Annuity Is Future Value 2024: Your Guide to Secure Retirement delves into the world of annuities, exploring their potential as a valuable tool for building a financially secure future. This guide will navigate the intricacies of annuities, from their fundamental principles to their role in retirement planning and the latest market trends.

Boost your productivity with Google Tasks! Google Tasks 2024: A Comprehensive Guide for Productivity provides a detailed guide to using this powerful tool effectively. From creating lists to setting deadlines, it’s your go-to guide for managing your day.

Understanding annuities involves appreciating their core characteristics, including the distinction between ordinary annuities and annuities due. We’ll examine the factors that influence their future value, such as interest rates and time periods, and explore the various types of annuities available, each with its unique features and benefits.

The Snapdragon 2024 is not just for phones, it’s also making its way to laptops! Snapdragon 2024 for laptops examines the implications of this new technology, including its potential to revolutionize laptop performance and battery life.

This exploration will empower you to make informed decisions about whether annuities align with your individual financial goals.

Battery life is a crucial factor for any device, especially with demanding processors. Snapdragon 2024 battery life and efficiency provides insights into its power consumption and efficiency, helping you understand its impact on device longevity.

Contents List

Annuity Basics

Annuity is a financial product that provides a series of regular payments over a specified period. It’s essentially a stream of income that can be used for various financial goals, such as retirement planning, income supplementation, or even estate planning.

Key Characteristics of an Annuity

Annuities have several key characteristics that distinguish them from other financial products. These characteristics are important to understand before investing in an annuity:

- Regular Payments:Annuities are designed to provide a steady stream of income, usually paid out monthly, quarterly, or annually.

- Specified Period:The payments from an annuity are made for a predetermined period, which can be for a fixed number of years, for the lifetime of the annuitant, or until a specific event occurs.

- Guaranteed Income:Some annuities offer guaranteed income payments, providing financial security and peace of mind. This is particularly attractive for retirees who need a reliable source of income.

- Tax Deferred Growth:In many cases, the earnings on annuity investments grow tax-deferred, meaning that taxes are not paid until the money is withdrawn.

Ordinary Annuities vs. Annuities Due

Annuities can be categorized as ordinary annuities or annuities due, depending on when the payments are made.

Curious about the latest features of Android WebView? Android WebView 202 vs previous versions provides a detailed comparison, highlighting improvements and new functionalities. Whether you’re a developer or simply an Android user, this information is valuable.

- Ordinary Annuity:Payments are made at the end of each period, such as at the end of each month or year.

- Annuity Due:Payments are made at the beginning of each period, such as at the beginning of each month or year.

Factors Influencing Future Value of an Annuity

The future value of an annuity is influenced by several factors. Understanding these factors can help investors make informed decisions about their annuity investments.

- Payment Amount:The higher the payment amount, the higher the future value of the annuity.

- Interest Rate:A higher interest rate leads to greater growth and a higher future value.

- Time Period:The longer the annuity term, the more time the investment has to grow, resulting in a higher future value.

Future Value Calculation

Calculating the future value of an annuity helps investors estimate the potential growth of their investment over time.

Considering an annuity? Is Annuity Certain 2024 addresses the key question of guaranteed payments. It’s a vital consideration when choosing an annuity, ensuring you understand the risks and rewards involved.

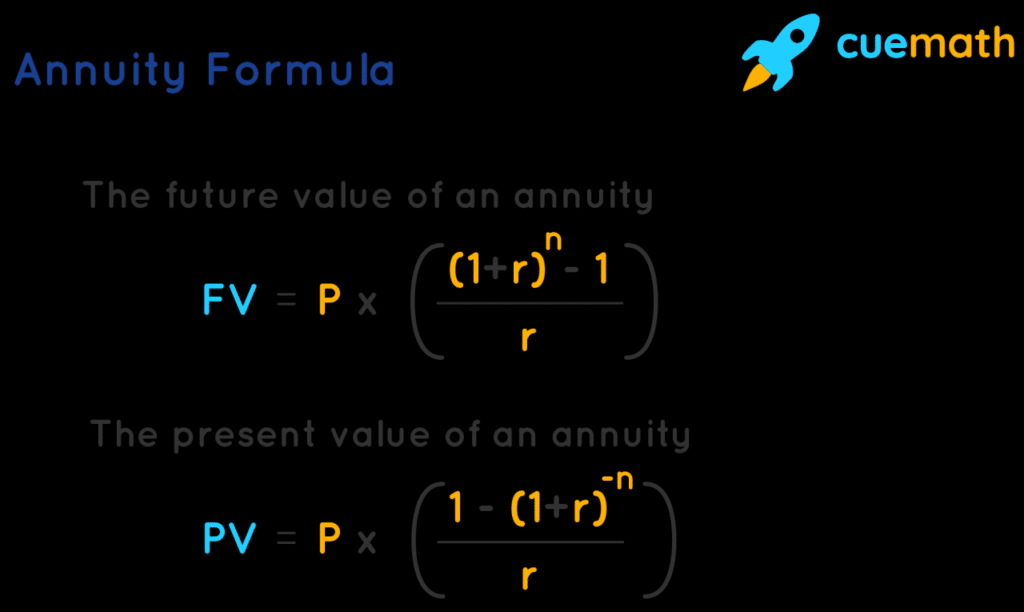

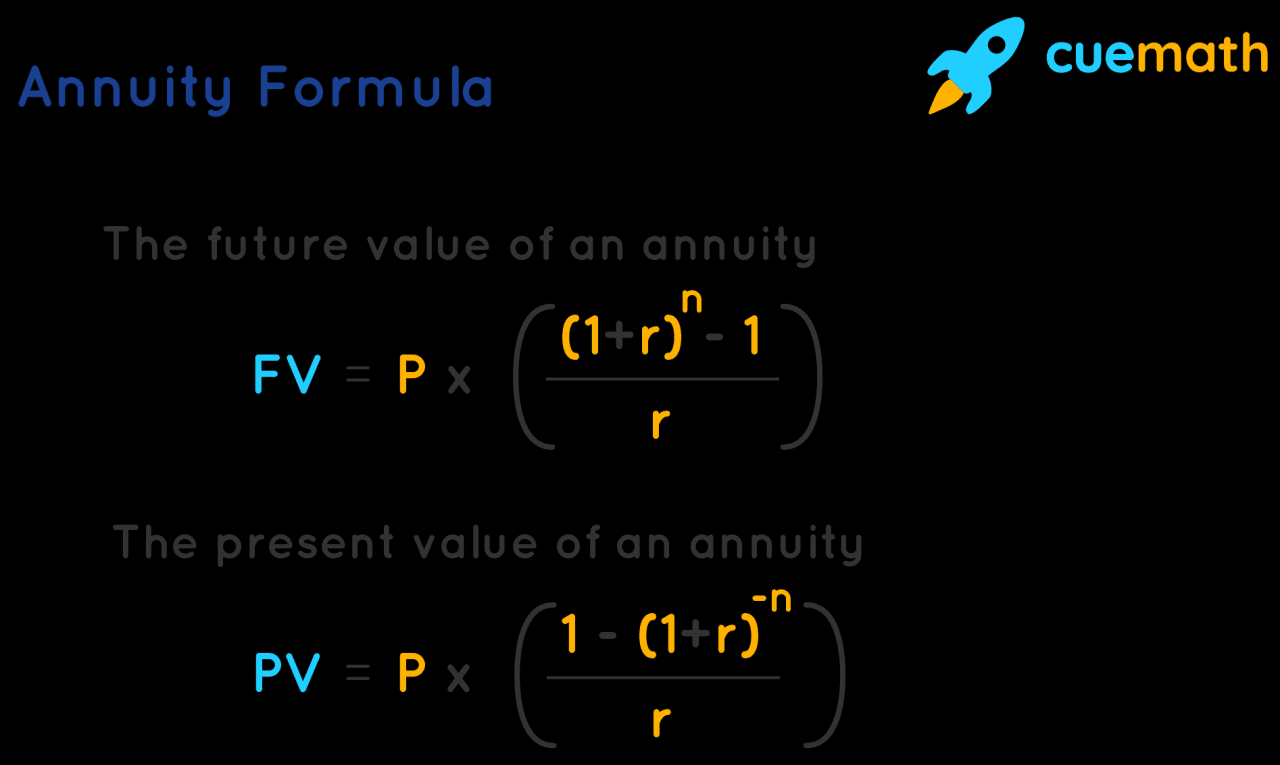

Formula for Calculating Future Value

Future Value of Annuity = P

Android WebView 202 is not just for individual users, it’s also a powerful tool for businesses. Android WebView 202 for enterprise use explores its applications in the enterprise world, including security enhancements and improved performance for business apps.

- [(1 + r)^n

- 1] / r

Where:

- P = Payment amount

- r = Interest rate per period

- n = Number of periods

Example Calculation, Annuity Is Future Value 2024

Let’s say you invest $1,000 per year for 10 years at an annual interest rate of 5%. Using the formula above, the future value of your annuity would be:

Future Value = $1,000

The rise of delivery apps like Glovo has a significant impact on local economies. Glovo app impact on local economy and employment explores the advantages and disadvantages of this trend, examining its effects on employment and local businesses.

- [(1 + 0.05)^10

- 1] / 0.05 = $12,577.89

This calculation shows that your initial investment of $10,000 would grow to $12,577.89 over 10 years due to the compounding effect of interest.

Impact of Interest Rate and Time Period

The future value of an annuity is significantly influenced by the interest rate and the time period. A higher interest rate or a longer time period will result in a higher future value.

Annuity Types

Annuities are available in various types, each with its own features and benefits. Understanding the different types can help you choose the best annuity for your specific financial goals.

If you’re considering an annuity for retirement planning, An Annuity Is Primarily Used To Provide 2024 explores the purpose and benefits of this financial tool. It’s a valuable resource for anyone seeking financial security in their later years.

Fixed Annuities

Fixed annuities offer a guaranteed interest rate for a specified period. This provides predictable income payments and protects your principal from market fluctuations.

Annuity decisions are complex, and there are pros and cons to consider. Annuity Is Good Or Bad 2024 provides a balanced perspective, highlighting the potential benefits and drawbacks. It’s a valuable resource for making informed decisions about your retirement savings.

- Features:Guaranteed interest rate, principal protection

- Benefits:Predictable income, low risk

- Suitability:Conservative investors seeking guaranteed income, retirees who need a reliable source of income

Variable Annuities

Variable annuities invest in mutual funds or other securities, allowing your investment to grow based on market performance. This offers the potential for higher returns but also carries higher risk.

Android WebView 202 is a game-changer for hybrid app developers. Android WebView 202 for hybrid apps explores the benefits and improvements for building hybrid apps. It’s a must-read for developers looking to enhance their app development process.

- Features:Investment in mutual funds or other securities, potential for higher returns

- Benefits:Potential for growth, tax-deferred earnings

- Suitability:Investors with a higher risk tolerance, those seeking potential for growth

Immediate Annuities

Immediate annuities begin paying out income immediately after the purchase. These are suitable for individuals who need immediate income, such as retirees or those facing a financial emergency.

Want to see how Snapdragon 2024 stacks up? Snapdragon 2024 performance benchmarks provides detailed insights into its performance capabilities. It’s a great resource for anyone considering a device with this powerful processor.

- Features:Immediate income payments

- Benefits:Immediate income stream, guaranteed payments

- Suitability:Individuals who need immediate income, retirees, those facing a financial emergency

Annuity in Retirement Planning

Annuities can play a crucial role in retirement income planning, providing a reliable source of income and helping to ensure financial security.

Guaranteed Income Streams

Annuities can provide guaranteed income streams, which can be particularly beneficial for retirees who need a predictable source of income. This helps to protect against inflation and market volatility.

Advantages of Using Annuities for Retirement

- Guaranteed Income:Some annuities offer guaranteed income payments, providing financial security and peace of mind.

- Tax-Deferred Growth:The earnings on annuity investments grow tax-deferred, meaning that taxes are not paid until the money is withdrawn.

- Protection from Market Risk:Fixed annuities protect your principal from market fluctuations, providing a safe haven for your retirement savings.

Disadvantages of Using Annuities for Retirement

- Limited Liquidity:Annuities can be illiquid, meaning that it can be difficult to access your money before the annuity payout begins.

- Fees and Charges:Annuities often come with fees and charges, which can impact your overall returns.

- Potential for Lower Returns:Fixed annuities may offer lower returns compared to other investment options, such as stocks or bonds.

Annuity Market Trends in 2024

The annuity market is constantly evolving, with new products and features emerging to meet the changing needs of investors.

Emerging Annuity Products

The annuity market is seeing a rise in innovative products that offer greater flexibility and customization. Some emerging annuity products include:

- Indexed Annuities:These annuities offer potential for growth based on the performance of a specific index, such as the S&P 500, while providing downside protection.

- Variable Annuities with Guaranteed Income Riders:These annuities offer the potential for growth with the added security of a guaranteed income stream.

- Deferred Income Annuities:These annuities allow you to defer income payments for a specified period, potentially increasing your overall returns.

Impact of Economic Factors on Annuity Rates and Investments

Economic factors, such as interest rates and inflation, can significantly impact annuity rates and investments. For example, rising interest rates may lead to higher annuity rates, while inflation can erode the purchasing power of annuity payments.

Investment Considerations

When considering an annuity, it’s important to compare and contrast it with other investment options and assess the associated risks and rewards.

Want to master Dollify? Dollify 2024: Advanced Techniques and Customization dives deep into advanced techniques and customization options. It’s a must-read for anyone who wants to create truly unique and expressive avatars.

Comparison with Other Investment Options

Annuities are just one investment option among many. Comparing annuities with other investment options, such as stocks and bonds, can help you make an informed decision based on your risk tolerance, financial goals, and investment horizon.

- Stocks:Offer potential for higher returns but carry higher risk.

- Bonds:Provide a more stable income stream but offer lower potential for growth.

Risks and Rewards of Annuities

Like any investment, annuities come with both risks and rewards. It’s important to carefully consider these factors before making an investment decision.

- Risks:Limited liquidity, fees and charges, potential for lower returns, inflation risk (for fixed annuities).

- Rewards:Guaranteed income payments, tax-deferred growth, principal protection (for fixed annuities), potential for growth (for variable annuities).

Selecting an Appropriate Annuity

Choosing the right annuity for your individual circumstances is crucial. Consider factors such as your age, risk tolerance, financial goals, and investment horizon. Consulting with a financial advisor can provide valuable insights and help you make an informed decision.

Annuity Regulations and Considerations

Annuities are regulated by government agencies to protect investors. It’s important to understand the regulatory framework and tax implications of annuity investments.

Still unsure about annuities? Annuity Examples 2024 provides real-world examples to illustrate how annuities work and their potential benefits. Understanding the specifics can make your decision easier.

Regulatory Framework

Annuities are regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These regulations ensure that annuity providers operate fairly and transparently, protecting investors from fraud and abuse.

Gamers, get ready for a powerful new chip! Snapdragon 2024 for gaming phones promises to deliver exceptional performance and graphics, taking mobile gaming to the next level. It’s a game-changer for the industry, and we can’t wait to see what developers create.

Tax Implications

The tax implications of annuity investments can vary depending on the type of annuity and the specific terms of the contract. It’s important to consult with a tax advisor to understand the tax implications of your annuity investment.

Choosing an Annuity Provider

When choosing an annuity provider, consider factors such as the provider’s financial stability, reputation, and customer service. It’s also important to carefully review the annuity contract before making a decision.

Ultimate Conclusion

In conclusion, Annuity Is Future Value 2024 offers a comprehensive overview of annuities, illuminating their potential as a vital component of retirement planning. By grasping the fundamentals, exploring the diverse types, and understanding the market dynamics, you can confidently evaluate whether annuities align with your financial aspirations.

Thinking about upgrading your Dollify app? Dollify 2024: Is it Worth the Upgrade? explores the latest features and improvements, helping you decide if it’s the right choice for you. It’s a fun and creative app, so the upgrade might be worth it.

Remember, seeking professional advice is crucial before making any investment decisions, ensuring you choose the right annuity strategy for your specific circumstances.

User Queries: Annuity Is Future Value 2024

What is the main difference between an ordinary annuity and an annuity due?

An ordinary annuity involves payments made at the end of each period, while an annuity due involves payments made at the beginning of each period. This timing difference affects the future value calculation.

How do interest rates affect the future value of an annuity?

Higher interest rates lead to a higher future value of an annuity, as the investment earns more interest over time. Conversely, lower interest rates result in a lower future value.

What are some key considerations when choosing an annuity provider?

When selecting an annuity provider, consider their financial stability, reputation, fees, and customer service. It’s also essential to carefully review the annuity contract terms and conditions before making a decision.