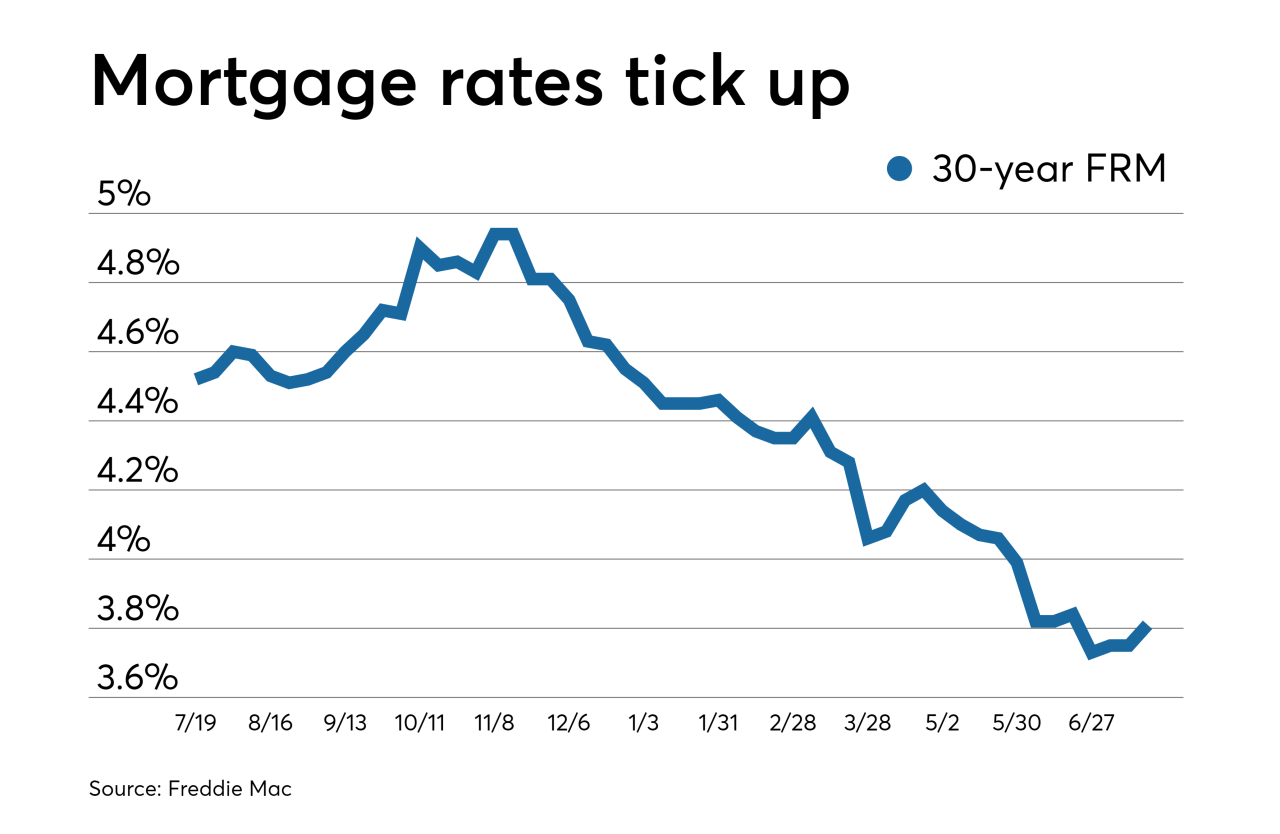

Typical Mortgage Interest Rate 2024 takes center stage as a key factor influencing homeownership decisions. Understanding the forces that drive mortgage rates is crucial for both prospective buyers and existing homeowners. The Federal Reserve’s monetary policy plays a pivotal role, influencing interest rates through its actions to manage inflation and economic growth.

An ARM mortgage in 2024 can offer lower initial interest rates, but keep in mind that the rates can adjust periodically, potentially increasing your monthly payments.

Key economic indicators like inflation, unemployment, and consumer confidence also impact the direction of mortgage rates.

Are you thinking about refinancing your mortgage in 2024? Refinance rates 2024 are fluctuating, so it’s essential to compare different lenders and options to find the best deal for your situation.

Navigating the complexities of mortgage interest rates requires a comprehensive understanding of current trends, historical data, and potential future scenarios. By examining these factors, we can gain insights into the potential trajectory of mortgage rates in 2024.

Saving for a down payment can be a challenge, but there are strategies to help you reach your goal. The best way to save for a house in 2024 might involve increasing your savings contributions, exploring high-yield savings accounts, or even taking advantage of government programs.

Conclusion

In conclusion, navigating the landscape of mortgage interest rates in 2024 requires a blend of understanding current trends, historical data, and potential future scenarios. By considering the interplay of economic forces, individual factors, and available mortgage options, both prospective buyers and existing homeowners can make informed decisions that align with their financial goals.

While subprime mortgages in 2024 might seem appealing for those with less-than-perfect credit, it’s crucial to understand the higher interest rates and potential risks associated with this type of loan.

Staying informed about mortgage interest rates remains essential in today’s dynamic economic environment.

Securing the lowest interest rate home loan in 2024 can save you significant money over the life of your mortgage. Shop around, compare rates, and consider factors like credit score and loan term to find the best deal.

Commonly Asked Questions: Typical Mortgage Interest Rate 2024

What is the average mortgage interest rate in 2024?

The average mortgage interest rate in 2024 can fluctuate significantly depending on various factors. It’s recommended to consult with a mortgage lender for current rates and personalized estimates.

How do I get the best mortgage interest rate?

Improving your credit score, increasing your down payment, and shopping around for different lenders can help secure a lower mortgage interest rate.

If you’re considering refinancing your existing mortgage, home refinance options in 2024 can help you lower your monthly payments, shorten your loan term, or access cash for home improvements.

What are the risks of an adjustable-rate mortgage (ARM)?

ARMs can offer lower initial rates, but they come with the risk of higher payments if interest rates rise in the future.

A bridge loan mortgage in 2024 can be a helpful tool if you need to bridge the gap between selling your current home and purchasing a new one. However, it’s important to carefully consider the terms and costs associated with this type of loan.

If you’re considering a mortgage with Bank of America, Bank of America mortgage rates in 2024 can vary depending on your credit score, loan type, and other factors. Be sure to compare their rates with other lenders.

Curious about the monthly payments on a $300,000 mortgage? A $300,000 mortgage payment over 30 years in 2024 will depend on the interest rate and loan type. Use a mortgage calculator to estimate your payments.

Looking for the best home loans in 2024 ? Explore different lenders, compare interest rates, and consider factors like loan terms, fees, and closing costs.

If you’re a first-time home buyer, Bank of America offers programs to help you navigate the process. Bank of America’s first-time home buyer programs in 2024 can provide valuable resources and support.

LoanCare is a mortgage servicing company that handles loan payments and other aspects of your mortgage. LoanCare mortgage services in 2024 include managing payments, providing online account access, and offering customer support.

Understanding your mortgage repayments is crucial. Mortgage repayments in 2024 can vary depending on the loan type, interest rate, and loan term.

For veterans and active-duty military personnel, VA home loan interest rates in 2024 offer competitive rates and flexible terms. Explore these programs to see if you qualify.

Planning to purchase a second home? Second home mortgage rates in 2024 can differ from those for primary residences. Research rates and compare lenders to find the best option for your situation.