HSA Insurance 2024 sets the stage for this comprehensive guide, offering readers a deep dive into the world of Health Savings Accounts. This exploration delves into the nuances of HSA eligibility, contribution limits, investment options, and withdrawal strategies, equipping individuals with the knowledge to make informed decisions about their healthcare savings.

Ameriprise is a financial services company that offers a variety of insurance products, including auto insurance. You can find out more about Ameriprise Auto Insurance 2024 by visiting their website or contacting an agent.

This guide provides a comprehensive overview of HSAs, addressing key aspects like eligibility, contribution limits, investment strategies, and tax implications. Whether you’re new to HSAs or seeking to optimize your existing account, this information will empower you to navigate the complexities of healthcare savings and make informed decisions that align with your financial goals.

Safety Insurance is a company that offers a variety of insurance products, including auto, home, and life insurance. You can find out more about their services and plans by visiting Safety Insurance 2024.

Contents List

HSA Basics

A Health Savings Account (HSA) is a tax-advantaged savings account that can be used to pay for qualified medical expenses. It’s a valuable tool for individuals and families who want to save money on healthcare costs and take control of their health spending.

Dental care can be expensive, but there are affordable options available. You can find out more about Affordable Dental Insurance 2024 by comparing plans and providers.

Eligibility Requirements for an HSA

To be eligible for an HSA, you must meet the following requirements:

- Be enrolled in a High Deductible Health Plan (HDHP).

- Not be covered by any other health insurance plan, such as Medicare or Medicaid.

- Not be claimed as a dependent on someone else’s tax return.

HSA-Eligible Medical Expenses

HSAs can be used to pay for a wide range of qualified medical expenses, including:

- Doctor’s visits

- Prescription drugs

- Hospital stays

- Dental and vision care

- Over-the-counter medications (with a prescription)

- Medical equipment

- Long-term care

Tax Advantages of an HSA

HSAs offer significant tax advantages, making them a popular choice for healthcare savings:

- Pre-tax contributions:Your contributions to an HSA are made with pre-tax dollars, reducing your taxable income.

- Tax-free growth:The money in your HSA grows tax-free, meaning you won’t have to pay taxes on investment earnings.

- Tax-free withdrawals for qualified medical expenses:When you withdraw money from your HSA to pay for qualified medical expenses, the withdrawals are tax-free.

HSA Contributions

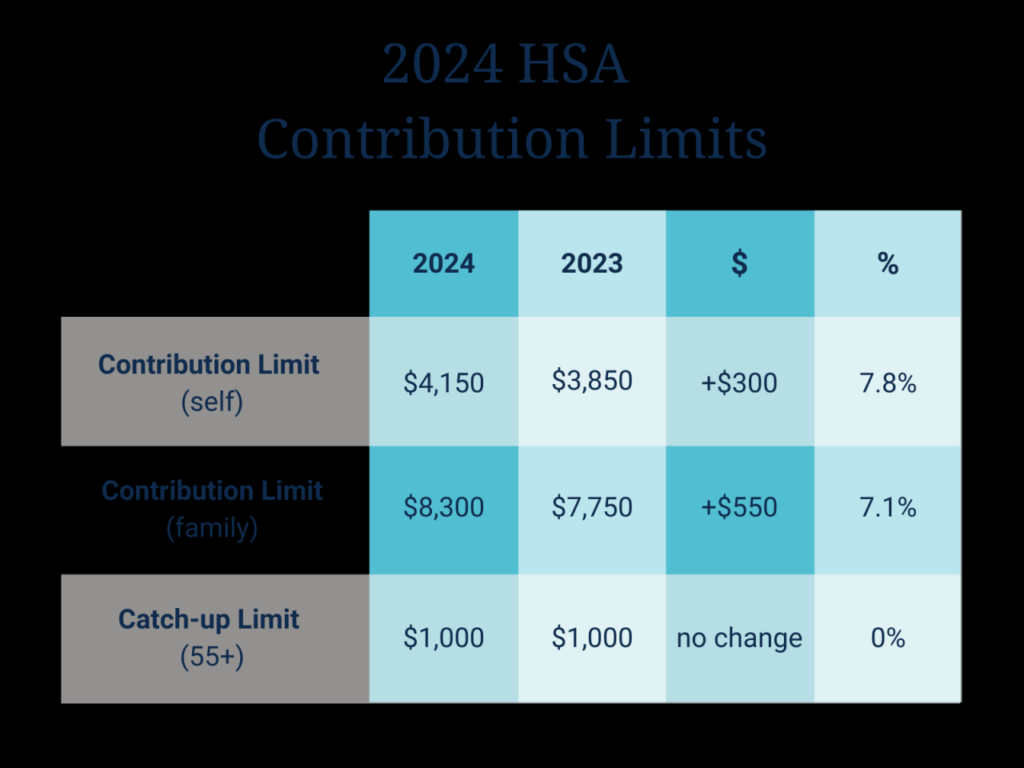

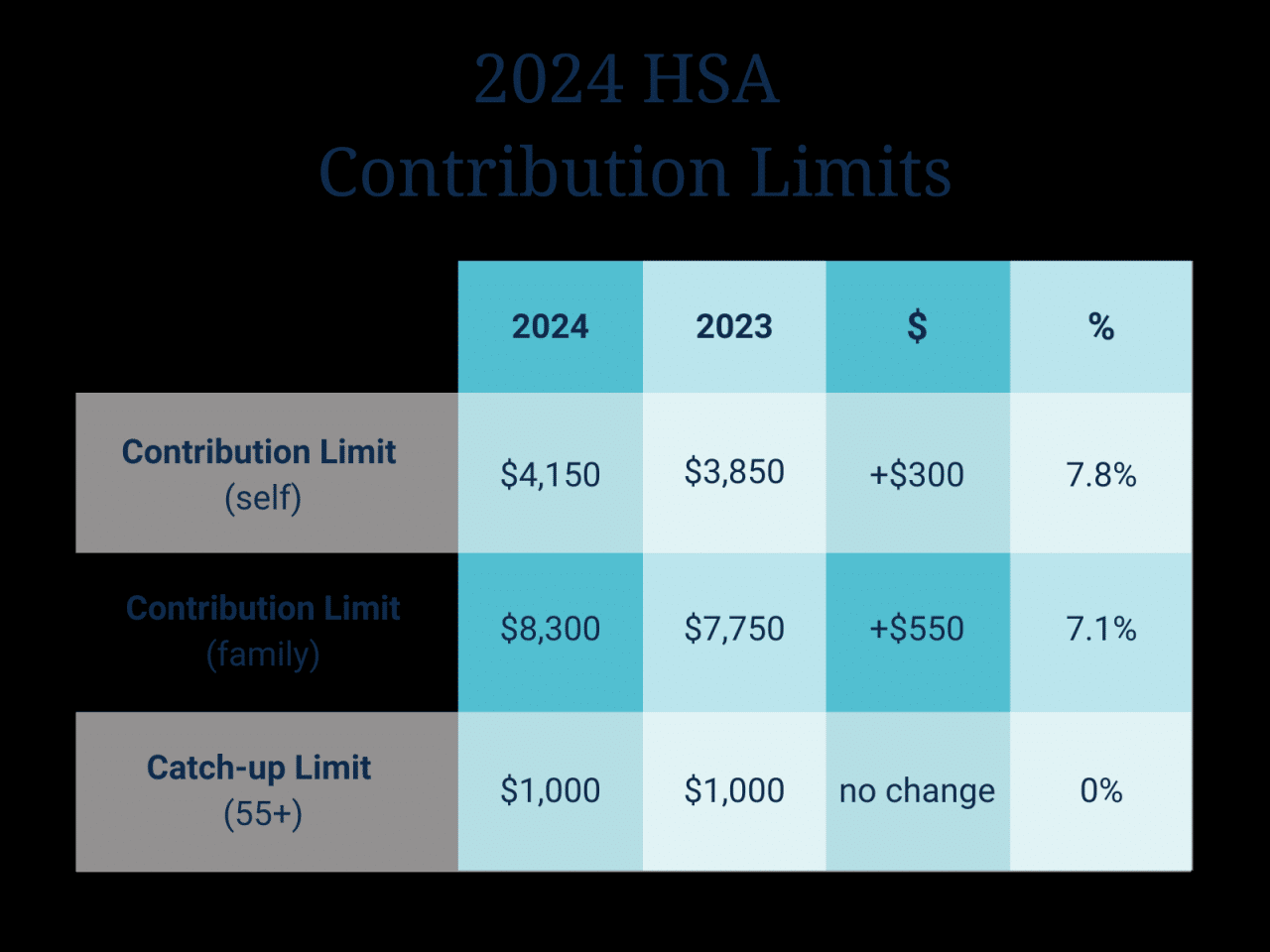

The maximum contribution limits for HSAs in 2024 are as follows:

Maximum Contribution Limits for HSAs in 2024

| Coverage | Individual | Family |

|---|---|---|

| 2024 | $3,850 | $7,750 |

Strategies for Maximizing HSA Contributions

Here are some strategies for maximizing your HSA contributions:

- Contribute the maximum amount allowed:The higher your contributions, the more money you’ll have to cover future medical expenses.

- Set up automatic contributions:Automate your HSA contributions to ensure you’re consistently saving.

- Consider a catch-up contribution:If you’re 55 or older, you can contribute an additional $1,000 to your HSA in 2024.

Impact of HSA Contributions on Taxes

HSA contributions reduce your taxable income, which can lower your tax liability. The exact impact will depend on your individual tax bracket.

An insurance agent can be a valuable resource when you’re looking for the right insurance plan. You can find an agent near you by searching for Insurance Agent 2024 online.

Contribution Limits for Single and Family Coverage

The contribution limits for HSAs vary depending on whether you have single or family coverage. The limits for 2024 are shown in the table above.

Looking for car insurance in your area? You can easily find Freeway Insurance Near Me 2024 by searching online. This will give you a list of local providers and their contact information, so you can get the best rates and coverage for your needs.

HSA Investment Options

HSAs offer a variety of investment options, allowing you to grow your savings over time. You can choose from a range of investments, including:

Investment Options for HSAs

The specific investment options available will depend on your HSA provider. Common investment options include:

- Mutual funds:Offer diversification across a range of asset classes.

- Exchange-traded funds (ETFs):Similar to mutual funds but traded on stock exchanges.

- Individual stocks:Offer the potential for higher returns but also come with higher risk.

- Bonds:Provide a more conservative investment option with lower risk than stocks.

Pros and Cons of Investing in an HSA

Investing in an HSA can be a smart way to grow your savings, but it’s important to understand the potential benefits and risks:

Pros

- Tax-free growth:Your investment earnings grow tax-free.

- Potential for higher returns:Investing can lead to higher returns than keeping your money in a low-yield savings account.

- Long-term savings:Investing for the long term can help you build a substantial nest egg for future medical expenses.

Cons

- Risk:Investments carry the risk of losing money.

- Market volatility:The value of your investments can fluctuate with market conditions.

- Time commitment:Managing investments requires some time and effort.

Choosing the Right Investment Strategy, Hsa Insurance 2024

When choosing an investment strategy for your HSA, consider your risk tolerance, time horizon, and financial goals. It’s wise to consult with a financial advisor to develop a personalized investment plan.

State Farm is a popular insurance company known for its catchy commercials. You can find more information about their latest ads by searching for State Farm Commercial 2024 online.

Investment Options Comparison

| Investment Option | Risk | Potential Return |

|---|---|---|

| Mutual Funds | Moderate | Moderate |

| ETFs | Moderate | Moderate |

| Individual Stocks | High | High |

| Bonds | Low | Low |

HSA Withdrawals

When you withdraw money from your HSA, the tax implications depend on whether the withdrawal is for a qualified medical expense or not.

Income insurance can provide financial protection if you’re unable to work due to an illness or injury. You can find out more about Income Insurance 2024 by contacting an insurance agent or doing some research online.

Tax Implications of HSA Withdrawals

Withdrawals for qualified medical expenses are tax-free and penalty-free. Withdrawals for non-qualified medical expenses are subject to both income tax and a 20% penalty.

Are you looking for insurance for your boat? Geico is a reputable insurance company, and they offer a variety of plans for boat owners. You can learn more about Geico Boat Insurance 2024 by visiting their website.

Qualified and Non-Qualified Withdrawals

Here’s a breakdown of qualified and non-qualified withdrawals:

Qualified Withdrawals

- Medical expenses:Include doctor’s visits, prescription drugs, hospital stays, dental and vision care, and other eligible expenses.

- Tax-free and penalty-free:Withdrawals for qualified medical expenses are tax-free and penalty-free.

Non-Qualified Withdrawals

- Non-medical expenses:Include expenses such as vacations, home repairs, or anything not related to medical care.

- Taxable and penalized:Withdrawals for non-qualified expenses are subject to both income tax and a 20% penalty.

Potential Penalties for Early Withdrawals

If you withdraw money from your HSA before age 65 for reasons other than qualified medical expenses, you’ll be subject to a 20% penalty, in addition to income tax.

EyeMed is a vision care provider that offers a variety of plans. You can find out more about their network of providers by visiting Eyemed Providers 2024.

Examples of Qualified Medical Expenses

Here are some examples of qualified medical expenses that can be paid for with HSA funds:

- Doctor’s visits and consultations

- Prescription drugs and over-the-counter medications (with a prescription)

- Hospital stays and surgery

- Dental and vision care

- Medical equipment, such as wheelchairs and hearing aids

- Long-term care services

HSA vs. FSA

HSAs and FSAs are both tax-advantaged accounts that can be used to pay for medical expenses. However, there are key differences between the two:

Comparison of HSAs and FSAs

| Feature | HSA | FSA |

|---|---|---|

| Eligibility | Must be enrolled in an HDHP | Offered by employers |

| Contribution Limits | $3,850 (individual), $7,750 (family) in 2024 | Varies by employer |

| Tax Benefits | Pre-tax contributions, tax-free growth, tax-free withdrawals for qualified expenses | Pre-tax contributions, tax-free withdrawals for qualified expenses |

| Carryover | Rolls over year to year | Use-it-or-lose-it |

Key Differences Between HSAs and FSAs

Here’s a breakdown of the key differences between HSAs and FSAs:

- Eligibility:HSAs are available to anyone enrolled in an HDHP, while FSAs are offered by employers.

- Contribution Limits:HSA contribution limits are set by the IRS, while FSA contribution limits are set by employers.

- Tax Benefits:HSAs offer tax-free growth in addition to pre-tax contributions and tax-free withdrawals, while FSAs only offer pre-tax contributions and tax-free withdrawals.

- Carryover:HSA funds roll over year to year, while FSA funds are typically use-it-or-lose-it.

Scenarios Where an HSA Might Be a Better Choice Than an FSA

An HSA may be a better choice than an FSA in the following scenarios:

- Long-term savings:If you’re looking to save for future medical expenses, an HSA’s tax-free growth and rollover feature make it a more attractive option.

- High deductible health plan:If you’re enrolled in an HDHP, you’re eligible for an HSA but not an FSA.

- Self-employed or independent contractor:If you’re self-employed or an independent contractor, you can open an HSA on your own, while FSAs are typically offered by employers.

Choosing the Right HSA Plan

When choosing an HSA plan, it’s essential to consider your healthcare needs, budget, and long-term goals.

Private health insurance can be a great option if you’re looking for comprehensive coverage. You can explore your options by checking out Private Health Insurance 2024 and comparing different plans.

Factors to Consider When Choosing an HSA Plan

Here are some factors to consider when selecting an HSA plan:

- Investment options:Choose a plan that offers investment options that align with your risk tolerance and financial goals.

- Fees:Compare fees, such as annual maintenance fees and transaction fees, to find a plan with reasonable costs.

- Customer service:Look for a provider with a reputation for excellent customer service and responsive support.

- Debit card availability:Choose a plan that offers a debit card for convenient access to your HSA funds.

Researching Different HSA Providers

It’s essential to research different HSA providers to find a plan that meets your needs. Compare features, fees, and customer service to make an informed decision.

Medicaid is a government-funded health insurance program that provides coverage for low-income individuals and families. You can find out more about Medicaid Insurance 2024 by visiting the official website for your state.

Role of Deductibles and Co-pays in HSA Plan Selection

The deductible and co-pays associated with your HDHP will impact your HSA needs. A higher deductible will generally result in lower premiums but may require a larger HSA balance to cover out-of-pocket expenses.

If you’re planning a trip, you may want to consider getting travel insurance. Single-trip travel insurance can help protect you against unexpected events. You can find out more about Single Trip Travel Insurance 2024 online.

Tips for Finding a Plan That Aligns with Your Healthcare Needs and Budget

Here are some tips for finding an HSA plan that aligns with your healthcare needs and budget:

- Consider your health history:If you have a history of high medical expenses, you may need a higher HSA contribution limit.

- Estimate your annual healthcare costs:Determine how much you typically spend on healthcare each year to estimate your HSA contribution needs.

- Review your HDHP:Ensure your HDHP’s deductible and co-pays are compatible with your HSA plan.

HSA Resources

There are numerous resources available to help you learn more about HSAs and make informed decisions.

Liberty Mutual is a well-known insurance company that offers a range of home insurance products. If you’re looking for more information, you can visit Liberty Mutual Home Insurance 2024 to learn more about their plans and coverage options.

Reputable Online Resources for HSA Information

- HSA.gov:The official website of the IRS for HSA information.

- HealthSavings.com:A comprehensive resource for HSA news, articles, and tools.

- Bankrate.com:Provides information on HSAs, including a comparison of different HSA providers.

Government Websites with HSA Guidance

- Internal Revenue Service (IRS):Provides tax guidance on HSAs.

- Department of Health and Human Services (HHS):Offers information on health insurance plans, including HDHPs.

Contact Information for HSA Providers and Financial Advisors

You can contact HSA providers directly to learn more about their plans and services. It’s also wise to consult with a financial advisor to discuss your HSA options and investment strategies.

Aetna is a well-known name in the healthcare industry, and their Medicare plans are popular choices for seniors. If you’re looking for more information, you can check out Aetna Medicare 2024 for details on their coverage and plans.

HSA Provider Comparison

| HSA Provider | Investment Options | Fees | Customer Service |

|---|---|---|---|

| Provider A | Mutual funds, ETFs, individual stocks | Low annual maintenance fee, no transaction fees | Excellent customer service, 24/7 support |

| Provider B | Mutual funds, ETFs | Moderate annual maintenance fee, transaction fees apply | Good customer service, limited support hours |

| Provider C | Mutual funds, ETFs, individual stocks, bonds | High annual maintenance fee, no transaction fees | Excellent customer service, 24/7 support |

Last Word

Understanding HSA Insurance in 2024 is essential for anyone seeking to take control of their healthcare costs. This guide has illuminated the key features of HSAs, empowering individuals to leverage the benefits of these tax-advantaged accounts. By navigating the intricacies of eligibility, contributions, investment options, and withdrawals, individuals can maximize their healthcare savings and secure a brighter financial future.

Clarifying Questions: Hsa Insurance 2024

What are the tax implications of withdrawing funds from an HSA for non-medical expenses?

Withdrawals for non-qualified medical expenses are subject to income tax and a 20% penalty (unless you are 65 or older, or meet certain other exceptions).

Can I contribute to an HSA if I have a Flexible Spending Account (FSA)?

Yes, you can contribute to both an HSA and an FSA, but you must be enrolled in a high-deductible health plan (HDHP) to be eligible for an HSA.

Are there any restrictions on how I can invest my HSA funds?

HSA investment options vary depending on your HSA provider. You can typically invest in a variety of assets, including stocks, bonds, mutual funds, and ETFs. It’s important to choose investments that align with your risk tolerance and financial goals.

Humana is a well-known health insurance provider that offers a variety of Medicare plans. If you’re interested in their plans, you can learn more about Humana Gold Plus 2024 by visiting their website.