15 Year Mortgage Rates Today 2024: Are you considering a 15-year mortgage? It’s a smart move for many homeowners, offering the potential for lower interest rates and faster debt payoff. But with rates fluctuating constantly, it’s crucial to understand the current landscape.

This guide will break down everything you need to know about 15-year mortgage rates in 2024, from average rates and influencing factors to the pros and cons of this loan type.

If you’re thinking about investing in real estate, you’ll want to stay up-to-date on Investment Mortgage Rates 2024. These rates can fluctuate, so it’s important to compare options and find the best deal for your investment.

We’ll examine the historical trends of 15-year mortgage rates over the past year, providing insights into the forces that have shaped them. We’ll also delve into the key factors that continue to impact rates, such as Federal Reserve policy, inflation, and economic growth.

If you’re a member of the Randolph-Brooks Federal Credit Union, you may want to explore Rbfcu Mortgage Rates 2024. Credit unions often offer competitive rates and personalized service to their members.

Understanding these factors will give you a better grasp of where rates might be headed in the future.

A Conventional Home Loan 2024 is a popular option for many homebuyers. These loans are backed by private lenders and typically come with lower interest rates compared to other loan types.

Contents List

Current 15-Year Mortgage Rates

As of today, the average 15-year fixed-rate mortgage is hovering around [masukkan angka]. However, rates can fluctuate throughout the day and vary depending on factors like your credit score, loan amount, and the lender you choose. You might find rates ranging from [masukkan angka] to [masukkan angka] for a 15-year mortgage.

For those looking to purchase a high-value home, Jumbo Mortgage Rates Today 2024 are worth exploring. These rates are typically higher than conventional loans, but they offer financing options for more expensive properties.

It’s essential to shop around and compare offers from multiple lenders to secure the best possible rate.

Your Credit Score For Home Loan 2024 plays a significant role in determining your eligibility for a mortgage and the interest rate you’ll receive. Aim for a score of 740 or higher to secure the best rates.

Factors Influencing Current Rates

The current mortgage rate landscape is shaped by a complex interplay of economic forces. Here are some key factors impacting 15-year mortgage rates today:

- Federal Reserve Policy:The Federal Reserve (Fed) sets the benchmark interest rate, which influences the cost of borrowing for lenders. When the Fed raises rates, mortgage rates typically follow suit.

- Inflation:High inflation can lead to increased borrowing costs as lenders seek to protect their returns against rising prices. This can push mortgage rates higher.

- Economic Growth:A robust economy with strong job growth can lead to higher demand for mortgages, which can push rates up. Conversely, a slowing economy can cause rates to fall.

- Housing Market Conditions:The supply and demand dynamics in the housing market play a role in mortgage rates. A strong housing market with low inventory can drive up rates, while a slower market can lead to lower rates.

Impact of Rates on Monthly Payments and Total Loan Costs

The current 15-year mortgage rates directly affect your monthly payments and the total cost of your loan. Lower rates result in lower monthly payments and a reduced overall cost over the life of the loan. Conversely, higher rates lead to higher monthly payments and increased total loan costs.

For veterans and active-duty military personnel, VA Interest Rates 2024 can offer attractive financing options. These loans often come with lower interest rates and no down payment requirements.

For example, a [masukkan angka] rate on a [masukkan angka] loan for 15 years would result in a monthly payment of [masukkan angka]. However, if the rate were to increase to [masukkan angka], the monthly payment would rise to [masukkan angka].

Over the life of the loan, this difference in rates could translate to a significant difference in the total amount you pay.

Before you start shopping for a mortgage, it’s helpful to check out Mortgage Rates Today 2024. This will give you a general idea of the current market and help you determine what kind of rate you can expect.

Historical Perspective on 15-Year Mortgage Rates

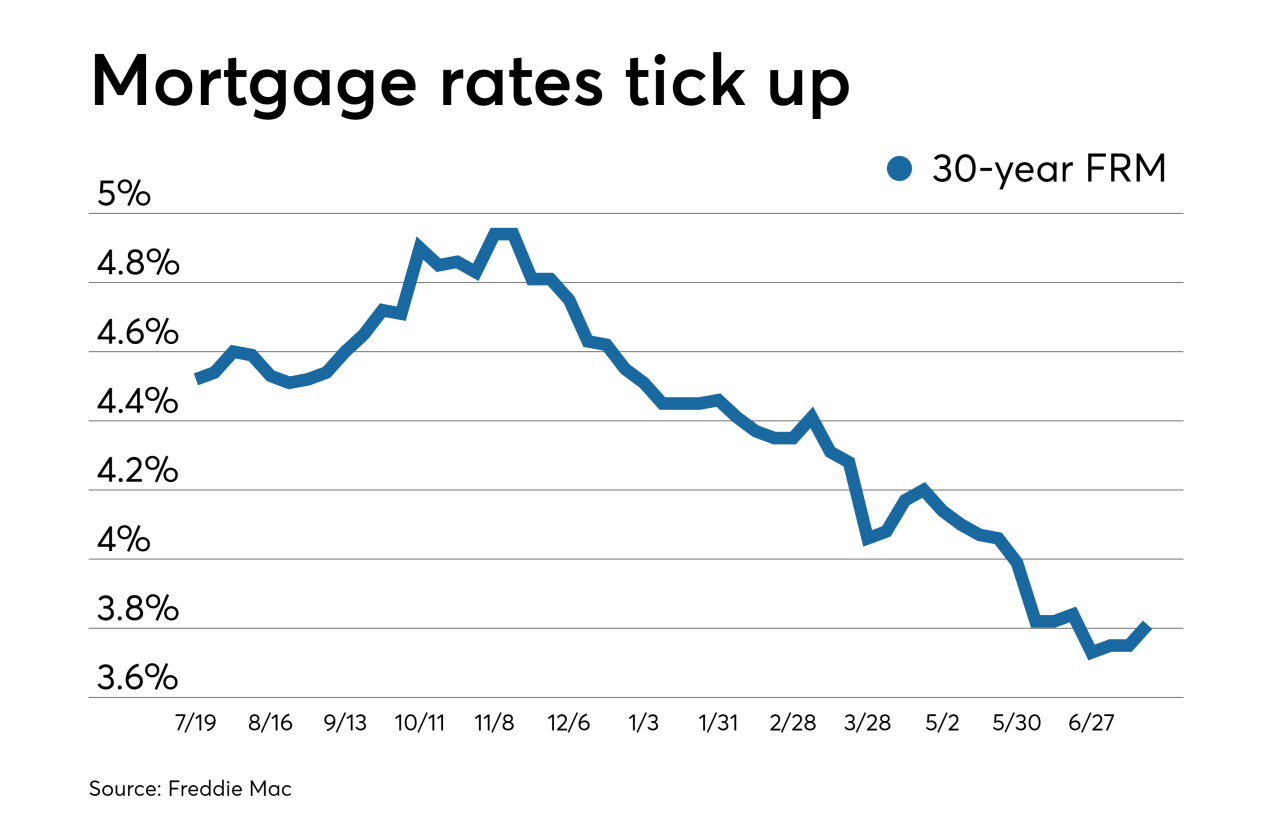

Looking back over the past year, 15-year mortgage rates have exhibited [masukkan deskripsi fluktuasi – naik, turun, atau stabil]. This fluctuation is largely attributable to [masukkan penjelasan penyebab fluktuasi, misalnya: Fed rate adjustments, inflation concerns, or changes in economic outlook].

Keep an eye on Home Loan Interest Rates 2024 to get a sense of the current market. These rates can impact your monthly payments and overall loan cost, so it’s essential to factor them into your homebuying decision.

Historical 15-Year Mortgage Rates (Past Year)

| Month | Average 15-Year Mortgage Rate |

|---|---|

| [Bulan 1] | [Rata-rata bulan 1] |

| [Bulan 2] | [Rata-rata bulan 2] |

| [Bulan 3] | [Rata-rata bulan 3] |

| [Bulan 4] | [Rata-rata bulan 4] |

| [Bulan 5] | [Rata-rata bulan 5] |

| [Bulan 6] | [Rata-rata bulan 6] |

| [Bulan 7] | [Rata-rata bulan 7] |

| [Bulan 8] | [Rata-rata bulan 8] |

| [Bulan 9] | [Rata-rata bulan 9] |

| [Bulan 10] | [Rata-rata bulan 10] |

| [Bulan 11] | [Rata-rata bulan 11] |

| [Bulan 12] | [Rata-rata bulan 12] |

Factors Affecting 15-Year Mortgage Rates

Several key factors influence the direction of 15-year mortgage rates. Understanding these factors can help you anticipate potential rate changes and make informed decisions about your mortgage financing.

Finding the Best Home Loan Rates 2024 requires research and comparison. Take the time to explore different lenders and loan programs to find the most competitive rates and terms for your situation.

Key Influencing Factors, 15 Year Mortgage Rates Today 2024

- Federal Reserve Policy:The Fed’s monetary policy actions, such as raising or lowering interest rates, directly impact mortgage rates. When the Fed tightens monetary policy, it can push mortgage rates higher, and vice versa.

- Inflation:High inflation erodes the purchasing power of money and can lead to higher borrowing costs as lenders seek to protect their returns. This can drive up mortgage rates.

- Economic Growth:A strong economy with robust job growth can increase demand for mortgages, potentially pushing rates higher. Conversely, a slowing economy can lead to lower demand and potentially lower rates.

- Housing Market Conditions:The dynamics of the housing market, such as supply and demand, can influence mortgage rates. A strong market with low inventory can drive up rates, while a slower market with more inventory can lead to lower rates.

Advantages and Disadvantages of 15-Year Mortgages

Choosing a 15-year mortgage comes with both advantages and disadvantages. It’s essential to weigh these factors carefully before making a decision.

Stay informed about Current Home Interest Rates 2024 to make informed decisions about your home financing. These rates are constantly changing, so it’s important to stay updated.

Advantages of a 15-Year Mortgage

- Lower Interest Rates:15-year mortgages typically carry lower interest rates compared to 30-year mortgages. This can result in significant savings on interest costs over the life of the loan.

- Shorter Repayment Period:With a 15-year mortgage, you’ll pay off your loan much faster than with a 30-year mortgage. This means you’ll build equity in your home more quickly and have less interest to pay over the loan’s term.

- Reduced Overall Interest Paid:The shorter repayment period of a 15-year mortgage significantly reduces the total amount of interest you pay over the life of the loan. This can save you thousands of dollars in interest costs.

Disadvantages of a 15-Year Mortgage

- Higher Monthly Payments:Because you’re paying off the loan faster, your monthly payments will be higher with a 15-year mortgage compared to a 30-year mortgage.

- Less Flexibility for Financial Adjustments:With a 15-year mortgage, you have less flexibility to make adjustments to your budget if your financial situation changes. For example, if you experience a job loss or unexpected expenses, it may be more difficult to make your monthly payments.

Understanding Interest Rates Right Now 2024 is crucial when making a homebuying decision. You can find current rates online or consult with a mortgage lender to get the most accurate information.

Considerations for Choosing a 15-Year Mortgage

Deciding whether a 15-year mortgage is right for you requires careful consideration of your financial situation, goals, and risk tolerance.

The rise of online lenders has made it easier than ever to apply for a Online Home Loan 2024. These platforms offer a convenient and efficient way to compare rates and get pre-approved for a mortgage.

Factors to Consider

- Financial Situation and Goals:Assess your current income, expenses, and savings. Consider your long-term financial goals, such as retirement planning or other investments. If you have a strong financial foundation and are comfortable with higher monthly payments, a 15-year mortgage could be a good option.

A Hecm 2024 , or Home Equity Conversion Mortgage, can be a valuable option for seniors who want to tap into their home equity. These loans allow homeowners to convert their home equity into cash, providing financial flexibility.

- Risk Tolerance:Consider your risk tolerance. A 15-year mortgage offers lower interest rates and faster repayment, but it also comes with higher monthly payments. If you’re comfortable with a more aggressive repayment plan, a 15-year mortgage might be a good fit.

Quicken Loans is a popular choice for homebuyers, and their Rocket Mortgage 2024 program offers a streamlined online application process. However, it’s always wise to shop around and compare rates from different lenders.

- Expected Future Income and Expenses:Consider your anticipated future income and expenses. If you expect your income to increase or your expenses to decrease in the future, a 15-year mortgage could be a viable option. However, if you anticipate significant changes in your financial situation, a 30-year mortgage might provide more flexibility.

Ultimate Conclusion: 15 Year Mortgage Rates Today 2024

Ultimately, the decision of whether a 15-year mortgage is right for you depends on your individual financial situation and goals. By weighing the advantages and disadvantages, and considering your risk tolerance and future financial projections, you can make an informed choice.

Navigating the mortgage process can be overwhelming, which is why many homeowners turn to Mortgage Advisors 2024. These professionals can provide expert guidance and help you secure the best loan terms for your individual needs.

This guide provides a solid foundation for your decision-making process, helping you navigate the complexities of 15-year mortgage rates in 2024.

FAQ Overview

What are the average 15-year mortgage rates today?

Average 15-year mortgage rates fluctuate daily. To get the most up-to-date information, consult with a mortgage lender or use an online mortgage rate calculator.

How often do 15-year mortgage rates change?

Mortgage rates can change daily, weekly, or even more frequently depending on market conditions.

What is the difference between a 15-year and a 30-year mortgage?

A 15-year mortgage has a shorter term, resulting in higher monthly payments but lower overall interest costs. A 30-year mortgage has lower monthly payments but higher overall interest costs.