Phhmortgage 2024 arrives amidst a dynamic housing landscape, where interest rates, inflation, and technological advancements intertwine to shape the mortgage experience. This year promises a complex yet exciting journey for both homebuyers and homeowners, demanding careful planning and informed decisions.

Choosing the right mortgage company can significantly impact your homebuying experience. Explore the Mortgage Companies 2024 landscape to find the best fit for your needs.

Understanding the current market trends, from rising interest rates to evolving mortgage products, is crucial for navigating the path to homeownership. Whether you’re a first-time buyer, a seasoned investor, or a homeowner seeking refinancing opportunities, Phhmortgage 2024 provides insights and strategies to help you achieve your financial goals.

A Variable Rate Mortgage 2024 can offer lower initial payments, but the interest rate can fluctuate over time. It’s important to understand the potential risks and benefits before making a decision.

Contents List

Mortgage Market Trends in 2024

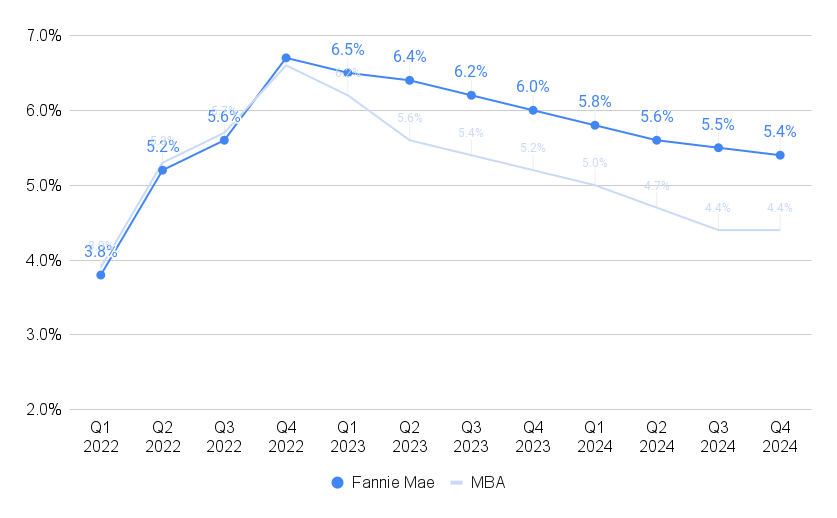

The mortgage market in 2024 is expected to be influenced by a complex interplay of factors, including interest rate fluctuations, inflation, and economic uncertainty. Understanding these trends is crucial for both homebuyers and sellers navigating the market.

Navy Federal is a great option for military members and their families. Check out their Navy Federal Va Loan Rates 2024 for competitive rates and flexible terms.

Key Factors Shaping the Mortgage Market

- Rising Interest Rates:The Federal Reserve’s efforts to combat inflation have resulted in higher interest rates, making borrowing more expensive. This trend is likely to continue in 2024, impacting affordability for homebuyers and potentially slowing down the housing market.

- Inflation and Economic Uncertainty:Persistent inflation and concerns about a potential recession are creating economic uncertainty, making it difficult to predict future housing market trends. This uncertainty can influence mortgage decisions as buyers and sellers grapple with the potential impact on their finances.

- Mortgage Product Offerings and Loan Terms:In response to changing market conditions, lenders may adjust mortgage product offerings and loan terms. This could include changes in down payment requirements, loan-to-value ratios, and interest rate structures.

Impact of Rising Interest Rates

Rising interest rates have a significant impact on both homebuyers and sellers. For homebuyers, higher interest rates translate into higher monthly mortgage payments, reducing affordability. Sellers, on the other hand, may face reduced demand as higher interest rates discourage potential buyers.

Looking to expand your real estate portfolio? Understanding the Investment Property Mortgage Rates 2024 is key to making informed decisions about your next purchase.

The impact of rising interest rates will depend on individual circumstances and market conditions.

Role of Inflation and Economic Uncertainty, Phhmortgage 2024

Inflation and economic uncertainty can influence mortgage decisions in several ways. Rising inflation erodes purchasing power, making it more expensive to buy a home. Economic uncertainty can lead to job losses and income instability, making it difficult to qualify for a mortgage or manage mortgage payments.

Anticipated Changes in Mortgage Products and Loan Terms

Lenders may adjust mortgage product offerings and loan terms in response to market conditions. This could include:

- Higher Down Payment Requirements:Lenders may require larger down payments to mitigate risk in a volatile market.

- More Stringent Credit Requirements:Lenders may tighten credit requirements to ensure borrowers can afford their mortgage payments.

- Increased Use of Adjustable-Rate Mortgages (ARMs):ARMs may become more attractive to borrowers seeking lower initial interest rates, but they carry the risk of higher rates in the future.

Homebuyer Considerations in 2024

Navigating the housing market in 2024 requires careful planning and consideration. Prospective homebuyers need to be aware of the factors that will impact affordability and purchasing power, and they should develop strategies for navigating a competitive market.

If you’re looking for a shorter-term mortgage, 20 Year Mortgage Rates 2024 can be a great option. While you’ll pay more each month, you’ll pay less overall interest and own your home sooner.

Essential Considerations for Homebuyers

- Budget and Affordability:Determine your budget based on your income, expenses, and credit score. Consider the impact of rising interest rates on your monthly mortgage payments.

- Loan Options:Explore different mortgage products, including fixed-rate and adjustable-rate mortgages, to find the best option for your financial situation.

- Market Conditions:Research local housing market trends, including inventory levels, average home prices, and time on market.

- Home Inspection:Ensure a thorough home inspection to identify any potential issues that could require costly repairs.

- Closing Costs:Factor in closing costs, which can include appraisal fees, title insurance, and legal fees.

Factors Impacting Affordability and Purchasing Power

- Interest Rates:Rising interest rates increase the cost of borrowing, reducing affordability for homebuyers.

- Inflation:Inflation erodes purchasing power, making it more expensive to buy a home.

- Inventory Levels:Limited inventory can lead to higher home prices and more competition among buyers.

- Economic Conditions:Economic uncertainty can impact job security and income, making it challenging to qualify for a mortgage or manage mortgage payments.

- Pre-Approval:Get pre-approved for a mortgage to demonstrate your financial readiness to sellers.

- Be Flexible:Consider expanding your search area or adjusting your criteria to increase your options.

- Be Prepared to Act Quickly:Move quickly on properties that meet your needs, as competition can be fierce.

- Work with a Real Estate Agent:An experienced real estate agent can provide valuable insights and guidance throughout the homebuying process.

Securing a Mortgage and Optimizing Loan Terms

- Shop Around:Compare mortgage rates and loan terms from multiple lenders to find the best deal.

- Improve Your Credit Score:A higher credit score can qualify you for lower interest rates.

- Negotiate Loan Terms:Don’t hesitate to negotiate with lenders to try to secure more favorable terms.

- Consider Points:Paying mortgage points upfront can lower your interest rate and save you money over the life of the loan.

Impact of Technology on the Mortgage Process: Phhmortgage 2024

Technology has revolutionized the mortgage industry, streamlining the application process and introducing new tools and solutions. Digital mortgage platforms and online tools have made it easier for borrowers to apply for a mortgage, track their progress, and manage their loans.

Chase is a well-known name in the financial world. Their Chase Home Mortgage 2024 options offer a variety of choices, from conventional loans to FHA and VA loans.

Digital Mortgage Platforms and Online Tools

- Online Applications:Digital mortgage platforms allow borrowers to apply for a mortgage online, eliminating the need for paper forms and in-person meetings.

- Real-Time Status Updates:Borrowers can track the progress of their application online, receiving real-time updates on the status of their loan.

- Digital Document Management:Digital mortgage platforms facilitate secure document management, allowing borrowers to upload and share documents electronically.

- Online Loan Management:Borrowers can manage their mortgage online, making payments, reviewing statements, and accessing loan information.

Artificial Intelligence (AI) in Mortgage Lending

AI is transforming mortgage lending by automating tasks, improving efficiency, and enhancing the customer experience. AI-powered tools can:

- Automate Underwriting:AI can automate the underwriting process, making it faster and more efficient.

- Personalize Loan Offers:AI can analyze borrower data to provide personalized loan offers based on their individual needs and circumstances.

- Improve Fraud Detection:AI can help detect fraudulent activity, protecting lenders and borrowers from financial loss.

Emerging Technologies in the Mortgage Industry

- Blockchain Technology:Blockchain technology can streamline the mortgage process by creating a secure and transparent record of transactions.

- Virtual Reality (VR) and Augmented Reality (AR):VR and AR technologies can provide immersive experiences for borrowers, allowing them to virtually tour properties or visualize renovations.

- Biometric Authentication:Biometric authentication can enhance security by verifying borrower identity using fingerprint or facial recognition technology.

Traditional Mortgage Processes vs. Modern Digital Solutions

| Process | Traditional Mortgage | Modern Digital Solution |

|---|---|---|

| Application | Paper forms, in-person meetings | Online application, electronic document submission |

| Underwriting | Manual review of documents | Automated underwriting using AI |

| Loan Closing | Physical document signing, in-person closing | Electronic document signing, virtual closing |

| Loan Management | Paper statements, phone calls | Online account access, mobile app |

Mortgage Rates and Refinancing Options

Mortgage interest rates are influenced by various factors, including the Federal Reserve’s monetary policy, inflation, and economic conditions. Understanding these factors is essential for borrowers considering a mortgage or refinancing their existing loan.

Ready to start your homeownership journey? Finding the right lender can make all the difference. Use a tool like Lenders Near Me 2024 to discover reputable lenders in your area.

Factors Influencing Mortgage Interest Rates

- Federal Reserve Policy:The Federal Reserve’s actions to control inflation, such as raising interest rates, can impact mortgage rates.

- Inflation:High inflation can lead to higher interest rates as lenders seek to protect themselves from the erosion of their returns.

- Economic Growth:Strong economic growth can lead to lower interest rates as investors are more willing to lend money.

- Demand for Loans:High demand for loans can drive up interest rates as lenders compete for borrowers.

Fixed-Rate vs. Adjustable-Rate Mortgages

- Fixed-Rate Mortgages:Fixed-rate mortgages offer a predictable interest rate that remains the same for the life of the loan. This provides stability in monthly payments but may result in a higher initial interest rate compared to ARMs.

- Adjustable-Rate Mortgages (ARMs):ARMs offer an initial interest rate that is typically lower than fixed-rate mortgages, but the rate can adjust periodically based on market conditions. This can lead to lower initial payments but carries the risk of higher rates in the future.

Credit unions are known for their member-focused approach. See if Credit Union Mortgage Rates 2024 align with your financial goals and offer competitive options.

Refinancing Landscape and Opportunities

Refinancing can be an option for homeowners seeking to lower their interest rate, shorten their loan term, or change their mortgage type. However, refinancing costs and interest rate fluctuations should be carefully considered.

Wells Fargo is another major player in the mortgage market. Their Wellsfargo Mortgage Rates 2024 are worth exploring as part of your research.

Understanding Mortgage Terms and Calculating Monthly Payments

- Principal:The original amount borrowed.

- Interest Rate:The percentage charged on the loan.

- Loan Term:The length of time over which the loan is repaid.

- Monthly Payment:The amount paid each month to cover principal and interest.

Monthly Payment Calculation:M = P [ i(1 + i)^n ] / [ (1 + i)^n

Bank of America is a well-known name in the mortgage industry. Their Bank Of America 0 Down Mortgage 2024 options can make homeownership more accessible to certain buyers.

1 ]

Where: M = Monthly Payment P = Principal i = Interest Rate (expressed as a decimal) n = Number of Payments

Buying a home for $300,000? Get an idea of your potential monthly payments by checking out the Mortgage On 300k 2024 rates and see what fits your budget.

Homeownership in 2024

Homeownership in 2024 presents both challenges and opportunities. Understanding the factors that will influence the housing market’s long-term outlook is crucial for homeowners making financial decisions.

Locking in a stable rate is a priority for many homeowners. The 30 Year Fixed Mortgage Rates 2024 offer predictability and protection from fluctuating interest rates, making them a popular choice.

Challenges and Opportunities for Homeowners

- Rising Interest Rates:Higher interest rates can make it more difficult to refinance or take out a home equity loan.

- Inflation:Inflation can erode the value of home equity, making it harder to benefit from appreciation.

- Economic Uncertainty:Economic uncertainty can impact job security and income, making it challenging to manage mortgage payments.

- Home Value Appreciation:Home value appreciation can provide a hedge against inflation and create wealth over time.

- Tax Benefits:Homeownership offers tax benefits, such as deductions for mortgage interest and property taxes.

Strategies for Managing Mortgage Payments and Maximizing Home Equity

- Budgeting and Financial Planning:Create a budget to track income and expenses and ensure you can afford your mortgage payments.

- Extra Payments:Make extra payments on your mortgage to reduce the principal balance and save on interest over time.

- Home Improvements:Invest in home improvements that increase value and enhance your living experience.

- Home Equity Loans:Consider a home equity loan or line of credit for major expenses or investments.

Key Factors Influencing the Housing Market’s Long-Term Outlook

- Economic Growth:Strong economic growth can drive housing demand and appreciation.

- Interest Rates:Lower interest rates tend to stimulate housing demand, while higher rates can dampen it.

- Demographics:Population growth and changing demographics can influence housing demand in specific areas.

- Government Policies:Government policies, such as tax incentives for homeownership, can impact the housing market.

Expected Trends in Home Values and Affordability

[Gambar ilustrasi menunjukkan tren nilai rumah dan keterjangkauan di tahun 2024]

Final Summary

As we conclude our exploration of Phhmortgage 2024, it’s clear that the housing market remains a dynamic and ever-evolving arena. By embracing the latest technological advancements, understanding the factors influencing mortgage rates, and carefully considering personal financial goals, individuals can navigate this complex landscape and make informed decisions that align with their aspirations.

Knowing your House Payment 2024 is a crucial step in planning your home purchase. It’s important to factor in not only the principal and interest but also property taxes, homeowners insurance, and potential HOA fees.

Frequently Asked Questions

What are the biggest challenges facing homebuyers in 2024?

Looking to tap into your home’s equity? A Cash Out Refi 2024 could be the answer. It allows you to borrow against your home’s value, giving you access to funds for various needs, like home improvements, debt consolidation, or even investment opportunities.

Rising interest rates and limited inventory are two of the most significant challenges facing homebuyers in 2024. These factors can make it difficult to qualify for a mortgage and find a suitable property within budget.

Thinking about purchasing a home? Understanding the current 30yr Fixed Mortgage Rate 2024 is crucial. This rate determines your monthly payments and overall cost of borrowing, so it’s essential to stay informed about market trends.

How can homeowners benefit from refinancing in 2024?

Homeowners can benefit from refinancing in 2024 by lowering their monthly payments, shortening their loan term, or switching from an adjustable-rate mortgage to a fixed-rate mortgage.

What are the key factors to consider when choosing a mortgage?

When choosing a mortgage, it’s important to consider factors such as interest rate, loan term, down payment requirements, and closing costs.

What are the latest technological advancements in the mortgage industry?

The mortgage industry is embracing technological advancements such as digital mortgage platforms, online tools, and artificial intelligence (AI) to streamline the application process and improve efficiency.