BBA in Finance 2024 is more than just a degree; it’s a gateway to a world of exciting possibilities in the dynamic financial industry. This program equips you with the essential knowledge and skills to navigate the complexities of finance, preparing you for a rewarding career in a field that’s constantly evolving.

Seeking a degree that leads to high earning potential? Easy Degrees That Pay Well 2024 can guide you towards a fulfilling and lucrative career path.

From understanding the fundamentals of financial accounting and corporate finance to exploring specialized tracks like investment banking and wealth management, you’ll gain a comprehensive understanding of financial concepts and their real-world applications. The program emphasizes both theoretical knowledge and practical skills, ensuring you’re ready to tackle the challenges and opportunities that await in the finance industry.

Ready to take your business skills to the next level? Mba Specializations 2024 offer focused programs to help you excel in specific areas of business.

Contents List

BBA in Finance: Overview and Relevance

A Bachelor of Business Administration (BBA) in Finance is a comprehensive degree program designed to equip students with the knowledge, skills, and analytical abilities needed to succeed in the dynamic world of finance. This program provides a strong foundation in core finance concepts, including financial accounting, corporate finance, and investments, while also offering opportunities to specialize in areas like investment banking, financial analysis, or wealth management.

Ready to pursue a career in healthcare? Rn Programs Near Me 2024 can help you find the right program to launch your nursing journey.

Core Curriculum and Key Skills

The core curriculum of a BBA in Finance program typically covers a wide range of subjects, including:

- Financial Accounting:Understanding financial statements, accounting principles, and their analysis.

- Corporate Finance:Capital budgeting, financial planning, and management of a company’s financial resources.

- Investments:Valuation of securities, portfolio management, and investment strategies.

- Financial Markets and Institutions:The structure and functioning of financial markets, including the stock market, bond market, and derivatives markets.

- Quantitative Finance:Statistical methods and mathematical models used in finance.

- Economics:Macroeconomic and microeconomic principles relevant to financial decision-making.

- Business Law:Legal aspects of finance, including contracts, securities regulations, and corporate governance.

Through this curriculum, students develop a range of essential skills, such as:

- Analytical and Problem-Solving Skills:Evaluating financial data, identifying trends, and making informed decisions.

- Financial Modeling and Forecasting:Using software and techniques to create financial models and project future outcomes.

- Communication and Presentation Skills:Effectively conveying financial information to stakeholders, both verbally and in writing.

- Critical Thinking and Decision-Making:Analyzing complex financial situations and making sound judgments.

- Teamwork and Collaboration:Working effectively with others in a financial context.

Career Paths for BBA Finance Graduates

A BBA in Finance opens doors to a wide range of career paths in the financial services industry and beyond. Graduates can pursue roles in:

- Investment Banking:Advising companies on mergers, acquisitions, and capital raising.

- Financial Analysis:Evaluating investment opportunities, preparing financial reports, and providing financial recommendations.

- Asset Management:Managing investment portfolios for individuals and institutions.

- Commercial Banking:Providing financial services to businesses and individuals.

- Corporate Finance:Managing a company’s financial operations, including budgeting, forecasting, and capital allocation.

- Insurance:Assessing risk, pricing insurance products, and managing insurance portfolios.

- Real Estate Finance:Financing real estate projects and managing real estate investments.

- Entrepreneurship:Starting and managing their own businesses.

Real-World Applications of Finance Concepts

The finance concepts learned in a BBA program have direct applications in real-world situations. For example:

- Financial Accounting:Analyzing a company’s financial statements to understand its profitability, liquidity, and solvency.

- Corporate Finance:Evaluating a proposed investment project using discounted cash flow analysis or net present value.

- Investments:Building a diversified investment portfolio based on risk tolerance and investment goals.

- Financial Markets:Understanding the impact of interest rate changes on bond prices or the relationship between stock prices and economic growth.

Finance Fundamentals in the BBA Program: Bba In Finance 2024

The foundation of a BBA in Finance program is built upon a set of fundamental courses that provide a comprehensive understanding of key financial concepts and principles. These courses serve as the building blocks for more specialized study and career paths in finance.

Looking to make a difference in people’s lives? Bachelor Of Social Work 2024 can equip you with the skills and knowledge to help those in need.

Foundational Finance Courses

Common foundational courses in a BBA Finance program include:

- Financial Accounting:This course covers the principles and practices of accounting, including financial statement analysis, asset valuation, and accounting for various business transactions. It equips students with the ability to understand and interpret financial information, which is essential for making sound financial decisions.

Are you ready to dive deep into your field of study? Phd Degree 2024 can help you reach the highest levels of academic achievement.

- Corporate Finance:This course focuses on the financial management of companies, including capital budgeting, financial planning, and dividend policy. Students learn how to evaluate investment opportunities, manage risk, and optimize the use of financial resources.

- Investments:This course explores the principles and practices of investing in various asset classes, including stocks, bonds, and real estate. Students learn about valuation methods, portfolio construction, and investment strategies to achieve financial goals.

Understanding Financial Statements

Financial statements, such as the balance sheet, income statement, and cash flow statement, provide a snapshot of a company’s financial health. Understanding these statements is crucial for analyzing a company’s performance, identifying potential risks, and making informed investment decisions.

Real-World Case Studies

To illustrate the practical application of these foundational concepts, finance programs often incorporate real-world case studies. For example, students might analyze the financial performance of a publicly traded company, evaluate a potential acquisition, or develop a financial plan for a startup business.

Interested in a career supporting legal professionals? Paralegal Studies 2024 can provide you with the skills and knowledge to thrive in this field.

Table: Key Concepts and Skills in Foundational Finance Courses

| Course | Key Concepts | Key Skills |

|---|---|---|

| Financial Accounting | Financial statements, accounting principles, asset valuation | Financial statement analysis, accounting software, financial reporting |

| Corporate Finance | Capital budgeting, financial planning, risk management | Financial modeling, valuation techniques, investment decision-making |

| Investments | Valuation methods, portfolio construction, investment strategies | Market analysis, risk assessment, portfolio optimization |

Specialized Finance Tracks within the BBA Program

Beyond the foundational courses, BBA Finance programs often offer specialized tracks that allow students to delve deeper into specific areas of finance. These tracks provide focused training and knowledge relevant to particular career paths.

Looking to specialize in physical therapy? Master Of Physiotherapy 2024 can provide you with the advanced knowledge and skills to help patients regain their mobility and function.

Specialized Tracks and Their Focus

Common specialized tracks in a BBA Finance program include:

- Investment Banking:This track focuses on advising companies on mergers, acquisitions, and capital raising. Students learn about financial modeling, valuation, and deal structuring.

- Financial Analysis:This track emphasizes the analysis of financial data, including financial statements, industry trends, and economic indicators. Students develop skills in financial modeling, forecasting, and investment research.

- Wealth Management:This track focuses on providing financial advice and investment management services to individuals and families. Students learn about portfolio management, estate planning, and tax optimization.

- Real Estate Finance:This track explores the financing of real estate projects, including mortgages, commercial loans, and real estate investment trusts. Students learn about real estate valuation, market analysis, and property management.

- Quantitative Finance:This track focuses on the use of mathematical and statistical models in finance. Students learn about financial modeling, risk management, and derivatives pricing.

Skills and Knowledge for Specialized Tracks

Each specialized track requires specific skills and knowledge. For example:

- Investment Banking:Strong analytical skills, financial modeling expertise, and excellent communication skills.

- Financial Analysis:Deep understanding of financial statements, industry knowledge, and strong research skills.

- Wealth Management:Financial planning expertise, investment knowledge, and strong client communication skills.

- Real Estate Finance:Understanding of real estate markets, valuation techniques, and mortgage financing.

- Quantitative Finance:Advanced mathematical and statistical skills, programming abilities, and knowledge of financial modeling techniques.

Career Opportunities and Salary Ranges

The career opportunities and potential salary ranges for each specialization can vary. For example:

- Investment Banking:High-paying roles in investment banks, private equity firms, and hedge funds.

- Financial Analysis:Roles in investment firms, corporate finance departments, and consulting firms.

- Wealth Management:Positions in wealth management firms, private banks, and financial advisory practices.

- Real Estate Finance:Jobs in real estate investment firms, mortgage lenders, and property management companies.

- Quantitative Finance:Roles in hedge funds, investment banks, and financial technology companies.

Table: Specialized Tracks, Core Courses, and Career Paths

| Specialized Track | Core Courses | Career Paths |

|---|---|---|

| Investment Banking | Mergers and Acquisitions, Valuation, Financial Modeling | Investment Banker, Analyst, Associate |

| Financial Analysis | Financial Statement Analysis, Forecasting, Investment Research | Financial Analyst, Equity Analyst, Research Analyst |

| Wealth Management | Portfolio Management, Estate Planning, Tax Optimization | Financial Advisor, Wealth Manager, Portfolio Manager |

| Real Estate Finance | Real Estate Valuation, Mortgage Financing, Property Management | Real Estate Analyst, Mortgage Lender, Property Manager |

| Quantitative Finance | Financial Modeling, Risk Management, Derivatives Pricing | Quantitative Analyst, Portfolio Manager, Financial Engineer |

Emerging Trends and Technologies in Finance

The finance industry is rapidly evolving, driven by technological advancements and changing market dynamics. Understanding these emerging trends and technologies is crucial for finance professionals who want to stay ahead of the curve and thrive in the future of finance.

Ready to explore the complexities of human behavior and society? Social Science Degree 2024 can provide you with a deep understanding of the world around us.

Impact of Technology on Finance, Bba In Finance 2024

Technology is transforming the finance industry in several ways:

- Fintech:Financial technology companies are disrupting traditional financial services with innovative solutions, such as mobile payments, peer-to-peer lending, and robo-advisory platforms.

- Blockchain:Blockchain technology is revolutionizing financial transactions by providing a secure, transparent, and decentralized platform for recording and verifying data. This has applications in areas like digital currencies, securities trading, and supply chain finance.

- Artificial Intelligence (AI):AI is being used to automate tasks, improve decision-making, and personalize financial services. AI-powered algorithms can analyze vast amounts of data, identify patterns, and predict market trends.

Data Analytics and Machine Learning

Data analytics and machine learning are becoming increasingly important in finance. These technologies enable financial institutions to analyze large datasets, identify patterns, and make more informed decisions about investments, risk management, and customer segmentation.

If you have a passion for fashion, Fashion Design Schools 2024 offer the opportunity to turn your creativity into a career.

Shaping Skills and Knowledge

These emerging trends are shaping the skills and knowledge required for future finance professionals. In addition to traditional finance skills, professionals will need to be proficient in:

- Data Analytics:Understanding and interpreting data, using data visualization tools, and applying statistical methods.

- Machine Learning:Understanding the principles of machine learning, building and training machine learning models, and interpreting results.

- Technology Adoption:Keeping abreast of new technologies, evaluating their potential impact on finance, and adapting to new tools and processes.

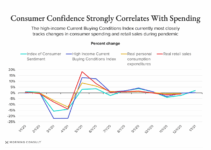

Visual Representation of Emerging Technologies and Finance Careers

A visual representation, such as a chart or diagram, could illustrate the relationship between emerging technologies and finance careers. For example, a chart could show the different areas of finance that are being impacted by fintech, blockchain, and AI, along with the corresponding career paths that are emerging in these areas.

Want to learn the art of fashion design? Fashion Design Course 2024 can help you develop your skills and bring your creative vision to life.

The Importance of Soft Skills in Finance

While technical skills are essential in finance, soft skills play a crucial role in career success. Soft skills, such as communication, teamwork, and problem-solving, enable finance professionals to effectively interact with colleagues, clients, and stakeholders, build relationships, and navigate complex situations.

Do you have a flair for design? Interior Design Programs 2024 can help you transform spaces and create beautiful environments.

Soft Skills and Their Importance

Soft skills are essential for success in finance because they:

- Enhance Communication:Effective communication is vital for presenting financial information, explaining complex concepts, and building trust with clients and colleagues.

- Foster Teamwork:Finance professionals often work in teams, and strong teamwork skills are necessary for collaboration, conflict resolution, and achieving shared goals.

- Improve Problem-Solving:The ability to analyze problems, identify solutions, and implement solutions effectively is essential in a dynamic financial environment.

- Build Relationships:Strong interpersonal skills are essential for building relationships with clients, colleagues, and other stakeholders, which can lead to opportunities and career advancement.

Examples of Soft Skills in Finance

Here are some examples of how soft skills contribute to success in finance roles:

- Communication:A financial analyst who can clearly and concisely explain complex financial data to a client.

- Teamwork:A team of investment bankers who work together effectively to complete a successful merger transaction.

- Problem-Solving:A portfolio manager who identifies and addresses a potential risk in a client’s investment portfolio.

- Relationship Building:A wealth manager who builds strong relationships with clients based on trust and understanding.

Leadership and Ethical Considerations

Leadership and ethical considerations are also important soft skills in finance. Finance professionals are often in positions of influence and responsibility, and they need to demonstrate strong ethical values, integrity, and the ability to lead and inspire others.

Want to earn a well-respected degree? Baccalaureate Degree 2024 opens doors to a wide range of career opportunities.

Developing and Enhancing Soft Skills

Soft skills can be developed and enhanced through:

- Active Listening:Paying close attention to what others are saying and demonstrating understanding.

- Effective Communication:Clearly and concisely expressing ideas both verbally and in writing.

- Teamwork Activities:Participating in group projects and learning to collaborate effectively with others.

- Problem-Solving Exercises:Engaging in activities that require analytical thinking and creative solutions.

- Leadership Training:Developing leadership skills through workshops, mentorship programs, and practical experience.

Final Summary

As you embark on your BBA in Finance journey, remember that success in this field requires a blend of technical expertise and strong soft skills. By mastering both, you’ll be well-equipped to thrive in a demanding yet rewarding career path.

The finance industry is constantly evolving, and staying informed about emerging trends and technologies is crucial for long-term success. Embrace the challenges and opportunities that lie ahead, and let your passion for finance guide you towards a fulfilling and impactful career.

Quick FAQs

What are the job prospects for BBA Finance graduates?

Interested in the intersection of psychology and law? Forensic Psychology Degree 2024 can prepare you for a challenging and rewarding career.

BBA Finance graduates are highly sought after by various industries, including financial institutions, corporations, and government agencies. Common career paths include financial analyst, investment banker, wealth manager, accountant, and financial consultant.

Planning your future? Undergraduate Degree 2024 provides a solid foundation for a successful career.

What are the admission requirements for a BBA in Finance program?

Admission requirements vary by institution, but typically include a high school diploma or equivalent, strong academic performance, and standardized test scores (e.g., SAT, ACT). Some programs may also require specific coursework in mathematics or economics.

Is a BBA in Finance a good choice for me?

Looking to broaden your knowledge base? General Education Courses 2024 can help you develop a well-rounded understanding of various subjects.

A BBA in Finance is a good choice for individuals with a strong interest in finance, mathematics, and economics. If you’re analytical, detail-oriented, and enjoy problem-solving, a finance career could be a good fit.