CPA Degree 2024: The accounting profession is constantly evolving, and a CPA degree remains a highly sought-after credential for those seeking a rewarding and stable career. This comprehensive guide will explore the ins and outs of pursuing a CPA degree in 2024, from the curriculum and career paths to exam preparation and future trends.

A Healthcare Management Degree 2024 is a great option if you want to lead and manage healthcare organizations. This degree can help you understand the complexities of the healthcare system and make a real difference in people’s lives.

Whether you’re a recent graduate considering your career options or a seasoned professional looking to enhance your credentials, understanding the value and opportunities associated with a CPA degree is crucial. This guide will provide insights into the benefits, challenges, and future prospects of pursuing a CPA degree in today’s dynamic business environment.

Interested in the human mind? A Psychology Masters Programs 2024 can provide you with a deep understanding of human behavior, allowing you to pursue careers in research, therapy, or other related fields.

Contents List

CPA Degree Overview: Cpa Degree 2024

A CPA degree, or Certified Public Accountant, is a highly sought-after credential in the accounting profession. It signifies a high level of expertise, ethical standards, and commitment to the field. Earning a CPA designation opens doors to diverse career opportunities and offers a competitive advantage in the job market.

If you’re looking to boost your career with a business degree, you might want to check out the Top Online MBA Programs 2024. This list features some of the best programs available, and you can find one that fits your needs and budget.

Benefits and Advantages of a CPA Degree

Pursuing a CPA degree comes with numerous benefits and advantages. Here are some key highlights:

- Enhanced Career Prospects:A CPA designation significantly boosts career prospects, making you a highly desirable candidate in the accounting and finance industries.

- Higher Earning Potential:CPAs generally earn higher salaries than non-CPA professionals in similar roles. The certification demonstrates your expertise and value to employers.

- Increased Job Security:The demand for qualified CPAs remains consistently high, ensuring a stable and secure career path.

- Professional Recognition and Credibility:Holding a CPA designation establishes you as a trusted and reputable professional in the accounting field.

- Leadership Opportunities:CPAs are often sought after for leadership positions in organizations due to their analytical skills, financial acumen, and ethical standards.

CPA Degree Requirements and Qualifications

Becoming a CPA requires meeting specific requirements and qualifications, which vary slightly depending on the state or jurisdiction. Generally, the following steps are involved:

- Education:Complete a bachelor’s degree in accounting or a related field from an accredited institution.

- Experience:Gain the required number of work experience hours under the supervision of a licensed CPA.

- CPA Exam:Pass the Uniform CPA Examination, a rigorous four-part exam covering accounting and auditing principles.

- Licensing:Apply for and obtain a CPA license from the state or jurisdiction where you intend to practice.

CPA Degree Curriculum and Specializations

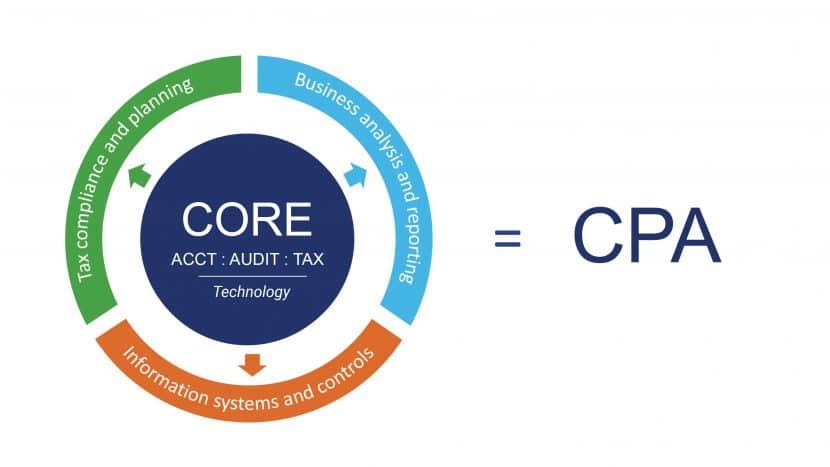

CPA degree programs are designed to provide a comprehensive understanding of accounting principles, practices, and regulations. The curriculum typically includes a mix of core courses and elective options, allowing students to tailor their studies to their career interests.

The digital world is constantly evolving, making cybersecurity a vital field. A Masters in Cyber Security 2024 program can equip you with the necessary skills to protect systems and data from threats.

Core Courses in a CPA Program

Here are some core courses commonly found in CPA degree programs:

- Financial Accounting:Covers the principles and methods used to record, classify, and summarize financial transactions.

- Managerial Accounting:Focuses on using accounting information to make internal management decisions.

- Auditing:Explores the process of examining and evaluating financial statements to ensure their accuracy and compliance with accounting standards.

- Taxation:Covers federal, state, and local tax laws and regulations, including individual and corporate income tax.

- Business Law:Introduces legal concepts relevant to business operations, including contracts, torts, and corporate governance.

- Ethics:Emphasizes the ethical principles and standards that govern the accounting profession.

Popular CPA Degree Specializations

CPA degree programs often offer specializations that allow students to deepen their knowledge in specific areas of accounting. Here are some popular specializations:

- Taxation:This specialization focuses on tax planning, compliance, and advisory services for individuals, businesses, and organizations.

- Auditing:This specialization prepares students for careers in auditing firms, where they conduct independent examinations of financial statements.

- Financial Accounting:This specialization focuses on the preparation and analysis of financial statements for various stakeholders, including investors and creditors.

- Forensic Accounting:This specialization involves investigating financial crimes and fraud, providing expert testimony in legal proceedings.

- Management Accounting:This specialization focuses on using accounting information to support internal management decision-making.

Role of Elective Courses in a CPA Degree

Elective courses provide an opportunity for students to explore areas of interest within accounting or related fields. These courses can enhance their skills and knowledge in specific industries or areas of expertise. For example, students may choose electives in:

- International Accounting:Gaining an understanding of accounting principles and practices in different countries.

- Information Systems Auditing:Focusing on the security and integrity of information systems used in accounting.

- Financial Modeling:Developing skills in creating and analyzing financial models to forecast and evaluate business performance.

Career Paths with a CPA Degree

A CPA degree opens doors to a wide range of career paths in various industries. CPAs are highly sought after for their expertise in financial reporting, auditing, tax compliance, and financial management.

For those seeking a more flexible path to a doctorate, the Online PhD 2024 programs offer a convenient way to continue your education while managing other responsibilities.

Potential Career Paths for CPA Graduates

Here are some common career paths for CPA graduates:

- Public Accounting:Working for accounting firms, providing audit, tax, and advisory services to businesses and individuals.

- Corporate Accounting:Holding positions in corporations, managing financial reporting, budgeting, and internal controls.

- Government Accounting:Working for government agencies, overseeing public funds and ensuring financial accountability.

- Forensic Accounting:Investigating financial crimes and fraud, providing expert testimony in legal proceedings.

- Financial Planning:Providing financial advice and planning services to individuals and families.

- Management Consulting:Providing strategic and operational advice to businesses, leveraging accounting expertise to improve financial performance.

Job Responsibilities and Industries Where CPAs Are in High Demand, Cpa Degree 2024

CPAs perform a variety of responsibilities, depending on their specific role and industry. Some common job responsibilities include:

- Financial Reporting:Preparing and analyzing financial statements, ensuring compliance with accounting standards.

- Auditing:Examining and evaluating financial records, ensuring accuracy and compliance with regulations.

- Tax Compliance:Preparing and filing tax returns, advising on tax planning strategies.

- Financial Management:Budgeting, forecasting, and managing financial resources.

- Internal Controls:Developing and implementing internal controls to safeguard assets and ensure operational efficiency.

CPAs are in high demand across various industries, including:

- Financial Services:Banks, investment firms, insurance companies.

- Manufacturing:Automotive, aerospace, consumer goods.

- Technology:Software development, hardware manufacturing, internet companies.

- Healthcare:Hospitals, clinics, pharmaceutical companies.

- Retail:Department stores, online retailers, grocery chains.

Salary Expectations and Career Growth Opportunities

CPA salaries vary depending on factors such as experience, location, industry, and specialization. According to the U.S. Bureau of Labor Statistics, the median annual salary for accountants and auditors in 2022 was $77,250. CPAs with specialized skills and experience can earn significantly higher salaries.

For those interested in managing projects effectively, the MBA Project Management 2024 programs provide specialized training and knowledge to excel in this field. This type of MBA can help you gain valuable skills to lead and execute projects successfully.

Career growth opportunities for CPAs are excellent. With experience and professional development, CPAs can advance to leadership positions, such as:

- Partner in a Public Accounting Firm:Leading a team of CPAs and providing strategic advice to clients.

- Chief Financial Officer (CFO):Overseeing all aspects of an organization’s financial operations.

- Controller:Managing the accounting department and ensuring accurate financial reporting.

- Financial Analyst:Analyzing financial data and providing insights to management.

CPA Exam Preparation and Resources

The CPA exam is a rigorous and challenging test that requires thorough preparation and dedication. Here’s a step-by-step guide to help you prepare for the exam:

Step-by-Step Guide for CPA Exam Preparation

- Understand the Exam Structure:Familiarize yourself with the four parts of the CPA exam: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). Each part covers specific areas of accounting knowledge.

- Choose a Study Method:Select a study method that aligns with your learning style. Popular options include self-study, CPA review courses, or online learning platforms.

- Develop a Study Plan:Create a detailed study plan that allocates sufficient time for each exam section and covers all the required material. Be realistic about your study schedule and adjust it as needed.

- Utilize Study Materials:Choose high-quality study materials, such as textbooks, practice questions, and mock exams. The AICPA (American Institute of Certified Public Accountants) provides official resources and study guides.

- Practice Regularly:Dedicate time to practicing multiple-choice questions, simulations, and task-based simulations. This helps you become familiar with the exam format and identify areas for improvement.

- Seek Support and Guidance:Join study groups or connect with other CPA candidates to share experiences, tips, and motivation.

- Manage Stress:The CPA exam can be stressful. Develop healthy coping mechanisms to manage stress and maintain a positive mindset during your preparation.

Valuable Resources and Study Materials for CPA Exam Preparation

Here are some valuable resources and study materials available for CPA exam preparation:

- AICPA (American Institute of Certified Public Accountants):The AICPA offers official CPA exam resources, including study guides, practice questions, and exam information.

- CPA Review Courses:Reputable CPA review courses provide comprehensive study materials, lectures, and practice exams.

- Online Learning Platforms:Online learning platforms offer flexible and interactive study options, including video lectures, quizzes, and discussion forums.

- Study Groups:Joining study groups can provide peer support, motivation, and shared learning experiences.

Strategies for Managing Stress and Maximizing Exam Performance

Here are some strategies for managing stress and maximizing exam performance:

- Prioritize Self-Care:Ensure you’re getting enough sleep, eating healthy foods, and engaging in regular exercise to maintain physical and mental well-being.

- Practice Time Management:During the exam, allocate time wisely to each section and avoid spending too much time on any one question.

- Stay Calm and Focused:Take deep breaths, visualize success, and focus on the task at hand.

- Review and Reflect:After each practice exam or study session, review your performance and identify areas for improvement.

The CPA Degree in 2024 and Beyond

The accounting profession is constantly evolving, driven by technological advancements, changing regulations, and evolving business needs. The CPA degree remains a valuable credential in this dynamic landscape, equipping professionals with the skills and knowledge to navigate these changes.

For those seeking the highest level of academic achievement, the Phd 2024 programs offer a rigorous path to becoming a leading expert in your chosen field.

Evolving Landscape of the Accounting Profession

Here are some key trends shaping the accounting profession:

- Automation and AI:Automation and artificial intelligence (AI) are transforming accounting tasks, from data entry to financial analysis. CPAs need to adapt and embrace these technologies to remain competitive.

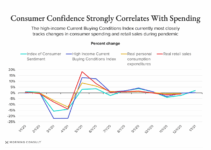

- Data Analytics:The increasing availability of data is creating opportunities for CPAs to leverage data analytics techniques to gain insights, improve decision-making, and identify potential risks.

- Cybersecurity:Cybersecurity threats are a growing concern for businesses. CPAs need to understand cybersecurity risks and develop strategies to protect sensitive financial data.

- Sustainability Reporting:Businesses are increasingly focusing on sustainability and environmental, social, and governance (ESG) factors. CPAs are playing a key role in developing and reporting on sustainability metrics.

Emerging Trends and Technologies Shaping the Role of CPAs

Here are some emerging trends and technologies that are shaping the role of CPAs:

- Cloud Computing:Cloud computing platforms are transforming how accounting data is stored, accessed, and analyzed. CPAs need to be proficient in cloud-based accounting software and services.

- Blockchain Technology:Blockchain technology offers the potential to streamline accounting processes, improve transparency, and enhance security. CPAs need to understand the implications of blockchain for the accounting profession.

- Big Data and Analytics:Big data and analytics tools enable CPAs to extract valuable insights from vast datasets, leading to more informed decision-making.

- Artificial Intelligence (AI):AI is automating repetitive accounting tasks, freeing up CPAs to focus on higher-value activities, such as analysis, strategy, and advisory services.

Future Career Prospects and Opportunities for CPA Graduates

The future for CPA graduates remains bright. As the accounting profession continues to evolve, CPAs with specialized skills and knowledge in emerging technologies and trends will be in high demand. Here are some future career prospects and opportunities:

- Data Analytics and Financial Modeling:CPAs with expertise in data analytics and financial modeling will be highly sought after to analyze large datasets and provide insights to businesses.

- Cybersecurity and Risk Management:CPAs with knowledge of cybersecurity and risk management will be crucial in protecting businesses from cyberattacks and data breaches.

- Sustainability Reporting and ESG Analysis:CPAs with expertise in sustainability reporting and ESG analysis will be in demand as businesses focus on environmental and social responsibility.

- Blockchain and Cryptocurrency Accounting:CPAs with knowledge of blockchain and cryptocurrency accounting will be needed to navigate the evolving landscape of digital currencies and decentralized finance.

- Artificial Intelligence and Automation:CPAs with expertise in AI and automation will be responsible for implementing and managing these technologies in accounting processes.

Concluding Remarks

In conclusion, pursuing a CPA degree in 2024 and beyond presents a compelling path towards a fulfilling and financially rewarding career. The demand for skilled and qualified accountants is expected to remain strong, making a CPA degree a valuable asset for individuals seeking to thrive in the evolving world of finance.

If you’re passionate about healthcare and want to become a registered nurse, you can find RN Programs Near Me 2024 to help you achieve your goal. These programs are designed to prepare you for a rewarding career in nursing.

By understanding the intricacies of the CPA profession, preparing thoroughly for the exam, and embracing the opportunities presented by emerging technologies, aspiring CPAs can position themselves for success in a dynamic and ever-changing landscape.

A Masters in Human Resource Management 2024 can open doors to leadership roles in organizations. This degree helps you understand the intricacies of managing people and building successful teams.

General Inquiries

What are the average salary expectations for CPAs?

The average salary for CPAs varies depending on experience, location, and specialization. However, CPAs generally earn competitive salaries with significant growth potential.

What are the key differences between a CPA and a CMA?

While both CPA and CMA certifications are highly regarded in the accounting field, they cater to different specialties. CPAs are primarily focused on public accounting, auditing, and taxation, while CMAs specialize in management accounting, cost accounting, and financial analysis.

Want to get a head start on your college journey? Dual Enrollment 2024 programs allow high school students to earn college credit while still in high school, saving time and money in the long run.

How long does it take to become a CPA?

The time it takes to become a CPA varies depending on individual circumstances, but it typically takes 2-4 years after completing a bachelor’s degree. This includes completing the required coursework, gaining practical experience, and passing the CPA exam.

Is a CPA degree worth it?

A CPA degree is a valuable investment that can open doors to a wide range of career opportunities and enhance earning potential. It is a challenging but rewarding path for individuals passionate about finance and accounting.

If you’re interested in exploring the depths of human psychology, a Doctorate in Psychology 2024 program can open doors to research, teaching, and clinical practice.

A career in healthcare is rewarding, and Online Medical Assistant Programs 2024 can help you get started. These programs provide the training you need to assist physicians in various healthcare settings.

Earning a doctorate online can be a great way to advance your career. Online PhD Programs 2024 offer flexibility and convenience while providing a high-quality education.

If you’re looking to pursue a career in law, an Online Law Degree 2024 can be a great option. These programs offer a flexible and convenient way to earn a legal education.

Interested in a career in nursing? Nursing Courses 2024 can help you develop the skills and knowledge you need to succeed in this rewarding profession.