Interest Rates Now 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The current economic landscape is dynamic, with interest rates playing a crucial role in shaping the financial decisions of individuals and businesses alike.

This exploration delves into the intricate workings of interest rate fluctuations, examining the factors that drive them, the impact on consumers and businesses, and the strategies for navigating this evolving terrain.

The Federal Reserve’s recent actions have significantly impacted interest rates across various loan types, from mortgages to auto loans and credit cards. Understanding the current interest rate environment is paramount for making informed financial decisions. This article dissects the complex interplay of economic indicators, geopolitical events, and global economic conditions that influence interest rate trends, providing insights into the potential trajectory of interest rates in 2024.

Contents List

Interest Rate Landscape in 2024

The current interest rate environment in the United States is characterized by ongoing adjustments as the Federal Reserve navigates a delicate balancing act between curbing inflation and supporting economic growth. After a series of aggressive interest rate hikes in 2022, the Fed has shifted to a more cautious approach in 2023, with smaller increases and a focus on assessing the impact of past policy decisions.

This dynamic landscape has significant implications for consumers and businesses alike.

Current Interest Rate Environment

The Federal Reserve’s primary tool for managing the economy is through setting the federal funds rate, which is the target rate at which banks lend reserves to each other overnight. The Fed has raised the federal funds rate significantly since early 2022, from near zero to a range of 5.25% to 5.5% in July 2023.

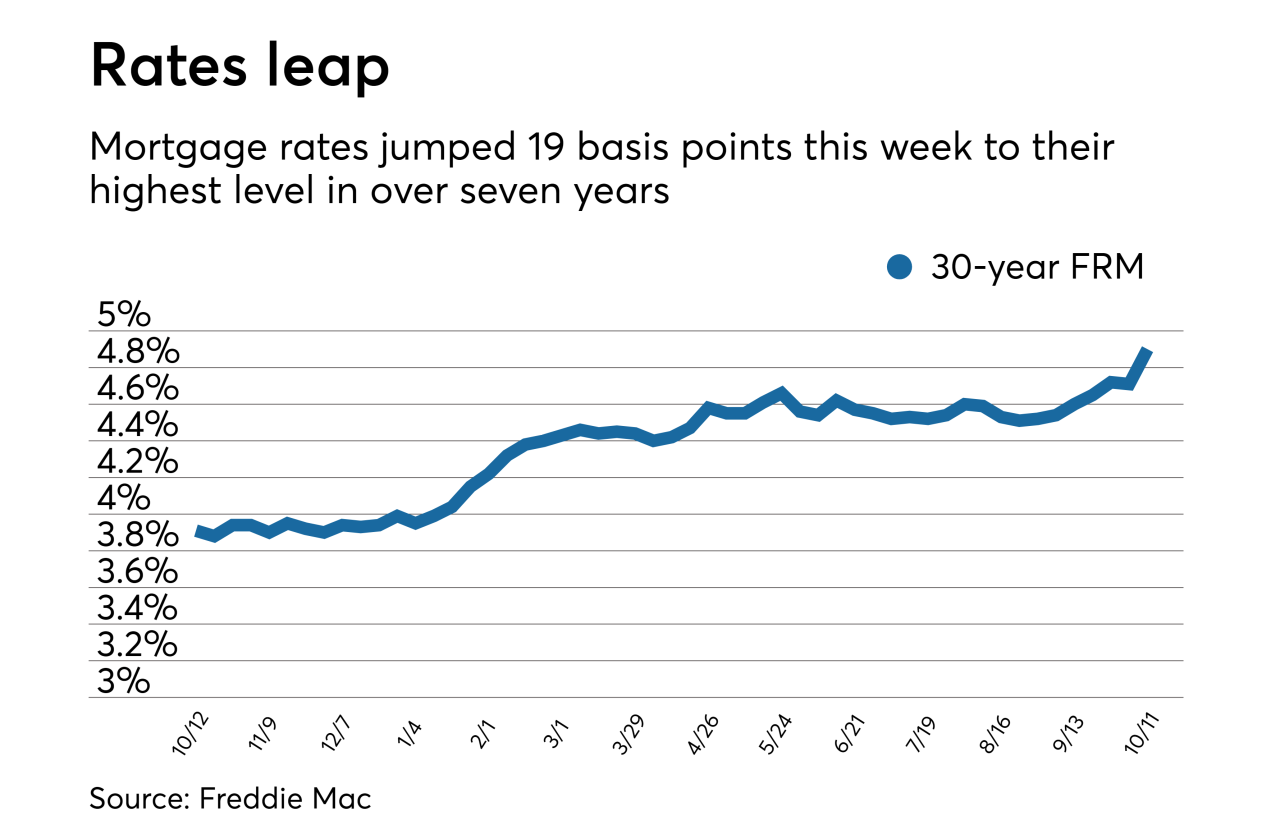

Planning to buy a home in 2024? Understanding interest rates and mortgage rates is crucial. Keep an eye on the best mortgage rates available and explore current 30-year fixed mortgage rates to get a good sense of the market.

These increases have ripple effects throughout the financial system, influencing interest rates on a wide range of loans, including mortgages, auto loans, and credit cards.

Looking for a traditional mortgage? Conventional home loans remain a popular choice. Keep an eye on mortgage loan interest rates and consider refinance rates for 30-year fixed mortgages if you’re looking to lower your monthly payments.

Factors Influencing Interest Rates

Interest rate decisions are driven by a complex interplay of economic factors. The Federal Reserve closely monitors key economic indicators to gauge the health of the economy and assess the need for adjustments to monetary policy.

- Inflation:The Fed’s primary mandate is to maintain price stability, which means keeping inflation at a target rate of 2%. When inflation is high, the Fed typically raises interest rates to cool down the economy and reduce demand, thereby slowing price increases.

Conversely, when inflation is low, the Fed may lower interest rates to stimulate economic activity.

- Unemployment:The unemployment rate is another crucial indicator. When unemployment is low, it suggests a strong economy with high demand for labor. This can lead to wage increases and potentially higher inflation. The Fed may raise interest rates to moderate economic growth and prevent inflation from spiraling out of control.

Mortgage financing options are plentiful in 2024. Explore mortgage financing options, including Fannie Mae mortgages , and consider the pros and cons of 10-year fixed-rate mortgages versus 30-year fixed mortgage rates.

- Economic Growth:The rate of economic growth is a key factor in determining interest rate policy. When the economy is growing rapidly, the Fed may raise interest rates to prevent overheating and potential inflation. Conversely, if the economy is slowing down, the Fed may lower interest rates to stimulate growth.

Impact on Consumers and Businesses, Interest Rates Now 2024

Rising interest rates have a direct impact on consumers and businesses.

- Consumer Spending and Borrowing:Higher interest rates make it more expensive to borrow money, which can dampen consumer spending. This is particularly true for large purchases like homes and cars. Individuals may also reduce their borrowing for discretionary items as the cost of credit increases.

- Business Investment Decisions:Businesses rely on loans for investments in expansion, equipment, and other projects. Higher interest rates increase the cost of borrowing, making these investments less attractive. This can lead to reduced business investment and slower economic growth.

- Impact on Different Segments:The impact of interest rate changes varies across different segments of the population. Homeowners with fixed-rate mortgages may benefit from rising rates as their existing loans become more valuable compared to new mortgages. However, borrowers with adjustable-rate mortgages may face higher monthly payments as their rates adjust upward.

Savers generally benefit from rising interest rates, as they earn higher returns on their deposits.

Interest Rate Projections and Forecasts

Predicting future interest rate movements is a challenging task, as it depends on a multitude of factors. Economists and financial analysts closely monitor economic data and policy announcements to form their forecasts.

| Scenario | Federal Funds Rate | Economic Impact |

|---|---|---|

| Scenario 1: Continued Inflation | Further increases in 2024 | Slower economic growth, potential recession, increased borrowing costs for businesses and consumers |

| Scenario 2: Moderating Inflation | Stable rates, potential pause or small increases | Balanced growth, manageable borrowing costs, moderate consumer spending |

| Scenario 3: Deflationary Pressures | Rate cuts in 2024 | Stimulated economic growth, lower borrowing costs, potential risk of asset bubbles |

Strategies for Managing Interest Rate Changes

Navigating a changing interest rate environment requires proactive strategies.

- Manage Debt:Prioritize paying down high-interest debt, such as credit cards. Consider refinancing existing loans to secure lower interest rates.

- Optimize Savings:Take advantage of higher interest rates on savings accounts and certificates of deposit (CDs). Explore investment options that can potentially outperform inflation.

- Investment Decisions:Carefully evaluate investment strategies, considering the impact of interest rates on asset classes. Seek professional advice to make informed decisions.

Last Recap

As we navigate the ever-changing landscape of interest rates in 2024, understanding the underlying forces at play is essential. This article has provided a comprehensive overview of the current interest rate environment, exploring the factors that influence rates, the impact on consumers and businesses, and strategies for managing these fluctuations.

By staying informed and adapting to these changes, individuals and businesses can make sound financial decisions that position them for success in the years to come.

Query Resolution: Interest Rates Now 2024

What are the main factors that influence interest rates?

Your credit score plays a significant role in securing a home loan. Check out USAA mortgage options for military personnel and their families. If you’re a first-time buyer , consider the resources available to you. You can also track Bankrate mortgage rates and current 30-year mortgage rates for the best deals.

Interest rates are primarily influenced by inflation, unemployment, economic growth, and the actions of central banks like the Federal Reserve.

How do rising interest rates impact consumers?

Rising interest rates increase borrowing costs for consumers, making it more expensive to obtain loans for mortgages, auto purchases, and credit cards. This can lead to reduced consumer spending and borrowing.

What strategies can businesses employ to manage rising interest rates?

Businesses can manage rising interest rates by optimizing their debt structure, exploring alternative financing options, and carefully managing their cash flow. They can also consider adjusting their investment strategies to account for higher borrowing costs.