First National Mortgage Rates are a key factor for anyone seeking a home loan. This comprehensive guide explores the current rates, loan options, and tools offered by First National Mortgage, providing you with the information you need to make informed decisions about your home financing.

Looking for a loan with a low interest rate? Low APR loans can help you save money over the life of your loan. These loans typically have lower interest rates than traditional loans, so you’ll pay less in interest charges.

From understanding the company’s history and mission to navigating their mortgage calculator and exploring customer reviews, we delve into the intricacies of securing a mortgage with First National Mortgage. We also examine current mortgage rate trends and predictions, giving you insights into the market dynamics that influence your borrowing costs.

Thinking about a 20-year mortgage? 20-year mortgage rates are currently very competitive. You can save money on interest charges by choosing a shorter loan term, and you’ll also build equity in your home faster.

Contents List

First National Mortgage Overview

First National Mortgage is a well-established mortgage lender with a long history of providing home financing solutions. Founded in [Tahun Berdiri], the company has grown into a leading provider of mortgage services across the United States.

Need a loan to buy a car? Car credit can help you finance your next vehicle. You can choose from a variety of loan terms and interest rates to find the best option for your needs.

History of First National Mortgage

First National Mortgage has been a trusted name in the mortgage industry for over [Jumlah] years. The company’s roots can be traced back to [Lokasi] where it began as a small, local lender. Through years of dedication to customer service and innovative lending practices, First National Mortgage has expanded its reach and established itself as a national player.

A revolving line of credit is a type of loan that allows you to borrow money as needed, up to a certain limit. Revolving lines of credit are often used for unexpected expenses, such as medical bills or home repairs.

You’ll only pay interest on the amount you borrow, and you can repay the loan over time.

Services Offered by First National Mortgage

First National Mortgage offers a wide range of mortgage services to meet the diverse needs of its customers. These services include:

- Conventional Mortgages

- FHA Loans

- VA Loans

- USDA Loans

- Refinance Mortgages

- Home Equity Loans

- Mortgage Insurance

- Closing Services

Mission and Values of First National Mortgage

First National Mortgage’s mission is to provide exceptional mortgage solutions that empower customers to achieve their homeownership dreams. The company’s core values include:

- Customer Focus

- Integrity

- Innovation

- Teamwork

- Community Involvement

Current Mortgage Rates: First National Mortgage Rates

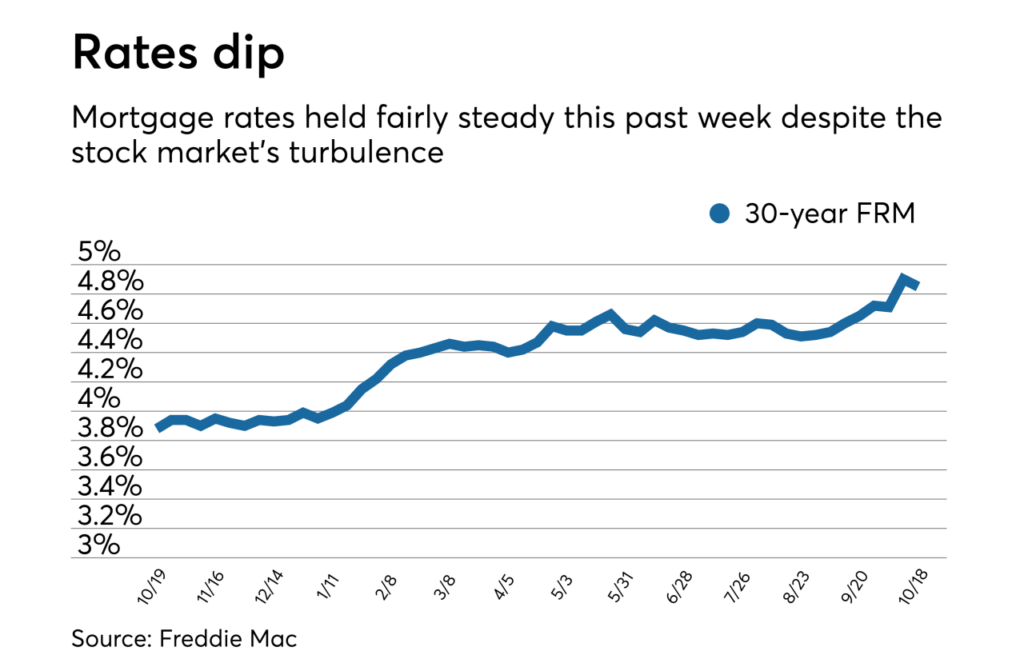

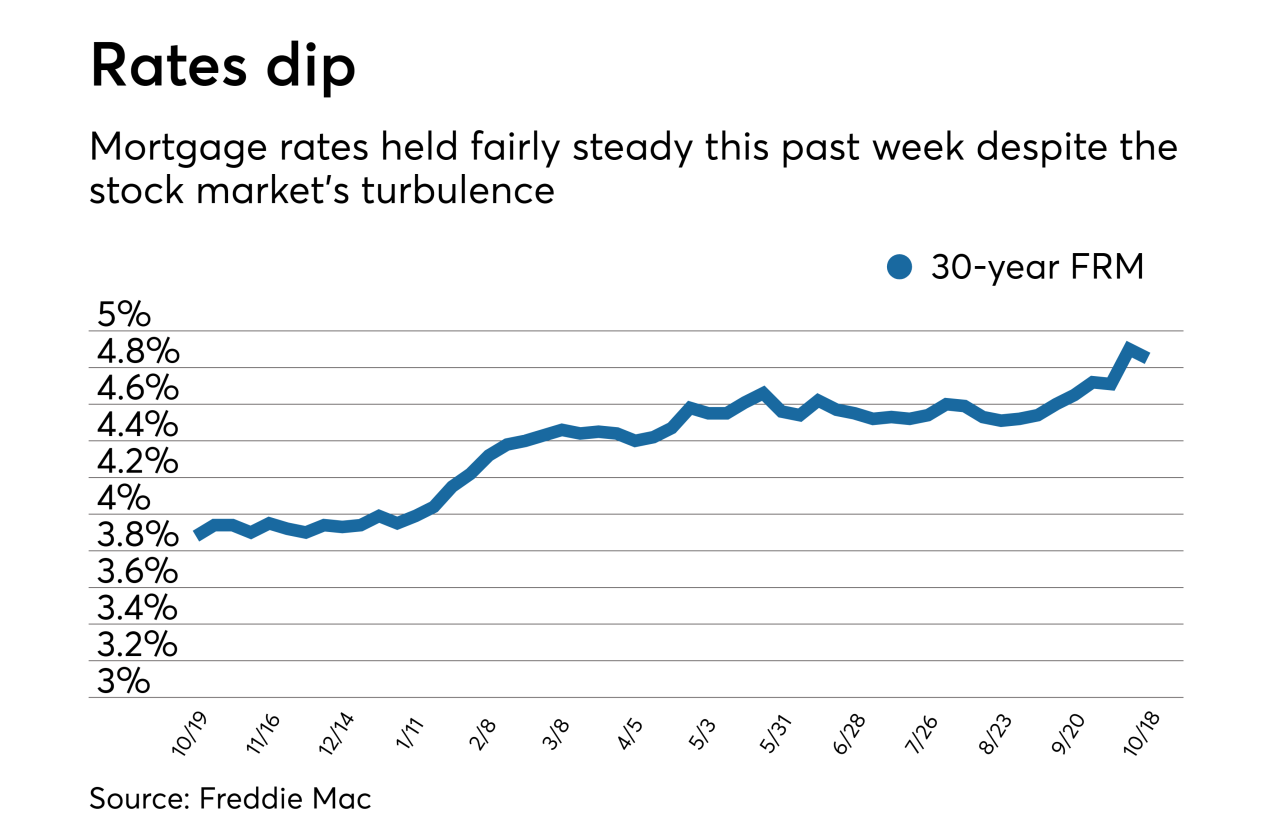

Mortgage rates are constantly fluctuating, influenced by various economic factors. First National Mortgage offers competitive rates that are updated regularly to reflect market conditions.

Discover offers a variety of loan products, including personal loans, home equity loans, and student loans. Discover Loans are known for their competitive rates and flexible terms. You can use a Discover loan for a variety of purposes, such as debt consolidation, home improvement, or medical expenses.

Average Mortgage Rates Offered by First National Mortgage, First National Mortgage Rates

As of [Tanggal], the average mortgage rates offered by First National Mortgage are:

| Loan Type | Interest Rate |

|---|---|

| 30-Year Fixed-Rate Mortgage | [Persentase] |

| 15-Year Fixed-Rate Mortgage | [Persentase] |

| Adjustable-Rate Mortgage (ARM) | [Persentase] |

Comparison with Other Major Mortgage Lenders

First National Mortgage’s rates are generally competitive with those offered by other major mortgage lenders. It’s important to compare rates from multiple lenders to ensure you’re getting the best deal.

Looking for a car loan? Chase Auto Loan offers a variety of loan options to help you finance your next vehicle. You can choose from a variety of loan terms and interest rates to find the best option for your needs.

Factors Influencing Current Mortgage Rates

Several factors influence current mortgage rates, including:

- Federal Reserve interest rate policy

- Inflation

- Economic growth

- Housing market conditions

- Investor demand for mortgage-backed securities

Loan Products and Options

First National Mortgage offers a variety of mortgage loan products to suit different borrower profiles and financial situations.

Types of Mortgage Loan Products

Here’s a table outlining the key features of First National Mortgage’s loan products:

| Loan Type | Interest Rate | Terms | Eligibility Requirements |

|---|---|---|---|

| Conventional Mortgages | Fixed or adjustable | 15, 20, or 30 years | Good credit score, sufficient income, and a down payment of at least 3% |

| FHA Loans | Fixed or adjustable | 15, 20, or 30 years | Lower credit score requirements, smaller down payment (as low as 3.5%), and income limits |

| VA Loans | Fixed or adjustable | 15, 20, or 30 years | For eligible veterans, active-duty military personnel, and surviving spouses |

| USDA Loans | Fixed | 30 years | For borrowers purchasing a home in eligible rural areas |

| Refinance Mortgages | Fixed or adjustable | 15, 20, or 30 years | Existing homeowner seeking to lower their interest rate, shorten their loan term, or access cash equity |

| Home Equity Loans | Fixed or adjustable | 5 to 30 years | Homeowners with equity in their homes seeking to borrow against that equity |

Pros and Cons of Each Loan Product

Each loan product has its own advantages and disadvantages, which should be carefully considered before making a decision.

Penfed offers a variety of mortgage products, including conventional, FHA, and VA loans. Penfed mortgage rates are competitive, and the lender offers a variety of programs to help borrowers find the right loan for their needs.

- Conventional Mortgages:Pros: Typically offer lower interest rates than government-backed loans. Cons: Higher credit score and down payment requirements.

- FHA Loans:Pros: More lenient credit score and down payment requirements, making homeownership accessible to a wider range of borrowers. Cons: Higher mortgage insurance premiums.

A construction loan is a short-term loan that is used to finance the construction of a new home. Construction loans typically have higher interest rates than traditional mortgages, but they can be a good option for borrowers who are building their dream home.

- VA Loans:Pros: No down payment requirement, lower interest rates, and no mortgage insurance. Cons: Only available to eligible veterans, active-duty military personnel, and surviving spouses.

- USDA Loans:Pros: Lower interest rates, no down payment requirement, and eligibility for rural properties. Cons: Limited to eligible rural areas.

- Refinance Mortgages:Pros: Can lower monthly payments, shorten loan term, or access cash equity. Cons: Closing costs and potential fees.

- Home Equity Loans:Pros: Can provide access to cash for home improvements, debt consolidation, or other purposes. Cons: Higher interest rates than other types of loans.

First National Mortgage is a leading provider of mortgage loans. First National Mortgage offers a variety of loan products, including conventional, FHA, and VA loans. The lender is known for its competitive rates and excellent customer service.

Mortgage Calculator and Tools

First National Mortgage provides a range of online tools to help customers navigate the mortgage process.

A Chase HELOC is a home equity line of credit that allows you to borrow against the equity in your home. Chase HELOCs can be used for a variety of purposes, such as home improvement, debt consolidation, or major purchases.

You can access your credit line as needed, and you’ll only pay interest on the amount you borrow.

Mortgage Calculator

The First National Mortgage calculator is a user-friendly tool that allows you to estimate your monthly mortgage payments based on loan amount, interest rate, and loan term. You can adjust these variables to see how they impact your payments.

Hard money loans are short-term loans that are secured by real estate. Hard money loans are often used by investors to purchase or renovate properties. They typically have higher interest rates than traditional loans, but they can be a good option for borrowers who need financing quickly.

Other Tools Available on the Website

In addition to the mortgage calculator, First National Mortgage offers other tools such as:

- Affordability Calculator:This tool helps you determine how much you can afford to borrow based on your income and expenses.

- Pre-qualification Tool:This tool provides a preliminary estimate of your loan eligibility based on your financial information.

- Loan Comparison Tool:This tool allows you to compare different loan products side-by-side to find the best option for your needs.

Withu offers a variety of loan products, including personal loans, home equity loans, and business loans. Withu loans are known for their competitive rates and flexible terms. You can use a Withu loan for a variety of purposes, such as debt consolidation, home improvement, or starting a business.

Using the Tools to Calculate Affordability and Pre-qualify

To use the affordability calculator, you’ll need to provide your annual income, monthly expenses, and desired debt-to-income ratio. The calculator will then estimate your maximum affordable loan amount.To pre-qualify for a loan, you’ll need to provide your name, address, Social Security number, income, and employment information.

Want to get the best possible deal on your next car loan? Best auto loans can help you compare rates and terms from different lenders. This can help you find the best loan for your needs and budget.

The pre-qualification tool will provide a preliminary estimate of your loan eligibility and potential interest rate.

Customer Reviews and Feedback

First National Mortgage has a strong reputation for providing excellent customer service and competitive mortgage products.

Need a loan to renovate your home? Home renovation loans can help you finance your next project. You can use a home renovation loan to make major improvements to your home, such as adding a new bathroom or kitchen, or to make smaller repairs.

Customer Testimonials

[Sertakan contoh testimonial pelanggan yang positif]

An ARM mortgage is a type of mortgage with an adjustable interest rate. ARM mortgages can be a good option for borrowers who are looking for a lower initial interest rate. However, the interest rate can adjust over time, so it’s important to understand the terms of the loan before you commit.

Company Reputation and Customer Service

First National Mortgage consistently receives positive feedback from its customers, who appreciate the company’s:

- Responsive and knowledgeable loan officers

- Clear and transparent communication

- Streamlined application process

- Commitment to customer satisfaction

Areas for Improvement

While First National Mortgage generally receives positive feedback, there are areas where the company can improve, such as:

- Expanding its online presence and digital tools

- Offering more flexible loan options for borrowers with unique circumstances

- Providing more personalized support and guidance throughout the mortgage process

Outcome Summary

By understanding First National Mortgage’s offerings and the current market landscape, you can gain a clear picture of what to expect when applying for a home loan. With the knowledge gained from this guide, you can confidently navigate the mortgage process and secure a loan that meets your individual needs and financial goals.

FAQ

What is First National Mortgage’s reputation?

First National Mortgage is known for its competitive rates, a wide range of loan products, and a commitment to customer service. However, it’s always advisable to research and compare different lenders before making a decision.

What are the typical closing costs associated with a First National Mortgage loan?

Closing costs can vary depending on the loan type, property location, and other factors. It’s essential to inquire about these costs upfront to factor them into your budget.

Does First National Mortgage offer pre-approval for a mortgage?

Yes, First National Mortgage offers pre-approval, which can strengthen your offer when purchasing a home and give you a clearer picture of your borrowing power.

How long does it typically take to get a mortgage approved with First National Mortgage?

The approval process can vary depending on factors like your credit score, income, and the complexity of your loan application. It’s best to consult with a First National Mortgage representative for a more accurate timeline.