Credit Score For FHA Loan 2024 is a crucial factor for anyone looking to secure a mortgage through the Federal Housing Administration (FHA). FHA loans are known for their flexibility and accessibility, especially for first-time homebuyers and those with less-than-perfect credit.

If you’re a veteran, you might be eligible for a VA home loan, which offers benefits like no down payment requirement and competitive interest rates. Check out the VA home loan benefits for 2024 to see if you qualify.

But how does your credit score impact your chances of getting approved and what kind of loan terms can you expect?

If you’re a physician, you might be eligible for specialized mortgage loans with attractive terms. Explore Physician Mortgage Loans 2024 to see if they’re right for you.

This guide delves into the intricacies of FHA loan requirements, exploring the minimum credit score needed, how your score affects interest rates, and practical strategies to improve your credit for a successful homeownership journey.

For homeowners looking to access their home equity, reverse mortgages are an option. You can compare different reverse mortgage companies and their offerings by visiting Reverse Mortgage Companies 2024.

Contents List

- 1 FHA Loans: Understanding the Basics and Credit Score Requirements

- 2 Final Thoughts: Credit Score For Fha Loan 2024

- 3 Popular Questions

FHA Loans: Understanding the Basics and Credit Score Requirements

In today’s housing market, securing a mortgage can be a daunting task, especially for first-time homebuyers or individuals with less-than-perfect credit. The Federal Housing Administration (FHA) offers a solution through FHA loans, designed to make homeownership more accessible. FHA loans are government-insured mortgages that cater to borrowers who may not meet traditional lending standards.

Conventional mortgages are a popular choice for homebuyers. You can find the latest Conventional Mortgage Rates 2024 to compare with other loan options.

This article will delve into the intricacies of FHA loans, focusing on the crucial role of credit score in loan approval and providing strategies to enhance your chances of securing an FHA mortgage.

FHA Loan Basics

FHA loans are government-insured mortgages offered by private lenders. They are designed to assist borrowers with lower credit scores or limited down payments in achieving homeownership. FHA loans are particularly advantageous for first-time homebuyers and those with less-than-perfect credit history.

Tracker mortgages offer interest rates that adjust based on a benchmark rate. Learn more about how they work and their potential advantages and disadvantages by visiting Tracker Mortgage 2024.

Purpose and Benefits of FHA Loans

- Lower Down Payment:FHA loans typically require a down payment of just 3.5%, making them significantly more accessible compared to conventional loans that often demand 20% down. This reduced down payment requirement allows borrowers to enter the housing market sooner and with less upfront capital.

A 30-year fixed mortgage offers predictable monthly payments, but rates can fluctuate. Keep an eye on the current 30 Fixed Mortgage Rates 2024 to make an informed decision.

- More Lenient Credit Score Requirements:FHA loans have more lenient credit score requirements compared to conventional loans. This is particularly beneficial for borrowers with lower credit scores who may face challenges securing traditional mortgages.

- Flexible Income Guidelines:FHA loans have less stringent income requirements, making them suitable for borrowers with varying financial situations. This inclusivity allows individuals with lower incomes to pursue homeownership.

- Government Insurance:The government insurance provided by FHA protects lenders against default, making FHA loans more attractive to lenders. This insurance helps to mitigate risk for lenders, leading to potentially more favorable loan terms for borrowers.

Eligibility Criteria for FHA Loans

- Credit Score:While FHA loans are more lenient with credit scores, there is still a minimum requirement. The minimum credit score for FHA loan approval in 2024 is typically 580, although some lenders may have higher requirements.

- Debt-to-Income Ratio (DTI):The DTI is a crucial factor in FHA loan approval. This ratio represents the percentage of your monthly income that goes towards debt payments. FHA loans generally allow for a higher DTI compared to conventional loans, but it is still a significant consideration.

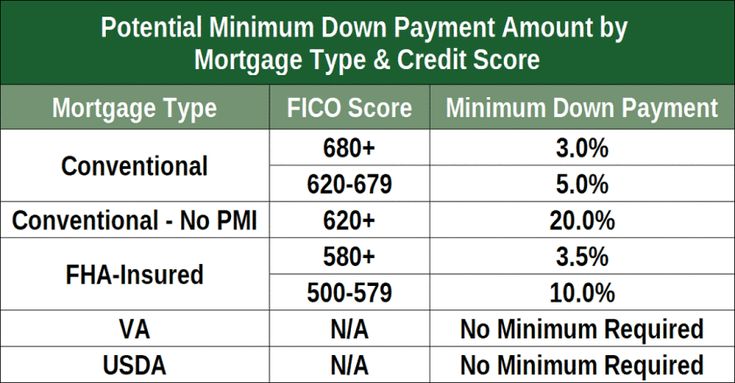

- Down Payment:As mentioned earlier, FHA loans require a minimum down payment of 3.5% of the purchase price. However, borrowers with credit scores below 580 may need a larger down payment, typically 10%.

- Occupancy:FHA loans are designed for primary residences. This means that the borrower must intend to occupy the property as their primary home.

- Property Type:FHA loans are generally available for single-family homes, condominiums, townhouses, and manufactured homes.

FHA Loan Process

The FHA loan process involves several stages, each with its own set of requirements and considerations. Understanding the process can help borrowers navigate the application and approval stages smoothly.

A 5/1 ARM mortgage combines a fixed rate for the first five years, followed by an adjustable rate for the remaining term. See the current 5/1 Arm Rates 2024 to compare with other options.

- Application:The first step is to find an FHA-approved lender and submit a loan application. This typically involves providing personal and financial information, including income, assets, debts, and credit history.

- Underwriting:Once the application is submitted, the lender will review your financial information and assess your creditworthiness. This process, known as underwriting, involves verifying your income, assets, and credit score.

- Appraisal:An appraisal is conducted to determine the fair market value of the property you intend to purchase. The appraisal report is crucial for the lender to ensure that the loan amount aligns with the property’s value.

- Closing:If the loan is approved, the final stage involves closing the loan. This includes signing all necessary documents, including the mortgage agreement, and transferring ownership of the property.

Credit Score Requirements for FHA Loans in 2024

Credit score is a pivotal factor in FHA loan approval, significantly influencing loan terms and interest rates. Understanding the minimum credit score requirements and how your score impacts the loan process is crucial for a successful home purchase.

FHA loans are designed to make homeownership more accessible for borrowers with lower credit scores or down payments. Learn more about FHA Financing 2024 to see if it’s a good fit for you.

Minimum Credit Score for FHA Loan Approval

As of 2024, the minimum credit score for FHA loan approval is typically 580. However, it’s essential to note that some lenders may have higher minimum credit score requirements.

Veterans United is a popular lender for veterans. You can check out their current Veterans United Interest Rates 2024 to see if they offer competitive rates.

Impact of Credit Score on Interest Rates and Loan Terms

Your credit score directly impacts the interest rate you qualify for and the overall terms of your FHA loan. A higher credit score generally leads to a lower interest rate, which translates to lower monthly payments and reduced overall borrowing costs.

Conversely, a lower credit score may result in a higher interest rate, leading to increased monthly payments and higher total loan costs.

Furthermore, your credit score can influence the loan terms, such as the loan-to-value (LTV) ratio, which is the percentage of the property’s value that is financed by the loan. Borrowers with lower credit scores may face higher LTV ratios, requiring larger down payments or additional mortgage insurance premiums.

Transferring your home loan to a new lender might be a good option if you’re looking for lower interest rates or better terms. Find out more about the process and potential benefits by checking out Home Loan Transfer 2024.

Factors Contributing to Credit Score

- Payment History:Your payment history accounts for a significant portion of your credit score. Timely payments on credit cards, loans, and other debts demonstrate responsible financial behavior and contribute to a higher score.

- Credit Utilization Ratio:This ratio represents the amount of credit you are using compared to your total available credit. Keeping your credit utilization ratio low is crucial for a healthy credit score. Aim to use less than 30% of your available credit.

- Length of Credit History:A longer credit history generally indicates financial stability and responsibility. Over time, your credit score improves as you build a positive credit history.

- Credit Mix:Having a mix of different credit accounts, such as credit cards, installment loans, and mortgages, can positively impact your credit score.

- New Credit:Applying for new credit can temporarily lower your credit score. It’s advisable to limit credit applications to avoid unnecessary credit score fluctuations.

Impact of Credit Score on FHA Loan Approval

Your credit score plays a critical role in the FHA loan approval process. Lenders carefully evaluate your credit history to assess your ability to repay the loan responsibly. A higher credit score generally increases your chances of loan approval and can lead to more favorable loan terms.

Ready to take the next step in your homeownership journey? Start the mortgage application process by visiting Apply For Mortgage 2024.

Relationship Between Credit Score and Loan Approval Probability

The relationship between credit score and loan approval probability is generally positive. A higher credit score typically indicates a lower risk for lenders, increasing the likelihood of loan approval. Conversely, a lower credit score may raise concerns about your ability to repay the loan, potentially leading to loan denial or less favorable terms.

Credit Score Ranges and Corresponding Loan Outcomes

| Credit Score Range | Loan Approval Probability | Loan Terms |

|---|---|---|

| 740+ | High | Favorable interest rates, lower down payment requirements, flexible loan terms. |

| 670-739 | Moderate | Competitive interest rates, standard down payment requirements, typical loan terms. |

| 580-669 | Low | Higher interest rates, potentially higher down payment requirements, stricter loan terms. |

| Below 580 | Very low | Loan denial or significantly unfavorable terms, requiring a larger down payment and higher mortgage insurance premiums. |

How a Low Credit Score Can Affect Loan Terms and Affordability

A low credit score can negatively impact your FHA loan terms and overall affordability. Borrowers with lower credit scores may face higher interest rates, leading to increased monthly payments and higher total loan costs. Additionally, they may need to make a larger down payment or pay higher mortgage insurance premiums.

In the UK, the Right to Buy scheme allows tenants of council homes to purchase their homes at a discounted rate. Check out the Right To Buy Mortgage 2024 options available.

Strategies for Improving Credit Score for FHA Loan Eligibility, Credit Score For Fha Loan 2024

If your credit score is below the minimum requirement for FHA loan approval, don’t despair. There are strategies you can implement to improve your credit score over time and enhance your chances of securing an FHA mortgage.

A 10-year ARM mortgage can offer lower initial rates compared to a 30-year fixed mortgage. See the current 10 Year Arm Rates 2024 to compare your options.

Step-by-Step Guide for Improving Credit Score

- Check Your Credit Report:Obtain a free copy of your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion). Review the report carefully for any errors or inaccuracies. Dispute any errors with the credit bureaus to ensure that your credit history is accurate.

Planning to buy a second home? Check out the latest Second Home Mortgage Rates 2024 to get a better understanding of financing options.

- Pay Bills on Time:Make all your bill payments on time, including credit card bills, loan payments, and utility bills. Late payments can significantly damage your credit score. Set reminders or automate payments to ensure timely payments.

- Reduce Credit Utilization Ratio:Aim to keep your credit utilization ratio below 30%. This means using less than 30% of your available credit. You can achieve this by paying down credit card balances or increasing your credit limits.

- Avoid Applying for New Credit:Every time you apply for new credit, a hard inquiry is placed on your credit report, which can temporarily lower your score. Limit your credit applications to only essential needs.

- Become an Authorized User:If you have a close friend or family member with good credit, ask to be added as an authorized user on their credit card account. This can help you benefit from their positive credit history and improve your score over time.

- Consider a Secured Credit Card:A secured credit card requires a security deposit, which acts as collateral. This can be a good option for building credit if you have limited credit history or a low credit score.

- Monitor Your Credit Score Regularly:Regularly check your credit score to track your progress and identify any potential issues. There are several free or paid credit monitoring services available online.

- Create a Budget:Develop a realistic budget that Artikels your income and expenses. This will help you track your spending and identify areas where you can reduce expenses to pay down debt faster.

- Prioritize Debt Payments:Focus on paying down high-interest debt first, such as credit card debt. This can help you save money on interest charges and improve your credit score.

- Negotiate Lower Interest Rates:Contact your creditors and negotiate lower interest rates on your existing debt. This can significantly reduce your monthly payments and help you pay down debt faster.

- Consider Debt Consolidation:If you have multiple debts, consider consolidating them into a single loan with a lower interest rate. This can simplify your debt management and potentially save you money on interest charges.

- Avoid Opening New Credit Accounts:Resist the temptation to open new credit accounts unless absolutely necessary. Too many credit accounts can negatively impact your credit utilization ratio and potentially lower your credit score.

- Credit Reporting Agencies:The three major credit reporting agencies (Equifax, Experian, and TransUnion) offer free credit reports annually. You can access these reports through AnnualCreditReport.com.

- Credit Monitoring Services:Credit monitoring services provide real-time updates on your credit score and credit report activity. They can alert you to potential fraud or identity theft.

- Credit Counseling Agencies:Credit counseling agencies offer guidance on managing debt, improving credit scores, and developing a budget. They can provide personalized advice and support.

- USDA Loans:USDA loans are designed for borrowers in rural areas. They offer 100% financing, no down payment requirement, and more lenient credit score requirements compared to conventional loans.

- VA Loans:VA loans are available to eligible veterans, active-duty military personnel, and surviving spouses. They offer competitive interest rates, no down payment requirement, and more flexible credit score requirements.

- Conventional Loans with Private Mortgage Insurance (PMI):Conventional loans with PMI can be an option for borrowers with lower credit scores. PMI protects the lender against default, allowing borrowers with lower credit scores to qualify for a mortgage.

- HomeReady and Home Possible Loans:These programs offered by Fannie Mae and Freddie Mac are designed to assist low- and moderate-income borrowers in achieving homeownership. They offer lower down payment requirements and more flexible credit score guidelines.

- Seller Financing:In some cases, sellers may be willing to finance the purchase of their property, offering more flexible terms for borrowers with lower credit scores.

- USDA Loans:USDA loans are specifically for borrowers in rural areas and offer 100% financing with no down payment. However, eligibility is restricted to properties located in eligible rural areas.

- VA Loans:VA loans are available to eligible veterans and offer competitive interest rates and no down payment. However, eligibility is limited to qualifying veterans and active-duty military personnel.

- Conventional Loans with PMI:Conventional loans with PMI can be an option for borrowers with lower credit scores, but they require PMI, which adds to the overall loan cost.

- HomeReady and Home Possible Loans:These programs offer lower down payment requirements and more flexible credit score guidelines, but they may have income or location restrictions.

- Seller Financing:Seller financing can offer more flexible terms, but it’s essential to carefully review the terms and conditions of the agreement.

Practical Tips for Managing Debt and Building Positive Credit History

Resources and Tools for Credit Score Improvement

Several resources and tools are available to help you improve your credit score and manage your finances effectively.

Alternatives to FHA Loans for Borrowers with Low Credit Scores

If your credit score is significantly below the minimum requirements for an FHA loan, or you are seeking alternative options, several other loan programs cater to borrowers with less-than-perfect credit.

Lending groups can offer competitive rates and personalized service. Explore different Lending Group 2024 options to find the right fit for you.

Alternative Loan Options for Borrowers with Low Credit Scores

Comparing and Contrasting Features and Benefits of Alternative Loans

Each alternative loan option has its own unique features, benefits, and eligibility requirements. It’s crucial to carefully compare these options to determine the best fit for your individual circumstances.

Pros and Cons of Each Option and Recommendations Based on Individual Circumstances

The best loan option for you will depend on your individual circumstances, credit score, financial situation, and location. It’s highly recommended to consult with a mortgage loan officer to discuss your options and determine the most suitable loan program for your needs.

Final Thoughts: Credit Score For Fha Loan 2024

Understanding the relationship between your credit score and FHA loan eligibility is essential for navigating the homebuying process. By understanding the factors that influence your score, you can take proactive steps to improve your creditworthiness and increase your chances of securing a favorable loan.

Remember, building a strong credit history is a long-term investment that can pay dividends for years to come, especially when it comes to realizing the dream of homeownership.

Popular Questions

What is the minimum credit score required for an FHA loan in 2024?

While the minimum credit score for an FHA loan is generally 580, lenders may have their own requirements, so it’s essential to check with individual lenders.

Can I get an FHA loan with a credit score below 580?

Yes, but you may need a larger down payment and could face higher interest rates. Some lenders offer FHA loans with a credit score as low as 500, but they often come with stricter terms.

How can I improve my credit score quickly?

Focus on paying your bills on time, reducing debt, and avoiding new credit applications. Consider using credit counseling services for personalized advice and strategies.