Interest Rates Right Now 2024: What You Need to Know – In a world where money is constantly in motion, understanding the ebb and flow of interest rates is crucial. These rates, the price of borrowing money, significantly impact everything from mortgage payments to credit card bills.

Finding the best mortgage rates can be a real challenge, especially in 2024. Better Mortgage Rates 2024 can help you navigate this complex process by providing insights and comparisons.

2024 has brought a unique set of economic challenges, prompting the Federal Reserve to make critical decisions about interest rates. This guide delves into the current interest rate landscape, exploring factors that influence them, and their impact on consumers and the economy as a whole.

Before you start shopping for a mortgage, it’s a good idea to get prequalified. Mortgage Prequalification 2024 provides information on the process and benefits of getting prequalified for a mortgage.

We’ll examine the current federal funds rate, the latest decisions by the Federal Reserve, and how these decisions translate into real-world costs for borrowing. We’ll also discuss the key economic indicators that drive interest rate changes, including inflation, unemployment, and economic growth.

Understanding these factors can help you make informed financial decisions and navigate the ever-changing landscape of interest rates.

Contents List

Interest Rates Right Now: 2024

Interest rates are a crucial aspect of the economy, impacting everything from borrowing costs to investment returns. Understanding the current interest rate landscape and its potential trajectory is essential for both individuals and businesses. In this article, we will delve into the current state of interest rates in 2024, exploring the key factors influencing their movement, and discussing the implications for consumers and investors.

Commercial mortgages are used to finance commercial properties. Commercial Mortgage Rates 2024 provides insights into the current rates and terms associated with these types of loans.

Current Interest Rate Landscape

The current interest rate landscape is characterized by a series of recent increases by the Federal Reserve, aimed at controlling inflation. The federal funds rate, the target rate at which banks lend reserves to each other overnight, is a key indicator of the overall cost of borrowing.

The Federal Reserve’s decisions on this rate directly influence interest rates for a wide range of loans, including mortgages, auto loans, and credit cards.

Latest Federal Reserve Decisions

The Federal Reserve has been raising interest rates since early 2022 to combat inflation. The most recent decision, announced on [Tanggal pengumuman], saw the federal funds rate increase to [Angka]%. This move reflects the Fed’s commitment to curbing inflation, even as it acknowledges the potential economic impact.

Variable interest rates fluctuate based on market conditions. Variable Interest Rate 2024 provides information on these types of mortgages, which can be advantageous in certain market scenarios.

Current Interest Rates for Loan Types

| Loan Type | Average Interest Rate |

|---|---|

| Mortgages (30-year fixed) | [Angka]% |

| Auto Loans (new vehicles) | [Angka]% |

| Credit Cards (variable APR) | [Angka]% |

Factors Influencing Interest Rates

Several economic indicators play a significant role in shaping the Federal Reserve’s decisions on interest rates. Understanding these factors can provide insights into the potential direction of interest rates in the future.

Inflation

Inflation is a primary driver of interest rate decisions. When inflation rises, the Federal Reserve typically raises interest rates to cool down the economy and curb price increases. This is because higher interest rates make borrowing more expensive, discouraging spending and potentially slowing inflation.

A second home mortgage is a specific type of loan for those seeking to finance a vacation property or additional residence. Second Home Mortgage 2024 offers insights into the process and factors to consider when applying for this type of mortgage.

Unemployment Rate

The unemployment rate is another key factor considered by the Federal Reserve. A low unemployment rate often indicates a strong economy, which can lead to inflation. In such scenarios, the Fed may raise interest rates to prevent the economy from overheating.

Me Bank is a major player in the Australian mortgage market. If you’re in Australia and looking for home loan rates, Me Bank Home Loan Rates 2024 provides information on their current offerings.

Conversely, if unemployment is high, the Fed might lower interest rates to stimulate economic growth.

Impact of Interest Rates on Consumers, Interest Rates Right Now 2024

Changes in interest rates have a direct impact on consumers, affecting their borrowing costs, savings returns, and overall financial planning.

The 30-year fixed mortgage is a popular choice for many borrowers. Current 30 Year Fixed Mortgage Rates 2024 provides an overview of the current rates available, allowing you to compare and potentially find the best deal.

Borrowing Costs

Rising interest rates make borrowing more expensive for consumers. This is particularly noticeable for loans with longer terms, such as mortgages. Higher interest rates translate to larger monthly payments and a higher overall cost of borrowing.

Navy Federal Credit Union offers mortgage services to its members. Navy Federal Mortgage Rates 2024 gives you an idea of their current mortgage rates, which can be helpful if you’re a member.

Mortgage Payments and Affordability

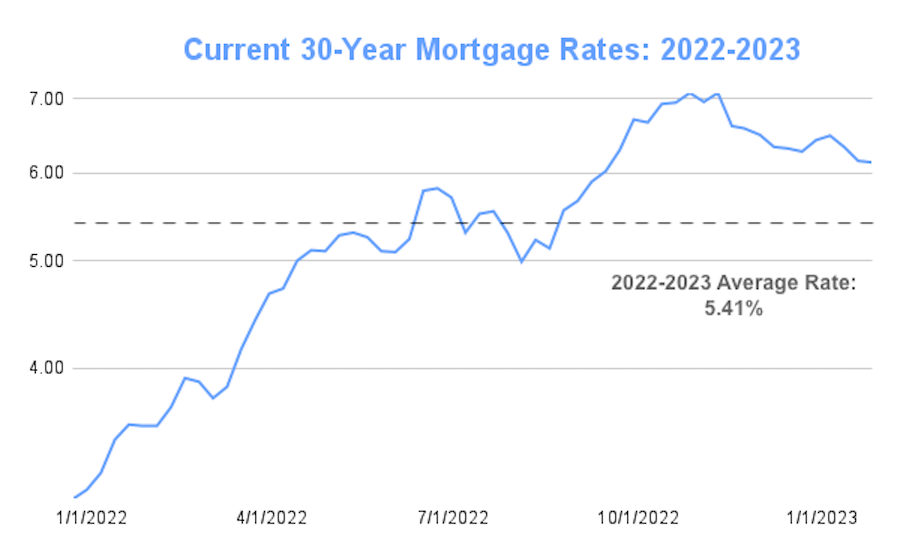

Interest rate changes significantly affect mortgage payments and affordability. When interest rates rise, monthly mortgage payments increase, making homeownership less accessible for some. Conversely, falling interest rates can lead to lower mortgage payments and increased affordability.

Managing Finances in a High-Interest Rate Environment

- Review and Refinance Loans:Explore refinancing options for existing loans, especially if interest rates have fallen since you took out the loan. This can lower your monthly payments and save you money in the long run.

- Prioritize Debt Repayment:Focus on paying down high-interest debt, such as credit card debt, as quickly as possible. This will minimize interest charges and free up cash flow for other financial goals.

- Build an Emergency Fund:Maintain a healthy emergency fund to cover unexpected expenses and avoid taking on high-interest debt.

Interest Rate Outlook for 2024

The trajectory of interest rates in 2024 is subject to various economic factors and uncertainties. While predicting the future is challenging, analysts offer several potential scenarios based on key economic indicators.

Everyone wants the best deal, especially when it comes to mortgage rates. Lowest Interest Rate Home Loan 2024 can help you find the lowest rates available, saving you money over the long term.

Potential Scenarios for Interest Rates in 2024

| Scenario | Key Factors | Expected Interest Rate Range |

|---|---|---|

| Scenario 1: Continued Rate Hikes | Persistent inflation, strong economic growth | [Angka]%

A second mortgage is a loan secured against your home. 2nd Mortgage Rates 2024 offers insights into the rates and terms associated with these loans, which can be useful for various financial needs.

|

| Scenario 2: Pause or Slowdown in Rate Hikes | Moderating inflation, signs of economic slowdown | [Angka]%

|

| Scenario 3: Rate Cuts | Recessionary fears, significant decline in inflation | [Angka]%

Thinking about a vacation home or a second property? 2nd Home Mortgage Rates 2024 offers information on the rates and terms associated with financing a second home.

|

Strategies for Managing Interest Rates

In a dynamic interest rate environment, proactive financial management is crucial. Here are some strategies for individuals to navigate the challenges and opportunities presented by fluctuating interest rates.

For those looking to invest in real estate, understanding Investment Property Interest Rates 2024 is crucial. These rates can impact the profitability of your investment, so it’s important to research and compare.

Managing Finances in a Rising Interest Rate Environment

- Minimize Debt:Focus on paying down high-interest debt as quickly as possible to reduce the impact of rising interest rates.

- Explore Fixed-Rate Options:Consider locking in fixed interest rates for loans and investments to protect yourself from future rate increases.

- Increase Savings:Aim to save more to offset the impact of higher borrowing costs and potentially earn higher returns on savings accounts.

Refinancing Loans in a Declining Interest Rate Environment

If interest rates decline, refinancing existing loans can significantly reduce your monthly payments and save you money over the life of the loan. However, it’s essential to factor in refinancing costs and ensure the new interest rate is significantly lower than your current rate to make it worthwhile.

Fixed-rate mortgages offer stability and predictability. Fixed Interest Rate Home Loan 2024 provides information on these types of mortgages, which can be beneficial for those seeking a predictable monthly payment.

Savings and Investment Options in the Current Interest Rate Landscape

- High-Yield Savings Accounts:Look for high-yield savings accounts to earn higher returns on your savings, especially in a rising interest rate environment.

- Certificates of Deposit (CDs):CDs offer fixed interest rates for a specific term, providing a guaranteed return on your savings. However, you are locked in for the term, so choose a term that aligns with your financial goals.

- Bonds:Bonds are debt securities that offer fixed interest payments. As interest rates rise, bond prices generally fall, but the fixed interest payments provide stability.

- Stocks:Stocks are equity securities that represent ownership in a company. While stock prices can fluctuate, they offer the potential for higher returns over the long term.

Epilogue: Interest Rates Right Now 2024

As we navigate the ever-evolving landscape of interest rates in 2024, staying informed is crucial. Understanding the factors that influence interest rates, their impact on borrowing costs, and strategies for managing your finances in this environment can empower you to make sound financial decisions.

Whether you’re looking to buy a home, take out a loan, or simply manage your savings, the information provided here can guide you towards a more financially secure future. Remember, staying informed and proactive is key to navigating the complexities of interest rates and maximizing your financial well-being.

FAQ

What is the current federal funds rate?

The current federal funds rate is set by the Federal Reserve and is the target rate that banks charge each other for overnight loans. It’s a key indicator of the cost of borrowing in the economy.

Chase is a major bank with a significant presence in the mortgage market. To get a sense of their current offerings, check out Chase Mortgage Rates Today 2024. This can help you understand their current rates and see if they align with your financial goals.

How often does the Federal Reserve adjust interest rates?

The Federal Reserve typically meets eight times a year to discuss and adjust interest rates, though they can hold emergency meetings if necessary.

What are some tips for managing finances in a high-interest rate environment?

Some tips include creating a budget, paying down high-interest debt, and exploring refinancing options for loans.

If you’re considering a rural property, Usda Rural Housing Loan 2024 offers a great opportunity for homeownership. It’s a government-backed loan program designed to help people purchase homes in rural areas.