Best VA Home Loan 2024: For eligible veterans and active-duty military personnel, the VA home loan program offers a unique opportunity to achieve the dream of homeownership with favorable terms and benefits. This guide will delve into the key features, advantages, and considerations of VA home loans in 2024, providing valuable insights for those seeking to navigate the home buying process.

Securing a home loan with a low interest rate can significantly impact your monthly payments. Explore options for finding cheap home loans in 2024: Cheap Home Loans 2024.

VA home loans are renowned for their competitive interest rates, flexible terms, and minimal down payment requirements. The program aims to assist those who have served our country in securing affordable and stable housing. Whether you’re a first-time homebuyer or looking to refinance an existing mortgage, understanding the nuances of VA home loans is crucial to making informed decisions.

Contents List

Understanding VA Home Loans: Best Va Home Loan 2024

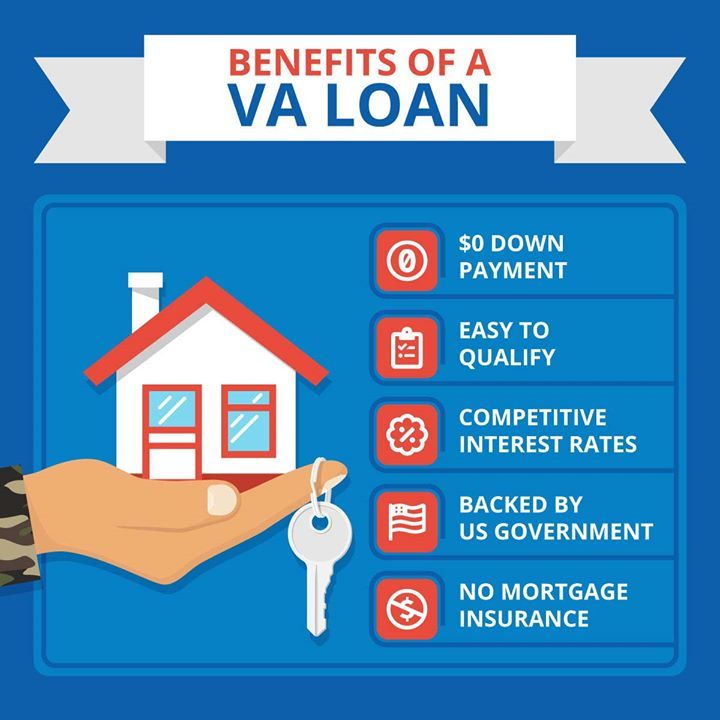

VA home loans are a fantastic option for eligible veterans and active-duty military personnel looking to buy a home. These loans offer numerous benefits, including zero down payment options, competitive interest rates, and no private mortgage insurance (PMI) requirements. Let’s delve into the details of VA home loans, exploring their benefits, eligibility criteria, and the loan process.

Wells Fargo is another major financial institution that offers mortgage services. Compare Wells Fargo’s mortgage rates with other lenders to find the best option for you. Learn more about Wells Fargo’s mortgage rates for 2024: Wells Fargo Mortgage Rates 2024.

Benefits of VA Home Loans

VA home loans provide several advantages that make them a compelling choice for eligible borrowers. These benefits include:

- Zero Down Payment:One of the most attractive features of VA loans is the ability to purchase a home with no down payment. This significantly reduces the upfront costs associated with homeownership and makes it easier for veterans to enter the housing market.

Citibank is another financial institution that offers mortgage services. To make an informed decision, it’s essential to compare Citibank’s mortgage rates with other lenders. Learn more about Citibank’s mortgage rates for 2024: Citibank Mortgage Rates 2024.

- Competitive Interest Rates:VA loans often come with lower interest rates compared to conventional mortgages. This translates to lower monthly payments and substantial savings over the life of the loan.

- No Private Mortgage Insurance (PMI):Unlike conventional loans, VA loans do not require PMI, which is an insurance policy that protects lenders against losses in case of default. This eliminates an additional monthly expense and further reduces the overall cost of borrowing.

- Flexible Loan Terms:VA loans offer flexible terms, allowing borrowers to choose loan durations that suit their financial situation. Options include 15-year, 20-year, and 30-year fixed-rate mortgages.

- No Prepayment Penalties:VA loans do not have prepayment penalties, meaning borrowers can pay off their loan early without incurring any additional fees. This allows for greater flexibility and the potential to save on interest payments.

Eligibility Requirements for VA Loans

To qualify for a VA loan, borrowers must meet specific eligibility requirements, including:

- Service History:Applicants must have served in the U.S. military for a minimum period, depending on their branch of service and the nature of their discharge. The specific requirements vary, so it’s crucial to check with the VA directly for accurate information.

FHA loans are known for being more accessible to borrowers with lower credit scores. They also often require lower down payments. Explore current FHA interest rates for 2024: Fha Interest Rates 2024.

- Credit Score:While there’s no minimum credit score requirement for VA loans, lenders generally prefer borrowers with good credit history. A higher credit score often leads to better interest rates and more favorable loan terms.

- Debt-to-Income Ratio (DTI):Lenders assess the borrower’s DTI, which represents the percentage of their monthly income allocated to debt payments. A lower DTI typically indicates a stronger financial standing and increases the likelihood of loan approval.

- Down Payment:While VA loans allow for zero down payment, some lenders may require a small down payment depending on the property’s value or other factors. It’s essential to discuss these requirements with potential lenders.

VA Loan Process

The VA loan process involves several steps, including:

- Pre-Approval:Before you start searching for a home, getting pre-approved for a VA loan is crucial. This involves providing your financial information to a lender, who will assess your eligibility and provide an estimate of the loan amount you can qualify for.

Truist is a well-known bank that offers mortgage services. If you’re considering Truist for your mortgage, it’s a good idea to compare their current rates with other lenders. Check out Truist’s mortgage rates for 2024: Truist Mortgage Rates 2024.

Pre-approval strengthens your offer when making an offer on a property and demonstrates your financial readiness to the seller.

- Home Search:Once you’re pre-approved, you can start looking for your dream home. Work with a real estate agent to find properties that meet your needs and budget.

- Offer and Negotiation:When you find a home you’re interested in, you’ll need to submit an offer. Your real estate agent will help you negotiate the purchase price and other terms of the sale.

- Loan Application:After your offer is accepted, you’ll need to complete a formal loan application with your chosen VA lender. This involves providing additional financial documentation, such as tax returns and pay stubs.

- Loan Underwriting:The lender will review your application and supporting documents to assess your creditworthiness and determine the loan terms. This process can take several weeks.

- Loan Closing:Once the loan is approved, you’ll attend a closing meeting where you’ll sign the final loan documents and officially transfer ownership of the property.

Key Features of VA Home Loans in 2024

VA home loans continue to evolve, adapting to the changing housing market. Let’s explore some key features of VA loans in 2024, including interest rates, comparisons to conventional mortgages, and the VA funding fee.

Truist Bank is a well-known financial institution that offers a variety of mortgage products. Explore Truist Bank’s mortgage offerings for 2024: Truist Bank Mortgage 2024.

Current Interest Rates for VA Home Loans

VA loan interest rates fluctuate based on market conditions, economic indicators, and the borrower’s creditworthiness. As of [Insert Current Date], average interest rates for 30-year fixed-rate VA loans are around [Insert Current Interest Rate]%. It’s essential to note that these rates are subject to change, and it’s always advisable to contact multiple lenders to compare rates and find the best deal.

Bank of America offers programs specifically designed for first-time homebuyers. These programs can provide valuable assistance and resources for those entering the homeownership market. Find out more about Bank of America’s programs for first-time homebuyers in 2024: Bank Of America First Time Home Buyer 2024.

Comparing VA Loans to Conventional Mortgages

VA loans offer distinct advantages compared to conventional mortgages, but it’s important to weigh the pros and cons of each option.

Knowing how much your monthly mortgage payment will be is crucial when planning your home purchase. There are online tools and calculators that can help you determine your estimated payment. Learn more about calculating your mortgage payment in 2024: Calculating Mortgage Payment 2024.

| Feature | VA Loan | Conventional Mortgage |

|---|---|---|

| Down Payment | Zero Down Payment (typically) | Typically requires a down payment (usually 3-20%) |

| Interest Rates | Often lower than conventional mortgages | Interest rates can vary based on factors like credit score and loan term |

| Private Mortgage Insurance (PMI) | Not required | Usually required for conventional loans with less than 20% down payment |

| Eligibility Requirements | Specific eligibility criteria for veterans and active-duty military personnel | Broader eligibility requirements based on creditworthiness and financial history |

| Funding Fee | VA Funding Fee (varies based on loan type and down payment) | No funding fee |

VA Funding Fee

The VA funding fee is a one-time charge that helps fund the VA loan program. The fee is calculated as a percentage of the loan amount and varies based on the type of loan and the amount of the down payment.

Mortgage interest rates are a key factor to consider when obtaining a home loan. Understanding current mortgage interest rates can help you make informed decisions about your financing options. Check out current mortgage interest rates for 2024: Mortgage Interest Rates 2024.

For example, first-time VA borrowers with no down payment may pay a funding fee of 2.3%. This fee can be financed into the loan or paid upfront at closing. While the funding fee adds to the overall cost of the loan, it’s important to consider the other benefits of VA loans, such as lower interest rates and no PMI.

Looking for a mortgage that fits your specific needs? There are a variety of mortgage options available, including conventional, FHA, and VA loans. Explore some of the top mortgage options for 2024: 5 Mortgages 2024.

Finding the Best VA Home Loan for Your Needs

With various VA loan options available, choosing the right one for your individual needs is crucial. Let’s explore factors to consider when selecting a VA lender and a checklist of questions to ask potential lenders.

Comparing VA Loan Options, Best Va Home Loan 2024

VA loans offer different options to cater to diverse borrower needs. Here’s a comparison of some common VA loan types:

| Loan Type | Description |

|---|---|

| Fixed-Rate Mortgage | Offers a fixed interest rate for the entire loan term, providing predictable monthly payments. |

| Adjustable-Rate Mortgage (ARM) | Features an interest rate that adjusts periodically based on market conditions. ARMs may offer lower initial interest rates, but the rates can fluctuate over time. |

| VA IRRRL (Interest Rate Reduction Refinance Loan) | Allows eligible veterans to refinance their existing VA loan to a lower interest rate, potentially saving money on monthly payments. |

| VA Cash-Out Refinance Loan | Enables veterans to refinance their existing VA loan and access a portion of their home equity as cash. This can be used for various purposes, such as home improvements, debt consolidation, or other financial needs. |

Choosing a VA Lender

When selecting a VA lender, consider the following factors:

- Loan Terms:Compare interest rates, loan terms, and closing costs offered by different lenders.

- Customer Service:Look for a lender with a reputation for excellent customer service and responsiveness. Read online reviews and testimonials to gauge the lender’s track record.

- Reputation:Choose a lender with a strong reputation for reliability and trustworthiness. Research the lender’s financial stability and any regulatory actions or complaints.

- Loan Programs:Ensure the lender offers a range of VA loan programs to suit your specific needs, such as fixed-rate, adjustable-rate, or refinance options.

Questions to Ask Potential Lenders

When you’re ready to start talking to VA lenders, ask these questions to ensure you’re getting the best possible deal:

- What are your current interest rates for VA home loans?

- What are your loan terms and closing costs?

- Do you offer any VA loan programs specific to my situation, such as a VA IRRRL or a VA Cash-Out Refinance Loan?

- What are your customer service policies and procedures?

- What is your reputation for loan processing speed and efficiency?

VA Loan Programs and Resources

The VA offers various loan programs and resources to assist veterans and active-duty military personnel with their homeownership goals. Let’s explore some of these programs and resources.

Similar to zero-down mortgages, 0 down home loans offer the possibility of purchasing a home without putting any money down. Learn more about these types of loans for 2024: 0 Down Home Loans 2024.

VA Loan Programs

- VA IRRRL (Interest Rate Reduction Refinance Loan):This program allows eligible veterans to refinance their existing VA loan to a lower interest rate, potentially saving money on monthly payments. The VA IRRRL is a streamlined process that typically involves less paperwork and a faster closing time.

Interest rates can fluctuate, and understanding current real estate interest rates is crucial when planning your mortgage. Check out the latest real estate interest rates for 2024: Real Estate Interest Rates 2024.

- VA Cash-Out Refinance Loan:This program enables veterans to refinance their existing VA loan and access a portion of their home equity as cash. This cash can be used for various purposes, such as home improvements, debt consolidation, or other financial needs. It’s important to note that cash-out refinance loans may come with higher interest rates than traditional VA loans.

Resources for Veterans

- VA Website:The VA website (www.va.gov) provides a wealth of information about VA home loans, eligibility requirements, loan programs, and resources. You can access online tools, calculators, and frequently asked questions (FAQs) to get answers to your questions.

- Local VA Offices:VA offices are located throughout the country, providing in-person assistance and guidance on VA loan programs. You can contact your local VA office to schedule an appointment or obtain information about their services.

- VA Loan Officers:Working with a qualified VA loan officer can be invaluable in navigating the loan process. Loan officers are experts in VA loans and can provide personalized guidance, answer your questions, and help you secure the best possible terms.

Epilogue

Securing a VA home loan can be a rewarding experience, opening doors to a new chapter in your life. By carefully evaluating your needs, researching lenders, and seeking professional guidance, you can confidently navigate the home buying process and unlock the benefits of this exceptional program.

Considering buying a home in 2024? It’s a good idea to get pre-approved for a mortgage first. This will give you a better understanding of how much you can afford to borrow and help you find the right loan for your needs.

You can learn more about getting pre-approved by checking out this helpful resource: Get Preapproved For A Mortgage 2024.

Remember, your service and dedication deserve the best, and VA home loans are a testament to that commitment.

Common Queries

What are the current interest rates for VA home loans in 2024?

Thinking about buying a home with no down payment? You might be interested in a zero-down mortgage. These mortgages allow you to purchase a home without putting any money down, which can be a great option for first-time homebuyers. Learn more about the possibility of a zero-down mortgage in 2024: Zero Down Mortgage 2024.

VA loan interest rates fluctuate based on market conditions. It’s recommended to consult with a lender for the most up-to-date information.

If you’re a veteran, you might be eligible for a VA home loan. These loans offer competitive rates and often require no down payment. Check out current VA home loan rates for 2024: Va Home Loan Rates 2024.

Can I use a VA loan to buy a second home?

Yes, you can use a VA loan to purchase a second home, but you’ll need to meet specific eligibility requirements.

What is the maximum loan amount for a VA home loan?

There is no set maximum loan amount for VA home loans. The limit is based on the conforming loan limit in your area.

How do I find a reputable VA lender?

Look for lenders with experience in VA loans, positive customer reviews, and competitive rates. You can also consult with the VA website for a list of approved lenders.