Current Auto Loan Rates are a crucial factor when considering financing a new or used vehicle. Understanding the forces that shape these rates, including economic conditions, credit scores, and loan terms, is essential for making informed financial decisions. This guide delves into the intricacies of auto loan rates, providing insights into how they work and strategies for securing the best possible terms.

While it’s not always easy to find, Guaranteed Loans are designed to offer a higher level of assurance for borrowers. These loans typically have specific eligibility requirements and may come with higher interest rates.

From the basics of APR and its components to the impact of credit scores and loan types, we explore the key elements that influence your individual auto loan rate. We also offer practical advice on finding competitive rates, negotiating effectively, and making informed financial choices when taking on an auto loan.

For immediate financial needs, Payday Loans Online Same Day can provide quick access to cash. These loans are typically small in amount and are designed to be repaid on your next payday.

Contents List

Current Auto Loan Rates Overview

Auto loan rates, like most interest rates, are influenced by a complex interplay of economic factors. Understanding these factors is crucial for borrowers seeking the best possible rates on their car loans.

Factors Influencing Current Auto Loan Rates

Several key factors contribute to the current auto loan rates, including:

- Federal Reserve Interest Rates:The Federal Reserve’s benchmark interest rates serve as a foundation for other interest rates, including auto loans. When the Fed raises rates, borrowing costs generally increase, impacting auto loan rates.

- Inflation:High inflation erodes the value of money, prompting lenders to raise rates to protect their returns against inflation’s impact.

- Demand for Auto Loans:When demand for auto loans is high, lenders may offer more competitive rates to attract borrowers. Conversely, low demand could lead to higher rates.

- Economic Growth:A strong economy typically leads to lower auto loan rates, as lenders are more confident in borrowers’ ability to repay. Conversely, economic uncertainty can result in higher rates.

Historical Perspective on Auto Loan Rates

Auto loan rates have fluctuated over time, reflecting changes in economic conditions. For example, rates were relatively low during periods of economic expansion, such as the late 1990s and early 2000s. However, rates rose significantly during the financial crisis of 2008-2009.

When considering a mortgage, it’s wise to check out Bank of America Mortgage Rates. They offer a range of mortgage options and competitive rates, which can help you find the right fit for your individual needs.

Impact of the Current Economic Climate, Current Auto Loan Rates

The current economic climate, characterized by rising inflation and interest rates, has led to an increase in auto loan rates. The Federal Reserve’s aggressive rate hikes aim to combat inflation, but these actions also impact borrowing costs for consumers.

For a significant financial need, a 20000 Loan can provide the funds you need. These loans can be used for a variety of purposes, such as debt consolidation, home improvements, or medical expenses.

Understanding Auto Loan Rates

Auto loan rates represent the cost of borrowing money to purchase a vehicle. Understanding the different components and factors influencing these rates is crucial for making informed financial decisions.

Applying for a loan online can be convenient and efficient. Easy Loans Online allows you to complete the application process from the comfort of your home, saving you time and effort.

APR (Annual Percentage Rate)

APR is the annual interest rate charged on an auto loan, expressed as a percentage. It encompasses the base interest rate and other costs associated with the loan, such as origination fees and lender fees.

Need a loan but don’t want to travel far? Loan Companies Near Me can help you find local lenders in your area. This can save you time and hassle when applying for a loan.

APR = Base Interest Rate + Other Loan Costs

Capital One is a well-known financial institution that offers a variety of auto loan options. Capital One Auto can be a good choice for those looking for competitive rates and flexible financing terms.

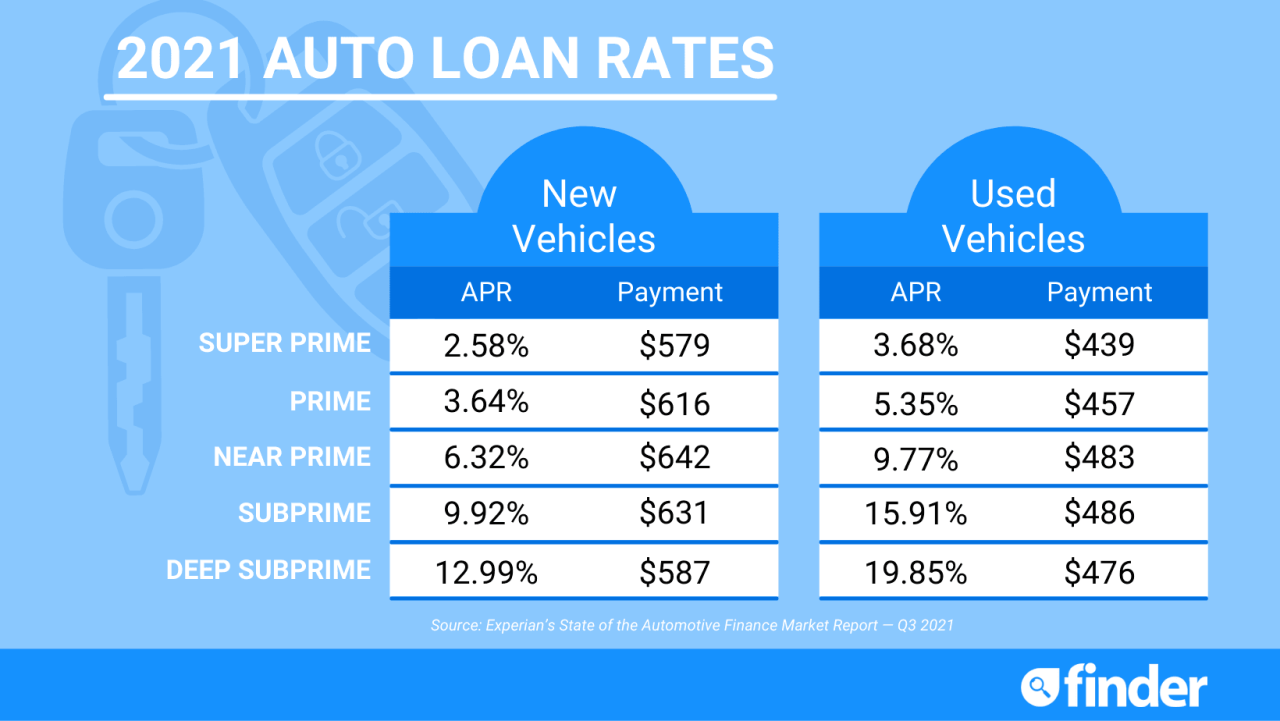

Credit Score and Auto Loan Rates

A borrower’s credit score is a significant factor determining their auto loan rate. Individuals with higher credit scores generally qualify for lower interest rates, reflecting their lower risk to lenders. Conversely, borrowers with lower credit scores may face higher rates due to their perceived higher risk.

A Credit Loan is a type of personal loan that is based on your creditworthiness. These loans can be used for a variety of purposes, such as debt consolidation or home improvements.

Types of Auto Loans and Rates

Different types of auto loans often come with varying interest rates, reflecting the specific terms and conditions of each loan.

If you’re looking for a straightforward and hassle-free loan application process, Easy Loans can be a good option. These loans often have simplified eligibility requirements and streamlined application procedures.

- New Car Loans:Typically offer lower interest rates than used car loans, reflecting the lower risk associated with newer vehicles.

- Used Car Loans:May have higher interest rates compared to new car loans due to the increased risk of depreciation and potential mechanical issues.

- Dealer Financing:Often provided by car dealerships, these loans can sometimes have competitive rates, but it’s essential to compare them with other options.

- Private Loans:Secured through private lenders, these loans can offer flexibility but may have higher interest rates than traditional auto loans.

Factors Affecting Individual Auto Loan Rates

Several factors beyond the broader economic conditions can influence an individual’s auto loan rate. These factors reflect the borrower’s specific financial profile and the characteristics of the loan itself.

Before committing to a loan, it’s always a good idea to research Best Loan Companies. Comparing different lenders and their terms can help you find the most favorable loan options.

Impact of Various Factors on Auto Loan Rates

| Factor | Description | Impact on Rate | Example |

|---|---|---|---|

| Loan Term | Length of the loan repayment period | Longer terms often result in lower monthly payments but higher overall interest costs | A 60-month loan typically has a lower monthly payment than a 36-month loan, but the total interest paid will be higher. |

| Vehicle Type | Type of vehicle being financed | Newer vehicles generally have lower rates than used vehicles | A new car loan may have a lower rate than a loan for a used car, reflecting the lower risk associated with newer vehicles. |

| Down Payment | Initial amount paid upfront | Higher down payments often lead to lower interest rates | A larger down payment reduces the loan amount, making the borrower appear less risky to lenders. |

| Trade-In Value | Value of a vehicle traded in as part of the purchase | A higher trade-in value can reduce the loan amount, potentially leading to a lower rate | A vehicle with a high trade-in value can offset the purchase price, reducing the loan amount and potentially lowering the interest rate. |

Finding the Best Auto Loan Rates

Obtaining the most favorable auto loan rates requires careful research and comparison. Several resources and strategies can help borrowers secure competitive rates.

Upstart is a popular online lending platform known for its technology-driven approach to personal loans. Upstart Personal Loans can offer competitive rates and a streamlined application process.

Reputable Sources for Comparing Auto Loan Rates

- Online Loan Aggregators:Websites like Bankrate, NerdWallet, and LendingTree allow borrowers to compare rates from multiple lenders in one place.

- Credit Unions:Often offer competitive rates and personalized service to their members.

- Local Banks and Credit Unions:Consider checking with local financial institutions for potential loan options.

Tips for Negotiating a Lower Auto Loan Rate

- Shop Around:Get quotes from multiple lenders to compare rates and terms.

- Improve Credit Score:A higher credit score generally leads to lower interest rates.

- Negotiate with the Lender:Discuss potential rate reductions based on your creditworthiness and financial history.

- Consider a Shorter Loan Term:While monthly payments may be higher, a shorter loan term can result in lower overall interest costs.

Benefits of Pre-Approval for an Auto Loan

Pre-approval for an auto loan before visiting a dealership can give borrowers a significant advantage in negotiations. Pre-approval provides a clear understanding of the rate and loan amount you qualify for, allowing you to confidently negotiate with dealers.

If you need cash fast, Same Day Loans Online can be a helpful solution. These loans are designed to provide you with funds within the same business day, often for emergencies or unexpected expenses.

Financial Considerations for Auto Loans

Taking on an auto loan is a significant financial commitment. Careful consideration of affordability, total cost of ownership, and potential risks is essential before making a decision.

If you have an existing car loan with a high interest rate, Refinancing Car Loan can help you lower your monthly payments and save money over the life of the loan.

Calculating Affordability

Before applying for an auto loan, it’s crucial to determine your affordability. This involves assessing your monthly income, expenses, and debt obligations to ensure that the loan payments fit comfortably within your budget.

Looking for the best deal on a new car? Best Auto Loan Rates can help you compare different lenders and find the most competitive rates. You can save a significant amount of money over the life of your loan by securing a low interest rate.

Total Cost of Ownership

The total cost of ownership extends beyond the loan payments. It encompasses expenses such as insurance, maintenance, fuel, and potential repairs. Carefully considering these costs can help you make a more informed decision about the vehicle you choose.

Potential Risks Associated with Auto Loans

Taking on an auto loan carries certain risks. These include:

- Negative Equity:If the value of the vehicle depreciates faster than the loan balance, you may end up owing more than the car is worth.

- High Interest Rates:If you have a low credit score or opt for a longer loan term, you may face higher interest rates, increasing the overall cost of the loan.

- Unexpected Expenses:Unexpected repairs or maintenance costs can strain your budget, especially if you’re already struggling to make loan payments.

Conclusion

Navigating the world of auto loan rates can feel overwhelming, but with the right knowledge and tools, you can secure a loan that aligns with your financial goals. By understanding the factors that influence rates, utilizing resources for comparison, and employing effective negotiation strategies, you can find the best auto loan deal possible.

Wells Fargo is a well-known financial institution that offers a variety of loan products. Wells Fargo Loans can be a good choice for those who value stability and a trusted brand name.

Remember, taking the time to research and compare options is key to achieving a successful and affordable car financing experience.

Top FAQs

What is the average auto loan interest rate?

The average auto loan interest rate varies depending on factors like credit score, loan term, and vehicle type. However, it typically ranges from 3% to 7% for new cars and 5% to 10% for used cars.

How do I improve my credit score to get a better auto loan rate?

You can improve your credit score by paying bills on time, keeping credit utilization low, and avoiding opening too many new credit accounts.

What are the risks of taking on an auto loan?

The risks of taking on an auto loan include potential financial strain, negative impact on your credit score if you miss payments, and the possibility of losing your vehicle if you default on the loan.