Current 30 Year Mortgage Rates are a crucial factor for anyone considering buying a home or refinancing their existing mortgage. Understanding the current landscape, including historical trends and influencing factors, is essential for making informed financial decisions. This guide delves into the intricacies of 30-year mortgage rates, providing insights into the current market and offering strategies for navigating the process.

Planning a home renovation project? A Home Renovation Loan can help you finance those upgrades and improvements. These loans are specifically designed for home improvement projects, making them a convenient choice.

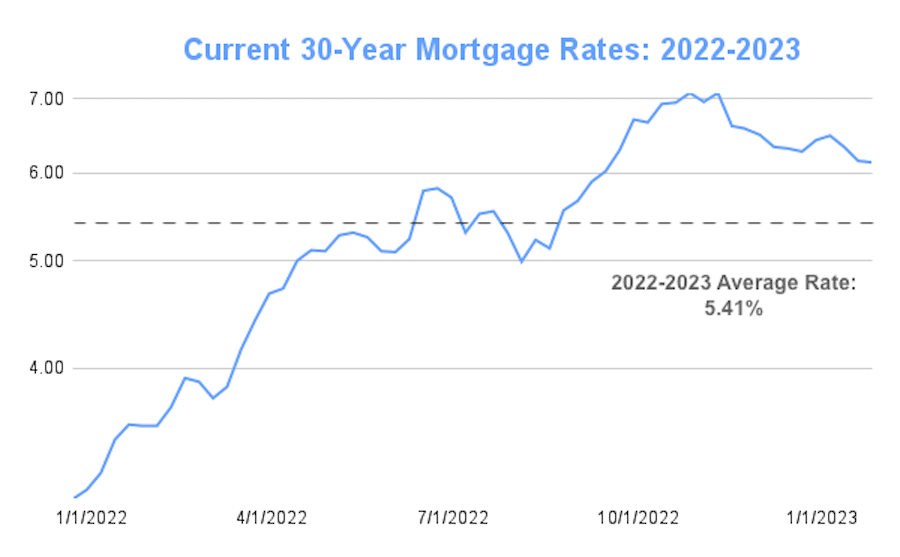

Rates fluctuate constantly, influenced by economic indicators, Federal Reserve policies, and investor sentiment. The current average 30-year mortgage rate reflects these factors, offering a snapshot of the borrowing environment. By understanding the historical context and the impact of recent events, you can gain a clearer perspective on the current rate landscape.

For those seeking financing for real estate investments, Hard Money Lenders can be a viable option. They often offer loans based on the property’s value rather than your credit score.

Outcome Summary

The current 30-year mortgage rate environment presents both challenges and opportunities for homebuyers and those seeking to refinance. While rates may be higher than historical averages, understanding the factors that influence them and employing effective strategies can help you secure the best possible terms.

Credit Karma is a popular platform for managing your credit score. They also offer Credit Karma Loans , which can be a good option if you’re looking for a loan from a reputable source.

By staying informed, shopping around for lenders, and considering your individual financial situation, you can navigate this market effectively and achieve your homeownership goals.

Need a larger loan amount? A 10000 Loan could provide the financial support you require. Explore your options and find a lender that meets your specific needs.

FAQ Explained: Current 30 Year Mortgage Rates

What is a 30-year fixed-rate mortgage?

Securing a mortgage can be a significant financial undertaking. Finding the Cheapest Mortgage Rates is crucial to keeping your monthly payments affordable. Shop around and compare offers from different lenders to find the best deal.

A 30-year fixed-rate mortgage is a loan with a fixed interest rate that you pay off over 30 years. The monthly payments remain the same throughout the loan term.

A Home Equity Line of Credit, or Heloc , can be a valuable tool for homeowners. It allows you to borrow against the equity in your home, providing access to funds for various needs.

How do I find the best mortgage rate?

Looking for a quick cash infusion? A 1000 Loan could be the solution you need. These loans are designed for short-term financial needs and can be a convenient way to bridge a gap until your next paycheck.

Shop around with multiple lenders, compare interest rates, fees, and loan terms. Consider factors like your credit score and down payment amount.

What are the current average 30-year mortgage rates?

If you’re seeking a loan with manageable monthly payments, consider exploring Low Interest Personal Loans. These options can help you save money on interest charges over the life of the loan.

Current average rates fluctuate daily. Check reputable financial websites or mortgage lenders for the most up-to-date information.

While it’s generally advisable to have good credit, there are Personal Loans No Credit Check available. These loans may have higher interest rates, so it’s essential to carefully evaluate the terms.

A 500 Dollar Loan can be a quick and convenient way to cover unexpected expenses. These small loans can be a lifesaver in emergencies.

Bright Lending is a financial technology company that offers a range of loan products. Explore their Bright Lending options to see if they meet your borrowing needs.

Purchasing a boat is a dream for many. Boat Loans can help you finance your nautical adventure. Look for lenders specializing in marine financing to get the best rates.

For flexible repayment options, consider Installment Loans Online. These loans allow you to spread out your payments over a predetermined period, making them manageable.

Payday advances can provide immediate cash, but they often come with high interest rates. Before considering a Payday Advance , explore alternative financing options that might be more affordable.

Discover offers a range of financial products, including Discover Personal Loans. Check out their loan terms and interest rates to see if they align with your financial goals.