Annuity Examples In Real Life 2024: Planning for Your Future explores the practical applications of annuities in today’s financial landscape. Annuities, often seen as complex financial instruments, can provide a valuable tool for individuals seeking to secure their financial future, whether it’s for retirement planning, income generation, or estate planning.

Looking for a free and effective task management app? Google Tasks is a simple yet powerful tool for organizing your daily tasks.

This guide delves into the various types of annuities, their benefits, and the key considerations before making an investment.

Annuity is a valuable option for retirement planning, as it provides a steady stream of income during your golden years. Learn more about how annuities can help you secure your future.

From understanding the difference between fixed and variable annuities to exploring real-life scenarios where annuities can be beneficial, this guide aims to demystify these financial products and empower individuals to make informed decisions. We’ll examine how annuities can provide a guaranteed income stream, potential for tax-deferred growth, and long-term financial security, while also addressing potential downsides such as surrender charges and the importance of carefully reviewing contract terms.

When deciding between an annuity and drawdown, it’s essential to consider your individual circumstances and financial goals. This article provides a detailed comparison to help you make the right choice.

Contents List

Understanding Annuities

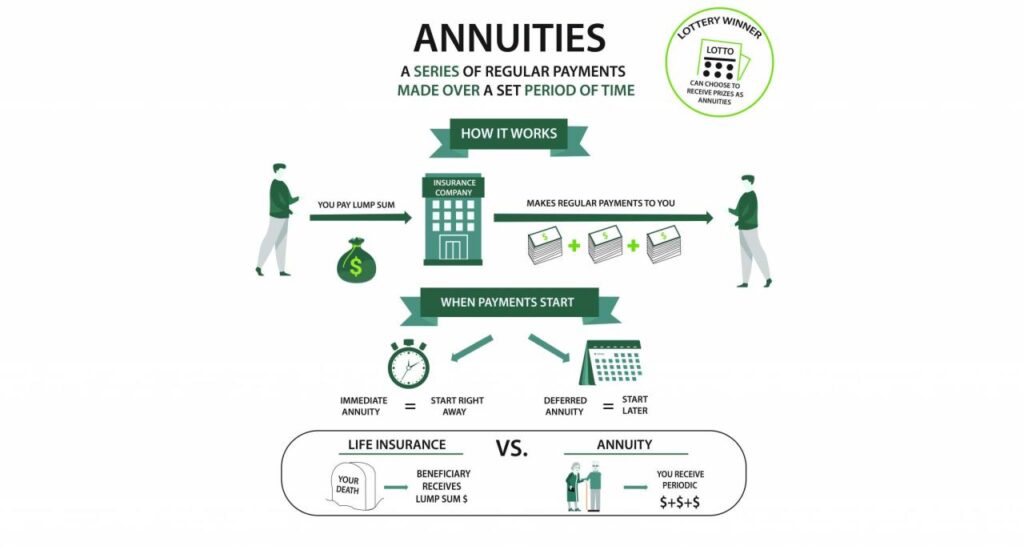

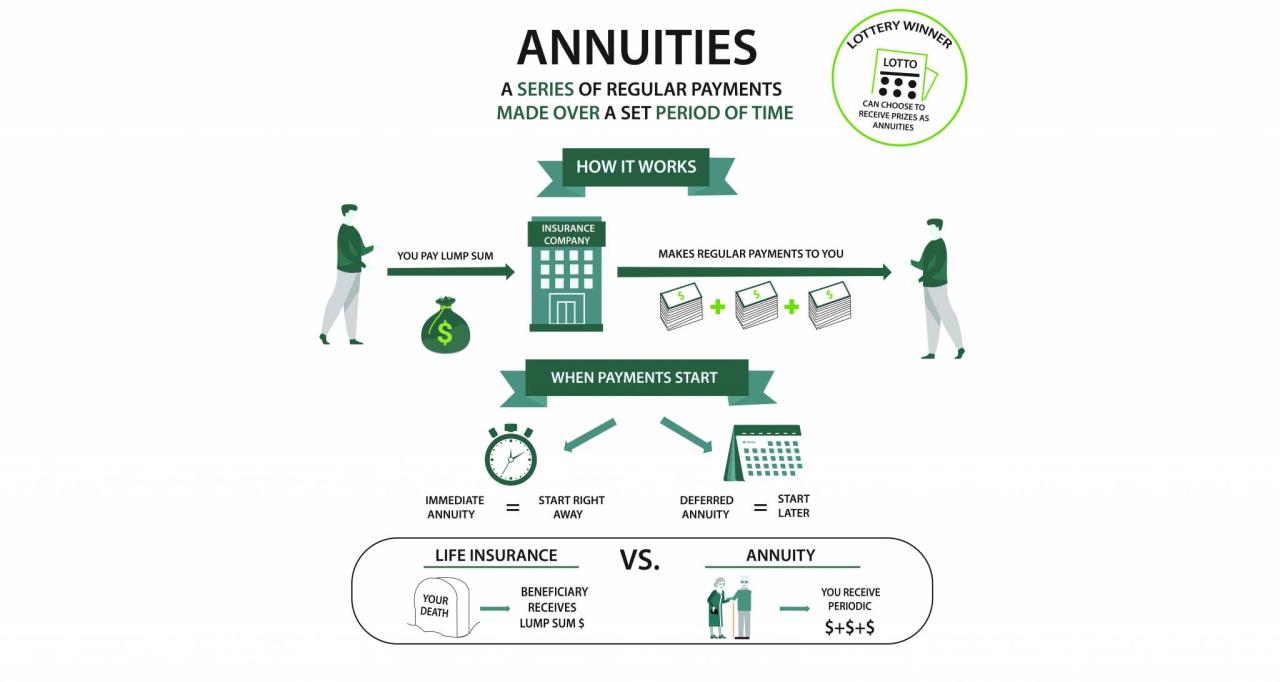

Annuities are financial products designed to provide a stream of regular payments, often used for retirement planning, income generation, or estate planning. They essentially convert a lump sum of money into a series of payments over a specified period.

In 2024, Android app development is playing a crucial role in enterprise solutions. Discover how Android apps are transforming businesses.

Types of Annuities

Annuities come in various forms, each tailored to specific financial goals and risk appetites. Here’s a breakdown of the most common types:

- Fixed Annuities:These offer guaranteed payments at a fixed interest rate, providing predictable income streams. The downside is that the returns are typically lower than variable annuities, and they don’t keep pace with inflation.

- Variable Annuities:These invest your money in a sub-account, allowing for potential growth based on market performance. However, the payments are not guaranteed, and the value of the annuity can fluctuate.

- Immediate Annuities:These start paying out immediately after purchase, providing a steady income stream for life or a set period.

- Deferred Annuities:These start paying out at a later date, often used for retirement planning. They allow your money to grow tax-deferred until you begin receiving payments.

- Indexed Annuities:These link their returns to a specific index, such as the S&P 500. They offer the potential for growth while providing some downside protection.

Real-Life Examples of Annuities in 2024

Annuities are versatile financial tools that can be used in various situations. Here are some real-life examples of how individuals might leverage annuities in 2024:

Retirement Planning, Annuity Examples In Real Life 2024

Annuities can play a crucial role in retirement planning by providing a guaranteed income stream. Imagine a couple retiring in 2024, they can use an annuity to convert a portion of their savings into a steady income that supplements their Social Security benefits.

Annuities can be a great way to grow your savings over time. Learn how annuities utilize compound interest to help you reach your financial goals.

This ensures they have a reliable source of funds to cover their living expenses in retirement.

Understanding the definition of an annuity is crucial for making informed financial decisions. This resource provides a clear and concise explanation of annuities.

Income Generation

Annuities can also be used to generate income for individuals who want to supplement their existing income streams. For example, someone who owns a small business might purchase an annuity to provide a regular income during their semi-retirement years.

Estate Planning

Annuities can be a valuable tool for estate planning, particularly for those who want to leave a legacy for their loved ones. An annuity can provide a stream of income to beneficiaries after the owner’s death, ensuring their financial security.

Want to create adorable avatars? Dollify is a fun and easy-to-use app. Check out these tips and tricks for beginners to get started.

Benefits of Annuities

Annuities offer several advantages that make them attractive to investors, particularly for retirement planning and long-term financial security. Here are some key benefits:

Guaranteed Income Stream

Fixed annuities provide a guaranteed income stream for life or a set period. This offers peace of mind, knowing that you will receive a consistent payment regardless of market fluctuations.

Creating a user-friendly Android app is essential for success in 2024. This guide provides insights into designing intuitive and engaging mobile experiences.

Tax-Deferred Growth

The earnings within an annuity grow tax-deferred, meaning you won’t pay taxes on the earnings until you start withdrawing them. This can help you accumulate wealth more quickly than with taxable investments.

Annuities are a versatile financial instrument with various names. Learn about the different terms used to describe annuities and their implications.

Long-Term Financial Security

Annuities can provide long-term financial security, especially for individuals who are concerned about outliving their savings. They offer a guaranteed income stream that can last for life, ensuring you have a steady source of funds to cover your expenses.

Understanding how annuities are calculated is essential for making informed financial decisions. This resource provides a step-by-step explanation of the calculation process.

Considerations and Risks

While annuities offer numerous benefits, it’s essential to understand their potential downsides and risks before making an investment.

An annuity certain is a popular type of annuity that guarantees payments for a specific period. Learn more about the benefits and features of this type of annuity.

Surrender Charges

Some annuities come with surrender charges, which are fees you pay if you withdraw your money before a specific period. These charges can be substantial, especially in the early years of the annuity contract.

Wondering if an annuity bond is right for you in 2024? This article explores the key aspects of annuity bonds and can help you make an informed decision.

Understanding Terms and Conditions

It’s crucial to thoroughly read and understand the terms and conditions of any annuity contract before signing. This includes the interest rate, fees, and surrender charges. Consult with a financial advisor if you have any questions or concerns.

The Android app development landscape is constantly evolving. Stay ahead of the curve by understanding the latest trends in 2024.

Risk Comparison

Fixed annuities offer lower returns than variable annuities but come with a guaranteed income stream. Variable annuities, on the other hand, have the potential for higher returns but also carry the risk of losing money if the market performs poorly.

The Snapdragon chipsets are known for their impressive camera capabilities. Explore the latest advancements in Snapdragon camera performance for 2024.

Annuity Examples in Action

To better understand how annuities work in practice, here’s a table comparing the features and benefits of different annuity types:

| Annuity Type | Features | Benefits | Risks |

|---|---|---|---|

| Fixed Annuity | Guaranteed interest rate, predictable payments | Guaranteed income stream, low risk | Lower returns, may not keep pace with inflation |

| Variable Annuity | Investment options, potential for growth | Potential for higher returns, tax-deferred growth | Not guaranteed, market risk, potential for loss |

| Immediate Annuity | Payments start immediately | Provides immediate income | May not be the best option for long-term growth |

| Deferred Annuity | Payments start at a later date | Allows for tax-deferred growth, flexible payment options | May not be suitable for immediate income needs |

| Indexed Annuity | Linked to a specific index | Potential for growth, downside protection | Limited upside potential, may not keep pace with inflation |

Last Recap: Annuity Examples In Real Life 2024

By understanding the nuances of annuities and their diverse applications, individuals can make informed decisions about incorporating them into their financial strategies. Whether you’re nearing retirement, seeking to supplement your income, or planning for your legacy, annuities offer a range of options to meet your unique needs and goals.

This guide provides a comprehensive overview of annuities, empowering you to navigate this complex financial landscape with confidence.

Clarifying Questions

What is the minimum amount I need to invest in an annuity?

The minimum investment amount for an annuity varies depending on the type of annuity and the issuing company. Some annuities may have minimum investment requirements of a few thousand dollars, while others may have lower thresholds.

Are annuities subject to taxes?

Yes, annuity payouts are generally taxable as ordinary income. However, the growth within the annuity may be tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them.

If you’re building hybrid apps, Android WebView 202 is a powerful tool to consider. It provides enhanced performance and security, making it a great choice for modern app development.

Can I withdraw my money from an annuity before the contract term?

You can usually withdraw money from an annuity before the contract term, but you may be subject to surrender charges or penalties. The terms and conditions of your annuity contract will specify the withdrawal rules.