Mortgage Best Buys 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the mortgage market can feel like a daunting task, especially in a year like 2024, where interest rates are fluctuating and loan options are diverse.

If you’re ready to buy a home but don’t have a hefty down payment, explore the Low Down Payment Mortgage 2024 options. These programs often require a smaller upfront investment, making homeownership more accessible.

This guide aims to demystify the process, empowering you to make informed decisions and secure the best possible mortgage for your unique circumstances.

Mr. Cooper is a leading mortgage lender and servicer. Learn more about Mrcooper 2024 offerings, including loan programs, refinancing options, and customer support.

We’ll delve into the current mortgage market landscape, analyzing key factors influencing rates and exploring the various mortgage types available. From fixed-rate to adjustable-rate and government-backed loans, we’ll compare and contrast their advantages and disadvantages, helping you determine which option best suits your financial goals and risk tolerance.

Looking for a stable mortgage option with predictable payments? A 10 Year Fixed Rate Mortgage 2024 could be a great choice. These mortgages offer consistent interest rates for a decade, providing financial security and peace of mind.

We’ll also guide you through the process of finding the best rates, evaluating lenders, and understanding associated fees and costs.

Contents List

Understanding Mortgage Best Buys in 2024

Navigating the mortgage market can be a daunting task, especially in a dynamic environment like 2024. With interest rates fluctuating and lending policies evolving, finding the best mortgage deal requires careful consideration and a strategic approach. This guide will provide insights into the current mortgage landscape, key factors influencing rates, and essential steps to securing the most advantageous mortgage for your individual needs.

Refinancing your existing mortgage can be a smart financial move. Learn about Home Refinance 2024 options to potentially lower your monthly payments, shorten your loan term, or access your home equity.

The Current Mortgage Market Landscape

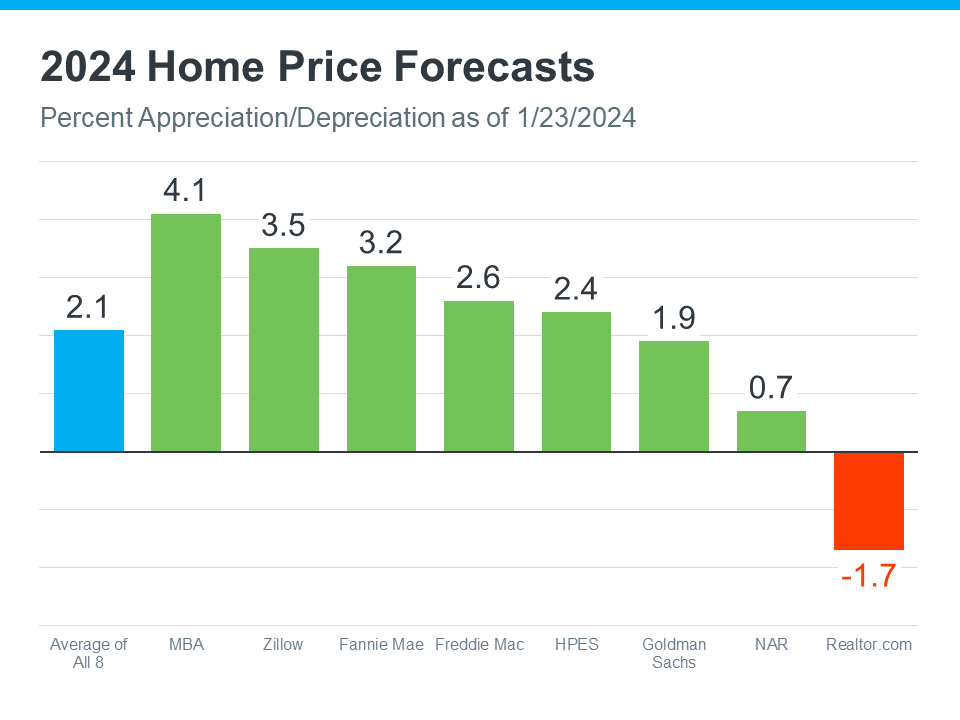

The mortgage market in 2024 is characterized by a delicate balance between rising interest rates and a competitive lending environment. The Federal Reserve’s efforts to curb inflation have led to increased borrowing costs, impacting mortgage rates. However, lenders remain eager to attract borrowers, resulting in a diverse range of loan options and competitive pricing strategies.

Planning for a long-term mortgage? Understanding the 30yr Mortgage Rates 2024 is crucial. These rates can fluctuate, so it’s important to research current trends and compare offers from different lenders.

This dynamic interplay creates both challenges and opportunities for homebuyers and refinancers.

Key Factors Influencing Mortgage Rates

Several factors contribute to the fluctuations in mortgage rates. Understanding these factors can help you make informed decisions about when to lock in a rate and what type of mortgage best suits your financial situation.

PNC Bank offers a variety of financial products, including HELOCs (Home Equity Lines of Credit). Research the Pnc Bank Heloc 2024 options to see if a HELOC is a suitable way to tap into your home’s equity.

- Federal Reserve Monetary Policy:The Federal Reserve’s decisions on interest rate targets directly influence the cost of borrowing, including mortgage rates. When the Fed raises rates to control inflation, mortgage rates generally follow suit.

- Inflation:High inflation erodes the purchasing power of money and can lead to higher interest rates as lenders seek to protect their investments against future price increases.

- Economic Growth:Strong economic growth can lead to increased demand for mortgages, potentially pushing rates higher. Conversely, economic slowdowns may result in lower rates as lenders compete for borrowers.

- Government Policies:Government policies, such as changes in housing regulations or tax incentives, can influence mortgage rates and lending practices.

- Investor Demand:The demand for mortgage-backed securities by investors plays a role in setting rates. When investor demand is high, rates may decrease, and vice versa.

The Importance of Comparing Mortgage Rates

In a competitive mortgage market, it’s crucial to compare rates from multiple lenders to find the best deal. Interest rates can vary significantly between lenders, and even small differences in rates can translate into substantial savings over the life of your loan.

Finding a mortgage with the lowest possible interest rate is a top priority for many homebuyers. Research Lower Mortgage 2024 options to find the best rates and terms available.

Moreover, lenders may offer different fees, loan terms, and closing costs, which further impact the overall cost of borrowing. By comparing offers side-by-side, you can identify the most favorable terms and make an informed decision that aligns with your financial goals.

Types of Mortgages to Consider: Mortgage Best Buys 2024

The mortgage market offers a variety of loan options, each with its own characteristics and suitability for different financial situations. Understanding the different types of mortgages available can help you choose the one that best aligns with your needs and risk tolerance.

Adjustable-rate mortgages (ARMs) can be a good choice for some borrowers. Stay up-to-date on Current Arm Rates 2024 to see if this type of mortgage aligns with your financial goals.

Fixed-Rate Mortgages

Fixed-rate mortgages offer a predictable monthly payment throughout the loan term. The interest rate remains constant, providing stability and peace of mind for borrowers. This type of mortgage is well-suited for those who prefer predictable budgeting and want to avoid the potential for rate increases.

Stay informed about Housing Interest Rates 2024 to make informed decisions about buying, refinancing, or investing in real estate. Rates can fluctuate, so it’s essential to monitor trends and compare offers.

- Advantages:Predictable monthly payments, protection against rising interest rates, long-term financial planning certainty.

- Disadvantages:Potentially higher initial interest rates compared to adjustable-rate mortgages, less flexibility for early repayment.

- Real-World Example:A homeowner who prioritizes financial stability and wants to lock in a predictable monthly payment for the next 30 years would likely opt for a fixed-rate mortgage.

Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages feature an interest rate that can change periodically, typically based on a benchmark index like the London Interbank Offered Rate (LIBOR). ARMs often offer lower initial interest rates compared to fixed-rate mortgages, making them attractive for borrowers who plan to sell or refinance their home before the interest rate adjusts.

The housing market is constantly changing. Keep up-to-date on trends affecting Home Buyers 2024 , such as interest rates, inventory levels, and affordability.

- Advantages:Lower initial interest rates, potential for lower monthly payments in the early years, flexibility for refinancing or selling the property.

- Disadvantages:Uncertainty about future interest rate changes, potential for higher monthly payments if rates rise, risk of negative amortization (where the principal balance increases).

- Real-World Example:A borrower who expects to move within the next five years and prioritizes lower initial payments might consider an ARM. However, they should be aware of the potential for higher payments if rates rise during the loan term.

Government-Backed Loans

Government-backed loans, such as FHA, VA, and USDA loans, are designed to make homeownership more accessible to specific groups of borrowers. These loans typically have more lenient eligibility requirements and offer lower down payments and interest rates compared to conventional loans.

- Advantages:Easier qualification, lower down payment requirements, potentially lower interest rates.

- Disadvantages:May have stricter lending guidelines, mortgage insurance premiums, potential for higher closing costs.

- Real-World Example:A first-time homebuyer with limited savings or a veteran looking to purchase a home may benefit from the more accessible terms offered by government-backed loans.

Finding the Best Mortgage Rates

To secure the most favorable mortgage rate, it’s essential to shop around and compare offers from multiple lenders. This comprehensive approach allows you to identify the best combination of interest rate, loan terms, and fees that aligns with your financial goals.

Choosing the right lender can make all the difference in your mortgage journey. Explore the Mortgage Lenders 2024 landscape to find the best fit for your needs, whether you’re looking for competitive rates, personalized service, or a specific loan type.

Reputable Mortgage Lenders and Their Offerings

The mortgage market is populated by a wide range of lenders, each with its own lending policies, rates, and fees. It’s crucial to choose a reputable lender with a track record of providing excellent customer service and competitive loan terms.

| Lender Name | Interest Rate | Loan Terms | Key Features |

|---|---|---|---|

| Lender A | 3.5% | 30 years | Fixed-rate, low closing costs, online application process |

| Lender B | 3.75% | 15 years | Fixed-rate, no origination fee, flexible payment options |

| Lender C | 3.25% | 30 years | Adjustable-rate, low initial rate, potential for rate increases |

| Lender D | 4.0% | 30 years | FHA-backed, low down payment, mortgage insurance premiums |

Note:The above table is for illustrative purposes only. Actual rates and loan terms may vary based on individual creditworthiness, loan amount, and market conditions.

Factors to Consider Beyond Interest Rates

While interest rates are a crucial factor in evaluating mortgage offers, it’s essential to consider other aspects that can impact the overall cost of borrowing. These factors include:

- Loan Terms:The length of the loan term (e.g., 15 years or 30 years) affects the monthly payment amount and the total interest paid over the life of the loan.

- Fees and Costs:Mortgage lenders charge various fees, including origination fees, appraisal fees, and closing costs. These fees can add up and significantly impact the overall cost of borrowing.

- Loan Features:Some lenders offer additional features, such as flexible payment options, early repayment options, or rate lock guarantees. These features can enhance the value of a mortgage offer and provide greater flexibility for borrowers.

- Customer Service:It’s essential to choose a lender with a reputation for excellent customer service and responsiveness. A lender who is readily available to answer your questions and provide support throughout the mortgage process can make the experience more manageable.

Mortgage Fees and Costs

Obtaining a mortgage involves various fees and costs that borrowers need to factor into their financial planning. Understanding these fees and their impact on the overall cost of borrowing is essential for making informed decisions.

Common Mortgage Fees and Costs, Mortgage Best Buys 2024

Here are some of the common fees and costs associated with obtaining a mortgage:

- Origination Fee:A fee charged by the lender for processing and underwriting the loan. It is typically a percentage of the loan amount.

- Appraisal Fee:A fee paid to a professional appraiser to assess the value of the property. This fee helps ensure that the loan amount is appropriate for the property’s worth.

- Closing Costs:A collection of fees paid at the closing of the loan, including title insurance, recording fees, and attorney fees.

- Mortgage Insurance:A premium paid by borrowers who make a down payment of less than 20%. This insurance protects the lender against losses if the borrower defaults on the loan.

- Prepayment Penalty:A fee charged by some lenders if the borrower repays the loan early. This penalty can discourage early repayment and protect the lender’s revenue stream.

Impact of Fees on the Overall Cost of Borrowing

Mortgage fees and costs can significantly impact the overall cost of borrowing. These fees add to the principal loan amount, increasing the total amount repaid over the life of the loan. It’s crucial to factor in these costs when comparing mortgage offers and to negotiate with lenders to minimize fees whenever possible.

If you’re a veteran or active-duty military member, you may be eligible for a VA loan. Check out the Va Home Loan Interest Rates 2024 to see what financing options are available to you.

Tips for Minimizing Mortgage Fees and Closing Costs

Here are some tips for minimizing mortgage fees and closing costs:

- Shop Around for Rates and Fees:Compare offers from multiple lenders to identify the lowest fees and most favorable terms.

- Negotiate Fees:Don’t hesitate to negotiate fees with lenders. They may be willing to waive or reduce certain fees to secure your business.

- Ask for Credit for Closing Costs:Some lenders may offer to credit closing costs towards the purchase price, reducing the amount of cash required at closing.

- Explore Loan Programs with Lower Fees:Certain loan programs, such as FHA loans, may have lower closing costs compared to conventional loans.

- Be Aware of Hidden Fees:Carefully review all loan documents and disclosures to ensure that there are no hidden fees or unexpected costs.

Mortgage Pre-Approval and Application Process

Getting pre-approved for a mortgage is a crucial step in the homebuying process. It demonstrates to sellers that you are a serious buyer with the financial capacity to purchase a home. The pre-approval process also provides you with a clear understanding of your borrowing power and helps you streamline the application process.

Significance of Pre-Approval

Here are some key benefits of getting pre-approved for a mortgage:

- Stronger Negotiating Position:Pre-approval shows sellers that you are a qualified buyer, increasing your negotiating power in a competitive market.

- Clear Understanding of Borrowing Power:Pre-approval helps you determine the price range of homes you can afford, preventing you from overextending yourself financially.

- Faster Closing Process:Pre-approval streamlines the application process, allowing for a quicker and smoother closing experience.

- Rate Lock Option:Some lenders offer rate lock options with pre-approval, allowing you to secure a specific interest rate for a certain period.

Steps Involved in the Mortgage Application Process

The mortgage application process typically involves the following steps:

- Pre-Approval:Provide the lender with basic financial information to receive a preliminary approval based on your credit score, income, and debt-to-income ratio.

- Loan Application:Complete a detailed loan application, providing extensive financial documentation, including income verification, tax returns, and asset statements.

- Property Appraisal:A professional appraiser will assess the value of the property to ensure it meets the loan amount.

- Underwriting:The lender will review your application and supporting documentation to assess your creditworthiness and determine if you qualify for the loan.

- Loan Closing:Once the loan is approved, you will sign the loan documents and finalize the transaction. The lender will disburse the loan funds, and you will receive the keys to your new home.

Tips for Preparing for a Smooth and Efficient Application Process

Here are some tips for preparing for a smooth and efficient mortgage application process:

- Gather Financial Documents:Organize all relevant financial documents, including pay stubs, bank statements, tax returns, and credit reports.

- Check Your Credit Score:Review your credit score and address any errors or negative items that may affect your eligibility for a loan.

- Shop Around for Rates and Fees:Compare offers from multiple lenders to find the best combination of interest rate, loan terms, and fees.

- Communicate with Your Lender:Keep your lender informed of any changes to your financial situation or the property purchase.

- Ask Questions:Don’t hesitate to ask questions and clarify any concerns you have about the mortgage application process.

Managing Your Mortgage

Once you have secured a mortgage, it’s essential to manage your loan responsibly to ensure on-time payments and minimize the overall cost of borrowing. This section provides insights into strategies for effective mortgage management, including making on-time payments, exploring refinancing options, and avoiding common pitfalls.

In addition to traditional mortgages, consider exploring Private Mortgage 2024 options. These loans may offer more flexibility but often have higher interest rates.

Strategies for Making On-Time Mortgage Payments

Making on-time mortgage payments is crucial for maintaining a good credit score and avoiding late fees and penalties. Here are some strategies for ensuring timely payments:

- Set Up Automatic Payments:Automate your mortgage payments to ensure that they are made on time each month. This eliminates the risk of forgetting or missing a payment.

- Budget for Your Mortgage Payment:Include your mortgage payment in your monthly budget and prioritize it as an essential expense.

- Set Reminders:Set reminders for your mortgage payment due date to avoid missing a payment.

- Communicate with Your Lender:If you anticipate difficulty making a payment, contact your lender as soon as possible to discuss potential solutions.

Refinancing Options and Their Potential Benefits

Refinancing your mortgage involves replacing your existing loan with a new one, often with a lower interest rate or different loan terms. Refinancing can be a valuable tool for reducing your monthly payments, shortening your loan term, or changing the type of mortgage you have.

Loancare is a well-known mortgage servicer. Learn about Loancare Mortgage 2024 services, including loan management, payment processing, and customer support.

However, it’s essential to carefully evaluate the costs and benefits of refinancing before making a decision.

- Lower Interest Rates:Refinancing to a lower interest rate can significantly reduce your monthly payments and save you money over the life of the loan.

- Shorter Loan Term:Refinancing to a shorter loan term can help you pay off your mortgage faster and reduce the total amount of interest you pay.

- Change in Loan Type:Refinancing can allow you to switch from a fixed-rate mortgage to an adjustable-rate mortgage or vice versa, depending on your current needs and market conditions.

Common Mortgage Pitfalls to Avoid

Here are some common mortgage pitfalls to avoid:

- Ignoring Late Payments:Late payments can damage your credit score and result in penalties from your lender. It’s crucial to prioritize on-time payments.

- Overextending Yourself:Don’t borrow more than you can comfortably afford. Overextending yourself financially can lead to financial strain and difficulty making payments.

- Not Shopping Around for Rates and Fees:Failing to compare offers from multiple lenders can result in paying higher interest rates or fees.

- Not Understanding Loan Terms:Carefully review all loan documents and disclosures to ensure you understand the terms and conditions of your mortgage.

- Ignoring Refinancing Opportunities:Refinancing can be a valuable tool for reducing your monthly payments or shortening your loan term. Stay informed about current interest rates and consider refinancing if it benefits your financial situation.

Conclusive Thoughts

Armed with this knowledge, you’ll be equipped to confidently navigate the mortgage application process, from pre-approval to securing your loan. We’ll provide tips for a smooth and efficient application, along with strategies for managing your mortgage effectively. This guide is your comprehensive resource for making smart choices and securing the mortgage that best fits your needs, ultimately paving the way for a brighter financial future.

Query Resolution

What is the difference between a fixed-rate and an adjustable-rate mortgage?

A fixed-rate mortgage offers a consistent interest rate throughout the loan term, providing predictable monthly payments. An adjustable-rate mortgage, on the other hand, has an initial fixed rate that can adjust periodically based on market conditions, potentially leading to fluctuating monthly payments.

How can I get pre-approved for a mortgage?

To get pre-approved, contact a mortgage lender and provide them with your financial information, including income, debt, and credit history. The lender will assess your financial situation and provide you with a pre-approval letter indicating the maximum loan amount you qualify for.

What are some common mortgage fees?

Common mortgage fees include origination fees, appraisal fees, title insurance, and closing costs. These fees can vary depending on the lender and loan type.

Dreaming of owning a home without a down payment? Learn about the Zero Down Mortgage 2024 options available. While these programs have specific eligibility requirements, they can be a great way to step into homeownership without upfront costs.

What is the best time to refinance my mortgage?

The best time to refinance is when interest rates are significantly lower than your current mortgage rate and when you have sufficient equity in your home. Consider consulting with a financial advisor to determine if refinancing is right for you.