Supplemental Health Insurance 2024 is a crucial aspect of modern healthcare, offering an additional layer of protection against unexpected medical costs. It’s not just about covering gaps in your primary insurance; it’s about ensuring peace of mind and financial stability in the face of health challenges.

UnitedHealthcare is a major provider of Medicare plans. Check out their offerings and see if Unitedhealthcare Medicare 2024 is a good option for you.

This guide will delve into the various types of supplemental health insurance, their benefits, and the key factors to consider when choosing a plan. We’ll also discuss the cost, affordability, and emerging trends in this dynamic market.

Secure your family’s financial future with life insurance. Compare policies and find Life Insurance 2024 that provides the coverage you need.

Contents List

- 1 Introduction to Supplemental Health Insurance

- 2 Benefits of Supplemental Health Insurance in 2024

- 3 Factors to Consider When Choosing Supplemental Health Insurance

- 4 Cost and Affordability of Supplemental Health Insurance

- 5 Trends in Supplemental Health Insurance for 2024

- 6 Final Review

- 7 Q&A: Supplemental Health Insurance 2024

Introduction to Supplemental Health Insurance

Supplemental health insurance, also known as gap insurance, is designed to fill in the gaps in coverage provided by your primary health insurance plan. It offers additional financial protection and peace of mind by covering expenses that your primary plan might not fully cover, such as deductibles, copayments, coinsurance, and out-of-network care.

AARP offers a variety of insurance products, including auto insurance. Explore Aarp Auto Insurance 2024 options to see if they can provide you with savings.

Examples of When Supplemental Health Insurance Can Be Beneficial

Supplemental health insurance can be particularly beneficial in situations where you face high medical expenses, such as:

- A serious illness or injury requiring extensive treatment.

- A chronic condition that necessitates regular medical care.

- Unexpected hospitalizations or emergency room visits.

- Out-of-network care when you’re traveling or require specialized treatment.

Types of Supplemental Health Insurance

There are several types of supplemental health insurance available, each offering different coverage and benefits. Common types include:

- Hospital Indemnity Insurance:Provides a fixed daily benefit for hospital stays, regardless of the cost of care.

- Critical Illness Insurance:Offers a lump-sum payment if you’re diagnosed with a serious illness, such as cancer, heart attack, or stroke.

- Accident Insurance:Covers medical expenses and lost income resulting from accidents.

- Short-Term Medical Insurance:Provides temporary coverage for individuals who are between jobs or ineligible for other health insurance plans.

- Medicare Supplement Insurance (Medigap):Helps cover out-of-pocket expenses associated with Medicare.

Benefits of Supplemental Health Insurance in 2024

Supplemental health insurance offers several advantages in today’s healthcare landscape, especially in 2024:

Coverage for Gaps in Primary Insurance

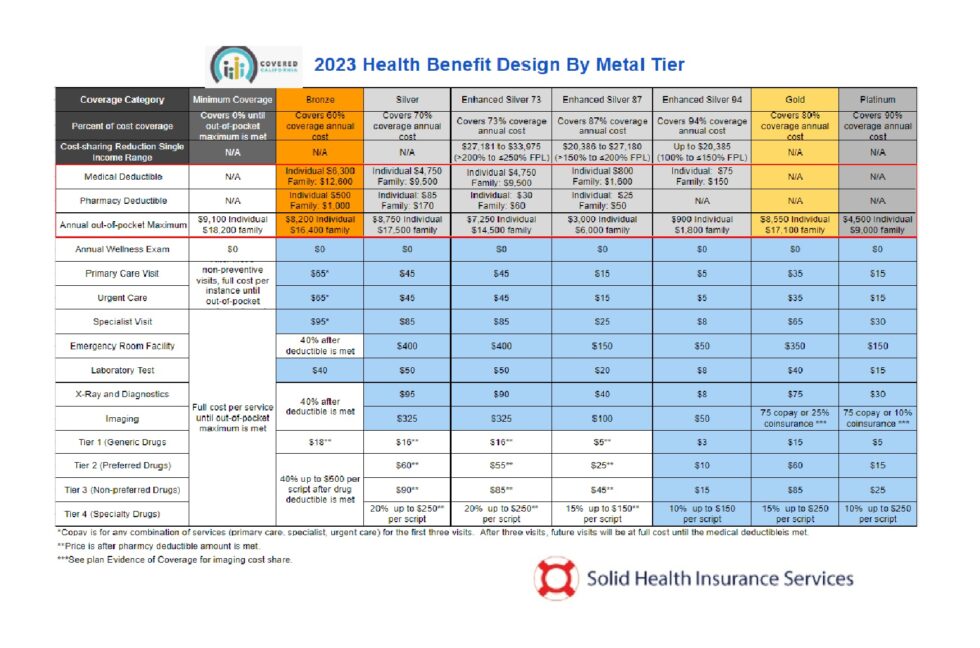

Supplemental health insurance can bridge the gap between your primary insurance coverage and the actual cost of medical care. It helps cover deductibles, copayments, coinsurance, and other out-of-pocket expenses that your primary plan may not fully cover.

Protection Against High Medical Expenses

Unexpected medical expenses can be financially devastating. Supplemental health insurance provides financial protection by covering a portion of these costs, reducing the financial burden and allowing you to focus on your recovery.

Looking for a more flexible and personalized insurance experience? Check out Toggle Insurance 2024 to see if their unique approach is right for you.

Factors to Consider When Choosing Supplemental Health Insurance

Choosing the right supplemental health insurance plan requires careful consideration of several factors:

Types of Plans and Coverage

Compare the different types of supplemental health insurance plans available and their coverage. Consider your individual needs, medical history, and financial situation when making your choice.

The General is a popular choice for non-standard auto insurance. Learn more about their offerings and see if Thegeneral 2024 is a good fit for you.

- Hospital Indemnity:Focuses on hospital stays.

- Critical Illness:Covers specific serious illnesses.

- Accident:Provides coverage for accidents.

- Short-Term Medical:Offers temporary coverage.

- Medicare Supplement:Helps cover Medicare out-of-pocket expenses.

Terms and Conditions

Thoroughly understand the terms and conditions of each plan, including coverage limits, exclusions, waiting periods, and claim procedures.

Traveling soon? Protect your trip with travel insurance. Find the right coverage for your needs by exploring Travel Insurance Online 2024 options.

Cost and Affordability of Supplemental Health Insurance

The cost of supplemental health insurance varies depending on factors such as your age, health, coverage level, and the insurer you choose. However, it can be a valuable investment, especially considering the potential financial benefits it provides.

Finding affordable insurance can be a challenge, but it doesn’t have to be a headache. Compare quotes and find Cheap Insurance Quotes 2024 to help you save money.

Average Cost

The average cost of supplemental health insurance plans in 2024 can range from a few hundred dollars to several thousand dollars per year, depending on the type of plan and coverage.

Tips for Finding Affordable Options

To find affordable supplemental health insurance options, consider the following:

- Shop around:Compare quotes from multiple insurers to find the best value.

- Consider a lower coverage level:If you’re on a tight budget, a lower coverage level might be a more affordable option.

- Bundle with your primary insurance:Some insurers offer discounts for bundling supplemental health insurance with your primary plan.

Tax Benefits

In some cases, premiums paid for supplemental health insurance may be tax-deductible, depending on your individual circumstances and the specific plan you choose. Consult with a tax advisor to determine your eligibility for tax benefits.

Looking for supplemental coverage to help offset Medicare costs? Check out the Aarp Medicare Supplement 2024 options for a plan that might be a good fit for you.

Trends in Supplemental Health Insurance for 2024

The supplemental health insurance market is constantly evolving, with several trends shaping the landscape in 2024.

Amica is known for its excellent customer service. Explore Amica Car Insurance 2024 options to see if they offer a plan that suits your needs.

Emerging Trends

Here are some emerging trends in the supplemental health insurance market:

- Increased demand:As healthcare costs continue to rise, more individuals are seeking supplemental health insurance to protect themselves from financial burdens.

- Focus on niche products:Insurers are developing specialized plans tailored to specific needs, such as coverage for chronic conditions or travel insurance.

- Digital innovation:Technology is playing a crucial role in streamlining the purchasing and claims process, making it easier for consumers to access and manage their supplemental health insurance.

Impact of Healthcare Reform

Healthcare reform measures can influence the availability and affordability of supplemental health insurance. It’s essential to stay informed about any changes to regulations or policies that may affect your coverage.

Saving money on car insurance is always a good thing! Compare rates and find Cheap Car Insurance 2024 that meets your coverage requirements.

Role of Technology, Supplemental Health Insurance 2024

Technology is transforming the supplemental health insurance industry, enabling more personalized and convenient experiences for consumers. Online platforms, mobile apps, and telehealth services are becoming increasingly integrated into the supplemental health insurance landscape.

Final Review

In conclusion, supplemental health insurance in 2024 is an essential tool for navigating the complexities of healthcare. By understanding the different types of plans, their benefits, and the factors to consider when making a choice, individuals can make informed decisions to protect their health and finances.

Finding affordable health insurance is essential. Explore Best Affordable Health Insurance 2024 plans to find one that fits your budget and needs.

As healthcare continues to evolve, supplemental health insurance will remain a vital component of a comprehensive healthcare strategy.

Traveling abroad? Don’t forget to secure international health insurance! International Health Insurance 2024 can provide peace of mind while you’re exploring the world.

Q&A: Supplemental Health Insurance 2024

Is supplemental health insurance necessary?

Whether supplemental health insurance is necessary depends on your individual needs and circumstances. If you have a high-deductible health plan or are concerned about covering unexpected medical expenses, supplemental health insurance can provide valuable protection.

Planning for the future can be tough, but final expense insurance can help ease the burden on loved ones. Learn more about Final Expense Insurance 2024 options.

How much does supplemental health insurance cost?

The cost of supplemental health insurance varies depending on factors such as your age, health status, and the type of plan you choose. It’s best to get quotes from multiple insurers to compare prices and coverage.

Planning a trip and want to protect yourself from unexpected events? Travel Guard Insurance 2024 can provide valuable coverage for your journey.

What are the different types of supplemental health insurance?

Common types of supplemental health insurance include gap insurance, critical illness insurance, and accident insurance. Each type provides specific coverage for different medical situations.

Can I claim supplemental health insurance on my taxes?

Want the best protection for your vehicle? Consider exploring Cheap Full Coverage Insurance 2024 options to ensure you’re covered in any situation.

The tax benefits of supplemental health insurance can vary depending on your specific plan and location. It’s advisable to consult with a tax professional for personalized advice.

How do I find the right supplemental health insurance plan?

To find the right plan, consider your needs, budget, and the coverage you require. Consult with a licensed insurance agent or broker for expert guidance.