Annuity Due Is 2024 – Annuity Due: A Comprehensive Guide for 2024 delves into the intricacies of annuities due, providing a thorough understanding of their characteristics, calculations, and applications. This guide explores the unique features of annuities due, differentiating them from ordinary annuities and highlighting their relevance in various financial scenarios.

From understanding the fundamental concepts of annuities due to analyzing their practical implications in investment strategies and retirement planning, this guide equips readers with the knowledge and insights necessary to navigate the world of annuities due confidently.

Stay ahead of the curve with the latest tech releases! Check out the anticipated Snapdragon 2024 release date and price for a glimpse into the future of mobile processors.

Contents List

Understanding Annuities Due

Annuities due are a type of financial instrument that involves a series of equal payments made at the beginning of each period. They are commonly used in various financial scenarios, such as retirement planning, loan amortization, and investment strategies. This article will delve into the intricacies of annuities due, exploring their characteristics, calculations, applications, and advantages and disadvantages.

Annuities are a complex financial instrument. Learn more about their characteristics and how they work by exploring annuity-related multiple-choice questions.

Defining Annuities Due

An annuity due is a stream of equal payments made at the beginning of each period, such as monthly, quarterly, or annually. The key characteristic that distinguishes annuities due from ordinary annuities is the timing of payments. In an ordinary annuity, payments are made at the end of each period, while in an annuity due, payments are made at the beginning.

Differentiating Annuities Due from Ordinary Annuities

The primary difference between annuities due and ordinary annuities lies in the timing of payments. Here’s a table summarizing the key distinctions:

| Feature | Annuities Due | Ordinary Annuities |

|---|---|---|

| Payment Timing | Beginning of each period | End of each period |

| Present Value Calculation | (1 + i)

Understanding the nuances of annuities can be tricky. Learn more about annuities and compound interest to make informed financial decisions in 2024.

|

Standard present value formula |

| Future Value Calculation | (1 + i)

The future of Android app development is intertwined with AI. Discover how AI is transforming the landscape and shaping the tools and techniques developers use.

|

Standard future value formula |

Examples of Annuities Due

Annuities due are prevalent in various real-world scenarios. Some common examples include:

- Rent Payments:When you pay rent at the beginning of each month, you are essentially making an annuity due payment.

- Insurance Premiums:Many insurance policies require premium payments at the beginning of each coverage period, making them annuities due.

- Loan Repayments:Some loans, such as mortgages, involve making payments at the beginning of each month, which constitutes an annuity due.

Annuity Due Calculations

Calculating the present value, future value, and payment amount of an annuity due involves specific formulas and considerations. These calculations are crucial for understanding the financial implications of annuities due and making informed investment decisions.

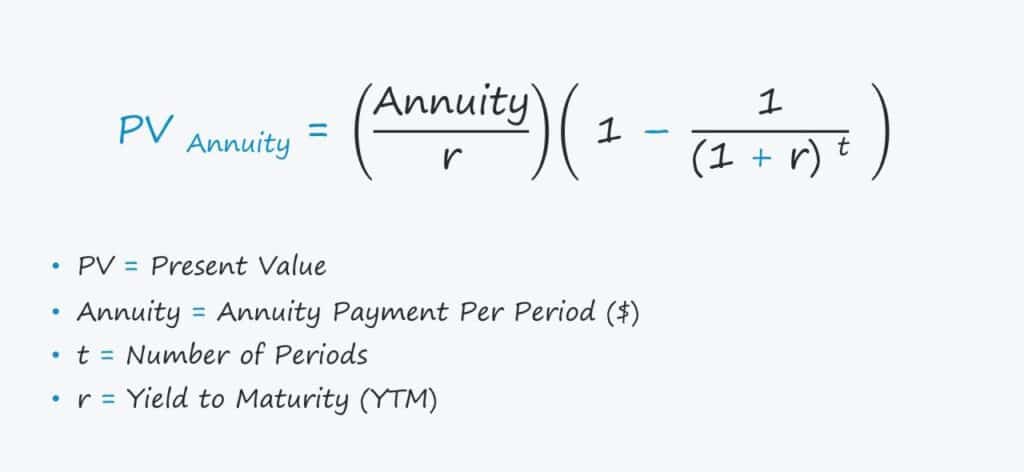

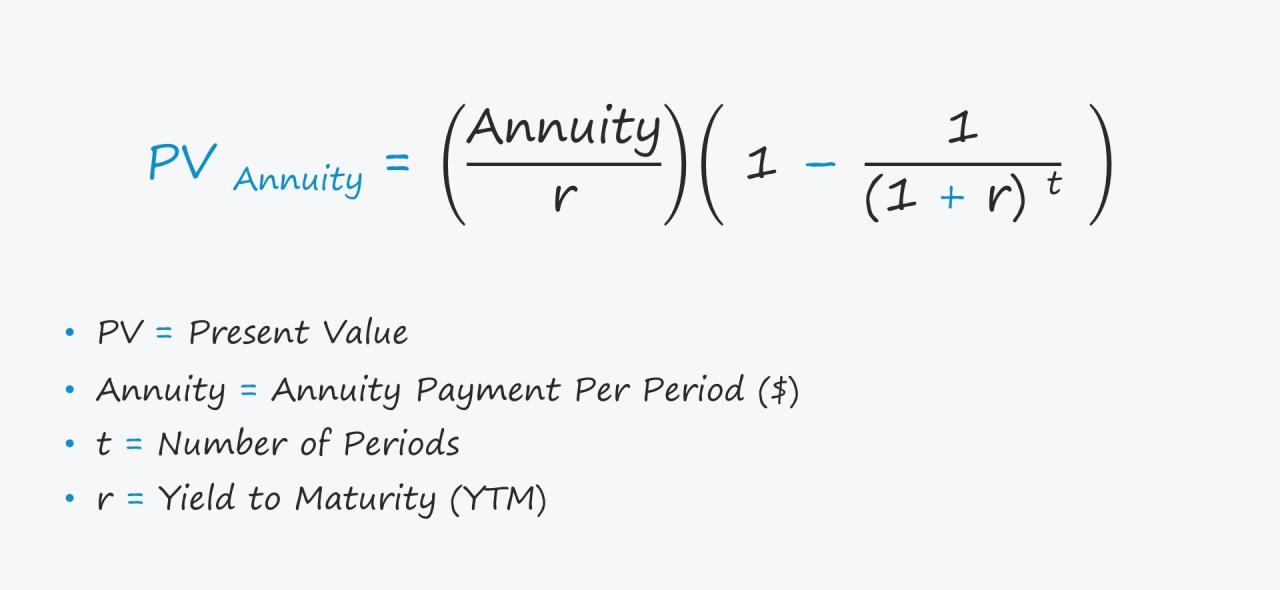

Present Value of an Annuity Due

The present value of an annuity due represents the current worth of a series of future payments made at the beginning of each period. It is calculated using the following formula:

PV = PMT

- [(1

- (1 + i)^-n) / i]

- (1 + i)

Where:

- PV = Present Value

- PMT = Payment Amount

- i = Interest Rate per Period

- n = Number of Periods

Future Value of an Annuity Due

The future value of an annuity due represents the total value of the payments at the end of the annuity period. It is calculated using the following formula:

FV = PMT

- [((1 + i)^n

- 1) / i]

- (1 + i)

Where:

- FV = Future Value

- PMT = Payment Amount

- i = Interest Rate per Period

- n = Number of Periods

Payment Amount for an Annuity Due

To calculate the payment amount for an annuity due, we can rearrange the present value formula:

PMT = PV / [(1

The rise of AI has a significant impact on the world of avatar creation. Learn how AI is shaping the future of avatars in tools like Dollify 2024.

- (1 + i)^-n) / i]

- (1 + i)

This formula helps determine the required payment amount to achieve a specific present value goal.

Want to spice up your social media presence? Dollify 2024 offers a fun and engaging way to create unique avatars for your profiles.

Factors Influencing Annuity Due Payments: Annuity Due Is 2024

Several factors influence the payments associated with annuities due. Understanding these factors is crucial for accurately assessing the financial implications of annuities due and making informed investment decisions.

The rise of avatar creation tools like Dollify raises important ethical questions about digital identity and representation. It’s crucial to consider these issues as we navigate the evolving landscape of online avatars.

Impact of Interest Rates

Interest rates play a significant role in annuity due calculations. Higher interest rates generally lead to larger future values and smaller present values. This is because higher interest rates mean that money grows faster over time, resulting in a larger future value.

Conversely, higher interest rates make the present value of future payments smaller, as the discounting factor is higher.

For developers seeking a more tailored approach, Android WebView 202 offers enhanced control and customization, making it ideal for specific use cases within your Android apps.

Time Period

The time period over which the annuity payments are made also affects the value of the annuity due. Longer time periods generally result in larger future values and smaller present values. This is because the payments have more time to accumulate interest, leading to a higher future value.

Looking for a powerful processor for your next tablet? The upcoming Snapdragon 2024 for tablets promises impressive performance and features.

Conversely, the present value of payments made over a longer period is smaller, as the discounting factor is applied over a longer time frame.

Looking to boost your productivity in 2024? Check out Google Tasks for Entrepreneurs , a tool that helps you organize your tasks and stay on top of your business goals.

Compounding Frequency, Annuity Due Is 2024

Compounding frequency refers to how often interest is calculated and added to the principal. More frequent compounding leads to higher future values. This is because interest is earned on previously earned interest, leading to exponential growth. For example, an annuity due with monthly compounding will generally have a higher future value than one with annual compounding, assuming all other factors are equal.

Before investing in an annuity, it’s essential to understand its pros and cons. Discover whether annuities are a good or bad financial decision for you.

Applications of Annuities Due

Annuities due find applications in various financial scenarios, offering flexibility and tailored solutions for different financial goals. Here are some key areas where annuities due are utilized.

Ready to dive into Android app development? Get started with our comprehensive guide on how to get started with Android app development.

Real-World Scenarios

- Retirement Planning:Annuities due are commonly used in retirement planning to provide a steady stream of income during retirement. By making regular payments into an annuity due account, individuals can accumulate a nest egg that generates a predictable income stream in their later years.

The right tools can make all the difference in Android app development. Explore the top Android app development tools to streamline your workflow and build exceptional apps.

- Loan Amortization:Annuities due are often used in loan amortization, where regular payments are made at the beginning of each period to gradually pay down the principal and interest. Mortgages, car loans, and student loans are common examples of loans that utilize annuities due.

- Investment Strategies:Annuities due can be incorporated into investment strategies to generate regular income or to accumulate wealth over time. For example, investors may use annuities due to create a steady stream of income from their investment portfolio.

Retirement Planning

Annuities due play a crucial role in retirement planning by providing a predictable income stream during retirement. By making regular payments into an annuity due account, individuals can accumulate a nest egg that generates a steady income stream during their retirement years.

Annuities due can be structured to provide lifetime income or for a specific period, depending on individual needs and financial goals.

Loan Amortization

Annuities due are commonly used in loan amortization, where regular payments are made at the beginning of each period to gradually pay down the principal and interest. This structure ensures that the loan is paid off within a predetermined timeframe, with each payment contributing to both principal and interest reduction.

Building a successful Android app in 2024 requires a strategic approach. Discover the essential steps and insights to create a thriving Android app.

Advantages and Disadvantages of Annuities Due

Annuities due offer several advantages, making them attractive for various financial purposes. However, it’s essential to consider potential drawbacks and risks associated with annuities due before making investment decisions.

Planning your next Glovo order? Get a better idea of estimated delivery times for different order types with Glovo’s app.

Advantages

- Guaranteed Income Stream:Annuities due provide a guaranteed income stream, offering financial security and predictability. This is particularly beneficial for individuals seeking a reliable source of income during retirement or other life stages.

- Tax Advantages:Depending on the type of annuity due, there may be tax advantages associated with the payments. For example, some annuities due offer tax-deferred growth, meaning that taxes are not paid until the income is withdrawn.

- Flexibility:Annuities due can be structured to meet individual needs and financial goals. They can be customized in terms of payment amounts, time periods, and investment options.

Disadvantages

- Potential for Lower Returns:Annuities due may offer lower returns compared to other investment options, such as stocks or mutual funds. This is because they typically involve a guaranteed income stream, which can limit potential growth.

- Fees and Expenses:Annuities due often involve fees and expenses, which can impact returns. It’s crucial to carefully review the fees and expenses associated with any annuity due before investing.

- Liquidity Concerns:Annuities due may have liquidity concerns, meaning that it may be difficult to access the funds before the agreed-upon time period. This can be a drawback for individuals who require access to their funds on short notice.

Ending Remarks

By grasping the principles and applications of annuities due, individuals can make informed financial decisions, maximizing their investment potential and ensuring a secure financial future. Whether you’re seeking to understand the mechanics of annuity due calculations or exploring their role in retirement planning, this guide provides a comprehensive and accessible resource for navigating the complexities of this important financial instrument.

Popular Questions

What are the key differences between an annuity due and an ordinary annuity?

The primary difference lies in the timing of payments. An annuity due has payments made at the beginning of each period, while an ordinary annuity has payments made at the end of each period.

How do interest rates impact annuity due payments?

Higher interest rates generally lead to larger future values for annuities due, as the accumulated interest earns interest itself over time.

What are some common examples of annuities due in real-world situations?

Examples include rent payments, insurance premiums, and certain types of investment products.

What are the advantages and disadvantages of using annuities due for investment purposes?

Advantages include potential for higher returns due to earlier compounding and guaranteed income streams. Disadvantages include potential for lower returns compared to other investments and potential for loss of principal.