Tricare Select 2024 offers military families a comprehensive health insurance plan with a network of providers nationwide. It’s a popular choice for those seeking a balance between affordability and access to quality care, but it’s important to understand the nuances of coverage, costs, and enrollment before making a decision.

Keep your home safe and secure with Aaa Home Insurance in 2024. They offer comprehensive coverage and excellent customer service to protect your investment.

This guide delves into the key features of Tricare Select 2024, providing a clear picture of what it offers and how it compares to other Tricare plans. We’ll explore the benefits, limitations, costs, and enrollment process, equipping you with the information you need to make informed choices about your health coverage.

Contents List

Tricare Select 2024 Overview

Tricare Select is a managed care health plan offered by the Department of Defense (DoD) to eligible beneficiaries. It provides comprehensive health coverage through a network of participating providers. Tricare Select offers a balance of affordability and choice, allowing beneficiaries to access care from a wide range of providers while managing healthcare costs.

Key Features of Tricare Select

Tricare Select offers a variety of features designed to provide comprehensive healthcare coverage to beneficiaries.

- Network Coverage:Tricare Select offers coverage through a network of participating providers, including doctors, hospitals, and other healthcare professionals. Beneficiaries must use in-network providers to receive the full benefits of the plan.

- Cost-Sharing:Tricare Select utilizes cost-sharing mechanisms, such as copayments and coinsurance, to help manage healthcare costs. These cost-sharing arrangements vary depending on the type of service received.

- Prescription Drug Coverage:Tricare Select includes prescription drug coverage through a formulary. Beneficiaries can access prescription drugs through participating pharmacies, subject to cost-sharing requirements.

- Annual Out-of-Pocket Maximum:Tricare Select has an annual out-of-pocket maximum, which limits the amount beneficiaries will have to pay for covered healthcare services in a given year.

Eligibility Requirements for Tricare Select

To be eligible for Tricare Select, beneficiaries must meet specific criteria. These criteria typically include:

- Active Duty Family Members:Family members of active duty service members are eligible for Tricare Select.

- Retired Military Personnel:Retired military personnel and their families are eligible for Tricare Select, depending on their years of service and other factors.

- Survivors of Military Personnel:Survivors of military personnel who died in the line of duty or due to service-connected disabilities are eligible for Tricare Select.

- Medically Retired Military Personnel:Military personnel who are medically retired due to service-connected disabilities are eligible for Tricare Select.

Benefits and Limitations of Tricare Select

Tricare Select offers several benefits compared to other Tricare plans. However, it also has some limitations that beneficiaries should consider.

- Benefits:

- Wide network of providers

- Comprehensive coverage for a variety of healthcare services

- Affordable premiums and cost-sharing

- Annual out-of-pocket maximum to protect beneficiaries from high costs

- Limitations:

- Requires beneficiaries to use in-network providers

- May have higher copayments and coinsurance compared to other plans

- Prescription drug coverage is subject to formulary restrictions

Premiums and Cost-Sharing

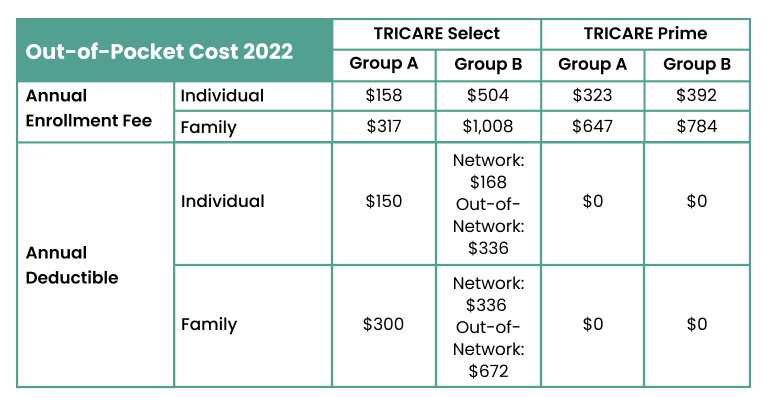

Tricare Select premiums and cost-sharing vary depending on several factors, including beneficiary status, age, and location.

Monthly Premiums for Tricare Select

The monthly premiums for Tricare Select in 2024 are as follows:

- Active Duty Family Members:The monthly premium for active duty family members is based on the service member’s rank and years of service.

- Retired Military Personnel:The monthly premium for retired military personnel is based on their years of service and other factors.

- Survivors of Military Personnel:The monthly premium for survivors of military personnel is based on the deceased service member’s rank and years of service.

- Medically Retired Military Personnel:The monthly premium for medically retired military personnel is based on their years of service and other factors.

Copayments and Coinsurance for Tricare Select

Tricare Select utilizes copayments and coinsurance to help manage healthcare costs.

Looking for the most affordable home insurance options in 2024? Compare quotes from multiple providers to find the best value for your money.

- Copayments:Copayments are fixed fees that beneficiaries pay for specific healthcare services, such as doctor’s visits or prescription drugs.

- Coinsurance:Coinsurance is a percentage of the cost of healthcare services that beneficiaries pay after meeting their deductible.

Out-of-Pocket Maximum for Tricare Select

Tricare Select has an annual out-of-pocket maximum, which limits the amount beneficiaries will have to pay for covered healthcare services in a given year. Once the out-of-pocket maximum is reached, Tricare will cover 100% of the cost of covered services for the remainder of the year.

Find a State Farm agent near you in 2024 with the help of their convenient location finder. They have a wide network of agents across the country.

Network Coverage

Tricare Select offers coverage through a network of participating providers. Beneficiaries must use in-network providers to receive the full benefits of the plan.

Participating Providers in the Tricare Select Network

The Tricare Select network includes a wide range of providers, including doctors, hospitals, and other healthcare professionals. The specific providers in the network may vary depending on location.

Secure your family’s future with a Best Term Life Insurance policy in 2024. These plans offer affordable protection for a specific period, ensuring your loved ones are financially secure.

Finding In-Network Providers

Beneficiaries can find in-network providers using the Tricare website or mobile app. The Tricare website and app allow beneficiaries to search for providers by specialty, location, and other criteria.

Protect your business assets with Commercial Property Insurance in 2024. This coverage provides financial protection for your building, equipment, and inventory.

Consequences of Using Out-of-Network Providers

Using out-of-network providers can result in higher out-of-pocket costs for beneficiaries. Tricare Select will typically cover a portion of the cost of out-of-network services, but beneficiaries will be responsible for a larger share of the cost.

Prescription Drug Coverage

Tricare Select includes prescription drug coverage through a formulary. The formulary is a list of prescription drugs that are covered by the plan.

Get a quick and easy quote for auto insurance from Geico in 2024. Their online quote tool makes it simple to compare rates and find the best coverage.

Formulary for Tricare Select Prescription Drugs

The Tricare Select formulary is updated periodically to include new drugs and to reflect changes in the pharmaceutical market. Beneficiaries can access the formulary through the Tricare website or mobile app.

Obtaining Prescription Drugs through Tricare Select, Tricare Select 2024

Beneficiaries can obtain prescription drugs through participating pharmacies. To obtain a prescription drug, beneficiaries will need to present their Tricare Select card and a valid prescription from their doctor.

Get comprehensive coverage for your vehicle with Comprehensive Car Insurance in 2024. This type of insurance protects you from damages caused by events like theft, vandalism, or natural disasters.

Cost-Sharing for Prescription Drugs

Tricare Select utilizes cost-sharing mechanisms, such as copayments and coinsurance, for prescription drugs. The cost-sharing for prescription drugs may vary depending on the drug’s tier on the formulary.

Protect your prized vessel with Geico Boat Insurance in 2024. They offer comprehensive coverage for a variety of boat types and sizes, ensuring peace of mind on the water.

Enrollment and Administration

Beneficiaries can enroll in Tricare Select during the annual open enrollment period or during a special enrollment period.

Enrollment Period for Tricare Select

The annual open enrollment period for Tricare Select is typically in the fall. During the open enrollment period, beneficiaries can enroll in Tricare Select, change their plan, or drop their coverage.

Enrolling in Tricare Select

Beneficiaries can enroll in Tricare Select online, by phone, or by mail. The enrollment process typically requires beneficiaries to provide personal information, such as their name, address, and date of birth.

Managing Your Tricare Select Benefits

Beneficiaries can manage their Tricare Select benefits online through the Tricare website or mobile app. The Tricare website and app allow beneficiaries to view their coverage, track their claims, and access other resources.

Changes and Updates for 2024

Tricare Select has undergone several changes and updates for 2024. These changes are designed to improve the plan’s benefits and services.

Get a quote for comprehensive homeowners insurance from Geico Homeowners Insurance in 2024. They offer competitive rates and customizable coverage options.

Significant Changes to Tricare Select for 2024

Some significant changes to Tricare Select for 2024 include:

- Expanded Network Coverage:The Tricare Select network has been expanded to include more providers.

- Updated Formulary:The Tricare Select formulary has been updated to include new drugs and to reflect changes in the pharmaceutical market.

- New Online Resources:Tricare has launched new online resources to make it easier for beneficiaries to manage their benefits.

Impact of Changes on Beneficiaries

The changes to Tricare Select for 2024 are expected to have a positive impact on beneficiaries. The expanded network coverage will provide beneficiaries with more choice in providers. The updated formulary will provide beneficiaries with access to newer and more effective drugs.

The new online resources will make it easier for beneficiaries to manage their benefits.

Official Resources for Additional Information

Beneficiaries can access additional information about Tricare Select on the Tricare website or by contacting Tricare customer service.

Looking for dependable home insurance in 2024? State Farm Home Insurance provides excellent coverage and a strong reputation for customer satisfaction.

Comparison with Other Tricare Plans

Tricare Select is just one of several health plans offered by the DoD. Other popular Tricare plans include Tricare Prime and Tricare For Life. Each plan offers different coverage, costs, and benefits.

Explore health insurance options for federal employees with Bcbs Federal in 2024. They provide comprehensive plans tailored to the needs of federal workers.

Key Differences in Coverage, Costs, and Benefits

The following table summarizes the key differences in coverage, costs, and benefits between Tricare Select, Tricare Prime, and Tricare For Life.

Ensure your business is protected with Workers Compensation insurance in 2024. This essential coverage protects your employees and your business from financial hardship in the event of a work-related injury.

| Plan | Coverage | Costs | Benefits |

|---|---|---|---|

| Tricare Select | Managed care plan with network coverage | Moderate premiums and cost-sharing | Wide network of providers, comprehensive coverage, annual out-of-pocket maximum |

| Tricare Prime | Managed care plan with primary care manager (PCM) and referral system | Lower premiums and cost-sharing | Lower copayments and coinsurance, access to specialty care through PCM referral |

| Tricare For Life | Fee-for-service plan for beneficiaries over 65 | Higher premiums but lower out-of-pocket costs | Coverage for Medicare-eligible beneficiaries, access to Medicare providers |

Resources and Support

Beneficiaries can access a variety of resources and support to help them understand and manage their Tricare Select benefits.

For reliable and affordable auto insurance in 2024, consider Allstate Auto Insurance. They offer a range of coverage options to suit your needs and budget.

Official Tricare Websites and Resources

The Tricare website provides comprehensive information about Tricare Select and other Tricare plans. The website includes information on enrollment, coverage, costs, and benefits.

Tricare Customer Service

Beneficiaries can contact Tricare customer service for assistance with their Tricare Select benefits. Tricare customer service representatives can answer questions, resolve issues, and provide support.

Travel with confidence and peace of mind with Geoblue Travel Insurance in 2024. Their plans provide comprehensive coverage for medical emergencies, trip cancellations, and more.

Support Groups and Community Resources

There are several support groups and community resources available to help beneficiaries with their Tricare Select benefits. These groups can provide information, support, and advocacy.

Closing Notes

Whether you’re new to Tricare or considering a switch to Tricare Select 2024, understanding the program’s ins and outs is crucial. This guide has provided a comprehensive overview of the plan’s features, costs, and enrollment process, but remember to consult official Tricare resources for the most up-to-date information and personalized guidance.

Frequently Asked Questions

What is the difference between Tricare Select and Tricare Prime?

Tricare Select is a fee-for-service plan, while Tricare Prime is a managed care plan. Tricare Select allows you to choose your own doctor, while Tricare Prime requires you to select a primary care manager. Tricare Prime generally has lower premiums but may have higher copayments.

Looking for the best home insurance deals in 2024? Compare The Market can help you compare quotes from various providers and find the best coverage for your needs.

Can I use Tricare Select outside the United States?

Tricare Select coverage is generally limited to the United States, but there are some exceptions for active duty personnel and their families.

How do I find a provider in the Tricare Select network?

You can find a provider in the Tricare Select network using the Tricare website or by calling Tricare customer service.

What are the out-of-pocket maximums for Tricare Select?

The out-of-pocket maximum for Tricare Select varies depending on your family size and other factors. You can find this information on the Tricare website.