additionally, some annuities may have surrender charges if you withdraw funds before a specified period.

How do annuities certain differ from other types of annuities?

Annuities certain are distinguished from other types of annuities by their fixed duration. Unlike variable annuities, which are tied to market performance, annuities certain provide guaranteed payments for a predetermined period, regardless of market fluctuations.

Annuity is a complex financial product, and it’s important to understand its features before making any decisions. To get a better grasp on the concept of annuities, you can check out this helpful resource: An Annuity Is Quizlet 2024.

Are annuities certain suitable for everyone?

The suitability of annuities certain depends on your individual financial circumstances and goals. It’s essential to consult with a financial advisor to determine if an annuity certain aligns with your specific needs and risk tolerance.