Union Bank Home Loan Interest Rate plays a crucial role in determining the affordability and overall cost of your dream home. Understanding the factors that influence these rates, comparing them to other lenders, and navigating the complexities of eligibility and fees are essential steps in securing a favorable mortgage.

If you need cash today, consider exploring instant approval loans. These loans can be a lifesaver in emergency situations.

This comprehensive guide will delve into the intricacies of Union Bank’s home loan interest rates, providing insights into the various factors that determine their rates, comparing them to other banks, and offering tips on how to improve your chances of securing a lower interest rate.

Federal loans, often referred to as Fed loans , are offered by the government for various purposes, including education and housing.

Contents List

Understanding Union Bank Home Loan Interest Rates

Securing a home loan is a significant financial decision, and understanding the interest rates involved is crucial. Union Bank, a reputable financial institution, offers a range of home loan options with varying interest rates. This article delves into the intricacies of Union Bank’s home loan interest rates, providing insights into factors influencing them, different types offered, current trends, and how they compare to other major banks.

Quick payday loans can be a tempting option in a pinch, but they often come with high interest rates and fees. Consider alternative options before taking out a payday loan.

Factors Influencing Interest Rates

Union Bank’s home loan interest rates are influenced by a combination of factors, including:

- Current Market Conditions:Interest rates are directly influenced by prevailing market conditions, such as the Federal Reserve’s benchmark interest rates, inflation, and overall economic health.

- Borrower’s Creditworthiness:Your credit score, debt-to-income ratio, and credit history play a significant role in determining your interest rate. A higher credit score generally translates to a lower interest rate.

- Loan Amount and Term:The amount you borrow and the duration of the loan term (e.g., 15 or 30 years) can affect your interest rate. Generally, larger loans and longer terms tend to have higher interest rates.

- Loan Type:Union Bank offers various home loan types, each with its own interest rate structure. For example, fixed-rate mortgages offer consistent payments, while adjustable-rate mortgages (ARMs) have rates that can fluctuate over time.

- Property Location and Type:The location and type of property you are financing can influence your interest rate. Properties in high-demand areas or with unique features might command higher rates.

Types of Home Loan Interest Rates, Union Bank Home Loan Interest Rate

Union Bank offers different types of home loan interest rates, each with its own characteristics:

- Fixed-Rate Mortgages:These loans have a fixed interest rate for the entire loan term, providing predictable monthly payments.

- Adjustable-Rate Mortgages (ARMs):ARMs have an initial fixed interest rate that adjusts periodically based on a specific index, such as the LIBOR. This can lead to lower initial payments but potentially higher payments in the future.

- Conforming Loans:These loans adhere to specific guidelines set by Fannie Mae and Freddie Mac, typically with lower interest rates and more lenient eligibility criteria.

- Non-Conforming Loans:These loans do not meet conforming loan guidelines and often have higher interest rates due to increased risk for lenders.

Current Interest Rate Trends

Interest rates for Union Bank home loans are subject to ongoing fluctuations. It’s essential to stay informed about current trends by checking Union Bank’s website or consulting with a loan officer. Keep in mind that interest rates are dynamic and can change quickly based on market conditions.

Looking for a specific loan provider? Hhloans is a reputable online platform that connects borrowers with various lenders.

Comparing Union Bank Home Loan Interest Rates

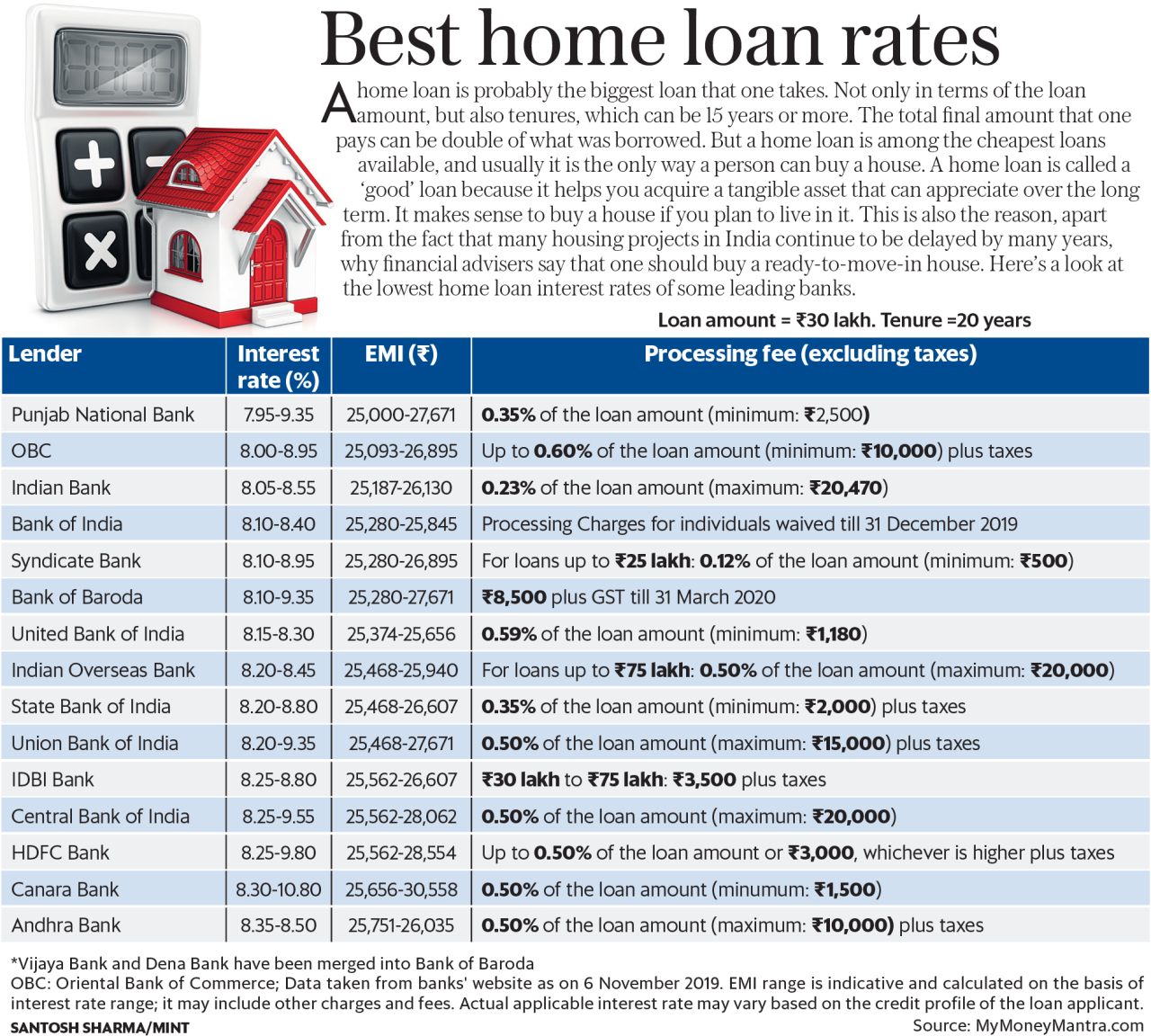

When choosing a home loan, comparing interest rates from different lenders is crucial to ensure you get the best deal. Let’s compare Union Bank’s home loan interest rates to those offered by other major banks in the market.

Applying for a personal loan online can be a quick and easy process. Many lenders allow you to complete the entire application process digitally.

Comparison with Other Banks

To provide a comprehensive comparison, we’ll consider interest rates for various loan types, such as fixed-rate mortgages and ARMs, offered by leading banks like Wells Fargo, Chase, Bank of America, and US Bank. It’s important to note that interest rates can vary based on specific loan terms, borrower’s creditworthiness, and other factors.

Marcus by Goldman Sachs offers personal loans with competitive rates and transparent terms. They are known for their user-friendly platform.

| Bank | Loan Type | Current Interest Rate |

|---|---|---|

| Union Bank | 30-Year Fixed-Rate Mortgage | [Insert Current Rate] |

| Wells Fargo | 30-Year Fixed-Rate Mortgage | [Insert Current Rate] |

| Chase | 30-Year Fixed-Rate Mortgage | [Insert Current Rate] |

| Bank of America | 30-Year Fixed-Rate Mortgage | [Insert Current Rate] |

| US Bank | 30-Year Fixed-Rate Mortgage | [Insert Current Rate] |

Advantages and Disadvantages

Union Bank’s home loan interest rates might offer certain advantages, such as:

- Competitive Rates:Union Bank strives to provide competitive interest rates to attract borrowers.

- Flexible Loan Options:They offer a range of loan types to cater to different borrower needs and financial situations.

- Potential for Special Offers:Union Bank may occasionally offer special promotions or discounts on interest rates.

However, some potential disadvantages might include:

- Higher Fees:Compared to some competitors, Union Bank’s fees associated with home loans might be higher.

- Limited Branch Network:Union Bank might have a smaller branch network compared to national banks, which could be a consideration for some borrowers.

Special Offers and Promotions

Union Bank periodically runs special offers and promotions for home loans. These offers can include:

- Reduced Interest Rates:Special promotions might offer lower interest rates for a limited time.

- Waived Fees:Union Bank might waive certain fees, such as loan origination fees, during promotional periods.

- Cash Back Rebates:Some promotions might offer cash back rebates for closing costs or other expenses.

It’s crucial to check Union Bank’s website or contact a loan officer for the latest special offers and promotions available.

Looking to tap into your home’s equity? Equity loan rates can vary depending on the lender and your financial situation. Shop around to find the best deal.

Analyzing Union Bank Home Loan Interest Rate Calculation

Understanding how Union Bank calculates its home loan interest rates is essential for making informed financial decisions. This section delves into the calculation process, providing examples and tips to potentially secure a lower interest rate.

Many lenders offer personal loans with online approval , making the process even more convenient. You can often receive an approval decision within minutes.

Calculation Process

Union Bank’s interest rate calculation involves a complex formula that considers various factors, including:

- Base Rate:This is a starting point for the interest rate, often based on prevailing market conditions.

- Credit Score Adjustment:Your credit score plays a significant role in determining the interest rate adjustment. A higher credit score generally results in a lower adjustment.

- Loan Amount and Term:The amount you borrow and the duration of the loan term can influence the interest rate calculation.

- Loan Type:Different loan types, such as fixed-rate mortgages and ARMs, have different interest rate calculation methods.

- Property Location and Type:The location and type of property you are financing can impact the interest rate calculation.

Interest Rate Scenarios and Monthly Payments

Here are some examples of different interest rate scenarios and their corresponding monthly payments, assuming a $300,000 loan amount and a 30-year term:

| Interest Rate | Monthly Payment |

|---|---|

| 4.00% | $1,432.25 |

| 4.50% | $1,520.04 |

| 5.00% | $1,608.28 |

As you can see, even small differences in interest rates can significantly impact your monthly payments over the life of the loan.

Tips for Securing a Lower Interest Rate

Here are some tips to improve your chances of securing a lower interest rate from Union Bank:

- Improve Your Credit Score:A higher credit score is crucial for obtaining a lower interest rate. Pay your bills on time, reduce credit card balances, and avoid opening new credit accounts unnecessarily.

- Shop Around for Rates:Compare interest rates from different lenders to ensure you’re getting the best deal.

- Consider a Shorter Loan Term:A shorter loan term, such as a 15-year mortgage, often comes with a lower interest rate.

- Make a Larger Down Payment:A larger down payment can lower your loan amount and potentially qualify you for a lower interest rate.

- Negotiate with the Lender:Don’t be afraid to negotiate with Union Bank’s loan officer to try and secure a better interest rate.

Evaluating Union Bank Home Loan Eligibility and Requirements

Before applying for a Union Bank home loan, it’s essential to understand the eligibility criteria and requirements. This section Artikels the key factors and procedures involved.

Planning to upgrade your backyard oasis? Pool loans can help finance your dream pool. They are designed specifically for pool construction and renovation.

Eligibility Criteria

To be eligible for a Union Bank home loan, you typically need to meet the following criteria:

- Credit Score:Union Bank generally requires a minimum credit score for home loan approval. The specific score requirement can vary based on the loan type and other factors.

- Debt-to-Income Ratio (DTI):Your DTI, which represents the percentage of your monthly income used for debt payments, is also considered. Union Bank typically has a maximum DTI threshold for home loan approval.

- Employment History:Union Bank may require a stable employment history, demonstrating your ability to repay the loan.

- Down Payment:You’ll need a down payment to secure a home loan. The minimum down payment requirement can vary based on the loan type and your creditworthiness.

- Residency Status:You must be a legal resident of the United States to qualify for a Union Bank home loan.

Required Documentation and Procedures

To apply for a Union Bank home loan, you’ll typically need to provide the following documentation:

- Personal Identification:Driver’s license, passport, or other government-issued ID.

- Proof of Income:Pay stubs, tax returns, or other documentation verifying your income.

- Credit Report:A copy of your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion).

- Bank Statements:Recent bank statements showing your account activity.

- Property Information:Details about the property you are purchasing, including the purchase agreement and appraisal report.

The application process typically involves:

- Pre-Approval:Get pre-approved for a loan to determine your borrowing capacity and provide a competitive offer for a home.

- Loan Application:Complete and submit a loan application with the required documentation.

- Loan Underwriting:Union Bank will review your application and supporting documents to assess your eligibility and loan terms.

- Loan Closing:Once the loan is approved, you’ll sign the necessary documents and complete the loan closing process.

Impact of Credit Score and DTI

Your credit score and debt-to-income ratio significantly impact your eligibility for a Union Bank home loan and the interest rate you qualify for. A higher credit score and a lower DTI generally result in better loan terms, including a lower interest rate.

USAA, known for its military-focused services, also offers various loan products , including personal loans and mortgages.

- Credit Score:A higher credit score indicates a lower risk for lenders, which can lead to a lower interest rate.

- DTI:A lower DTI shows that you have more disposable income available for debt payments, making you a less risky borrower.

End of Discussion

Armed with this knowledge, you can confidently navigate the home loan landscape, making informed decisions that align with your financial goals. Remember, securing a competitive interest rate can significantly impact your monthly payments and overall loan cost, making it a crucial aspect of your homeownership journey.

Whether you’re facing a financial emergency or need funds for a specific purpose, saying “I need a loan” is a common sentiment. Fortunately, there are many options available. Finding the right loan requires some research and comparison.

Essential Questionnaire

What is the current average interest rate for Union Bank home loans?

The current average interest rate for Union Bank home loans varies depending on factors such as loan type, credit score, and market conditions. It’s best to contact Union Bank directly for the most up-to-date information.

Finding banks that finance mobile homes with land can be challenging, but not impossible. Look for lenders specializing in manufactured housing.

What are the eligibility requirements for a Union Bank home loan?

An adjustable-rate mortgage (ARM) can offer lower initial rates, but they can fluctuate over time. It’s important to understand the potential risks and benefits before making a decision.

Eligibility requirements for a Union Bank home loan typically include factors like credit score, debt-to-income ratio, and income verification. You can find detailed information on their website or by contacting their loan officers.

What are the fees associated with a Union Bank home loan?

When it comes to buying a home, USAA mortgage rates can be competitive. Be sure to compare rates from multiple lenders to find the best fit for your needs.

Union Bank home loans may involve fees such as origination fees, appraisal fees, and closing costs. These fees can vary depending on the loan type and amount. It’s important to understand all fees upfront before committing to a loan.

Need cash fast? A quick cash loan online could be the solution. These loans are designed to provide quick access to funds, often with a simple application process.