Annuity How It Works 2024: Planning for a secure and comfortable retirement is a crucial aspect of financial well-being, and annuities can play a significant role in achieving that goal. An annuity is a financial product that provides a stream of regular payments, either for a fixed period or for the lifetime of the annuitant.

The question of whether an annuity is a better choice than a 401k is often debated. Is Annuity Better Than 401k 2024 compares these two retirement savings options, highlighting their pros and cons to help you make an informed decision.

They offer a unique way to manage your retirement savings and ensure a steady income stream during your golden years.

Dollify has become a popular app for creating avatars and expressing oneself. Dollify 2024: The Future of Dollify and Avatar Creation explores the potential future of Dollify and its role in the evolving world of digital identity and self-expression.

This comprehensive guide will delve into the intricacies of annuities, explaining their various types, how they work, and the advantages and disadvantages they present. We’ll explore the current landscape of the annuity market in 2024, highlighting key trends and innovative products that have emerged.

Google Tasks has become a popular tool for managing projects, and entrepreneurs can benefit from its features. Google Tasks 2024: Google Tasks for Entrepreneurs delves into how this app can streamline workflows and improve productivity for those running their own businesses.

By understanding the fundamentals of annuities, you can make informed decisions about whether they are the right fit for your individual financial needs and retirement aspirations.

Mastering Google Tasks can significantly boost your productivity. Google Tasks 2024: Tips and Tricks for Using Google Tasks offers helpful tips and tricks to get the most out of this popular task management app.

Contents List

What is an Annuity?

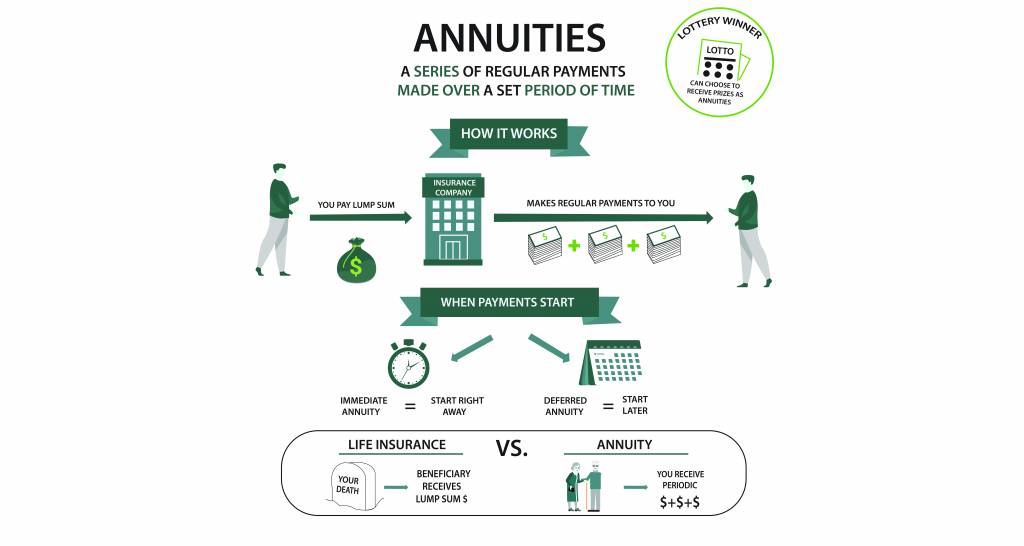

An annuity is a financial product that provides a stream of regular payments for a set period of time. Think of it as a guaranteed income stream that can help you meet your financial goals, like retirement income or long-term care expenses.

Understanding the taxability of annuities is crucial for financial planning. Annuity Is Taxable 2024 provides information on the taxability of annuities, helping you navigate the complexities of this financial product.

It’s like having a financial safety net that provides a consistent income, regardless of market fluctuations.

An annuity is essentially a stream of payments over a set period. An Annuity Is A Stream Of 2024 explains this concept in detail, clarifying how annuities work and their potential benefits for retirement planning.

Types of Annuities

Annuities come in different flavors, each with its own characteristics and benefits. Here’s a rundown of the most common types:

- Fixed Annuities:These offer a fixed interest rate, meaning your payments are predictable and guaranteed. This is ideal for those seeking stability and a secure income stream.

- Variable Annuities:These are linked to the performance of the stock market. Your payments can fluctuate based on market performance, offering potential for higher returns but also higher risk.

- Indexed Annuities:These provide a return linked to a specific market index, like the S&P 500. They offer potential for growth with some downside protection, providing a balance between risk and reward.

Examples of Annuity Uses

Annuities can be tailored to meet various financial goals. Here are some common examples:

- Retirement Income:Annuities can provide a steady income stream during retirement, supplementing other sources like Social Security or savings.

- Income Protection:Annuities can act as a safety net, ensuring a regular income even if you experience unexpected job loss or disability.

- Long-Term Care:Annuities can provide funds to cover the high costs associated with long-term care, ensuring you have financial support if you need assisted living or nursing home care.

How Annuities Work

Purchasing an annuity involves a few key steps, and the payout amount depends on several factors.

Creating a user-friendly Android app is essential for success. How to design a user-friendly Android app in 2024 provides valuable tips and insights on user interface design principles to ensure your app is intuitive and enjoyable to use.

Purchasing an Annuity

To purchase an annuity, you make a lump-sum payment or a series of payments to an insurance company. This payment is called the “premium.” In return, the insurance company agrees to provide you with a stream of regular payments, either immediately or at a later date.

Android WebView 202 is a powerful tool for integrating web content into your apps. Android WebView 202 debugging tools provides insights into the debugging tools available for this technology, helping you troubleshoot and optimize your WebView implementation.

Factors Determining Payout Amount

The amount of your annuity payments is determined by several factors, including:

- Premium Amount:The larger your premium, the larger your payments will be.

- Annuity Type:The type of annuity you choose (fixed, variable, or indexed) will affect the payout amount.

- Interest Rates:For fixed annuities, the interest rate at the time of purchase will influence the payment amount.

- Your Age and Life Expectancy:The younger you are, the longer you’re expected to live, resulting in smaller payments.

Immediate vs. Deferred Annuities

Annuities can be either immediate or deferred, each offering different benefits:

- Immediate Annuities:Payments begin immediately after you purchase the annuity. This is ideal for those seeking immediate income.

- Deferred Annuities:Payments begin at a later date, allowing your money to grow tax-deferred until you start receiving payments. This is suitable for long-term financial goals.

Tax Implications of Annuities

Annuities have specific tax implications. When you receive annuity payments, a portion of the payment is considered a return of your principal (which is tax-free) and the remaining portion is considered interest or earnings (which is taxable as ordinary income).

Tax implications are an important consideration when dealing with annuities. Is Annuity For Life Insurance Taxable 2024 explores whether annuities for life insurance are taxable and the relevant tax rules to keep in mind.

Advantages and Disadvantages of Annuities

Annuities offer potential benefits but also come with drawbacks. Understanding both sides is crucial before making a decision.

For those looking for a free and effective task management app, Google Tasks is a strong contender. Google Tasks 2024: The Best Free Task Management App discusses its strengths and how it can be a valuable tool for managing your daily tasks.

Benefits of Annuities

- Guaranteed Income:Fixed annuities provide a guaranteed income stream, offering financial security and peace of mind.

- Tax Advantages:Annuity payments are typically taxed favorably, with a portion of each payment being tax-free.

- Potential for Growth:Variable and indexed annuities offer the potential for growth, allowing your money to potentially outpace inflation.

- Protection from Market Volatility:Fixed annuities provide protection from market downturns, ensuring a stable income stream.

Disadvantages of Annuities

- Potential for Lower Returns:Fixed annuities typically offer lower returns compared to other investments like stocks or bonds.

- Limited Liquidity:Accessing your annuity funds before the start date can result in surrender charges or penalties.

- Complexity:Annuities can be complex financial products, requiring careful consideration and potentially professional advice.

Risk and Reward Comparison, Annuity How It Works 2024

The risks and rewards associated with different types of annuities vary:

| Annuity Type | Risk | Reward |

|---|---|---|

| Fixed Annuity | Low | Low |

| Variable Annuity | High | High |

| Indexed Annuity | Moderate | Moderate |

Annuity Options in 2024

The annuity market is constantly evolving, with new products and trends emerging. Here’s a look at the landscape in 2024.

Annuity plans can be a complex financial product, and understanding their health is crucial. Annuity Health 2024 examines the factors that contribute to the health of annuity plans and what to consider when making decisions.

Current Trends in the Annuity Market

In 2024, we’re seeing increased demand for annuities due to factors like rising interest rates and concerns about market volatility. This has led to greater competition among insurance companies, offering more innovative and attractive annuity products.

Google Tasks isn’t the only task management app out there. Google Tasks 2024: Comparison to Other Task Management Apps provides a detailed comparison of Google Tasks to its competitors, helping you choose the best option for your needs.

New and Innovative Annuity Products

Recent years have seen the introduction of innovative annuity products, such as:

- Income Riders:These add-ons to variable annuities can provide guaranteed income streams even if the underlying investments perform poorly.

- Long-Term Care Riders:These riders provide financial protection for long-term care expenses, offering peace of mind for future health needs.

- Hybrid Annuities:These combine features of fixed and variable annuities, offering potential for growth with some downside protection.

Annuity Landscape in 2024

In 2024, the annuity market offers a wide range of options to suit different needs and risk tolerances. When choosing an annuity, consider factors like:

- Your Financial Goals:What are you hoping to achieve with an annuity, such as retirement income or long-term care protection?

- Your Risk Tolerance:How comfortable are you with market fluctuations and potential for losses?

- Your Time Horizon:How long do you plan to hold the annuity?

- Your Age and Health:Your age and health status can influence the type of annuity that’s right for you.

Annuity Considerations

Before deciding if an annuity is right for you, carefully consider these factors:

Factors to Consider

- Your Financial Situation:Evaluate your current financial resources, income, and expenses to determine if an annuity fits your overall financial plan.

- Your Investment Goals:What are your long-term investment goals? Do you prioritize guaranteed income, potential for growth, or both?

- Your Risk Tolerance:Understand your comfort level with market volatility and the potential for losses. Choose an annuity that aligns with your risk appetite.

- Your Time Horizon:Consider how long you plan to hold the annuity. If you need access to your funds in the short term, an annuity may not be the best option.

Choosing the Right Annuity

Selecting the right type of annuity depends on several factors:

- Age:Younger individuals with a longer time horizon may benefit from variable or indexed annuities with potential for growth.

- Risk Tolerance:Those seeking stability and guaranteed income should consider fixed annuities, while those with higher risk tolerance may opt for variable or indexed annuities.

- Financial Goals:Choose an annuity that aligns with your specific financial goals, such as retirement income, income protection, or long-term care.

Seeking Professional Advice

Before purchasing an annuity, it’s crucial to seek advice from a qualified financial advisor. They can help you understand the complexities of annuities, assess your individual needs, and recommend the best option for your situation.

Annuity income is often a subject of tax implications. Is Annuity Income Capital Gains 2024 clarifies whether annuity income is considered capital gains and the potential tax consequences.

Last Point: Annuity How It Works 2024

As you navigate the world of annuities, remember that seeking guidance from a qualified financial advisor is essential. They can help you assess your individual circumstances, set realistic financial goals, and choose the annuity that best aligns with your risk tolerance and retirement objectives.

With careful planning and the right approach, annuities can provide a valuable tool for securing a comfortable and financially secure retirement.

FAQ Section

What are the different types of annuities?

Annuity plans have become a popular way to secure retirement income. Annuity Is 2024 provides insights into the current landscape of annuities and their potential benefits.

Annuities come in various types, each with its own characteristics and benefits. Common types include fixed annuities, variable annuities, and indexed annuities. Fixed annuities offer a guaranteed rate of return, while variable annuities provide the potential for growth but also carry investment risk.

Indexed annuities offer a return linked to a specific market index, providing potential for growth with some downside protection.

How do I choose the right annuity for me?

Choosing the right annuity depends on your individual circumstances, financial goals, and risk tolerance. Consider your age, time horizon, and desired level of income security. A financial advisor can help you evaluate your options and determine the most suitable annuity for your needs.

Are there any penalties for withdrawing from an annuity?

Yes, most annuities have surrender charges, which are penalties for withdrawing funds before a certain period. These charges can vary depending on the type of annuity and the length of time you’ve held it. It’s important to understand the surrender charges associated with any annuity you’re considering.

Can I use an annuity to cover long-term care expenses?

Some annuities offer features that can help cover long-term care expenses. These annuities may include a long-term care rider that allows you to withdraw a portion of the annuity’s value to pay for care. However, it’s important to carefully review the terms and conditions of any long-term care rider before purchasing an annuity.

Building an Android app in 2024 requires understanding the specific needs of each industry. Android app development for specific industries in 2024 explores the latest trends and how developers can tailor apps to meet the unique demands of different sectors.