Balloon mortgages are a type of loan that offers lower initial payments but requires a large lump sum payment at the end of the loan term. This structure can be attractive for borrowers seeking short-term financing or those who anticipate a significant increase in their income.

However, it’s crucial to understand the risks associated with balloon mortgages, such as the potential for default if you’re unable to make the balloon payment.

This guide will delve into the intricacies of balloon mortgages, exploring their advantages and disadvantages, and comparing them to traditional mortgages. We’ll also discuss alternative financing options and provide a checklist of factors to consider before taking out a balloon mortgage.

Contents List

- 1 What is a Balloon Mortgage?

- 2 How Balloon Mortgages Work

- 3 Advantages of Balloon Mortgages

- 4 Disadvantages of Balloon Mortgages

- 5 Balloon Mortgage vs. Traditional Mortgage

- 6 Balloon Mortgage Alternatives

- 7 Balloon Mortgage Risks

- 8 Balloon Mortgage Considerations

- 9 Balloon Mortgage Examples

- 10 Epilogue

- 11 Question & Answer Hub

What is a Balloon Mortgage?

A balloon mortgage is a type of loan that features lower monthly payments than a traditional mortgage, but with a large lump sum payment due at the end of the loan term. This final payment is called a “balloon payment” and can be significantly larger than the regular monthly payments.

Key Characteristics of Balloon Mortgages

Balloon mortgages are characterized by:

- Lower Monthly Payments:Since the loan amount is not fully amortized over the loan term, monthly payments are typically lower than traditional mortgages.

- Large Balloon Payment:A significant lump sum payment is due at the end of the loan term, covering the remaining principal balance.

- Shorter Loan Terms:Balloon mortgages often have shorter loan terms compared to traditional mortgages, typically ranging from 5 to 10 years.

- Interest-Only Payments:In some cases, balloon mortgages may involve interest-only payments, where the monthly payments only cover the interest accrued on the loan, leaving the principal balance untouched until the balloon payment.

Examples of Balloon Mortgage Scenarios

Balloon mortgages can be used in various scenarios, including:

- Short-Term Financing:When borrowers need financing for a short period, such as for a business venture or a temporary housing situation, a balloon mortgage can provide lower monthly payments during the short term.

- Bridge Loans:Balloon mortgages can serve as bridge loans to help borrowers transition between properties. For instance, if a borrower is selling their current home and buying a new one, a balloon mortgage can provide temporary financing until the sale of the current home closes.

- Commercial Real Estate:Balloon mortgages are sometimes used for commercial real estate investments, allowing businesses to acquire properties with lower monthly payments while focusing on generating income and building equity.

How Balloon Mortgages Work

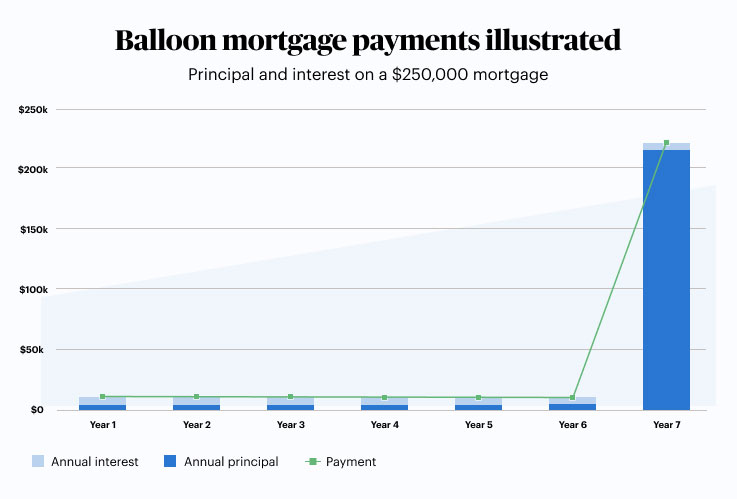

Balloon mortgages work differently from traditional mortgages in terms of their payment structure.

Payment Structure

- Regular Payments:Balloon mortgage payments are typically lower than traditional mortgage payments, as they only cover a portion of the interest and principal. This results in a smaller amount being paid off each month.

- Balloon Payment:At the end of the loan term, a large lump sum payment is due, known as the balloon payment. This payment covers the remaining principal balance that was not amortized during the loan term.

Difference from Traditional Mortgages

Traditional mortgages feature fully amortized payments, meaning that each payment covers a portion of both the principal and interest. This results in a gradually decreasing principal balance over the loan term, and the loan is fully paid off at the end of the term.

In contrast, balloon mortgages only partially amortize the principal, leading to a large balloon payment at the end.

Balloon Payment Impact

The balloon payment can have a significant impact on borrowers, as it represents a substantial financial obligation that needs to be met at the end of the loan term. If borrowers are unable to make the balloon payment, they may face foreclosure or other consequences.

Micro Loans are a great option for small businesses or individuals seeking smaller loans. Loans For People On Benefits are also available, providing access to financing for those receiving government assistance.

Advantages of Balloon Mortgages

Balloon mortgages offer certain advantages, making them suitable for specific situations.

Buying a home is a big step, and Home Loan Interest Rates are a crucial factor to consider. Santander Auto Loan and Rocketmortgage are just two examples of the many options available.

Lower Interest Rates

Balloon mortgages can sometimes have lower interest rates compared to traditional mortgages. This is because lenders perceive them as a lower risk due to the shorter loan term and the large balloon payment at the end.

Short-Term Financing

Balloon mortgages are beneficial for short-term financing needs, as they allow borrowers to access funds with lower monthly payments during the short term.

Navigating the world of mortgages can be overwhelming. Mortgage Companies offer a variety of loan products and services, so it’s important to shop around and compare rates.

Advantageous Situations

Balloon mortgages can be advantageous in situations where:

- Borrowers have a plan to repay the balloon payment:If borrowers have a clear plan to pay off the balloon payment at the end of the loan term, a balloon mortgage can be a cost-effective option.

- Borrowers anticipate a change in financial circumstances:If borrowers expect their financial situation to improve significantly in the future, a balloon mortgage can provide lower monthly payments during a period of financial strain.

- Borrowers need financing for a specific project:For projects with a limited duration, such as a business venture or a temporary housing situation, a balloon mortgage can be a suitable financing option.

Disadvantages of Balloon Mortgages

While balloon mortgages offer advantages, they also come with certain drawbacks.

Getting a car loan can be a major financial decision. Car Loan Rates fluctuate, and Td Bank Auto Loan is one of many institutions offering loans.

Risk of Large Balloon Payment

The most significant disadvantage of a balloon mortgage is the risk of a large balloon payment at the end of the loan term. If borrowers are unable to make this payment, they may face serious financial consequences, including foreclosure.

Refinancing Difficulties

If market interest rates increase, refinancing a balloon mortgage can become challenging. Lenders may be hesitant to refinance a loan with a large balloon payment, and borrowers may face higher interest rates or stricter lending requirements.

Importance of Planning

Borrowers considering a balloon mortgage need to have a clear plan for how they will repay the balloon payment. This plan should include:

- Saving enough money:Setting aside sufficient funds to cover the balloon payment is crucial.

- Exploring refinancing options:Researching alternative financing options before the balloon payment comes due is essential to ensure a smooth transition.

- Considering other repayment strategies:Exploring options such as selling the property or obtaining additional financing to cover the balloon payment is necessary.

Balloon Mortgage vs. Traditional Mortgage

Understanding the key differences between balloon mortgages and traditional mortgages is crucial for making an informed decision.

Payment Structures

- Balloon Mortgage:Lower monthly payments, but with a large balloon payment due at the end of the loan term.

- Traditional Mortgage:Higher monthly payments, but the loan is fully amortized over the loan term, with no balloon payment due at the end.

Advantages and Disadvantages

- Balloon Mortgage Advantages:Lower interest rates, lower monthly payments during the loan term.

- Balloon Mortgage Disadvantages:Risk of a large balloon payment at the end, potential refinancing difficulties, requires careful planning.

- Traditional Mortgage Advantages:No balloon payment, predictable monthly payments, easier refinancing options.

- Traditional Mortgage Disadvantages:Higher interest rates, higher monthly payments.

Factors to Consider

When deciding between a balloon mortgage and a traditional mortgage, borrowers should consider:

- Financial situation:Assess your current financial resources and ability to repay the loan.

- Loan term:Consider your financing needs and how long you plan to keep the loan.

- Interest rates:Compare interest rates offered by different lenders for both balloon and traditional mortgages.

- Refinancing options:Explore the potential for refinancing a balloon mortgage if market rates change.

- Risk tolerance:Evaluate your willingness to accept the risk of a large balloon payment.

Balloon Mortgage Alternatives

If a balloon mortgage does not seem like the right fit, there are alternative financing options that may be more suitable.

Other Financing Options

- Traditional Mortgages:These offer fully amortized payments, eliminating the risk of a large balloon payment.

- Adjustable-Rate Mortgages (ARMs):ARMs feature interest rates that can adjust periodically, offering potential for lower initial rates but with the risk of rate increases.

- Home Equity Loans:These loans use the equity in your home as collateral, offering lower interest rates but with the risk of losing your home if you default.

- Personal Loans:Personal loans can be used for various purposes, including home improvements or debt consolidation, but they typically have higher interest rates than mortgages.

Pros and Cons of Alternatives

Each alternative financing option has its own set of advantages and disadvantages:

- Traditional Mortgages:Pros: No balloon payment, predictable monthly payments, easier refinancing options. Cons: Higher interest rates, higher monthly payments.

- ARMs:Pros: Potentially lower initial rates. Cons: Risk of interest rate increases, less predictable monthly payments.

- Home Equity Loans:Pros: Lower interest rates. Cons: Risk of losing your home if you default, limited loan amounts.

- Personal Loans:Pros: Flexible use, quick approval. Cons: Higher interest rates, shorter loan terms.

Balloon Mortgage Risks

Balloon mortgages carry certain risks that borrowers should be aware of.

Potential for Default

The most significant risk associated with balloon mortgages is the potential for default. If borrowers are unable to make the balloon payment at the end of the loan term, they may face foreclosure or other consequences.

Market Interest Rate Fluctuations, Balloon Mortgage

Market interest rates can fluctuate, potentially impacting the ability to refinance a balloon mortgage. If interest rates rise, refinancing may become more expensive or even impossible.

Keeping track of Mortgage Interest Rates Today can be tricky, as they fluctuate constantly. Understanding the Average Interest Rate is a good starting point, but remember that individual rates vary depending on your credit score, loan amount, and other factors.

Importance of Financial Planning

Thorough financial planning is essential before taking out a balloon mortgage. Borrowers should carefully assess their financial resources and repayment capabilities to ensure they can handle the balloon payment at the end of the loan term.

Balloon Mortgage Considerations

Before obtaining a balloon mortgage, borrowers should carefully consider several factors.

Checklist of Factors

- Financial resources:Assess your current financial situation and ability to make the balloon payment.

- Repayment capabilities:Evaluate your future income and expenses to ensure you can meet the balloon payment obligation.

- Loan term:Determine the length of the loan term and whether it aligns with your financing needs.

- Interest rates:Compare interest rates offered by different lenders for balloon mortgages.

- Refinancing options:Explore the potential for refinancing the balloon mortgage if market rates change.

- Balloon payment amount:Understand the exact amount of the balloon payment and how it will impact your finances.

Assessing Financial Resources

It is crucial to have a clear understanding of your current financial resources and future income projections. This will help you determine if you can realistically afford the balloon payment.

Understanding the Balloon Payment

Ensure you fully comprehend the balloon payment amount, the timing of the payment, and the consequences of failing to make the payment. This understanding will help you make an informed decision about whether a balloon mortgage is right for you.

If you’re looking to invest in real estate, Investment Property Loans can help you get started. Td Mortgage Rates and First National Mortgage are just a couple of lenders to explore.

Balloon Mortgage Examples

Here are some real-life examples of balloon mortgage scenarios:

| Scenario | Loan Term | Interest Rate | Balloon Payment | Outcome |

|---|---|---|---|---|

| Business expansion | 5 years | 5% | $500,000 | Successful if the business generates sufficient profits to cover the balloon payment. |

| Bridge loan for home purchase | 1 year | 6% | $200,000 | Successful if the sale of the current home generates enough funds to cover the balloon payment. |

| Investment property | 7 years | 4.5% | $350,000 | Successful if the rental income from the property is sufficient to cover the balloon payment. |

These examples illustrate the various factors that can influence the success or failure of a balloon mortgage. It is important to carefully consider your specific situation and financial resources before taking out a balloon mortgage.

For those pursuing higher education, Direct Unsubsidized Loan options are available. However, it’s essential to research Bhg Loans and other financing options to make an informed decision.

Epilogue

Ultimately, the decision of whether or not to take out a balloon mortgage depends on your individual financial situation and goals. By carefully considering the risks and rewards, and seeking professional financial advice, you can make an informed decision that aligns with your financial objectives.

Remember, a balloon mortgage can be a viable option for some borrowers, but it’s not suitable for everyone.

Question & Answer Hub

How do balloon mortgages work?

Balloon mortgages have lower monthly payments than traditional mortgages, but they require a large lump sum payment, known as the balloon payment, at the end of the loan term. This payment can be a significant portion of the original loan amount.

Who are balloon mortgages suitable for?

Balloon mortgages can be suitable for borrowers with short-term financing needs, those who anticipate a significant increase in income, or those who plan to refinance before the balloon payment is due.

What are the risks associated with balloon mortgages?

The main risk of a balloon mortgage is the potential for default if you’re unable to make the balloon payment at the end of the loan term. You may also face refinancing difficulties if market interest rates increase.

What are some alternatives to balloon mortgages?

Alternatives to balloon mortgages include traditional fixed-rate mortgages, adjustable-rate mortgages (ARMs), and interest-only mortgages. Each option has its own advantages and disadvantages, so it’s important to compare them carefully.