Mortgage Interest Rates 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The year 2024 presents a unique landscape for homebuyers and borrowers, as mortgage interest rates continue to fluctuate, driven by a complex interplay of economic factors.

Finding ways to lower your mortgage can save you a lot of money over the life of your loan.

Understanding these trends is crucial for making informed decisions about purchasing or refinancing a home.

Everyone wants the best deal. Explore options for a lowest interest rate mortgage in 2024.

This guide delves into the intricacies of mortgage interest rates in 2024, exploring current trends, predictions for the future, and the impact on the housing market. We’ll analyze the factors influencing these rates, including economic indicators, Federal Reserve policies, and expert opinions.

For stability and predictability, consider a fixed-rate mortgage. This type of loan protects you from fluctuating interest rates.

By providing a comprehensive overview, we aim to empower readers with the knowledge they need to navigate this dynamic market and make strategic choices that align with their financial goals.

Check out the current 30-year mortgage rates to see what you might qualify for.

Contents List

- 1 Current Mortgage Interest Rate Trends

- 2 Predictions for Mortgage Interest Rates in 2024

- 3 Impact of Mortgage Interest Rates on the Housing Market

- 4 Strategies for Navigating Mortgage Interest Rates in 2024

- 5 Alternative Financing Options for Homebuyers

- 6 Ultimate Conclusion

- 7 Commonly Asked Questions: Mortgage Interest Rates 2024

Current Mortgage Interest Rate Trends

Mortgage interest rates have been fluctuating significantly in 2024, reflecting a complex interplay of economic factors and Federal Reserve policies. Understanding these trends is crucial for homebuyers and borrowers seeking to make informed decisions.

A mortgage broker can help you navigate the mortgage process and find the best options for your needs.

Current Mortgage Interest Rate Landscape

As of [Tambahkan tanggal terkini], average mortgage interest rates for various loan types are:

| Loan Type | Average Interest Rate |

|---|---|

| 30-Year Fixed-Rate Mortgage | [Tambahkan persentase] |

| 15-Year Fixed-Rate Mortgage | [Tambahkan persentase] |

| Adjustable-Rate Mortgage (ARM) | [Tambahkan persentase] |

These rates represent a [Tambahkan deskripsi tren, misal: “slight increase” atau “significant decrease”] compared to [Tambahkan periode pembanding, misal: “the previous quarter” atau “the same time last year”].

Choosing the right lender is essential. Explore the best home loan lenders to find the best rates and terms for your situation.

Factors Influencing Mortgage Interest Rates

Several factors contribute to the fluctuations in mortgage interest rates, including:

- Inflation:High inflation typically leads to higher interest rates as the Federal Reserve raises rates to control inflation.

- Federal Reserve Policies:The Federal Reserve’s monetary policy decisions, such as adjusting the federal funds rate, directly impact mortgage interest rates.

- Economic Growth:Strong economic growth can lead to higher interest rates as investors demand higher returns.

- Unemployment:Low unemployment can also push interest rates higher due to increased demand for loans.

- Government Bond Yields:Mortgage rates often move in tandem with yields on government bonds, as investors seek similar returns.

Historical Context

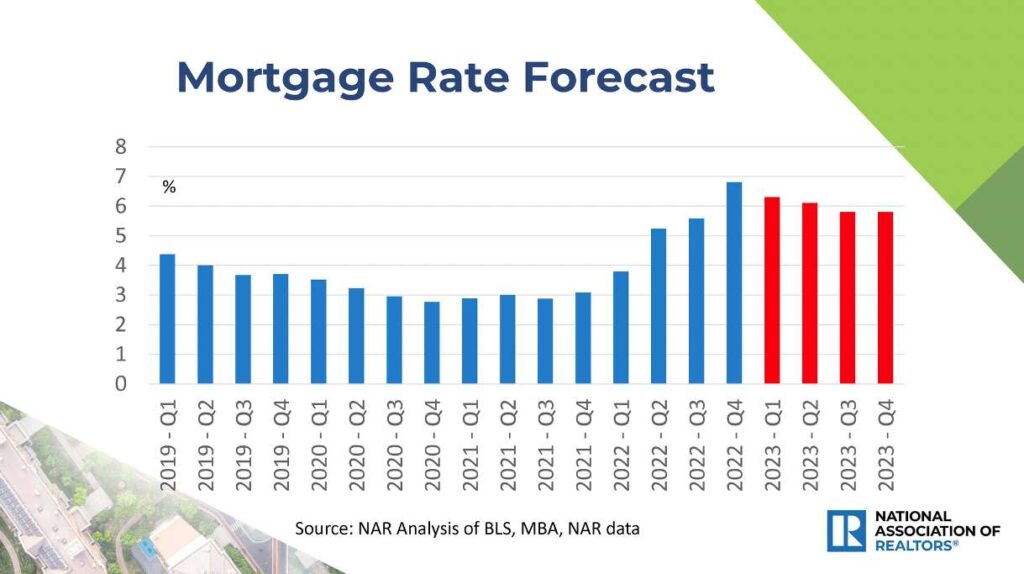

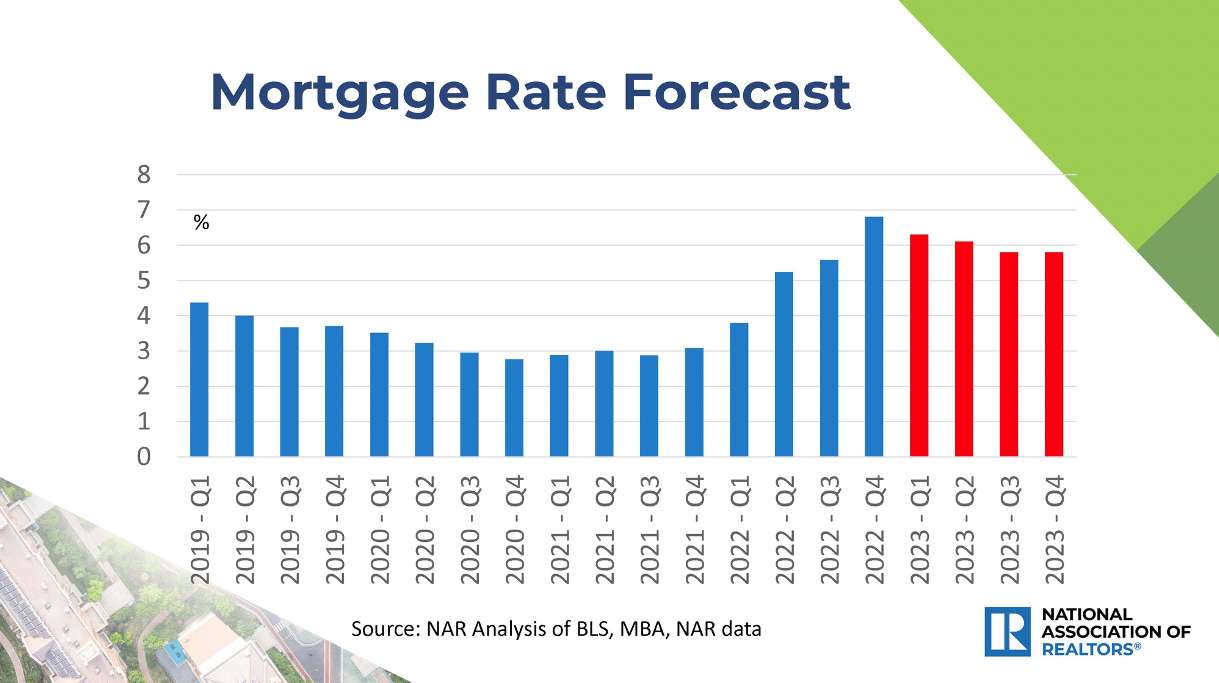

To understand the current mortgage rate environment, it’s helpful to compare it to previous years. [Tambahkan informasi tentang tren historis, seperti: “In 2023, average mortgage interest rates reached a [Tambahkan persentase] high, but they have since [Tambahkan deskripsi tren].”]

If you’re a veteran, you might be eligible for a VA loan. Check out the current VA refinance rates to see if you can save money on your mortgage.

Predictions for Mortgage Interest Rates in 2024

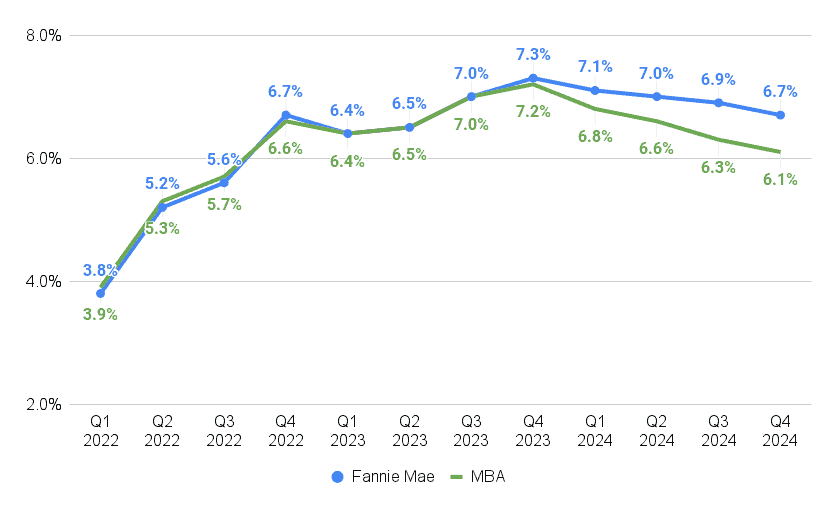

Forecasting mortgage interest rates is a complex endeavor, as numerous factors can influence their direction. However, experts offer various predictions and insights into what might lie ahead in 2024.

Expert Opinions and Forecasts

Some experts believe that mortgage interest rates will [Tambahkan deskripsi prediksi, misal: “continue to rise” atau “stabilize” or “decline”] in 2024, citing [Tambahkan alasan, misal: “persisting inflation” or “expectations of a recession”]. Others predict that rates will [Tambahkan deskripsi prediksi, misal: “remain relatively stable” or “decline slightly”] due to [Tambahkan alasan, misal: “easing inflation” or “a slowdown in economic growth”].

Veterans United is a popular choice for mortgage loans. See what Veterans United mortgage rates look like in 2024.

Potential Drivers of Rate Changes

Several factors could impact mortgage interest rates throughout 2024:

- Inflation:If inflation remains high or rises further, the Federal Reserve may continue to raise interest rates, pushing mortgage rates higher.

- Economic Growth:A strong economy can lead to higher interest rates, while a slowdown in economic growth could put downward pressure on rates.

- Unemployment:Changes in unemployment rates can influence investor confidence and affect interest rates.

- Government Policies:Government policies, such as fiscal spending or tax changes, can also impact mortgage rates.

Impact on Homebuyers and Borrowers, Mortgage Interest Rates 2024

Fluctuations in mortgage interest rates can have a significant impact on homebuyers and borrowers. [Tambahkan deskripsi dampak, misal: “Rising interest rates make homeownership less affordable, potentially reducing demand for homes.” or “Falling interest rates can make homes more affordable, leading to increased demand.”]

Locking in a fixed-rate mortgage can offer peace of mind, knowing your monthly payments won’t change with market fluctuations.

Timeline of Key Events

Here’s a potential timeline of key events that could affect mortgage interest rates in 2024:

- [Tambahkan bulan dan deskripsi event, misal: “January: The Federal Reserve releases its latest economic projections.”]

- [Tambahkan bulan dan deskripsi event, misal: “March: The Federal Reserve holds its next monetary policy meeting.”]

- [Tambahkan bulan dan deskripsi event, misal: “June: The government releases its latest inflation data.”]

- [Tambahkan bulan dan deskripsi event, misal: “September: The Federal Reserve releases its economic outlook for the year.”]

Impact of Mortgage Interest Rates on the Housing Market

Mortgage interest rates play a crucial role in shaping the housing market, influencing home prices, affordability, and demand.

Wells Fargo is a major financial institution. See what their mortgage offerings look like in 2024.

Relationship between Mortgage Interest Rates and Home Prices

Generally, higher mortgage interest rates tend to [Tambahkan deskripsi dampak, misal: “reduce demand for homes, leading to a slowdown in price growth or even price declines.” or “increase the cost of borrowing, making homes less affordable and potentially putting downward pressure on prices.”]

Secure your future with a home mortgage in 2024. It’s a big step, but a rewarding one.

Impact on Affordability and Demand

Rising mortgage interest rates can make homeownership less affordable, especially for first-time buyers with limited savings. [Tambahkan deskripsi dampak, misal: “This can lead to reduced demand for homes, potentially affecting the overall market.”]

Impact on Different Segments of the Housing Market

The impact of mortgage interest rates can vary across different segments of the housing market:

- First-time Buyers:Rising interest rates can make it significantly harder for first-time buyers to enter the market, as their purchasing power is reduced.

- Investors:Investors may be more sensitive to interest rate changes, as they often rely on leverage and financing to purchase properties. Rising rates can make investment less attractive.

- Luxury Homebuyers:While luxury homebuyers may be less affected by interest rate changes, they could still see a slowdown in price growth or even price declines if demand weakens.

Monthly Mortgage Payments at Different Interest Rates

| Loan Amount | Interest Rate | Monthly Payment |

|---|---|---|

| $200,000 | [Tambahkan persentase] | [Tambahkan jumlah pembayaran bulanan] |

| $300,000 | [Tambahkan persentase] | [Tambahkan jumlah pembayaran bulanan] |

| $400,000 | [Tambahkan persentase] | [Tambahkan jumlah pembayaran bulanan] |

This table illustrates how even small changes in interest rates can significantly impact monthly mortgage payments.

Compare different lenders and their offerings to find the home lenders that best suit your situation.

In the current mortgage interest rate environment, it’s essential for borrowers to have a strategic approach to securing a mortgage.

Securing the Best Possible Interest Rate

Here are some strategies for obtaining a favorable mortgage interest rate:

- Improve Credit Score:A higher credit score typically qualifies you for lower interest rates.

- Shop Around for Lenders:Compare interest rates and terms from multiple lenders to find the best deal.

- Negotiate with Lenders:Don’t be afraid to negotiate with lenders, especially if you have a strong credit score and a large down payment.

- Consider a Shorter Loan Term:A 15-year fixed-rate mortgage typically has a lower interest rate than a 30-year mortgage.

- Lock in Your Rate:If you’re concerned about rising interest rates, consider locking in your rate with a rate lock agreement.

Advantages and Disadvantages of Mortgage Types

Understanding the different mortgage types available can help you make an informed decision:

- Fixed-Rate Mortgages:Offer predictable monthly payments with a fixed interest rate for the life of the loan. They provide stability and protection from rising interest rates.

- Adjustable-Rate Mortgages (ARMs):Have an initial fixed interest rate that adjusts periodically based on market conditions. They can offer lower initial payments but may become more expensive if interest rates rise.

Managing Mortgage Payments and Avoiding Financial Stress

Here are some tips for managing your mortgage payments and minimizing financial stress:

- Budgeting:Create a realistic budget that includes your mortgage payment and other expenses.

- Extra Payments:Consider making extra payments on your mortgage to reduce the principal and shorten the loan term.

- Refinance:If interest rates fall, consider refinancing your mortgage to lower your monthly payments.

- Seek Financial Advice:Consult with a financial advisor to develop a personalized plan for managing your mortgage.

Alternative Financing Options for Homebuyers

In addition to traditional mortgages, homebuyers have several alternative financing options available to them.

Government-Backed Loans

Government-backed loans, such as FHA and VA loans, can offer more lenient qualification requirements and lower down payments, making homeownership more accessible to certain borrowers.

Planning to buy a home in 2024? Understanding mortgage payments is crucial. You’ll need to factor in interest rates, loan terms, and your down payment to get a realistic idea of your monthly costs.

- FHA Loans:Insured by the Federal Housing Administration, FHA loans typically require a lower down payment and credit score than conventional loans.

- VA Loans:Guaranteed by the Department of Veterans Affairs, VA loans are available to eligible veterans, active-duty military personnel, and surviving spouses.

Private Mortgage Lenders

Private mortgage lenders offer a variety of loan products and terms, often catering to borrowers with unique financial situations or specific needs.

For those looking to access home equity, consider reverse mortgage rates in 2024.

Creative Financing Methods

Creative financing methods, such as seller financing or owner financing, can provide alternative options for homebuyers who may not qualify for traditional mortgages.

Ready to buy your dream home? Learn how to get a mortgage in 2024.

- Seller Financing:The seller provides financing for the purchase of the property, often with a lower down payment and interest rate than traditional mortgages.

- Owner Financing:Similar to seller financing, owner financing involves the current owner providing financing for the property.

Ultimate Conclusion

As we conclude our exploration of Mortgage Interest Rates 2024, it’s clear that the housing market remains a complex and ever-evolving landscape. Understanding the factors driving mortgage rates and their impact on affordability is essential for both buyers and sellers.

By staying informed, utilizing available resources, and seeking professional guidance, individuals can navigate this market with confidence and make informed decisions that align with their unique circumstances. Whether you’re a first-time buyer, seasoned investor, or simply seeking to refinance, the knowledge gained from this guide can be invaluable in achieving your real estate goals.

Commonly Asked Questions: Mortgage Interest Rates 2024

What are the current mortgage interest rates in 2024?

Current mortgage interest rates in 2024 vary depending on the loan type, lender, and borrower’s creditworthiness. It’s best to check with multiple lenders for the most up-to-date information.

How often do mortgage interest rates change?

Mortgage interest rates can fluctuate daily, weekly, or even monthly, depending on market conditions and economic factors. It’s important to stay informed about these changes and monitor the market closely.

What is the best mortgage type for me?

The best mortgage type depends on your individual financial situation, risk tolerance, and long-term goals. A fixed-rate mortgage offers stability and predictability, while an adjustable-rate mortgage can offer lower initial rates but carries the risk of future rate increases.