Medicare Premiums 2022 2024 – Medicare Premiums 2022-2024: Navigating the complexities of Medicare premiums can be a daunting task, especially as costs continue to rise. Understanding how premiums are calculated, what factors influence them, and what strategies can be employed to manage them is essential for beneficiaries.

E Insurance offers a convenient online platform for comparing and purchasing insurance policies. Visit E Insurance 2024 to simplify your insurance search and find the best deals.

This comprehensive guide provides a detailed overview of Medicare premiums, covering everything from basic concepts to future projections.

Jerry Insurance helps you compare car insurance quotes from various providers. Check out Jerry Insurance 2024 to find the best deals and save on your car insurance premiums.

The information presented here will equip individuals with the knowledge they need to make informed decisions regarding their Medicare coverage and financial planning. From the different types of premiums and their corresponding coverage to the impact of income levels and potential future trends, this guide offers a comprehensive exploration of Medicare premiums in the context of 2022 and 2024.

Finding the right health insurance plan can be overwhelming. Explore Best Health Insurance 2024 for a comprehensive guide to top-rated plans, helping you make an informed decision.

Contents List

Medicare Premiums Overview

Medicare premiums are a significant factor in the cost of healthcare for millions of Americans. Understanding how these premiums work, what factors influence them, and how to manage them is essential for anyone enrolled in Medicare. This article provides a comprehensive overview of Medicare premiums, covering key components, different types, average costs, and strategies for managing them.

Key Components of Medicare Premiums

Medicare premiums are payments made by beneficiaries to help cover the cost of their healthcare coverage. These premiums are typically paid monthly, either directly to the government or through a private insurance company, depending on the type of Medicare plan you have.

IUL life insurance combines death benefit coverage with potential cash value growth. Explore Iul Life Insurance 2024 to learn more about this hybrid insurance option.

The amount you pay in premiums can vary based on several factors, including your income, the type of Medicare coverage you choose, and your geographic location.

Types of Medicare Premiums and Coverage

Medicare offers various types of coverage, each with its own premium structure.

Need temporary insurance coverage for a specific event? Explore One Day Insurance 2024 to find short-term insurance solutions for your unique requirements.

- Medicare Part A (Hospital Insurance):This part covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health services. Most people don’t pay a monthly premium for Part A because they’ve paid Medicare taxes while working. However, some individuals may have to pay a premium if they didn’t work long enough to qualify for premium-free Part A.

- Medicare Part B (Medical Insurance):This part covers doctor’s visits, outpatient care, preventive services, and some durable medical equipment. You pay a monthly premium for Part B, and the amount can vary depending on your income.

- Medicare Part D (Prescription Drug Coverage):This part covers prescription drugs. You pay a monthly premium for Part D, and the amount can vary depending on the specific drug plan you choose.

- Medicare Advantage (Part C):These are private health plans that offer Medicare benefits. They typically have a monthly premium, which can be higher or lower than the combined premiums for Original Medicare (Part A and Part B).

Average Medicare Premiums for 2022 and 2024

The average Medicare premiums for 2022 and 2024 are expected to be as follows:

| Medicare Part | 2022 Average Premium | 2024 Estimated Average Premium |

|---|---|---|

| Part A (if required) | $499 | $550 |

| Part B | $170.10 | $190.00 |

| Part D (average across plans) | $30 | $35 |

These figures are based on current trends and projections and may vary depending on individual circumstances.

Universal Insurance offers a variety of insurance products, including home, auto, and life insurance. Visit Universal Insurance 2024 to find comprehensive coverage for your needs.

Factors Influencing Medicare Premiums

Medicare premiums are influenced by a variety of factors, including healthcare costs, inflation, and government policies. Understanding these factors is crucial for comprehending the fluctuations in premium costs.

AARP members can access dental insurance plans through their network. Explore Aarp Dental Insurance 2024 to find affordable plans that meet your dental needs.

Impact of Inflation and Healthcare Costs

Inflation and healthcare costs are major drivers of Medicare premium increases. As the cost of medical services, prescription drugs, and other healthcare-related expenses rises, Medicare premiums tend to follow suit. This is because Medicare is a program that pays for healthcare, and the cost of providing these services has been rising steadily over time.

Government Policies and Regulations

Government policies and regulations also play a significant role in shaping Medicare premium trends. For example, changes to Medicare coverage rules, such as the introduction of new benefits or the elimination of existing ones, can impact premiums. Additionally, decisions about how Medicare funds are allocated and managed can affect the overall cost of the program and, consequently, the premiums that beneficiaries pay.

Looking for a life insurance policy that fits your budget and needs? Explore Term Insurance Plans 2024 for options that provide coverage for a specific period, offering peace of mind for your loved ones.

Medicare Premium Costs for Different Parts

Medicare premiums vary depending on the specific part of Medicare coverage you choose. Understanding the premium differences for each part is essential for making informed decisions about your healthcare coverage.

Premium Comparison for Medicare Part A, Part B, and Part D

The table below compares the premiums for Medicare Part A, Part B, and Part D in 2022 and 2024:

| Medicare Part | 2022 Premium | 2024 Estimated Premium |

|---|---|---|

| Part A (if required) | $499 | $550 |

| Part B | $170.10 | $190.00 |

| Part D (average across plans) | $30 | $35 |

Visual Representation of Premium Changes

[Illustrative bar chart showing the premium changes for each part over time]This chart visually demonstrates the growth in Medicare premiums over time, highlighting the impact of inflation and healthcare cost increases on the cost of coverage.

Impact on Individual Beneficiaries

The rising cost of Medicare premiums can have a significant impact on individual beneficiaries. For those on fixed incomes or with limited financial resources, these increases can strain their budgets and make it difficult to afford essential healthcare. It’s crucial to understand how premium changes can affect your personal finances and to explore strategies for managing these costs.

Strategies for Managing Medicare Premiums

While Medicare premiums are unavoidable, there are strategies you can employ to minimize their impact on your finances.

Petsbest offers comprehensive pet insurance plans to cover various medical expenses. Visit Petsbest 2024 to explore their coverage options and ensure your furry friend’s health is protected.

Strategies to Minimize Premiums

- Enroll in a Medicare Advantage Plan:Medicare Advantage plans often have lower premiums than Original Medicare. However, it’s essential to carefully compare plans and ensure that the coverage meets your needs.

- Shop for a Lower-Cost Part D Prescription Drug Plan:Medicare Part D plans have varying premiums and drug formularies. Take the time to compare plans and choose one that offers the drugs you need at a lower cost.

- Take Advantage of Savings Programs:Some drug manufacturers offer savings programs that can help reduce the cost of prescription medications.

- Consider Delaying Enrollment in Part B:If you’re not yet eligible for Medicare, you may be able to delay enrollment in Part B and avoid paying premiums for a period of time.

- Explore Financial Assistance Programs:The government offers financial assistance programs to help eligible individuals afford Medicare premiums and other healthcare costs.

Medicare Advantage Plans: Benefits and Drawbacks

Medicare Advantage plans offer a combination of Medicare Part A, Part B, and often Part D coverage. They may also include additional benefits, such as vision, dental, and hearing care. While these plans can be cost-effective, it’s important to consider their potential drawbacks:

- Limited Network:Medicare Advantage plans often have limited networks of doctors and hospitals.

- Prior Authorization Requirements:Some plans require prior authorization for certain services.

- Potential for Higher Out-of-Pocket Costs:While premiums may be lower, out-of-pocket costs for services can be higher with Medicare Advantage plans.

Medicare can be a complex system, and navigating its various options and enrollment processes can be overwhelming. Fortunately, there are resources available to help you understand your options and make informed decisions:

- Medicare.gov:The official Medicare website provides comprehensive information about Medicare programs, coverage options, premiums, and enrollment processes.

- State Health Insurance Assistance Programs (SHIPs):These programs offer free, unbiased counseling and assistance to Medicare beneficiaries.

- Medicare Enrollment Counselors:You can find certified Medicare enrollment counselors in your area through the SHIPs program or other community organizations.

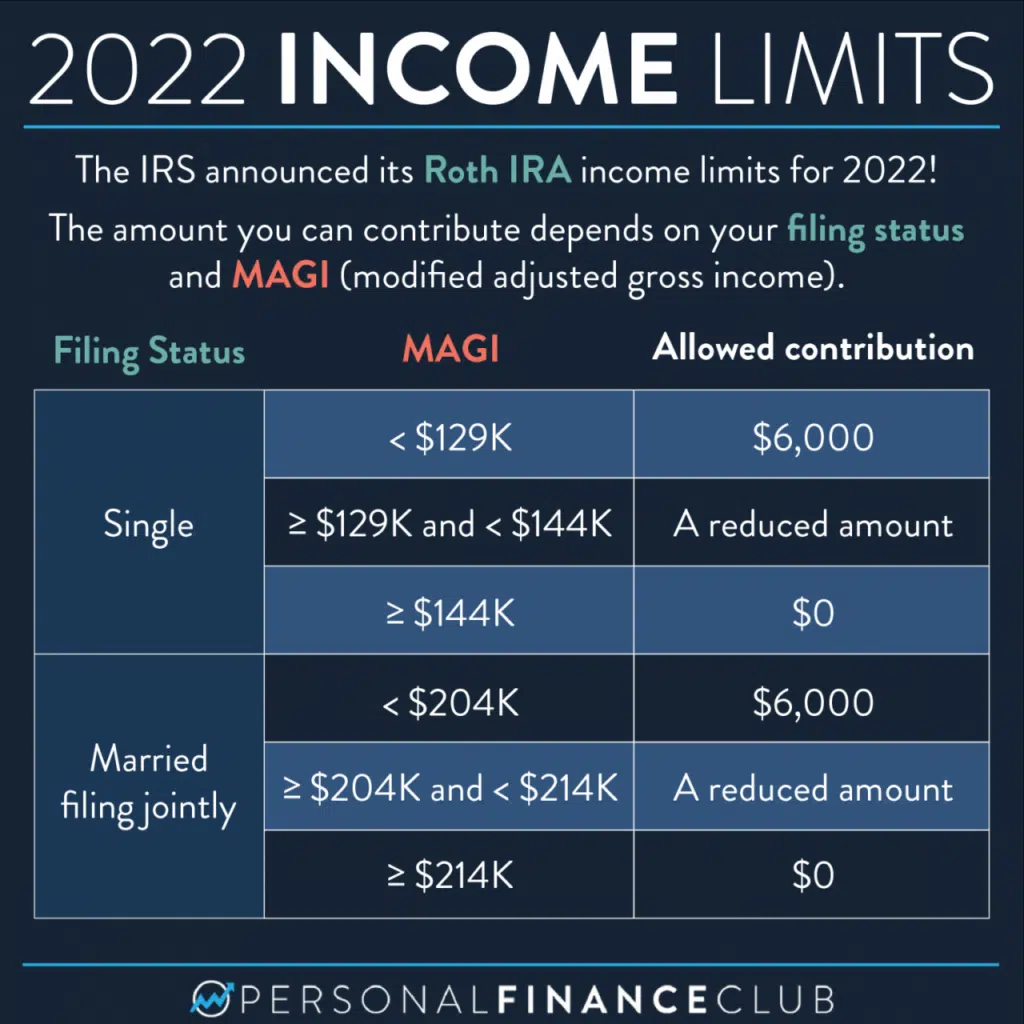

Medicare Premiums and Income Levels

Income levels play a significant role in determining Medicare premiums, particularly for Part B. The higher your income, the more you’ll pay in premiums.

Safe Auto Insurance specializes in providing affordable coverage for drivers with less-than-perfect driving records. Check out Safe Auto Insurance 2024 to see if their rates fit your budget.

Income-Based Premium Adjustments

Medicare Part B premiums are adjusted based on income. Individuals with higher incomes pay a higher premium, while those with lower incomes pay a lower premium. This is known as the “Income-Related Monthly Adjustment Amount” (IRMAA).

Premium Rates for Different Income Brackets

The table below shows the estimated Part B premiums for different income brackets in 2022 and 2024:

| Income Bracket | 2022 Premium | 2024 Estimated Premium |

|---|---|---|

$0

|

$170.10 | $190.00 |

$88,001

|

$219.00 | $240.00 |

| $110,001

Security National Insurance Company provides a range of insurance solutions. Explore Security National Insurance Company 2024 to discover their offerings for auto, home, and other insurance needs.

|

$267.90 | $290.00 |

$134,001

|

$316.80 | $340.00 |

| $160,001+ (single filer) | $365.70 | $390.00 |

These figures are estimates and may vary depending on the specific income thresholds and adjustment amounts for the year.

Protect your beloved equine companion with specialized coverage. Learn more about Horse Insurance 2024 and find the right plan for your horse’s health and well-being.

The Future of Medicare Premiums

Predicting the future of Medicare premiums is challenging, as it depends on a complex interplay of factors, including healthcare costs, inflation, demographics, and government policies. However, several trends suggest potential future scenarios for Medicare premiums.

Colonial Life Insurance offers a range of life insurance products, including supplemental benefits. Check out Colonial Life Insurance 2024 to find a plan that provides financial security for your family.

Impact of Demographic Changes and Healthcare Advancements, Medicare Premiums 2022 2024

As the population ages and healthcare technology advances, Medicare premiums are likely to continue rising. The increasing number of seniors will place a greater strain on the Medicare system, leading to higher healthcare costs. At the same time, new treatments and technologies, while often beneficial, can also be expensive.

Ethos offers a streamlined and digital approach to life insurance. Visit Ethos Life Insurance 2024 to learn about their transparent policies and convenient online application process.

Expert Opinions and Projections

Experts and policymakers are closely watching Medicare premium trends and their implications for the program’s sustainability. Projections vary, but many experts anticipate continued increases in Medicare premiums over the coming years.

Last Point

As Medicare continues to evolve, understanding the dynamics of premiums is crucial for both current and future beneficiaries. By staying informed about the factors influencing premiums, individuals can proactively manage their costs and ensure access to the healthcare they need.

This guide has provided a foundation for navigating the intricacies of Medicare premiums, empowering individuals to make informed decisions and plan for their healthcare future.

Detailed FAQs: Medicare Premiums 2022 2024

How do I know what my Medicare premiums will be?

Your Medicare premiums are determined by several factors, including your income, the type of Medicare plan you choose, and whether you have certain medical conditions. You can receive a personalized estimate of your premiums by contacting the Social Security Administration or your Medicare insurance provider.

What happens if I can’t afford my Medicare premiums?

If you are struggling to afford your Medicare premiums, you may be eligible for financial assistance programs. The Social Security Administration offers a variety of programs to help low-income individuals pay for their Medicare premiums. You can learn more about these programs by visiting the SSA website or contacting your local SSA office.

Can I change my Medicare plan after I enroll?

Yes, you can change your Medicare plan during the annual open enrollment period, which runs from October 15th to December 7th each year. You can also change your plan if you experience a qualifying life event, such as moving to a new state or losing your job.

What is the difference between Medicare Part A and Part B?

Medicare Part A covers inpatient hospital services, while Medicare Part B covers outpatient services, such as doctor visits and medical tests. Both Part A and Part B have premiums, but the amount you pay will vary depending on your income and other factors.

What is Medicare Advantage?

Medicare Advantage is a type of Medicare plan offered by private insurance companies. These plans typically provide comprehensive coverage, including prescription drugs, and may have lower monthly premiums than traditional Medicare. However, they may also have more restrictions on coverage and provider choices.

Costco members enjoy exclusive perks, including potential savings on car insurance. Check out Costco Car Insurance 2024 to see if you can benefit from their competitive rates and bundled discounts.